Discover the best crypto platforms with 100x leverage in 2025. Learn how to apply 100x leverage safety and explore proven strategi...

Discover the best growth stocks to invest in, according to analyst insights and market trends. Discover the best growth stocks to invest in, according to analyst insights and market trends.

Research suggests that the best growth stocks to buy are HYLQ Strategy Corp. and Sol Strategies Inc. These low-cap equities operate in the high-growth digital asset market, providing exposure to emerging technologies at startup valuations.

When exploring publicly traded companies with long-term growth potential, the best practice is diversification. Identify industries and innovative concepts with strong market conviction and the ability to outperform traditional indexes.

Read on to evaluate top growth stock picks in 2025 and learn expert-led strategies to build a risk-averse portfolio.

Best Growth Stocks Key Takeaways

- Growth stocks are public companies expected to outperform market benchmarks like the S&P 500.

- Stocks in this investing niche can be low or large-cap equities, and they rarely pay dividends.

- Investing in growth companies early enables shareholders to experience the full growth cycle.

- The best growth stocks to buy often operate in disruptive markets like blockchain, AI, and cybersecurity.

Best Growth Stocks to Invest in Reviewed

Here is a curated list of undervalued growth stocks rated highly by sell-side analysts:

- HYLQ Strategy Corp. (CSE: HYLQ) — The Overall Best Growth Stock to Buy in 2025

- Sol Strategies Inc. (CSE: HODL) — Gain Exposure to the Solana Blockchain Infrastructure at a Growth Valuation

- NVIDIA Corp. (NASDAQ: NVDA) — The De Facto Market Leader in the GPU and AI Industries

- Sezzle Inc. (NASDAQ: SEZL) — Buy Now Pay Later Services With 875% Share Gains in the Past Year

- Coinbase Global Inc. (NASDAQ: COIN) — Tier-One Crypto Exchange for Retail and Institutional Clients

- Shopify Inc. (NASDAQ: SHOP) — Subscription-Based E-commerce Platform With 5.6 Million Active Stores

- CrowdStrike Holdings Inc. (NASDAQ: CRWD) — Undervalued Cybersecurity Stock Specializing in Threat Intelligence and Response Services

- Meta Platforms Inc. (NASDAQ: META) — Social Media Giant With Almost 4 Billion Monthly Active Users

- Toast Inc. (NYSE: TOST) — Fast-Growing Restaurant Software Solutions With 140,000 Partnered Locations

- Duolingo Inc. (NASDAQ: DUOL) — Popular Language-Learning App With Over 10 Million Paying Subscribers

Best Growth Stocks to Invest in Reviewed

Learn more about expert-recommended penny growth stocks in 2025. The following sections explore key investing metrics, from industry concepts and price performance to financial stability and insider transactions.

1. HYLQ Strategy Corp. (CSE: HYLQ): Micro-Cap Growth Stock With Strong Momentum in the Cryptocurrency and Blockchain Industries

HYLQ Strategy Corp. is a Canadian holding company that makes strategic investments in Web 3.0 technologies, including the best cryptocurrencies, blockchain, and decentralized ecosystems. The firm’s overarching objective is to provide shareholders with exposure to innovative and undervalued startups from the ground up.

Strategy Corp. stock 12-month performance. Source: Google Finance

It allocates venture capital to high-potential projects after identifying disruptive concepts within the digital asset market. Most funding rounds are exclusively offered to institutional clients, so they’re rarely available to the public. This dynamic makes HYLQ Strategy Corp. the best growth stock to access difficult-to-reach markets passively.

Public data shows that management has a strong conviction in the Hyperliquid (HYPER) blockchain. As one of the fastest-growing networks, Hyperliquid revolutionizes traditional finance through decentralized trading, merging the conventional order book system with distributed ledger technology. HYLQ Strategy Corp.’s growing HYPER holdings provide priority access to new projects within the Hyperliquid network.

While the holding company is bullish on cryptocurrencies and blockchain, it also diversifies into alternative emerging markets. Other investment industries include payment innovation, remote gambling, and financial services.

HYLQ shares are listed on the Canadian Securities Exchange (CSE) and remain a constituent of the CSE25 Index. They offer growth investors a nano-cap valuation of just CAD 20.6 million (about $15.2 million), reflecting substantial upside potential but also high volatility risks. The most recent financial statements show a 580.9% year-on-year increase in net income, with a 19.3% decrease in operating expenses.

Recent price performance is notable. HYLQ shares rose by 285% in the past 12 months, which vastly outperforms the CSE25 benchmark. Since hitting a CAD 4.19 (about $3.08) all-time high in June 2025, the growth stock has entered a correction phase, dropping to a more favorable entry price of CAD 1.58 (about $1.16).

| Growth Stock | HYLQ Strategy Corp. |

| Ticker | HYLQ |

| Core Business | Investment holding company |

| Primary Stock Exchange | CSE |

| Market Cap | CAD 20.6 million |

| 12-Month Performance | 285% |

| 52-Week Low / High | $1.25 / $4.19 |

2. Sol Strategies Inc. (CSE: HODL): Solana Investment and Staking Firm With an Incoming NASDAQ Listing

Sol Strategies Inc. is another Canadian growth stock with explosive price potential. The CSE-listed company specializes in the Solana (SOL) blockchain, providing shareholders with access to its broader ecosystem without needing to use cryptocurrency exchanges or control non-custodial wallets.

Sol Strategies Inc. stock 12-month performance. Source: Google Finance

Management primarily invests in SOL, which unlocks access to secondary projects. These are called “Solana Program Library” (SPL) tokens and operate in various Web 3.0 narratives like decentralized finance (DeFi), gamification, and real-world asset (RWA) tokenization.

As per the company’s recent investor call, Sol Strategies Inc. holds over 420,000 SOL in its treasury. With SOL delivering rapid returns in recent weeks, those holdings are now valued at approximately $80 million.

Another business division is the validator service, which “delegates” SOL into the Solana blockchain to help keep it secure and decentralized. The firm has delegated over 3.51 million SOL with an estimated value of $666 million. The service generates passive rewards from the proof-of-stake system, providing Sol Strategies Inc. with an additional income stream.

Although HODL shares primarily trade on the CSE, a recent publication suggests a NASDAQ listing is imminent. This is a significant move for the company, as it will join other heavyweight cryptocurrency stocks like Coinbase Global Inc. and MicroStrategy Inc. It also provides HOLD with access to the more lucrative and liquidity-rich U.S. market. Note that to satisfy NASDAQ listing requirements, management proposes a 1-for-8 reverse stock split. Shareholder ownership remains the same without dilution.

Despite the much-anticipated American debut, Sol Strategies Inc. remains one of the best growth stocks to buy for small-cap investors. With a market capitalization of just CAD 237 million (about $174 million), some analysts suggest that HODL is massively undervalued. This bullishness is reflected in the HODL stock price, with 12-month returns of 733%.

| Growth Stock | Sol Strategies Inc. |

| Ticker | HODL |

| Core Business | Solana investing and staking |

| Primary Stock Exchange | CSE |

| Market Cap | CAD 237 million |

| 12-Month Performance | 733% |

| 52-Week Low / High | $0.14 / $6.12 |

3. NVIDIA Corp. (NASDAQ: NVDA): Global Leader in GPU Technology for the AI and Gaming Markets

Despite becoming the world’s first $4 trillion equity, NVIDIA Corp. is one of the best growth stocks for beginners. It has unmatched dominance in the graphics processing unit (GPU) industry, particularly for desktop PCs and global data centers. NVIDIA Corp. also leads the artificial intelligence (AI) chip race, as its GPU technologies power AI model training, inference, and 3D rendering solutions.

NVIDIA Corp. stock 12-month performance. Source: Google Finance

Financial statements smashed analysts’ forecasts in the most recent quarter, with NVIDIA Corp. reporting a 69.18% rise in revenue, and net income increasing by 26.17% to $18.78 billion. The tech stock also has a robust balance sheet. With $53.69 billion in cash and short-term investments, it has significant resources for research and development, and to meet ever-rising product demand.

NVIDIA Corp.’s massive valuation hasn’t hindered its stock performance, either. NVDA shares are up almost 50% in the past 12 months. Long-term holders have witnessed the biggest returns, with a five-year growth of over 1,575%.

| Growth Stock | NVIDIA Corp. |

| Ticker | NVDA |

| Core Business | GPU products for AI, gaming, and other industries |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $4.1 trillion |

| 12-Month Performance | 49% |

| 52-Week Low / High | $86.63 / $174.24 |

4. Sezzle Inc. (NASDAQ: SEZL): One of the Best-Performing Growth Stocks in 2025

Sezzle Inc. is a financial technology company that specializes in “Buy Now, Pay Later” (BNPL) payments. Operating in the U.S. and Canada, it enables customers to spread purchases over four installments, with repayment terms lasting for six weeks.

Sol Strategies Inc. stock 12-month performance. Source: Google Finance

While Sezzle Inc. provides lending services, it does not charge interest payments on its BNPL structure. Instead, it generates revenue from merchant fees, similar to credit card issuers like Visa and MasterCard. The growth firm also revolutionizes the lending assessment process by using behavior risk analysis rather than relying solely on FICO credit scores.

Its innovative business model faces competition from PayPal, Klarna, and other FinTech leaders, yet Sezzle Inc. stock has outperformed its market rivals by considerable amounts. The NASDAQ-listed shares are up 875% in the past 12 months, and over 200% year-to-date.

Its $4.6 billion market capitalization appeals to long-term growth investors, especially considering recent quarterly results. SEZL reported a 123.32% year-on-year revenue increase, with a 351.65% rise in net income.

| Growth Stock | Sezzle Inc. |

| Ticker | SEZL |

| Core Business | Consumer-facing lending services without interest |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $4.6 billion |

| 12-Month Performance | 875% |

| 52-Week Low / High | $11.67 / $186.74 |

5. Coinbase Global Inc. (NASDAQ: COIN): Regulated Crypto Exchange and Brokerage With Diversified Revenues

With over 100 million retail accounts, Coinbase Global Inc. is one of the best crypto exchanges globally. The platform also serves the world’s biggest financial institutions by providing large-scale trading services and custodianship.

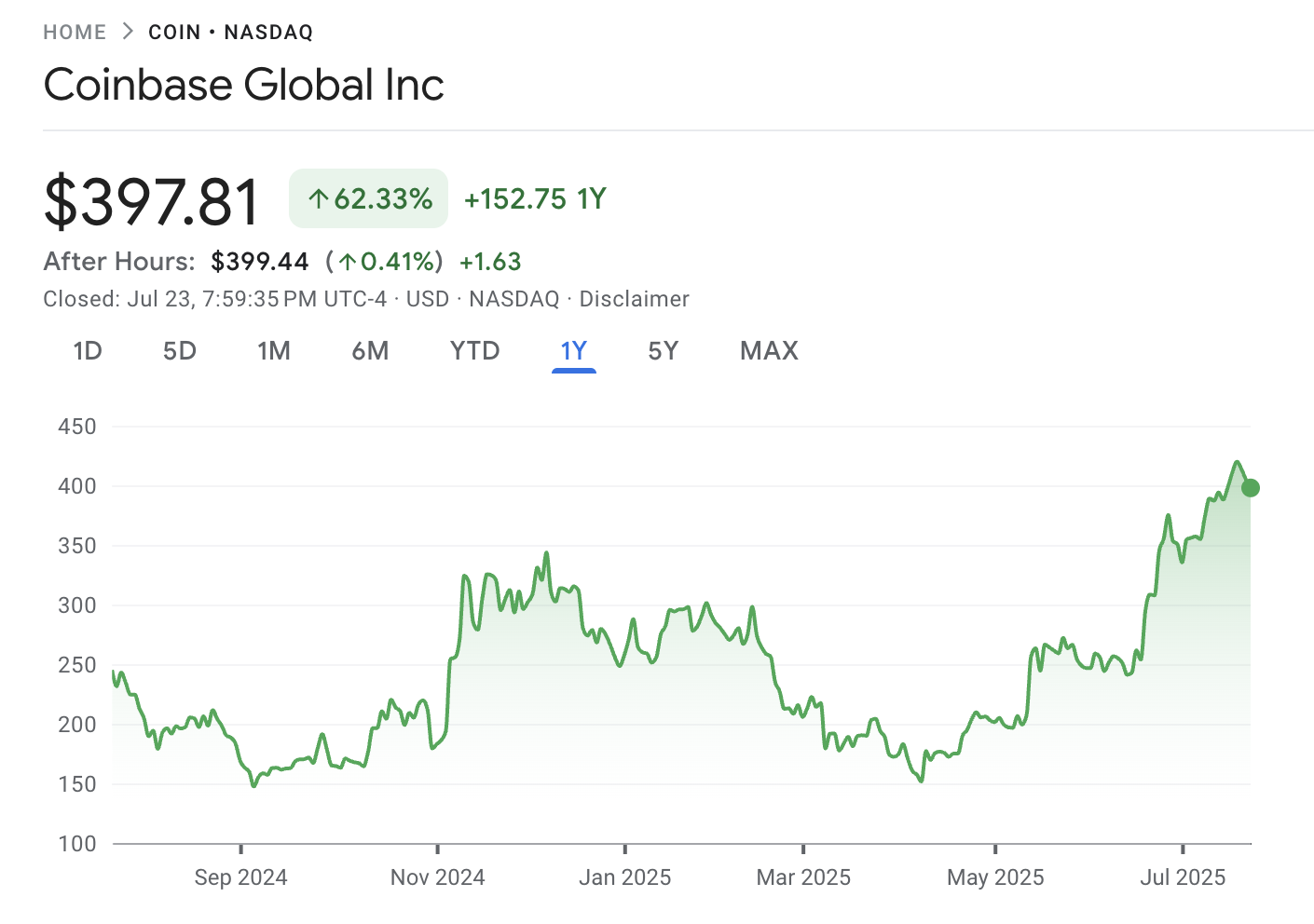

Coinbase Global Inc. stock 12-month performance. Source: Google Finance

Coinbase Global Inc., which is regulated and licensed by the world’s most reputable financial watchdogs, generates most of its revenue from trading commissions. While it makes money on buy and sell orders regardless of broader market conditions, commission income declines during bearish cycles.

The firm has diversified into other business areas to reduce its reliance on cyclical factors. The Base network, for instance, is a Layer 2 sidechain built on the Ethereum blockchain. Base is the fastest-growing crypto ecosystem in 2025, and it collects network fees on all transaction movements. Coinbase Global Inc. also offers subscription services through Coinbase One. The service surpassed 600,000 subscribers in late 2024.

COIN shares trade on the NASDAQ with a $101 billion market capitalization. As one of the best crypto stocks, COIN has strong momentum with 12-month gains of about 62%.

| Growth Stock | Coinbase Global Inc. |

| Ticker | COIN |

| Core Business | Crypto exchange, brokerage, custodian, and other services |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $101 billion |

| 12-Month Performance | 62% |

| 52-Week Low / High | $142.58 / $444.65 |

6. Shopify Inc. (NASDAQ: SHOP): Global E-commerce Platform With Over 875 Million Customers

Shopify Inc. is an e-commerce giant that helps small-to-medium businesses sell products online and in-store. It provides all-in-one solutions from the get-go, from launching websites and processing payments to managing inventory and shipments.

Shopify Inc. stock 12-month performance. Source: Google Finance

The Ottawa-based firm has over 5.6 million active stores that serve 875 million customers worldwide. Recent company reports show that Shopify Inc. now has a 12% share of the U.S. e-commerce market. International growth, particularly in emerging markets, is notable.

Impressive global expansion is backed by strong financial results. Quarterly revenue increased 26.81% to $2.26 billion, while operating expenses were modest at just $891 million. With over $5.51 billion in cash and short-term investments, Shopify Inc. has ample resources to accelerate growth and diversify into new markets.

As one of the best growth stocks to buy, SHOP shares have delivered 106% gains in the past year. While the $158 billion market capitalization may not appeal to some investors, most sell-side analysts rate SHOP a strong buy.

| Growth Stock | Shopify Inc. |

| Ticker | SHOP |

| Core Business | E-commerce services for small-to-medium businesses |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $158 billion |

| 12-Month Performance | 106% |

| 52-Week Low / High | $69.84 / $129.29 |

7. CrowdStrike Holdings Inc. (NASDAQ: CRWD): Top-Rated Cybersecurity Stock With 78% Annual Returns

CrowdStrike Holdings Inc. operates in a hugely disruptive market: cybersecurity. Although the U.S.-based firm initially specialized exclusively in endpoint protection, it has since expanded into other key business divisions like security analytics and threat detection.

CrowdStrike Holdings Inc. stock 12-month performance. Source: Google Finance

CrowdStrike Holdings Inc. also provides innovative AI-backed virtual assistants. Known as “Charlotte AI”, the technology helps businesses detect and investigate external risks through natural language processing. The system streamlines cybersecurity solutions for non-technical users, potentially saving corporate clients from consequential data breaches.

As one of the best growth stocks to buy, CrowdStrike Holdings Inc. could be heavily undervalued, even with its existing $115 billion market capitalization. The shares are performing strongly, producing 12-month returns of almost 79%. In the five-year timeframe, CRWD shares have risen by over 361%.

While recent financial statements show a $110 million quarterly loss, this doesn’t factor in one-time payments and stock compensation. In addition, the stock has over $396.13 million in free cash flow, a small year-on-year increase of 5.91%.

| Growth Stock | CrowdStrike Holdings Inc. |

| Ticker | CRWD |

| Core Business | Cybersecurity solutions with threat Intelligence and response services |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $115 billion |

| 12-Month Performance | 79% |

| 52-Week Low / High | $69.84 / $129.29 |

8. Meta Platforms Inc. (NASDAQ: META): The Social Network Leader With Significant Investment in AI Research

Meta Platforms Inc. is the world’s largest social media giant, with its portfolio of networks including Facebook, Threads, Instagram, and WhatsApp. The firm’s most recent earnings call confirmed its social ecosystem now has almost 4 billion monthly active users (MAUs), representing nearly half the global population.

Meta Platforms Inc. stock 12-month performance. Source: Google Finance

While Wall Street expects continued quarterly growth in the social media division, Meta Platforms Inc. is also making waves in the AI sector. The firm reports that Meta AI, which integrates into its core family of apps, has almost 1 billion MAUs.

Company CEO and founder Mark Zuckerberg confirms that Meta AI aims to challenge existing AI chatbots through paid monthly services, creating an entirely new revenue source. Zuckerberg commits to the broader AI superintelligence race, with hundreds of billions of dollars allocated to the research and development team.

Meta Platforms Inc. stock remains firmly in the growth stage, even with its $1.7 trillion valuation. The shares are up 54% in the past year, and they offer a small running dividend yield of 0.29%.

| Growth Stock | Meta Platforms Inc. |

| Ticker | META |

| Core Business | Social media |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $1.7 trillion |

| 12-Month Performance | 54% |

| 52-Week Low / High | $442.65 / $747.90 |

9. Toast Inc. (NYSE: TOST): All-in-One Software Solutions for U.S. and Canadian Food Establishments

Toast Inc. is a software and payment platform built specifically for restaurants. It offers a one-stop shop for local food establishments that seek streamlined business services. The software facilitates point-of-sale systems, marketing tools, payroll, stock management, and everything in between.

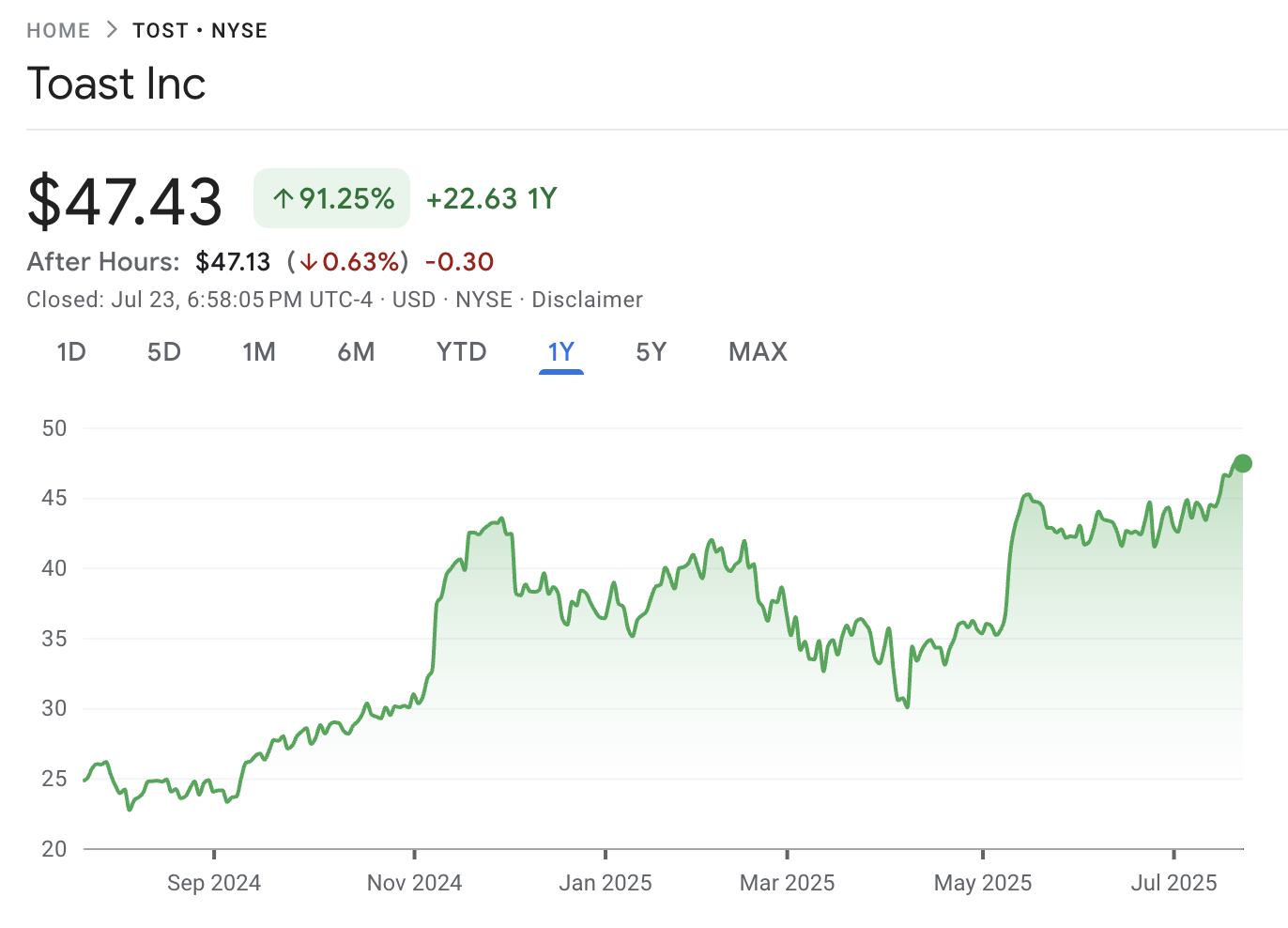

Toast Inc. stock 12-month performance. Source: Google Finance

Toast Inc. sells AI solutions as an optional add-on through “Souf Chef”. The tool helps restaurant managers analyze diner insights and menu prices, boosting sales and maximizing efficiency. With Toast Inc.’s software now active in 140,000 locations, it’s one of the fastest-growing growth stocks in the food and beverage niche.

According to some analysts, the stock’s $27 billion market capitalization is a fraction of its true potential. TOST shares, which trade on the NYSE, are up over 91% in the past year. The balance sheet is healthy, too. Toast Inc. has about $1.49 billion in cash and short-term investments, yet just $891 million in liabilities. These robust financials help the growth stock accelerate its expansion goals.

| Growth Stock | Toast Inc. |

| Ticker | TOST |

| Core Business | All-in-one software solutions for restaurants |

| Primary Stock Exchange | NYSE |

| Market Cap | $2.7 billion |

| 12-Month Performance | 91% |

| 52-Week Low / High | $22.10 / $48.35 |

10. Duolingo Inc. (NASDAQ: DUOL): AI-Backed Language Application With 40% Year-on-Year Growth in Paying Customers

Founded in 2012 and going public in 2021, Duolingo is a language-learning provider with a global audience that spans 46 million daily active users. The Duolingo app, which offers over 40 languages via gamified elements, recently surpassed 10 million paying subscribers, reflecting 40% year-on-year growth.

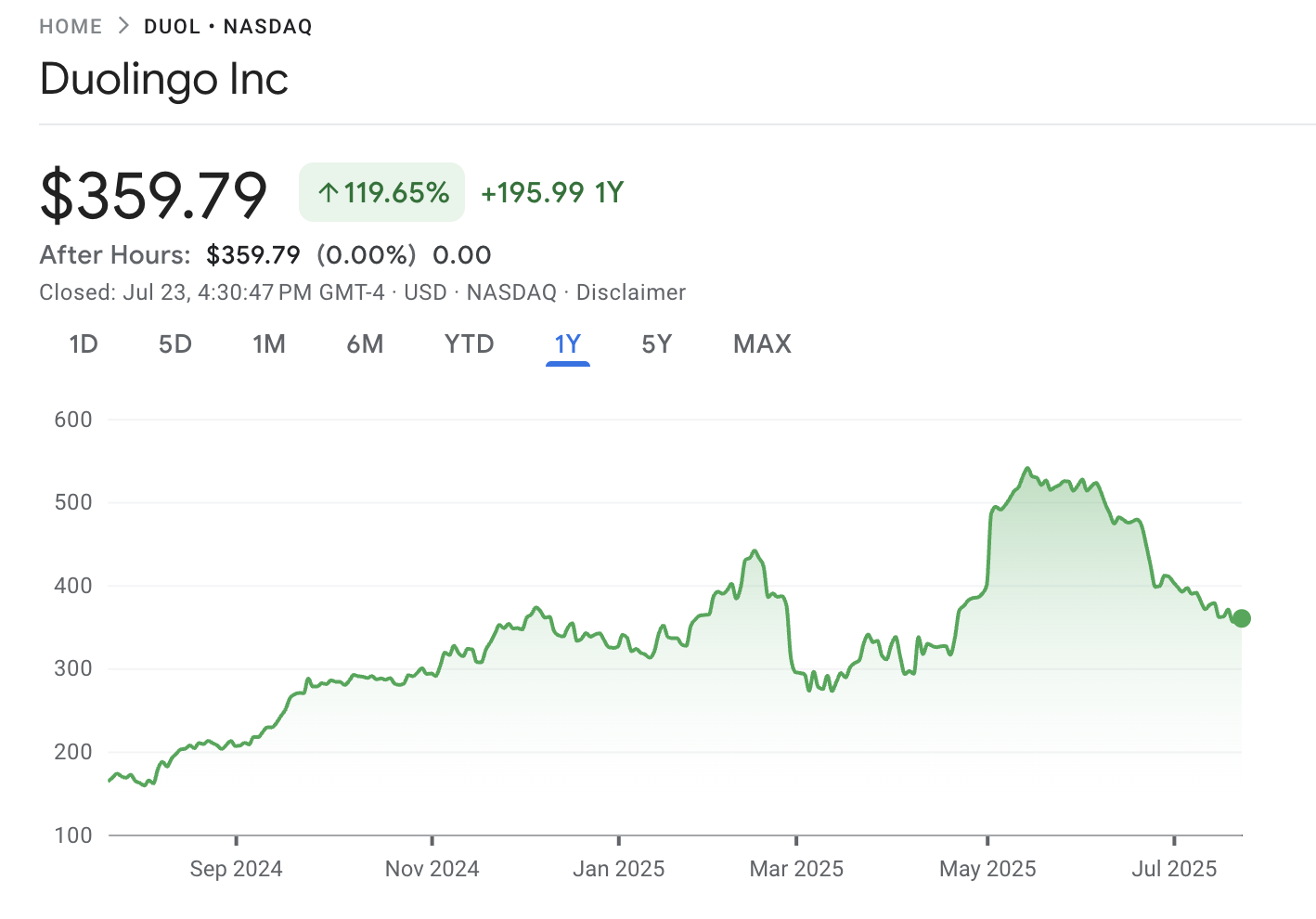

Duolingo Inc. stock 12-month performance. Source: Google Finance

One of the software application’s latest features is Duolingo Max. The premium-tier package offers AI-powered tutoring, providing users with tailored learning materials and roleplay scenarios for real-time improvements. Although some analysts raise concerns about Duolingo’s reliance on third-party AI software (it uses the GPT-4 model), stock prices continue to outperform the wider market.

In the past 12 months, DUOL shares have delivered 119% returns, valuing the firm at just over $16 billion. DUOL trades approximately 33% below its 52-week high, so the recent pullback offers a sizable discount.

| Growth Stock | Duolingo Inc. |

| Ticker | DUOL |

| Core Business | Language-learning app |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $16 billion |

| 12-Month Performance | 119% |

| 52-Week Low / High | $145.05 / $544.93 |

How to Buy Growth Stocks

Investors buy popular growth stocks from online brokerages. This section explains how to build a growth stock portfolio with a regulated platform.

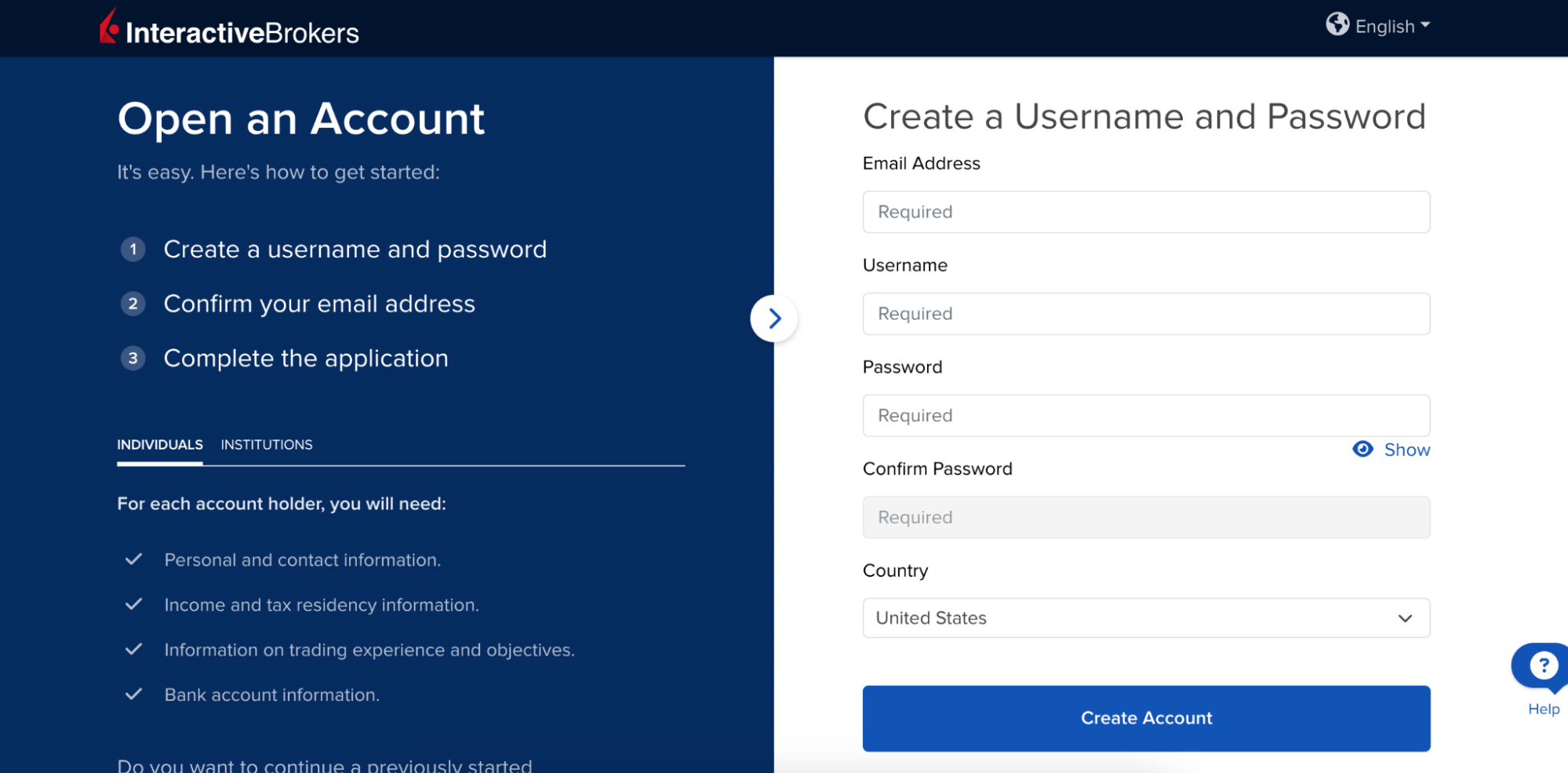

Step 1: Choose a Stock Brokerage Platform

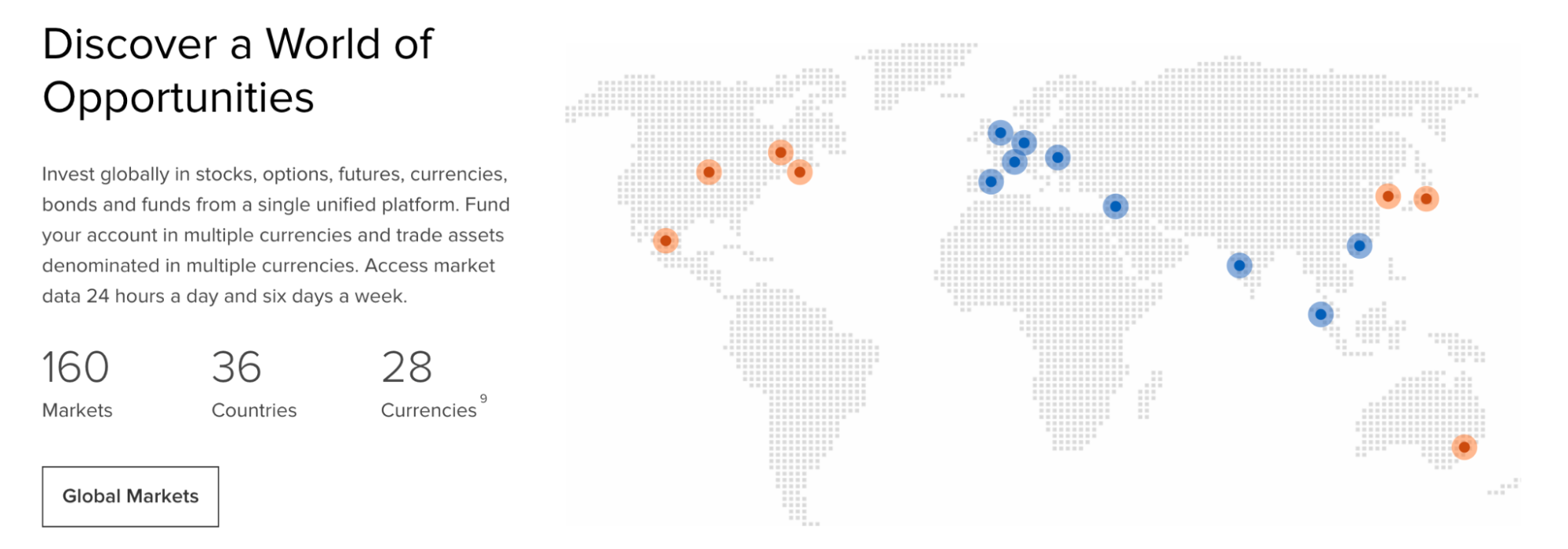

There are dozens of brokerage sites to choose from. We prefer regulated providers with investor protection schemes and an established reputation for client satisfaction. Research shows that Interactive Brokers is the best option in 2025.

Interactive Brokers is authorized and licensed in many countries, including the U.S., the UK, Australia, Hong Kong, and the wider European Union.

Interactive Brokers is the best place to buy growth stocks. Source: Interactive Brokers

The brokerage supports thousands of equities from over 30 countries, making it a great choice for diversification. This is an important distinction, as growth companies present higher volatility risks compared to blue-chip stocks, so having a well-balanced portfolio is a must.

Interactive Brokers earns praise for its low-fee structure, with account holders able to trade most major stocks at 0% commission.

Step 2: Open a Brokerage Account and Upload ID

Registering an account with Interactive Brokers takes about 10 minutes.

Visit the Interactive Brokers website and click “Open Account” and “Start Application”. Then enter your email address, username, and country of residence. Choose a strong password and select “Create Account.

Interactive Brokers offers stock trading accounts in most countries. Source: Interactive Brokers

The next steps require personal and financial information, including your full name, tax residency, home address, and social security number. As a regulated brokerage, the platform also requires your previous trading experience, financial objectives, and risk profile.

The final step is to complete KYC verification. Upload a passport, driver’s license, or state ID card, plus a recently issued proof of address. This document can be a utility bill, bank/credit card statement, or tax bill.

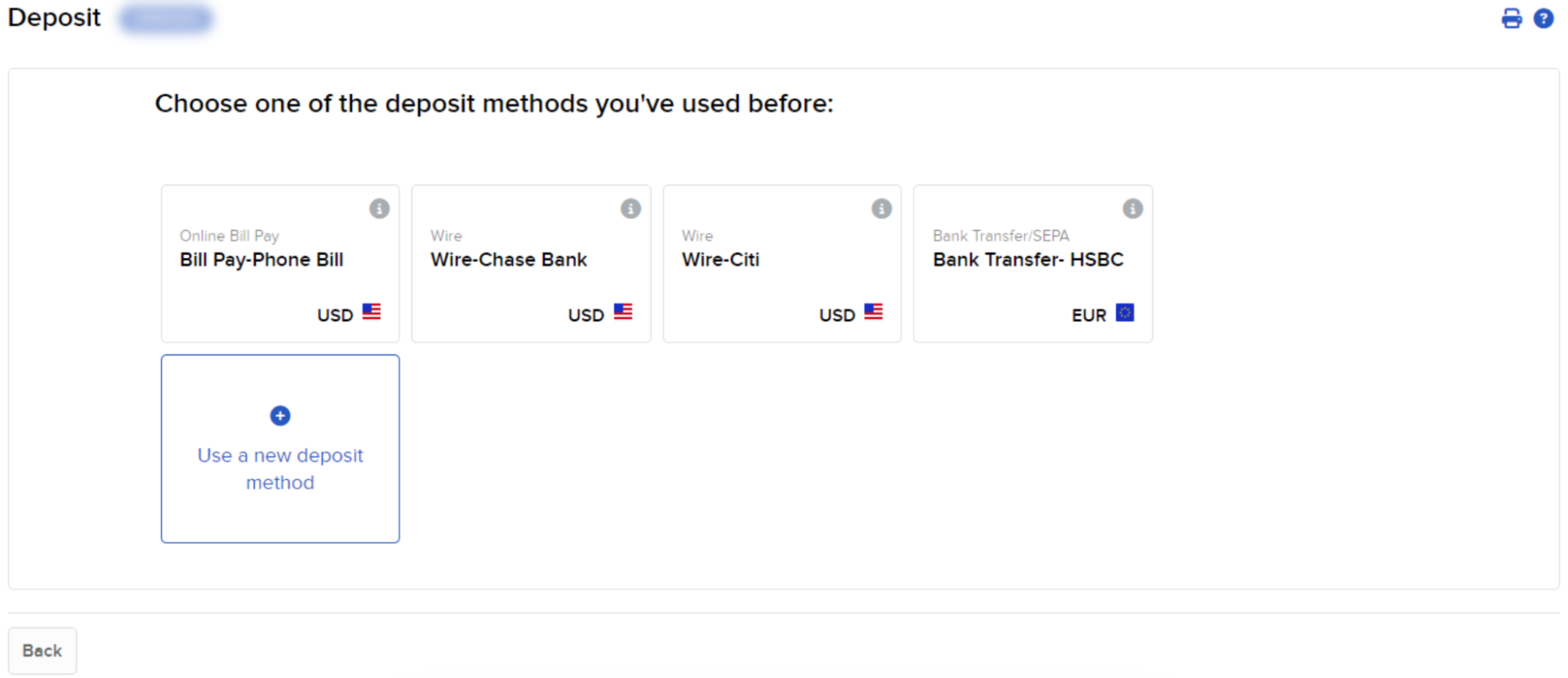

Step 3: Deposit Funds

Interactive Brokers may need several days to verify KYC documents, yet you can deposit funds into the account. It supports banking methods through ACH, domestic wire, Faster Payments, Wise, and SWIFT.

Interactive Brokers supports bank account payments without deposit fees. Source: Interactive Brokers

Transfer funds to the provided bank account details, ensuring you use the given reference.

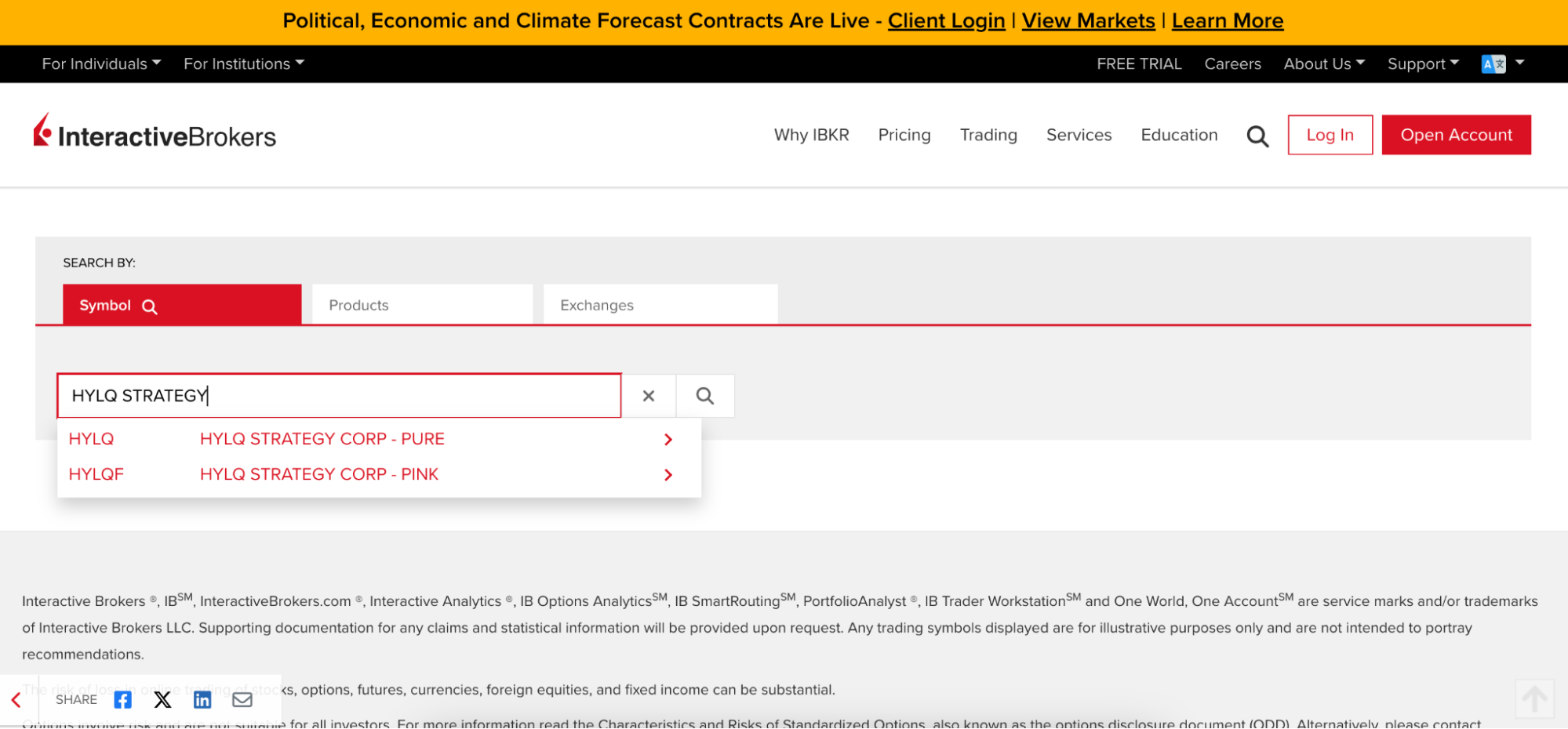

Step 4: Search for the Growth Stock

Once the funds arrive, use the search box to find a suitable equity. Interactive Brokers supports the best growth stocks to buy, including the 10 expert-led picks listed on this page.

Interactive Brokers supports low-cap growth stocks like HYLQ Strategy Corp. Source: Interactive Brokers

In the above example, the user is searching for HYLQ Strategy Corp. You will notice that two exchanges appear, as HYLQ shares trade on the CSE (PURE) and Pink Sheets (PINK) (and soon the NASDAQ).

If you’re buying HYLQ, select PURE, since the CSE is a regulated stock exchange (PINK is for OTC trading).

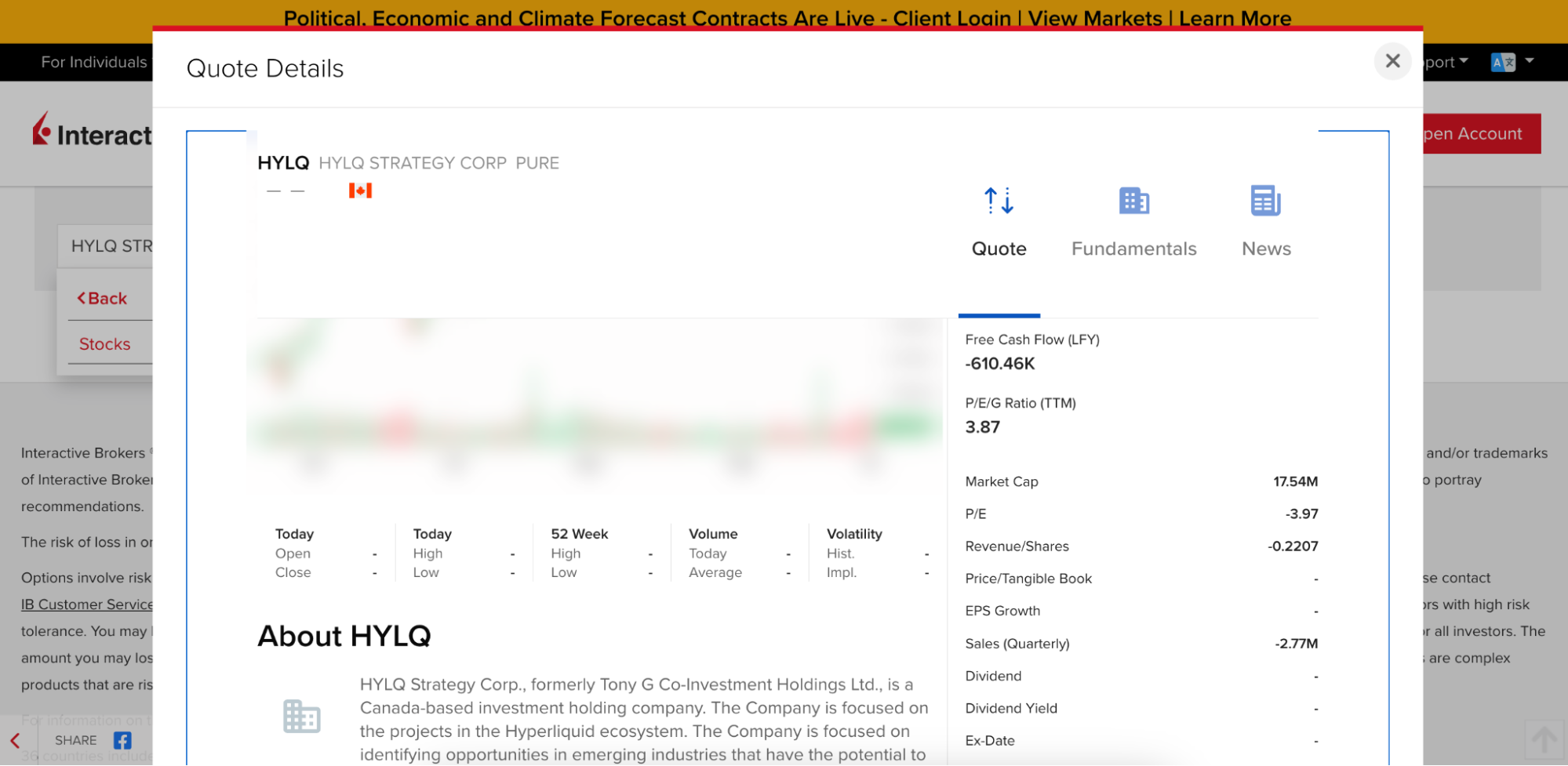

Step 5: Choose the Right Stock Trading Order

Interactive Brokers supports limit and market orders. Ordinarily, market orders are the best option when buying large-cap growth stocks like Meta Platforms Inc. and NVIDIA Corp.

However, as one of the top penny growth stocks, HYLQ Strategy Corp. has a small market capitalization and low daily trading volumes. As such, limit orders are a better fit for this stock, as you can choose the entry price. The platform will not execute your investment until the target price matches.

If you prefer market orders for their instant execution, be aware that wide slippage is possible. This outcome means you may get a less favorable cost basis compared to the market price.

Step 6: Buy Growth Stocks

Complete the stock purchase by entering the trade size.

Interactive Brokers offers two options when placing orders:

- Total number of shares

- Total purchase amount in the stock exchange’s currency

When buying cheap growth stocks like HYLQ Strategy Corp., most traders purchase full shares. Each share is priced at just CAD 1.58, an affordable amount even for those on a budget.

Interactive Brokers offers extensive market data when trading stocks. Source: Interactive Brokers

In contrast, larger growth companies like Coinbase Global Inc. trade at nearly $400 per share. Interactive Brokers allows fractional share investments from $1, so enter the total purchase amount when buying expensive stocks.

Finally, confirm the limit or market order to complete the investment.

What Is a Growth Stock?

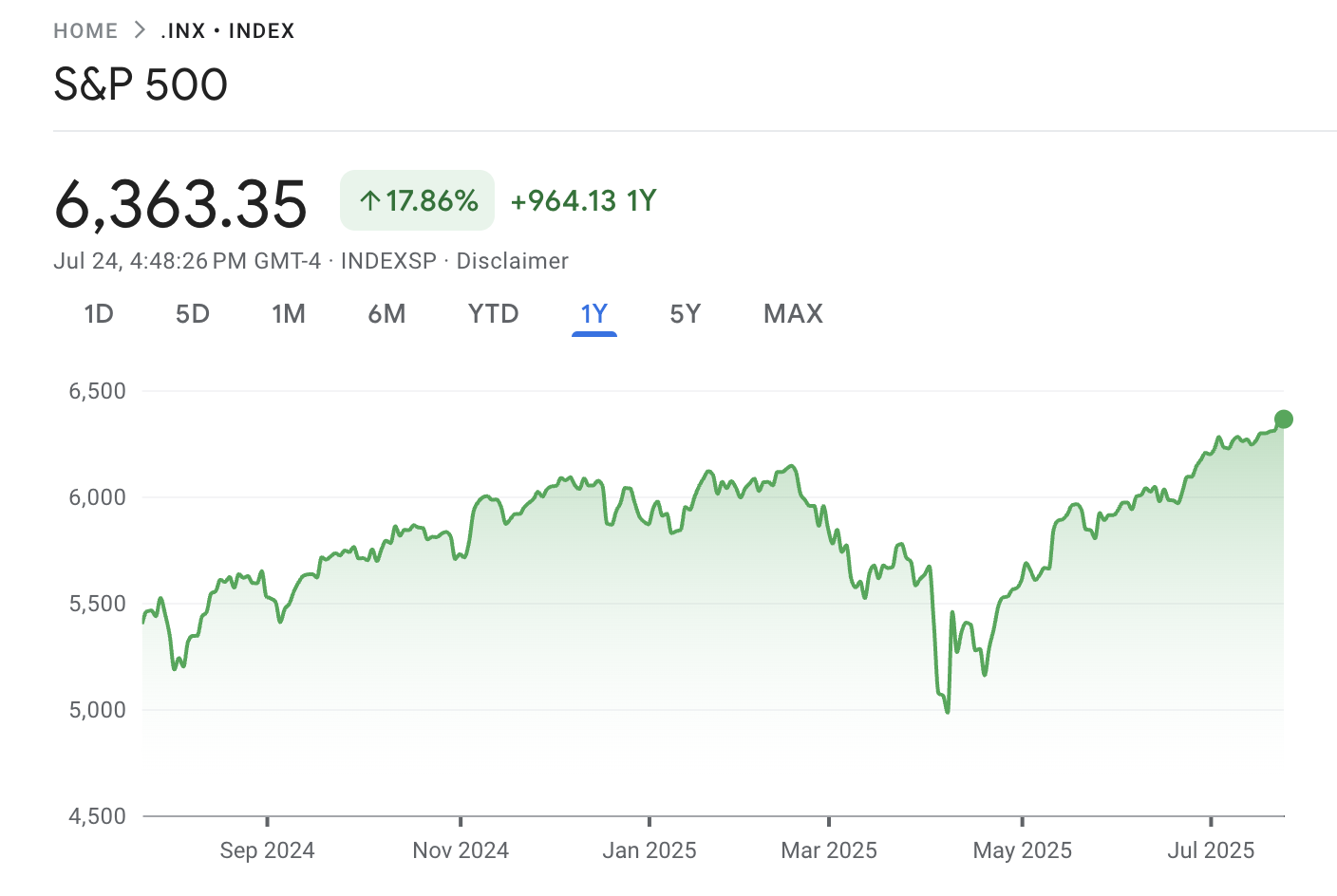

Growth stocks are publicly traded companies that meet certain characteristics. At their core, investors expect these stock types to grow at a faster rate than the market average. Most analysts use the S&P 500 index to gauge the broader benchmark, which historically averages about 10% growth annually.

Companies in the growth category rarely pay dividends, since they reinvest most profits back into their growth. Firms often allocate funds to research and development, company acquisitions, or global expansion. This strategy lets companies retain their free cash flow and accelerate long-term growth, rather than distribute resources to shareholders.

Many growth equities operate in emerging and disruptive industries, too. Examples include blockchain technology, green energy, AI, and cybersecurity.

An important takeaway is that while growth stocks can produce above-average gains, there are no valuation restrictions like other investing categories. For example, HYLQ Strategy Corp. and NVIDIA Corp. are both top growth stocks to buy, yet they have vastly different market capitalizations. HYLQ shares trade at about $15.2 million, while NVDA recently surpassed $4 trillion.

How to Pick the Best Growth Stocks to Invest In?

The growth stock market is highly extensive, with hundreds of potential companies from every sector and industry imaginable. Here are some proven methods that seasoned analysts use to pick top-performing growth stocks.

Explore High-Growth Industries

Growth stocks provide access to emerging industries before they achieve mass adoption. Investing in these industries offers a first-mover advantage and often a more appealing cost valuation.

One example is cryptocurrencies and blockchain. HYLQ Strategy Corp. and Sol Strategies Inc. are top growth companies in this industry. These firms have strong price momentum and a small market capitalization, although they’re also more volatile than large-caps like Coinbase Global Inc.

Sol Strategies Inc. operates in the high-growth blockchain industry. Source: Sol Strategies Inc.

Another hot industry to watch is cybersecurity. Crowdstrike Holdings Inc. specializes in threat intelligence and response services, allowing it to tap into the lucrative corporate and governance security spaces.

Look for Consistent Revenue Growth

Revenue is a key driver when identifying the best growth stocks to watch. Check financial statements to compare quarterly revenues against previous accounting periods.

High-growth companies consistently outperform prior quarters, signaling in-demand products or services.

Evaluate Financial Stability

The best cheap stocks are often in the startup stage, so they may lack robust balance sheets. Assess the firm’s free cash flow and debt to ensure its financial stability.

Healthy companies have sufficient cash and short-term investments to meet operating expenses and fuel growth and expansion. These factors also support research and development into new product markets.

Stock Price Momentum

Investors target above-average gains when buying growth stocks. Look for companies that consistently outperform the S&P 500 benchmark, which has historically produced average annualized returns of about 10%.

Compare stock price performance with companies in the same industry for added validity. Outperforming both the stock market and industry average is a strong signal.

Monitor Insider Transactions

This strategy is best used when investing in growth stocks with small market capitalizations. Insider transactions are stock purchases or sales made by company directors, and they’re reported to stock exchange regulators to ensure transparency.

Using personal funds to buy shares shows strong confidence from key company leaders, but insider sales indicate the opposite sentiment.

Why Invest in Growth Stocks?

Read on to learn the benefits of adding growth stocks to your investment portfolio.

Higher Return Potential

Most people buy growth stocks because they seek higher returns than the market average. The S&P 500 index has increased by 17% in the past year, reflecting strong performance and positive market sentiment.

Growth investors aim to outperform the S&P 500 index. Source: Google Finance

However, these stock gains pale in comparison to many growth companies. Sezzle Inc. and Sol Strategies Inc., for instance, have returned 875% and 733% over the same period.

What Is the Best Growth Stock ETF?

Picking individual stocks is challenging, which is why some people prefer ETFs. Many ETFs track baskets of growth stocks from different industries, allowing investors to diversify across dozens or hundreds of companies in one investment.

One option is the Vanguard Growth ETF (VUG). It holds 165 growth companies, mostly with large market capitalizations, including NVIDIA Corp, Meta Platforms Inc., and Tesla Inc.

ARK Innovation ETF (ARKK) is a better fit to invest in disruptive innovations like neural networks, smart contracts, next-generation cloud storage, and autonomous mobility. Key holdings include Coinbase Global Inc., Circle Internet Group Inc., Shopify Inc., and Roku Inc.

Exposure to Disruptive Products and Services

Growth stock investments offer exposure to disruptive industries with significant growth potential. Meta Platforms Inc. and NVIDIA Corp. offer access to the AI boom, while Toast Inc. stands out in the consumer-facing software market.

Ark Invest offers a growth stock ETF that tracks companies behind disruptive technologies. Source: Google Finance

Other emerging narratives to research include space exploration, green and renewable energy technology, distributed ledgers, and natural sciences.

Expansion Focused

Growth stocks create shareholder value through long-term price appreciation. Rather than transfer company profits to investors, they reallocate resources to expansion. This often means investing in new markets and researching and developing new products.

Management often allocates funds for company acquisitions, too, giving shareholders access to a diversified portfolio of revenue sources. Meta Platforms Inc., for example, operates in several high-growth markets, including social media, AI, and virtual reality.

How to Stay Updated About Growth Plans?

Successful investors ensure they’re kept abreast of key developments that impact their stock investments.

The best practice is to review quarterly earnings calls. Every three months, management (usually the CEO) outlines recent performance, financial statements like the balance sheet and income statement, and future plans.

Investors gain insights about expansion strategies, new geographic launches, and how the company intends to use its resources.

Pros & Cons of Buying Growth Stocks

Consider these benefits and drawbacks of investing in growth companies:

Pros

- The best growth stocks outperform the broader market benchmark

- Gain exposure to disruptive industries like the best altcoins and cybersecurity

- Invest in companies that reinvest their profits to accelerate long-term growth

- Significant market choice supports portfolio diversification

Cons

- Growth stocks are typically more volatile than blue-chip staples

- Firms are more reliant on strong macroeconomic conditions

- Rarely do growth companies have dividend policies

- Their speculative nature means growth stocks often trade at high valuations

Conclusion

In our view, HYLQ Strategy Corp. and Sol Strategies Inc. are the best growth stocks to buy now for low-cap exposure to blockchain and digital assets.

Those with a lower risk appetite may prefer NVIDIA Corp., Sezzle Inc., and Shopify Inc., which operate in AI chipmaking, consumer finance, and e-commerce software, respectively.

Diversification remains key, since growth companies carry a higher risk-reward spectrum than most blue-chip stocks. Explore emerging markets and disruptive technologies when researching potential picks, and remember to only risk amounts you are comfortable losing.

FAQs

What are the best high-growth stocks?

What is the 7% rule in stocks?

When is the best time to buy growth stocks?

Why don’t growth stocks pay dividends?

What makes a growth stock?

What are growth penny stocks?

References

- CSE25 Index (Canadian Securities Exchange)

- Nvidia’s stock market value hits $4 trillion on AI dominance (Reuters)

- Coinbase One just hit 600,000 members. Here’s what’s next. (Coinbase)

- Shopify Merchant Success Powers Q4 Outperformance Across Both Top and Bottom-Line (Shopify)

- Mark Zuckerberg says Meta AI has 1 billion monthly active users (CNBC)

- Meta’s Zuckerberg pledges hundreds of billions for AI data centers in superintelligence push (Reuters)

- Duolingo Adds Record Number of DAUs, Surpasses 10 Million Paid Subscribers, and Reports 38% Year-over-Year Revenue Growth in First Quarter 2025 (Duolingo)

- Stock futures inch higher after S&P 500, Nasdaq score another record close: Live updates (CNBC)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Discover the top exchanges for 1,000x leverage. Learn where to trade crypto derivatives with a 0.1% margin requirement, and what f...

Discover the best growth stocks to invest in, according to analyst insights and market trends. Discover the best growth stocks to ...

26 mins

26 mins

Otar Topuria

Crypto Editor, 15 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.