Super Pepe (SUPEPE) is a 2025 meme coin with a charitable twist. In this post, you will discover some realistic price scenarios, a...

Best Crypto Futures Exchanges in 2025 – Compare Top Trading Platforms

26 mins

26 mins Looking for the best crypto futures trading platform? Read our top 10 selections and learn how these services work, what they offer, and more.

Based on recent surveys and our own research, the leading crypto futures exchanges in 2025 are MEXC, Binance Futures, and OKX Futures.

Binance Futures is known for its liquidity and wide choice of perpetual contracts. Bybit appeals to many traders with its simple interface and robust risk controls, while OKX earns points for its low fees and seamless on-chain integrations.

Futures trading remains in high demand, with volumes and open interest at record highs. That makes choosing the right platform in 2025 more important than ever.

Key Takeaways for Crypto Futures Trading Platforms

- MEXC stands out with up to 200x leverage, support for more than 700 assets, and zero maker fees, which makes it especially appealing to active traders.

- Binance Futures remains the busiest exchange, handling billions in daily volume across over 250 different contracts.

- Perpetual contracts are where OKX and Bybit shine, with OKX offering more than 300 pairs and seven order types for flexible trading.

- Fees differ a lot from platform to platform, usually 0.02%–0.05%, but exchanges like MEXC and KCEX keep them close to zero.

- According to CME’s Q2 2025 Crypto Insights report, open interest across leading platforms reached record levels in Q1 2025, showing that demand for leveraged products is still climbing.

Top Crypto Futures Trading Platforms List for December 2025

Listed below are the best crypto futures exchanges for 2025:

- MEXC – Up to 200x leverage, 700+ assets, and zero maker fees for cost-efficient futures trading.

- Binance Futures – World’s largest exchange by volume with 250+ contracts and deep liquidity.

- OKX Futures – Leading in perpetual swaps with 300+ pairs and advanced risk tools.

- CoinEx – Altcoin-focused platform with diverse futures markets beyond BTC and ETH.

- BloFin – Offers up to 150x leverage on major pairs with a beginner-friendly interface.

- Kraken Futures – Best-in-class security and compliance with 350+ markets supported.

- KCEX – New platform attracting traders with zero maker fees and USDT rewards.

- BingX – Social and copy trading pioneer with promotions worth thousands in USDT.

- PrimeXBT – Multi-asset platform with up to 200x leverage on crypto, forex, and indices.

- Pionex Futures – Bot-powered trading with integrated automation for beginners.

10 Best Crypto Futures Trading Platforms Reviewed

Let’s take a closer look at what each platform offers in terms of max leverage, supported assets, fees, and more.

1. MEXC – Overall Best Platform for Crypto Futures Trading

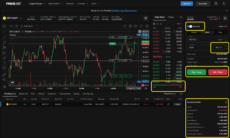

MEXC is a centralized crypto exchange that supports spot, margin, and futures trading. Launched in 2018, it’s now among the top 20 crypto trading platforms globally.

It’s our top choice thanks to its generous leverage of up to 200x, support for over 700 cryptocurrencies, and exceptionally low fees: the maker fee is 0% while takers need to pay up to 0.02%.

Bitcoin/USDT perpetual futures chart on MEXC with price action, moving averages, and order book view. Source: MEXC

MEXC has a fairly user-friendly interface, but it might still be complex for beginners who are not yet familiar with what is futures trading crypto. However, experienced users will appreciate the wide range of order types and TradingView-powered charting tools.

With its many complex and advanced trading tools, MEXC caters mainly to advanced users, but it is also an excellent option for beginners who take crypto trading seriously.

MEXC is suitable for you if:

- You want access to up to 200x leverage for maximum exposure.

- Low trading costs are a priority, thanks to 0% maker fees and minimal taker fees.

- You prefer advanced charting tools powered by TradingView.

- You enjoy frequent promotions and trading incentives.

MEXC is not suitable for you if:

- You rely heavily on fiat withdrawal options, as they are limited here.

- You’re a complete beginner and may find the interface complex at first.

| Max Leverage | Up to 200× |

| Futures Type | USDT-margined perpetual contracts |

| Coins & Pairs Supported | 700+ |

| Fees (Maker/Taker) | 0% / 0.02% |

| Min Deposit | $0 |

| Order Types | Limit, Market, Stop-Limit, OCO |

| Trading Interface & Tools | TradingView charts, multiple indicators |

2. Binance Futures – Best for High Liquidity and Volume

Binance, launched in 2017, is the world’s largest crypto exchange by trading volume. That advantage extends to its futures platform, introduced in late 2019.

You are given access to over 250 futures contracts with leverage going as high as 125x, although most contracts have lower caps. The fee structure varies based on your VIP level and whether you hold BNB. Default fees are 0.02% for makers and 0.05% for takers, but they can drop to 0% and 0.0153%, respectively.

Bitcoin/USDT perpetual futures chart on Binance Futures with price trend, order book, and trading panel for long and short positions. Source: Binance Futures

Binance Futures supports USD-M, COIN-M, perpetual, and quarterly futures. USD-M is most popular, as it uses stablecoins like USDT or USDC for margin, simplifying the cost structure.

Beyond derivatives, traders also closely monitor new binance listings, as fresh coins often drive additional liquidity and trading opportunities.

Binance Futures is suitable for you if:

- You want access to one of the most extensive selections of trading pairs.

- Advanced trading tools and features are essential to your strategy.

- You’re interested in crypto copy trading platform to follow experienced traders.

- A strong, well-established brand reputation gives you confidence.

Binance Futures is not suitable for you if:

- Fast and consistent customer support is critical to you, as delays can occur.

- You prefer platforms with less exposure to ongoing global regulatory scrutiny.

| Max Leverage | Up to 125× |

| Futures Type | USD-M & COIN-M perpetual and quarterly contracts |

| Coins & Pairs Supported | 500+ |

| Fees (Maker/Taker) | Up to 0.02% / 0.05% |

| Min Deposit | $15 |

| Order Types | Limit, Market, Stop, Stop-Limit, Trailing Stop |

| Trading Interface & Tools | Advanced charts, trading bots, copy trading |

Visit Binance Official Website

3. OKX Futures – Best for Perpetual Swap Contracts

OKX is a reputable global crypto exchange and Web3 platform offering services such as crypto spot and futures trading, P2P trading, trading bots, staking, and lending.

When it comes to futures contracts, OKX predominantly offers perpetual swaps, but also a range of standard futures contracts and various margin types, including USDT-margined, USDC-margined, and inverse contracts.

Bitcoin futures contract (BTC/USDT) on OKX with live chart, volume bars, and detailed order book. Source: OKX

The leverage on OKX goes up to 100x or 125x, but the higher leverage is usually available only on the most liquid pairs, like BTC/USDT or ETH/USDT. It supports over 300 cryptos, resulting in hundreds of trading pairs.

At the same time, fees are based on your 30-day trading volume and whether you are holding OKB, the brand’s native token. Maker fees are up to 0.02% and taker fees up to 0.05%.

If you’re looking for the best crypto futures trading platform in the USA, you’ll be glad to know that OKX started offering its trading services in the US as of April 2025.

OKX Futures is suitable for you if:

- You want access to a wide selection of contract types and trading pairs.

- Flexibility matters, with as many as seven different order types available.

- Proof of reserves and constant audits give you confidence in platform security.

- You’re interested in exploring an extensive range of Web3 products alongside futures.

OKX Futures is not suitable for you if:

- You need maximum leverage across all trading pairs, as it’s available only on a few.

- A clean, beginner-friendly interface is a must, since the platform can feel overwhelming at first.

| Max Leverage | Up to 125× |

| Futures Type | Perpetual swaps, standard futures |

| Coins & Pairs Supported | 300+ |

| Fees (Maker/Taker) | Up to 0.02% / 0.05% |

| Min Deposit | $10 |

| Order Types | 7 types incl. Limit, Market, Stop, OCO |

| Trading Interface & Tools | Trading bots, copy trading, OKX Academy |

4. CoinEx – Best for Altcoin Futures Diversity

Founded in 2017, CoinEx is a global crypto exchange known for supporting various altcoins, including many not found on major platforms. It offers linear USDT- and USDC-margined contracts and inverse futures for BTC/USD and ETH/USD.

BTC/USDT futures chart on CoinEx with technical indicators, live order book, and trading options for limit and market orders. Source: CoinEx Futures

Leverage goes up to 100x, although it’s lower for niche assets. The platform doesn’t support as many cryptocurrencies overall, but it shines when it comes to altcoin selection.

The exact fees are based on your 30-day trading volumes and VIP status, while the actual numbers aren’t that much different from most other futures platforms on this list. Maker fees go up to 0.03% and taker fees up to 0.05%.

CoinEx Futures is suitable for you if:

- You want a straightforward, user-friendly trading platform.

- A broad selection of altcoin futures appeals to your trading strategy.

- You value multilingual support for a smoother global experience.

- Copy trading and demo trading tools are important for learning and testing.

CoinEx Futures is not suitable for you if:

- You trade niche pairs that may suffer from low liquidity.

- You want to avoid platforms with a higher risk of auto-deleveraging in volatile markets.

| Max Leverage | Up to 100× |

| Futures Type | Linear USDT/USDC contracts, inverse futures |

| Coins & Pairs Supported | 200+ |

| Fees (Maker/Taker) | Up to 0.03% / 0.05% |

| Min Deposit | $0 |

| Order Types | Limit, Market, Stop |

| Trading Interface & Tools | Integrated charting, copy & demo trading |

5. BloFin – Best for High Leverage on Popular Pairs

BloFin is a crypto derivatives trading platform that focuses on spot and futures trading, while also offering good copy trading and staking options. On some popular pairs, it allows leverage of up to 150x, which is more than most competitors.

Thanks to its user-friendly and clean interface, BloFin is the best futures trading platform for beginners, but it still offers advanced trading options, including TradingView charts. The focus when it comes to futures trading lies in USDT-margined perpetual futures.

Real-time Bitcoin futures trading screen on BloFin featuring candlestick analysis, live order book, and market execution tools. Source: BloFin

A standout feature is the unique Rewards Hub, where you can complete daily tasks and earn rewards.

Standard fees on BloFin are 0.02% for makers and 0.06% for takers, and the latter are slightly higher than what other platforms on the list offer. However, fees are still determined based on your 30-day total trading volume and VIP tier. Moreover, BloFin also offers time-limited discounts on select pairs.

BloFin is suitable for you if:

- You like earning rewards through daily tasks and time-limited fee discounts.

- High leverage of up to 150x on major trading pairs matches your strategy.

- You need a platform that can process large trading volumes with minimal latency.

- You prefer focusing on USDT-margined perpetual futures.

BloFin is not suitable for you if:

- Keeping trading costs as low as possible is a priority, since taker fees are slightly higher than average.

- You rely on multiple direct fiat payment options, which are limited here.

| Max Leverage | Up to 150× |

| Futures Type | USDT-margined perpetual futures |

| Coins & Pairs Supported | 400+ |

| Fees (Maker/Taker) | 0.02% / 0.06% |

| Min Deposit | $0 |

| Order Types | Limit, Market, Stop, Conditional |

| Trading Interface & Tools | TradingView integration, rewards hub |

6. Kraken Futures – Best for Security-Focused Traders

Kraken is one of the world’s oldest and most reputable crypto exchanges, best known for its strong emphasis on security and compliance.

One of the bigger downsides of Kraken is that it doesn’t offer crypto futures trading in the US and several other countries. However, if you come from a country where it’s fully licensed, you’ll find it to be one of the top choices.

Kraken Pro interface displaying BTC/USD futures with candlestick chart, order book depth, and limit order setup panel. Source: Kraken Futures

To gain access to futures trading, you’ll need to use Kraken Pro, the brand’s more advanced trading platform designed primarily for derivatives, including futures contracts. It focuses on perpetual futures, and the contracts are usually margined in specific cryptocurrencies, not just stablecoins.

Kraken supports over 350 futures markets, and leverage is up to 50x. Fees depend on your trading activity and can go up to 0.02% for makers and 0.05% for takers.

Kraken Futures is suitable for you if:

- Security and regulatory compliance are your top priorities.

- You value multi-collateral margining for flexible trading.

- Trading futures contracts margined in various cryptocurrencies fits your needs.

- You prefer a professional-grade interface designed for advanced traders.

Kraken Futures is not suitable for you if:

- You require leverage above 50x for your strategies.

- You are based in key markets like the US, where derivatives are not available.

| Max Leverage | Up to 50× |

| Futures Type | Perpetual contracts, various crypto-margined futures |

| Coins & Pairs Supported | 300+ |

| Fees (Maker/Taker) | Up to 0.02% / 0.05% |

| Min Deposit | $10 |

| Order Types | Limit, Market, Stop |

| Trading Interface & Tools | Pro-grade platform, multi-collateral margining |

7. KCEX – Best for Traders Looking for New Platforms with Incentives

KCEX is a relatively new crypto trading platform trying to break into the market with various incentives, making it ideal for users looking for new crypto futures trading platforms.

It offers beginner tasks with USDT rewards and some of the lowest fees on the market. Maker fees are zero while takers need to pay only 0.01%.

The site features perpetual and quarterly contracts with leverage up to 100x, supporting over 500 cryptocurrencies and a vast range of trading pairs.

KCEX trading dashboard for BTC/USDT showing candlestick movements, moving averages, and live order book with buy/sell options. Source: KCEX

The good news about KCEX is that it’s also suitable for beginners, so with the promos it offers new users, it can be an ideal testing ground for beginners. However, it doesn’t feature a demo account or copy trading.

KCEX is suitable for you if:

- Extremely low costs matter, with zero maker fees and minimal taker fees.

- You want to benefit from frequent promotions and new user rewards.

- Reliable, high-quality 24/7 customer support is a priority.

- You’re looking for a wide range of supported assets to trade.

KCEX is not suitable for you if:

- You need demo accounts or copy trading tools to practice or follow others.

- You prefer established platforms, as KCEX is still relatively untested.

| Max Leverage | Up to 100× |

| Futures Type | Perpetual & quarterly contracts |

| Coins & Pairs Supported | 500+ |

| Fees (Maker/Taker) | 0% / 0.01% |

| Min Deposit | $0 |

| Order Types | Limit, Market, Stop |

| Trading Interface & Tools | User-friendly design, 24/7 support, promotions |

8. BingX – Best for Copy and Social Trading

BingX is a crypto exchange and trading platform primarily known for its social and copy trading features. It’s ideal for beginners because you can easily copy trades from experts. Moreover, it’s one of the best crypto futures platforms for the variety of bonuses it provides, especially to newcomers.

The exchange features both USDT-M and coin-margined perpetual futures and offers a 0-slippage guarantee. The default fees for futures trading are 0.02% for makers and 0.05% for takers, with discounts available via VIP tiers.

BingX futures trading interface showing BTC/USDT market activity with candlestick chart, order book, and quick trade options. Source: BingX

You can benefit from leverage of up to 150x on major pairs, while the site supports a wide selection of assets, including various popular and new crypto coins.

BingX boasts a Rewards Hub where you’ll find new user tasks promising over 1,500 USDT in rewards and exclusive trading challenges for limited users that award over 5,300 USDT.

BingX is suitable for you if:

- You want strong social and copy trading features to follow experienced traders.

- High leverage of up to 150x fits your trading strategy.

- You like frequent promotions and access to a Reward Hub with extra incentives.

- A wide range of trading pairs is important to you.

- You prefer testing strategies safely with a demo account.

BingX is not suitable for you if:

- You live in regions where the platform is not available.

- You need consistently deep liquidity across all altcoins, as some pairs are thinly traded.

| Max Leverage | Up to 200× |

| Futures Type | USDT-M and coin-margined perpetual futures |

| Coins & Pairs Supported | 400+ |

| Fees (Maker/Taker) | Up to 0.02% / 0.05% |

| Min Deposit | $0 |

| Order Types | Limit, Market, Stop, Trailing Stop |

| Trading Interface & Tools | Copy trading, demo trading, reward hub |

9. PrimeXBT – Best for High-Leverage, Multi-Asset Traders

PrimeXBT is a multi-asset platform offering crypto futures, CFDs, forex, commodities, and indices, all under one roof.

It provides up to 200x leverage on crypto pairs with just 0.5% margin requirements. Interestingly, the leverage can go even higher on other financial instruments, like forex.

PrimeXBT trading interface with BTC/USDT perpetual contract, showing candlestick analysis, one-click order panel, and account margin details. Source: PrimeXBT

However, all this comes at the cost of fewer supported cryptocurrencies. There are only around 30 available for futures trading.

PrimeXBT combines several trading platforms into one, including a PXTrader, MetaTrader 4, an exchange, and a crypto wallet. On top of that, fees are typically lower than on other platforms, with takers having to pay 0.045% at the most, and often much lower on high VIP Tiers.

PrimeXBT is suitable for you if:

- You want access to up to 200x leverage across multiple trading pairs.

- An integrated trading environment with different tools in one place appeals to you.

- You’re interested in multi-asset trading beyond crypto, including forex and commodities.

- A competitive fee model is important for keeping costs low.

PrimeXBT is not suitable for you if:

- You want a broad selection of cryptocurrencies, as the list is limited.

- Strong regulatory oversight is a must-have for your trading platform choice.

| Max Leverage | Up to 200× |

| Futures Type | Perpetual contracts, CFDs |

| Coins & Pairs Supported | 30+ |

| Fees (Maker/Taker) | 0.01% / 0.045% |

| Min Deposit | $0 |

| Order Types | Limit, Market, Stop |

| Trading Interface & Tools | Multi-asset terminal, copy trading |

Visit PrimeXBT Official Website

10. Pionex Futures – Best for Beginners Looking to Use Trading Bots

Pionex is a relatively young crypto exchange and trading platform founded in 2019. Beginners particularly appreciate its integrated and diverse trading bots, which you can use for both spot and futures trading. For futures, you can choose from Grid, Signal, Cross Margin, and several other bots.

Pionex trading screen for BTC/USDT perpetual futures with candlestick chart, live order book, and integrated trading bot options. Source: Pionex Futures

Leverage reaches up to 100x, while the fee structure is fairly standard, at 0.02% for makers and 0.05% for takers. However, like on most other futures trading platforms, you will pay lower fees on higher VIP levels.

That said, can you trade crypto futures in the US using Pionex? Unfortunately, no, but Pionex still maintains a separate US-friendly platform with spot trading and bots.

Pionex Futures is suitable for you if:

- You want free access to integrated trading bots for automation.

- Aggregated liquidity from larger exchanges is important to reduce slippage.

- You prefer testing strategies with a demo trading feature.

- You’re based in the US and want a version tailored for spot trading.

Pionex Futures is not suitable for you if:

- You rely on a wide range of fiat deposit options, which are limited here.

- You expect guaranteed results from trading bots, as performance can vary.

| Max Leverage | Up to 100× |

| Futures Type | USDT-margined perpetual futures |

| Coins & Pairs Supported | 300+ |

| Fees (Maker/Taker) | 0.02% / 0.05% |

| Min Deposit | $0 |

| Order Types | Limit, Market, Stop |

| Trading Interface & Tools | Integrated trading bots, demo mode |

What Is Crypto Futures Trading?

Crypto futures trading is a way to bet on the future price of a digital asset without actually buying it. Instead of holding coins, you trade contracts that rise or fall in value depending on where the market moves.

The idea comes from traditional finance, where futures have long been used in commodities, stocks, and forex. In crypto, the same logic applies: traders can go long if they believe a coin’s price will climb or go short if they expect it to drop.

Leverage is central to this type of trading. By borrowing from the exchange, a trader can control a much larger position than their initial deposit allows. For example, $100 at 10x leverage becomes a $1,000 position, while 50x turns it into $5,000. The upside is clear, but so is the risk. If the market turns against you, the position can be liquidated and the margin lost.

Why has this market grown so quickly? Futures give investors tools to hedge against downturns, opportunities to speculate on short-term volatility, and the ability to use advanced strategies such as arbitrage or spread trading. For many, it’s a way to amplify both potential gains and potential losses in an already fast-moving market.

What Are the Benefits & Risks of Trading Crypto Futures?

Trading crypto futures comes with clear advantages, but also very real risks. Here’s what stands out on both sides.

Benefits

- Leverage as a growth tool. By borrowing from the exchange, you can control a position far larger than your initial deposit.

- Profit in any market. Futures allow you to go long or short, so both rallies and downturns present opportunities.

- Built-in hedge. Holders can use futures contracts to protect their portfolios against sharp declines.

- No need to own coins. You trade on price movements without buying or storing the underlying asset.

- Speculation and diversification. Futures are attractive for active traders looking to capture short-term swings or add variety to their portfolios.

Risks

- Losses cut both ways. The same leverage that boosts profits can wipe out your margin if the market turns.

- Volatility factor. Crypto’s extreme price swings make liquidations far more common than in traditional markets.

- Steep learning curve. Futures are complex instruments; trading them without experience can be costly.

- Uncertain regulation. Rules differ across jurisdictions and can shift quickly, affecting which platforms remain available.

How to Choose the Best Crypto Futures Exchange

Not every futures platform is the same, so it’s worth weighing a few essentials before you decide where to trade:

- Leverage. Exchanges offer anywhere from 2x to 200x. Casual traders may not need high multiples, but if you’re chasing maximum exposure, platforms like MEXC provide some of the highest options.

- Pairs and liquidity. A wide selection of contracts is only useful if the market is liquid. Top-tier platforms with strong daily volumes usually deliver the tightest spreads and smoother execution.

- Fees. Small differences add up fast. Most platforms charge around 0.02% for makers and 0.05% for takers, but leading venues often offer discounts or even zero maker fees.

- KYC rules. Know what’s required. Some exchanges give limited access without full verification, while others demand full KYC before trading futures.

- Trading tools. Features like advanced charting, multiple order types, API support, or trading bots can make a platform more versatile.

- Security. Stick to exchanges that are licensed, provide proof of reserves, and have strong user protection in place.

Best Crypto Futures Trading Platforms 2025 Comparison Table

Before we move on to reviews of our top 10 platforms, here’s a quick comparison table to give you an idea of which one might be the best fit, based on what you want to see in a trading platform.

| Platform | Max Leverage | Fees (Maker/Taker) | Min Deposit | KYC? | Coins/Futures |

| MEXC | 200x | 0% / 0.02% | $0 | Partial (full for more access) | 700+ perpetuals |

| Binance Futures | 125x | 0.02% / 0.05% | $15 | Yes | 500+ futures |

| OKX Futures | 125x | 0.02% / 0.05% | $10 | Yes | 300+ futures |

| CoinEx | 100x | 0.03% / 0.05% | $0 | Yes (full for futures) | 200+ futures |

| BloFin | 150x | 0.02% / 0.06% | $0 | Yes | 400+ futures |

| Kraken Futures | 50x | 0.02% / 0.05% | $10 | Yes | 300+ futures |

| KCEX | 100x | 0% / 0.01% | $0 | Yes (full for futures) | 500+ futures |

| BingX | 200x | 0.02% / 0.05% | $0 | Yes (full for futures) | 400+ futures |

| PrimeXBT | 200x | 0.01% / 0.045% | $0 | Yes (full for futures) | 30+ futures |

| Pionex Futures | 100x | 0.02% / 0.05% | $0 | Yes (full for futures) | 300+ futures |

How Does Trading on a Crypto Futures Platform Work?

Trading crypto futures may sound complex, but the process follows a clear set of steps. Here’s how it works in practice:

- Choose a platform and open an account. Start by selecting a regulated exchange that offers futures contracts. Most platforms require KYC verification for full access but if you’re interested in alternatives, check out our guide to crypto exchanges without KYC.

- Fund your account. Deposit crypto or stablecoins (like USDT/USDC) to use as margin. Some platforms also support fiat deposits.

- Select a futures contract. Pick the asset you want to trade (e.g., BTC/USDT). Contracts may be perpetual (no expiry) or time-limited.

- Set your leverage. Decide how much leverage to apply. Higher leverage (e.g., 50x or 100x) increases potential profits but also heightens risk.

- Go long or short.

- Long position: You expect the price to rise.

- Short position: You expect the price to fall.

- Place your order. Use market orders for immediate execution or limit orders for more control over entry price.

- Manage risk. Platforms provide tools like stop-loss and take-profit orders to help protect your position.

- Monitor and close the trade. You can manually close your position or let the system do it if your margin drops too low (liquidation).

Key takeaway: On a futures platform, you’re not buying coins directly but trading contracts that track price movements. Leverage can multiply gains, but it also magnifies losses, so risk management is essential.

How to Start Using a Crypto Futures Platform?

- First, pick a solid exchange. Make sure it’s licensed, has proof of reserves, good liquidity, fair fees, and a decent range of contracts.

- Open an account and lock it down. Turn on 2FA or passkeys, add an anti-phishing code, and set up withdrawal whitelists so your funds stay safe.

- Do KYC if the platform asks for it. That usually gives you higher limits and full access to futures.

- Add funds to your account. You can deposit fiat or crypto, then move it from your spot wallet to your futures or derivatives wallet. If you’re not sure which wallet to go with, check our guide to the best crypto wallets.

- Pick the type of contract you want to trade. You’ll need to choose between perpetuals or delivery futures, and also decide whether to use USDT, USDC, or coin-margined collateral.

- Decide on your margin mode. Isolated margin keeps risk on a single trade, while cross margin spreads it across positions.

- Choose your leverage. Start small, then adjust depending on volatility and your own risk tolerance. Just remember higher leverage leaves less room before liquidation.

- Choose your direction. Go long if you think the price will go up, or short if you think it’ll go down.

- Place your order. Market orders fill straight away, limit orders give you price control, and you can also use stop, trigger, or trailing stops if you want more flexibility.

- Manage your risk. Set stop-loss and take-profit, enable reduce-only, and consider post-only to avoid taker fees.

- Keep track of the costs and mechanics. Watch funding rates, maker and taker fees, maintenance margin, and your live liquidation price.

- Manage and close positions. Scale in or out, check your PnL, move profits back to spot, withdraw when you need to, and keep records for taxes.

Most big exchanges also offer a demo or testnet, and it’s worth practicing there first to get a feel for how orders work and how leverage affects liquidation.

Are Crypto Futures Trading Platforms Safe?

The safety of a crypto futures trading platform depends on both the exchange’s safeguards and how you manage your own risk. While many leading platforms are secure and reliable, there are several factors you should evaluate before trading:

- Regulation and licensing. Reputable exchanges often operate under recognized jurisdictions, which improves oversight and investor protection.

- Proof of reserves. Transparent audits showing that an exchange holds enough assets to cover user balances are a strong sign of solvency.

- Platform security. Look for features such as two-factor authentication (2FA), withdrawal whitelists, anti-phishing codes, and cold storage for customer funds.

- Reputation and track record. Platforms with years of stable operation and high trading volumes tend to be more trustworthy than new, untested exchanges.

- Risk of liquidation. Even on secure exchanges, trading with high leverage exposes you to the danger of forced liquidation if the market moves sharply against your position.

Crypto futures platforms can be safe if you choose regulated, transparent exchanges and follow best practices such as enabling strong account security and using sensible leverage. Safety comes from both the platform and the trader’s discipline.

Does Crypto Futures Trading Have a Future?

The short answer is yes. Crypto futures trading is expanding, with both the market and the available trading platforms growing steadily.

High volatility and accessibility continue to drive this growth, while interesting products like perpetual futures have made the space even more attractive.

More than that, the rise of decentralized futures platforms has brought users complete control over their assets, more transparency, and fewer KYC requirements.

While regulatory scrutiny remains in some regions, many jurisdictions have made the regulations clearer, which has increased the number and confidence of institutional investors, fueling the growth of the industry further.

On top of that, the booming AI industry has made crypto futures trading even better. Many platforms now offer a variety of trading bots, quantitative analysis, risk management tools, and more.

Final Thoughts: What Is the Best Crypto Future Exchange for Me?

There’s no shortage of platforms that support crypto futures trading, and many deliver high-quality services that make them worthy of your consideration. We’ve recommended enough options for beginners, experienced traders, and those looking for copy and social trading solutions.

However, the overall best platform for crypto futures contracts is MEXC. It offers leverage of up to 200x, supports over 700 assets and even more trading pairs, covers signals and copy trading, and charges some of the lowest taker fees and no maker fees.

Register to see all of that in action, but remember to trade responsibly and do your homework on crypto futures before you begin, to understand how it works and the risks involved.

FAQ

What is the best platform for crypto futures trading?

Is trading crypto futures worth it?

References

- Crypto Insights | April 2025 – CME Group

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

AlphaPepe has quickly become one of the more talked-about meme presales, thanks to the instant token delivery, active community, a...

In this guide, we explain how to purchase MoonBull tokens through the presale, explore the project's meme-meets-DeFi mechanics.

Tony Frank

Crypto Editor, 56 postsTony Frank is an accomplished cryptocurrency analyst, author, and educator whose work bridges the gap between complex blockchain technology and accessible, actionable insights for global audiences. Over the past decade, he has emerged as a respected voice in the rapidly evolving world of digital assets, combining technical expertise with a talent for storytelling to help readers navigate everything from Bitcoin’s monetary philosophy to the intricacies of decentralized finance (DeFi). Tony earned his Bachelor’s degree in Economics and Finance from the University of Melbourne, where he developed a deep interest in monetary systems and market structures. He later pursued a Master’s degree in Blockchain and Digital Currency from the University of Nicosia, one of the first academic institutions to offer accredited programs in cryptocurrency studies. Before focusing full-time on blockchain, Tony worked as a financial analyst for a multinational investment firm, covering emerging technologies and alternative asset classes. His early exposure to macroeconomic policy, global market behavior, and fintech innovation laid the foundation for his later work in crypto research and writing. Tony’s expertise spans multiple sectors of the blockchain industry, including cryptocurrency fundamentals, altcoin market cycles, DeFi and web3 trends and regulatory landscapes. Tony combines on-chain data analysis with macroeconomic research, providing readers with both the technical “how” and the market “why” of cryptocurrency movements.