LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

According to our research, the top crypto stocks to invest in are HYLQ Strategy Corp. and Sol Strategies Inc. These growth companies offer innovative business models, small market capitalizations, and strong price momentum, which are key factors for long-term holders.

Crypto stocks offer exposure to the digital asset market without requiring investors to hold or manage coins. Publicly-listed companies are behind various products and services, from venture capital and Web 3.0 staking to Bitcoin mining and regulated exchanges.

This guide examines the best crypto stocks to buy in 2026 for long-term upside. Discover expert-driven stock picks from multiple crypto sectors, learn how to build a risk-averse portfolio, and follow best practices when making investments.

Best Crypto Stocks Key Takeaways

- Crypto stocks trade on public exchanges like the NASDAQ, TSE, and CSE.

- Buying stocks eliminates the need to secure private wallets.

- Investors own a slice of their chosen companies in a regulated environment.

- Key markets include crypto exchanges, proof-of-stake mining, venture capital, and staking.

- Company valuations range from low to large-caps, covering all investor profiles.

10 Best Crypto Stocks to Buy in 2026

Market research shows that these companies reflect the best crypto stocks to buy:

- HYLQ Strategy Corp. (CSE: HYLQ) – Holding Company That Invests in Web 3.0 Stocks With Long-Term Potential

- Sol Strategies Inc. (CSE: HODL) – Solana Treasury and Staking Validator with Strong Price Momentum

- Coinbase Global, Inc. (NASDAQ: COIN) — Regulated Crypto Exchange and an S&P 500 Constituent

- Robinhood Markets, Inc. (NASDAQ: HOOD) — Retail Brokerage with An Expanding Crypto Division

- Strategy Inc. (NASDAQ: MSTR) — The World’s Largest Corporate Owner of Bitcoin

- Bakkt Holdings, Inc. (NYSE: BKKT) — Institutional-Focused Digital Asset Infrastructure Provider

- MARA Holdings, Inc. (NASDAQ: MARA) — Tier-One Bitcoin Mining Company with 15 Global Data Centers

- Twenty One Capital, Inc. (NYSE: XXI) — Bitcoin Treasury Firm Backed by Tether and SoftBank

- Galaxy Digital Inc. (TSE: GLXY) — Diversified Digital Asset Services for Institutional Clients

- Hut 8 Corp. (NASDAQ: HUT) — Integrated Tech Operations Across Crypto Mining and Energy Infrastructure

Best Crypto Stocks to Invest In: Reviewed

Read on to learn more about the top crypto stocks to invest in. This section explains the fundamentals for each company, including its core business, financial standing, price performance, and long-term potential.

1. HYLQ Strategy Corp. (CSE: HYLQ) – One Stock Unlocks Exposure to Innovative Web 3.0 Investments

HYLQ Strategy Corp. is an investment holding company listed on the Canadian Securities Exchange (CSE). The firm was originally a diversified holding company but rebranded from Tony G Co-Investment Holdings Ltd. in June 2025 to focus almost entirely on the Hyperliquid ecosystem.

As of Q1 2026, the company holds 93,558.97 HYPE tokens after purchasing an additional 34,597 tokens at an average price of US$25.35 each.

HYLQ shares hit a 52-week high of CAD $6.79 before a sharp decline. The stock recently traded around CAD $0.90.

Editor’s Take: HYLQ holds BTC, ETH, SOL, and XRP in a single equity, which I think is undervalued given most peers are Bitcoin-only. It’s a smaller, earlier-stage play with more risk, but the multi-asset thesis makes sense if you believe the next cycle lifts more than just Bitcoin.

| Crypto Stock | HYLQ Strategy Corp. |

| Ticker | HYLQ |

| Core Business | Investment holding company |

| Primary Stock Exchange | CSE |

| Market Cap | CAD 17 million |

| 12-Month Performance | 276% |

2. Sol Strategies Inc. (CSE: HODL) – Invest in Solana’s Growth via a Regulated Staking Validator

Sol Strategies Inc. is a Canadian company that invests exclusively in Solana (SOL), the world’s largest ecosystem for meme coin trading. The stock’s value correlates directly to the Solana price.

The company provides additional value through its institutional-grade validator service. It allocates SOL into staking contracts, with annual yields averaging 7-8%. Investors have staked more than 3.67 million SOL through the validator, and management reinvests yields back into the company’s growth. This structure means that Sol Strategies Inc. has no dividend policy, so shareholders target returns only via capital gains.

HODL shares hit an all-time high of CAD $48.96 in January 2025 after a strong rally tied to Solana’s price surge. The stock has since dropped sharply and recently traded around CAD $2.28, down more than 95% from that peak. The company’s market cap sits at roughly CAD 64 million. In September 2025, Sol Strategies also listed on the Nasdaq under the ticker STKE after a 1-for-8 share consolidation.

Editor’s Take: The stock is down roughly 95% from its January 2025 high of CAD $49, yet ARK Invest and VanEck both selected Sol Strategies as their Solana staking provider, and the company holds ~395,000 SOL with ~90% gross margins. I believe this is one of the most asymmetric setups on the list if Solana reclaims momentum in 2026.

| Crypto Stock | Sol Strategies Inc. |

| Ticker | HODL |

| Core Business | Solana investing and staking |

| Primary Stock Exchange | CSE |

| Market Cap | CAD 63 million |

| 12-Month Performance | -78% |

3. Coinbase Global, Inc. (NASDAQ: COIN) – Leading US Crypto Exchange with a Strong Regulatory Framework

Traded on the NASDAQ, Coinbase Global, Inc. went public in 2021, opting for a direct exchange listing rather than a traditional initial public offering (IPO). The stock offers exposure to one of the largest crypto exchanges globally, with Coinbase now home to over 100 million verified users.

Institutional investors also use the platform. Coinbase provides custodian services for billions of dollars worth of digital assets, and in May 2025, the company was added to the S&P 500 index. In August 2025, Coinbase closed its $2.9 billion acquisition of Deribit, the world’s largest crypto options exchange. The combined platform now offers spot, futures, perpetuals, and options, with Deribit alone responsible for over $1 trillion in annual volume.

The Coinbase stock price correlates closely with wider crypto sentiment. COIN hit an all-time high of $444.65 in July 2025 but has since dropped to around $194, with a 52-week range of $142.58 to $444.65. In June 2025, its first full month as an S&P 500 component, COIN was the index’s top performer with a 43% gain.

The most recent quarterly report (Q3 2025) showed $1.87 billion in total revenue, $433 million in net income, and $801 million in adjusted EBITDA. Coinbase holds approximately $11.9 billion in USD resources and benefits from one of the strongest regulatory positions in the crypto industry. COIN shares currently carry a market cap of around $53 billion, so the stock is unlikely to deliver the same multiples as smaller-cap crypto plays.

Editor’s Take: Coinbase is the only crypto-native company in the S&P 500 and posted $6.6 billion in revenue in 2025, which tells me the business has moved well beyond speculation. I think its regulatory moat, plus revenue growth from Base L2, staking, and USDC interest income, makes it the closest thing to a blue-chip in crypto.

| Crypto Stock | Coinbase Global, Inc. |

| Ticker | COIN |

| Core Business | Regulated crypto exchange and custodian services |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $52 billion |

| 12-Month Performance | 31% |

4. Robinhood Markets, Inc. (NASDAQ: HOOD) — Retail Brokerage with An Expanding Crypto Division

Robinhood Markets, Inc. is a financial services platform best known for popularizing commission-free stock trading for retail investors. Listed on the NASDAQ, the company has expanded well beyond its original brokerage model and now offers crypto trading, staking, and custody services.

Crypto has become a significant part of the business. As of Q3 2025, the platform held $51 billion in crypto assets under custody and processed $232 billion in notional trading volume over the trailing twelve months. Crypto transactions accounted for over 43% of total transaction revenue in recent quarters.

In 2025, Robinhood completed a $200 million acquisition of Bitstamp to expand its institutional and global reach. The firm also rolled out Ethereum and Solana staking, launched perpetual futures in Europe with up to 7x leverage, and introduced tokenized U.S. stocks and ETFs across 30 EU and EEA countries. The company also announced Robinhood Chain, a Layer 2 blockchain built on Arbitrum for tokenized assets and around-the-clock trading.

Editor’s Take: With Q3 2025 net income of $556 million and crypto now at 43% of transaction revenue, I think Robinhood’s transformation into a crypto-native financial platform is underappreciated even after a ~200% run. The Bitstamp acquisition, Robinhood Chain, and EU perpetual futures give it multiple new revenue vectors for 2026.

| Crypto Stock | Robinhood Markets, Inc. |

| Ticker | HOOD |

| Core Business | Commission-free brokerage with integrated crypto trading, staking, and custody services |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $95 billion |

| 12-Month Performance | 200% |

5. Strategy Inc. (NASDAQ: MSTR) – Bitcoin Treasury Fund with Over $60 Billion Worth of BTC

Originally a business intelligence and software company, Strategy Inc. (formerly MicroStrategy) is now a fully-fledged Bitcoin treasury fund and one of the best crypto stocks to buy. With the NASDAQ-listed company now holding $60 billion worth of BTC, it’s the largest corporate Bitcoin investor globally.

According to company documents, the firm issues equity and convertible debt to fund its Bitcoin purchases. This financial structure means it buys BTC with borrowed funds, albeit at significantly low interest rates.

Some commentators claim that MicroStrategy Inc. is massively overvalued, as the firm trades with a much higher market capitalization compared to its Bitcoin holdings.

In early January 2026, MSCI decided not to exclude digital asset treasury companies from its indexes, which removed a major overhang. However, MSCI said it will conduct a broader review, so the risk of index exclusion has not fully disappeared. Next earnings are scheduled for February 5, 2026.

Editor’s Take: This is the highest-conviction Bitcoin bet on public markets, with over 471,000 BTC and an active $42 billion capital raise to buy more. From my perspective, the premium to net asset value only works if Bitcoin goes significantly higher, but if it does, MSTR’s leveraged structure captures outsized upside compared to spot BTC.

| Crypto Stock | Strategy Inc. |

| Ticker | MSTR |

| Core Business | Bitcoin treasury with a debt-focused funding model |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $107 billion |

| 12-Month Performance | 181% |

6. Bakkt Holdings, Inc. (NYSE: BKKT) — Institutional-Focused Digital Asset Infrastructure Provider

Bakkt Holdings, Inc. is a digital asset infrastructure company founded in 2018 by Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange. The firm provides crypto trading, custody, and payment solutions primarily to financial institutions, fintechs, and broker-dealers.

The company restructured its business in 2025, selling off its Loyalty division and simplifying its corporate structure. It now operates through three units. Bakkt Markets (institutional trading and custody), Bakkt Agent (stablecoin and payment solutions), and Bakkt Global (international expansion). The firm eliminated its long-term debt and ended Q3 2025 with $64.4 million in cash.

Bakkt reported Q3 2025 GAAP revenue of $402.2 million, up 27% year-over-year, with adjusted EBITDA of $28.7 million.

Editor’s Take: Bakkt is a contrarian pick. The stock is down ~40% over 12 months and the $350 million market cap looks tiny relative to Q3 revenue of $402 million and a debt-free balance sheet. I think the restructured three-unit model and institutional-grade custody make it either an acquisition target or a sleeper if crypto regulation opens institutional floodgates.

| Crypto Stock | Bakkt Holdings, Inc. |

| Ticker | BKKT |

| Core Business | Digital asset trading, custody, and payment infrastructure for institutions |

| Primary Stock Exchange | NYSE |

| Market Cap | $350 million |

| 12-Month Performance | -40% |

7. MARA Holdings, Inc. (NASDAQ: MARA) – One of the Top Crypto Mining Stocks to Buy in 2026

MARA Holdings, Inc. is one of the largest Bitcoin mining companies globally. Recent reports show that the firm operates multiple data centers across four continents, with key locations including the US, Paraguay, and the UAE.

While the firm remains invested in clean energy sources, it increasingly leverages natural gas resources to reduce operating costs. This is welcome news for MARA shareholders, who have witnessed a subpar price performance in recent times.

MARA shares trade around $9.49, roughly 60% below the 52-week high of $23.45. The stock has declined approximately 50% over the past 12 months. The most recent quarterly report (Q3 2025) showed $252.4 million in revenue, a 92% increase year over year, with net income of $123.1 million.

MARA currently trades at a trailing P/E ratio of around 5x, with a market capitalization of approximately $3.6 billion. However, forward earnings estimates are volatile since profitability is largely dependant on Bitcoin’s price.

Editor’s Take: MARA is the largest publicly traded Bitcoin miner with over 50 EH/s of hashrate and roughly 46,000 BTC on its balance sheet, which gives it a built-in floor most miners lack. I believe its move into AI/HPC adds a non-crypto revenue stream that could re-rate the stock if the market starts to price it as infrastructure rather than a pure miner.

| Crypto Stock | MARA Holdings, Inc. |

| Ticker | MARA |

| Core Business | Bitcoin mining company |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $3.6 billion |

| 12-Month Performance | -50% |

8. Twenty One Capital, Inc. (NYSE: XXI) — Bitcoin Treasury Firm Backed by Tether and SoftBank

Twenty One Capital, Inc. is a Bitcoin-focused company that began trading on the New York Stock Exchange in December 2025 following a SPAC merger with Cantor Equity Partners. The firm holds over 43,500 BTC, worth roughly $4 billion at the time of listing, which makes it the third-largest public corporate Bitcoin holder after Strategy (formerly MicroStrategy) and MARA Holdings.

The company is majority-owned by Tether, the world’s largest stablecoin issuer, and crypto exchange Bitfinex. SoftBank holds a significant minority stake. Jack Mallers, founder of the payments app Strike, serves as CEO.

Twenty One operates as a Bitcoin treasury company with plans to build additional revenue streams around Bitcoin-native financial services, including lending, capital markets advisory, and educational media. The firm publishes on-chain proof of its Bitcoin holdings for shareholder verification. Management has stated its primary goal is to increase “Bitcoin per share” over time.

Editor’s Take: As the third-largest public corporate Bitcoin holder with ~43,500 BTC, backed by Tether and SoftBank, this is as close to institutional-grade Bitcoin exposure as it gets without a spot ETF. I think the Bitcoin-per-share metric they’ve introduced could become an industry standard, and with Cantor Fitzgerald behind operations, I expect them to scale fast through 2026.

| Crypto Stock | Twenty One Capital, Inc. |

| Ticker | XXI |

| Core Business | Bitcoin treasury and planned Bitcoin-native financial services |

| Primary Stock Exchange | NYSE |

| Market Cap | $4-5 billion |

| 12-Month Performance | N/A (listed December 2025) |

9. Galaxy Digital inc. (TSE: GLXY) — Institution-Focused Investment Firm with Various Crypto Services

Founded in 2018, Galaxy Digital Inc. is a financial services and infrastructure company specializing in digital asset products for institutional clients. In May 2025, the firm completed a long-awaited direct listing on NASDAQ after years of regulatory hurdles, and now trades on both NASDAQ and the Toronto Stock Exchange under the ticker GLXY.

Core divisions include trading and derivatives, asset management, lending, staking validation, investment banking, and asset tokenization. Galaxy is also pivoting its Texas-based Helios data center campus — with 800 megawatts of approved capacity — away from Bitcoin mining and into AI and high-performance computing (HPC) hosting.

CoreWeave has committed to the full 800 MW under a 15-year lease expected to generate over $1 billion in annual revenue once fully operational. The first phase is scheduled for delivery in H1 2026, backed by a $1.4 billion project financing facility from Deutsche Bank.

Editor’s Take: Galaxy posted $505 million in net income in Q3 2025 and locked in a CoreWeave deal that could generate $1 billion+ in annual revenue once its 800 MW Helios data center is fully built out. In my view, the NASDAQ debut and pivot from crypto to AI/HPC infrastructure has fundamentally changed what this company is.

| Crypto Stock | Galaxy Digital Inc. |

| Ticker | GLXY |

| Core Business | Diversified portfolio of services includes mining, trading, investment banking, advisory, and staking validation |

| Primary Stock Exchange | TSE |

| Market Cap | CAD 10.43 billion |

| 12-Month Performance | 60% |

10. Hut 8 Corp. (NASDAQ: HUT) — Integrated Tech Operations Across Crypto Mining and Energy Infrastructure

Hut 8 Corp. is a Miami-based energy infrastructure platform that integrates power generation, digital infrastructure, and compute at scale. The company operates in four segments and holds a strategic Bitcoin reserve of 13,696 BTC worth approximately $1.6 billion as of Q3 2025.

Its power portfolio spans natural gas generation in Ontario and grid-connected sites across the U.S., including a 50/50 wind energy joint venture in Texas.

In early 2025, Hut 8 spun off its Bitcoin mining operations into American Bitcoin Corp. (NASDAQ: ABTC), a majority-owned subsidiary now trading publicly. This freed the company to accelerate its pivot toward AI and high-performance computing infrastructure.

In Q3 2025, Hut 8 reported revenue of $83.5 million, up 91% year over year, with net income surging to $50.6 million from just $0.9 million in Q3 2024. Adjusted EBITDA hit $109 million, up from $5.6 million. The company held $1.9 billion in cash and stablecoins and $3.2 billion in total equity at quarter end.Across 16 sell-side ratings, all analysts rate Hut 8 Corp. as a “strong buy”. However, the fundamentals fail to match the HUT price, with shares gaining just 15% in the past 12 months.

Editor’s Take: The $7 billion Fluidstack/Anthropic/Google deal alone justifies a second look, with projected annual NOI of $454 million from the initial 245 MW phase and potential to scale to 2.3 GW. I believe Hut 8 has executed the cleanest pivot from crypto to AI infrastructure of any company on this list.

| Crypto Stock | Hut 8 Corp. |

| Ticker | HUT |

| Core Business | Bitcoin mining company with third-party infrastructure services |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $6 billion |

| 12-Month Performance | 400% |

What Is a Crypto Stock?

A crypto stock is a publicly traded company that earns most or all of its revenue from the cryptocurrency industry.

This includes exchanges like Coinbase and Robinhood, Bitcoin miners like MARA and Hut 8, treasury companies like Strategy and Twenty One Capital that hold large amounts of BTC on their balance sheet, and infrastructure providers like Galaxy Digital and Bakkt that offer custody, trading, and financial services to institutions.

Crypto stocks trade on regulated exchanges like the NASDAQ and NYSE. That means you can hold them in a standard brokerage account, an IRA, or a 401(k).

They also come with corporate fundamentals you can analyze. Revenue, earnings, margins, and management decisions all affect the stock price independently of the broader crypto market.

How to Buy Crypto Stocks

Investors purchase crypto-related equities from traditional brokerage platforms, making them more accessible for beginners who aren’t comfortable using Bitcoin exchanges. This section explains the key steps when investing in crypto stocks.

Step 1: Choose a Stock Brokerage Platform

The first step is choosing an online brokerage that supports your preferred crypto stock. Market access varies widely depending on the stock exchange.

As a major US exchange, crypto-related stocks on the NASDAQ are available on most platforms, usually at 0% commission. NASDAQ-listed companies include MARA Holdings Inc., Coinbase Global, Inc., and Hut 8 Corp.

Interactive Brokers homepage showing investing market availability. Source: Interactive Brokers

Canadian exchanges, including the TSE and CSE, also host multiple crypto stocks due to their more relaxed regulatory framework. Many brokerages support Canadian-listed companies, although fees and account minimums vary depending on the provider.

The best practice is to use a low-cost brokerage with global exchange access. Interactive Brokers, for instance, supports thousands of equities from 36 countries and 160 markets, including the top crypto stocks to buy from the US and Canada.

Step 2: Open a Brokerage Account and Deposit Funds

Once you’ve chosen a brokerage, visit its website to register for an account. The process requires basic personal information, including your full name, nationality, residential address, and date of birth.

Most platforms have a know-your-customer (KYC) procedure to ensure regulatory compliance. KYC verification requires users to upload a government-issued ID and a recently issued proof of address, like a bank statement or energy bill.

After verifying your identity, make an account deposit with a supported payment method. Local bank transfers (e.g., ACH or Interac e-Transfer) are often instant and free, while debit/credit cards typically incur additional charges.

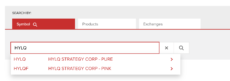

Step 3: Search for the Crypto Stock

Type the crypto stock’s name or ticker into the brokerage’s search bar.

Searching for HYLQ stock on Interactive Brokers. Source: Interactive Brokers

Note that some crypto stocks trade on more than one exchange, so ensure you select the right one. In the above example, Interactive Brokers shows two marketplaces for HYLQ – the CSE (PURE) and the Pink Sheets.

CSE is the best option for beginners, as the Pink Sheets are an over-the-counter (OTC) exchange that requires direct market participation.

Step 4: Set up a Stock Trading Order

Most trading sites support market and limit orders:

- Limit orders let users select an entry price. They’re executed when the target price aligns with real-time market prices.

- Market orders execute instantly at the next best available price.

Market orders are sufficient when buying crypto stocks with large market capitalizations like Coinbase Global, Inc., and MicroStrategy Inc., as these equities have significant liquidity.

However, if you’re trading smaller-cap stocks like HYLQ Strategy Corp., limit orders are a better option to reduce slippage risks.

Step 5: Buy Crypto Stocks

The final step is to select the investment size. Some brokers require users to purchase full shares, while others support fractional ownership, so you can typically invest any dollar amount.

Buying HYLQ stock on Interactive Brokers. Source: Interactive Brokers

Check the order details are correct and confirm. The brokerage executes the investment right away if you place a market order. Limit orders remain pending until the market matches the target price.

How to Pick the Best Crypto Stocks to Invest In

We use a weighted methodology to evaluate crypto stocks across six factors. Together they form a balanced framework for comparing companies with very different business models, risk profiles, and growth trajectories.

Revenue Quality and Diversification (25%)

This is the single most important factor. A crypto stock that relies on one revenue stream is far more vulnerable to downturns than one with multiple independent sources of income. Companies that score highest here have at least three distinct revenue lines, with no single source above 50% of total income.

Coinbase earns from trading commissions, staking yields, USDC interest, Base L2 fees, and institutional custody. Galaxy Digital generates revenue from advisory, trading, asset management, staking, and AI/HPC hosting. We also favor recurring income from staking or long-term leases over transactional trading commissions.

Balance Sheet Strength (20%)

A strong balance sheet separates companies that survive crypto winters from those that collapse during them. We evaluate total cash, debt-to-equity ratios, and the composition of any crypto treasury holdings. We favor companies with low or zero long-term debt.

Strategy Inc. and Twenty One Capital hold massive Bitcoin reserves that amplify returns in bull markets but also introduce significant downside risk. Hut 8 maintains $1.9 billion in cash and stablecoins. Companies with large crypto treasuries will see their balance sheets swing with the market, so we adjust for that volatility.

Strategic Catalysts and Execution (20%)

Forward-looking catalysts often matter more than historical performance. We evaluate announced deals, product launches, and strategic pivots that could materially change a company’s revenue trajectory within the next 12 months.

Hut 8’s $7 billion Anthropic/Fluidstack/Google deal and Galaxy Digital’s CoreWeave partnership both transformed those companies in late 2025. We score higher when catalysts are confirmed and contractually committed rather than speculative.

Risk Profile and Market Capitalization (15%)

Market cap directly affects both upside potential and downside risk. A large-cap like Coinbase at $90 billion offers stability but limited room for explosive growth. A micro-cap like Bakkt at $350 million carries more volatility but greater upside if the thesis plays out.

We also assess concentration risk. Sol Strategies ties almost its entire value to Solana, while Galaxy Digital spreads exposure across dozens of assets and business lines. Higher concentration means higher beta in both directions.

Historical Price Performance vs. Benchmarks (10%)

We compare each stock’s 12-month return against Bitcoin, the S&P 500, and its own sector peers. A crypto stock should outperform spot BTC over a full cycle to justify the additional risks of equity ownership.

This factor carries lower weight because past performance does not predict future returns. But consistent outperformance or underperformance reveals how well management converts crypto tailwinds into shareholder value.

Regulatory Positioning (10%)

Companies with strong compliance frameworks, multiple licenses, and major exchange listings face fewer existential risks. Coinbase holds a New York BitLicense and MSB registrations across all 50 states. Robinhood operates under full FINRA and SEC broker-dealer oversight.

We score higher when companies hold licenses that competitors cannot easily replicate. This factor also accounts for listing quality, since NASDAQ or NYSE access unlocks institutional capital, index inclusion, and options markets.

Investor Accessibility and Regulatory Framework

The best crypto exchanges for beginners are aimed at retail clients, yet first-time buyers are often intimidated by the investing process. Many exchanges operate without clear licensing frameworks, and the unregulated nature of cryptocurrencies presents safety concerns.

FTX was the biggest exchange collapse, with the now bankrupt platform mishandling billions of dollars worth of client funds.

While experts recommend withdrawing exchange assets to a private wallet, the process is far from beginner-friendly. Wallet hacks and scams occur frequently – victims cannot recover funds if hackers steal them, due to the blockchain’s decentralized structure.

When investing in crypto stocks, companies operate on regulated stock exchanges like the NASDAQ and CSE. Investors make stock purchases via licensed brokerage firms that must adhere to consumer protections. US-based platforms, for instance, must offer Securities Investor Protection Corporation (SIPC) insurance, which covers investor balances up to $500,000 in the event of bankruptcy.

Another safeguard is that hackers cannot steal shares, unlike digital assets. They’re registered on centralized databases, ensuring investors can prove equity ownership even if they lose access to their brokerage account.

Invest in Real Businesses

The best crypto stocks to buy provide exposure to real businesses with clear revenue streams. HYLQ Strategy Corp. makes money from diversified Web 3.0 investments, while MARA Holdings, Inc. is a Bitcoin mining company with physical infrastructure and global data centers.

Bitcoin mining output for MARA Holdings, Inc. Source: MARA Holdings, Inc.

In most international markets, publicly-traded stocks must release quarterly reports that outline company performance, including revenue, net income, debt, and assets. Investors can evaluate profitability, growth, and market risks in a transparent environment with real data.

Most cryptocurrencies operate without use cases, so they hold little to no intrinsic value. Even the best meme coins rely on hype, FOMO, and social media vitality, making them unattractive to traditional investors who seek long-term value.

Where to Evaluate Crypto Stock Financials

Beginners can use Google Finance to explore crypto stocks performance, including historical income statements and balance sheets, sector comparisons, and pricing data. Google Finance also provides accounting ratios like price-to-earnings (P/E) and price-to-book (P/B) – key factors when making a crypto stocks analysis.

The best practice is to add quarterly earnings to your financial calendar to ensure you’re up-to-date with the latest filings. For an added edge, you can listen to earnings calls in real-time, often on the company’s website.

Diversified Revenue Streams

Some crypto stocks have multiple income streams that cover various products and services, providing shareholders with diversified revenues and reduced market risk.

One example is Hut 8 Corp. The firm’s primary business is Bitcoin mining operations, with energy resources including hydro and nuclear power. It also provides services to third-party miners like physical infrastructure and maintenance. This diversification reduces Hut 8 Corp.’s exposure to Bitcoin price swings, unlike mining pure-plays.

Access Web 3.0 Startups Reserved for Institutional Clients

Several blockchain companies double as venture capitalists (VC), where they invest capital into Web 3.0 startups from the ground up. VCs often invest at the lowest valuation, giving shareholders a significant advantage over retail clients.

Solana’s public fundraising campaign offered SOL for $0.22, yet seed round investors paid just $0.04. This disparity reflects nearly an 82% discount for institutional buyers.

The most effective way for casual investors to access early-stage companies is via crypto-related stocks, such as HYLQ Strategy Corp. Shareholders benefit from HYLQ’s institutional privileges, as the firm’s net asset value (NAV) correlates to its stock price.

Tax-Advantage Accounts

Many countries offer tax-efficient accounts for stock investments.

US clients get tax advantages via individual retirement accounts (IRAs) and employer-sponsored 401(k) accounts. In the UK, residents invest up to £20,000 annually in Individual Savings Accounts (ISAs) without paying tax on potential gains.

Many brokerages offer these accounts internally, which helps reduce investing-related taxes.

Taxes to Pay on Crypto Stocks

In general, crypto-related stocks are taxed like other financial securities, although specific laws vary depending on the jurisdiction.

Investors typically only pay crypto tax on realized gains, which means they’ve disposed of their shares and made a profit. The key exception is if the stocks are held in a tax-efficient account, like IRAs or ISAs.

Pros & Cons of Buying Crypto Stocks

Let’s summarize the benefits and disadvantages of investing in crypto-related equities:

Pros

- Invest in real businesses with revenue-generating products and services

- Securities regulations require publicly-listed firms to release quarterly financials

- Some crypto stocks have highly diversified business models

- Investors make stock purchases via licensed brokerages

- No requirement to use crypto exchanges or manage non-custodial wallets

- Many countries offer tax-advantaged accounts for stock investments

Cons

- Stock prices don’t always correlate with the broader crypto markets

- Crypto stocks may be listed on international exchanges, increasing trading fees

- Micro-cap equities attract low trading volumes and weak liquidity

- You don’t directly own digital assets

- Only a handful of crypto-related companies are publicly traded

Crypto Trends & Emerging Technologies to Watch

The crypto ETF market has exploded since 2024. The SEC has now approved spot products for Bitcoin, Ethereum, Solana, and XRP, with 39 funds already live in the U.S. and over 125 additional filings in the pipeline. Bitwise and Galaxy Research both expect more than 100 new crypto ETFs to launch this year, with net inflows potentially exceeding $50 billion.

Stablecoin adoption is picking up fast after Congress passed the GENIUS Act in July 2025, the first federal framework for payment stablecoins. Total supply has already passed $269 billion, and 21Shares forecasts it could cross $1 trillion by year-end. JPMorgan, PayPal, Visa, and Mastercard have all moved into the space, and multiple banks are expected to launch their own stablecoins in 2026.

Real-world asset tokenization is another major change. The total value of tokenized financial assets grew from $5.6 billion to nearly $19 billion in 2025 alone. Analysts at SVB and Grayscale expect this to expand beyond Treasury bills into private credit, real estate, and consumer investment products this year.

AI and crypto are also becoming harder to separate. For every VC dollar invested into crypto companies in 2025, 40 cents went to a company also building AI products, up from 18 cents the year before.

Finally, the CLARITY Act cleared the House in 2025 with bipartisan support and is expected to reach the Senate floor this year. If passed, it would create the first full U.S. regulatory framework for digital assets, which could unlock a new wave of institutional capital across the entire crypto market.

Conclusion

Crypto stocks offer digital asset exposure via regulated financial securities. Companies must report financial statements quarterly, allowing investors to monitor performance, growth, and sector risks. Investors get involved via traditional brokerages with licensed frameworks, which ensures a smooth and secure investing process.

A limited number of crypto-related stocks are publicly traded, though, making diversification more challenging. There’s also a disparity between stock valuations and broader crypto prices, which may present opportunity risks. Ensure adequate research before proceeding, and consider adding non-crypto stocks to maintain a balanced investment portfolio.

FAQ

What are crypto stocks?

How do crypto stocks differ from cryptocurrencies?

Which companies are considered crypto stocks?

Do crypto stocks move in sync with Bitcoin prices?

Are crypto stocks safer than buying cryptocurrencies directly?

How can investors buy crypto stocks?

What risks are associated with investing in crypto stocks?

Do crypto stocks pay dividends?

How do regulations affect crypto-related stocks?

Are crypto stocks suitable for long-term investing?

References

- HYLQ Strategy Announces Purchase of Additional 5,000 HyperLiquid Tokens (Newsfile Corp)

- Coinbase is the Best-Performing Stock in the S&P 500 in June, and may Have Even More Room to run (CNBC)

- Coinbase Valued at $86 bln in Choppy NASDAQ Debut (Reuters)

- Strategy Makes Second-Smallest Bitcoin Purchase Since November (Bloomberg)

- Why Regulating DeFi is Necessary: The $20 Trillion Dollar Opportunity (NASDAQ)

- Hut 8 Corp. Analyst Ratings (The Wall Street Journal)

- What are the Different Canadian Stock Markets and Exchanges? (National Bank Direct Brokerage)

- ‘Old-Fashioned Embezzlement’: Where did all of FTX’s Money go? (The Guardian)

- The Securities Investor Protection Corporation (SIPC) Protects Customers if Their Brokerage Firm Fails (SIPC)

- Cryptoverse: Next Wave of US Crypto ETFs Already in the Pipeline (Reuters)

- Real-World Assets (RWAs) Explained (Chainlink)

- Stock Price and Company Data (Google Finance)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

31 mins

31 mins

Filip Stojanovic

, 45 postsI’m a crypto content strategist and writer who helps Web3 projects tell their story, build trust, and grow engaged communities in an increasingly competitive space. I’ve worked with presale tokens, exchanges, blockchain startups, and crypto marketing agencies, shaping content strategies that not only explain complex concepts but also inspire confidence, attract investors, and drive adoption.

My experience spans a wide variety of formats, from whitepapers, token launch campaigns, and pitch decks to thought leadership articles, technical documentation, and in-depth guides. Before diving into Web3, I built my expertise in B2B SaaS writing. This structured, analytical approach now underpins my work in crypto, allowing me to bring clarity and credibility to projects in a space often criticized for hype and jargon.

I’m especially interested in how blockchain innovation translates into real-world utility. My recent work explores the evolving role of DeFi protocols, NFT ecosystems, and next-generation infrastructure in reshaping industries and creating new opportunities for both businesses and individuals.