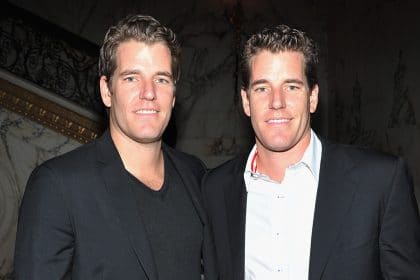

The Winklevoss brothers has expressed their optimistic attitude to Bitcoin and new ambitions of making Bitcoin ETFs a reality during the latest AMA session on Reddit.

The Winklevoss twins are not going to give up on making Bitcoin exchange-traded funds (ETFs) a reality, as they stated during an Ask Me Anything (AMA) session on Reddit today, January 7, which covered many tricky questions related to Bitcoin’s future, Gemini exchange and cryptocurrencies in general.

An exchange-traded fund represents itself a basket of assets that can be united together and sold as one product. Properly, each application for ETFs should be approved by the Securities and Exchange Commission (SEC), so that to make them legally tradeable in the United States.

As a comprehensive reply to the question about whether or not Bitcoin will keep its number one position among cryptocurrencies, Cameron Winklevoss stated:

“Bitcoin is certainly the OG crypto! It’s hard to defeat network effects — so in terms of ‘hard money’ (i.e., store of value) Bitcoin is most likely the winner in the long term.”

Concerning the both brothers’ ambition to finally make Bitcoin ETFs a reality, the Winklevosses said that they are going to continue working on further attemps are not planning to stop, despite their two preceeding failures. The first application for a Bitcoin ETF was rejected by the SEC in March 2017, while the second was declined later in July 2018.

During the AMA session, Tyler Winklevoss expressed his strongest belief in Bitcoin by calling it ‘gold than gold’:

“Our thesis around bitcoin’s upside remains unchanged. We believe bitcoin is better at being gold than gold. If we’re right, then over time the market cap of bitcoin will surpass the ~7trillion dollar market cap of gold.”

Answering the question on the relative importance of blockchain versus cryptocurrencies, both brothers agreed that one cannot exist without the other, comparing that blockchain without cryptocurrencies is like ‘calling AOL the Internet’.

In 2014, Cameron and Tyler Winklevoss has founded Gemini, a licensed digital asset exchange and custodian built for both individuals and institutions. In September 2018, they launched the Gemini dollar (GUSD), which is reportedly backed by United States dollars that are held at a bank located in the United States and eligible for FDIC ‘pass-through’ deposit insurance, subject to applicable limitations.

Gemini Exchange is still very much a work in progress, not offering tokens and features that other exchanges across the world serve. This fact brought about another tricky question, which was asked during the AMA session. It was related to the Bitcoin’s latest technology, which for some reason has not been implemented on Gemini yet. The Winklevosses explained:

“Our Bitcoin hot wallet was made before Segwit was but a twinkle in Pieter Wuille’s eye. It would be very tricky to retrofit Segwit into there. So we built a new hot wallet, from the ground up, with support for Segwit, transaction batching, Bech32 addresses, and all sorts of other goodies. We used that new system for Zcash, Litecoin, and Bitcoin Cash, which is why we’re already using both native and P2SH wrapped Segwit for Litecoin. We’re working on migrating Bitcoin to the new system, and it should be done in Q1.”

Whether or not the brothers will succed in their attempts is yet to be seen. Some experts believe that if they move their focus outside the US, the chances would be more realistic.

next