Is Bitcoin Hyper a legitimate project? In this article we analyze its team, tokenomics, utility, audits, and more.

Discover the best Bitcoin futures exchanges for 2025. Find the right platform for you, whether you are a beginner in Bitcoin trading or seeking advanced trading tools.

In this guide, we take a close look at the best Bitcoin futures trading platforms and help you decide which one is right for you.

Bitcoin futures trading offers an opportunity to place directional bets on Bitcoin and speculate on its future price. Futures trading allows for very flexible trading strategies and efficient use of capital with high leverage.

But it is important to choose the right futures trading platform so that you get access to the best trading tools and lowest fees. Hence our guide to the top BTC futures exchanges for 2025.

Key Takeaways

- Bitcoin futures let traders speculate on BTC’s price with leverage and flexible strategies.

- Top exchanges offer varying fees, leverage limits, and contract types.

- Platforms like Binance, OKX, and ByBit provide advanced tools for experienced traders.

- U.S. traders have limited options, with Kraken standing out domestically.

- We recommend CoinFutures for a simple, beginner-friendly way to trade simulated BTC futures.

The 6 Best Bitcoin Futures Platforms in 2025

Let’s dive straight into our list of the six best Bitcoin futures trading platforms to use today.

- CoinFutures – Trade simulated BTC futures with no KYC and no complexity

- MEXC – Low fee BTC futures trading with up to 500x leverage

- OKX – Widest range of tradable crypto futures contracts

- Binance – Perpetual BTC futures settled in Bitcoin

- Kraken – One of the few U.S. exchange for Bitcoin futures trading

- ByBit – Bitcoin futures platform with features for advanced traders and 100x leverage

A Closer Look at the Best Bitcoin Futures Trading Platforms

Now let’s take a closer look at each of our top-ranked Bitcoin futures exchanges so you can decide which one to use.

1. CoinFutures: Trade Simulated BTC Futures with No KYC

CoinFutures is a unique betting game from the gambling platform CoinPoker that has a lot of similarities to Bitcoin futures trading, but without the complexity.

CoinFutures uses simulated crypto price action and simulated buy and sell orders, rather than relying on real-time price data. So users do not need to worry about buying or holding crypto, using wallets, crypto market developments, or other types of analysis that typically go into Bitcoin futures trading. It makes for a much more simpler and beginner-friendly trading experience.

In CoinFutures, you make directional up or down bets on the future price of BTC and other popular cryptocurrencies. You can apply up to 1,000x leverage, far more than any other BTC futures exchange allows, and cash out whenever you want.

CoinFutures uses simulated trades for an easy futures trading experience. Source: CoinFutures

There are no changing contract prices to focus on. You simply pay a flat fee or cut of your trade profits for each bet (you choose which fee structure you prefer). You can keep your wager open and let winnings run as long as you like. The only limit is that if the token’s price reaches your bet’s bust price, your position will end and you’ll lose your wager.

CoinFutures is available around the world, including in the U.S., and doesn’t require any Know Your Customer (KYC) checks. You can sign up within a few minutes and start making bets on Bitcoin’s price action anonymously.

Pros

- Place directional bets on BTC price action without navigating real futures contracts

- No technical or crypto market analysis involved

- Apply up to 1,000x leverage

- Cash out positions anytime

- No KYC required

Cons

- Requires software download for Windows, Mac, or iOS

- Doesn’t offer trading on real Bitcoin futures contracts

2. MEXC: Lowest Fee BTC Futures Trading Platform

MEXC is one of the most popular crypto futures exchanges because it offers ultra-low fees. When trading BTC futures on this platform, you’ll pay just 0.01% if you create liquidity and just 0.04% if you take liquidity. If you hold the exchange’s native MX crypto token, you’ll also qualify for a 50% trading fee reduction.

MEXC trading platform showing BTC/USDT perpetual futures. Source: MEXC

You can trade BTC futures denominated in USDT, USDC, and BTC at MEXC, giving you a lot of flexibility to trade in the tokens you already own. Deposits in any of these tokens are free and withdrawals come with some of the lowest fees in the industry.

MEXC is also one of the top BTC futures exchanges for offering leverage. You can trade BTC/USDT perpetual futures contracts with up to 500x margin, compared to just 100x at most competing exchanges.

The trading futures platform includes powerful technical analysis tools, a demo trading environment, and a copy trading suite, giving you more ways to approach the Bitcoin futures market.

Pros

- Fees from 0.01%/0.04% for BTC futures trading

- Trade BTC/USDT perpetual with up to 500x leverage

- Supports BTC-denominated futures contracts

- Strong selection of trading tools, including copy trading

- Welcome and referral bonuses available

Cons

- KYC required for futures trading (not for spot trading)

- Limited customer support availability

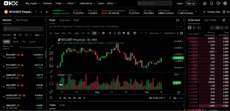

3. OKX: Widest Range of Crypto Futures to Trade

OKX stands out for offering the widest range of crypto futures contracts to trade of any major exchange. It has more than 640 contracts in total, including perpetual BTC futures denominated in USDT, USDC, USDG, and TRY. You can also trade a wide range of futures contracts denominated in BTC, such as ETH/BTC, SOL/BTC, and LTC/BTC.

These unique contracts allow you to make directional bets on how altcoins will move relative to Bitcoin, isolating macroeconomic movements in the cryptocurrency market.

OKX offers a generous 100x leverage on most Bitcoin futures contracts. Source: OKX

OKX offers up to 100x leverage on most of these Bitcoin futures contracts, although you’ll need to complete KYC checks on your account to gain access to margin trading. You can also find expiration-dated Bitcoin futures on OKX, which have more volatility since they become worthless after the expiration date.

The exchange has very deep liquidity for Bitcoin futures trading, as well as key tools like a copy trading platform and trading bots. OKX also supports demo trading and features technical charts from TradingView to assist you in conducting analysis.

However, the fee structure is complex and confusing, making it difficult to determine exactly how much you’ll pay for any trade. In general, you can expect to pay around 0.02% for makers and 0.05% for takers.

Pros

- Extremely wide range of BTC futures contracts

- Offers up to 100x leverage on most futures

- Expiration-dated BTC futures available

- Supports copy trading and trading bots

- User-friendly trading interface

Cons

- Confusing futures fee structure

- Not available in U.S., UK, or Canada

4. Binance: Perpetual BTC Futures Settled in Bitcoin

Binance is another user-friendly Bitcoin futures trading platform that offers a lot of different options for trading. You can trade perpetual BTC futures denominated in USDT, USDC, or BTC, as well as expiring futures that result in delivery of real BTC to your account when executed.

You can trade BTC/USDT perpetual contracts with up to 125x leverage, which is slightly higher than average.

Low fees and a strong reputation make Binance a great crypto futures exchange. Source: Binance

Futures trading fees at Binance start at 0.02% for makers and 0.05% for takers, but you can qualify for a discount just by holding Binance’s BNB token in your exchange account. There are also bonuses available when you participate in trading leagues or refer other traders to the exchange.

As the largest crypto exchange in the world, Binance has unparalleled liquidity and an incredibly advanced trading platform. You’ll find a huge array of technical analysis tools, crypto market news feeds, ready-made trading bots, a copy trading marketplace, and much more. Binance also supports advanced hedging strategies using Bitcoin futures, making it one of the top futures platforms for experienced traders.

Pros

- Perpetual and expiring BTC futures contracts

- USDT, USDC, and BTC-denominated contracts

- Fee discounts for holding BNB

- Expansive range of trading tools

- 24/7 live chat support available

Cons

- Not available in the U.S., UK, Canada, or the Netherlands

- Relatively high base trading fees

5. Kraken: Best U.S. Exchange for Bitcoin Futures Trading

Kraken is one of the only U.S. crypto exchanges offering perpetual BTC futures trading. There are more than 300 contracts available, although leverage for BTC/USDT is limited to 10x and the exchange has less liquidity than some of its globally dominant peers.

However, if you’re in the U.S. and looking for a place to trade perpetual BTC futures, Kraken is your best bet.

Kraken is one of the few U.S.-friendly exchanges to offer crypto futures. Source: Kraken

It’s worth noting that in addition to perpetual contracts, Kraken also offers trading on CME-traded futures contracts for BTC, ETH, and SOL. The Bitcoin and Micro Bitcoin contracts offer minimum tick sizes of $25 and $0.50, respectively, and both are settled in cash. These contracts expire on a monthly basis.

Kraken charges futures fees of 0.02% for makers and 0.05% for takers, but there’s no crypto token you can hold to get a discount. Trading fees are reduced only if you have at least $2.5 million in 30-day trading volume, which isn’t feasible for many traders. It’s also important to note that Kraken doesn’t support trading bots or copy trading for BTC futures.

Pros

- Offers 300+ perpetual futures contracts in the U.S.

- Trade CME-listed BTC and Micro BTC futures

- User-friendly trading platform

- Competitive trading fees for U.S. users

- Offers 24/7 live chat support

Cons

- Fee discounts available only with $2.5M+ in monthly volume

- Limited to 10x leverage for perpetual BTC/USDT futures

6. ByBit: Feature-rich Futures Exchange with 100x Leverage

ByBit is another popular Bitcoin futures exchange with a lot of features and a wide range of tradable assets. It offers more than 400 futures trading pairs, including USDT, USDC, and BTC-denominated contracts. Both perpetual and expiring contracts are available in all of these Bitcoin pairs.

ByBit has some of the most advanced tools for traders, with an especially comprehensive charting interface. Source: ByBit

ByBit offers the experienced trader an array of trading tools, including TradingView charts, premade trading bots, a copy trading platform, and a PnL simulator for futures positions. The exchange has also incorporated generative AI to offer AI-powered token analysis and strategy help. The trading platform is very easy to use, making it a good choice for beginners and advanced traders alike.

Trading fees start at 0.02% for makers and 0.055% for takers, with discounts available based on 30-day trading volume or account balance. Leverage is available up to 100x on most BTC futures contracts. Notably, ByBit suffered a major hack in early 2025, but the exchange used reserves to ensure no customers’ funds were affected.

Pros

- USDT, USDC, and BTC-denominated futures contracts

- Offers perpetual and expiring BTC futures

- PnL simulator and AI-powered analysis tools

- Very user-friendly trading platform

- Supports signal trading and conditional orders

Cons

- Suffered a major hack in 2025

- Limited support for fiat currencies

Top Bitcoin Futures Exchanges Compared

Here’s an overview of how our top-rated Bitcoin futures trading platforms stack up:

| No. of Futures Contracts | Maker/taker fee | Maximum Leverage | Accepted Countries | |

| CoinFutures | 11 | Flat fee or PnL fee | 1,000x | Global |

| MEXC | 400+ | 0.01% / 0.04% | 500x | Global, except U.S., Canada, and Singapore |

| OKX | 640+ | 0.02% / 0.05% | 100x | Global, except U.S., UK, Canada, Singapore, and Malaysia |

| Binance | 340+ | 0.02% / 0.05% | 125x | Global, except U.S., UK, Canada, and the Netherlands |

| Kraken | 300+ | 0.02% / 0.05% | 10x | Global |

| ByBit | 400+ | 0.02% / 0.055% | 100x | Global, except U.S., Canada, and Singapore |

What Are Bitcoin Futures?

Bitcoin futures are legal contracts that investors can trade among one another. They impose an obligation on the contract holder to buy or sell Bitcoin at a specific price on a certain future date.

In effect, Bitcoin futures allow individuals to make directional bets on the future price of BTC. If you believe the price of Bitcoin will increase in the next few weeks, you can purchase a BTC futures contract that expires in one month, which gives you the right to buy Bitcoin at its current market price. If the token’s price rises by the futures contract’s expiration date, you’ll earn a profit because you receive BTC at the contract’s strike price and can sell it at the now-higher market price for a profit.

Most futures contracts are exercised automatically upon expiration, and the profit or loss is settled in dollars or a stablecoin like USDT or USDC. However, there are some futures contracts that actually result in BTC changing hands, which we’ll cover in more detail below.

How Does Crypto Futures Trading Work?

Crypto futures can be complex, so it’s important to understand all the different ways futures trading can work.

In the example above, you simply bought a futures contract and then exercised it to turn a profit when your directional bet on the price of Bitcoin worked in your favor. If the trade went against you, you would realize a loss when the contract expired.

However, you don’t have to hold futures contracts until expiration. Bitcoin futures contracts themselves have prices, which fluctuate depending on how likely it is that a specific contract will result in a profit or loss at expiration. So, you can potentially earn a profit by buying a contract like the one described above, and then selling the contract at a higher price after the price of Bitcoin moves higher.

This creates opportunities for different types of strategies using Bitcoin futures as well as gives you flexibility to limit your risk from a trade. Many top Bitcoin futures trading platforms offer simulators, allowing you to calculate your potential profit or loss from a contract based on how the Bitcoin price moves over the duration of the futures contract.

How to Trade Bitcoin Futures

Now that you know the basics of Bitcoin futures, let’s walk through how to get started trading. We’ll use our top-rated platform, CoinFutures, as an example.

Step 1: Sign Up for CoinPoker

CoinFutures is a part of the CoinPoker crypto gambling platform, so you’ll need a CoinPoker account to play. Visit CoinFutures and click Register. Then enter your email address, a username for your account, and a password.

Register for CoinFutures / CoinPoker. Source: CoinFutures

CoinPoker doesn’t require any KYC check or ID verification, so you don’t have to provide any personal information. It’s completely anonymous.

Step 2: Download CoinPoker App

Next, download the CoinPoker app for Windows, Mac, or Android. Install the software on your device and open the platform.

Download the CoinPoker app for Windows, macOS, or Android. Source: CoinPoker

Step 3: Make a Deposit

Click the wallet icon in the CoinPoker dashboard to make a deposit. CoinPoker accepts a variety of popular cryptocurrencies including BTC, ETH, SOL, TRX, USDT, USDC, and BNB. You can also make a deposit using a credit or debit card or a bank transfer.

Start trading by making a deposit of your choice of cryptocurrency. Source: CoinPoker

Step 4: Navigate to CoinFutures

Click on Crypto Futures in the CoinPoker app dashboard to launch CoinFutures. Then select Bitcoin as the cryptocurrency you want to bet on.

Head to Crypto Futures to start placing your bet on price direction. Source: CoinPoker

Step 5: Place a Bet

Choose whether you think the price of Bitcoin will go up or down and enter the amount you want to wager. Then select a multiplier for your bet up to 1,000x. You can optionally select take-profit and stop-loss levels for your trade as well to cash out your position automatically. When ready, click Place Bet to open your position.

Place a bet, deciding if the BTC price will go up or down. Source: CoinPoker

Crypto Futures vs Crypto Options

Bitcoin futures are closely related to another type of derivative: Bitcoin options. The crucial difference is that while Bitcoin futures obligate you to exercise your contract at expiration, options give you the right, but not the obligation, to exercise the contract. Essentially, you have the option to allow options contracts to expire and become worthless.

This is important because it results in big differences in how futures and options work. The value of futures contracts depends only on price changes in the underlying asset. The value of options contracts, on the other hand, depends on the price of the underlying asset and how close the contract is to its expiration date.

Futures contracts have unlimited downside risk since they must be exercised. Options, on the other hand, limit your risk to the premium you paid to buy the contract. In addition, since options depend on time, they aren’t purely directional bets and can instead be used to speculate on volatility in Bitcoin’s price.

Ultimately, Bitcoin options are much more complex than Bitcoin futures and should only be used by experienced traders.

What You Need to Know Before Trading Bitcoin Futures

There are a few nuances to trading crypto futures that are important to understand before you start trading.

Perpetual vs Expiring Futures

All of the examples of futures trading we’ve covered above have focused on expiring futures contracts – that is, contracts that expire on a specific date and are automatically exercised at that time.

However, many exchanges now offer perpetual Bitcoin futures, which never expire. With perpetual futures, you get to decide when to exercise your contract. Perpetual futures have become very popular because they offer more flexibility than expiring contracts.

Many exchanges offer perpetual Bitcoin contracts that do not expire. Source: ByBit

Importantly, perpetual futures require a funding rate to be applied at regular intervals (usually every eight hours) to keep the contract price in line with Bitcoin’s spot price. Essentially, if the Bitcoin perpetual futures contract price is higher than the BTC spot price, long holders must pay a fee to short holders. If the contract price is lower than the spot price, short holders pay a fee to long holders. These fees can impact the profitability of a perpetual futures position.

Settlement Currencies

Bitcoin futures always trade in pairs with other currencies and the profits or losses from a contract being exercised are usually settled in that other currency without any Bitcoin actually trading hands.

For example, most BTC futures are denominated in USDT or USDC, stablecoins that are always worth around $1. When a contract is exercised at its expiration date, the buyer and seller realize profits or losses in USDT or USDC rather than transacting BTC with one another. The Chicago Mercantile Exchange (CME) also offers Bitcoin futures that are settled in U.S. dollars.

However, there are also BTC-denominated contracts in which Bitcoin is used as the settlement currency. These work the same way as USDT or USDC-denominated contracts, except that BTC actually does trade hands when the contract is exercised.

Margin Types

There are two types of margins offered at most Bitcoin futures exchanges: cross margin and isolated margin.

Cross margin uses all of the positions across your exchange account to supply collateral for your trades. This reduces liquidation risk since profitable positions can serve as collateral for leveraged positions that lose money. However, you have less control over the risk associated with any single trade and your entire account balance is at risk if a trade goes very badly.

How margin trading works versus other forms. Source: Binance

Isolated margin requires you to assign collateral to each individual trade. It requires more capital management and doesn’t enable you to use all of the funds within your exchange account to support new trades. However, your maximum risk for any single trade is clearly defined and it’s much easier to predict when a specific position could be at risk of liquidation.

In general, newer traders should stick to isolated margin for Bitcoin futures trading. Cross margin should be used very carefully as it puts your entire account balance at risk.

Risk Management Tools

Most major Bitcoin futures trading platforms offer risk management tools to help you minimize your losses and maximize your profits.

The most important of these tools are different order types that enable you to automatically close positions when they go against you. Stop loss orders automatically sell your BTC futures contract if the price of Bitcoin falls below a level you specify. This can enable you to lock in unrealized profits or limit the amount of money you can lose when a trade goes against you.

Take-profit orders automatically sell your BTC futures contract if the price of Bitcoin reaches a level you specify. This allows you to close your trade early to lock in profits.

Another important risk management tool is a demo account, which lets you practice Bitcoin futures trading in a simulated environment using virtual money. It’s a good idea to use a demo account to practice your futures trading strategy and ensure you can be consistently profitable before trading in a live account.

Some exchanges also offer a PnL simulator. This allows you to visualize the potential outcomes from a Bitcoin futures trade under different market scenarios. You can use these simulators to understand your risk if Bitcoin’s price were to reach a specific price level.

Benefits of Trading Bitcoin Futures

Trading Bitcoin futures can have a number of advantages over spot trading. Here are a few of the key reasons why Bitcoin futures trading has exploded in popularity.

Go Long or Short Bitcoin

A major benefit to trading Bitcoin futures is that you can make a directional bet in either direction. That’s a big plus for short sellers, who can face limited liquidity and high borrowing costs for trying to short BTC in spot markets (and many exchanges don’t support short selling at all).

So, if you think the price of Bitcoin is going to fall, you can use Bitcoin futures to try to profit from that movement.

Efficient Capital Allocation with Leverage

Bitcoin futures contracts can be traded with 100x leverage or more at many exchanges, enabling you to take relatively large positions with very small amounts of capital. This is important because it enables individual traders who don’t have hundreds of thousands of dollars to earn large profits from small price movements.

Since leveraged futures positions don’t require much capital, they also enable you to spread the capital you have across more positions. This is key for hedging and diversifying your portfolio, thus minimizing your risk to any one token.

Extremely High Liquidity

Bitcoin futures markets trade with incredibly deep liquidity. Bitcoin futures trades can be executed instantly 24/7 without worrying about slippage.

In addition, although liquidity in spot BTC isn’t an issue at most exchanges, deep liquidity in the futures market is a very important benefit for trading around other tokens that aren’t as popular as Bitcoin.

Low Trading Fees

Trading fees for Bitcoin futures contracts are very low for makers and takers, especially compared to trading fees for spot Bitcoin. ByBit, for example, charges just 0.02% for makers and 0.055% for takers in its Bitcoin futures market, but 0.1% for all spot Bitcoin trades. That’s a 50x higher fee for makers trading spot BTC!

These reduced fees can add up to significant savings and make more of your trades profitable.

Doesn’t Require Owning BTC

Many crypto traders prefer to own stablecoins like USDT and USDC rather than BTC, which is notoriously volatile in price. When trading spot Bitcoin, you have to own BTC in order to profit from price changes.

However, when trading Bitcoin futures, you never have to take ownership of actual Bitcoin. Most contracts are denominated in and settled in stablecoins like USDT or USDC, which helps protect your account from Bitcoin’s volatility.

Supports Hedging Strategies

Another reason to use Bitcoin futures contracts is to hedge against other positions in your portfolio. For example, if you have a large bullish trade open with spot BTC, you can open a short Bitcoin futures position to hedge. If the price of Bitcoin falls, profits from your futures position will help make up for lost value in your spot position. If the price of Bitcoin continues to go up, the profits from your spot position can more than offset any losses from your futures position.

Pros & Cons of Bitcoin Futures Trading

Here’s a full overview of the benefits and drawbacks of Bitcoin futures trading.

Pros

- Support long and short directional bets

- Highly leveraged positions possible

- Deep liquidity with little to no slippage

- Reduced trading fees compared to spot BTC trading

- Can hold positions in stablecoins like USDT or USDC

- Supports hedging strategies

Cons

- Directional bets have unlimited risk

- Leveraged trading magnifies losses and adds liquidation risk

- More complex than trading spot cryptocurrencies

Conclusion

Bitcoin futures contracts give traders more flexibility to trade around the price of Bitcoin. They let you take directional positions with high leverage and low trading fees. Futures trading has deep liquidity and many exchanges now offer perpetual Bitcoin futures with no expiration dates.

Based on our analysis, the best Bitcoin futures trading platform today is CoinFutures. CoinFutures lets you bet on simulated BTC price action without the complexity of real Bitcoin futures. You can trade with up to 1,000x leverage, cash out at any time, and there’s no KYC required.

References

- Hackers Steal $1.5 Billion from Exchange Bybit in Biggest-ever Crypto Heist (CNBC)

- How Perpetual Futures Differs from Traditional Futures and Why It Matters for Crypto (The Digital Chamber)

- Using Futures to Hedge Against Market Downturns (Charles Schwab)

FAQ

What is the best Bitcoin futures exchange?

What are perpetual Bitcoin futures?

Are Bitcoin futures risky?

How much money do I need to trade Bitcoin futures?

Should I trade Bitcoin futures or options?

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Meme coins are a unique category of cryptocurrency often inspired by internet jokes, viral culture, and fun online communities.

Discover the best Bitcoin futures exchanges for 2025. Find the right platform for you, whether you are a beginner in Bitcoin tradi...

Fact-Checked by:

Fact-Checked by:

23 mins

23 mins

Ibrahim Ajibade

, 167 postsIbrahim Ajibade is a seasoned research analyst with a background in supporting various Web3 startups and financial organizations. He earned his undergraduate degree in Economics and is currently studying for a Master’s in Blockchain and Distributed Ledger Technologies at the University of Malta.