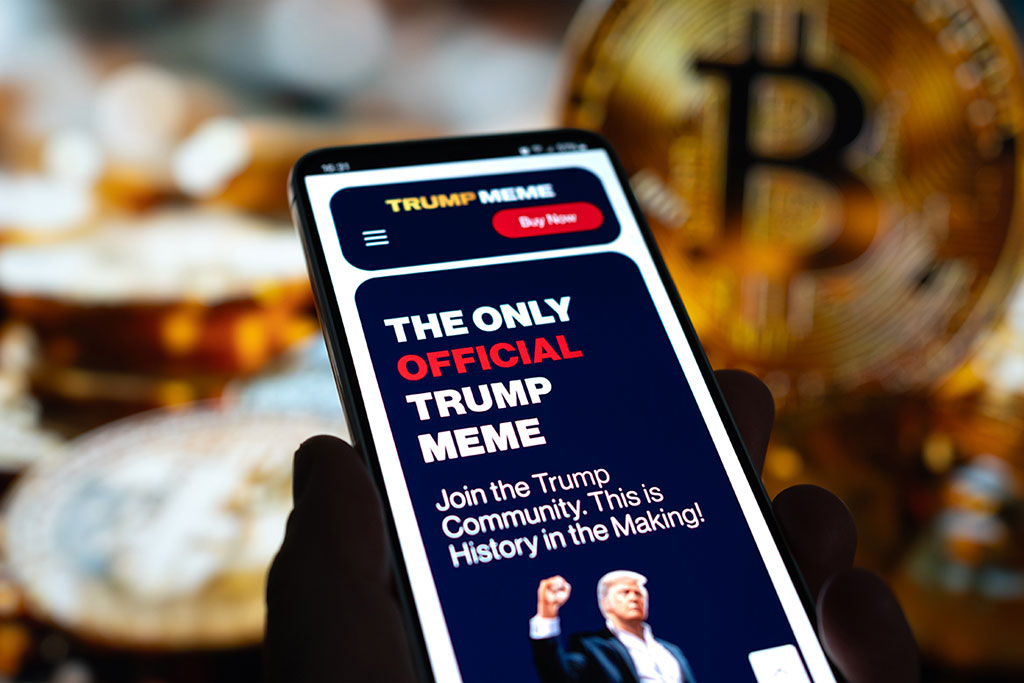

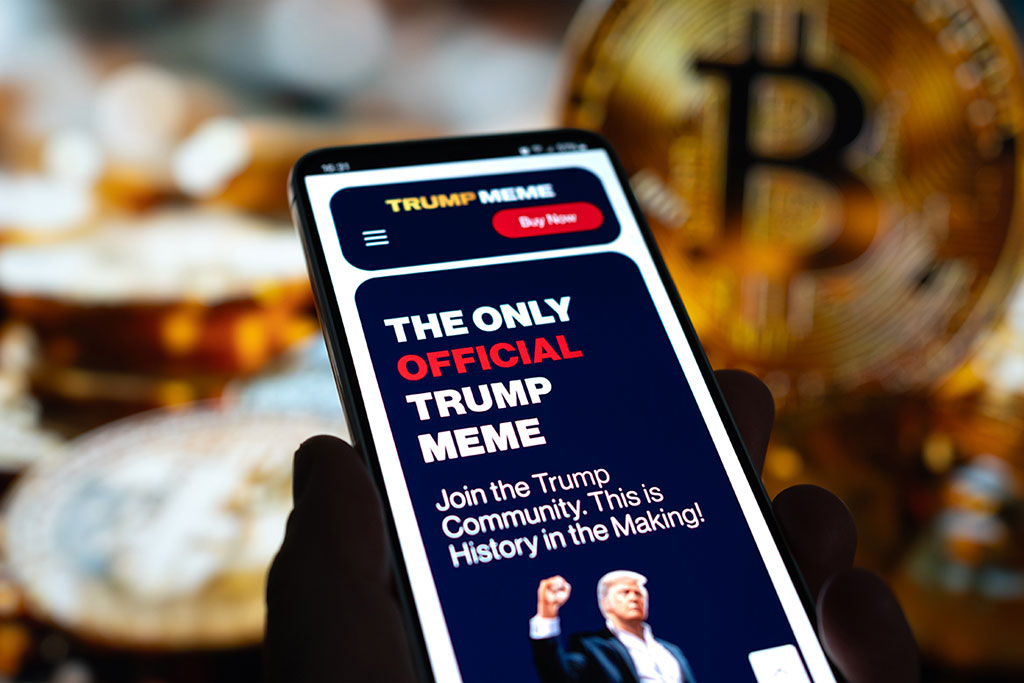

Ripple, Galaxy Execs Loaned $160M to MoonPay for TRUMP Meme Coin Launch

Despite its very impressive launch, the TRUMP token has since struggled in the crypto market. Prices have fallen over 79% from their January 19 peak.

CEO at Ripple.

Bradley Kent “Brad” Garlinghouse is CEO of financial technology company Ripple. He was formerly the CEO and Chairman of Hightail (formerly YouSendIt), the file sharing site. Prior to Hightail, he was President of Consumer Applications at AOL for two years, after his role as Senior Vice President at Yahoo! running its Communications business which included the Homepage, Flickr, Yahoo! Mail, and Yahoo! Messenger. While at Yahoo! he penned the famous Peanut Butter Manifesto calling for a shake up at the then fledgling Internet company.

Garlinghouse also had stints at Silver Lake Partners, Ventures, Home Network, SBC Communications and was CEO of Dialpad Communications. He is an active angel investor in over 40 companies including hardware company Pure Storage, AI startup Diffbot, and Indigo Agriculture. He is a board member at Animoto, and OutMatch, and previously held board positions at Ancestry.com, and Tonic Health.

Ripple

Feb 6th, 1971

American

California, United States

University of Kansas, BA in Economics

Harvard Business School, MBA

Ripple - CEO

Despite its very impressive launch, the TRUMP token has since struggled in the crypto market. Prices have fallen over 79% from their January 19 peak.

Bitcoin maximalists criticized Ripple, arguing that BTC is a superior store of value, while Brad Garlinghouse called for industry collaboration.

Ripple’s Brad Garlinghouse pushes for a multichain digital asset reserve while Bitcoin proponents champion BTC’s exclusive suitability as a reserve currency.

The US SEC has filed an appeal in the Ripple lawsuit, challenging the district court’s July 2023 decision that XRP transactions don’t qualify as “investment contracts”.

Analysts predict a 40% surge in XRP prices with the resumption of Donald Trump’s presidency, as they anticipate a favorable shift in crypto regulations.