This Vortex FX (VFX) price prediction guide explores prices predicted through 2026, 2030, and 2036, looking at the potential heigh...

Ethereum remains at the forefront of crypto growth, topping the list of altcoins to watch in 2026.

Following behind are Bitcoin Hyper (HYPER), a Layer 2 project aiming to scale Bitcoin, and Maxi Doge (MAXI), a viral meme coin embodying the culture and spirit of degen trading.

The Coinspeaker team analyzed over 75 promising crypto projects before narrowing down our list of the 11 best altcoins for 2026. Below, we included in-depth reviews of all of our top altcoin selections, detailing key information about each token, relevant risks and considerations, and an explanation of our selection methodology.

The inclusion of these tokens does not guarantee future performance or investment success.

Top Altcoins List in January 2026 – Editor’s Picks

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Build your own virtual meme coin mining rig.

- 100% virtual and requires no additional computing power.

- Top miners get additional bonuses in Pepe, Fartcoin, and other meme coins.

Best Altcoins to Invest in 2026

Our top altcoin list for 2026 includes a mix of new projects and established names that are gaining attention in the market.

- Ethereum (ETH) – Largest and most popular altcoin

- Bitcoin Hyper (HYPER) – Bitcoin Layer 2 scaling solution with meme packaging

- Maxi Doge (MAXI) – Degen-themed meme coin touting itself as Dogecoin “final form”

- Solana (SOL) – Low fees, speed, and scalability

- BMIC (BMIC) – Quantum-resistant wallet with enterprise security APIs

- PEPENODE (PEPENODE) – Ethereum-based virtual mining coin

- SUBBD (SUBBD) – SocialFi for content creators and fans

- Ripple (XRP) – Leading token for global payments

- Binance Coin (BNB) – Multi-use platform and exchange token

- TRON (TRX) – Content distribution platform and stablecoin hub

- Cardano (ADA) – Research-driven smart contract platform

Best Altcoins to Buy – Reviews and Analysis

Here’s the full version of our analysis on the top 11 cryptocurrencies to invest in for 2026, starting with our most highly rated choice.

1. Ethereum (ETH) – Largest and Most Popular Altcoin

Ethereum ETH $3 214 24h volatility: 0.4% Market cap: $387.93 B Vol. 24h: $27.83 B is the largest and most popular altcoin in the crypto market. Its launch started a revolution that changed the crypto market entirely by infusing vastly more utility into blockchain networks. It was the first network to enable decentralized finance, and it sparked the creation of entire sectors from NFTs to blockchain gaming.

Even though hundreds of new Layer 1 blockchains, such as Solana or BSC, have tried to replace the king of DeFi, Ethereum has held strong and remains the second-largest coin by a massive margin. It still suffers from pricey and slow transactions, but its talented team of developers is diligently working on multiple intertwining upgrades, including Layer 2 solutions and sharding. Within a few years, Ethereum may have solved these problems, reducing the demand for smaller, faster Layer 1s and reclaiming its former dominance.

| Project | Ethereum |

| Use Case | DeFi, NFTs, and more |

| Blockchain | Ethereum |

| Project Status | Live |

| Current Price | ETH $3 214 24h volatility: 0.4% Market cap: $387.93 B Vol. 24h: $27.83 B |

| Market Cap Range | $375B |

| Community Size | 500K daily active addresses |

| Audited | Yes |

| Staking Options? | Native and liquid staking (~1.9%-4%) |

2. Bitcoin Hyper (HYPER) – Bitcoin Layer 2 Scaling Solution with Meme Packaging

Bitcoin Hyper is a Layer 2 solution that aims to transform BTC into a fully functional and scalable blockchain, with low fees and smart contract capabilities. This means that dApps, DeFi, trading, and meme coins could all be built on Bitcoin.

Bitcoin Hyper Presale Page. Source: Bitcoin Hyper

Bitcoin Hyper leverages advanced technology by bringing the Solana Virtual Machine (SVM) to Bitcoin. Solana’s superior coding language and Proof of History consensus mechanism improves transaction speed compared to Bitcoin and even Ethereum Virtual Machine (EVM) blockchains. With its low price and added functionality, it stands out as one of the best penny cryptocurrencies.

| Project | Bitcoin Hyper |

| Use Case | Bitcoin Layer 2, Bridge, DeFi |

| Blockchain | Ethereum (for Presale) Bitcoin / Solana |

| Project Status | Presale |

| Presale Price | $0.013545 |

| Amount Raised | $30.21M |

| Presale Start Date | May 2025 |

| Market Cap Range | <$5M (Micro-cap) |

| Community Size | 14.2K Twitter, 4.6k Telegram |

| Audit Status | By Coinsult and SpyWolf |

| Staking Options? | On the BTC Hyper Website, 40% APY |

| Time Until Next Price Increase | Loading...

|

3. Maxi Doge (MAXI) – Degen-Themed Meme Coin Touting Itself as Dogecoin “Final Form”

Maxi Doge wants to be the ultimate version of Dogecoin, hence the name. Its mascot, a ripped Shiba Inu with a penchant for 1000x trading, embodies the spirit of the thousands of meme coin degens who are always watching charts, trying to hit it big on one or two massive trades.

Maxi Doge Presale Page. Source: Maxi Doge

Like its inspiration, Maxi Doge isn’t trying to build complex utility. The idea is to build a community of like-minded shitcoin traders who are all just trying to make it out of the trenches. So far, the presale has been massively successful, with $4.43M raised so far.

While Maxi Doge isn’t focused on utility, there is an ethos around rewarding community members for their support with special trading contests and staking. Investors can already stake their MAXI tokens for up to approx 200% rewards. The team is also preparing contests for its top community members to earn MAXI. Investors can already stake their MAXI tokens for up to approximately 72% rewards.

| Project | Maxi Doge |

| Use Case | Meme Coin |

| Blockchain | Ethereum (for Presale) |

| Project Status | Presale |

| Presale Price | $0.000277 |

| Amount Raised | $4.43M |

| Presale Start Date | July 2025 |

| Market Cap Range | <$5M (Micro-cap) |

| Community Size | 4K Twitter, 106k Telegram |

| Audit Status | By SolidProof and Coinsult |

| Staking Options? | On the Maxi Doge website, 72% APY |

| Time Until Next Price Increase | Loading...

|

4. Solana (SOL) – Low Fees, Speed, and Scalability

Solana SOL $137.4 24h volatility: 0.5% Market cap: $77.37 B Vol. 24h: $6.18 B is a Layer 1 blockchain that was built as a low-cost, faster alternative to Ethereum and EVM-compatible blockchains. In July 2025, Rex Osprey launched a Solana Staking ETF, making Solana the first blockchain to receive an ETF with staking rewards, which could be highly attractive to institutional investors.

One of Solana’s key strengths is the Jupiter DEX aggregator, which helps users find the most cost-effective token swaps. Its smart routing system taps into deep liquidity across multiple DEXs, delivering better swap prices, low slippage, and enabling large trades to be executed smoothly. This powerful liquidity infrastructure partly explains the Solana meme coin boom of 2024/5.

| Project | Solana |

| Use Case | Layer 1 gas token / Governance, DeFi / NFTs / Gaming |

| Blockchain | Solana |

| Project Status | Live |

| Current Price | SOL $137.4 24h volatility: 0.5% Market cap: $77.37 B Vol. 24h: $6.18 B |

| Market Cap Range | >$100B (Large-cap) |

| Community Size | 3.5M Twitter, 70K Telegram. 299M Monthly active users (MAU) |

| Audited | Ongoing audits by various companies |

| Staking Options | Native and Liquid staking, average 6-7% APY |

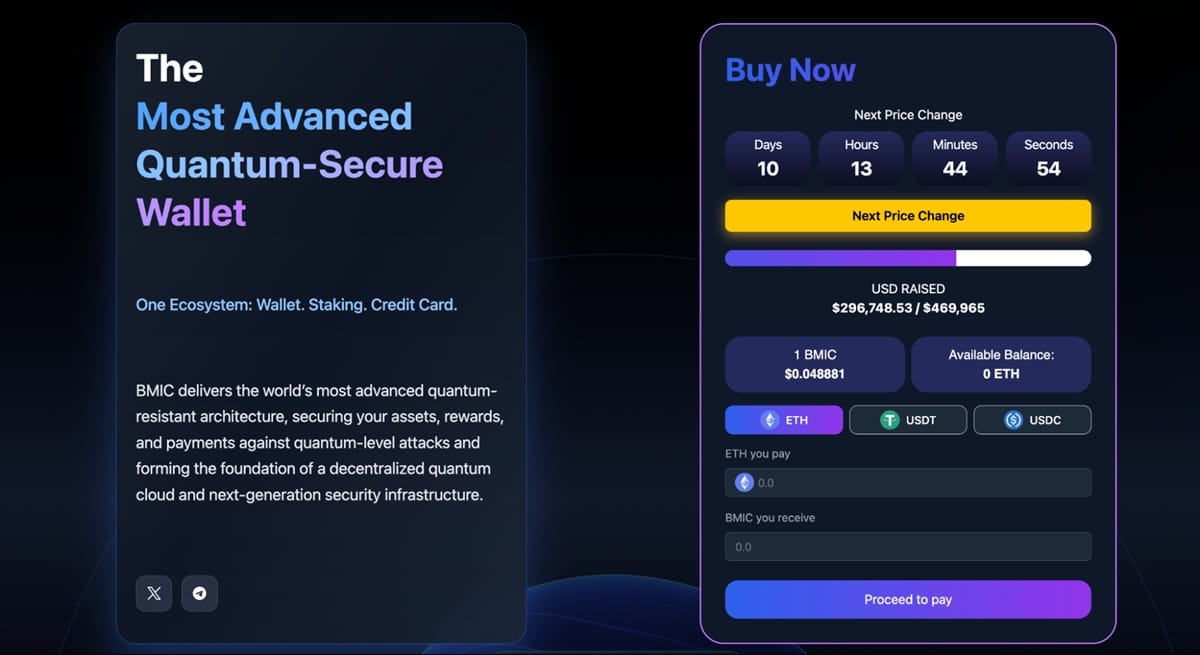

5. BMIC (BMIC) – A Quantum-Resistant Wallet With Enterprise Security APIs

Existing crypto wallets rely on encryption techniques that quantum computers may one day be able to break. BMIC is a new altcoin project that aims to safeguard digital assets through post-quantum cryptography (PQC). It claims to incorporate NIST-approved PQC algorithms from the outset, along with signature-hiding smart accounts designed to keep public keys off-chain.

BMIC, a new Web3 wallet ecosystem that claims to address the huge threat posed by quantum computing. Source: BMIC

The project also outlines plans for staking, a credit card system, and enterprise security APIs intended for institutional use. In fact, subsequent roadmap phases even hint at a decentralized compute layer that will link quantum hardware providers. Notably, the roadmap stretches to 2028, with an alpha version of the wallet set to launch in 2026.

| Project | BMIC |

| Use Case | Quantum Security, Wallet, Cloud Compute |

| Blockchain | Ethereum |

| Project Status | Presale |

| Presale Price | $0.048881 |

| Amount Raised | About $300,000 |

| Presale Start Date | December 2025 |

| Market Cap Range | TBD |

| Community Size | Over 7,000 on Telegram and X |

| Audit Status | Smart contract is audited |

| Staking Options? | Yes |

6. PEPENODE (PEPENODE) – Ethereum-Based Virtual Mining Coin

PEPENODE operates a mining simulator where you earn real crypto by managing virtual server farms. The project skips the usual presale waiting game, allowing users to start staking immediately, build their mining operations, and watch rewards accumulate before the token even launches.

PEPENODE presale homepage featuring the virtual mining facility and token sale details. Source: PEPENODE

PEPENODE calculates your share based on your virtual hashpower. Early investors get to build better nodes to earn more rewards. The system is currently off-chain, but it will be moved entirely on-chain after launch through smart contracts to provide full transparency. In a mechanism designed to create natural scarcity PEPENODE burns 70% of tokens spent on upgrades, as players compete to build the best rigs.

| Project | PEPENODE |

| Use Case | Virtual mining game with token rewards |

| Blockchain | Ethereum |

| Project Status | Presale with live game |

| Presale Price | $0.0012161 |

| Presale Start Date | July 2025 |

| Market Cap Range | <$5M (Micro-cap) |

| Community Size | 3.5K Twitter, 44K Telegram |

| Audit Status | Smart contract-based with transparent mechanics |

| Staking Options? | Yes, 570% APY (dynamic based on participation) |

| Time Until Next Price Increase | Loading...

|

7. SUBBD (SUBBD) – SocialFi for Content Creators and Fans

SUBBD is a next-generation platform that allows influencers and fans to co-create, curate, and manage content more directly by combining AI with cryptocurrency. Many social platforms take a big cut of what influencers earn – for example, YouTube keeps 45%. However, SUBBD eliminates the middlemen and gives both creators and fans greater control and a larger share of the value they generate.

SUBBD token official website. Source: SUBBD

SUBBD is targeting the colossal creator economy, valued at $250 billion, according to Deloitte. With its growing list of ambassadors and access to an existing influencer community, SUBBD could have long-term potential. According to our analysis, it ranks as one of the best crypto presales of 2026, though much will depend on whether it can compete with the big platforms.

| Project | SUBBD |

| Use Case | SocialFi / AI-Assisted Influencer Content Creation |

| Blockchain | Ethereum |

| Project Status | Presale |

| Presale Price | $0.0574 |

| Amount Raised | $1.42M |

| Presale Start Date | April 2025 |

| Market Cap Range | <$5M (Micro-cap) |

| Community Size | 250M+ follower ecosystem, 60K Twitter, 12K Telegram |

| Audit Status | SolidProof and Coinsult |

| Staking Options? | On SUBBD Website, 20% APY |

| Time Until Next Price Increase | Loading...

|

8. Ripple (XRP) – Industry Leader in Global Payments

Ripple was created in 2012 to provide a faster, cheaper alternative to Bitcoin. Its path to success has been quite rocky, fighting through a handful of painful price crashes and even a major SEC lawsuit, but it is now far and away the largest payment-focused crypto behind Bitcoin.

Ripple can technically be used by anyone, and plenty of regular investors use it, but the team has concentrated its focus on institutions and businesses. The coin has proven to be a useful medium of exchange for financial firms and other players because of its vastly higher transaction throughput, low fees, and secure open-source infrastructure. Many analysts believe that the institutional crypto market still has a ton of growth potential and Ripple is one of the best-suited coins to benefit from the new wave of funds.

| Project | Ripple |

| Use Case | Global payments |

| Blockchain/s | Ripple |

| Project Status | Live |

| Current Price | XRP $2.24 24h volatility: 4.8% Market cap: $136.00 B Vol. 24h: $6.09 B |

| Market Cap Range | $134B (Large-cap) |

| Community Size | 3.1M Twitter |

| Staking Options? | No native staking, some platforms offer 0.1%-10% APY |

9. Binance Coin (BNB) – Multi-Use Platform and Exchange Token

Binance Coin is the utility token of Binance Smart Chain, the Layer 1 Ethereum competitor network created by Binance, the largest crypto exchange. Like many other popular Layer 1 blockchains, BSC focuses on minimizing gas fees and dramatically speeding up transactions. However, it sacrifices decentralization and security to do so by drastically reducing the number of validators that secure the network.

While some crypto enthusiasts dislike BSC and BNB because of this trade-off, it is still one of the most popular DeFi hubs in the world, along with Solana and Ethereum. It is home to a massive ecosystem of finance apps, NFTs, play-to-earn games, and even meme coins. BNB lies at the heart of the network, powering every transaction, offering trading fee discounts on Binance, and supporting its consensus mechanism through a form of Proof of Stake.

| Project | Binance Coin |

| Use Case | Layer 1, DeFi, NFT Utility |

| Blockchain | Binance Smart Chain |

| Project Status | Live |

| Market Cap Range | $128B |

| Community Size | 5M active daily users |

| Audit Status | Yes |

| Staking Options? | Yes, native and liquid |

10. TRON (TRX) – Content Distribution Platform and Stablecoin Hub

Established by Justin Sun 2017, TRON TRX $0.29 24h volatility: 1.2% Market cap: $27.92 B Vol. 24h: $571.72 M has grown into one of the leading blockchain networks based on market value, and now holds the 8th largest market capitalization at $26 billion. The platform works to decentralize digital content distribution and entertainment services, helping to remove middlemen so content producers can establish direct relationships with their viewers while keeping most of their created value.

The platform operates at high speeds, claiming capacity to process 2,000 transactions per second, which exceeds Bitcoin’s six transactions per second and Ethereum’s 25 transactions. The platform dominates the market in stablecoin transactions, primarily through USDT. The network processes half of all worldwide USDT transactions which makes it an essential backbone for cryptocurrency payment systems. The platform’s features have helped it maintain solid fundamental value for TRX through many market fluctuations.

| Project | TRON |

| Use Case | Content distribution, DeFi, Stablecoin transactions |

| Blockchain/s | TRON |

| Project Status | Live |

| Current Price | TRX $0.29 24h volatility: 1.2% Market cap: $27.92 B Vol. 24h: $571.72 M |

| Market Cap Range | $26B (Large-cap) |

| Community Size | 3.5M+ active addresses |

| Audit Status | Ongoing audits |

| Staking Options? | No native staking, some platforms offer 0.1%-10% APY |

11. Cardano (ADA) – Research-Driven Smart Contract Platform

Cardano ADA $0.41 24h volatility: 1.8% Market cap: $15.08 B Vol. 24h: $864.54 M is as a third-generation blockchain system that implements peer-reviewed academic research and scientific development methods. Charles Hoskinson co-founded Ethereum before establishing Cardano as a blockchain platform in 2017. The cryptocurrency ranks #10 in market capitalization with more than $13 billion in value. The platform runs a distinctive two-layer system that keeps transaction processing separate from smart contract execution.

Cardano uses a Proof of Stake consensus mechanism that is significantly more energy-efficient than Bitcoin’s Proof of Work. The network has introduced new features through scheduled upgrades which brought smart contract capabilities to the platform through the Alonzo hard fork. In February 2025, major asset manager Grayscale Investments filed to create an ADA exchange-traded fund with the SEC. The approval of this fund could enable traditional investors to buy ADA through exchange-traded funds which might lead to substantial institutional adoption.

| Project | Cardano |

| Use Case | Smart contracts, DeFi, DApps |

| Blockchain/s | Cardano |

| Project Status | Live |

| Current Price | ADA $0.41 24h volatility: 1.8% Market cap: $15.08 B Vol. 24h: $864.54 M |

| Market Cap Range | $13-14B (Large-cap) |

| Community Size | 35M+ circulating token holders |

| Audit Status | Yes, extensive peer review |

| Staking Options? | Native staking, average 4-6% APY |

Top New Altcoins Compared

Now that we have detailed our top picks, here is a comparison table to help you determine which projects you might be interested in. For more comprehensive overviews of these projects, please refer to our ICO Calendar.

| Altcoin | Category | Primary Use Case | Tech | Notes |

| Ethereum (ETH) | Smart-contract platform | Decentralized apps (DeFi, NFTs), programmable money | Proof-of-Stake, large ecosystem | Widely used infrastructure; high real utility and developer adoption. |

| Bitcoin Hyper (HYPER) | Bitcoin Layer 2 scaling + Meme packaging | Low-fee BTC transactions, DeFi on Bitcoin | Layer-2 on Solana Virtual Machine + zk proof settlement | Aims to bring DeFi & scalability to Bitcoin; presale stage and speculative by nature. |

| Maxi Doge (MAXI) | Meme coin | Community / degen trading, staking rewards | ERC-20 (Ethereum) | Meme-driven; high APY staking but limited inherent utility; highly speculative. |

| Solana (SOL) | High-performance smart contract platform | Fast dApps, DeFi, memecoins | PoS + Proof of History | Known for low fees and high throughput; strong competitor to Ethereum. |

| BMIC (BMIC) | Quantum-resistant wallet & security token | Advanced wallet features, enterprise security APIs | Quantum-resistant cryptography | Combines utility with security focus; still niche/early stage. |

| PEPENODE (PEPENODE) | Ethereum meme + gamified mining | “Mine-to-earn” virtual mining and meme engagement | ERC-20 (Ethereum) | Gamified meme token; speculative with game mechanics. |

| SUBBD (SUBBD) | SocialFi / creator economy token | Creator-to-fan monetization, tipping | Platform token (specific chain depends on project) | SocialFi use case with AI integration; utility tied to creator platform. |

| Ripple (XRP) | Cross-border payments | Fast & low-cost global transactions | XRP Ledger Consensus Protocol | Real payment use case bridging fiat and crypto; used by banks/fintech. |

| Binance Coin (BNB) | Exchange & ecosystem token | Fee discounts, fuel for BNB Chain, DeFi | BNB Chain PoS | Utility token with broad ecosystem demand plus periodic burns. |

| TRON (TRX) | Content & stablecoin ecosystem | Content distribution, dApps, stablecoins | Delegated PoS (DPoS) | Focuses on high throughput & low fees; strong in stablecoin volume. |

| Cardano (ADA) | Research-driven smart contract platform | Secure institutional dApps | PoS (Ouroboros) | Emphasis on academic rigor and sustainability; slower development pace. |

Top Altcoins That Didn’t Make the Cut

Now let’s dive into a few of the most promising altcoins that didn’t quite make our list.

Chainlink (LINK)

Chainlink is inarguably one of the most important infrastructure-focused crypto projects in the market, providing essential, reliable data across countless blockchains through its advanced oracle system.

Why It Didn’t Make the Cut: Chainlink is an incredibly important project, but the coin hasn’t fared as well as other altcoins in recent years, and it may not have enough growth potential to beat out other top choices.

Monero (XMR)

Monero is the leading privacy-focused blockchain in the market, using advanced technology like ring signatures and stealth addresses to hide the sender, receiver, and even the amount of every single transaction on the blockchain.

Why It Didn’t Make the Cut: Monero is great at what it does, but there simply may not be a large enough market for it to capture in order to experience major growth.

Shiba Inu (SHIB)

Shiba Inu is the second-largest meme coin, behind only Dogecoin, powered by dog memes and utility alike. Unlike the vast majority of meme coins, it powers an entire ecosystem of DeFi apps as well as its own Layer 2 blockchain.

Why It Didn’t Make the Cut: Shiba Inu may very well perform better than most altcoins, but meme tokens like SHIB are so volatile and reliant on narratives and hype cycles that it is nearly impossible to predict future prices accurately.

What Are Altcoins and How Do They Work?

‘Altcoin’ refers to any crypto that isn’t Bitcoin. This is because Bitcoin was the first cryptocurrency, making all other coins alternatives. The term ‘altcoins’ includes DeFi, AI, meme coins, Layer 1 and Layer 2 blockchains, as well as decentralized dApps and services that aim to recreate popular web2 and real-world concepts on the blockchain.

A review of the top 100 altcoins reveals a diverse range of altcoins targeting various technology sectors, audiences, and traders with diverse risk profiles. Some altcoins are hyped as the’next big thing’ and yet may soon fade away. Others are positioned for sustained presence.

Some trending coins featured on Coingecko’s Highlights. Source: CoinGecko

Altcoins often underpin the ecosystems upon which they are built. For example, ETH is used for gas fees and governance on the Ethereum network. This means their use can serve as a measure of the project’s success.

However, some altcoin use cases are more abstract, or even non-existent. This applies to many meme coins, which usually have no inherent utility. In these cases, the price is primarily based on hype, viral memetics, community belief, marketing, and support.

Types of Altcoins and Who They’re For

There are many different types of altcoins. They come with varying risk profiles to suit different investment styles. Here are some of the most popular categories:

| Altcoin Type | Use Case | Best For | Risk Level |

| Layer 1 Blockchains | Infrastructure for DeFi, dApps, NFTs, and all things web3 | Medium to Long-term investors | Medium |

| Layer 2 Blockchains | Scaling Layer 1 chains | Medium to Long-term investors | Medium/High |

| LST (Liquid Staking Tokens) | Allow staking and reusing the tokens in DeFi apps | Medium to Long-term investors | Medium |

| Utility Coins | Power decentralized apps, DeFi protocols, and staking | Long-term investors | Medium |

| Meme Coins | Community-driven, viral narratives | Speculators, meme traders | Very High |

| Stablecoins | Pegged to fiat for price stability | Hedging, low-risk trading | Low |

| DePIN | Incentivize people to build and operate real-world hardware networks. | Forward-looking investors | Medium |

Why Top Altcoins Will Continue Gaining Traction in 2026

Altcoins are gaining traction because the crypto market is exhibiting characteristics commonly associated with a bull run, as well as altcoin season, which could happen early in 2026.

Institutional Adoption and Mainstream Awareness

This environment is influenced by several factors, including macroeconomic factors, the Bitcoin halving, a crypto-friendly US administration, and institutions buying crypto spot ETFs.

This confluence of events is contributing to broader mainstream awareness of the crypto ecosystem, with financial entities like JPMorgan, which once expressed skepticism about Bitcoin, now offering it to their clients.

As many holders take profits from their Bitcoin positions, this capital typically moves into altcoins. This shift of funds contributes to increased activity and value in the altcoin market. This pattern represents a classic altcoin season dynamic, where investors rotate profits from Bitcoin into higher-risk, higher-reward alternative cryptocurrencies.

Macroeconomic Factors

Macroeconomic conditions, such as falling interest rates and rising global debt, suggest that fiat currencies are weakening. It is also becoming increasingly challenging to achieve inflation-beating returns from traditional financial products, such as bonds.

This can be seen by comparing global money supply charts (M2) with Bitcoin, which illustrates the amount of fiat currency made available by central banks and its relation to Bitcoin. There is a sharp correlation between them.

Bitcoin price and Global Money supply (M2) chart – growing together. Source: BGeometrics

Fiat is, by design, inflationary, while most cryptocurrencies are deflationary. Central banks, such as the Fed, need their currencies to depreciate so that when they come to refinance their debts (owed to other countries), they can do so at a lower rate. This is because the debt becomes more affordable in relative terms.

As of January 2026, the US national debt stands at $38.51 trillion, and given that the US is still running a deficit, this isn’t going away anytime soon.

All this is bullish for Bitcoin and, by extension, altcoins.

Also, VCs are returning to crypto, and the convergence of AI and web3 is an attractive narrative that is driving the altcoin markets and cryptocurrency prices higher.

Technology and User Experience Improvements

Other factors contributing to altcoin growth include Ethereum upgrades and Layer 2 solutions built on Ethereum, as well as fast Layer 1 smart contract platforms like Solana. This means that gas fees are now cheaper than before, making trading altcoins easier.

DeFi and DEX innovations like Uniswap’s v3/4 pools, Raydium’s CLMM v4 pools, and Solana’s Jupiter DEX aggregator play a role in the increased traction of altcoins. By offering traders deeper liquidity, these tools make trading and taking profits simpler and less costly.

While web3 is still developing in terms of user experience, wallet providers like Best Wallet, MetaMask, and Rabby are making it easier to view your entire portfolio, onramp, and perform swaps, all from within the crypto wallet. This makes crypto adoption easier for new investors.

To discover up-and-coming trends, such as Telegram bots and DePIN, traders can use tools like DEXTools or DexScreener to identify new tokens and narratives emerging. The trending sections on CoinMarketCap and CoinGecko can be another helpful resource.

What Are the Risks of Altcoin Investing?

Investing in altcoins can be quite risky, especially if you aren’t well-informed about the potential risks you face. These are some of the main risks you need to consider before you consider investing in any crypto, but especially altcoins.

Volatility and Price Fluctuations

Naturally, most of the risks involved in trading altcoins and crypto in general come down to price volatility. Altcoins are especially prone to price fluctuations for a few main reasons, mostly due to their small size, low liquidity, and the fast-paced nature of the crypto market.

Before you buy any altcoins, you should be prepared for major losses. Anything from an error in a smart contract to an economic collapse on the other side of the globe can push prices down quickly and substantially. This volatility is the great double-edged sword of the crypto market. It allows for massive potential gains, but also major losses.

Unclear Regulations

As altcoins are still a burgeoning market, most regions and jurisdictions haven’t fully worked out their regulations for them yet. When a major jurisdiction like the EU or the US shifts its policies, even if you don’t live in said region, it can cause altcoins to fall in value.

Simple regulatory uncertainty can also keep crypto prices down, even if there aren’t any direct crackdowns.Some countries may completely ban crypto trading or have onerous rules that make it more complicated to do so legally. Make sure to do your research to ensure that you are following your nation’s laws to the letter.

Wider Market Conditions

As much as many investors would like to believe that the crypto market is wholly separate from the rest of the global economy, it simply isn’t. Even the largest coins like Bitcoin and Ethereum have historically been correlated with US stocks and the larger economy to some extent. This isn’t always the case, but coins often suffer major corrections when less volatile assets like stocks start to fall significantly.

Keeping a close eye on all of the major facets of the economy isn’t easy, but it’s important to help you make the best investment decisions possible, even if you only invest in crypto.

Where to Buy Top Altcoins Safely

Two primary options exist for buying altcoins safely: centralized exchanges (CEXs) and decentralized exchanges (DEXs).

Popular CEXs include: Binance, Coinbase, Kraken, Crypto.com, Gemini, Bybit, KuCoin, Bitstamp, OKX, and Huobi.

Popular DEXs include: Uniswap, PancakeSwap, Curve, SushiSwap, dYdX, Raydium, Serum, QuickSwap, and 1inch.

A wallet is needed for either choice. Our best wallets guide can help you choose a suitable wallet for your investment needs.

How to Buy Altcoins

1. Download a Crypto Wallet

First, you will need to either download a crypto wallet or sign up for a crypto exchange if you haven’t already. Buying most smaller crypto assets will require a crypto wallet, and experts agree that keeping your digital currencies in your own wallet is important for security.

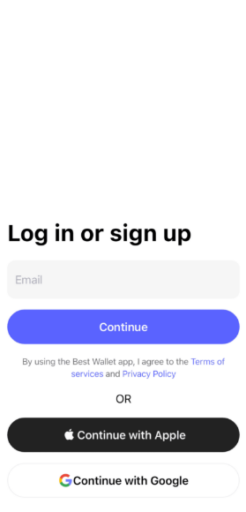

There are dozens of popular crypto wallets out there. Some of the most popular and useful options are Best Wallet, MetaMask, Coinbase Wallet, and Trust Wallet. You can check out our full guide on the best crypto wallets if you aren’t sure which one to pick yet. We will be using Best Wallet as an example for this guide because it’s a top choice for retail investors and it doesn’t require Know Your Customer (KYC) verification.

Best Wallet is available on both iOS and Android phones, so all you need to do is navigate to the App Store or Google Play Store, search Best Wallet, and download it. You can also scan the QR code from its website to open the app store page quickly.

How to download Best Wallet from its website. Source: Best Wallet

2. Set Up Your Wallet

Now it’s time to get your wallet set up. Best Wallet offers 3 main ways to sign up for an account: email, Apple, and Google. Select the option you want to use and follow the instructions provided. You will be asked to verify your email or Apple account.

Best Wallet login page. Source: Best Wallet

Once your account is created, you will be prompted to create a passcode. Make sure to make it difficult to guess and unique from any other passcodes you have used in the past. Next, it will ask you whether you want to back up your wallet. This is an absolutely essential step to avoid losing your funds because your funds could be lost forever if you lose your phone or accidentally uninstall the app without a backup.

Secure your Best Wallet account. Source: Best Wallet

Top Tip: Never share your wallet passcode, private keys, or backups with anyone. No legitimate support agent will ask you for this information and sharing it will compromise all of the funds in the wallet immediately.

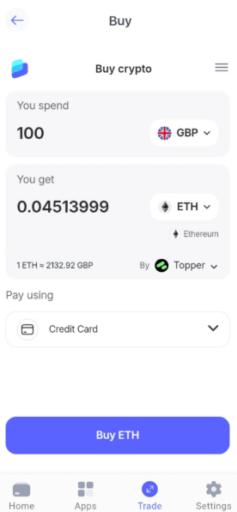

3. Start Trading

All you need to do now is start investing in your preferred tokens. Click the “Trade” button at the bottom and search for the token you want to purchase. Enter the amount of coins you want to purchase and select your payment method. Best Wallet and many other popular wallets allow investors to use debit or credit cards as well as payment services like Apple Pay.

Buying crypto within Best Wallet. Source: Best Wallet

If you want to use cryptocurrencies that you already own, you can send them to your new wallet by clicking “Receive” on the homepage. Double-check that the wallet address and network are correct to avoid lost funds.

4. Enjoy Your New Tokens

After a few seconds or minutes, your new altcoins should show up in your wallet dashboard. If you’re interested in staking your new coins or interacting with decentralized finance (DeFi) platforms, you can navigate to the “Apps” tab or use the wallet’s Wallet Connect compatibility to connect to DeFi apps on your desktop.

How to Evaluate the Best Altcoins Before Investing

Before you start trading altcoins, it’s important to understand the various metrics and factors that often determine whether an altcoin is successful. Here are some of the main metrics to evaluate.

Tokenomics

Tokenomics, the economic design of a coin, is one of the most vital factors to analyze when researching any kind of cryptocurrency. Check out aspects like the token distribution, circulating supply, inflation rate, and deflationary mechanisms.

Many of the strongest tokens will have fair token distributions with few whales and a large number of holders, low token inflation (or strong deflationary mechanisms), and significant token rewards or utility.

Team Credibility

Team transparency and credibility are also another important factors to consider when evaluating new coins. The more information about the team and founders the better. However, many, if not most, new coins provide little or none of this info and many anonymous coins have been remarkably successful (with the main example being Bitcoin).

Roadmap Progress

Naturally, a team’s ability to meet the goals it has set for itself in its roadmap can be a major tell for investors. If a new coin promises incredibly ambitious milestones, but doesn’t meet its expectations, hype will likely fade and other investors will lose trust in the project.

Whitepaper/Litepaper

While many new tokens, namely memecoins, don’t release whitepapers or litepapers, they can be a helpful tool in gauging a project’s potential. Look for a unique selling point or USP that could set it apart from the rest of the market and dive into the details. Are its goals reasonable and achievable? If not, you may want to stay away from the coin.

Upcoming Token Unlocks

Token unlocks, where a portion of locked coins can be sold on the open market, can be disastrous for new projects. Teams often lock away a large portion of their token allotments to reduce dumping after launch, but it often simply pushes the problem down the road. If a massive amount of tokens is about to be unlocked, you may want to wait to see what happens before diving in.

Community Support and Sentiment

Because the cryptocurrency world revolves around engagement and social networks, keeping an eye on a project’s community is essential. Check out each project’s social media accounts (X, Telegram, and Reddit mostly) to see if it regularly gets strong engagement on its posts and watch out for bots.

Exchange Listings or Possible Exchange Listings

When a relatively small altcoin secures a listing on a major exchange like Coinbase, Binance, or MEXC, it can dramatically increase its liquidity and accessibility. In turn, these listings also often boost the token’s price, though this isn’t a hard rule by any means.

Sometimes, you can catch hints of an upcoming exchange listing early. For example, Coinbase often adds Custody support for a token before it is listed. These hints don’t always translate to listings, but they can be helpful for traders with higher risk tolerances.

How We Picked These Altcoins – Our Methodology

The selection process for these altcoins focused on identifying projects that could contribute to a balanced and diverse portfolio. Popular trends, tokenomics, community engagement, project innovation, and trustworthiness were key factors in consideration.

Crypto price predictions are complex. The review highlights presales with good reputations and performance, as these present high growth potential. It also includes large, well-established coins that align with promising narratives, strategic developments, use cases, and upcoming market trends for 2026.

Market Research and Trends (30%)

Our editorial team researched some of the top trends in altcoins, including Layer 1s, Layer 2s, AI coins, blockchain technology and infrastructure plays, wallet providers, meme coins, and RWAs. Other factors included growth potential, community, and developer adoption and usage.

Token Utility (30%)

While tokens sometimes rise solely on the strength of the popularity of the projects they underpin, long-term success is usually driven, in part, by the utility of the token. Therefore, we primarily focused on coins that offer clear utility, such as staking for passive income, scaling solutions, blockchain gas tokens, reduced platform fees for holders, and meme coins with added utility.

Project Innovation (20%)

As the number of cryptocurrencies continues to increase, our team scoured the landscape for projects that offer true innovation and novel use cases. We listed tokens that are focused on developing advanced solutions like scalable blockchains, tokenizing real-world assets, and mainstream adoption of cryptocurrencies.

Trustworthiness and Community (10%)

While there are no guarantees in crypto, our methodology focuses on projects that are well-established or presales that have undergone security audits. Full team transparency is uncommon in presales due to regulatory reasons. However, the chosen projects were prioritized based on reputational checks within the broader crypto community. They were also included for demonstrating genuine user support and active engagement.

Spot ETF Speculation (10%)

Given the success of the Bitcoin and Ethereum Spot ETFs, our team highlighted coins with potential spot or staking ETF approvals or applications, and coins built on chains that have spot ETFs approved or pending. Other features tied to institutional interest and adoption were also a ranking factor.

Tools to Find and Track Promising Altcoins

To find and track promising altcoins, you can use websites and tools such as CoinMarketCap and CoinGecko, which often cover altcoins before they are listed on exchanges.

CoinGecko also has a portfolio tracker feature. This can be very handy, especially if you buy coins in various places, such as different centralized crypto exchanges and blockchains. It helps traders and holders track large movements and see profit and loss at a glance.

Coingecko’s free portfolio manager. Source: Coingecko

If you want to go deeper into web3, try websites such as DexTools’ Live Pair Checker and DexScreener to find new coins. For coins on Solana, check Jupiter’s AlphaScan, and look at the launchpad page for access to sites where people launch new projects and coins, such as the Raydium Dex Launchpad.

You can also explore social media, including Reddit, X, Telegram, and YouTube. However, there may be scams and potential rug pulls, so don’t trust blindly.

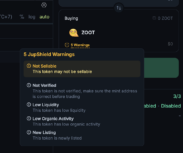

Telegram bots will help you find new tokens. These bots usually check for various trust signals, such as whether the liquidity has been locked, and if the token is a honeypot.

A honeypot token is a bit like the song Hotel California – you can buy, but you can never sell. And that’s just one of the things that can go wrong.

To stay safe, it’s very important to do further research.

Brand new coins on Solana. Source: Jupiter’s AlphaScan

To explore the safety of a new coin, take the Contract Address (CA) and paste it into TokenSniffer.

CoinGecko, CoinMarketCap, and DexTools have contract addresses, and they look something like this:

0x6982508145454ce325ddbe47a25d4ec3d2311933

(That’s the contract address for PEPE.)

TokenSniffer can give you lots of useful information about a coin. Source: Tokensniffer Pepe Page

Jupiter will also warn you of potential issues, for example, here’s a random coin:

Jupiter’s JupShield warns you about some key facts. Source: Jup.ag

Once you’ve found a coin that you like and want to support, you can add it to your portfolio tracker and also join the X and Telegram groups associated with it. Again, be sure to check that you are following the right coin.

And for safety, disable DMs in Telegram from people who aren’t contacts, as scammers will often pretend to be moderators. If you don’t want to do this, or you need a moderator to help you, then just remember, Moderators NEVER DM you first!

Are Altcoins Worth It in 2026? Our Final Word

With clear strategies in place to mitigate risks and emotions, altcoins, particularly those with lower market capitalizations, may offer vastly greater growth potential compared to Bitcoin in 2026. Nevertheless, it’s vital to remember not to invest more than you can afford to lose.

If you are an experienced investor with a high risk tolerance, allocating more funds to these emerging tokens may be suitable for you. However, experts suggest that even traders with high risk tolerances should consider diversifying their portfolios to avoid catastrophic losses. For beginners or less experienced investors, it is especially important to conduct thorough analysis and carefully consider risks before making large investments.

For further inspiration on what crypto to add to your portfolio, see our guide on the best cryptocurrencies to buy in 2026.

FAQ

Is it safe to invest in altcoins?

Where is the best place to buy altcoins?

How many altcoins are there?

How to trade altcoins?

When will altcoins pump?

Will altcoins go up?

References

- Bitcoin Market Analysis (Grand View Research)

- Bitcoin Price History (Investopedia)

- Growing Enthusiasm Propels Digital Assets into the Mainstream (EY)

- Solana Token Overview (CoinGecko)

- Alpha Scanner Tool for Solana Tokens (Jupiter Aggregator)

- Raoul Pal Sees SUI Becoming a Top 5 Crypto: Can It Reach $22? (Binance Square)

- Chainlink Project Overview (Messari)

- Token Intelligence and Analytics (Tokenomist)

- Cardano DeFi Analytics (DeFiLlama)

- Chainlink Ecosystem Directory (Chainlink Ecosystem)

- Live Token Data (DexTools)

- On-chain Token Screening (DexScreener)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

BMIC (BMIC) is a presale project that wants to create quantum-resistant security for crypto wallets and digital assets. The team s...

Wondering how to buy crypto but not sure where to start? Our beginner's guide explains how and where to invest in digital assets l...

Fact-Checked By:

Fact-Checked By:

37 mins

37 mins

Otar Topuria

Crypto Editor, 30 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.