Discover the 2025–2030 price prediction for PEPENODE (PEPENODE), a new GameFi project where players buy virtual miner nodes and up...

Discover everything about the CoinFutures platform, including available futures markets, trading fees, and maximum leverage multiples.

CoinFutures, backed by the established CoinPoker brand, offers simulated crypto futures with 1000x leverage. The platform allows long and short positions with a $1 minimum requirement, making it a popular choice with casual crypto traders.

But is CoinFutures safe and legit? This CoinFutures review covers everything you need to know. We tested the CoinFutures desktop and mobile software for key metrics, including licensing, supported assets, fees, and withdrawal times. Read on for our findings.

CoinFutures Key Takeaways

- CoinFutures offers simulated crypto futures, which track price movements in real-time.

- At 1000x, users get the highest leverage multiples in the market.

- The provider appeals to short-term traders who want to trade both market directions.

- With just 11 supported digital assets, CoinFutures lacks asset diversity.

- Key benefits include no KYC requirements, instant withdrawals, and robust platform security.

CoinFutures: Benefits and Drawbacks

Our CoinFutures review discovered the following pros and cons:

Pros

- Trade cryptocurrencies with leverage of up to 1000x

- Profit from rising and falling prices via long and short trading

- $1 is the minimum trade requirement

- Backed by CoinPoker, a regulated platform that launched in 2017

- Provides audited proof of reserves and ringfenced Fireblocks vaults

- Most withdrawal requests are processed instantly

- Users open accounts without providing personal information or KYC documents

- Also offers regulated sports betting and casino games

Cons

- Complicated fee structure

- The iOS app is under development

- Trades are liquidated when the markets trigger bust prices

- Simulated futures do not reflect real asset ownership

- Supports a limited range of cryptocurrencies

An Overview of CoinFutures

Part of the CoinPoker group, CoinFutures is an online trading platform that specializes in simulated crypto futures. Traders speculate on crypto price movements without owning the underlying coins or tokens.

While CoinFutures does not suit long-term investors, the platform is ideal for short-term strategies like swing trading and day trading. Crypto traders go long and short via “Up” and “Down” buttons, providing trading opportunities in bullish, bearish, and sideways markets.

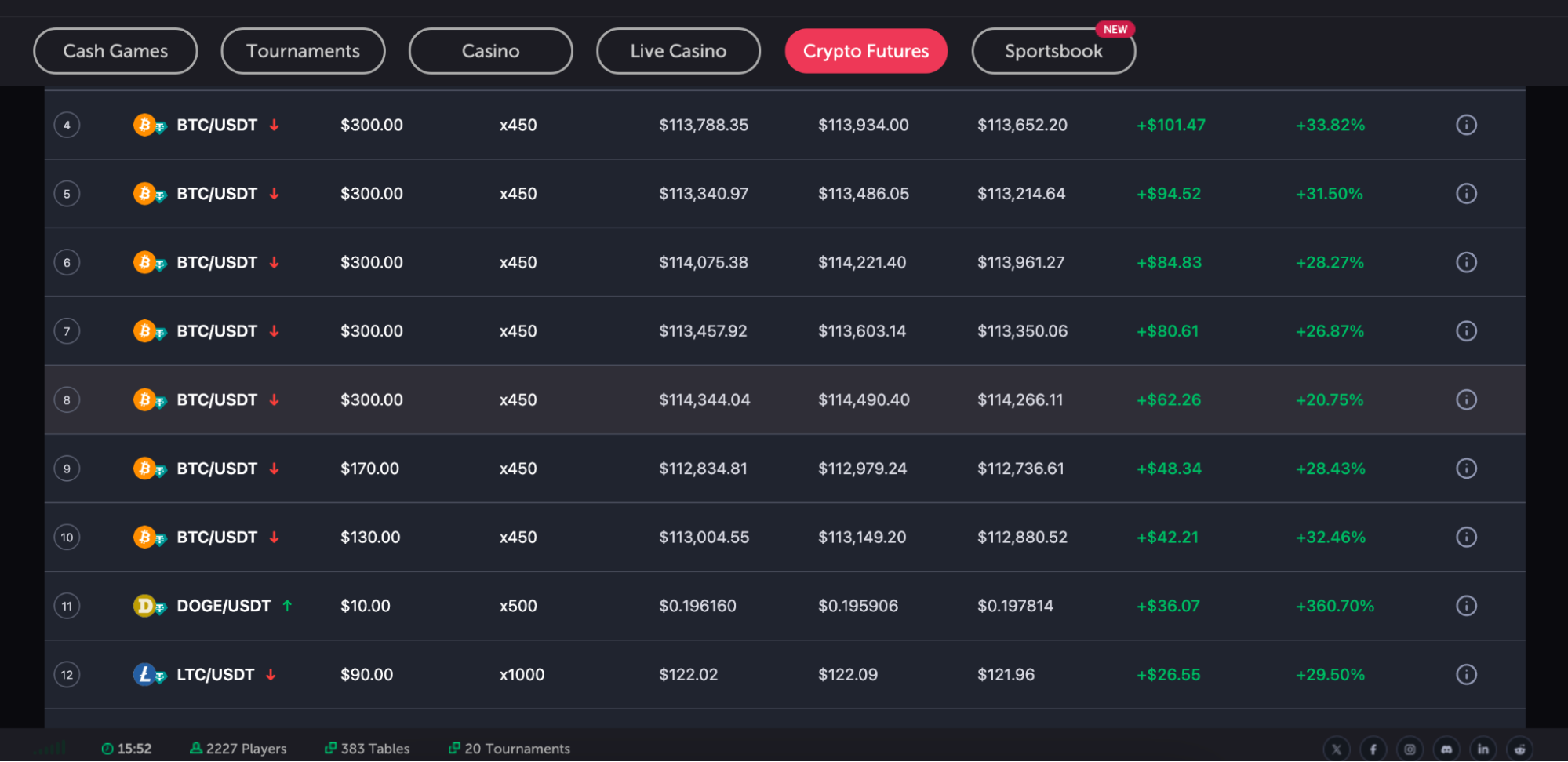

CoinFutures offers 1000x leverage on Bitcoin and other popular cryptocurrencies. Source: CoinFutures

Short-term strategies benefit from high leverage. CoinFutures provides multipliers of between 1x and 1000x, so a small $10 wager turns into $10,000. This dynamic appeals to traders who don’t have enough capital to target big gains, as well as those using low-risk strategies like scalping and range trading.

CoinFutures supports the best cryptocurrencies to buy like Bitcoin, Ethereum, and XRP. However, with just 11 futures pairs available, it lacks broad market exposure, especially for new cryptocurrencies with smaller valuations.

As a crypto-centric platform, CoinFutures provides instant deposits and withdrawals in popular assets such as USDT, USDC, Bitcoin, and Solana. Users deposit with fiat currency, too, including debit/credit cards and Google/Apple Pay. There is no minimum deposit, and withdrawal minimums are just $5.

Our CoinFutures review found that users trade anonymously, as new customers aren’t asked for personal information or ID documents when registering. This is a major benefit for traders who are unable to access leveraged products domestically.

A Closer Look at How CoinFutures Works

Some traders rate CoinFutures as the best crypto futures trading platform, yet its simulated products operate differently from most providers. Traders speculate on digital assets without other market participants or order books. They place trades without limit or market orders, ensuring instant execution and protection from frontrunning bots.

Instead, simulated futures use secure algorithms to track market prices in real-time. You place an “Up” or “Down” trade depending on whether you predict rising or falling prices. There are no contract terms like with delivery futures, so traders can enter and exit positions at any time.

In addition to long and short trading, a key benefit of simulated futures is that they permit leverage. As users amplify their wagers by up to 1000x, they access $10,000 in market exposure for every $10 in the account balance.

CoinFutures supports tick and candlestick timeframes from five seconds to five minutes. Source: CoinFutures

While CoinFutures does not have traditional collateral requirements or margin calls, futures trades can still become liquidated. The exchange refers to liquidation in terms of “bust prices”, although it’s effectively the same outcome.

As our CoinFutures review confirmed, the platform closes trades automatically if the bust price is triggered. The exact bust price depends on the market direction and the trader’s leverage multiple. Using low leverage multiples of 2x provides a 50% safety zone, yet 100x reduces the buffer to just 1%. Trading with the maximum 1000x multiple offers a 0.1% buffer, making liquidation almost certain.

CoinFutures Supported Cryptocurrencies

CoinFutures supports 11 crypto markets, which is insignificant compared to most trading platforms. This includes large-caps like Bitcoin and Ethereum, plus major altcoins such as Solana, Litecoin, and Cardano. Among the top meme coins, it currently supports Dogecoin only, although the platform states that new markets are added frequently.

Users trade simulated futures via USDT-dominated pairs, although wagers, profits/losses, and account balances show in USD.

Here is a full list of available CoinFutures pairs:

- BTC/USDT

- ETH/USDT

- XRP/USDT

- SOL/USDT

- ADA/USDT

- LTC/USDT

- DOGE/USDT

- BNB/USDT

- LINK/USDT

- AVAX/USDT

- TRX/USDT

Alongside crypto futures, CoinFutures also supports regulated poker tables and tournaments, casino games, and sports betting with competitive odds.

CoinFutures Core Features and Tools

This section of our CoinFutures review reveals the platform’s most popular features.

1000x Leverage

While the best crypto exchanges cap leverage to 100x, CoinFutures offers multiples of up to 1000x. The maximum leverage translates to a theoretical collateral requirement of just 0.1%. As such, traders control $100,000 in market exposure for every $100 wagered.

Leverage is a high-risk tool, but when used correctly, it can generate substantial gains. Negative balance protection is the key safeguard. Traders cannot lose more than they wager, so the maximum downside on a $100 trade is $100 only, even with 1000x leverage.

This risk mitigation tool ensures traders do not risk more than they can afford to lose. This isn’t the industry norm, as some derivative instruments carry unlimited risk. Short-selling options, for instance, can lead to uncapped losses, which traders invariably owe the platform if the balance turns negative.

Stop-Losses and Take-Profits

Switching on “Auto” mode provides access to additional risk management tools like stop-losses and take-profits.

Stop-losses let users set their maximum loss before confirming the trade. It can be stated in USD or traditional stop-loss prices. As CoinFutures does not rely on order books, other market participants are not required to match the stated exit point. This means stop-losses are always honored irrespective of market volatility or volume.

Auto mode also supports take-profits. The trader sets their profit target, and CoinFutures closes the trade automatically if that price is reached.

Stop-losses and take-profits promote sensible trading practices, as users have predetermined exit strategies, eliminating emotions like fear and greed.

Short-Selling

CoinFutures offers a simple and hassle-free way to short-sell cryptocurrencies. This strategy lets you profit from falling crypto prices and extended bear cycles.

At CoinFutures, traders can short-sell altcoins like BNB with high leverage on one of the leading crypto futures trading platforms. Source: CoinFutures

Unlike traditional short-selling, which requires experienced traders to borrow shares from other market participants, users simply place a “Down” trade on CoinFutures. The potential profit depends on the wager and price decline, and users may exit the short trade at any time.

Native Software

A drawback for some users is a lack of browser-based support. CoinFutures is available only on the CoinPoker interface. It offers native desktop software for Windows and Mac, while Android users have access to a mobile app. According to CoinPoker crypto futures, the iOS app is currently “in the works”, although it provides no specific date.

Both the desktop and mobile interfaces offer a superb trading experience, with both device types connecting to the same account. This flexibility lets users perform most trades on a larger desktop screen, while still having 24/7 access to the markets at the tap of a button.

No KYC Requirements

Many crypto investors detest KYC verification. It’s often a slow and cumbersome process, and creates potential privacy risks. According to Reuters, Coinbase has recently suffered a widespread data breach that leaked sensitive customer details, including social security numbers and government-issued IDs.

No such risks exist when using CoinFutures. It does not request KYC details from new customers, including personal information and ID. As CoinFutures doesn’t hold sensitive information, hackers cannot target user accounts.

Instant Withdrawals

CoinFutures, just like its parent company, CoinPoker, offers instant crypto withdrawals. Account holders can request payouts to their private wallet address, and the platform usually processes them right away.

Our CoinFutures review found that manual verification is needed in rare instances. An unusually large withdrawal to a new wallet address, for instance, may trigger security checks to protect users from unauthorized access.

Nonetheless, most users report receiving their crypto withdrawals in minutes.

Leaderboard

The public leaderboard is a popular CoinFutures feature. Located below the main trading chart, it adds an element of competition, as futures traders compete with one another to climb the rankings.

The most profitable CoinFutures traders appear on the public leaderboard. Source: CoinFutures

CoinFutures may launch trading competitions in the future to incentivize participation.

CoinFutures Fees and Trading Commissions

There are no fees to open an account or deposit funds. Traders cover gas fees when they transfer coins or tokens from a private wallet.

CoinFutures charges trading fees like any other platform. Before placing a trade, users choose between a flat or profit-based commission.

The profit-based option means traders only incur fees if their futures trade is profitable. It averages about 5% but varies depending on the trade parameters. What’s more, CoinFutures applies an extra 0.5% fee hourly, similar to leverage funding rates. You can avoid this surcharge if the trade is closed within the first 60 minutes.

The flat fee option reflects conventional exchange commissions. The trade size (based on the leverage amount) is multiplied by the commission and averages 1-3%. Again, the exact commission depends on the trade size and leverage multiple.

If you’re wondering which option is best, the flat fee suits traders who plan to keep positions open for at least an hour. Higher-frequency and shorter-term strategies like scalping benefit from the profit-sharing fee. The fees make sense after a while, but there is a slightly steep learning curve, so make sure you factor fees into your trades.

In terms of withdrawals, CoinFutures charges a flat 5 USDT per payout request.

CoinFutures User Experience

Experts typically discourage trading leveraged products due to their complex and high-risk nature. That said, CoinFutures has designed its trading platform with beginners in mind.

Both the desktop software and mobile application are simple to navigate, and the trading dashboard does not rely on the order book system. This framework appeals to inexperienced traders who aren’t comfortable placing limit or market orders or trading with other exchange participants.

Meanwhile, traders cannot be liquidated because of unanswered margin calls. Rather, the dashboard clearly displays the bust price, which remains constant until the trader closes the position. Setting up trades is also seamless. You select “Up” or “Down” to trade long or short, respectively, and enter the wager in USD terms.

CoinFutures also simplifies risk management. While traders may set stop-losses in price-point terms, they can also enter their maximum USD loss. The same concept is applied to take-profits.

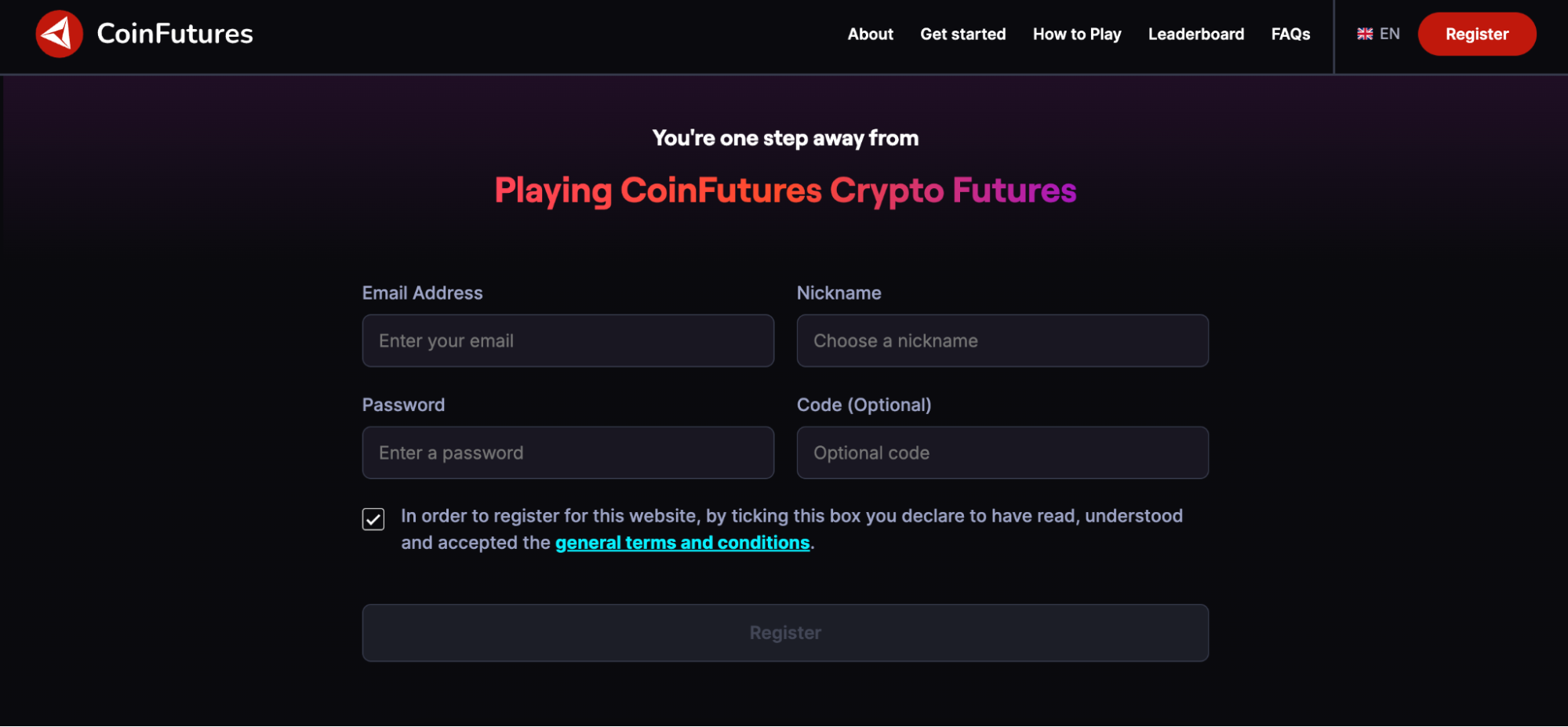

Our CoinFutures review confirms that the onboarding procedure is also user-centric. First-time users provide an email address and nickname, download the software or mobile application, and deposit funds right away. The end-to-end process takes less than five minutes.

Is CoinFutures Safe and Legit?

Most crypto futures exchanges operate without regulatory approval. CoinPoker, which owns the CoinFutures brand, is authorized and regulated by the Government of the Autonomous Island of Anjouan, Union of Comoros. The published license number is ALSl-202412004-FI1.

Although the license issuer remains an unknown entity to most traders, it ensures CoinFutures has regulatory oversight, including fair practices and client-fund protection.

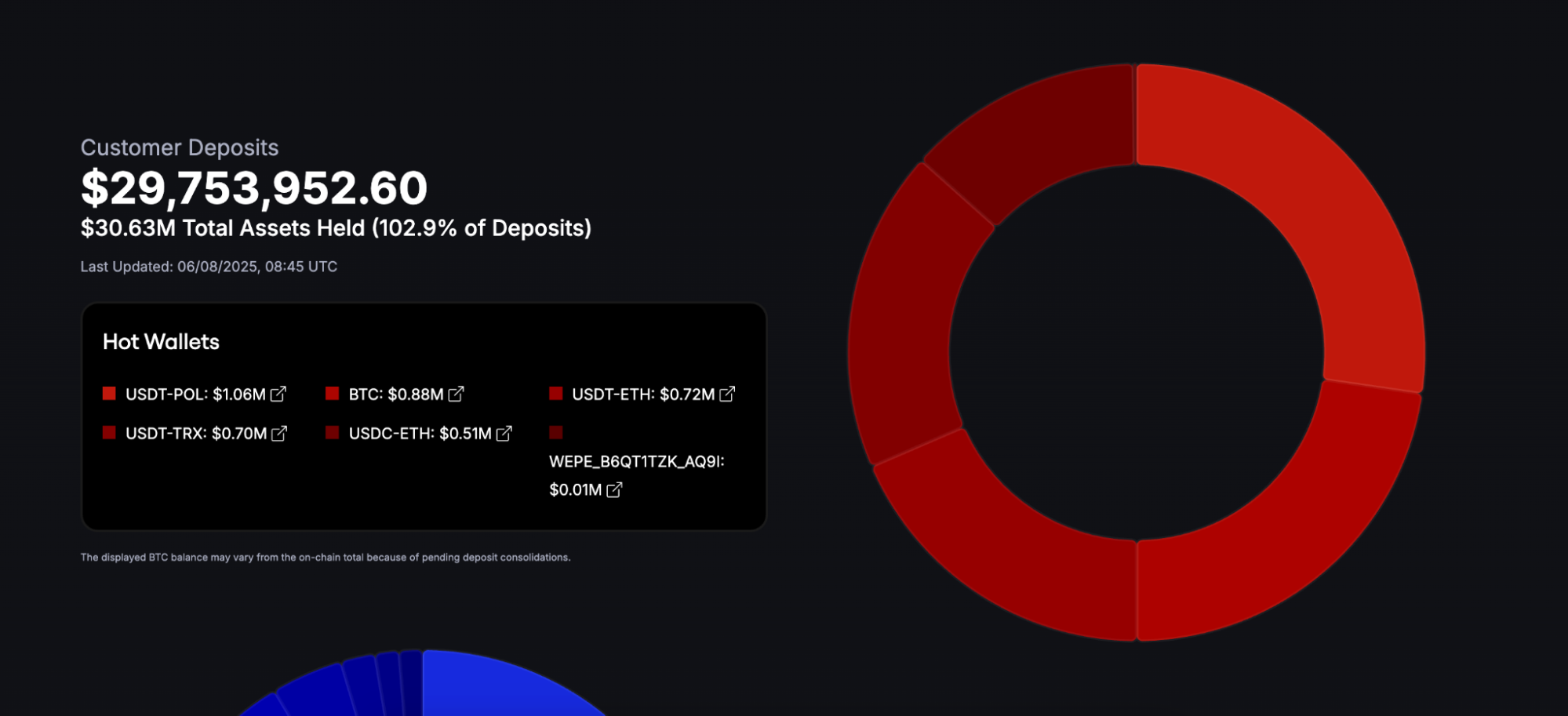

Proof of reserves is the most important safeguard, as it ensures platforms have sufficient reserves to cover customer deposits.

CoinFutures has audited proof of reserves that are updated daily. Source: CoinFutures

The CoinFutures website shows the audited reserves, allowing users to verify assets. They state that Fireblocks stores 100% of client-owned cryptocurrencies in secure vaults. Fireblocks protects and insures digital assets for financial institutions and is regarded as a tier-one custodian for security.

One disadvantage is that CoinFutures lacks two-factor authentication. This security tool provides an extra layer of security via secondary devices, so we hope the platform adds support in the future.

How to Contact CoinFutures Customer Service

CoinPoker handles customer support for CoinFutures users. With no telephone or live chat support, users must send an email or submit a support ticket.

Research suggests that response times vary depending on workload. Most users receive replies within 24 hours, and some much sooner.

CoinPoker representatives are also active on Reddit and other social media networks. These channels often encourage faster replies, although make sure you’re speaking with an official CoinPoker agent.

The CoinPoker crypto futures website lists help articles across key categories like technical issues, deposits and withdrawals, and registration. However, self-help documents are limited, with just 30 published articles.

CoinFutures vs Other Crypto Futures Platforms

CoinFutures provides several advantages over other crypto futures platforms. It offers an anonymous trading experience and, at 1000x, the highest leverage multiples in the industry.

The platform delivers an excellent user experience and streamlines futures trading for beginners. It lacks in other departments, including fees, available markets, and iOS support.

Here is how CoinFutures compares with other futures platforms for key metrics:

| Type of Futures | Futures Markets | Maximum Leverage | KYC? | Standard Fees | |

| CoinFutures | Simulated | 11 | 1000x | No | Variable profit-based or flat fee |

| MEXC | Perpetual | 4,100+ | 500x | No | 0.01% (limits), 0.04% (markets) |

| Margex | Perpetual | 50 | 100x | No | 0.019% (limits), 0.060% (markets) |

| Binance | Perpetual and delivery | 560+ | 125x | Yes | 0.0180% (limits), 0.0450% (markets) |

CoinFutures Step-by-Step Walkthough

The platform’s no-KYC feature allows new users to get started in minutes. Here is a step-by-step guide on how to trade simulated crypto futures at CoinFutures.

Step 1: Register and Download

Visit the CoinFutures website, click “Register”, and provide an email, nickname, and password.

CoinFutures offers a no-KYC experience when opening an account. Source: CoinFutures

Verify the email address and download the CoinPoker interface for Windows, Mac, or Android.

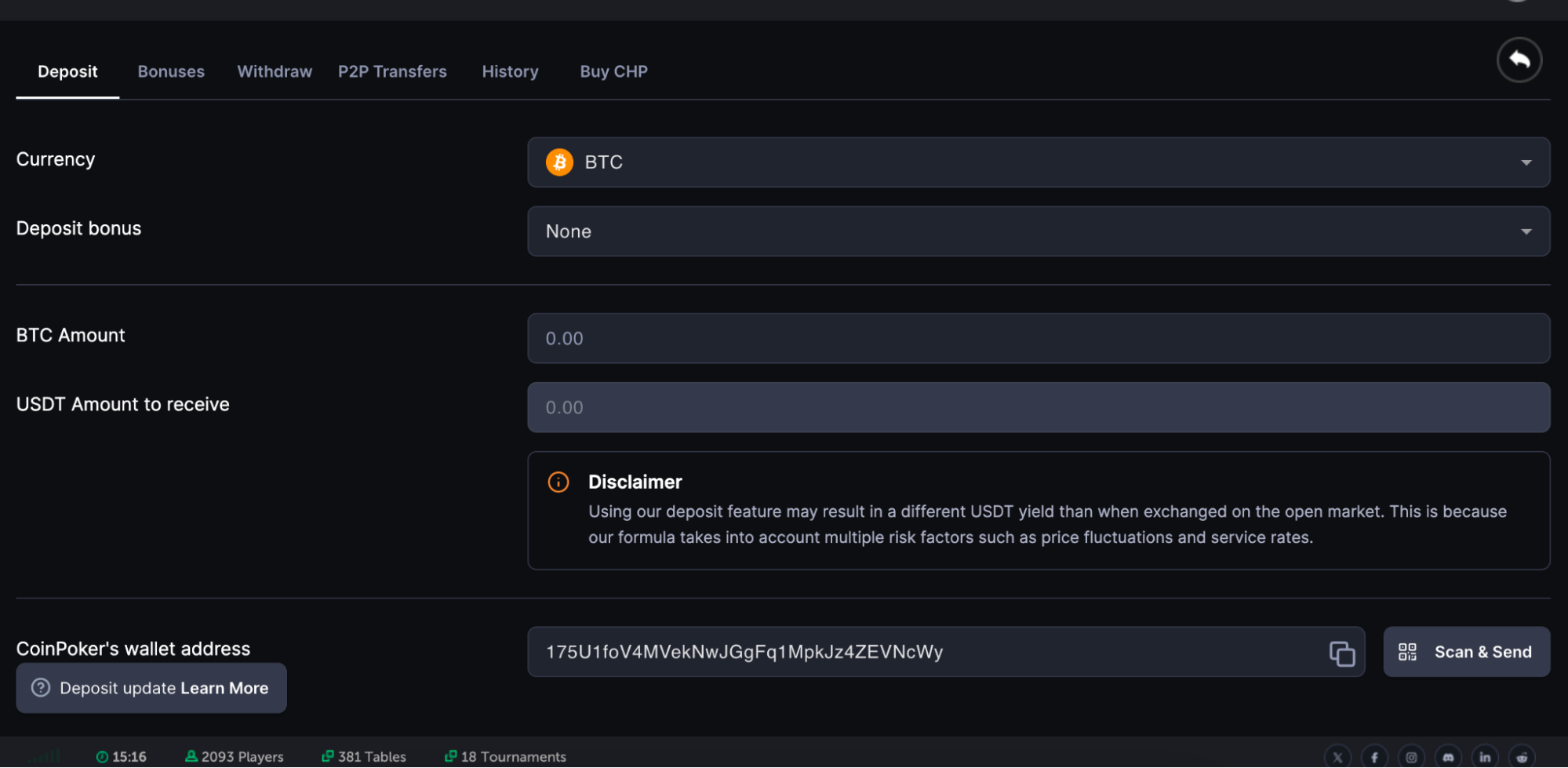

Step 2: Make a Deposit

Log in to the CoinPoker interface and click the wallet icon (located in the top-right corner of the dashboard).

CoinFutures payments process instantly without fees. Source: CoinFutures

Choose an accepted crypto to deposit. Options include trading Bitcoin futures, along with Ethereum, Solana, USDT, USDC, and other top altcoins. Go to your private wallet and transfer funds to the provided wallet address. The address is unique to your CoinPoker account.

Alternatively, deposit funds with a debit/credit card or e-wallet like Google/Apple Pay.

What is the CoinFutures minimum deposit?

CoinFutures does not have minimum deposit requirements. The minimum futures trade is an affordable $1.

Step 3: Choose a Market

Close the deposit screen and click “Crypto Futures”.

CoinFutures markets focus on large-cap assets like trading Bitcoin futures, as well as Ethereum and XRP. Source: CoinFutures

The dashboard shows BTC/USDT, but you can easily change the market from the drop-down list. Just click the preferred pair, such as ETH/USDT or XRP/USDT.

Step 4: Place a Long or Short Trade

To trade simulated crypto futures, enter the following parameters:

- Up or Down: Choose the market prediction. “Up” and “Down” mirror long and short positions.

- Wager: Stated in USD, the wager is the amount you want to risk on the trade.

- Leverage: CoinFutures supports any leverage multiple between 1x and 1000x. Check the bust price after adjusting the multiple.

In the example below, the user wagers $25 on an XRP/USDT short position with 200x leverage.

CoinFutures has a beginner-friendly trading dashboard along with advanced trading tools and a maximum leverage of 1000x. Source: CoinFutures

Optionally, you may use stop-losses and take-profits. Switch from “Manual” to “Auto” and select the exit price levels.

The final step is to place the trade.

Conclusion

Overall, CoinFutures is one of the best crypto futures exchanges for beginners who want exposure to leveraged cryptocurrencies. Its simulated futures products support 1000x leverage, long and short trading, and risk management tools like stop-losses.

Getting started takes minutes, since CoinFutures provides no-KYC accounts with near-instant deposit times. According to our CoinFutures review, key drawbacks include above-average trading fees and support for just 11 cryptocurrencies.

How We Tested and Reviewed CoinFutures

Our research team explored every angle necessary for this CoinFutures review. We evaluated platform legitimacy through licensing checks, parent company ownership, and security for client-owned assets like proof of reserves and cold storage. Our methodology extracted data points such as supported futures markets, trading commissions, and account minimums, and compared them with other top platforms.

We then tested the CoinPoker software on Windows and Mac devices, as well as the Android app. The objective was to assess the user experience, required learning curve, and platform reliability metrics like execution speed and slippage. All collected data points remain accurate at publication.

FAQs

Is CoinFutures legit?

What deposit types does CoinFutures accept?

Does CoinFutures require KYC?

What is the CoinFutures max leverage?

How to cash out on CoinFutures?

References

- Key strategies to avoid liquidations in perpetual futures (Coinbase)

- Psychological challenges of trading (Fidelity)

- Adopt a trader mindset to manage your emotions (Charles Schwab)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The purpose of this in-depth guide is to answer the question: Is TOKEN6900 legit or a scam? Keep reading to learn more about our f...

Discover everything about the CoinFutures platform, including available futures markets, trading fees, and maximum leverage multip...

16 mins

16 mins

Tony Frank

Crypto Editor, 84 postsTony Frank is an accomplished cryptocurrency analyst, author, and educator whose work bridges the gap between complex blockchain technology and accessible, actionable insights for global audiences. Over the past decade, he has emerged as a respected voice in the rapidly evolving world of digital assets, combining technical expertise with a talent for storytelling to help readers navigate everything from Bitcoin’s monetary philosophy to the intricacies of decentralized finance (DeFi). Tony earned his Bachelor’s degree in Economics and Finance from the University of Melbourne, where he developed a deep interest in monetary systems and market structures. He later pursued a Master’s degree in Blockchain and Digital Currency from the University of Nicosia, one of the first academic institutions to offer accredited programs in cryptocurrency studies. Before focusing full-time on blockchain, Tony worked as a financial analyst for a multinational investment firm, covering emerging technologies and alternative asset classes. His early exposure to macroeconomic policy, global market behavior, and fintech innovation laid the foundation for his later work in crypto research and writing. Tony’s expertise spans multiple sectors of the blockchain industry, including cryptocurrency fundamentals, altcoin market cycles, DeFi and web3 trends and regulatory landscapes. Tony combines on-chain data analysis with macroeconomic research, providing readers with both the technical “how” and the market “why” of cryptocurrency movements.