Identifying the best crypto to mine in 2026 depends on your hardware, electricity costs, and risk tolerance.

Best Yield Farming Crypto 2026 – Top DeFi Coins for Passive Income

31 mins

31 mins After weeks of testing yield farming protocols across DeFi, we found that Curve, Pendle, and Aave deliver the best combination of sustainable APYs, battle-tested security, and actual liquidity depth.

We’ve used our rigorous methodology to analyze everything from tokenomics and emission schedules, to TVL trends and exploit history behind each protocol.

In this piece, we’ll break down everything you need to know about yield farming crypto, the top platforms available, how they stack up against each other, and how you can start farming safely in just a few steps.

Best Yield Farming Crypto – Key Takeaways

- Curve dominates stablecoin farming with $2.73B TVL and 5-20% APY through vote-locked CRV that boosts yields up to 2.5x while it processes billions in daily volume

- Pendle’s yield tokenization hit $8.27B TVL at its peak and lets farmers lock in fixed rates or trade future APYs with 14.5% on Ethena sUSDe pools

- Aave leads DeFi lending with $40B TVL and generates $178M quarterly in fees while it pays 4-7% on stablecoins through genuine lending demand

- EigenLayer transformed $17.51B of idle staked ETH into restaking yields, with liquid restaking protocols like Ether.fi built as billion-dollar businesses on top

- Maverick’s dynamic liquidity follows price movements automatically and eliminates the constant position management that kills profits on Uniswap V3

Alternative Project Spotlight – Bitcoin Hyper

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

Project spotlights are independent from our ranking methodology and may include sponsored partners.

What Is Yield Farming Crypto?

Yield farming is how you put your crypto to work, earning rewards in DeFi protocols. Instead of just holding tokens in your wallet, you provide them as liquidity to decentralized exchanges or lending platforms, and in return, you earn a share of trading fees, interest, or bonus tokens.

DEXs need liquidity to function. When someone wants to swap ETH for USDC, there needs to be a pool of both tokens available. That’s where yield farmers come in. They deposit equal values of both tokens into these pools, and the DEX rewards them with a cut of every trade that happens in that pool.

The “farming” part comes from how you cultivate these returns. Just like actual farming, you plant your assets (provide liquidity), tend to them (monitor and adjust positions), and harvest your rewards (claim your earnings).

The entire DeFi ecosystem depends on yield farmers for liquidity. Without farmers providing their tokens to these pools, decentralized trading wouldn’t be possible at the scale we see today.

Top 10 Best Yield Farming Crypto List in 2026

Before we go any further, here’s a quick overview of best yield farming crypto in 2026:

- Curve (CRV) – Specialized AMM with Deep Stablecoin Liquidity & Vote-Boosted Yields

- Pendle (PENDLE) – Yield Tokenization Protocol with Fixed Income Trading & Cross-Chain Expansion

- EigenLayer – Ethereum Restaking Protocol with Shared Security & AVS Marketplace

- Aave (AAVE) – DeFi Lending Protocol with Flash Loans & Multi-Chain Markets

- Uniswap (UNI) – Decentralized Exchange with Automated Liquidity Pools & Multi-Chain Trading

- Frax Finance (FRAX) – Stablecoin Protocol with Liquid Staking & Layer 2 Blockchain

- GMX (GMX) – Decentralized Perpetual Exchange with 100x Leverage & Revenue Sharing

- Lido (LDO) – Liquid Staking Protocol with stETH Tokens & DeFi Integration

- Balancer (BAL) – Customizable AMM with Multi-Token Pools & Portfolio Management

- Maverick Protocol (MAV) – Dynamic AMM That Moves Liquidity Automatically

Yield Farming Crypto Projects to Watch – Reviews and Key Metrics

With the basics out of the way, we can move on to our detailed reviews of the best yield farming cryptos in 2026:

1. Curve (CRV) – Specialized AMM with Deep Stablecoin Liquidity & Vote-Boosted Yields

Curve Finance runs the most efficient stablecoin exchange in DeFi, processing billions in swaps with minimal slippage through its specialized AMM design.

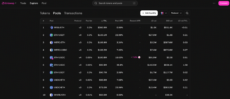

Curve Finance has $2.39B in TVL and generates $38.99M in annual fees from stablecoin swaps. Source: DeFiLlama

The protocol uses a unique bonding curve algorithm that keeps trading costs low when swapping between similarly priced assets like USDC, USDT, and DAI.

With total value locked at $2.732 billion, Curve is the go-to platform for both retail traders that are looking for stable yields and institutions that need deep liquidity for large trades.

The protocol just launched a new Yield Basis proposal that transforms CRV into an income-generating asset, while its new Telegram integration through TAC brings DeFi trading directly into chat windows.

| Attribute | Details |

| What Makes It Stand Out | Vote-locked CRV tokens boost yields up to 2.5x, while the protocol handles billions in volume with industry-low slippage |

| Suitable For | Conservative yield farmers who want stable returns, advanced users who maximize veCRV strategies, whales that need deep liquidity |

| Investment Narrative | DeFi TVL surged to $163.2 billion in 2025, up 40.9% from January, with Curve at the center of stablecoin growth |

| Risks to Consider | Smart contract vulnerabilities, founder liquidation events that crash CRV price, competition from newer AMMs |

| Category | DEX/AMM with Lending and Stablecoin Issuance |

| Chain | Ethereum, Arbitrum, Optimism, Base, Polygon, plus 15 other networks |

| Market Cap | $1.1B (ranked #79 on CoinMarketCap) |

| Status | Listed on Binance, Coinbase, and recently added to Robinhood |

| TVL | $2.73B across all deployments |

| Community Size | 15,000+ Telegram members, 180K Twitter followers |

| Where to Farm | Native Curve pools, Convex for boosted rewards, Yearn vaults for auto-compounding |

2. Pendle (PENDLE) – Yield Tokenization Protocol with Fixed Income Trading & Cross-Chain Expansion

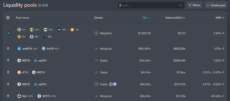

Pendle Finance splits yield-bearing assets into tradable Principal Tokens (PT) and Yield Tokens (YT), which creates a fixed-income market for DeFi participants.

The protocol’s specialized AMM handles time-decaying assets through concentrated liquidity curves that shift as tokens approach maturity.

Pendle V2 gives traders an option to lock in fixed yields or trade future APYs through yield tokenization. Source: Pendle

Pendle’s TVL reached $8.27 billion in August 2025, while the token gained 45% in one week after the Boros platform launch. The protocol holds over 50% of DeFi yield sector TVL, five times more than the next largest competitor.

Pendle operates across EVM chains and plans expansion to Solana and TON through Citadel deployments, while institutional capital enters through integrations with Aave, Ethena, and liquid staking protocols.

| Attribute | Details |

| What Makes It Stand Out | Yield tokenization lets users lock fixed rates or trade future APYs, while the v2 AMM provides efficient pricing for time-sensitive assets |

| Suitable For | Institutions that need predictable returns, DeFi traders who arbitrage rate volatility, stakers who want to hedge reward fluctuations |

| Investment Narrative | Institutional traders now hedge $8 billion worth of yield exposure through Pendle’s markets, while retail traders split their staking rewards to lock in profits before APYs drop further |

| Risks to Consider | Complex interface limits adoption, YT tokens can lose 100% value if yields drop, smart contract risk from protocol dependencies |

| Category | Yield Tokenization/Fixed Income Protocol |

| Chain | Ethereum, Arbitrum, BNB Chain, Base, Optimism, Avalanche, plus Solana/TON planned |

| Market Cap | $875M (ranked #137 on CoinGecko) |

| Status | Listed on Binance, MEXC, HTX, integrated with major DeFi protocols |

| TVL | $8.27B peak in August 2025, typically ranges $3-7B based on market conditions |

| Community Size | 155K Twitter followers, 26K+ Discord members, Telegram at @pendlefinance |

| Where to Farm | Pendle pools for PT/YT trades, Ethena sUSDe at 14.5% APY, liquid staking tokens for leveraged ETH yields |

3. EigenLayer – Ethereum Restaking Protocol with Shared Security & AVS Marketplace

EigenLayer is a project built so that the Ethereum stakers can reuse their locked ETH to secure additional protocols and earn extra rewards through a restaking mechanism.

The protocol created a marketplace where developers can tap into Ethereum’s $30 billion security pool without bootstrapping their own validator networks.

EigenLayer allows Ethereum stakers to earn extra rewards by restaking their ETH or liquid staking tokens across multiple protocols. Source: EigenLayer

With $17.51 billion in TVL and over $128 million in rewards already paid to operators, EigenLayer transformed idle staked ETH into productive capital across multiple services.

The platform supports both native restaking for node operators with 32 ETH and liquid restaking through tokens like stETH and rETH for smaller traders.

| Attribute | Details |

| What Makes It Stand Out | Pooled security model lets one ETH stake secure multiple protocols, while AVS marketplace connects security providers with consumers |

| Suitable For | ETH validators who want extra yield on locked stakes, protocol developers who need security without validator bootstrapping |

| Investment Narrative | Liquid restaking protocols like Ether.fi built billion-dollar businesses on top of EigenLayer, which shows how much demand there is for leveraged staking yields |

| Risks to Consider | Slashing risk multiplies across secured protocols, TVL dropped from peaks as users unstaked before slashing activation, complex technical requirements for operators |

| Category | Restaking/Shared Security Protocol |

| Chain | Ethereum mainnet with smart contract layer |

| Market Cap | $645M (ranked #114 on CoinMarketCap) |

| Status | EIGEN token tradable since October 2024, listed on major exchanges |

| TVL | $17.51B staked across the protocol |

| Community Size | Growing Twitter presence @eigenlayer, private Discord for testnet participants, Telegram groups run by community |

| Where to Farm | Native restaking for 32 ETH validators, liquid restaking through Ether.fi/Renzo/Kelp, AVS operator rewards for running infrastructure |

4. Aave (AAVE) – DeFi Lending Protocol with Flash Loans & Multi-Chain Markets

Aave is a lending protocol where users deposit crypto to earn interest or borrow against their deposits, with $40 billion in TVL. The platform offers variable rates around 4-7% APY for stablecoins and 2-3% for ETH, though rates fluctuate based on utilization.

Aave’s Core Instance offers variable lending rates across multiple crypto assets including ETH, USDT, and wrapped tokens. Source: Aave

Users can borrow up to 80% of their collateral value for most assets, or 97% for correlated pairs like stETH/ETH through eMode. Flash loans let traders borrow millions without collateral if they repay in the same transaction, mostly for arbitrage trades.

The protocol generated $178 million in fees last quarter, with revenue from interest spreads and liquidation penalties. Aave runs on Ethereum, Polygon, Arbitrum, Base, Optimism, and Avalanche, each with different yields and liquidity.

| Attribute | Details |

| What Makes It Stand Out | Flash loans let you borrow millions with zero collateral, variable rates adjust to market conditions, aTokens earn yield but stay tradeable |

| Suitable For | People who want 4-7% on stablecoins, traders who need leverage on ETH positions, and arbitrage bots that execute flash loan strategies |

| Investment Narrative | The protocol holds 51% of DeFi lending at $40 billion TVL and makes $3 million daily in fees, more than competitors combined |

| Risks to Consider | $40B sits in smart contracts that could have bugs, market crashes trigger liquidation cascades, and large holders control governance votes |

| Category | Lending/Borrowing Protocol |

| Chain | Ethereum, Polygon, Arbitrum, Optimism, Base, Avalanche |

| Market Cap | $4.7B (ranked #30 on CoinMarketCap) |

| Status | Trades on Binance, Coinbase, OKEx, and most major exchanges |

| TVL | $40B across all deployments |

| Community Size | 28K+ Discord members, 664K Twitter followers |

| Where to Farm | USDC pays 4-7% APY, ETH pays 2-3% APY, eMode allows up to 97% LTV on similar assets |

5. Uniswap (UNI) – Decentralized Exchange with Automated Liquidity Pools & Multi-Chain Trading

Uniswap is the largest decentralized exchange where users swap tokens directly from their wallets without intermediaries.. The protocol uses automated market makers (AMMs) that price assets through liquidity pools.

Uniswap farmers earn fees from billions in TVL across ETH, WBTC, and stablecoin liquidity pools. Source: Uniswap

Uniswap’s current market cap is $5.28B at a price of $9.25 per UNI token, while the protocol processes billions in daily volume across Ethereum, Base, Arbitrum, Polygon, and 20+ other chains.

V3 introduced concentrated liquidity where LPs can target specific price ranges for higher capital efficiency and better fees.

The protocol generates fees from swaps but makes no revenue for UNI holders. Uniswap recently launched V4 with hooks for custom trading strategies and plans its own Layer 2 chain called Unichain for faster, cheaper swaps.

| Attribute | Details |

| What Makes It Stand Out | Concentrated liquidity lets LPs earn higher fees in targeted price ranges, flash swaps allow zero-collateral arbitrage trades |

| Suitable For | Active liquidity providers who manage price ranges, arbitrage traders who use flash swaps, and users who want direct wallet-to-wallet token swaps |

| Investment Narrative | Uniswap held about 35.9% market share in August 2025 as the dominant DEX, with V3 and V2 combining for over $5 billion TVL across all chains |

| Risks to Consider | Impermanent loss for LPs when token prices diverge, smart contract bugs with billions at risk, scam tokens that mimic legitimate projects |

| Category | Decentralized Exchange/AMM |

| Chain | Ethereum, Base, Arbitrum, Polygon, Optimism, plus 20+ networks |

| Market Cap | $6.07B (ranked #39 on CoinGecko) |

| Status | Listed on Binance, Coinbase, OKX, and all major exchanges |

| TVL | $5.15B combined across V3 and V2 |

| Community Size | 93,970 Discord members, active Twitter @uniswap |

| Where to Farm | Provide liquidity to ETH/USDC pools for 5-20% APY, concentrated positions in V3 for higher fees, stable pairs for lower risk |

6. Frax Finance (FRAX) – Stablecoin Protocol with Liquid Staking & Layer 2 Blockchain

Frax Finance is a multi-stablecoin ecosystem where users can mint FRAX stablecoins, stake for yields, and access liquid staking derivatives.

Frax Finance offers multi-stablecoin yield farming with FRAX, FPI, and frxETH tokens tracking Federal Reserve rates. Source: Frax Finance

The protocol has three stablecoins: FRAX (USD-pegged), FPI (inflation-indexed), and frxETH (ETH-pegged liquid staking token), each with different stability mechanisms and use cases.

The sFRAX staking vault targets 5-10% APY that tracks the Federal Reserve’s interest rate, while the protocol deploys capital through Algorithmic Market Operations (AMOs) across Curve, Uniswap, and lending markets.

| Attribute | Details |

| What Makes It Stand Out | The staking vault pays yields that track Federal Reserve interest rates, currently around 5-10% on stablecoins |

| Suitable For | Stablecoin farmers who want Treasury-backed yields, ETH stakers who need liquid derivatives, builders who want Layer 2 deployment |

| Investment Narrative | Frax only has a tiny slice of the stablecoin pie compared to giants like Tether and USDC, but that means plenty of room to grow |

| Risks to Consider | The algorithmic stablecoin model failed for Terra Luna and other projects, which can make some users nervous about stability |

| Category | Stablecoin Protocol/Liquid Staking/Layer 2 |

| Chain | Ethereum, Fraxtal L2, plus deployments on Polygon, Arbitrum, BSC |

| Market Cap | $249.6M (ranked #190 on CoinMarketCap) |

| Status | Listed on major exchanges, FXS rebranded to FRAX in 2025 |

| TVL | Protocol TVL varies, Fraxtal L2 at $13.2M currently |

| Community Size | 3,640 Discord members, active Telegram group, Twitter @fraxfinance |

| Where to Farm | sFRAX staking vault for 5-10% APY, Curve FRAX pools, frxETH/sfrxETH for ETH staking yields |

7. GMX (GMX) – Decentralized Perpetual Exchange with 100x Leverage & Revenue Sharing

GMX is a decentralized perpetual exchange where traders use up to 100x leverage directly from their wallets on Arbitrum, Avalanche, and Solana.

The protocol operates through multi-asset liquidity pools that earn providers 70% of all platform fees from swaps, leverage trades, and liquidations.

GMX enables decentralized perpetual trading with up to 100x leverage while liquidity providers earn 70% of platform fees. Source: GMX

Traders can benefit from Chainlink oracle pricing that prevents manipulation and allows for market, limit, and stop-loss orders on major crypto pairs.

GMX stakers receive 30% of all collected fees paid in ETH or AVAX, plus escrowed GMX tokens and multiplier points that boost rewards over time.

The exchange expanded to Solana in March 2025 and now offers 70+ tradable assets across its V2 platform.

| Attribute | Details |

| What Makes It Stand Out | Zero price impact trades let whales open massive positions without moving the market |

| Suitable For | Leverage traders who want up to 100x on perpetuals or liquidity providers who earn 70% of all platform fees |

| Investment Narrative | GMX accounts for $1.1 billion in weekly derivatives volume as one of the top perpetual DEXs with room to capture more market share |

| Risks to Consider | Limited asset selection compared to centralized exchanges plus complex interface that confuses new users |

| Category | Decentralized Perpetual Exchange/DEX |

| Chain | Arbitrum, Avalanche, Solana |

| Market Cap | $144M (ranked #397 on CoinGecko) |

| Status | Listed on Binance, MEXC, OrangeX |

| TVL | $283M across all deployments |

| Community Size | Active Discord community, Telegram groups for multiple languages |

| Where to Farm | Stake GMX for 10-30% APY in ETH/AVAX rewards, provide liquidity via GLP tokens, or trade with leverage for profit |

8. Lido (LDO) – Liquid Staking Protocol with stETH Tokens & DeFi Integration

Lido is the largest liquid staking protocol, where users stake any amount of ETH and receive stETH tokens that earn daily rewards.

The project removes the 32 ETH requirement for solo staking and lets users keep their funds liquid through stETH, which trades 1:1 with ETH but compounds rewards automatically.

Lido removes the 32 ETH staking requirement by offering liquid stETH tokens that earn rewards while remaining tradeable. Source: Lido

You earn about 3% APY after Lido takes its 10% cut to pay validators and fund operations. Since stETH works on pretty much every DeFi protocol out there, it’s become the default liquid staking token that everyone accepts.

They recently launched a new Community Staking Module feature where solo stakers can run validators with only 1.3 ETH instead of 32, which opens up validation to way more people.

| Attribute | Details |

| What Makes It Stand Out | stETH stays liquid and tradeable while it earns staking rewards that compound daily |

| Suitable For | ETH holders who want staking yields without the 32 ETH minimum or DeFi users who need liquid collateral |

| Investment Narrative | stETH works as collateral across hundreds of DeFi protocols, which creates network effects that lock in Lido’s dominance |

| Risks to Consider | Smart contract bugs with billions at stake plus stETH can trade below ETH price during market stress |

| Category | Liquid Staking Protocol |

| Chain | Ethereum (discontinued Solana and Polygon support) |

| Market Cap | $1.13B (ranked #77 on CoinMarketCap) |

| Status | Listed on all major exchanges |

| TVL | $32.5B in staked assets |

| Community Size | 229K Twitter followers, 31K Discord members, 11K Telegram members |

| Where to Farm | Stake ETH for 3% APY in stETH, use stETH in Curve pools or Aave for extra yield, or wrap to wstETH for Layer 2 |

9. Balancer (BAL) – Customizable AMM with Multi-Token Pools & Portfolio Management

Balancer is an automated market maker where users create pools with up to 8 different tokens in custom ratios.

It functions as both a DEX and an automated portfolio manager where pools automatically rebalance as prices change, so an 80/20 ETH/DAI pool maintains that ratio through trades.

Balancer allows custom pool weights up to 8 tokens with 80/20 ratios that reduce impermanent loss for farmers. Source: Balancer

Unlike standard 50/50 AMMs, Balancer allows any weight combination from 2% to 98%, which reduces impermanent loss for certain strategies. The protocol vault architecture consolidates all liquidity for gas efficiency, while external developers can create custom pool types and earn fees.

Liquidity providers earn base APR from fees around 5-10%, but boosted pools can reach 30-50% through external incentives.

| Attribute | Details |

| What Makes It Stand Out | Pools can hold up to 8 tokens in any ratio that you want |

| Suitable For | Advanced DeFi users who want custom portfolio strategies or DAOs that need to manage treasury assets |

| Investment Narrative | Balancer gives a lot of flexibility in pool design that attracts institutional and advanced DeFi users who need more than basic AMM functionality |

| Risks to Consider | The complex interface can be confusing for new users, and custom pools may show unexpected behavior during volatility |

| Category | Decentralized Exchange/AMM/Portfolio Manager |

| Chain | Ethereum, Arbitrum, Polygon, Base, Avalanche |

| Market Cap | $80M (ranked #437 on CoinMarketCap) |

| Status | Listed on major exchanges |

| TVL | $837M combined across V2 and V3 |

| Community Size | Active Discord server, 150K+ followers on Twitter |

| Where to Farm | Weighted pools for portfolio management, stable pools for low IL, boosted pools for 30-50% APY with incentives |

10. Maverick Protocol (MAV) – Dynamic AMM That Moves Liquidity Automatically

Maverick Protocol takes a different approach to liquidity management – instead of you manually adjusting your positions like on Uniswap V3, Maverick moves your liquidity automatically to keep it in the active trading range.

Maverick Protocol automatically repositions liquidity to follow price movements without manual intervention for farmers. Source: Maverick X page

What makes Maverick unique is its four movement modes. You can set your liquidity to follow prices up (bullish mode), follow prices down (bearish mode), track both directions (for stable pairs), or stay static for custom strategies.

The protocol operates across Ethereum, zkSync, Arbitrum, Base, and several other chains. Projects can add extra incentives through Boosted Positions, with qualifying pools getting $2,000 in MAV rewards every two weeks.

| Attribute | Details |

| What Makes It Stand Out | Liquidity automatically repositions itself to follow price movements without manual intervention |

| Suitable For | LPs tired of managing concentrated positions or projects that need flexible liquidity strategies |

| Investment Narrative | While competitors focus on static concentrated liquidity, Maverick’s dynamic repositioning could become the standard for next-gen AMMs |

| Risks to Consider | The AMM mechanics take time to understand, plus whales control 91% of the supply |

| Category | Dynamic Distribution AMM/DEX |

| Chain | Ethereum, zkSync, Arbitrum, Base, BNB Chain, Scroll |

| Market Cap | $50M (ranked #590 on CoinGecko) |

| Status | Listed on Binance, MEXC, KuCoin |

| TVL | Varies across different chains |

| Community Size | 15K on Telegram, 226K+ on X |

| Where to Farm | Boosted Positions for extra rewards, LST pools for high fees, or custom pools for token launches |

Why Does Yield Farming Crypto Have Unique Potential in 2026?

Yield farming in 2026 looks nothing like it did even two years ago. Here’s why yield farming pays better now than it used to.

- Liquid staking has exploded. With 30% of ETH now staked, farmers can earn staking rewards plus DeFi yields on the same capital. You deposit ETH, get stETH, then farm with that stETH while still earning the base 3% staking rate.

- Restaking multiplies rewards. Protocols like EigenLayer let you secure multiple networks with the same tokens. One ETH deposit can earn rewards from Ethereum validation, EigenLayer operators, and whatever DeFi protocol you’re farming on.

- Stablecoins finally pay real yield. With tokenized treasuries and RWA backing, stablecoin farmers earn 4-5% base yields before any DeFi incentives. Your bank’s savings account pays 0.5%.

Traditional Finance vs DeFi Yields (2026)

We’ve created this quick table to see how the returns of traditional banks compare to the yields that you can expect in DeFi.

| Source | Traditional Finance | DeFi Yield Farming |

| Savings Account | 0.5% | 4-5% (stablecoins) |

| Stock Dividends | 2-3% | 10-30% (blue chips) |

| Corporate Bonds | 4-5% | 15-50% (with incentives) |

| Entry Minimum | $1,000-100,000 | $100 |

As you can see, DeFi stablecoins pay what banks used to pay in the 1990s. Add in the farming incentives, and you’re looking at returns that traditional finance simply can’t match.

Yield Farming Trends to Watch in January 2026

The way people farm yields has changed a lot this year, with some new strategies working better than the old pool-and-pray approach.

- Restaking Surge: People are stacking yields by using the same ETH to secure multiple protocols at once – EigenLayer alone has $19B locked up this way. You don’t need 32 ETH anymore either, since liquid restaking protocols let anyone get these multiplied rewards with whatever amount they have.

- Tokenized Yield Derivatives: Pendle hit $8.27B because it made it possible for farmers to split their yields into separate tokens that they can trade. Big institutions are using this to hedge billions worth of yield exposure, which is completely new to DeFi.

- Layer 2 Yield Opportunities: You can get the same farming yields on Arbitrum or Base but pay $0.50 in fees instead of $50 on Ethereum mainnet. All the major protocols are there now, so there’s no reason to burn money on gas unless you’re farming with huge amounts.

- Dynamic Liquidity AMMs: Maverick and similar protocols move your liquidity automatically as prices change, so you don’t have to babysit your positions like on Uniswap V3. Farmers using these report 20-30% better returns just from staying in the profitable range without doing anything.

How to Identify Sustainable Yield Farming Projects

Finding farms that last longer than a few months requires checking a few key metrics before you deposit.

- TVL Growth: Check the protocol’s DeFiLlama page for a steady or growing TVL trend over at least 3 months. Sudden spikes followed by drops mean mercenary capital that leaves when rewards dry up.

- Security Record: Look for at least one audit from a recognized firm like Certik, Trail of Bits, or OpenZeppelin. Check if they’ve had any exploits by searching the protocol name with “hack” or “exploit” on Google.

- Realistic APY: Sustainable yields come from real revenue (trading fees, lending interest), not token emissions. Anything over 50% APY usually means heavy token printing that won’t last.

- Liquidity Depth: Check if you can sell $10,000 worth of rewards without moving the price more than 2%. Thin liquidity means your high APY is meaningless if you can’t actually cash out.

- Transparent Governance: Read one recent governance proposal to see if the team clearly explains changes and gives the community real input. Mystery updates and sudden parameter changes are red flags.

Projects that check at least four of these boxes tend to survive bear markets and keep paying yields long-term. Skip anything that fails more than two checks.

Alternative Project Spotlight – Maxi Doge

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

Project spotlights are independent from our ranking methodology and may include sponsored partners.

Historical Yield Farming Performers & Lessons

The platforms we reviewed once paid thousands of percent APY to early farmers before they became today’s stable yield generators.

Here’s how these protocols performed at their peaks, from launch hype to the inevitable return to sustainable rates.

| Token/Platform | Launch APY | Peak APY | ROI | Key Catalyst |

| Curve (CRV) | 300-500% | 2,500%+ | 40x ($0.30 → $12) | Launched during DeFi Summer 2020, pioneered vote-locked tokenomics with veCRV boosting yields up to 2.5x |

| Aave (AAVE) | 50-100% | 400%+ | 130x ($3 → $390) | Flash loans innovation in 2020, offering up to 4% APY on stablecoins when banks paid 0.05% |

| Uniswap (UNI) | 100-200% | 400%+ | 25x ($0.30 → $7.66) | Airdropped 400 UNI tokens worth over $1,000 to users, launched liquidity mining attracting $2B |

| Balancer (BAL) | 145% | 250%+ | 20x ($0.80 → $16) | Followed Compound’s liquidity mining model with customizable pool weights, reducing impermanent loss |

| Yearn Finance (YFI) | 10-30% | 3,000%+ | 3,000x ($30 → $90,000) | Fair launch without pre-mine, reached $90,000 in September 2020 with only 30,000 tokens |

| GMX (GMX) | 20-30% | 100%+ | 15x ($2 → $30) | Zero price impact trades for whales, 70% fee sharing with LPs during 2021-2022 bull run |

| Lido (LDO) | 5-10% | 50%+ | 20x ($0.40 → $8) | Ethereum merge anticipation, liquid staking breakthrough allowing any amount of ETH to earn staking rewards |

| Frax (FXS) | 15-25% | 200%+ | 25x ($1.50 → $38) | sFRAX vault targeting 5-10% APY tracking Federal Reserve rates, algorithmic stablecoin innovation |

How We Picked These Yield Farming Projects – Our Methodology

Yield farming plays by different rules than regular staking. Higher rewards come with higher risks, so our evaluation criteria focuses on what actually matters for DeFi farmers. Platforms that passed all five criteria made our list. Those that excelled in TVL and liquidity but had questionable tokenomics got flagged with appropriate warnings.

We dropped anything with security concerns or purely inflationary rewards, no matter how high the APY.

Total Value Locked (TVL) & Growth (25%)

TVL tells you if investors trust a protocol. We tracked each project’s TVL across DefiLlama and DeBank over 6 months, because $10 billion locked means something, while $10 million might vanish overnight.

We checked if TVL spread across hundreds of farmers or concentrated in three whale wallets, whether it grew steadily or spiked from one unsustainable incentive program, and how much TVL fled during the last market downturn?

Liquidity & Trading Volume (25%)

That 500% APY means nothing if you lose 20% selling your rewards due to thin liquidity.

We tested selling $1,000 and $10,000 worth of each reward token to see the real slippage. Then we monitored 24-hour volumes – if daily volume is less than 1% of market cap, you’ll struggle to exit without crashing the price.

Tokenomics & Emission Schedule (20%)

Most yield farms die from token inflation because they print tokens faster than demand can absorb them.

We mapped out each protocol’s emission schedule for the next 12 months. How many tokens get minted daily? When do team tokens unlock? Is there any mechanism to remove tokens from circulation?

Security & Audit History (15%)

One bad smart contract can vaporize your entire position, principal and rewards gone in a single transaction.

We only included protocols with at least two audits from recognized firms (CertiK, Trail of Bits, Quantstamp).

Then we checked their incident history. Not just if they’ve been hacked, but how they handled it. Did users get compensated? How quickly did they respond?

Reward Sustainability (Real vs Ponzi APY) (15%)

There’s a huge difference between earning 20% from actual trading fees versus 200% from token printing.

We broke down exactly where each protocol’s yield comes from. Curve pays you from real swap fees. Some newer farms just print governance tokens with no underlying revenue. Guess which one survives bear markets?

How to Start Yield Farming Safely

Getting started with yield farming doesn’t require complex strategies or huge capital, just follow these steps carefully and respect the risks involved.

Step 1: Choose a Platform

Start with Curve for stable yields, Aave for lending markets, or Uniswap for deeper liquidity. These protocols have survived multiple market cycles and handle billions in volume daily.

Step 2: Connect a Wallet

Use MetaMask for broad compatibility or Rabby for better transaction previews. Create a separate farming wallet, never use your main holdings wallet for DeFi interactions.

Step 3: Select Pool & Deposit Assets

Pick pools based on your risk tolerance: stablecoin pairs for 5-15% with minimal IL, blue-chip pairs (ETH/USDC) for 15-30%, or volatile pairs for 50%+ but higher IL risk. Approve the spending limit, then deposit your tokens to receive LP tokens back.

Step 4: Monitor APYs & Risks

Check your position daily, APYs fluctuate with TVL and volume. Watch for reward token price drops, major withdrawals from your pool, or governance votes that could affect yields. Use DeFiLlama or the protocol’s native dashboard.

Step 5: Withdraw/Reinvest

Claim rewards based on gas costs – weekly for large positions, monthly for smaller ones. Either compound rewards back into the pool for higher returns or sell for stablecoins to lock in profits. When exiting, unstake LP tokens first, then withdraw liquidity to get your original assets plus earned fees.

Risk Level Table

| Risk Type | Warning Signs | Potential Loss | How to Avoid |

| Rug Pull | Anonymous team, no audit, <1 week old | 100% of deposit | Only use audited protocols with real teams |

| Impermanent Loss | Volatile pair farming | 5-50% of principal | Stick to stablecoin or correlated asset pools |

| Smart Contract Exploit | New protocol, forked code | 100% of deposit | Check audit dates, insurance availability |

| Gas Fee Trap | Small deposit on Ethereum | 10-30% to fees | Use L2s or farm with >$5,000 |

| Reward Token Crash | Emissions exceed buying pressure | 90% of rewards value | Sell rewards daily, avoid hyperinflationary tokens |

Risks of Yield Farming Crypto in 2026

Catastrophic Risks (100% Loss Potential)

- Protocol Hacks & Exploits: Smart contract exploits can drain entire protocols in minutes. Euler Finance lost $197 million in March 2023 despite four audits. Bonq protocol lost $120 million to an oracle hack in February 2023. Your deposits and rewards vanish instantly with no recourse.

- Rug Pulls: Anonymous teams, unaudited code, and forced locking periods usually end the same way, where developers drain the protocol and disappear. AnubisDAO vanished with $60 million in 2021. Even “doxxed” teams can exit scam, like the Stable Magnet rug that took $27 million just last year. If you can’t sell reward tokens or withdraw liquidity freely, you’re probably in a rug.

Major Risks (20-50% Loss Potential)

- Impermanent Loss in Volatile Markets: IL compounds during extreme volatility. Farmers in ETH/USDC pools during the 2022 crash lost 40% even with rewards included. A token doing a 5x sounds great until you realize you have 50% less of it than if you just held.

- Governance Attacks: Beanstalk lost $182 million when an attacker borrowed tokens, voted to drain the treasury, then repaid the loan, and all that in one transaction. When whales control voting, they can redirect fees, pause contracts, or change tokenomics to benefit themselves at your expense.

Ongoing Risks (Steady Profit Erosion)

- APY Decay: Pools that launch with a 1,000% APY typically drop to 50% within weeks as more capital enters the project.

- Reward Token Hyperinflation Most farms print reward tokens faster than demand can absorb it. OlympusDAO went from $1,400 to $7. Time Wonderland from $10,000 to $100.

Should You Consider Yield Farming in 2026?

Yield farming isn’t for everyone, it demands active management, risk tolerance, and enough capital to make the complexity worthwhile. Let’s figure out if it makes sense for your specific situation.

Yield farming makes sense if:

- You have at least $5,000 to deploy – smaller amounts get eaten by gas fees and transaction costs

- You can afford to lose 30% of this capital without it affecting your life or causing financial stress

- You already understand DeFi basics like using MetaMask, reading Etherscan, and swapping tokens

- You’ll check positions at least weekly to monitor APY changes, protocol updates, and reward token prices

- You’re comfortable with complex tax reporting since every claim and reinvestment creates taxable events

- You enjoy researching protocols and reading audit reports, analyzing tokenomics, and tracking TVL trends

Skip yield farming if:

- You have less than $1,000 to invest – gas fees alone will eliminate any potential profits

- You need this money within 6 months, since funds can get locked or lose value suddenly

- You don’t understand impermanent loss or why a 2x price change means 5.7% guaranteed loss

- You want true passive income – farming requires constant monitoring and active decisions

- Complex interfaces frustrate you since one wrong click can send funds to an unrecoverable address

- You can’t handle seeing -50% some days, even if long-term yields remain positive

Final Verdict – Is Yield Farming Crypto Worth It in January 2026?

The yield farming market today looks nothing like the wild west of DeFi Summer 2020. Most of those 10,000% APY pools are dead, their reward tokens worth pennies, and the protocols that offered them either hacked or abandoned.

The ones that are still active today, like Curve, Aave, and Uniswap have proven they can weather exploits, bear markets, and regulatory threats.

But they still require constant monitoring, a deep understanding of DeFi mechanics, and enough capital to make gas fees worthwhile.

For most investors, the complexity and risk aren’t worth it. One smart contract bug, one governance attack, or one wrong click can wipe out your investment.

But if you have risk capital, time to research, and the stomach for volatility, yield farming is still one of crypto’s most reliable income streams.

FAQ

What is yield farming in crypto?

Which platforms offer the best yield farming in 2026?

Is yield farming safe?

What APYs can I expect?

How do I minimize risks in yield farming?

References

- Curve – Messari

- Pendle’s TVL Hits Record – CoinDesk

- Aave Statistics 2025 – CoinLaw

- Uniswap – Coinbase

- sFRAX Staking – FraxFinance

- GMX Solana Expansion – Medium

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

Fact-Checked by:

Fact-Checked by:

Filip Stojanovic

, 43 postsI’m a crypto content strategist and writer who helps Web3 projects tell their story, build trust, and grow engaged communities in an increasingly competitive space. I’ve worked with presale tokens, exchanges, blockchain startups, and crypto marketing agencies, shaping content strategies that not only explain complex concepts but also inspire confidence, attract investors, and drive adoption.

My experience spans a wide variety of formats, from whitepapers, token launch campaigns, and pitch decks to thought leadership articles, technical documentation, and in-depth guides. Before diving into Web3, I built my expertise in B2B SaaS writing. This structured, analytical approach now underpins my work in crypto, allowing me to bring clarity and credibility to projects in a space often criticized for hype and jargon.

I’m especially interested in how blockchain innovation translates into real-world utility. My recent work explores the evolving role of DeFi protocols, NFT ecosystems, and next-generation infrastructure in reshaping industries and creating new opportunities for both businesses and individuals.