Read our expert-led reviews for the best crypto options platforms. Learn how to trade these popular derivative products safely.

Read our expert-led reviews for the best crypto options platforms. Learn how to trade these popular derivative products safely.

According to our research, the best crypto options trading platforms are Binance and Bybit, while CoinFutures is a popular alternative for accessing 1000x leverage. These platforms are cost-effective, secure, and ideal for short-term trading strategies.

Options traders consider a wide range of metrics when selecting a broker, including safety, commissions, available markets, and premium prices. This guide explores the best places to trade Bitcoin and altcoin options in 2025. Read on to choose the right platform for you.

Key Takeaways

- Options are derivative instruments that enable traders to speculate on cryptocurrencies without owning the underlying assets.

- Traders enter positions by paying a “premium,” which gives them the right but not the obligation to buy or sell those cryptocurrencies at a later date.

- When choosing a platform for crypto options trading, consider security, supported markets, and trading tools.

- While CoinFutures offers simulated crypto futures, it’s the best option for trading digital assets with leverage.

- Those seeking conventional options contracts may consider Binance and Bybit for their extensive chains and deep liquidity.

The Best Crypto Options Platforms Ranked

Listed below are the top crypto options exchanges in 2025:

- CoinFutures: Trade bitcoin and popular altcoins with 1000x leverage

- Binance: Best choice for trading medium-term crypto options

- Bybit: European options contracts for BTC, ETH, and SOL

- Deribit: Top-rated crypto options wizard aimed at beginners

- OKX: Buy and sell bitcoin options without using complicated chains

- CME Group: Institutional-grade options markets for seasoned derivative traders

Comparing the Top Crypto Options Exchanges

| Platform | Markets | Trading Commissions | Availability |

| CoinFutures | 14 leveraged markets | Flat upfront fee or profit reduction | Global |

| Binance | BTC, ETH, BNB, SOL, XRP, DOGE | 0.03% without any discounts | Most countries (excluding the U.S. and the UK) |

| Bybit | BTC, ETH, SOL | Commissions start at 0.03% but discounts for VIPs and market makers | Most countries (excluding the U.S. and the UK) |

| OKX | BTC, ETH | Commissions start at 0.03% but discounts for VIPs and market makers | Global |

| Deribit | BTC, ETH, SOL, XRP | Commissions start at 0.03% but discounts for VIPs and market makers | Most countries (excluding the U.S.) |

| CME Group | BTC, ETH | Depends on the connected brokerage | Global |

Best Crypto Options Trading Platforms Reviewed

We tested and reviewed the best places for trading crypto options. Our methodology explored the most important factors for options traders, including available markets, strike prices, premiums, maturity dates, and fees. Let’s examine the top platforms in more detail.

1. CoinFutures: Regulated Platform With 1000x Leverage and Instant Withdrawals

CoinFutures is the overall best place to trade cryptocurrencies with high leverage. The platform, which is part of the CoinPoker group (a regulated poker site established in 2017), offers simulated crypto futures with leverage of up to 1000x. This high-leverage framework means staking just $20 provides users with $10,000 in market exposure.

CoinFutures offers the maximum leverage multiple on all supported markets, including the best meme coins like Dogecoin, SPX6900, and dogwifhat. Platform users can go long or short on any available crypto pair, and access risk-management tools like stop-losses and take-profits. Users can also trade manually and cash out their profits at any time.

CoinFutures offers 1000x leverage on popular meme coins like Pudgy Penguins. Source: CoinFutures

Getting started at CoinFutures is a hassle-free experience. Users download the native software for Windows, Mac, or Linux, or the Android app (iOS app is in development). New customers register with an email address and username only, as CoinFutures does not implement KYC verification.

Deposits and withdrawals are near-instant when using cryptocurrencies. Fiat payments are accepted too, including debit/credit cards and e-wallets.

In terms of drawbacks, CoinFutures does not offer traditional options contracts, meaning a lack of strike prices, premiums, and maturity dates. It also offers basic charting and analysis tools, which may not appeal to experienced technical traders.

Pros

- Trade Bitcoin and altcoins with 1000x leverage

- Go long or short without purchasing premiums

- Backed by the reputable CoinPoker brand

- Deposit and withdraw crypto near-instantly

- Open an account without providing KYC details

Cons

- Does not offer real crypto options

- Market prices are simulated via algorithms

- Only suitable for short-term trading strategies

2. Binance: Trade Bitcoin and Ethereum Options With 12-Month Maturity Dates

Binance is the largest crypto exchange for spot trading and derivative volume, including futures and options. The options trading platform supports six cryptocurrencies: Bitcoin, Ethereum, BNB, Solana, XRP, and Dogecoin.

Bitcoin and Ethereum have the most extensive selection of maturity dates, ranging from one day to 12 months. This makes Binance one of the best options brokers for entering longer-term positions. Traders also rate Binance for its deep liquidity and comprehensive options chains. The BTC/USDT 12-month market, for instance, offers strike prices from $60,000 to $170,000.

Binance offers medium-term options contracts on BTC/USDT and ETH/USDT. Source: Binance

One disadvantage is a lack of options markets outside of the top two cryptocurrencies. DOGE/USDT and XRP/USDT are tradable on the weekly market only, and strike price options are minimal.

Moving on to fees, Binance charges 0.03% for all supported options markets, regardless of monthly trading volumes or whether you’re placing limit/market orders. This means complete beginners get the same fees as large-scale crypto whales who provide liquidity.

Pros

- Deep liquidity on six large-cap cryptocurrencies

- BTC and ETH options contracts range from daily to yearly

- Advanced charting tools include technical indicators

- Backed by the largest crypto exchange globally

- Fiat payments are available in some regions

Cons

- No discounted fees for market makers or large monthly volumes

- Dogecoin is the only supported meme coin

- Some markets come with limited strike prices and maturity dates

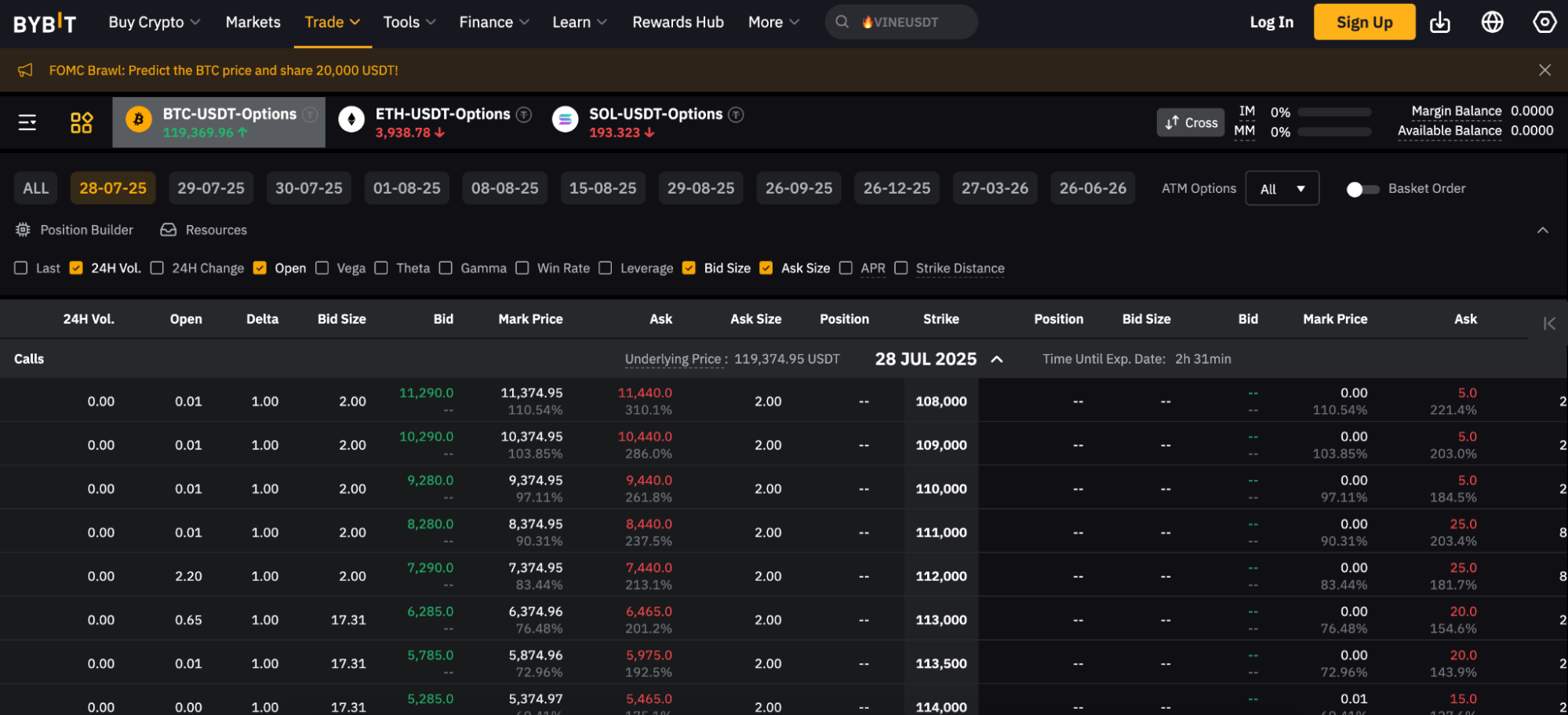

3. Bybit: Advanced Crypto Options Trading Tools Across Multiple Strategies

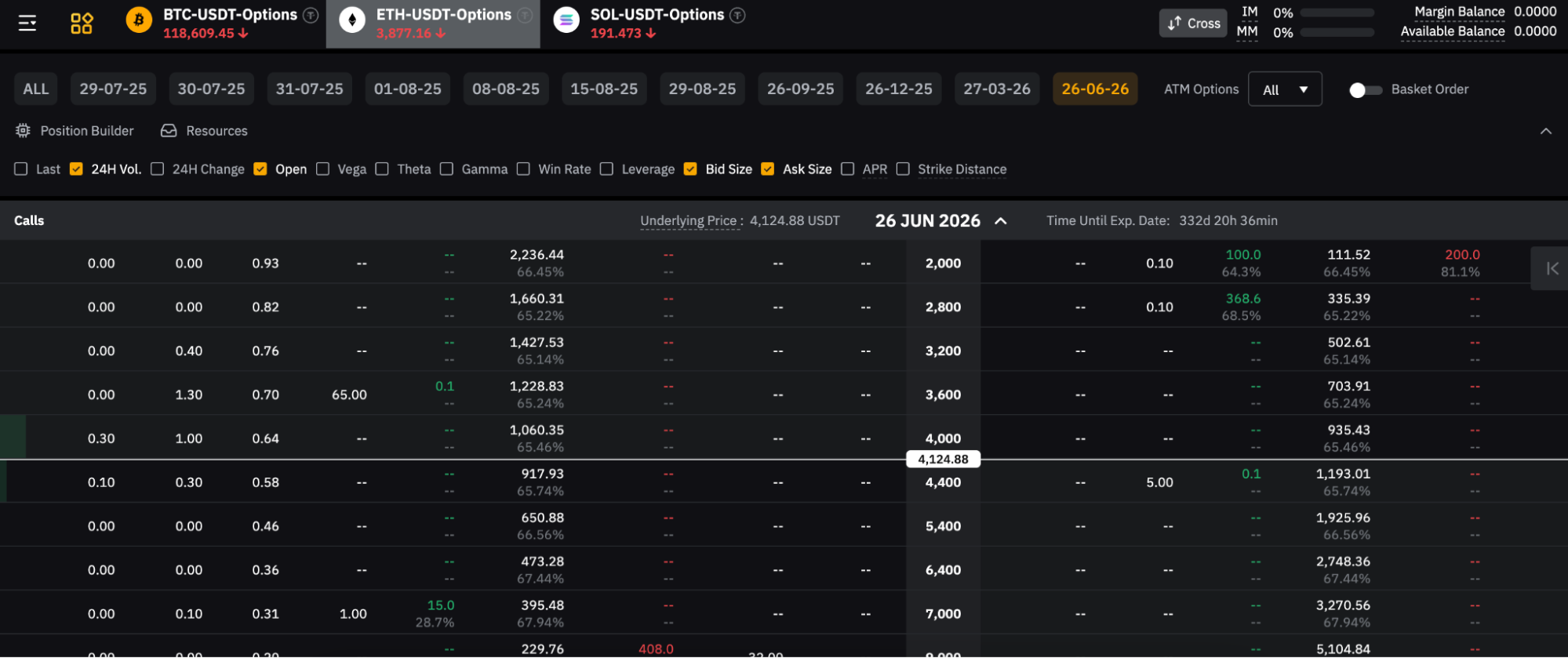

Founded in 2018, Bybit is a tier-one crypto exchange that offers a wide range of products, including spot trading, perpetual futures, and European options. The platform supports short and medium-term contracts for three options markets: Bitcoin, Ethereum, and Solana, each settled in USDT on the chosen expiry date.

Near-term maturity includes daily, weekly, and bi-monthly, while longer-term positions extend up to 12 months. Strike price selections are wide, and users can filter markets by Vega, Theta, Gamma, volume, APR, and other core metrics.

Bybit supports Bitcoin, Ethereum, and Solana options contracts with competitive fees. Source: Bybit

Bybit’s advanced charting suite supports drawing tools, economic indicators, and TradingView integration. It allows the most popular options strategies, from covered calls and protective puts to straddles, strangles, and butterflies.

Research shows that Bybit remains one of the best no-KYC crypto exchanges. Users may withdraw up to 20,000 USDT daily without providing personal information or ID verification documents. Most cases see crypto withdrawals processed near-instantly.

Pros

- Supports advanced options trading strategies like straddles and covered calls

- Extensive options chains include daily, weekly, and bi-monthly

- Tier-one trading volumes and deep liquidity

- Withdraw up to 20,000 USDT daily without completing KYC

Cons

- The options dashboard supports just three digital assets

- Users from some IP address locations are restricted

- The Bybit platform was recently hacked by North Korean hackers

4. OKX: Streamline Crypto Predictions via Simplified Options Trading

OKX is a tier-one trading platform designed for both inexperienced and seasoned crypto investors.

First-time traders like the “simple” options dashboard, which eliminates requirements for fully-fledged options chains. Beginners enter their predicted price and maturity timeframe for BTC or ETH, and OKX lists available contracts. Each suggestion shows the estimated profit and loss and break-even price.

While the simple options tool lets users purchase their preferred contract instantly, only call contracts are supported. Those wishing to buy or sell puts must use the primary options chain. Alongside more flexible order types, the main options platform also offers more strike prices, contract maturities, and strategies.

OKX simplifies crypto options for first-time traders. Source: OKX

Fees align with the industry average, with both market makers and takers initially paying 0.03% per slide. Like many options trading platforms, fees are reduced as 30-day volumes rise.

All OKX users must complete the KYC process before trading. Once completed, verified users may deposit funds with credit cards or crypto. They can also access a peer-to-peer exchange that supports over 100 additional payment types.

Pros

- Regulated tier-one exchange with institutional-grade liquidity

- Deposit funds with credit cards and other popular payment methods

- Offers options tools that cater to all experience levels

- The OKX ecosystem includes DeFi, non-custodial wallets, and OTC trading

Cons

- Options markets feature Bitcoin and Ethereum only

- The simple options platform only allows call contracts

- Customer support is poorly rated

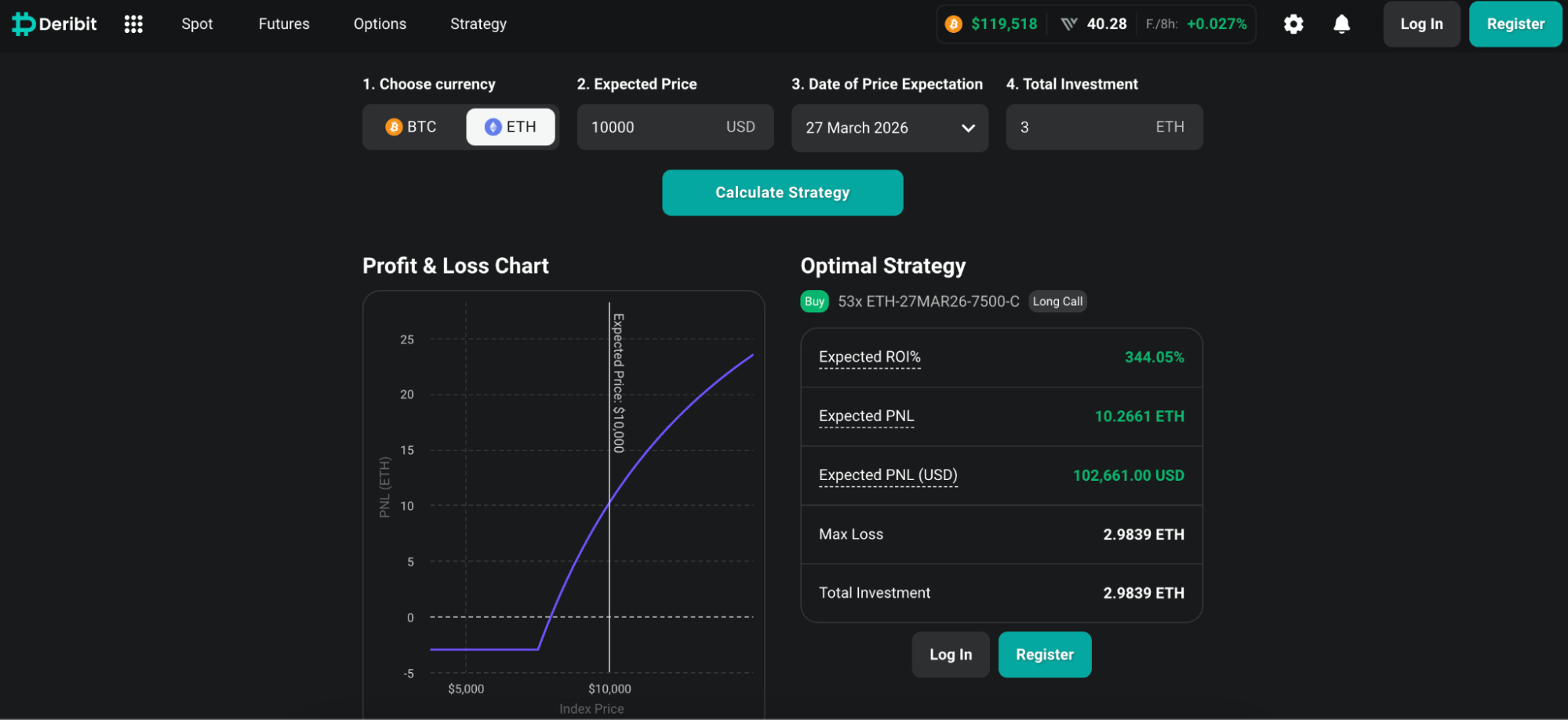

5. Deribit: Optimal Contract Suggestions Based on Price Expectations

Deribit is a crypto derivatives platform with deep liquidity and extensive options chains for Bitcoin and Ethereum. It also supports Solana and XRP contracts, although with thinner strike price ranges and maturity dates.

While Deribit is one of the best crypto options trading platforms for advanced users, it also offers beginner-friendly tools. The Options Wizard, for example, lets users enter their expected price and timeframe, and the tool suggests the optimal contract based on the perceived value. It also displays the projected return on investment and premium value, so novice traders can easily determine their risk and reward.

Deribit’s Options Wizard tool helps beginners find suitable options contracts. Source: Deribit

Trading fees vary depending on the asset and contract type. Most options traders pay 0.03%, with a slight discount offered to market makers. The platform charges a 0.015% settlement fee, although daily and weekly contracts are exempt.

In addition to options contracts, Deribit also offers perpetual futures and spot trading markets. New customers must complete a standard KYC procedure before they can get started.

Pros

- Automatically suggests the best contract based on the expected price

- Allows multi-leg strategies and block trades

- Also supports perpetual futures and spot trading

- Offers a crypto options trading app for iOS and Android

Cons

- Complicated trading fee structure

- Does not allow withdrawals until KYC is completed

- U.S. clients are prohibited from joining

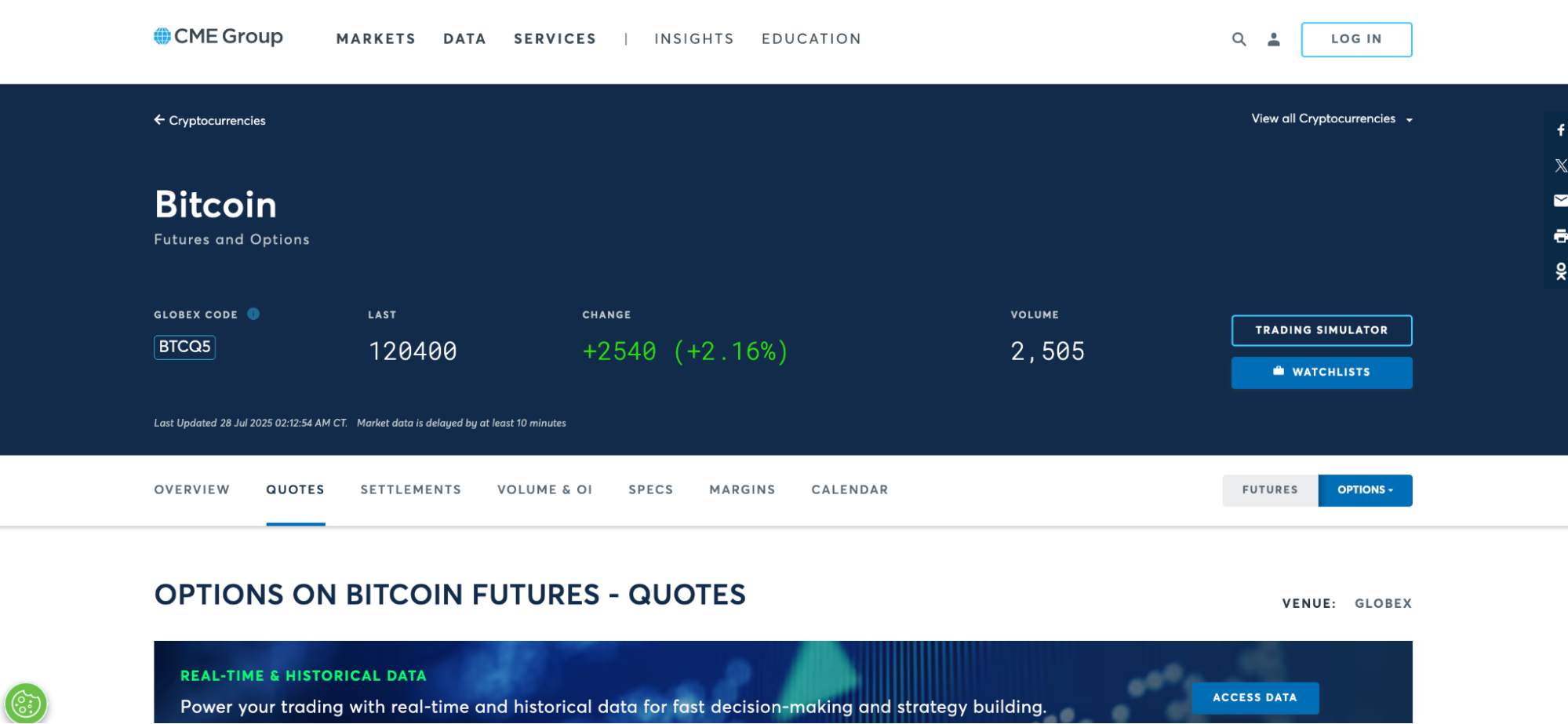

6. CME Group: Fully Regulated Bitcoin Futures With Full or Micro Contracts

CME Group is the only officially regulated Bitcoin options market in the sector. Full Bitcoin options have a minimum trade value of 1 BTC, while micro-futures reflect 1/10th of that contract amount.

Traders buy and sell contracts with other market participants, and expiration periods range from monthly to 18 months. Strike prices suit the most bearish and bullish of investors, with long-term contracts ranging from $80,000 to $170,000.

CME Group is typically used by institutional and accredited clients to trade crypto options and futures. Source: CME Group

CME Group also offers Ethereum options, yet trading volumes are much smaller than the BTC/USD market.

The regulated exchange, while aimed at seasoned derivative traders, offers an online trading simulator. Platform users can test-drive new options trading strategies and tactics without risking real money.

CME Group provides unprecedented data sets, including CFTC reports, roll activities, and historical benchmark indicators.

Pros

- The best options trading platform for accredited investors in the U.S.

- Regulated tier-one exchange with institutional-grade liquidity

- Partners with licensed brokerage platforms

Cons

- Real Bitcoin options have a 1 BTC minimum

- The exchange has smaller trading volumes than many crypto derivative platforms.

- Not suitable for complete beginners

What are Cryptocurrency Options?

Options are derivative products that let traders speculate on cryptocurrencies without owning or controlling the underlying assets. They appeal to some crypto investors due to their significant market exposure and limited financial risk.

Options traders pay an upfront premium to unlock large trade sizes, and the potential losses remain limited to that premium. This is because options offer the right but not the obligation to buy or sell the traded asset.

The best crypto options trading platforms offer deep chains on major markets like Bitcoin, Ethereum, and XRP. Traders purchase call or put contracts based on their projected price and timeframe, and the premium adjusts based on the perceived probability.

If BTC/USD is priced at $120,000 and the trader sets the strike price at $123,000 with a one-month expiry, the odds of that prediction coming true are very high. As such, the premium price is also high, due to the reduced risk. Increasing the strike price to $170,000 would vastly reduce the win probability but also the upfront premium.

The key takeaway is that crypto options offer significant upside when traders speculate correctly, and limited downside when they’re wrong. This makes them ideal for trading new cryptocurrencies with volatile pricing swings.

How Does Crypto Options Trading Work?

Read on to learn more about crypto options, including concepts like calls and puts, premiums, and expiration dates.

Calls and Puts

As an options buyer, you purchase calls or puts. These instruments simply determine the predicted market direction. Call options resemble long positions, while buying put options means you’re short.

Avoid selling calls or puts, as these increase the risk by substantial amounts. The downside risk for buyers is the premium only.

Options Premium

Options traders pay a premium for the right but not the obligation to buy or sell the underlying digital assets. The premium is a percentage of the overall market exposure, but it varies considerably depending on the trade parameters.

Binance premiums rise and fall based on various factors, including spot prices and time to decay. Source: Binance

Premiums increase as the probability of the trade winning grows. Importantly, you can never lose more than the options premium, as long as you purchase calls or puts. Selling them would make you a market maker and remove the risk barrier.

Strike Prices

There is a direct correlation between strike prices and premiums, as these metrics determine the risk-reward of the crypto options trade.

If you’re going long via calls, you need the contracts to expire above the strike price. And vice versa when purchasing put options.

The best crypto options trading platforms offer an extensive selection of strike prices, allowing both bullish and bearish traders to enter trades based on their predictions.

Suppose the current ETH/USD price is $3,000. The premium on a $7,000 strike price could be just 3% of the contract value. Yet, a $3,500 strike price may amount to 60%, as the probability of ETH/USD surpassing $3,500 is much higher.

Expiration Date

Crypto options contracts always include an expiry date, unlike perpetual futures, which remain open indefinitely.

Depending on the platform, contracts are often available from just one day to over 12 months. Longer-term contracts are more expensive, as traders have more time to hit their strike price target (and vice versa for short-term markets).

Crypto Options Example

Here is a simplified example of how crypto options work:

- A trader purchases Solana call options at a $190 strike price and a one-month expiration. They pay a $19 premium per contract and buy 10 contracts ($190 outlay).

- The Solana price reaches $250 when the contract expiration date arrives. With the premium ($19) and strike price ($190), the trader makes $41 per contract. They purchased 10 contracts, so their profit is $410, less fees.

In the above example, had Solana closed below the break-even price ($190 + $19), the trader would have lost the $19 premium only (per contract).

Crypto Options vs Futures

Options and futures share some similarities. They support long and short trading, allowing investors to speculate on rising and falling crypto prices. Both trading products are derivative products, so the contract holder does not own the underlying coins or tokens.

The key difference between them is that options offer the right but not the obligation to buy or sell the respective digital asset on the settlement date. Therefore, if the trader speculates unsuccessfully, they simply lose the initial upfront premium paid, choosing not to exercise their contract rights.

Futures, on the other hand, require the holder to buy or sell the contracts. This is why during COVID-19, WTI Oil Futures were traded negatively. Global storage facilities were at maximum capacity, so contract holders were willing to pay people to take delivery of the oil.

Another core difference is liquidation risk. Options buyers do not face margin calls or brokerage liquidation, since they hold the contracts until they expire. Perpetual crypto futures, which are heavily traded by retail clients, incur substantial liquidation threats, especially when high leverage is used.

However, due to their complexity and thinner liquidity, options markets are more limited compared to futures. Options rarely track penny cryptocurrencies, so they are a better fit for large-cap investors.

Key Things to Know About Crypto Options Trading

Options trading crypto can be a low-risk, high-reward strategy, yet so many traders incur consistent losses. Here are some key considerations and best practices to explore before getting involved.

Never “Sell” Calls or Puts as a Beginner

Selling calls or puts makes you an options underwriter. You bear the full market exposure, depending on the market direction.

Selling a call option, for instance, means substantial losses if the digital asset blows up. This is because the other trader’s profit is yours to deliver. If the same asset crashed, you would only make that trader’s premium.

While selling calls and puts can be a smart strategy for experienced options traders, beginners should stick with traditional options buying. The financial risk is capped at the upfront premium only.

Evaluate the Break Even

Beginners often make the mistake of thinking the strike price is their break-even level. However, the premium should be added, increasing or decreasing the break-even point depending on the market direction.

Start With Longer-Term Contracts

Active options traders may prefer short-term contracts with daily or weekly expirations. Prices are more volatile, so they present additional trading opportunities. These options markets can be hard to predict, as crypto price movements are less predictable in the near term.

Bybit offers 12-month options contracts on ETH/USDT. Source: Bybit

As a beginner, consider trading longer-term options like the six or 12-month contracts at Binance or Bybit. These are available for BTC and ETH only, yet they provide inexperienced traders more time and flexibility.

You Don’t Need to Hold Until Expiry

Some options traders hold until their contracts expire, yet this isn’t mandatory. Traders can exit positions before the options mature, potentially allowing them to lock in profits early. They may also limit losses, meaning they get some of their premium back.

The real-time value of outstanding options trades is driven by various factors, including the digital asset’s spot price, implied volatility, and time remaining until expiration. The simple explanation is that the cash out yield reflects the probability of the options contract closing in the money.

What are the Benefits of Trading Crypto Options?

Crypto options provide traders with several advantages over traditional spot markets.

The premium allows traders to enter positions worth much more than the upfront risk. If the premium amounts to 4% of the overall contract value, the trader gets 25 times more market exposure than the balance permits.

Despite their high-leverage capabilities, the potential financial losses are capped. Options buyers can lose no more than the initial margin, eliminating liquidation and negative balance risks.

Options, like most derivative products, support both market directions. Traders may purchase call options to go long or put options to speculate short. This makes crypto options suitable for bull, bear, and sideways markets.

An often understated benefit is that options are more flexible than perpetual futures. Traders can keep perpetual positions open indefinitely, yet this would not make sense considering the typical eight-hour funding cycle. The best crypto options trading platforms offer 12-month contracts, which remain open until the settlement date without incurring daily fees.

Pros & Cons of Crypto Options Trading

Consider these pros and cons of trading Bitcoin and altcoin options:

Pros

- Risk is a small fraction of the overall market exposure

- The potential financial loss is capped at the upfront premium

- Speculate on rising and falling crypto prices

- Successful options trades can yield substantial returns

- Contract maturities often range from one day to 12 months

- No liquidation risks for options buyers

Cons

- Limited market available compared to perpetual futures

- Options platforms often only support large-cap cryptocurrencies

- Beginners may find options chains complex and intimidating

- While losses are limited, consistently losing can lead to consequential amounts

How to Trade Crypto Options

This section explains how to trade cryptocurrencies on CoinFutures. Although CoinFutures offers simulated crypto futures, these share the same characteristics as conventional options. Platform users go long or short and can access leverage of up to 1,000x.

Read on to get started in under 10 minutes.

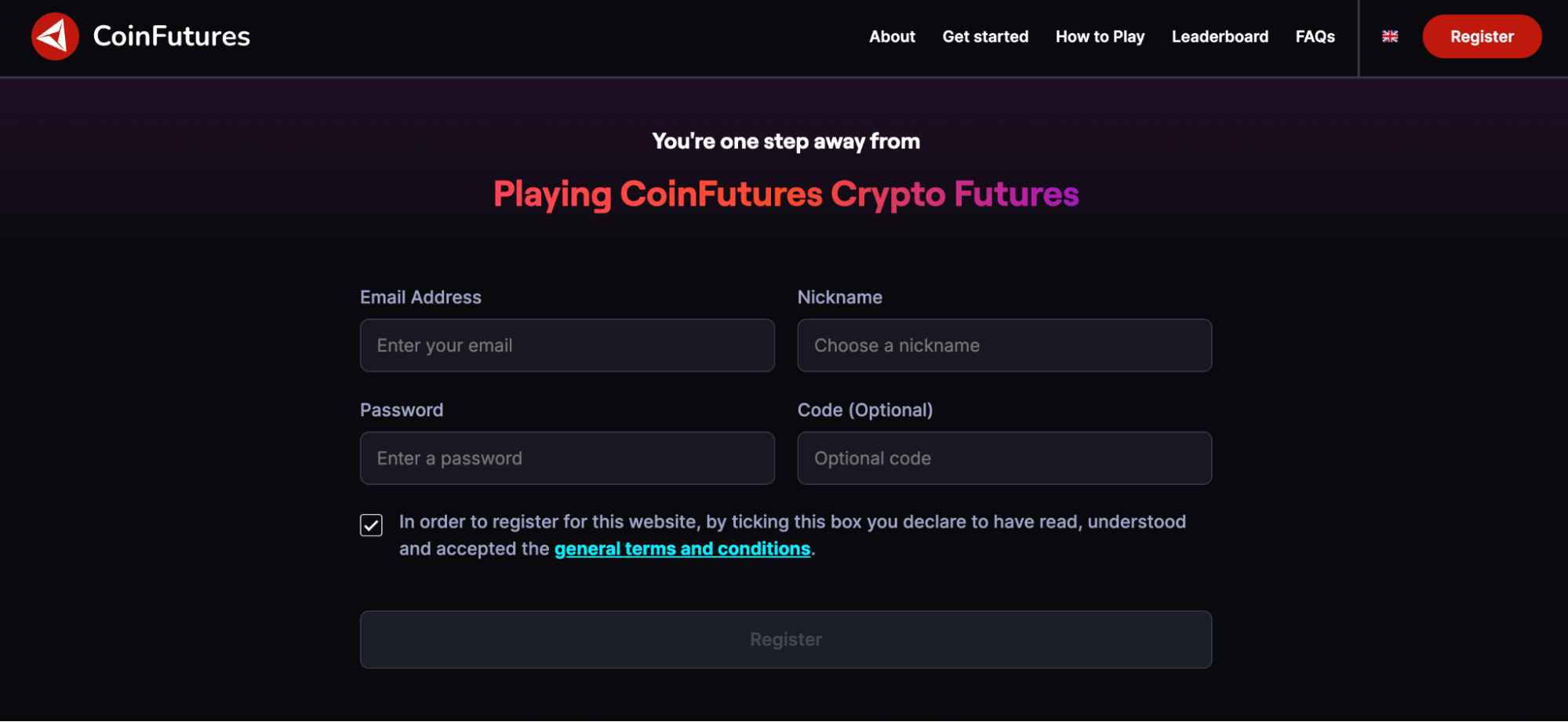

Step 1: Open an Account

Visit the CoinFutures website to register a new account. Click “Register”, enter an email address, and choose a nickname and password.

CoinFutures requires an email address, nickname, and password when opening a new account. Source: CoinFutures

Select “Register” again to complete the registration process. You will notice that, unlike many options trading platforms, CoinFutures supports privacy and anonymity.

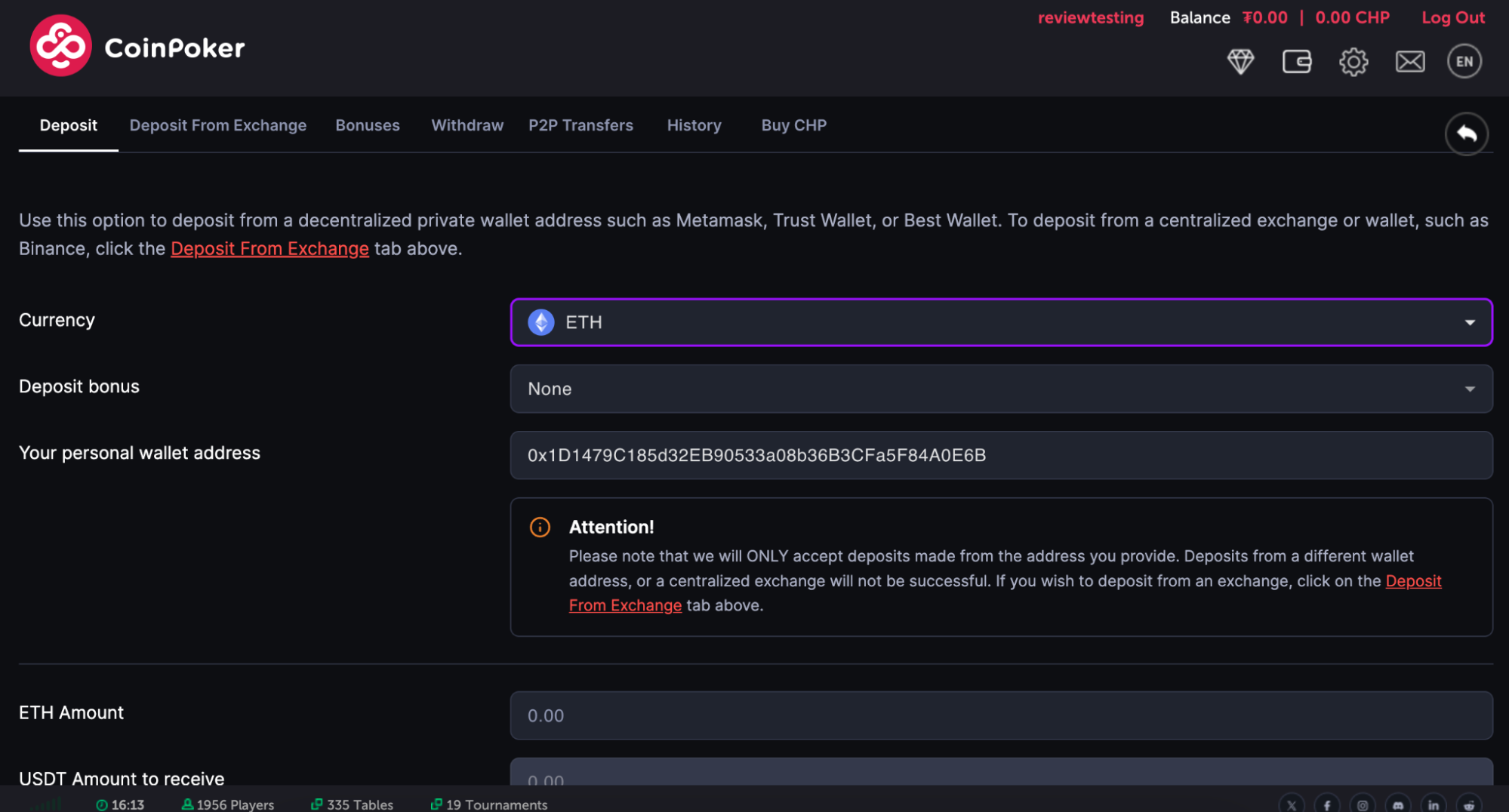

Step 2: Download CoinPoker Client

CoinFutures is backed by the trusted CoinPoker brand, an established poker platform with casino and sports betting.

You need the CoinPoker client to trade simulated markets. The provider offers free desktop software and mobile applications. Select your preferred operating system to begin the download and installation.

Step 3: Log In and Deposit Funds

Open the CoinPoker client and sign in with your email address and chosen password. Then click the “Wallet” icon to make a deposit.

Traditional deposit methods include Google/Apple Pay, debit/credit cards from Visa and MasterCard, and PIX.

Most traders fund their accounts with cryptocurrencies, as payments are private, near-instant, and hassle-free.

CoinFutures users get near-instant payments when they deposit crypto. Source: CoinFutures

CoinFutures accepts Bitcoin and the best altcoins like USDT, USDC, and Ethereum. Crypto payments function similarly to depositing funds into an online exchange. Copy the unique deposit address and complete the payment from a private wallet.

Note: If you deposit cryptocurrencies, ensure you enter your private wallet address correctly. Sending assets from a different address may result in delays or returned funds. This is a security procedure to protect CoinFutures customers from potential threats.

Step 4: Choose a Crypto Leverage Market

Click the “Crypto Futures” button and choose a suitable trading market. 14 leveraged cryptocurrencies are available, from Bitcoin, Dogecoin, and Shiba Inu to Ethereum and Cardano.

Step 5: Place a Leveraged Crypto Trade

CoinFutures offers a user-friendly experience, even for first-time traders. There is no requirement to research options chains, strike prices, premiums, or maturity dates. Instead, start by choosing between “Up” or “Down”. The decision is based on whether you believe prices will rise or fall.

The CoinFutures trading dashboard is beginner-friendly. Source: CoinFutures

Now enter the wager amount. Similar to a premium, this represents the maximum amount you will risk on the leverage trade. If you speculate incorrectly, the wager amount is kept by the platform.

If you wish to trade with leverage, set your multiple from 2x to 1000x. Notice the “Bust” price update, which is effectively the liquidation price to avoid.

Click “Place Bet” to complete the trade.

Note: Switch to “Auto” to place stop-losses and take-profits. Otherwise, in “Manual” mode, traders open and close positions manually.

Conclusion

Crypto options offer the ideal balance between profit maximization and risk management. By paying a small premium, traders increase their position sizes while the potential financial loss is capped.

That said, inexperienced traders may find options chains, strategies, and principles intimidating. A more beginner-friendly option is trading simulated futures at CoinFutures. It offers 1000x leverage, a minimum trade size of $1, and the ability to go long or short.

FAQs

What are options in crypto?

Why do people trade crypto options?

Are crypto options more risky?

What’s the minimum amount you need to trade crypto options?

What is the best crypto options trading platform?

References

- FBI Says North Korea Was Responsible for $1.5 Billion ByBit Hack (Reuters)

- Perpetual Futures Contracts and Cryptocurrency Market Quality: Insights from Emerging Markets (Cornell SC Johnson College of Business)

- Options Pricing (Merrill Lynch)

- Options Premium and the Greeks (CME Group)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The PEPENODE presale is regularly breaking major milestones as investors flock into its innovative virtual mining ecosystem, makin...

Read our expert-led reviews for the top leverage trading crypto platforms. Learn how to trade leveraged Bitcoin products like simu...

22 mins

22 mins

Victoria Ronina

, 3 posts