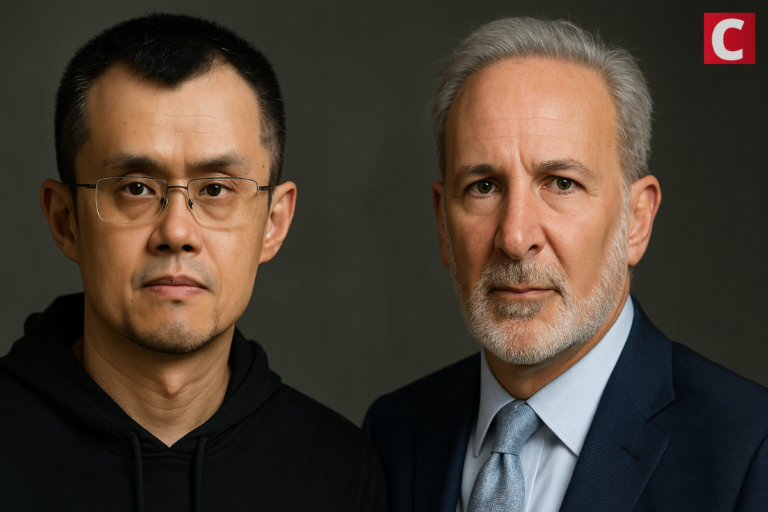

Binance’s CZ warns tokenized gold is not true on-chain gold and carries counterparty risk. Peter Schiff plans a tokenized gold product despite the limits

Bitcoin BTC $89 205 24h volatility: 1.1% Market cap: $1.78 T Vol. 24h: $40.51 B critic Peter Schiff is entering the real-world assets (RWA) tokenization space, planning to launch a tokenized gold product.

However, Binance founder Changpeng Zhao (CZ) pointed out that tokenizing gold is not the same as having physical gold on-chain.

Binance’s Changpeng Zhao on Limitations of Tokenized Gold

During a recent podcast interview, Gold buff Peter Schiff announced plans to launch a tokenized gold product.

Speaking on the development, Schiff said: “You’ll be able to buy gold on an app through your phone, the gold will be stored in a vault and then you will be able to effortlessly transfer ownership of gold to people you know or redeem it for physical gold.”

Peter Schiff reveals he will be launching a tokenized gold product

"You'll be able to buy gold on an app through your phone, the gold will be stored in a vault and then you will be able to effortlessly transfer ownership of gold to people you know or redeem it for physical gold" pic.twitter.com/mWCXVKj9v8

— Tengen (@Crypto_Tengen) October 23, 2025

Binance founder Changpeng Zhao has cautioned investors about the limitations of tokenized gold. He emphasized that such tokens do not represent “on-chain” ownership of physical gold.

Zhao explained that tokenized gold relies on trust in a third party to deliver the actual asset, potentially decades later, even amid management changes or geopolitical disruptions.

He referred to these as “trust me bro” tokens, highlighting the inherent counterparty risk.

Saying the obvious. Most people “in crypto” know this, most people “not in crypto” may not understand yet.

Tokenizing gold is NOT “on chain” gold.

It’s tokenizing that you trust some third party will give you gold at some later date, even after their management changes, maybe… https://t.co/KMYfz2dG04

— CZ 🔶 BNB (@cz_binance) October 23, 2025

The Binance founder noted that this fundamental reliance on trust is why gold-backed tokens have yet to achieve widespread adoption in the crypto market.

CZ recently suggested that Bitcoin could surpass gold in the future, following gold’s market cap reaching $30 trillion.

Responding to CZ, Schiff questioned the reliability of tokenized gold, comparing it to stablecoins and pointing out the long-standing trust in traditional gold storage.

People have trusted third parties to hold their gold for centuries. Brinks has been storing gold for over 160 years and has never lost an ounce. However, tokenized gold is the same custodial concept as stablecoins. Does this mean that you are against that entire industry too?

— Peter Schiff (@PeterSchiff) October 23, 2025

Gold Liquidity Coming To Bitcoin? Peter Schiff Says No

Following its all-time highs above $4,350 last week, the gold price has corrected over 6.5%.

Economist and gold advocate Peter Schiff has warned that Bitcoin could face a major downturn if gold’s recent volatility is any indication.

Schiff noted that gold’s 6.5% single-day drop amid panic selling highlights how quickly markets can reverse, suggesting Bitcoin could see an even sharper decline.

He added that instead of triggering a rotation from gold into Bitcoin, the correction might prompt investors to exit both assets. Schiff also pointed out the early sell-off taking place in Bitcoin-related stocks.

next