After months of trial and error, we’ve come up with a proven methodology that we’ve used to identify the next crypto that could hi...

After months of trial and error, we’ve come up with a proven methodology that we’ve used to identify the next crypto that could hit $1.

After analyzing dozens of cryptos under $1 through presale data, market trends, and early adoption signals, we found that HYPER, MAXI, T6900, SNORT, and BEST are most likely to hit $1 in 2025.

Our methodology takes into account everything from tokenomics and liquidity to developer activity and listing rumors for both existing coins and brand new presales.

In this guide, we’ll break down the ten most promising cryptos under $1, compare what makes each special, and explain the market conditions that could push them past $1.

Key Takeaways for Best Crypto under $1

- Affordable doesn’t mean safe, since sub-$1 tokens can explode upward but crash just as fast.

- Narratives matter, and coins tied to themes like AI, scaling, or PayFi tend to attract more attention.

- Presales give early buyers an edge when projects like Bitcoin Hyper, Best Wallet, or Remittix gain traction before listings.

- Meme coins with strong communities, like Pudgy Penguins, usually last longer than purely hype-driven launches.

- Liquidity depth, balanced token distribution, and transparent leadership are decisive factors in distinguishing credible projects from opportunistic cash grabs.

Best Crypto Under $1 Likely to Hit $1 – Top Picks for 2025

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Dual-chain design with Ethereum and Solana integration

- Exclusive Alpha Chat community and trading utilities

- NFT ecosystem, gamified quests, and loyalty rewards

- Inspired by SPX6900 & early 2000s internet culture

- 80% supply in fair launch presale ($5M cap)

- Fixed-supply meme coin, no utility or minting

- Fastest meme coin sniper on Solana and EVM

- Multichain Telegram bot with lowest fees and instant execution

- Snipe new tokens before bots and whales

- Exclusive in-app access to vetted crypto presales

- Staking rewards with an annual percentage yield (APY) of up to 152%

- Upcoming Best Card enables crypto spending at millions of merchants with cashback

- Build your own virtual meme coin mining rig.

- 100% virtual and requires no additional computing power.

- Top miners get additional bonuses in Pepe, Fartcoin, and other meme coins.

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

11 Cheap Cryptos That Could Reach $1

Before we move on, let’s take a quick look at the fundamentals of the best cheap crypto to buy in 2025:

- Bitcoin Hyper (HYPER) – Bitcoin Layer-2 Solution Powered by Solana Virtual Machine

- MAXI Doge (MAXI) – Meme Coin Built on Leverage and Trading Culture

- Wall Street Pepe (WEPE) – Meme Coin With Exclusive Trading Alpha Group

- TOKEN6900 (T6900) – Meme Coin That’s Embraced Its Lack of Utility

- Snorter Token (SNORT) – Trading Bot Powered Through Telegram’s Interface

- Best Wallet Token (BEST) – Utility Token for a High-Growth Multichain Wallet Ecosystem

- Remittix (RTX) – Cross-Border Payments Platform For DeFi Apps

- Layer Brett (LBRETT) – Ethereum Layer-2 Packaged as a Meme Coin

- MobileCoin (MOB) – Privacy Payments Integrated With the Signal App

- Pudgy Penguins (PENGU) – Meme Coin Tied to One of the Biggest NFT Collections

- Nexchain AI (NEX) – Layer-1 Blockchain With Built-In AI Infrastructure

Next 10 Crypto to hit $1 – Reviews and Analysis

With fundamentals out of the way, let’s move on to our detailed reviews and analysis of each best crypto under $1:

1. Bitcoin Hyper ($HYPER) – Bitcoin Layer-2 Solution Powered by Solana Virtual Machine

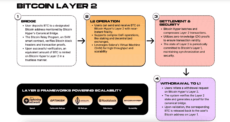

Bitcoin Hyper wants to solve Bitcoin’s biggest problems by building the first Layer-2 scaling solution for the Bitcoin blockchain.

The project processes over 65,000 transactions per second compared to Bitcoin’s 3 to 5 TPS and solves the network’s persistent speed and cost problems.

Bitcoin Hyper utility explained. Source: Bitcoin Hyper

We picked it because Bitcoin sits near all-time highs with massive institutional adoption, yet the network still can’t handle basic payment functionality.

Rather than competing with Bitcoin, they’re upgrading with a fast lane for transactions that still settle on Bitcoin’s main chain for security. The presale raised over $12.04M so far with tokens priced at $0.012815.

Project Details:

- Why It Could Hit $1: Bitcoin’s trillion-dollar market cap needs scaling solutions as institutional adoption grows. If Bitcoin Hyper captures a small fraction of Bitcoin transaction volume, demand for HYPER could explode.

- Suitable For: Traders who want exposure to BTC ecosystem projects.

- Community Growth: Since its launch in May, the project gathered over 18,000 Telegram members and 12,000 X followers

- Key Risk Factors: Anonymous team, vague technical documentation, slow Bitcoin ecosystem adoption, and the Lightning Network already exists as competition.

- Where to Buy: Presale runs on Bitcoin Hyper’s official website; accepts ETH, USDT, BNB through MetaMask, Best Wallet, and standard Web3 wallets.

| Category: | Layer-2 / Infrastructure |

| Chain: | Bitcoin Layer-2 (using SVM) |

| Launch Status: | In Presale |

| Current Price: | $0.012815 |

| Exchange Signal: | No confirmed listings yet |

| Community Size: | 18K+ Telegram / 12K+ X |

2. MAXI Doge ($MAXI) – Meme Coin Built on Leverage and Trading Culture

Maxi Doge reimagines the classic dog-themed meme coin through gym culture and extreme trading themes. The project has raised $1.6M since its July 2025 launch, with most funds coming in the first few weeks.

The Maxi Doge roadmap. Source: Maxi Doge Presale Website

This initial traction happened despite launching during a relatively quiet period for meme coins, which suggests a strong market interest in this niche. The team plans integration with futures platforms where MAXI holders can trade with 100x to 1000x leverage, though it’s not clear how they plan to execute this.

The presale is structured with 50 stages that start from $0.000253 and are going to end with $0.0002745, with a $15 million hard cap.

Project Details:

- Why It Could Hit $1: Combines Doge’s brand recognition with high-yield staking and trading incentives.

- Suitable For: Leverage traders who want a meme coin that matches their risk appetite and trading style.

- Key Risk Factors: No real utility, pure meme play, futures integration might never happen, and the market is saturated.

- Where to Buy: Presale runs on the Maxi Doge website. Accepts ETH, USDT, and card payments through Best Wallet and payment widgets.

| Category: | Meme / Lifestyle |

| Chain: | Ethereum |

| Launch Status: | In Presale |

| Presale Price: | $0.000254 |

| Exchange Signal: | No confirmed listings yet |

| Community Size: | 9.6K on X, and over 1,500 people on Telegram |

3. Wall Street Pepe (WEPE) – Meme Coin With Exclusive Trading Alpha Group

Wall Street Pepe wants to democratize profitable trading by giving retail investors access to the same alpha calls that whales use to dominate markets.

The project built a 1,300-member Alpha Chat where traders share strategies that members claim deliver 500% to 1,000% returns.

Wall Street Pepe has launched on Solana. Source: Wall Street Pepe

We picked it because other meme coins that don’t offer any utility, WEPE gives you access to a trading community with verifiable results.

The team behind it is building real value through collective trading intelligence that helps small holders compete against market manipulators.

The project raised $73.88 million in presale and now trades on both Ethereum and Solana with a burn mechanism that destroys tokens with every Solana purchase, which shrinks the supply and attracts demand from both networks.

Project Details:

- Why It Could Hit $1: Burn mechanism plus working Alpha Chat with real trading calls.

- Suitable For: Active traders who want alpha calls and will use the community features.

- Key Risk Factors: Anonymous team, unverified profits, dual-chain complexity, meme coin volatility.

- Where to Buy: Uniswap for ETH version, wallstreetpepe.com for SOL version

| Category | Meme with Trading Utility |

| Chain | Ethereum and Solana |

| Launch Status | Launched February 2025 |

| Current Price | $0.0000643 on Ethereum, $0.001 on Solana |

| Exchange Signal | Major CEX listings pending |

| Community Size | 68.5K Twitter / 23,000 Telegram |

4. TOKEN6900 ($T6900) – Meme Coin That’s Embraced Its Lack of Utility

TOKEN6900 operates as a pure speculation play with no utility or roadmap apart from community sentiment and trader interest.

That blunt positioning echoes the success of SPX6900, which reached a $1.5 billion market cap by leaning into absurdity rather than utility.

Token6900 homepage. Source: Token6900

TOKEN6900 already pulled in $2.77M within weeks, proving that self-aware satire still resonates within this market.

The project mocks the idea of use cases by claiming that buyers themselves become the utility. Ironically, that honesty makes it more trustworthy than tokens with roadmaps they never intend to deliver.

Project Details:

- Why It Could Hit $1: Clear parody narrative, strong presale raise, and links to a proven meme model.

- Suitable For: Meme traders, satire fans, and degens who buy into self-referential humor.

- Key Risk Factors: No real utility, sentiment-driven, and highly speculative by design.

- Where to Buy: Presale through the TOKEN6900 site; also supported via Best Wallet.

| Category: | Meme / Satire |

| Chain: | Ethereum |

| Launch Status: | In Presale |

| Presale Price: | $0.012815 |

| Exchange Signal: | No confirmed listings yet |

| Community Size: | 5,000 followers on X |

5. Snorter Token ($SNORT) – Trading Bot Powered Through Telegram’s Interface

Snorter Token pairs a Telegram trading bot with a utility token on Solana. The bot routes trades through a custom RPC infrastructure that beats public endpoints on speed, while the token unlocks lower fees and governance rights.

Snorter Token homepage. Source: Snorter Token

The technical setup solves real problems traders face daily. Transactions execute in under one second through private relayers, which matters when you’re competing for new token launches.

The honeypot detection system scans for blacklist functions and mint traps before trades go through, and it caught about 85% of scam tokens during beta testing.

Project Details:

- Why It Could Hit $1: Real-time trading utility, strong presale traction, and token-linked fee discounts drive demand.

- Suitable For: Traders who execute multiple daily transactions and want lower fees plus automated scam detection.

- Key Risk Factors: Reliance on bot performance, competition from other sniping tools, and execution challenges across chains.

- Where to Buy: Available through Snorter presale website. Accepts ETH, SOL, USDT, BNB, and card payments via standard processors.

| Category: | Trading Bot / Utility |

| Chain: | Solana / Ethereum |

| Launch Status: | In Presale |

| Presale Price: | $0.1025 |

| Exchange Signal: | No confirmed listings yet |

| Community Size: | 15K+ X, and 2.5K on Telegram |

6. Best Wallet Token ($BEST) – Utility Token for a High-Growth Multichain Wallet Ecosystem

Best Wallet is a non-custodial crypto wallet that already has over 500,000 users who manage assets across 60+ blockchains.

Users can swap tokens across 330 DEXs, stake for yields, and soon spend crypto through a debit card with 8% cashback. The presale raised over $15.18M in its ongoing presale.

Best Wallet presale page. Source: Best Wallet

BEST holders pay lower transaction fees, get higher staking rewards at 110% APY, and access new presales before public launch through the Upcoming Tokens feature. The wallet uses MPC technology for security without seed phrases, supports biometric authentication, and has never suffered a hack.

Project Details:

- Why It Could Hit $1: The wallet already processes thousands of daily transactions, and BEST directly links to fee reductions, staking, and presale access.

- Suitable For: Users who want a working product with immediate utility.

- Key Risk Factors: Competes with MetaMask, Trust Wallet, and other established players.

- Where to Buy: Best Wallet Token presale website or directly in the app. Accepts ETH, USDT, BNB, and cards through integrated payment processors.

| Category: | Utility / Infrastructure |

| Chain: | Multi-chain |

| Launch Status: | In Presale |

| Presale Price: | $0.025535 |

| Exchange Signal: | Launching DEXs first, CEXs later |

| Community Size: | 500K+ app users |

7. Remittix ($RTX) – Cross-Border Payments Platform For DeFi Apps

Remittix ties crypto utility directly to real-world payments. It supports crypto-to-bank transfers in more than 30 countries, and adds DeFi mechanics like staking and low-fee swaps.

Remittix presale homepage: Source: Remittix

It serves both everyday users who want cheaper transfers and DeFi traders who are looking for staking yields.

We added it to our list because it has a working product vision, it sits at the crossroads of global payments and decentralized finance, and it trades under $1 despite strong presale traction.

Project Details:

- Why It Could Hit $1: Real-world PayFi use cases get tens of thousands of users converting crypto to fiat quickly, and staking demand will likely rise once the wallet goes live.

- Suitable For: Investors who want exposure to functional crypto infrastructure, not volatile meme coins.

- Key Risk Factors: Aggressive competition in crypto‑fiat conversions and reliance on hitting exchange listings.

- Where to Buy: Available on the official Remittix presale platform. The token bonus up to 40% remains active until $20M funding triggers a BitMart listing.

| Category | PayFi / Crypto-to-Bank Utility |

| Chain | Ethereum (with cross-chain features) |

| Launch Status | In Presale; wallet beta Q3 2025 |

| Presale Raised | Around $20M raised so far |

| Exchange Signal | BitMart listing triggered at $20M |

| Community Size | 15K followers on X |

8. Layer Brett ($LBRETT) – Ethereum Layer-2 Packaged as a Meme Coin

Layer Brett positions itself at the intersection of meme culture and serious blockchain utility. It was built on Ethereum Layer-2 to deliver fast and low-cost transactions.

Layer Brett homepage. Source: Layer Brett

The project also integrates NFT rewards and gamified features to drive community engagement.

Instead of relying only on meme appeal, $LBRETT adds features that give people more reasons to use and hold the token. But it’s still questionable whether it can sustain momentum once the presale ends.

Project Details:

- Why It Could Hit $1: Strong presale traction, Ethereum-backed infrastructure, and a hybrid meme/utility model.

- Suitable For: High-risk traders who want exposure to speculative meme coins with additional staking incentives.

- Key Risk Factors: It relies on hype to some degree without proven utility.

- Where to Buy: Available in presale on the official Layer Brett site.

| Category | Meme Coin |

| Chain | Ethereum Layer-2 |

| Launch Status | In Presale |

| Presale Price | ~$0.0044 |

| Exchange Signal | No listings confirmed |

| Community Size | Growing presence across X & Telegram |

9. MobileCoin ($MOB) – Privacy Payments Integrated With the Signal App

MobileCoin focuses on fast, private payments built directly into messaging apps. The project integrates with Signal to give millions of users access to crypto transfers inside an app they already trust for private communication.

MobCoin homepage. Source: MobileCoin

Its design puts speed and simplicity first, with transactions settling in seconds and protected by strong cryptography.

While most privacy coins struggle with usability, MobileCoin hides complexity under the hood and delivers a product fit for mainstream adoption.

Project details:

- Why It Could Hit $1: It’s already deployed inside Signal, one of the world’s most used encrypted apps.

- Suitable For: It resonates with investors who value transaction privacy and traders who are looking for under-the-radar assets.

- Community Growth: Small but active following tied to the Signal ecosystem; momentum grows with each app update.

- Key Risk Factors: Regulatory pressure on privacy coins, limited exchange availability, and competition from other payment-focused chains.

- Where to Buy: Listed on exchanges like Binance, Kraken, and Bitfinex.

| Category | Privacy / Payments |

| Chain | Custom chain (MobileCoin) |

| Launch Status | Live since 2021 |

| Price | ~$0.22 |

| Exchange Signal | Listed on Binance, Kraken |

| Community Size | 22K followers on X |

10. Pudgy Penguins ($PENGU) – Meme Coin Tied to One of the Biggest NFT Collections

Pudgy Penguins is a meme coin tied to one of the most recognizable NFT collections in the market. The brand already has visibility through toys, licensing deals, and community-driven initiatives, which gives it more recognition than most meme projects.

Pudgy Penguins homepage. Source: Pudgy Penguins

The $PENGU token extends that brand into the crypto market and gives trading opportunities and community incentives for holders.

While its appeal still rests on meme culture, the connection to an existing NFT brand adds a layer of credibility and reach that new tokens usually don’t have.

Coin Details:

- Why It Could Hit $1: Large Web3 brand with a Solana-based token tied to content, events, and community access.

- Suitable For: NFT collectors, community-driven traders, and investors looking for utility with brand backing.

- Key Risk Factors: Dependence on brand strength, speculative sentiment, and the ability of Pudgy World to deliver on its vision.

- Where to Buy: Available on Solana DEXs and supported by major Solana wallets.

| Category | Meme / NFT Brand Extension |

| Chain | Ethereum |

| Launch Status | Live since 2024 |

| Price | $0.03148 |

| Exchange Signal | Listed on multiple CEX/DEX |

| Community Size | Large NFT + token following |

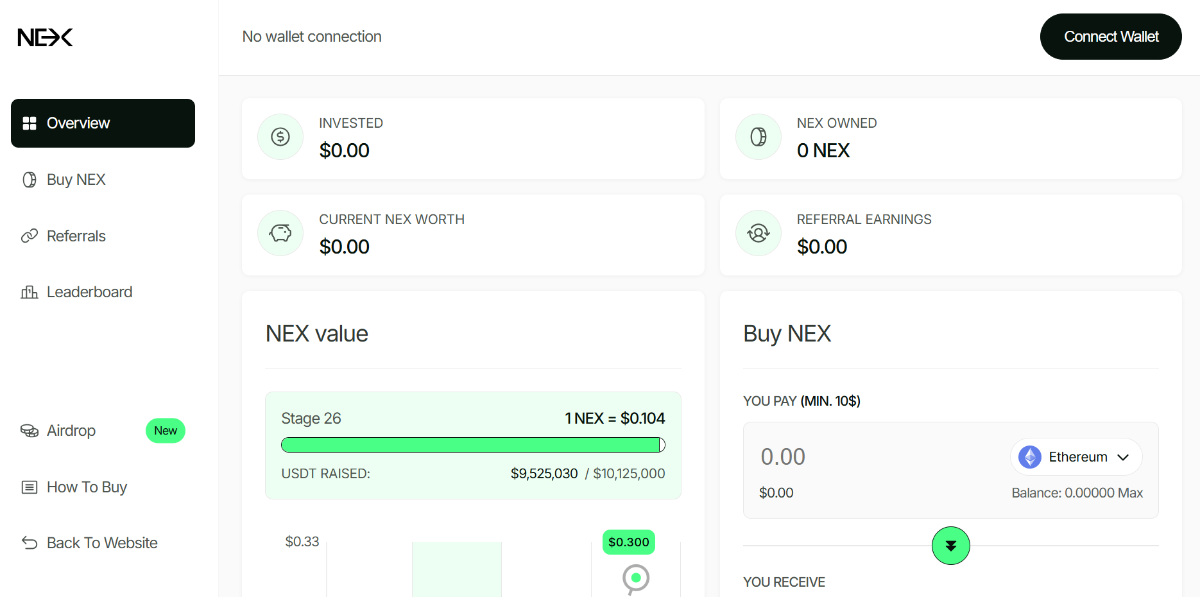

11. Nexchain AI ($NEX) – Layer-1 Blockchain With Built-In AI Infrastructure

Nexchain AI runs a Layer-1 network that integrates artificial intelligence directly into its development stack. Developers can already test contracts on their public network and access AI tools for automation, optimization, and model execution.

NexChain home page. Source: NexChain

The project raised more than $8.9 million in its presale, which shows that there’s clear market demand for this type of AI project.

Unlike chains that plug into third-party APIs, Nexchain embeds AI functions directly on-chain, which creates a tighter ecosystem and stronger developer control.

Coin Details:

- Why It Could Hit $1: Ongoing presale momentum and a niche focus on AI-powered contracts.

- What Makes It Unique: Native AI integration at the protocol level rather than external add-ons.

- Suitable For: Investors watching AI infrastructure, early adopters who want exposure to AI-crypto convergence.

- Key Risk Factors: Pre-mainnet risks, adoption hurdles, and direct competition from larger AI platforms.

- Where to Buy: Available through the Nexchain AI presale site.

| Category | Layer-1 / AI Infrastructure |

| Chain | Nexchain (AI-optimized blockchain) |

| Launch Status | Active presale (Stage 26) |

| Price | $0.104 per NEX token |

| Exchange Signal | Not yet listed on exchanges |

| Community Size | Growing through presale & testnet campaigns |

Next Crypto to Hit $1 Launch Timeline

To make things clear, we’ve laid out the key launch details and milestones for every token in one simple table:

| Token | Launch Date | Presale Ends | Listing | Milestone |

| Bitcoin Hyper ($HYPER) | May 14, 2025 | Expected Q3–Q4 2025 | Not yet listed | Raised $12.04M, Bitcoin Layer-2 scaling |

| Maxi Doge ($MAXI) | July 2025 | End expected Q3 2025 | Not yet listed | Raised over $1.6M in less than a month |

| Wall Street Pepe ($WEPE) | February 2025 | Ended in February | MEXC listed, majors pending | Raised over $70 million in presale |

| TOKEN6900 ($T6900) | June 30, 2025 | Expected late September 2025 | Not yet listed | $2.77M raised, meme satire theme |

| Snorter Token ($SNORT) | May 28, 2025 | October 31, 2025 | Not yet listed | Telegram trading bot + scam filter |

| Best Wallet Token ($BEST) | Q1 2025 (Presale live) | Estimated late 2025 | DEX first, CEX later | $15.18M raised, wallet utility token |

| Remittix ($RTX) | 2025 (Presale live) | Listing kicks in after $20M reached | BitMart confirmed | Beta wallet Q3 2025, PayFi features |

| Layer Brett ($LBRETT) | 2025 (Presale live) | Not confirmed | Not yet listed | High staking percentage |

| Pudgy Penguins ($PENGU) | Dec 17, 2024 | N/A (no presale) | Live on Binance, LCX & more | NFT brand token with wide listing rollout |

| Nexchain AI ($NEX) | April 2, 2025 | August 1, 2025 | Not yet listed | AI-native Layer-1 chain presale |

| MobileCoin ($MOB) | Dec 2020 | N/A | Listed across exchanges | Integrated into the Signal app for private payments |

Which under $1 Crypto Fits Your Investment Style?

Not every sub-$1 token appeals to the same type of investor. To make things clearer, here’s a look at how each project lines up with different profiles, the trend it’s part of, and the key trigger that could drive it toward $1:

| Coin | Investor Profile | Trend Theme | Key Price Catalyst | Listing Signal |

| Bitcoin Hyper ($HYPER) | Long-term utility | Bitcoin Layer-2 | Mainnet launch and first tier-1 listing | No listings confirmed |

| Maxi Doge ($MAXI) | High-risk degen | Meme + leverage culture | Futures platform integration and presale completion | No listings confirmed |

| Wall Street Pepe ($WEPE) | High-risk alpha seeker | Meme + alpha calls | Alpha Chat growth and burn mechanism impact | MEXC listed, majors pending |

| TOKEN6900 ($T6900) | High-risk degen | Parody meme | Viral momentum | No listings confirmed |

| Snorter Token ($SNORT) | Narrative trader | Telegram trading bots | User growth and fee-discount demand | No listings confirmed |

| Best Wallet Token ($BEST) | Long-term utility | Wallet infrastructure / MPC | App growth and token utility uptake | DEX first, CEX later |

| Remittix ($RTX) | Long-term utility | PayFi / crypto-to-bank | BitMart goes live at $20M raise and wallet beta | BitMart at $20M raise |

| Layer Brett ($LBRETT) | Yield hunter | Meme + L2 yield | High APY rewards and first CEX debut | No listings confirmed |

| MobileCoin ($MOB) | Long-term utility | Privacy payments | Signal user growth and new liquidity | Listed on Binance, Kraken |

| Pudgy Penguins ($PENGU) | Narrative trader | NFT brand token | Retail tie-ins and ecosystem rollouts | Listed on multiple CEX/DEX |

| Nexchain AI ($NEX) | Long-term utility | AI Layer-1 | Mainnet launch and developer traction | Not yet listed |

Why 2025 Could Trigger the Next Crypto to Hit $1

Let’s look at some of the reasons why 2025 might be one of the best years for the projects under the $1 valuation:

Alt-Season Rotation

Capital is shifting away from Bitcoin and into altcoins faster than expected. Bitcoin’s dominance fell from around 65% in May to 59% by August 2025, while the altcoin market cap surged over 50% to $1.4 trillion.

That repositioning of funds gives projects below $1 a potential to grow as investors turn to smaller projects.

Bigger Presale Rounds & VC Liquidity

Presale rounds are no longer raising a few million; the stronger ones are pulling in tens of millions before launch. With more funding, these projects can build faster and market harder, which gives them a better shot at climbing toward $1.

Meme-Coin Revival + Narrative Rotation

Meme coins are back in the spotlight, but this cycle isn’t only about memes. Narratives around AI, DeFi, and even politics are moving capital quickly from one sector to another. Tokens that fit the mood of the moment can rocket, and those starting under $1 have the most upside.

Looser US Exchange Appetite & ETF Tailwinds

Regulatory winds are shifting, and exchanges are opening up more space for listings. Combine that with ETFs and institutional money trickling back into crypto, and you get a flood of new liquidity. Smaller tokens often see the biggest benefit when this liquidity reaches beyond the top 20 charts.

The Risks of Investing in Cheap Crypto Projects

Just because a token trades under a dollar doesn’t mean it’s safe. In fact, low-priced coins often carry higher risks. Here are the biggest risks to watch out for:

Volatility

Daily price swings of 20% or more are common in low-cap tokens. Because these projects often trade in smaller pools with less volume, even a few big buys or sells can move the chart dramatically.

Investors who aren’t ready for this kind of turbulence can end up panic-selling or missing their exit.

Low Liquidity

Thin order books make entering and exiting positions costly. A single market order can cause heavy slippage, and sometimes it’s impossible to sell without crushing the price. For anyone putting in meaningful capital, liquidity is just as important as price.

Rug Pulls & Scams

Unaudited smart contracts, anonymous developer teams, and rushed presale structures open the door for bad actors.

Many sub-$1 tokens vanish overnight and leave buyers with worthless assets.

Exchange Delistings

Smaller caps often get listed on mid-tier exchanges, but if volumes dry up or compliance concerns arise, they can lose support quickly.

De-listing leaves investors stranded, unable to trade their tokens outside obscure decentralized pairs with near-zero liquidity.

How to Reduce Risk

- Diversify across sectors: Don’t go all-in on one theme like meme coins or AI. Spread exposure so one sector’s collapse doesn’t wipe out your portfolio.

- Vet tokenomics and contracts: Study inflation schedules, unlock timelines, and whether the project passed audits to spot red flags early.

- Prioritize doxxed teams: Tokens backed by visible, verifiable developers carry less risk than those run by anonymous figures.

- Watch community sentiment: Check Telegram, Discord, and Twitter. Healthy projects grow communities steadily, while scams rely on hype and spammy engagement.

How We Picked These $1 Crypto Contenders – Our Methodology

We analyzed hundreds of projects under $1 to find the ones with genuine potential to reach that milestone in 2025. Here’s the framework we applied:

Presale Performance & Funding Analysis (20%)

The presale stage reveals everything about market demand and investor confidence. Projects that cannot raise meaningful capital rarely survive long enough to approach the $1 mark, which is why this is the starting point of our evaluation.

We looked closely at how much a project raised in the first 48 hours compared to week ten, whether whale wallets or retail investors were driving the accumulation, and if the presale structure rewarded early participants without creating conditions for massive dumps later on. Another key factor was the allocation of supply, specifically, how much was made available to the public versus how much remained with the team and venture capital investors.

The best crypto projects to buy demonstrated clear signs of organic strength. They raised at least $1 million without leaning on paid celebrity endorsements, showed consistent funding growth rather than one-time spikes, allocated 60% or more of their tokens to public buyers, and implemented vesting schedules that prevented insiders from dumping tokens on the market.

Technical Feasibility & Market Fit (20%)

For a project to realistically reach $1, it must combine genuine technological execution with perfect market timing. We examined whether the technology actually worked in practice or was simply presented in a whitepaper. Delivery capability was another focus, assessed through the team’s past performance and track record. Audited smart contracts from reputable firms served as another trust marker, as did clear competitive advantages that set the technology apart from rivals.

Market timing was equally important. We asked whether the project aligned with prevailing crypto narratives such as Layer-2s, AI, or meme tokens, and whether there was existing demand for the product being built. The best cases were those where value could be understood by traders in under thirty seconds while also holding relevance six months into the future, rather than fading as a passing trend.

Exchange Listing Signals & Liquidity Planning (20%)

Exchange listings provide the liquidity that allows a token to climb toward $1. Our analysis focused on identifying projects that showed early signs of being positioned for major listings. Positive signals included a dedicated budget for exchange fees, daily decentralized exchange (DEX) trading volumes exceeding $500,000, a broad holder base of at least 5,000 wallets, and tokenomics structured to sustain healthy trading without creating heavy sell pressure.

Liquidity planning was another vital dimension. Projects that allocated more than 10% of their raise to liquidity pools, locked those pools for at least twelve months, and sustained trading activity without constant team interventions ranked higher. Additional confidence came from evidence that market makers were showing interest in supporting liquidity.

Community Quality & Growth Metrics (20%)

Community strength is what propels tokens to $1. To measure this, we looked for authentic engagement and avoided vanity metrics. Healthy projects showed organic growth rates between 20% and 50% monthly, with members creating content on their own rather than through bounty programs. Communities that fostered technical discussions alongside price speculation and maintained consistent activity across multiple channels were seen as especially promising.

In contrast, we eliminated projects that displayed obvious red flags, such as Telegram groups boasting 50,000 members but only 100 active users, Twitter accounts with huge followings yet negligible engagement, copy-paste shill activity across platforms, or communities that only came alive during price pumps.

Risk Assessment & Sustainability (10%)

Every token under $1 carries risk, but the difference lies in whether those risks are acceptable or fatal. Acceptable risks included anonymous teams with a proven delivery record, new technologies still awaiting market validation, competition from larger incumbents, or regulatory uncertainty in certain jurisdictions. These risks, while notable, did not automatically rule out a project.

However, dealbreakers were non-negotiable. We rejected any project without a working product after more than six months of development, teams that controlled over 40% of the token supply, smart contracts containing mint functions or hidden fees, developers with a history of failed projects, and tokens promoted through obvious paid campaigns with no organic traction.

Data Sources & Verification (10%)

To filter out manipulation and inflated claims, we relied on multiple independent data sources. On-chain analysis was performed through Etherscan and BSCScan, while DEXTools and DexScreener provided trading data. GitHub repositories revealed development activity, and audits from CertiK, Hacken, and Solidproof offered further validation.

Verification involved cross-referencing fundraising claims with actual on-chain transfers, comparing community size across different platforms, tracking wallet movements to identify coordinated activity, and weighing development commits against marketing announcements. This rigorous process eliminated 95% of projects claiming they could reach $1, leaving only those with measurable, verifiable potential.

What Does “Next Crypto to Hit $1” Really Mean?

When people ask what’s the next crypto to hit $1, they usually picture a coin exploding in value.

But the $1 milestone is only meaningful if you look at market capitalization and token supply. A token trading at $0.005 with a massive circulating supply might need hundreds of billions in market cap to ever touch $1, which makes it mathematically unrealistic.

To evaluate whether a coin can reach $1, you need to multiply its supply by that price and ask: Is this market cap feasible compared to other projects?

Dogecoin and Shiba Inu, for example, have shown that hype can push meme coins far, but both still struggle with huge supplies that limit upside.

Here’s a quick feasibility table that shows why not every sub-$1 crypto can make the leap:

| Price Now | Market Cap at $1 | Feasibility* | Precedent |

| $0.001 | $1B | Rare | DOGE, SHIB |

| $0.05 | $20B | Difficult | ADA, SOL (took years + listings) |

| $0.25 | $5B | Moderate | MATIC, XRP |

| $0.70 | $700M | Likely | Smaller caps with narrative tailwinds |

*Feasibility = relative odds based on supply, precedent, and exchange traction.

Examples of Coins That Already Hit $1

These cryptocurrencies started well below $1 and proved that massive price leaps happen when fundamentals align with market demand.

| Token | Start Price | Date Hit $1 | Time Elapsed | Key Driver |

| MATIC | $0.003 | May 2021 | ~2 years | L2 adoption surge |

| AXS | $0.12 | July 2021 | ~8 months | Play-to-earn boom |

| SAND | $0.05 | Nov 2021 | ~18 months | Metaverse hype |

| FTM | $0.02 | Oct 2021 | ~2.5 years | DeFi expansion |

| AVAX | $0.50 | Nov 2020 | ~3 months | ETH alternative |

Every successful $1 breakthrough combined a compelling utility narrative, major CEX listings like Binance or Coinbase, and viral community growth that created sustained buying pressure.

That’s why the coins featured in our 2025 picks were chosen not just because they’re cheap, but because they align with the right catalysts.

Early Signals That a Crypto Might Hit $1

Spotting the next crypto to hit $1 often comes down to watching the right early signals across on-chain data, social activity, and market traction.

Here are the cues that you should keep track of:

- Whale accumulation: When whale wallets begin accumulating tokens during low-volume periods, it often means institutional investors see future value.

- GitHub Commits Surge: A steady rise in developer activity is a good sign that the real features are being built behind the scenes.

- CEX Wallet Integration: Exchanges often integrate wallets quietly weeks before announcing a listing. Seeing this early is one of the clearest hints that a token may get wider exposure.

- DEX Liquidity Climbs: More liquidity on decentralized exchanges shows real money is flowing in, which reduces the slippage and gives the token stronger trading support.

Should You Bet on Crypto Under $1? Pros and Cons

Cheap tokens look tempting. After all, who wouldn’t want to grab thousands of coins for a few dollars? But whether the next crypto to hit $1 is truly a bargain depends on understanding the trade-offs.

- Massive upside potential: A token moving from $0.10 to $1 delivers 10x returns, while Bitcoin needs to hit $1 million for the same multiplier.

- Lower capital requirements: You can build meaningful positions with $500-1000, unlike blue-chip cryptos, where that barely buys a fraction of one token.

- Portfolio diversification: Small allocations across multiple sub-$1 projects spread risk and still expose you to high-profit potential projects.

- Community access: Smaller projects often have direct team communication and real influence on project direction through governance.

- Higher failure rate: About 95% of tokens under $1 never reach that milestone, with many going to zero instead.

- Liquidity problems: Low trading volume makes it hard to exit positions without massive slippage, especially during panic selling.

- Manipulation risk: Whale wallets can pump and dump prices easily when market caps stay under $100 million.

- Limited exchange access: Most sub-$1 tokens only trade on DEXs or sketchy exchanges with withdrawal issues and security concerns.

- Research difficulty: Finding reliable information requires extensive on-chain analysis since professional coverage rarely exists.

At the end of the day, coins under $1 can deliver big profits, but only if you size your bets wisely and do your research first.

Will Another Token Hit $1 in 2025? Final Verdict

The $1 price target keeps attracting investors with stories of tremendous gains, and those stories happen every bull cycle.

But for every MATIC or AXS that crossed $1, hundreds of projects promised the same and delivered nothing.

Most investors buy tokens under $1, thinking they’ve found the next breakout, then watch their investment evaporate through failed launches, abandoned development, or simple market indifference.

The projects we’ve analyzed show stronger potential than most tokens chasing that $1 milestone. Bitcoin Hyper and Best Wallet Token have the clearest path forward.

They’ve raised significant capital, built working products that people use, and demonstrated the early signals that historically precede major price movements.

FAQs

What is the next crypto to hit $1?

What are the best cryptos under $1 to buy?

Can a crypto under 1 cent reach $1?

Is it smart to invest in sub-$1 altcoins?

Which meme coins could hit $1 in 2025?

References

- Crypto Treasury Companies Risk – CoinDesk

- State of Solana 2025 – CoinDesk

- Better Standards for Meme Coins – CoinDesk

- Token Supply Explained – Binance Academy

- Tokenomics Deep Dive – Binance Research

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Crypto analyst specializing in meme coins, tokenomics, and community-driven projects. Provides in-depth reviews of presales, DeFi ...

Snorter Token ($SNORT) is a presale meme coin that powers a Telegram trading bot designed for meme coin sniping on Solana. Check o...

29 mins

29 mins

Filip Stojanovic

, 3 postsFilip is a crypto content expert who helps Web3 projects tell their story, grow their communities, and stand out in a crowded market. He’s worked with presale tokens, exchanges, and crypto marketing agencies to craft content that explains complex concepts in ways that inspire confidence and drive adoption. His work spans whitepapers, token launch campaigns, thought leadership articles, and deep-dive guides that connect projects with both seasoned investors and newcomers to crypto. With a background in B2B SaaS writing, Filip brings a structured, analytical approach to the fast-moving world of Web3. His clear, narrative-driven writing makes technical projects accessible and compelling. He’s particularly focused on how blockchain innovation intersects with real-world utility, whether that’s through DeFi, NFTs, or emerging infrastructure.