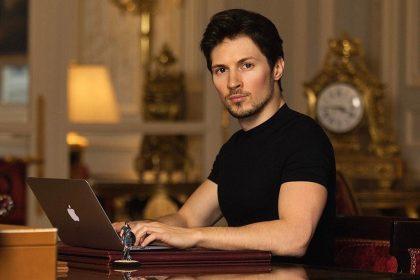

Telegram founder Pavel Durov along with the company’s vice president and one more employee will give testimonies beginning on the SEC case.

District Judge P. Kevin Castel of the New York Southern District Court, has signed a document which requires a deposition from three members of the Telegram team, as the case regarding its GRAM token sale continues. According to the document, Telegram founder and CEO Pavel Durov himself is expected to testify, along with two others.

Dated Nov. 25, the document states that the depositions will begin on December 10 with Telegram employee Shyam Parekh. Although it doesn’t state Parekh’s position at the company, the employee is involved as the name was a part of several letters Telegram had written to investors, which was leaked to the public following the Securities and Exchange Commission’s (SEC) decision to sue Telegram. The document specifies that Parekh’s testimony will be taken in London.

On December 16, Telegram Vice President Ilya Perekopsky will be deposed as well. Perekopsky was supposedly in charge of correspondence with investors and will have to be deposed at an agreed-upon location in London as well.

The order further states that CEO Durov’s deposition will be the last, and will take place on “January 7 or 8, 2020” and also compels the plaintiff to furnish Durov – as well as other defendants – with a list of topics for the deposition.

Telegram’s woes began last month when it was sued by the SEC and ordered to halt its proposed token sale, shortly before it was slated to begin. The SEC said that the GRAM tokens are unregistered securities and due process for the sale had not been properly followed and also that information had been withheld from investors. Telegram quickly filed with the United States District Court for the Southern District of New York to refute the SEC’s claims, insisting that the GRAM tokens were not securities. Regardless, the company did agree to temporarily discontinue floating the GRAM tokens until the court fully resolves the issues. Telegram also added that it was “surprised and disappointed” at the SEC’s decision to halt the sale and that it disagreed with the regulator’s ruling.

In its initial process with the SEC, Telegram filed a “Form D” application under Exemption 506(c), back in February 2018, which is a filing that allows a company to issue securities if they are only sold to accredited investors. The SEC’s position is that once GRAM launches, investors will be able to re-sell these tokens to unaccredited investors, thus breaking the rule.

Telegram has however still been going strong with its plans, and many exchange platforms, including Coinbase, have indicated interest to list the GRAM tokens as soon as it is available. The company also moved to keep its word to refund its investors because of the recent problems. However, investors have passed a vote of confidence, and have decided against receiving refunds.

Court case has been fixed for February 18 and 19, 2020.