Stox announced the end of the ICO as it has met its goal just two days after the start of the ICO.

Stox, an open source Bancor-based prediction market platform, started its ICO two days ago and has already managed to raise 148,000 ETH, which is equal to $33,3 million. The current price of Ethereum makes up $225.28, according to the CoinMarketCap.

Stox has announced the end of the ICO in Twitter. The company has already met its goal.

Surprise Announcement:

$30M Raised. It's all we need. Please stop sending ETH.

Thank you to all the contributors!#ETH #ICO pic.twitter.com/MS9Mkh5kzy

— STOX (@stx_coin) August 3, 2017

There is no official information about investors so far. But again, Stox’s twitter informs about a total number of 2,500 contributors.

We just hit the 6-hour mark:

2500 Contributors = 113,924 ETH

Join the community… Official Wallet Info: https://t.co/XlEQnALHaq

— STOX (@stx_coin) August 2, 2017

According to Stox’s social media profiles, such a quick achievement of the goal became possible due to a couple of new partnerships, including TaaS and Decentral. The latter said it would integrate the Ethereum-based STX token once it is ready for distribution. Decentral looks forward to working with STOX.

Founder and CEO of Jaxx, Anthony Di Iorio, said: “We’re excited to support Stox as a new token. We’re always looking to build a more harmonious blockchain community and this partnership brings us closer to that vision. The project is gaining a lot of attention and we definitely want to help bring prediction markets to the next level.”

Token-as-a-Service (TaaS), the tokenized closed-end fund dedicated to blockchain assets, admits it has contributed 500 ETH to the Stox ICO.

“This contribution shows our commitment to include the most stable and liquid assets in the fund’s portfolio for the benefit of its token owners. TaaS embraces diversification as a key pillar for sustaining and scaling up the fund’s performance. We are excited to contribute to STOX’s TGE and to support their effort of becoming a pioneering member of the Bancor network,” Ruslan Gavrilyuk, co-founder and CEO of TaaS, said.

An element of success of the ICO might belong to some kind of promotion from Floyd Mayweather, one of the greatest boxers of all time. He published a post on Instagram advertising the ICO.

Mayweather stated he was going to make a “ton of money” from the capital raise. According to Entertainment and Sports Programming Network, this profit can be just in time for the boxer as Mayweather’s wealth is tied up in assets and not liquid. That is why he couldn’t pay back a tax liability of $22.2 million to the IRS.

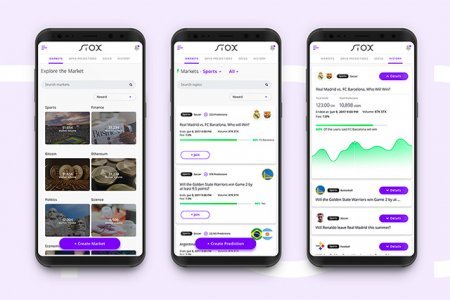

Stox was launched earlier this July. Invest.com used Bancor protocol to allow users to predict events basing on the crowd’s assessments of events. Bancor was chosen as the foundation for the invest.com team’s platform as this guarantees continuous and high liquidity for Stox users on Ethereum. Users of Stox’s prediction market platform get a possibility to, firstly, purchase STX directly with the BNT smart token using Ether, and secondly, easily liquidate STX back to Ether, with guarantee of low slippage and absence of spread.

next