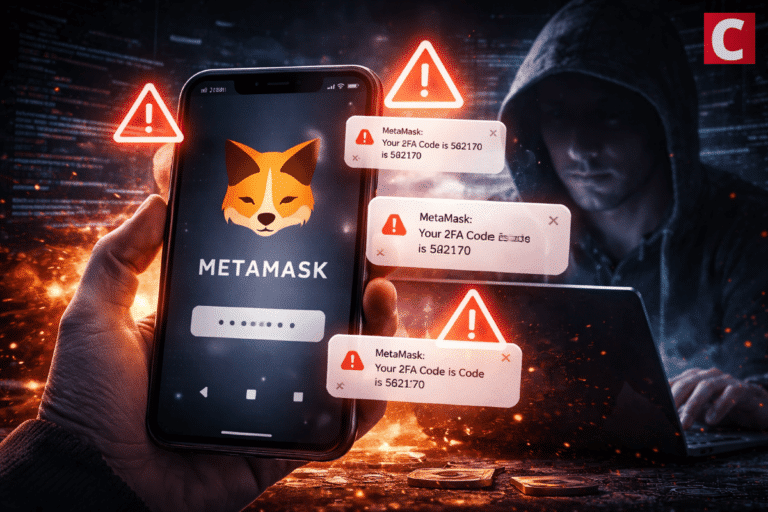

A new phishing campaign flagged by SlowMist is actively targeting users of MetaMask by impersonating two-factor authentication security checks.

The Strategy (NASDAQ: MSTR) stock is seeing the much-needed recovery in the past 2-3 trading sessions. During the overnight trading session on Sunday, Jan. 4, the MSTR stock gained another 3.5%, moving past $163. This comes as Bitcoin BTC $72 156 24h volatility: 4.0% Market cap: $1.44 T Vol. 24h: $77.96 B price also shows strength, moving to $92,500 with Michael Saylor hinting at additional BTC purchases.

MSTR Stock Makes Healthy Recovery

The MSTR stock has bounced after forming support at $150. During the Jan. 4 overnight trading, the stock gained past $163, according to Yahoo Finance data, showing signs of potential recovery. This is a major relief for investors after the stock price corrected 50% in 2025.

Investors are still on edge with the January 15 deadline approaching that would decide whether or not MSTR stays in the MSCI Index. Banking giant JPMorgan predicted last year that a fallout from the index could lead to $8.8 billion in outflows.

The good thing is MSTR stock’s net asset value (mNAV) has just regained above 1 against its $62 billion BTC reserve. Some bullish analysts have also shrugged off concerns relating to the company’s ability to pay dividends to shareholders.

Strategy up 5% overnight.

What's funny is that Saylor can literally take this level of premium handed to him, from one trading session, and raise close to enough cash to pay the dividends for an entire year.

The idiot bears will continue to whine and moan about "HOW HE'S GONNA… pic.twitter.com/CqFwMwqZOx

— Adam Livingston (@AdamBLiv) January 5, 2026

Furthermore, institutional demand for MSTR is also gathering steam once again, as the company raises its USD reserves to $2.2 billion.

Michael Saylor Hints at Additional Bitcoin Purchases

On Jan. 4, Strategy Executive Chairman Michael Saylor hinted at additional BTC purchases for the company through his X post. Saylor shared the phrase “Orange or Green?” alongside a chart tracking Strategy’s Bitcoin investments.

https://twitter.com/saylor/status/2007810888166961549

Market participants noted that Saylor has previously used similar signals ahead of confirmed disclosures of additional Bitcoin purchases.

According to regulatory filings, Strategy currently holds 672,497 Bitcoin, acquired at an average cost of $74,997 per BTC, bringing the company’s total acquisition cost to approximately $50.44 billion.

At current market prices, with Bitcoin trading around $92,481, Strategy’s Bitcoin holdings are valued at more than $62 billion. This shows 23% unrealized gains of over $11 billion.

next