Discover the 2025–2030 price prediction for PEPENODE (PEPENODE), a new GameFi project where players buy virtual miner nodes and up...

Discover the 2025–2030 price prediction for PEPENODE (PEPENODE), a new GameFi project where players buy virtual miner nodes and upgrade facilities to boost yield.

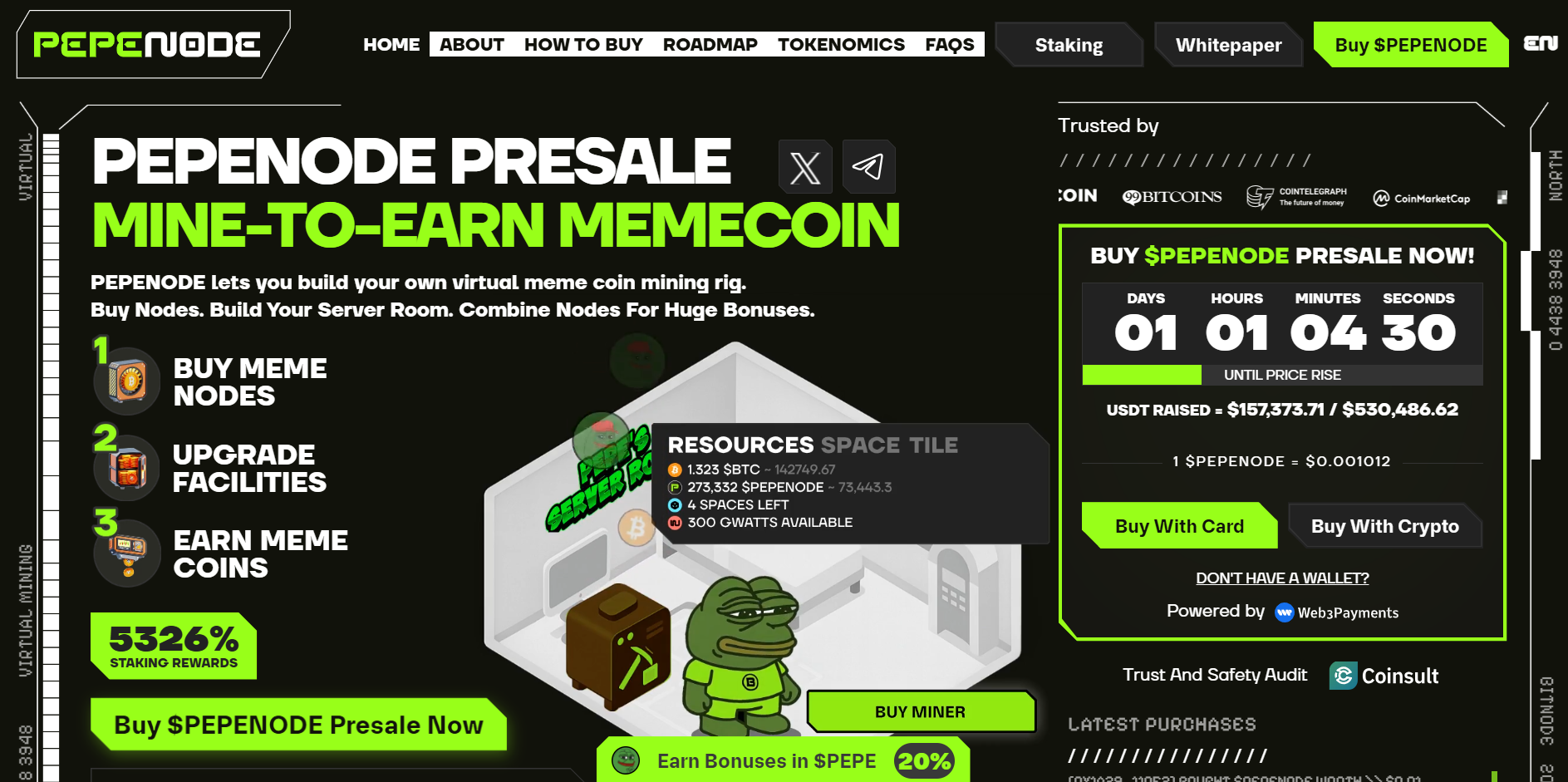

PEPENODE (PEPENODE) is an Ethereum-based GameFi project that combines meme-centric virtual mining and a presale structure. Inspired by the famous PEPE coin, there’s a growing network and a clear vision for decentralization behind the memes, which makes people believe this could be more than a short-lived trend.

The big question is can PEPENODE keep climbing or will it eventually run out of steam? While no one can say for sure, in this article, we will tell you what’s been driving its rise and where the PEPENODE price might be going next.

PEPENODE Key Facts and Price Prediction

| Metric | Data |

| Current Presale Price | $0.001 |

| Time to Next Price Increase | live countdown from the official site |

| Forecasted Launch Price | $0.01-$0.05 |

| Forecasted 2025 High | $0.05 |

| Forecasted 2030 High | $1+ |

| Blockchain | Ethereum |

| Use Case | GameFi virtual mining, staking rewards, meme token airdrops |

| Token Supply | 210,000,000,000 PEPENODE |

What Is PEPENODE?

Pepenode (PEPENODE) is an Ethereum-based project where players buy virtual miner nodes and upgrade facilities to boost yield. They do all this via a gamified interface, no physical hardware required.

Unlike most meme coin presales, the project’s main features are already live and users can start earning $PEPENODE and even some entrenched meme tokens like $PEPE or $FARTCOIN right now.

After the token generation event (TGE), it all goes fully on-chain.

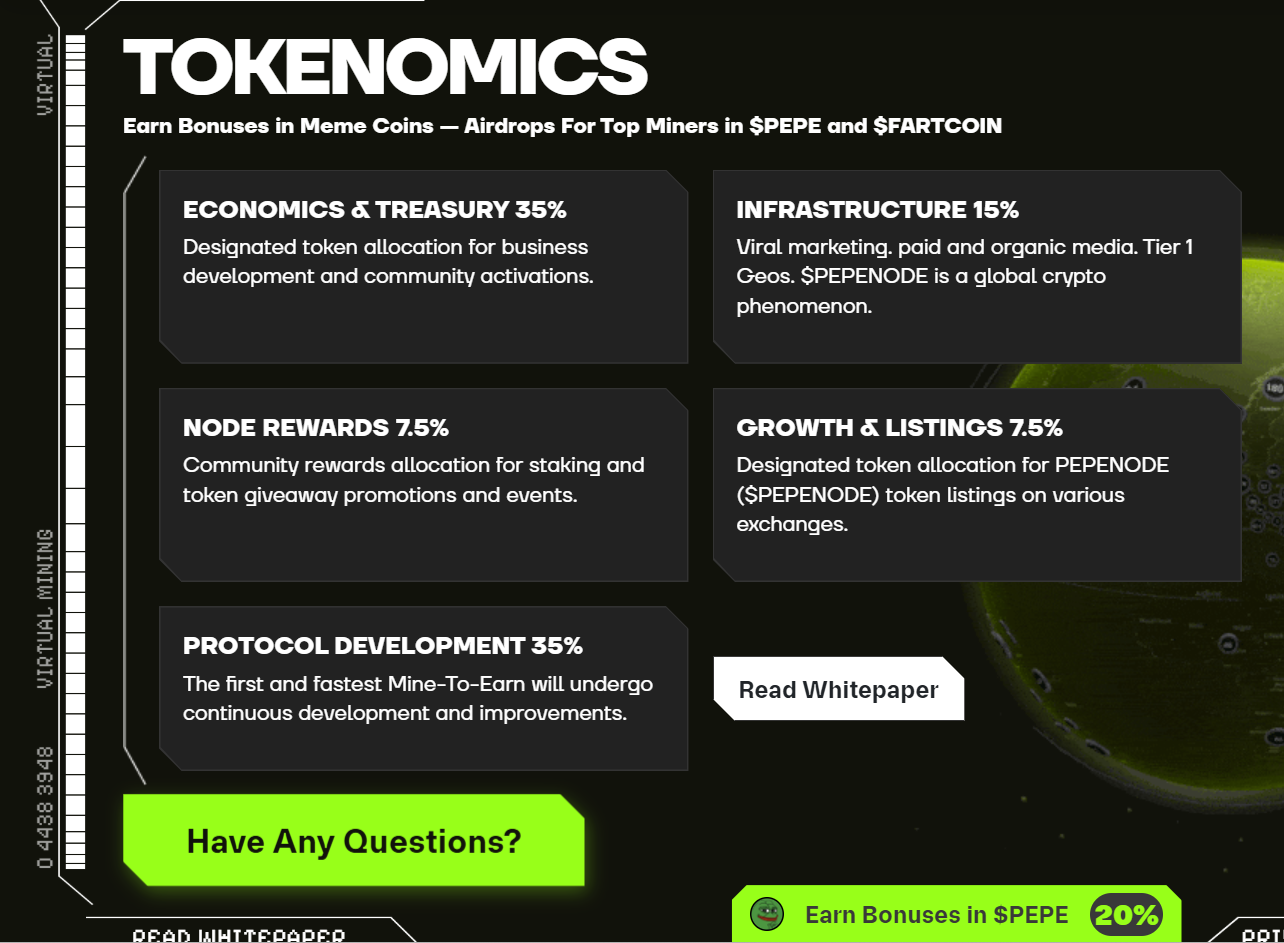

Approximately 70% of the tokens spent on upgrades are burned, resulting in a deflationary token over time. The tokenomics of the project allocate the 210 billion token supply as follows:

- 35% to protocol development

- 35% to the treasury

- 15% infrastructure and marketing

- 7.5% node rewards

- 7.5% growth and listings

Why Are Investors Watching PEPENODE?

PEPENODE is trending on the crypto market these days for several reasons. Here are a few reasons why this project is turning heads right now:

- Immediate gameplay utility: You are active from day one, not passively buying and waiting for a token listing.

- Deflationary pressure via heavy burning: If demand exists, the supply will shrink, which should increase the value of the token.

- Viral potential: Through leaderboard rewards and meme bonus drops.

- Transparent structure: Public presale with no private rounds and locked liquidity.

- GameFi resurgence: Interest in crypto gaming’s earning models is back after the lull.

- Contract audit: The smart contract of this project has been manually reviewed by Coinsult.

PepeNode Potential Price Growth

Let’s break this down by timeframe, flowing from practical conditions to speculative possibilities:

| Time Horizon | Key Drivers | Potential Price Range |

| Short-term (2025) | Presale hype, immediate staking, early virtual mining momentum | $0.01-$0.05 from $0.001 |

| Mid-term (2026-7) | Platform retention, viral gameplay, token burn impact | $0.05-$0.2 |

| Long-term (2028-2030+) | GameFi mainstreaming, utility, scarcity-driven demand | $0.5-$1+ |

Here, it is important to note that these are just speculations based on the current trends of the project. There is no guarantee that the current price will go upward in the long term.

Let’s take a look at what could lift PEPENODE’s price.

Short-Term (by the End of 2025)

- TGE and listings: If the token generation event lands and PEPENODE lists on DEXes like Uniswap, or CEXes, the liquidity-based price movement becomes possible.

- Early hype: Strong presale traction, active mining contests, and leaderboard buzz could push the price up to $0.01-$0.05 from a presale base price of $0.001.

Medium-Term (2026-2027)

- Gameplay retention: If miner upgrades remain sticky and the simulated mining continues to engage players, the value could stretch further.

- Utility growth: Partnerships, mobile UI, meme-mode integrations, and expanded mining mechanics could create higher demand.

Long-Term (2028-2030)

- GameFi mainstreaming: If virtual mining becomes a recognized niche, PEPENODE could be one of its first movers. The prices of $0.5-$1 or more could be plausible in this scenario.

- Scarcity and sustained demand: With 70% burning and a capped supply, even moderate demand could boost the price significantly.

Now that we’ve covered some of the main factors that could affect PEPENODE’s price, let’s lay out a more structured, realistic prediction scenario, based on the project design and tokenomics.

2025 (Post-TGE Launch Year)

Base case: Price hovers near presale value ($0.0001-$0.002).

Bullish: Breaking out to $0.01-$0.05 if it achieves widespread presale traction, listings go live on decentralized exchanges (DEXs), and new users engage with the GameFi mechanics.

Why this seems plausible: High APRs, deflationary burns, and meme incentives could pull bullish investor interest early on.

2026-2027 (Ecosystem Maturation)

Modest success: It may settle in the $0.05-$0.2 range if the gameplay loop sticks, community growth remains steady, and there are new utility or gamified features added.

Stretch goal: If Ethereum gas optimization and mobile adoption land, we could see a rise of $0.3-$0.5.

However, many presales stagnate without sustained roadmap delivery. This means that low-end traction is a real scenario, too.

2028-2030 (Extended Future Play)

Optimistic: If the virtual mining concept echoes into wider trends, it’s possible that $0.5-$1 could become a reality.

Aggressive dream scenario: Widespread adoption and tier-one listing could push the price even further to $1-$2.

Again, these are highly speculative targets and are only realizable with community connection, utility expansion, and a bit of luck.

Risks You Shouldn’t Ignore

Like all other new digital assets, PEPENODE comes with its fair share of risks. Yes, the hype can be exciting, but investors need to remember that market conditions can turn very quickly. Let’s take a look at the risks that you should be considering:

Liquidity concerns

Right now, PEPENODE is still in its presale stage and no one can be sure how liquid it will be at launch. Until it lands on a decentralized exchange or a major centralized listing, many traders may find it hard to move in or out without huge slippage.

Execution dependency

The project’s success leans heavily on the smooth delivery of its promises for game design, staking interfaces, and even the mining simulator. If any of these stumble, the hype could go away fast.

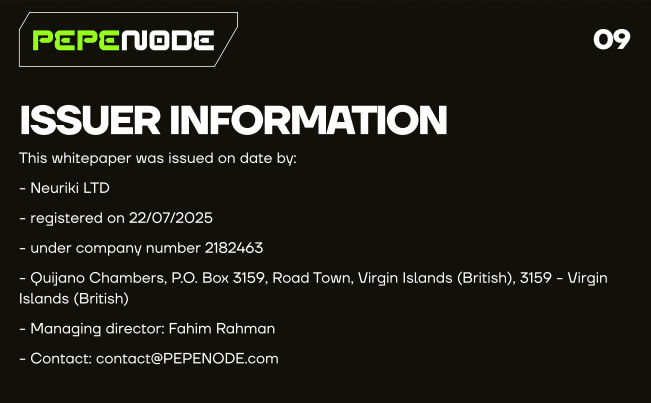

Limited team transparency (no audit)

The whitepaper lists the issuer Neuriki LTD and a managing director, but there are no individual developer bios or backgrounds anywhere online.

Presale fatigue

High APYs sound great, but they usually shrink as the supply unlocks or early backers cash out. This is very common in the crypto market.

Market cap volatility

A small or mid-range market cap can mean big price swings, both up and down. A single large trade from one of the many traders involved can seriously change the price.

Greed index influence

If the crypto market’s “fear and greed index” leans too far into greed, this can signal an overheated market, increasing the chances of a pullback.

Meme market saturation

There are many meme coins and projects on the market right now. When the cap for this type of digital asset space gets too crowded, hype can vanish almost overnight.

How to Buy PEPENODE

Getting in early in projects like this one is simple and can end up being highly profitable. The price of $PEPENODE rises as the presale continues, so those who buy early can get the most for their money.

Here is how one can buy PEPENODE on the market:

- Set up a wallet like MetaMask, Best Wallet, Coinbase Wallet, or WalletConnect.

- Fund the wallet with ETH, BNB, USDT, or USDC. You can also use a credit/debit card via supported wallets.

- Visit the official PEPENODE website, where you can connect your wallet.

- Choose the “Buy and Stake” option. This option will let you start mining immediately.

- Confirm the transaction. Make sure to factor in Ethereum gas fees once on-chain.

Post-TGE, you can claim your tokens and migrate fully on-chain to access new features.

Should You Invest in PEPENODE?

PEPENODE is still a small-cap token, which makes it highly volatile and risky. After launch, the prices could double in a week, but they could also drop significantly overnight.

PEPENODE is a bit of an underdog story in the meme coin world. Still, it has had a stronger start than most and is slowly building a following. It is already showing signs of genuine growth. If this momentum continues, the price could see some impressive gains over the next few years.

That being said, small-cap cryptos are always high-risk, high-reward. If you are thinking of getting in, it is best to do it with money you can afford to lose.

FAQ

What is PEPENODE?

What is the market cap of PEPENODE?

Is PEPENODE audited?

Who is behind PEPENODE?

How can I track PEPENODE’s price when it launches?

Is PEPENODE a good investment?

References

- What is Cloud Mining in Crypto – Coinbase

- What Is a Token Generation Event – GeniusYield Academy

- What Does It Mean to Burn Crypto – Investopedia

- What Does Locked Liquidity Mean – Bitcan

- What are Decentralized Exchanges, and How Do DEXs Work – CoinTelegraph

- APY vs APR: What’s the Difference – Coinbase

- What Is Slippage in Crypto – Kraken

- Official PEPENODE Project Website – PEPENODE

- ETH Gas Fees: What are Ethereum Gas Fees – Crypto.com

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The purpose of this in-depth guide is to answer the question: Is TOKEN6900 legit or a scam? Keep reading to learn more about our f...

Discover everything about the CoinFutures platform, including available futures markets, trading fees, and maximum leverage multip...

9 mins

9 mins

Tony Frank

Crypto Editor, 84 postsTony Frank is an accomplished cryptocurrency analyst, author, and educator whose work bridges the gap between complex blockchain technology and accessible, actionable insights for global audiences. Over the past decade, he has emerged as a respected voice in the rapidly evolving world of digital assets, combining technical expertise with a talent for storytelling to help readers navigate everything from Bitcoin’s monetary philosophy to the intricacies of decentralized finance (DeFi). Tony earned his Bachelor’s degree in Economics and Finance from the University of Melbourne, where he developed a deep interest in monetary systems and market structures. He later pursued a Master’s degree in Blockchain and Digital Currency from the University of Nicosia, one of the first academic institutions to offer accredited programs in cryptocurrency studies. Before focusing full-time on blockchain, Tony worked as a financial analyst for a multinational investment firm, covering emerging technologies and alternative asset classes. His early exposure to macroeconomic policy, global market behavior, and fintech innovation laid the foundation for his later work in crypto research and writing. Tony’s expertise spans multiple sectors of the blockchain industry, including cryptocurrency fundamentals, altcoin market cycles, DeFi and web3 trends and regulatory landscapes. Tony combines on-chain data analysis with macroeconomic research, providing readers with both the technical “how” and the market “why” of cryptocurrency movements.