Ripple’s Brad Garlinghouse pushes for a multichain digital asset reserve while Bitcoin proponents champion BTC’s exclusive suitability as a reserve currency.

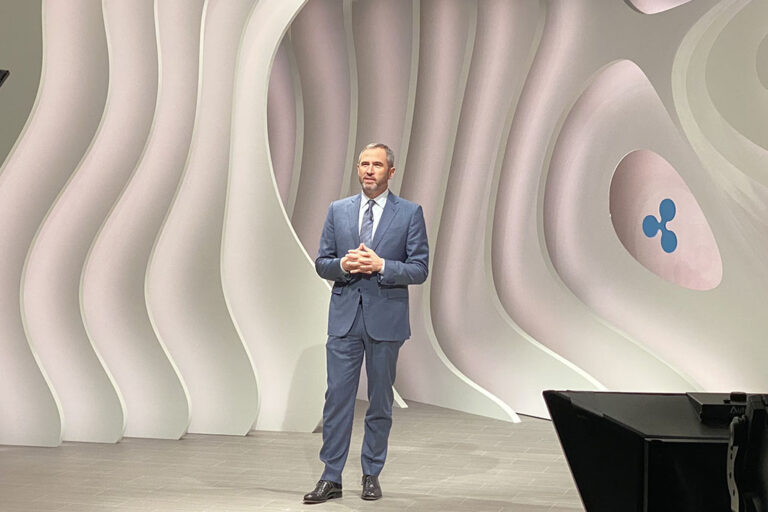

Brad Garlinghouse, the CEO of Ripple, has weighed in on the ongoing discussions surrounding the US government’s consideration of a national digital asset reserve. As the initiative, which originally focused solely on Bitcoin BTC $68 999 24h volatility: 0.6% Market cap: $1.38 T Vol. 24h: $39.70 B , gains momentum, Garlinghouse has stated the need for a multichain approach that represents a broad spectrum of cryptocurrencies, including XRP XRP $1.52 24h volatility: 4.2% Market cap: $92.71 B Vol. 24h: $4.86 B .

According to Garlinghouse, the cryptocurrency landscape should not devolve into a “winner-takes-all” scenario. Instead, he urged industry players to work together rather than compete divisively. Highlighting his personal holdings in XRP, Bitcoin, and Ethereum, he expressed his belief that future digital asset reserves should be diversified rather than solely favoring one token.

Maximalism: An Enemy?

Garlinghouse described maximalism — the view that one cryptocurrency is superior to all others — as a persistent “enemy” to the industry’s growth. However, he noted a gradual decline in this ideology. He stated:

“If a govt digital asset reserve is created – I believe it should be representative of the industry, not just one token.”

This idea aligns with many experts who argue that diversifying the reserve with other cryptocurrencies could provide better risk management and potentially higher returns. This is similar to how traditional reserves often include a mix of assets.

On the other hand, critics, particularly from Bitcoin-focused communities, remain skeptical. Riot Platforms Vice President Pierre Rochard and Messari CEO Ryan Selkis maintain that Bitcoin’s decentralized and limited supply makes it the most suitable reserve currency. They argue that including other altcoins would dilute the fundamental advantages that a Bitcoin-centric reserve offers.

The debate intensified following an executive order signed by President Trump on January 23, 2025. The order created a working group to draft new crypto regulations and explore a potential national cryptocurrency stockpile. Though the order did not explicitly mandate the creation of a reserve, it has fueled conversations on how the government might structure such an initiative.

States Push Forward with Bitcoin Reserves

As of writing, several states in the US are considering proposals to establish strategic Bitcoin reserves, with a total of nine states currently fielding such proposals.

Additionally, Senator Cynthia Lummis has proposed a federal Bitcoin reserve plan under which the US Treasury would acquire 200,000 Bitcoin annually for five years until the reserve reaches one million tokens.

Meanwhile, XRP has demonstrated a major recovery from Monday’s price slump. After dipping to $2.80, the token has rebounded to $3.10, reflecting a 12% gain in the past day. On the other hand, Bitcoin has also seen a 3.8% surge in its value, currently trading around $102,700.

next