Token6900 (TOKEN6900) is a new meme coin built on hype and the ‘collective hallucination’ of meme coin traders. We explore the fut...

Top 14 best cryptocurrencies to buy in 2025. Expert picks with high growth potential, market trends, and key investment insights.

Bitcoin, Solana, Bitcoin Hyper, and Maxi Doge currently lead our ranking of the best crypto to buy. These projects stand out for their momentum in both retail traction and long-term positioning, especially amid evolving trends in global crypto adoption and regulatory frameworks. While crypto markets remain volatile, these tokens show resilience during both upward and downward cycles, making them worth considering for 2025.

Our methodology is built on a multi-factor framework that evaluates community engagement, tokenomics strength, go-to-market strategy, and real-world use cases. This approach prioritizes data over hype, aiming to surface projects that can benefit from renewed capital inflows during market rebounds. The result is a research-backed shortlist of top crypto to invest in with the fundamentals and momentum to deliver significant returns.

Best Crypto to Buy Key Takeaways

- Bitcoin (BTC) is still the dominant and most stable cryptocurrency in the market, with institutional backing and proven resilience

- Maxi Doge (MAXI) targets the $154B meme coin market with a 1000x leverage trading narrative and 25% token allocation to partnerships

- Solana (SOL) continues expanding its ecosystem with fast transaction speeds and low fees, but faces ongoing competition from other Layer 1 blockchains in the DeFi and NFT markets

- Bitcoin Hyper offers 284% staking APY through Solana VM Layer 2 infrastructure, attracting 18,000+ Telegram members seeking Bitcoin smart contract utility

- TOKEN6900 leads presale rankings with $5M hard cap and 80% supply allocation, positioning as satirical “anti-S&P 500” alternative to SPX6900’s $1.2B market cap

- XRP trades above $2.60 with potential ETF catalysts on the horizon, though regulatory outcomes and banking adoption timelines remain uncertain

- Snorter Token raised $175,000 on day one with 0.85% trading fees and 85% scam detection accuracy, targeting the $154B trading bot market by 2033

- Best Wallet raised $11M+ for integrated DEX and launchpad features, following exchange token growth patterns like BNB’s recent performance surge

Best Crypto to Buy in August 2025 – Editor’s Picks

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Inspired by SPX6900 & early 2000s internet culture

- 80% supply in fair launch presale ($5M cap)

- Fixed-supply meme coin, no utility or minting

- Fastest meme coin sniper on Solana and EVM

- Multichain Telegram bot with lowest fees and instant execution

- Snipe new tokens before bots and whales

- Exclusive in-app access to vetted crypto presales

- Staking rewards with an annual percentage yield (APY) of up to 152%

- Upcoming Best Card enables crypto spending at millions of merchants with cashback

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

Top Crypto List to Invest in 2025

Let’s dive straight into the best crypto to buy now:

- Bitcoin (BTC) – Market leader with lofty predictions for growth in 2025 and beyond

- Solana (SOL) – High-speed Layer 1 blockchain with explosive ecosystem growth in DeFi, NFTs, and memecoins

- Bitcoin Hyper (HYPER) – a Solana VM-based Layer 2 token blending meme coin hype with 284% staking rewards

- Maxi Doge (MAXI) – Ultra-ipped alpha Doge meme coin targeting 1000x leverage

- TOKEN6900 (T6900) – Anti-S&P 500 satirical meme coin with $5M hard cap presale offering zero utility and “brain rot finance” for terminally online traders

- Wall Street Pepe (WEPE) – Trading-focused meme coin providing exclusive alpha calls and market insights to token holders through a private “WEPE Army” community on Ethereum

- XRP (XRP) – Leading cross-border payments cryptocurrency with 90% ETF approval odds, trading above $2.6

- Snorter Token (SNORT) – Telegram-native trading bot with fastest execution and advanced scam protection on Solana

- Best Wallet Token (BEST) – Cutting-edge Web3 wallet with generous perks for investors

- Hyperliquid (HYPE) – High-performance Layer 1 DEX with 200,000+ orders/second throughput, $15B market cap

- SpacePay (SPY) – Crypto payment infrastructure enabling point-of-sale (PoS) transactions with any digital asset, bridging online and offline commerce through NFC, QR codes, and wearables

- Toncoin (TON) – Telegram-backed crypto with a potential user base

- Arbitrum (ARB) – Leading Ethereum Layer 2 token with growing development base

- Ondo Finance (ONDO) – DeFi platform bridging the gap to traditional financial institutions

Best Crypto to Invest In Reviewed

Want to know more about what makes these tokens the best crypto to buy now? We’ll dive into the key features, pros, and cons of each coin so you can decide which ones to add to your portfolio.

1. Bitcoin (BTC) – Market Leader Poised for Growth in 2025 and Beyond

Why We Picked Bitcoin:

- Proven resilience as the oldest and most established cryptocurrency

- Strong institutional adoption provides market stability

- Regulatory clarity is improving compared to other digital assets

Bitcoin is the oldest and largest cryptocurrency, maintaining its position as the most valuable token by market capitalization. Though it experiences significant volatility, Bitcoin has demonstrated long-term resilience through multiple market cycles since its 2009 launch.

The cryptocurrency has garnered substantial institutional support, with major companies and investment funds incorporating Bitcoin into their balance sheets. However, this institutional interest also means that macroeconomic factors and corporate decisions can heavily influence Bitcoin’s price.

Bitcoin Price Chart. Photo: CoinGecko

Recent developments include potential government reserves and continued ETF adoption, though these catalysts don’t guarantee price appreciation.

While some analysts project significant price increases, with figures like Cathie Wood’s $1.5 million prediction, these remain speculative targets that may not materialize. Bitcoin’s volatility means investors should expect substantial price swings in both directions, regardless of long-term potential.

Suitable For: Long-term holders, institutional investors, and those seeking exposure to a macro-driven store of value.

Community Stats: Most recognized crypto globally, 1M+ Reddit subscribers, strong presence on X, and extensive media coverage.

Price & Market Outlook: Historically volatile with significant boom-bust cycles; institutional adoption provides some stability but doesn’t eliminate risk.

| Category | Store of Value / Digital Gold |

| Presale Price | N/A |

| Chain | Bitcoin (Layer 1) |

| Utility | Payments, reserve asset |

| Catalysts | Halving cycle, ETF adoption, global macro interest |

| Market Cap | ~$2.3T |

| Launch Status | Launched (2009) |

2. Solana (SOL) – High-Speed Blockchain Powering the Next Wave of Web3 Apps

Why We Picked Solana:

- Fast transaction speeds and low fees compared to Ethereum

- Growing enterprise partnerships and developer adoption

- Proven ability to recover from network outages and technical challenges

Solana has established itself as a competitive Layer 1 blockchain known for its Proof-of-History consensus mechanism and ability to process thousands of transactions per second at low costs. While these technical advantages attract developers and users, the network has faced reliability challenges, including multiple outages that raise questions about long-term stability.

The platform has gained traction with enterprise partners like Visa for pilot programs and has seen significant activity in DeFi and NFT markets. But, much of Solana’s recent growth has been driven by speculative meme coin trading, which may not provide sustainable long-term value for the ecosystem.

Solana Price Chart. Photo: CoinGecko

Solana competes directly with Ethereum and other Layer 1 blockchains, but this competition means market share isn’t guaranteed. The network’s focus on speed sometimes comes at the cost of decentralization, with fewer validators than more established networks like Bitcoin or Ethereum.

Suitable For: Traders, developers, and NFT collectors looking for speed, scalability, and low transaction fees.

Community Stats: Over 8M wallets and an active developer community, though activity levels fluctuate with market conditions and network performance.

Price & Market Outlook: Highly volatile and correlated with speculative trading trends; technical capabilities provide advantages but don’t eliminate market risks.

| Category | Layer-1 / High-Performance Blockchain |

| Presale Price | ~$0.22 (historical) |

| Chain | Solana |

| Utility | Smart contracts, DeFi, NFTs |

| Catalysts | Meme coin activity, global app growth |

| Market Cap | ~$94B |

| Launch Status | Launched |

3. Bitcoin Hyper (HYPER) – High-APY Bitcoin Layer 2 Presale Token with Meme Momentum

Why We Picked Bitcoin Hyper Token:

- Represents an emerging trend in Bitcoin Layer 2 development

- Early-stage project for investors comfortable with high risk

- Combining technical concepts with speculative meme coin elements

Bitcoin Hyper attempts to scale Bitcoin’s ecosystem through a Layer 2 network powered by the Solana Virtual Machine (SVM). As a presale token, this project carries significant risk and remains unproven in real-world applications.

The project’s technical claims about SVM-based Layer 2 architecture are ambitious. While the concept of bringing smart contracts to Bitcoin is appealing, many similar projects have failed to deliver on their promises. The project launched its presale at $0.0115 per token, offering investors early access to a high-risk, high-reward opportunity that blends DeFi infrastructure with meme coin appeal.

Bitcoin Hyper Official Website. Photo: Bitcoin Hyper

Unlike typical meme tokens that rely solely on community hype, Bitcoin Hyper backs its branding with real technical ambition. The SVM-based Layer 2 architecture unlocks smart contract functionality for Bitcoin, aiming to bring speed and scalability where the original network falls short.

Momentum is building fast – the Telegram group has surpassed 18,000 members, and HYPER is gaining visibility on crypto Twitter. But remember that community growth on Telegram and social media may reflect hype rather than genuine utility or adoption.

Suitable For: High-risk, high-reward DeFi investors, meme coin speculators, and Bitcoin maximalists looking for smart contract utility.

Community Stats: 18,000+ Telegram members, strong meme engagement across social media, and growing mentions on crypto analyst pages.

Price & Market Outlook: Presale ongoing at $0.0125; early-stage project with high staking APYs and upcoming listings expected to drive demand.

| Category | Bitcoin Layer 2 / Meme + AI |

| Presale Price | $0.0125 |

| Chain | Solana VM |

| Utility | Staking, smart contracts on Bitcoin Layer 2 |

| Catalysts | SVM infrastructure, 284% APY staking |

| Market Cap | Presale |

| Launch Status | Q2 2025 |

4. Maxi Doge (MAXI) – Ultra-Ripped Meme Token with High-Risk Bodybuilding-Crypto Narrative

Why We Picked Maxi Doge:

- Capitalizes on the proven success of dog-themed meme coins like Dogecoin and Shiba Inu

- Clear target audience of leverage traders and crypto enthusiasts seeking extreme narratives

- Early presale stage offers potential for significant gains, but with elevated risk

Maxi Doge calls itself the “ultra-ripped alpha Doge” who trades on 1000x leverage and represents “ultimate strength, hustle, and the grind of the bull market”. The project explicitly embraces meme culture and speculative trading, with a disclaimer stating “Maxi Doge is a meme token with vibe utility” and warning that “crypto can pump or dump”.

Maxi Doge Official Website. Photo: Maxi Doge

The tokenomics include staking rewards, community contests, and planned futures platform partnerships, which could provide some utility beyond pure speculation. However, these features remain largely conceptual during the presale phase, and MAXI carries high risk typical of early-stage meme coins, with success dependent entirely on community adoption and viral marketing rather than technical utility.

Suitable For: High-risk meme coin speculators, leverage trading enthusiasts, and investors comfortable with the complete loss of principal in exchange for potential outsized gains.

Community Stats: Early presale stage with active social media presence; community growth will be critical for determining project viability and market adoption.

Price & Market Outlook: Presale token with no established price history; success depends entirely on viral adoption and community building.

| Category | Meme Coin / Leverage Trading Culture |

| Presale Price | $0.00025 |

| Chain | Ethereum |

| Utility | Staking, contests, and planned futures platform access |

| Catalysts | Meme coin supercycle, leverage trading trends, viral marketing |

| Market Cap | Presale |

| Launch Status | Q2-Q3 2025 (estimated) |

5. TOKEN6900 (T6900) – Anti-S&P 500 Satirical Meme Coin Redefining Brain Rot Finance

Why We Picked TOKEN6900:

- Transparent about lacking utility, avoiding misleading investor expectations

- Satirical approach to meme coin culture may resonate with certain investors

- Limited presale supply structure designed to prevent early whale dominance

- Represents the emerging trend of self-aware speculative tokens

TOKEN6900 takes an unusual approach by explicitly stating it offers no utility or real-world value. While this transparency is refreshing in a space often filled with unrealistic promises, it also means investors are knowingly buying into speculation.

What sets TOKEN6900 apart is its brutal honesty about offering zero utility while embracing pure “collective delusion as liquidity.” Built on early 2000s nostalgia and “69” energy, the project doesn’t hide behind AI buzzwords or fake roadmaps. Instead, it presents itself as a “consciousness parasite” – a tradable emotion for coping with the chaos of modern finance.

Token 6900 presale page. Photo: Token6900

TOKEN6900’s honest approach to being a “tradable emotion” may attract investors who appreciate transparency, but it also highlights that there’s no fundamental value backing the token. The project’s success depends entirely on continued community interest and meme culture trends, which can shift rapidly and unpredictably.

Suitable For: Anti-establishment traders, SPX6900 enthusiasts seeking the “next level”, meme coin speculators who appreciate satirical honesty, and investors tired of fake utility promises.

Community Stats: Active presale engagement and social media presence, though the viral nature of meme coins can fade quickly without sustained interest.

Price & Market Outlook: Presale pricing from $0.0064 to $0.007125, targeting the massive success of SPX6900 (currently $1.2B market cap) while positioning as the superior alternative.

| Category | Meme Coin / Financial Satire |

| Presale Price | $0.0064–$0.007125 |

| Chain | Ethereum |

| Utility | Zero utility, staking, meme culture |

| Catalysts | Meme supercycle, SPX6900 comparisons, brain rot theory |

| Market Cap | Presale |

| Launch Status | Q3 2025 |

6. Wall Street Pepe (WEPE) – Trading-Focused Meme Coin with Exclusive Community Access

Why We Picked Wall Street Pepe:

- Exclusive trading insights and alpha calls for token holders

- Private community model creating potential network effects

- High presale momentum with $60M+ raised

- The staking rewards system designed to promote long-term holding

Wall Street Pepe positions itself as more than a typical meme coin by offering exclusive trading content and market insights to WEPE holders. The project centers around the “WEPE Army”, a private community where token holders gain access to trading signals, meme coin picks, and market strategies designed to level the playing field against institutional traders.

The token operates on Ethereum and includes a staking mechanism that rewards early adopters with dynamic APY returns. WEPE holders can participate in trading competitions, submit successful trades for rewards, and access premium content that’s unavailable to non-holders. This utility-driven approach differentiates it from purely speculative meme coins.

Wall Street Pepe Price. Photo: CoinGecko

However, the project faces significant transparency challenges. The team remains anonymous with no verified KYC, and the whitepaper lacks detailed explanations of how the substantial fundraising will be used. Recent changes to the staking program and discrepancies in the launch price have raised questions about the execution of tokenomics.

Suitable For: Meme coin speculators, retail traders seeking exclusive insights, and investors comfortable with high-risk presale tokens.

Community Stats: $60M+ presale funding, active Telegram presence, growing social media following across crypto influencer networks.

Price & Market Outlook: Presale concluded with mixed launch performance; success depends on delivering promised trading utilities and maintaining community engagement.

| Category | Trading Community / Meme Coin |

| Presale Price | $0.0002-$0.0003665 |

| Chain | Ethereum |

| Utility | Trading insights, community access, and staking |

| Catalysts | Exclusive alpha calls, trading competitions, and community growth |

| Market Cap | 24M |

| Launch Status | Recently Launched |

7. XRP (XRP) – Leading Cross-Border Payments Cryptocurrency with Banking-Grade Infrastructure

Why We Picked XRP:

- 90% ETF approval probability with SEC fast-tracking approval process from 240 days to 75 days

- Trading above $2.6 with technical breakout targeting $2.92–$3.40 resistance levels

- Ripple pursuing US banking license while expanding institutional partnerships globally

- Massive $1.94 billion trading volume on major exchanges shows strong institutional demand

XRP is an institutional-grade solution for cross-border payments, positioning itself as the bridge between traditional banking and blockchain technology. The project addresses the issues related to international money transfers, including slow settlement times, high fees, and complex correspondent banking relationships.

What sets XRP apart is its focus on real-world usage rather than speculative trading. According to Binance, numerous financial institutions are already using Ripple’s technology for cross-border settlements.

Built on the XRP Ledger’s consensus mechanism, the network processes transactions in 3–5 seconds compared to traditional banking systems that can take days. The protocol operates without mining, making it more energy-efficient than Bitcoin while maintaining enterprise-level security.

XRP Price Chart. Photo: CoinGecko

The recent surge in institutional interest shows us growing confidence in XRP’s regulatory status following Ripple’s legal victories against the SEC. With Grayscale adding XRP to its Digital Large Cap Fund and ten spot ETF applications pending approval, the token is poised to benefit from the same institutional flows that drove the adoption of Bitcoin and Ethereum. The network’s integration with USDC stablecoin and launch of an Ethereum-compatible sidechain further expands its DeFi capabilities.

Suitable For: Institutional investors seeking regulated crypto exposure, cross-border payment users, ETF investors, and traders positioning for regulatory clarity catalysts.

Community Stats: Strong institutional backing and growing partnerships, though high address concentration suggests limited retail distribution compared to other major cryptocurrencies.

Price & Market Outlook: Currently trading at around $2.6 with analyst targets ranging from $5.50 (Standard Chartered) to $15 (optimistic scenarios), driven by ETF approvals and banking adoption.

| Category | Cross-Border Payments / Digital Asset |

| Presale Price | N/A |

| Chain | XRP Ledger |

| Utility | Cross-border payments, bridge currency, settlement |

| Catalysts | ETF approval, banking license, institutional adoption |

| Market Cap | ~$156B |

| Launch Status | Launched (2012) |

8. Snorter Token (SNORT) – Telegram-Native Trading Bot Shaping Solana Meme Coin Trading

Why We Picked Snorter Token:

- Fastest execution speeds on Solana with sub-second trade completion and MEV protection

- Lowest trading fees in the market at 0.85% for token holders vs 1.5%+ for competitors

- Advanced scam detection algorithms achieving 85% accuracy against rug pulls and honeypots

- Explosive presale momentum with $175,000+ raised in just one day

Snorter Token aims to provide trading bot functionality within Telegram, targeting the growing market for automated crypto trading tools. While the concept addresses real trader pain points like MEV attacks and scam detection, the project remains in early development with unverified performance claims.

The 85% scam detection accuracy and sub-second execution speeds are impressive, but these metrics haven’t been independently verified or tested at scale. Trading bot competition is intense, with established players like Maestro and Banana Gun already serving similar markets.

Snorter Token Official Website. Photo: Snorter Token

Telegram integration provides genuine convenience for mobile traders, and MEV protection addresses a real concern in DeFi trading. However, the project faces significant technical challenges in delivering on its promises, including maintaining speed and accuracy as user volume grows.

Suitable For: Active meme coin traders, Solana ecosystem participants, and copy trading enthusiasts who want institutional-grade protection without sacrificing speed or convenience.

Community Stats: Early growth with $175,000 collected in the first day, viral social media momentum across major crypto influencers, and rapidly expanding Telegram trading community.

Price & Market Outlook: Priced at $0.1001 in presale, with massive upside potential targeting the $154 billion trading bot market (expected to reach around 2033). Success depends on delivering claimed technical capabilities in a competitive market.

| Category | Trading Bot / Meme Coin |

| Presale Price | $0.1001 |

| Chain | Multi-chain (Solana launch) |

| Utility | Trading bot access, staking, and fee discounts |

| Catalysts | Telegram-native UX, MEV protection, trading bot market |

| Market Cap | Presale |

| Launch Status | Q2 2025 |

9. Best Wallet (BEST) – Web3 Wallet with Generous Investor Perks

Why We Picked Best Wallet:

- Popular and fast-growing Web3 wallet

- BEST holders receive discounted fees and enhanced staking rewards

- Crypto bull run could boost trading volumes and BEST token demand

Best Wallet attempts to combine multiple crypto services, including a DEX, staking platform, and iGaming hub, into a single application. While this comprehensive approach offers convenience, the wallet market is highly competitive, with established players dominating user adoption.

The BEST token offers genuine utility through fee discounts and access to launchpads, following proven models from successful exchange tokens. However, the wallet’s adoption depends on attracting users away from established alternatives, which typically requires significant marketing spending and superior features.

Best Wallet Official Website. Photo: Best Wallet

The $14.43M million in presale funding indicates initial investor interest, but remember that presale success doesn’t guarantee user adoption or long-term viability. Planned features, such as crypto debit cards, face regulatory hurdles and competition from existing crypto card providers. Additionally, the iGaming integration may limit adoption in jurisdictions with strict gambling regulations.

Key strengths of the project include a comprehensive feature set and clear token utility model. However, risks include intense wallet competition, regulatory challenges for certain features, execution risk associated with promised integrations, and dependence on broader crypto adoption trends. The comparison to BNB and BGB’s success stories may not be applicable given the different market conditions and competitive landscapes.

Suitable For: Web3 investors, crypto gamers, and launchpad participants looking for utility and convenience in a single wallet.

Community Stats: $14.43M raised, strong user growth from DeFi and iGaming segments, supported by strategic rollout of product features.

Price & Market Outlook: Still in presale, plans for debit card, expanded integrations, and launchpad utility create exchange-token upside.

| Category | Web3 Wallet / Exchange Token |

| Presale Price | $0.025425 |

| Chain | Ethereum |

| Utility | Fee discounts, staking, early launchpad access |

| Catalysts | Integrated DEX, iGaming, debit card |

| Market Cap | Presale |

| Launch Status | Q2 2025 |

10. Hyperliquid (HYPE) – High-Performance Layer 1 DEX with Institutional-Grade Trading Infrastructure

Why We Picked Hyperliquid:

- Custom L1 Blockchain: 200,000+ orders/second with sub-second finality via HyperBFT consensus

- Record Airdrop Success: $45K average allocation to 94,000 users, setting new industry standards

- Fully On-Chain Trading: Perpetual futures and spot markets with CEX-like experience but fully decentralized

- Deep Liquidity: $9.3B open interest with innovative vault system for community market-making

Hyperliquid has changed decentralized trading by building its own high-performance Layer 1 blockchain from the ground up, specifically optimized for financial applications. The platform combines the speed and user experience of centralized exchanges with the transparency and security of decentralized protocols.

Unlike other DEXs that compromise on performance or rely on external infrastructure, Hyperliquid’s custom HyperBFT consensus algorithm delivers institutional-grade speed with 0.2-second median latency and Byzantine fault tolerance. The platform’s HyperEVM brings Ethereum compatibility while maintaining the performance advantages of its native architecture.

Hyperliquid price chart. Photo: CoinGecko

The project gained massive attention following its November 2024 airdrop, which distributed 31% of the total supply to active users without any venture capital allocation. The community-first approach and technical excellence drove HYPE from $4 to $35+ post-launch, establishing it as a top-15 cryptocurrency by market cap.

Suitable For: Serious derivatives traders, DeFi power users seeking institutional-grade infrastructure, yield farmers utilizing vault strategies, and developers building advanced financial applications.

Community Stats: Self-funded team from Harvard/MIT with traditional finance background, active Discord community, $8B+ ecosystem market cap, and growing developer adoption on HyperEVM.

Price & Market Outlook: Trading around $47 with $15B market cap; positioned to benefit from growing derivatives trading demand and continued ecosystem development.

| Category | Layer 1 / Decentralized Exchange |

| Presale Price | N/A |

| Chain | Hyperliquid L1 |

| Utility | Trading fees, staking, governance, and vault participation |

| Catalysts | Derivatives market growth, institutional adoption, developer ecosystem |

| Market Cap | ~$15B |

| Launch Status | Launched (2024) |

11. SpacePay (SPY) – Crypto Payment Infrastructure for Real-World Transactions

Why We Picked SpacePay:

- Solves a real-world problem: spending crypto at physical points of sale

- Multi-chain support with NFC, QR, and wearable integration

- Presale access to a utility-driven payment ecosystem

SpacePay aims to bridge the gap between cryptocurrency and traditional retail payments through NFC terminals, QR codes, and wearable devices. While crypto payment infrastructure addresses a real market gap, adoption faces significant challenges, including merchant reluctance, regulatory uncertainty, and competition from established payment processors.

The technical approach supporting multiple blockchains could provide flexibility, but managing multi-chain complexity often creates user experience and security challenges. Merchant adoption remains the critical bottleneck, as retailers typically prefer stable, regulated payment methods over volatile cryptocurrencies. Additionally, existing payment giants like Visa and PayPal are developing their own crypto payment solutions.

SpacePay Official Website. Photo: SpacePay

The UK beta rollout provides some validation of merchant interest; however, scaling beyond early adopters requires overcoming tax reporting complexity, concerns about price volatility, and ensuring regulatory compliance across different jurisdictions. Token-based rewards and governance may appeal to crypto users, but mainstream merchants typically prioritize simplicity over tokenized features.

Key strengths include a practical utility focus and the integration of emerging payment technologies. However, risks include slow merchant adoption, regulatory barriers, competition from established payment companies, the technical complexity of multi-chain systems, and the challenge of convincing consumers to change their established payment habits.

Suitable For: Everyday crypto users, DePIN investors, and those bullish on crypto payments adoption.

Community Stats: Early-stage project with active presale, beta merchant rollout in the UK underway, building traction among NFC payment enthusiasts.

Price & Market Outlook: Presale stage facing typical crypto payment adoption challenges; success depends on overcoming merchant and regulatory barriers that have limited similar projects.

| Category | Payments / Real-World Crypto Adoption |

| Presale Price | $0.003181 |

| Chain | Multi-chain |

| Utility | Retail payments, transaction rewards, governance |

| Catalysts | Merchant integration, wearable tech adoption, crypto payment regulations |

| Market Cap | Presale |

| Launch Status | Q3 2025 (est.) |

12. Toncoin (TON) – Telegram-backed Token with Rapidly Growing User Base

Why We Picked Toncoin:

- Partnership with Telegram messaging app

- Speedy growth since the 2022 launch

- Home to viral crypto play-to-earn games

Toncoin is a Layer 1 smart contract blockchain that competes directly with Ethereum, BNB Smart Chain, and Solana. While it’s not quite as large, Toncoin is also relatively newer – it launched in 20,22 compared to 2014 for Ethereum, 2017 for BNB Smart Chain, and 2020 for Solana. The network has experienced very impressive growth, especially considering it hasn’t yet entered a true crypto bull market.

However, despite Telegram’s massive user base, actual blockchain adoption remains limited compared to the platform’s potential reach. Most Telegram users engage with TON-based games casually rather than using the blockchain for serious DeFi or development purposes. The ecosystem remains heavily dependent on simple tap-to-earn games rather than applications.

Toncoin Price Chart. Photo: CoinGecko

Telegram has nearly 1 billion monthly active users, so its partnership with Toncoin is immensely valuable. No other major blockchain has a similarly large user base built in. As crypto prices rise and more people around the world look to invest in digital assets for the first time, Telegram and Toncoin could be their entry point.

Suitable For: Retail users within the Telegram ecosystem, mobile-native DeFi explorers, and investors in Layer 1 scalability.

Community Stats: Integrated access to Telegram’s 900M+ users, rapidly growing TON ecosystem, and increasing developer participation.

Price & Market Outlook: Growth tied to Telegram integration success, but faces challenges converting casual users to meaningful blockchain adoption.

| Category | Layer 1 / Messaging Integration |

| Presale Price | N/A |

| Chain | The Open Network (TON) |

| Utility | Transactions, staking, dApps |

| Catalysts | Telegram integration, growing user base |

| Market Cap | ~$8B |

| Launch Status | Launched |

13. Arbitrum (ARB) – Leading Ethereum Layer 2 Token with Growing Development

Why We Picked Arbitrum:

- Largest Ethereum Layer 2 by TVL and market cap

- Very popular for decentralized finance (DeFi) development

- ARB token could eventually offer revenue sharing

Arbitrum has established itself as the leading Ethereum Layer 2 solution with over $13 billion in total value locked. The platform successfully attracts DeFi protocols seeking lower fees and faster transactions, and its technical approach, utilizing optimistic rollups, has proven reliable for both users and developers.

However, the ARB token currently serves only as a governance token with no direct revenue sharing or staking rewards. While future revenue sharing remains possible through DAO governance, there’s no guarantee this will be implemented, and token holders have no claim to protocol fees currently. The token’s value depends largely on speculation about future utility rather than present cash flows.

Arbitrum Price Chart. Photo: CoinGecko

Arbitrum faces increasing competition from other Layer 2 solutions like Optimism, Base, and Polygon, which are actively competing for developer mindshare and user adoption. Additionally, Ethereum’s own scaling improvements through upgrades could reduce reliance on Layer 2 solutions over time. The prediction that Layer 2s will become more valuable than the Ethereum mainnet by 2030 remains highly speculative.

Suitable For: Ethereum-native users, DeFi builders, and DAO participants interested in Layer 2 governance and scaling.

Community Stats: Over 1.5M unique addresses, active governance via Arbitrum DAO, and widely adopted among top DeFi protocols.

Price & Market Outlook: Currently valued on speculation about future utility rather than present revenue; success depends on maintaining Layer 2 leadership and implementing value accrual mechanisms.

| Category | Layer 2 / Ethereum Scaling |

| Presale Price | N/A |

| Chain | Arbitrum (Layer 2) |

| Utility | Governance, network incentives |

| Catalysts | On-chain governance, developer adoption |

| Market Cap | ~$2.5B |

| Launch Status | Launched |

14. Ondo Finance – DeFi Platform Bridging the Gap to TradFi

Why We Picked Ondo Finance:

- Fast-growing RWA tokenization platform with $1B+ in TVL

- Offers high-yield staking opportunities for investors

- Stands to benefit from relaxed crypto rules under the Trump administration

Ondo Finance has positioned itself as a leading platform for tokenizing real-world assets, particularly US Treasury bills and other institutional-grade securities. The platform’s $1 billion+ TVL demonstrates genuine institutional adoption, and the RWA sector addresses real demand for yield-bearing crypto assets backed by traditional finance.

However, Ondo’s success remains heavily dependent on regulatory frameworks that could change unexpectedly. While the current political situation favors crypto-friendly policies, regulatory approaches can shift with changes in administration or market conditions. Additionally, the RWA space faces increasing competition from both traditional financial institutions and other crypto platforms that are developing similar offerings.

Ondo Finance Price Chart. Photo: CoinGecko

The platform’s institutional focus provides stability but may limit retail participation and broader crypto adoption. Token utility for ONDO remains primarily governance-based, with limited direct revenue sharing or staking rewards for holders. The platform also faces technical challenges in maintaining compliance across multiple jurisdictions as it scales its operations.

Suitable For: Yield-seeking investors, RWA enthusiasts, and institutions exploring tokenized bonds and treasuries.

Community Stats: Rapid institutional traction, coverage from financial media, and rising presence in tokenized asset reports.

Price & Market Outlook: Growth tied to RWA sector expansion and regulatory environment; faces competition from traditional finance, developing similar offerings.

| Category | Real-World Assets / Tokenized Treasuries |

| Presale Price | N/A |

| Chain | Ethereum |

| Utility | Governance, protocol fees, RWAs |

| Catalysts | Institutional demand, tokenized bonds trend |

| Market Cap | ~$3.3B |

| Launch Status | Launched |

Compare the Best Crypto to Buy by Investment Strategy

Not every crypto investor has the same goals. Some prioritize long-term stability, while others chase outsized returns from early-stage projects. Below is a comparison of the best crypto tokens to consider in August 2025, depending on your investment strategy and risk appetite.

| Investment Strategy | Best Picks | Why These Tokens Fit |

| Long-Term Growth | Bitcoin, XRP, Hyperliquid, Arbitrum, Solana | These projects have strong fundamentals, deep liquidity, and growing institutional support. Bitcoin leads as a macro asset, Arbitrum anchors Ethereum Layer 2 scaling, and Toncoin benefits from Telegram’s massive user base. |

| High-Risk, High-Reward | TOKEN6900, Bitcoin Hyper, Maxi Doge | Early-stage tokens with strong narratives (meme, AI, social), high presale momentum, and potential for outsized gains – but also elevated volatility and execution risk. |

| Utility & Ecosystem Use | Best Wallet, Snorter Token, SpacePay, Hyperliquid | These tokens offer real-world use: DEX perks, Layer 2 scalability, and trading infrastructure. They’re attractive to active users seeking both functionality and token appreciation. |

How to Pick the Best Crypto to Buy Right Now – Our Methodology

Now that you know more about the top cryptocurrencies to invest in 2025, it’s time to narrow down your selection. Below, we outline the key factors to consider when evaluating which crypto to buy today and how to build a solid investment approach.

Growth Potential and Catalysts

For most investors, the main goal is price appreciation. Some tokens offer value through staking or utilities, but potential price growth is the primary factor to consider.

Since traditional valuation metrics don’t apply, look at a token’s market cap compared to others in its category. You can also compare its current price to past highs, though this isn’t always reliable – not all tokens revisit ATHs.

Catalysts are another important element. Are there upcoming releases, updates, or use cases that could drive attention and utility? Could broader market trends, like a bull run, amplify this effect?

Don’t ignore negative catalysts either – regulatory changes, project delays, or macro risks can also affect price.

Staking Rewards

Staking lets users earn passive income by locking tokens to help secure a network. APYs vary by project and can add to total returns. Some platforms require fixed lockups, while others offer flexible terms.

Top Staking Assets. Photo: Staking Rewards

High staking rewards can enhance a token’s appeal, especially when paired with price gains. However, reward rates can change suddenly, so staking shouldn’t be the only reason to buy a token.

Utility

Utility matters. Many tokens grant access to features or discounts unavailable otherwise.

For instance, BEST from Best Wallet offers trading fee discounts and better staking terms. SNORT provides access to Telegram-native trading tools with reduced fees and MEV protection. These real-use cases can add value even if price growth is slower, especially for active users.

Analyst Predictions

Price forecasts from crypto analysts can help spot promising tokens. These experts study the market daily and often catch early trends.

That said, approach predictions with caution. Some analysts may be biased or have financial interests. Always check multiple viewpoints and review both bullish and bearish cases.

Tokenomics

Tokenomics shows how a token is structured – how it’s distributed, unlocked, and inflated.

TOKEN6900 Tokenomics. Photo: Token Website

Studying tokenomics reveals how decentralized a project is, who controls the majority of the supply, and whether inflation could erode value over time. It’s essential to understand before making an investment.

Best Crypto to Buy in August 2025 – Market Snapshot

August 2025 arrives with renewed momentum in the crypto market, fueled by fresh institutional activity, network upgrades, and speculative flows returning to meme coins and presale tokens. Bitcoin recently broke above $107,000 for the first time, triggering renewed interest in early-stage projects with high upside potential.Within the meme coin ecosystem, satirical finance projects are capturing massive attention. TOKEN6900 has emerged as the standout presale this month, positioning itself as the “anti-S&P 500” with its $5M hard cap and transparent zero-utility approach. The project’s “Peak Brain Rot Theory” and direct challenge to SPX6900’s $1.2B dominance have sparked viral discussions across crypto communities.

Meanwhile, Snorter Token has gained viral traction as Telegram-based trading bots continue to dominate Solana meme coin trading. With over $175,000 raised on day one and copy trading tools already in beta, the token is trending across social media as traders look for speed and protection in a volatile market.

Bitcoin Hyper (HYPER) is benefiting from increased attention on Layer 2 Bitcoin narratives. As investors seek exposure beyond BTC spot ETFs, HYPER’s 3,100% staking APY and smart contract capabilities via Solana VM make it one of the most talked-about presale tokens this month.

Lastly, utility tokens like Best Wallet’s BEST are gaining interest among long-term holders. As new features roll out – including debit card previews and decentralized content ranking – both are showing signs of early adoption.

This mix of hype cycles, platform growth, and macro tailwinds makes August a critical month to assess which cryptos offer both short-term momentum and longer-term utility.

Why Invest in Cryptocurrency?

A key question many new investors in the crypto world have is, why invest in crypto at all? There are several reasons why digital assets have become one of the fastest-growing investment classes, attracting millions of people worldwide.

Strong Growth Potential

The biggest reason for investors to consider cryptos as part of their portfolio is that digital assets – including cryptocurrencies, NFTs, and other digital investments – have enormous growth potential. From 2017 to 2025, Bitcoin’s price jumped nearly 8,0x and Ethereum surged nearly 200x. There are very few stocks that have delivered such explosive gains over such a short period.

Nor is the exponential growth phase over. Cryptocurrencies remain a relatively new technology, with many exciting new projects being released every week. These tokens are vying to be the next Bitcoin or Ethereum and could see similar triple-digit growth.

There’s also more headroom for growth in mega-cap tokens like Bitcoin and Ethereum. Analysts widely anticipate that Bitcoin could be headed for a price of $1 million, a more than 10x gain from its current price.

Cryptocurrencies aren’t the only asset class with strong growth potential in 2025 and beyond, but there are more high-return opportunities in the crypto market than in virtually any other market.

Diversification from Traditional Assets

Another reason many investors are turning to cryptocurrencies is to diversify their portfolios away from traditional assets, such as stocks, real estate, and cash. Cryptocurrencies are an entirely distinct asset class, so holding them can provide some protection against downturns in other markets.

For example, when inflation was high in 2023-2024, cash lost value very quickly, and the stock market underperformed expectations. At the same time, cryptocurrencies saw significant growth. Bitcoin, in particular, saw gains as investors poured into ‘digital gold’ as an inflation hedge.

Gold and Bitcoin

Cryptocurrency performance is still correlated with stock market performance to some extent, so it’s not a perfect hedge. However, spreading investments across distinct asset classes is an important strategy investors can use to make their portfolios more resilient.

High Yields from Staking Rewards

Another benefit of investing in cryptocurrencies is that they offer staking rewards, as discussed earlier. Yields from staking rewards are often much higher than yields from traditional assets like cash. Whereas the US average interest rate is just 0.41% APY, staking rates for emerging cryptocurrencies often exceed 100% APY. Staking rates for major cryptocurrencies, such as Ethereum, typically range from 2% to 5% APY.

Staking isn’t as safe as holding cash in an insured savings account, but it offers relatively low risk. Therefore, the significantly higher APYs of staking crypto can be very attractive to investors deciding what to do with their money.

Access to Web3 and Decentralized Utilities

Cryptocurrencies are the gateway to Web3, the decentralized internet. They not only provide investment returns but also access to new ways of interacting with people and technology around the world.

For example, decentralized utilities provided by a token can spur new ways of thinking or financial relationships that were previously impossible. These interactions can create value for individual investors but can also be worthwhile regardless of their profit-making potential.

Investors may enter the cryptocurrency market in search of gains, but many remain invested even during downturns because of the utilities their tokens provide.

Where to Find the Top Crypto to Buy

Another important part of investing in cryptocurrencies is developing new ideas for the best crypto to invest in now. This guide serves as an important starting point, but investors can expand their portfolios to include more than just the 10 cryptocurrencies we have covered.

So, where can investors find ideas? We’ll cover four broad categories of sources to explore.

Social Media

Social media channels like X and Reddit are hotbeds of crypto enthusiasm, and they’re frequented by crypto investors, traders, and analysts. These platforms can be excellent for monitoring crypto news, gaining insights into market movements, or discovering the latest hot new cryptocurrencies.

Investors can directly communicate with one another on social media about cryptos to buy. In addition, almost all major crypto projects – and most new projects – have a presence on social media. So, checking social media can be a good way to evaluate tokens, find out what they’re all about, and assess how much community support they have.

Crypto Analysts and Influencers

Crypto analysts and influencers can be very good sources of information about the best crypto coins to buy in any market condition. They spend their days searching for exciting new tokens and analyzing factors that could be bullish or bearish surrounding existing coins.

In many cases, analysts and influencers are public with their analysis. They share price predictions and technical analysis on social media, on YouTube, or through their channels. Finding analysts who have an investment style that matches your own and following their latest insights can be a great way to generate ideas for cryptocurrencies to invest in.

Crypto News Platforms

Following crypto market news is another key way investors can stay informed about the market and identify tokens to buy. Market news may highlight tokens that are pulling back, for example, creating buying opportunities. Or outlets might cover new developments that make an existing project more valuable.

Investors should check multiple news platforms to ensure they never miss a big story. It’s also possible to set up news alerts for specific tokens, which can be great for investors looking for an entry point into one of the best cryptocurrencies to invest in.

Exchange and Presale Aggregators

Investors can also monitor token prices, news, new launches, and more on crypto exchanges and presale aggregators like DEXTools. These exchanges and aggregators serve as hubs for the crypto market, and they typically display information about trending tokens to help investors see what’s hot.

DEXtools interface. Photo: DEXtools

Investors can also use these sites to conduct basic analysis, such as comparing tokens to other cryptos in the same market sector or performing basic technical analysis. While exchanges and aggregators don’t replace dedicated research tools, they can be a starting point for finding the best cryptocurrencies to buy.

Potential Risks of Investing in Crypto

Although investing in crypto has the potential to yield strong returns, this market also involves risks that investors need to be aware of. We’ll highlight three of the main risks that stem from investing in crypto.

Risk of Losses

The biggest risk that crypto investors face is the possibility of losing money. Not all tokens will go up in price, and some could lose all of their value. It’s not always possible to tell which cryptocurrencies will lose money, and tokens that had previously delivered gains could suddenly turn downward.

There is no way to eliminate the risk of losses. However, investors can use stop-loss orders to limit the amount of money they lose on any single position. It’s also important for investors to be mindful of this risk and only invest with money they are willing to lose.

High Volatility

Cryptocurrencies are notoriously volatile, meaning they can undergo large price swings in very short periods. This volatility can be great for investors when the net direction of a price movement is up. However, high volatility can also work against investors, as token prices can fall rapidly.

Investors in crypto need to be aware of this volatility. It’s important to have a strong stomach when buying cryptocurrencies and holding them over long periods.

Scams and Security Threats

While there are thousands of legitimate tokens and Web3 services in the crypto market, this environment is also rife with scams seeking to take advantage of unsuspecting investors. It’s very important to make sure you only click on trusted links and always do your research before making a transaction.

Investors also need to keep in mind that storing crypto in a wallet is distinct from storing money in a bank account or stocks in a brokerage account. You are responsible for your wallet’s security. If you hold tokens in a custodial wallet, such as a crypto exchange account, bear in mind that you do not fully control your crypto, and it could be liquidated if an exchange faces a bank run.

Things to Consider Before Buying Crypto

Before buying crypto, investors should ensure they’re fully prepared and set up for success. Here are a few things to consider.

Set a Budget

Setting a budget for how much you plan to invest is a good way to manage your risk. Only invest money you can afford to lose – never invest money you need to pay for essential expenses.

A good rule of thumb is to start out investing a small percentage of your portfolio in crypto. Once you’re comfortable investing 1% or 5% of your total portfolio, you can consider whether a larger investment makes sense for your goals.

Identify Your Risk Tolerance

Cryptocurrency is a high-risk investment compared to stocks, bonds, and other traditional investments. Token prices are highly volatile, and there are risks related to wallet security that don’t exist for other investments.

That said, there’s also a wide range of risk profiles for different cryptocurrency tokens. It’s up to you to decide whether you want to invest in high-risk, high-reward tokens like presale coins or whether a more conservative mega-cap crypto makes more sense for your portfolio. To make this decision, think about how much you plan to invest and how you would feel if your entire investment were lost.

Define Your Crypto Investing Goals

Your cryptocurrency investing goals should align with your risk tolerance and broader investment objectives. For example, is your aim to generate long-term profits from holding tokens or short-term profits from trading? Are you trying to generate passive income from staking?

Defining your goals can help you identify what types of cryptos to invest in and how to diversify your portfolio across different coins.

Keep Your Wallet Secure

Finally, be sure to keep your crypto wallet fully secure. Write down your wallet’s seed phrase so you can recover your tokens on another device if needed. Never share your seed phrase or wallet password with anyone, and don’t store this information online.

If you plan to invest heavily in crypto, it may be worth considering a hardware wallet to store your cryptocurrency offline. This is typically more secure than a software wallet, which is always connected to the internet.

Crypto Trends Driving the Top Coins to Invest in 2025

2025 is expected to be an exciting year for the crypto market. Here are several trends to watch that could have a big impact on token prices and even which coin is the top cryptocurrency to buy.

Loosening Crypto Rules

The Trump administration has aligned itself with the crypto industry and is expected to make a major push to loosen crypto rules. The Securities and Exchange Commission, under the new administration, has appointed a chair who is much more crypto-friendly and is currently working with industry participants to develop new rules for the crypto sector. In addition, Trump himself is involved in several crypto projects, which could mean a greater role for the White House in advertising crypto as an emerging industry.

Donald Trump at the Bitcoin 2024 Conference. Photo: Bitcoin 2024 Conference

Strategic Bitcoin Reserve

One of the Trump administration’s biggest moves in the crypto industry so far is the implementation of a strategic Bitcoin reserve, similar to the US’s strategic gold reserve. The strategic Bitcoin reserve is designed to hold any Bitcoin the US already owns through seizures and other means; however, as of 2025, it will not result in any new Bitcoin purchases. However, the reserve indicates that the US views Bitcoin as an asset worth owning, and it could spark significant BTC purchases by other countries.

Meme Coin Supercycle

The meme coin supercycle is a long-term trend characterized by rising meme coin prices and increasing trading volume. Crypto analyst Murad Mahmudov originally proposed the idea at the TOKEN2049 conference, and has since become very popular within the crypto community. According to the supercycle theory, meme coin communities are highly valuable, and the growth of meme coin users will drive exponentially higher value in this sector.

Decentralized AI

Decentralized AI has already made a splash in the crypto market, with emerging sectors like AI agent tokens now worth around $4 billion. Decentralized AI projects aim to deploy AI models on-chain, enabling anyone to run their own custom models and create new use cases for crypto tokens. AI is advancing at a rapid pace, and blockchains will likely become a playground for new AI technology in 2025 and beyond. AI-related tokens could be among the best cryptos to invest in as this technology becomes more prevalent.

How to Buy Crypto

Ready to start building your crypto portfolio? We’ll walk you through the steps to buy the most promising crypto on the market today.

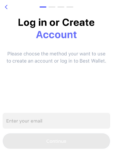

Step 1: Create a Wallet or Exchange Account

To get started, you’ll need either a crypto wallet like Best Wallet or an account at a crypto exchange like Binance or Coinbase. We recommend using Best Wallet because it gives you full control over your crypto tokens and offers access to a wider range of coins than many exchanges. You can also sign up for Best Wallet with just an email address, whereas exchanges require you to go through Know Your Customer checks.

Best Wallet App. Photo: Best Wallet

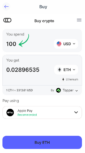

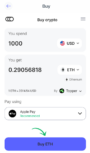

Step 2: Choose Your Payment Method

On Best Wallet, you’ll choose your payment method and make a payment instantly as part of the crypto buying process. You can pay with a credit or debit card, PayPal, bank transfer, Neteller, or Skrill.

Best Wallet App. Photo: Best Wallet

At an exchange, you’ll need to deposit funds before purchasing. Payment methods vary, but most exchanges accept bank transfers, and some accept e-wallets.

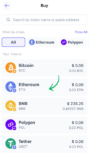

Step 3: Choose Your Cryptocurrency

Select the cryptocurrency you wish to buy and enter the amount to purchase. With Best Wallet, you can convert directly from dollars to thousands of cryptocurrencies. On many exchanges, you have to first buy Tether (USDT) and then swap that for the cryptocurrency you want.

Best Wallet App. Photo: Best Wallet

Step 4: Confirm Your Order

Once your order is ready, click or tap Buy to complete the transaction. Your purchased tokens will appear in your crypto wallet or exchange account immediately.

Best Wallet App. Photo: Best Wallet

When to Sell Crypto

Once you buy one of the top cryptocurrencies, you can hold it for any amount of time and then sell it whenever you want. You can sell your crypto through the same wallet app or exchange you used to buy crypto in the previous steps.

It’s important to think about your investment time frame when selling. Some investors look to hold tokens for years and don’t worry about day-to-day pullbacks. Others take a more active approach, buying and selling the same token repeatedly to try to maximize profits.

To turn a profit, you need to sell tokens at a higher price than you bought them for – and the price difference needs to be enough to offset any transaction fees you paid along the way. If you sell tokens at a price lower than you bought them for, you’ll lose money on your investment.

That said, it doesn’t always make sense to hold tokens until they turn a profit. Some never will. It’s better to sell cryptocurrencies that aren’t living up to your expectations and put the money into a different token than to ride a coin down and lose your entire investment.

Conclusion

Cryptocurrencies are a popular investment class because they offer more growth potential than stocks and other traditional asset classes. Building a strong crypto portfolio can be a way to achieve financial success. However, cryptocurrencies are also risky, so it’s important to have a strong grasp of how this market works and what tokens to buy.

According to our analysis, the best tokens to buy today include Bitcoin, Solana, Maxi Doge, Bitcoin Hyper, TOKEN6900, Toncoin, and Arbitrum. Check out the rest of our crypto coverage to get the latest updates on these coins and start building your crypto portfolio today.

FAQ

What is the best crypto to buy right now?

How do I find the best cryptocurrency to buy?

Can you get rich from crypto?

Is it safe to buy crypto?

Which coin will be the next Bitcoin?

Which crypto will reach $1 next?

References

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Looking for the best low cap crypto in 2025? Our detailed research methodology has revealed some undervalued coins with high growt...

This guide explains how to buy SUBBD token, a content subscription platform that merges artificial intelligence (AI) with blockcha...

45 mins

45 mins

Otar Topuria

, 13 postsOtar Topuria is a crypto writer on Coinspeaker with over 3 years of experience in <strong> fintech and cryptocurrency analysis </strong> . He focuses on market movements and investment trends, exploring the narratives behind their patterns. His work has also appeared on Insidebitcoins. Before specializing in crypto, he contributed to the IT sector by writing technical content about software development and emerging technologies. With a master’s degree in comparative literature, he developed analytical precision and the skills to break down complex concepts into clear ideas. Otar is particularly interested in <strong>early-stage project discovery and crypto trading</strong>, bringing a deep understanding of market dynamics to his content.