Token6900 (TOKEN6900) is a new meme coin built on hype and the ‘collective hallucination’ of meme coin traders. We explore the fut...

Looking for the new coins coming to Coinbase in 2025? Discover our data-driven picks like Solaxy, Bitcoin Bull, and Snorter Bot with high growth potential and strong community backing.

Disclaimer: Cryptocurrencies are high-risk investments. This article is for informational purposes only and not financial advice. By using our site, you accept our terms and conditions. Some content may include affiliate links that may earn us a commission.

Based on our analysis, tokens like Maxi Doge, Bitcoin Hyper, and Hyperliquid are among the new coins that investors should watch this year, thanks to strong community demand, solid presale momentum, and increasing U.S. market readiness.

Coinbase’s new listings can spark big market moves, and tracking them is one of the smartest ways to spot new opportunities early. In this guide, we’ll break down which new Coinbase coins in 2025 could be listed next, how we identified them, and key factors to know before investing.

Key Takeaways

- Coinbase listings in 2025 Coinbase listings in 2025 are favoring RWA, Infrastructure, and Layer 2 tokens — including HYPER, W, and ENA — driven by institutional demand and infrastructure readiness.

- Early support in Coinbase Wallet and inclusion in Coinbase Custody are strong indicators of an upcoming listing.

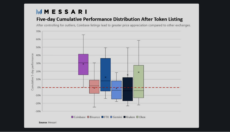

- The “Coinbase Effect” — listed tokens achieving an average 91% price gain within five days — shows the significance of Coinbase listings.

- U.S. regulatory compliance is crucial. Coinbase, which reported $2.3 billion in revenue for Q4 2024, prioritizes projects adhering to KYC/AML best practices and offering regulatory transparency.

- Tokens with established market demand and sufficient liquidity on other major exchanges often progress to Coinbase. High trading volume and active communities are important factors.

- Coinbase’s listing process typically involves stages: Coinbase Wallet support, Coinbase Custody inclusion, Roadmap announcement, limited exchange listing, and then full exchange listing.

- In 2025, more tokens are being listed than before — CEO Brian Armstrong indicated that Coinbase now aims for a more permissive listing approach.

Upcoming Coinbase Listings Watchlist in August 2025

Our research shows that several new coins on Coinbase could be added soon, based on key listing signals and market momentum. This curated watchlist of upcoming Coinbase listings highlights the top projects to track in August 2025 and beyond, providing investors with an edge as new opportunities emerge.

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Inspired by SPX6900 & early 2000s internet culture

- 80% supply in fair launch presale ($5M cap)

- Fixed-supply meme coin, no utility or minting

- Fastest meme coin sniper on Solana and EVM

- Multichain Telegram bot with lowest fees and instant execution

- Snipe new tokens before bots and whales

- Exclusive in-app access to vetted crypto presales

- Staking rewards with an annual percentage yield (APY) of up to 152%

- Upcoming Best Card enables crypto spending at millions of merchants with cashback

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

Expected New Coinbase Listings

List of speculative tokens most likely to list on Coinbase in 2025:

- Bitcoin Hyper (HYPER) — Bitcoin Layer 2 Meme Coin Built for Speed & Cross-Chain Utility

- Maxi Doge (MAXI) — Degen Humor Dog Meme coin with Utility

- Token6900 (T6900) — Anti-S&P 500 Satirical Meme Coin with Zero Utility

- Snorter (SNORT) — Trading Bot Meme Coin with High-Yield Utility

- Jupiter Exchange (JUP) — Solana DEX Aggregator Token

- Wall Street Pepe (WEPE) — Pepe Inspired Meme Coin Movement

- Best Wallet (BEST) — Multi-Chain and Presale-Focused Crypto Wallet Token

- Hyperliquid (HYPE) — Layer 1 Blockchain and Perps DEX with $2.5B TVL

- SUBBD (SUBBD) — Content Monetization Token with Web3 Creator Ecosystem

- SpacePay (SPY) — Utility-focused Token Powering Crypto Payments for the Real World

- World Liberty Financial (WLFI) — Governance token for the Trump-backed DeFi voting protocol

Overview of New Coinbase Listings and Possible New Coins

Here’s a quick look at some of the latest tokens listed on Coinbase and a few that might be added soon.

1. Bitcoin Hyper (HYPER) — Bitcoin Layer 2 Meme Coin Built for Speed & Cross-Chain Utility

Bitcoin Hyper is a Bitcoin Layer 2 meme coin built on the Solana Virtual Machine (SVM), offering fast and low-cost transactions, as well as a trustless BTC bridge. Designed to bring Bitcoin’s brand and ethos into the high-speed world of Solana, Bitcoin Hyper allows users to move BTC across chains with minimal fees, while participating in the culture and fun of the meme coin ecosystem.

Bitcoin Hyper Official Website. Source: Bitcoin Hyper

The project combines ERC-20 / SVM compatibility, rapid transaction finality, and a BTC-backed cross-chain architecture, making it a compelling candidate for Coinbase’s new listings in 2025. As a new ICO crypto with U.S.-aligned compliance and a growing community, HYPER reflects the kind of fun yet functional projects Coinbase has previously listed, especially as it expands support for BTC-based multi-chain assets.

Project Snapshot:

| Category | Layer 2 Meme Coin / BTC Cross-Chain Utility |

| Launch Date | Q3 2025 (Presale underway) |

| Chain | Solana Virtual Machine (SVM) + ERC-20 compatibility |

| Amount Raised | $6.28M |

| Current Exchanges | Currently in presale |

| Coinbase Wallet Support | No (targeting post-mainnet launch) |

| Coinbase Roadmap | No |

| Regulatory Profile | KYC-compliant presale, ERC-20 architecture aligned with U.S. norms |

| Listing Signals | BTC-linked utility, SVM multi-chain architecture, community traction |

| Coinbase Fit | High: aligns with Coinbase’s BTC Layer 2 interest, meme-friendly culture, and cross-chain support initiatives. |

2. Maxi Doge — Community-focused Whimsical Dog Meme Coin

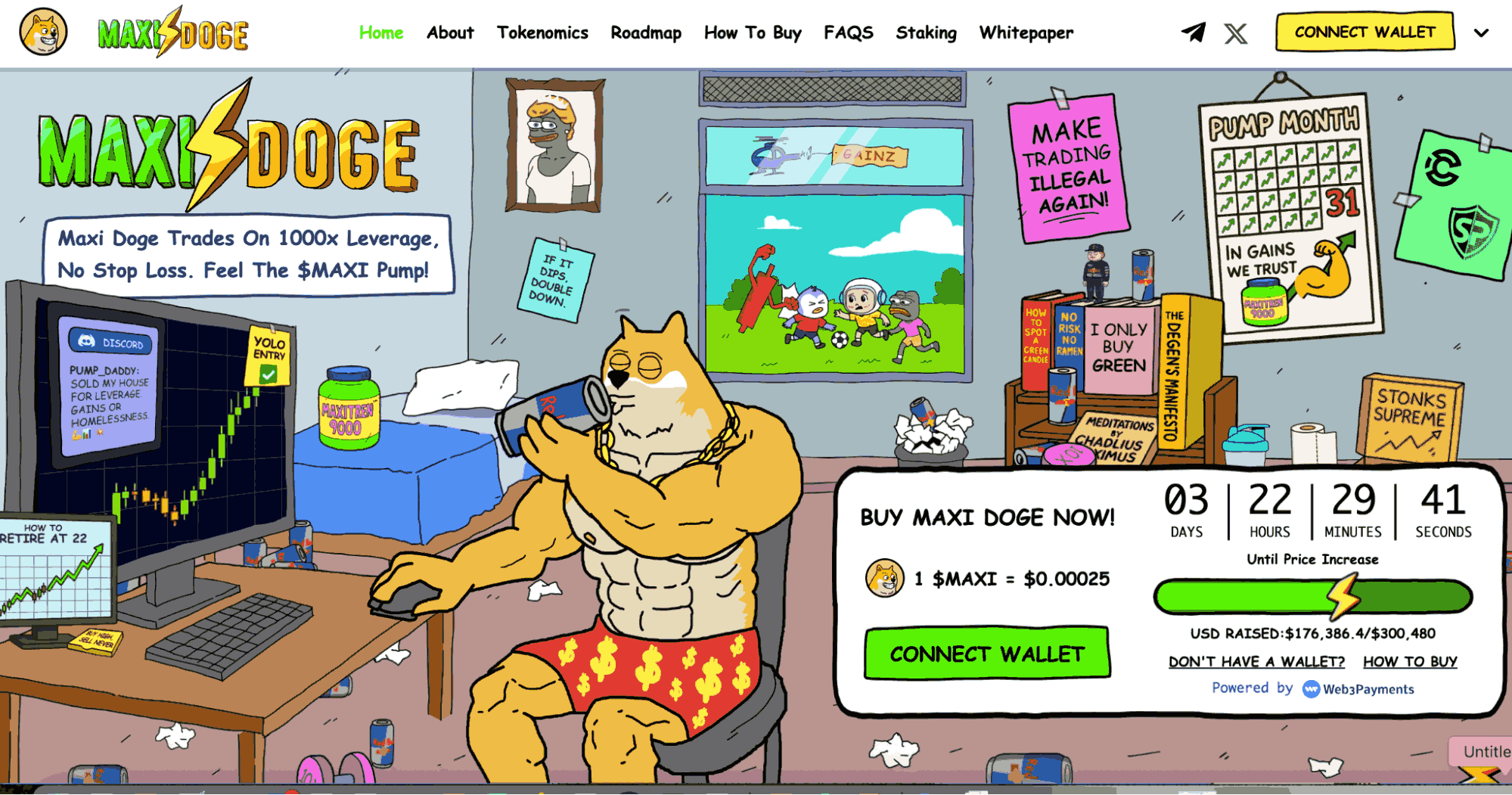

Maxi Doge is a meme coin using humor, dogs, and a community focus to attract viral attention and growth. The presale website features colorful graphics and references that make sense to true crypto meme enthusiasts, such as Pengu and Pepe playing in the garden, while Maxi Doge sits at the computer, consuming energy drinks and yoloing the top with 1000x leverage.

Maxi Doge in his bedroom. Source: Maxi Doge

The coin serves as a parody of gym bros and degens, but also as a relatable meme, building on the success of Dogecoin, Shiba Inu, and Floki Inu. These established dog coins have succeeded mainly on simplistic and cute memes. MAXI aims to add humor and utility to create a community of traders.

MAXI token holders can stake the coin for high APYs, and will be able to join a trading group. Meme coins come with high risk and high reward, and MAXI plays into this by referencing high leverage.

The token plans to partner with a perps platform, which may allow high leverage trading with MAXI and other tokens. Competitions will be a key feature to increase excitement and engagement.

Project Snapshot:

| Category | Dog Meme Coin |

| Launch Date | Presale launched on 29/07/25 |

| Chain | Ethereum (ERC-20) |

| Amount Raised | $215.02K |

| Current Exchanges | Currently in presale |

| Coinbase Wallet Support | No |

| Coinbase Roadmap | No |

| Regulatory Profile | ERC-20 architecture aligned with U.S. norms |

| Listing Signals | Community growth, Successful raise of $15M hardcap |

| Coinbase Fit | High: aligns with Coinbase’s meme-friendly culture. |

3. Token6900 (T6900) — Anti-S&P 500 Satirical Meme Coin

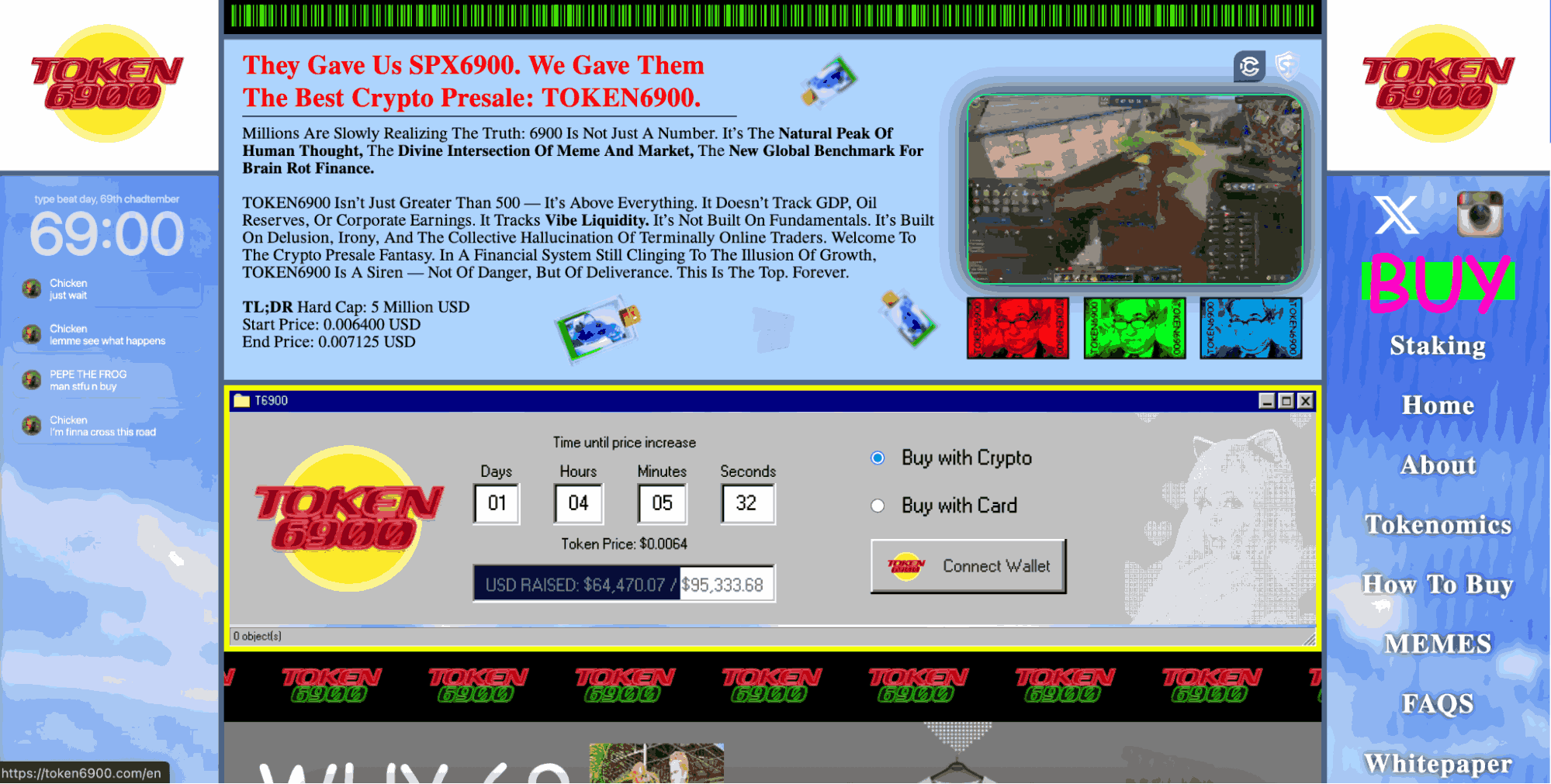

Token6900 is a bold experiment in satirical finance, positioning itself as the “anti-S&P 500” alternative that embraces complete transparency about offering zero utility. Unlike traditional crypto projects that promise roadmaps and features, Token6900 openly markets itself as “collective delusion as liquidity” while incorporating early 2000s nostalgia and “Peak Brain Rot Theory” to challenge conventional market thinking.

TOKEN6900 Official Website Source: TOKEN6900

While Token6900’s anti-establishment approach contrasts sharply with typical Coinbase listing criteria, its ERC-20 structure, transparent tokenomics, and growing cultural impact within crypto communities demonstrate the evolution of meme finance. The project’s $5M hard cap presale, 80% public allocation, and 195% staking APY through the “Brain Rot Vault” show genuine market demand for satirical financial products, potentially paving the way for a new category of honest meme investments.

Another reason to consider Token6900 for a Coinbase listing is that memecoin is inspired by SPX6900. While SPX6900 isn’t tradable on spot on Coinbase, perpetual futures are available, indicating that Coinbase may consider these types of coins in the future.

Project Snapshot:

| Category | Satirical Finance / Meme Coin |

| Launch Date | Presale launched in July 2025 |

| Chain | Ethereum (ERC-20) |

| Amount Raised | $1.54M in presale |

| Current Exchanges | Presale only; DEX listings planned |

| Coinbase Wallet Support | Yes — ERC-20 compatibility |

| Coinbase Roadmap | No |

| Custody Support | No |

| Regulatory Profile | Transparent tokenomics; satirical positioning may face regulatory scrutiny |

| Listing Signals | ERC-20 standard, transparent supply, growing meme finance movement |

| Coinbase Fit | Generally, satirical nature conflicts with institutional requirements, but the cultural impact is noteworthy |

3. Snorter (SNORT) — Telegram Trading Bot Meme Coin with High-Yield Utility

Snorter Token powers an innovative Telegram-based trading bot designed to help users quickly identify and trade Solana and Ethereum meme coins. Unlike most meme coins, Snorter combines utility with high-yield staking. Its core features include fast swaps, honeypot/rug-pull protection, copy-trading, and dynamic fee discounts — all within the Telegram app.

Snorter Official Website. Source: Snorter

With Coinbase Wallet support, audited smart contracts, and growing U.S. community interest, Snorter aligns with trending Coinbase listing signals. Although not yet supported on the Coinbase Wallet, its mix of bot utility, cross-chain expansion plans, and rapid presale traction places it among the most compelling coins likely to launch on Coinbase in 2025.

Project Snapshot:

| Category | Meme Coin + Trading Bot / Utility Token |

| Launch Date | Presale launched in May 2025 |

| Chain | Solana and Ethereum (ERC‑20/SPL multi-chain support) |

| Amount Raised | $2.72M in presale |

| Current Exchanges | Presale only (via Best Wallet); no CEX listings yet |

| Coinbase Wallet Support | Yes — compatible per Coinbase Wallet documentation |

| Coinbase Roadmap | No |

| Regulatory Profile | KYC-compliant presale; audited by SolidProof & Coinsult |

| Listing Signals | Wallet support, 850% APY staking, cross-chain utility, audited smart contracts, growing U.S. engagement |

| Coinbase Fit | High — combines utility, governance, and Ethereum compatibility; signals set for 2025 listings |

4. Jupiter (JUP) — Solana’s DEX Aggregator, Launchpad, and Lend Platform

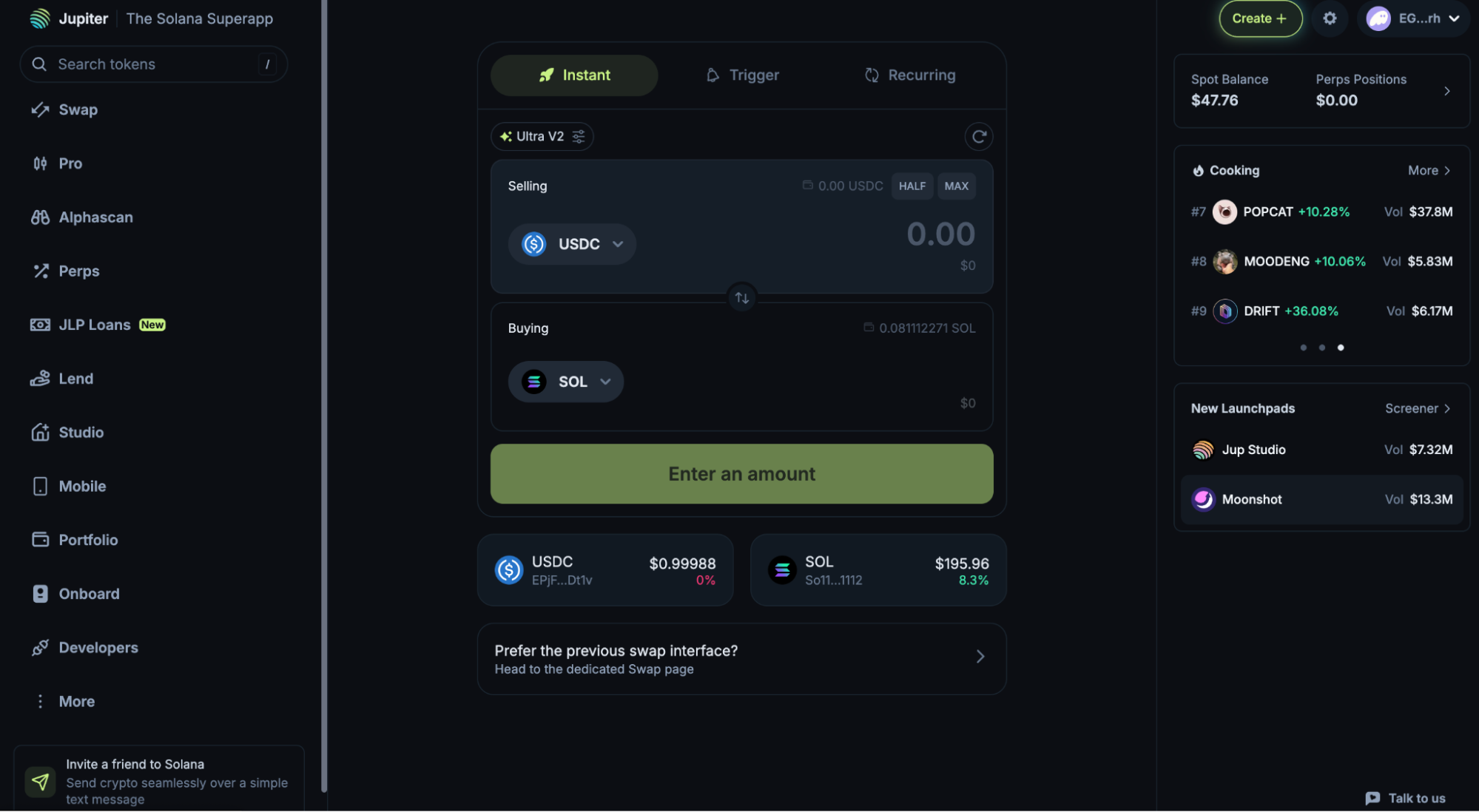

Jupiter is the leading DEX aggregation platform on Solana. Jupiter uses a smart routing system called Metis, which allows trades to be executed across several DEXs, solving the problem of fragmented liquidity on Solana. Jupiter also offers very specific conditions for dollar cost averaging and setting limit orders. For example, users can set a limit order or ‘Trigger’ that happens at a certain price, but also after a specific duration of time has passed.

Swapping using Jupiter. Source: Jup.ag

Jupiter’s advanced liquidity features are one of the reasons that Solana’s no-code meme launcher platforms like pump.fun and bonk.fun became possible.

The JUP JUP $0.45 24h volatility: 5.7% Market cap: $1.37 B Vol. 24h: $66.06 M token is used for governance and was one of the biggest airdrops in crypto history. This brought a lot of attention and users to the platform. Jupiter frequently adds new functionalities, and so JUP may gain extra use cases over time.

Coinbase Custody holds JUP. The token has a market capitalization of $1.4B. These factors make it a strong contender for the Coinbase Exchange.

Project Snapshot:

| Category | DeFi and Dex Aggregator |

| Launch Date | January 31, 2024 (Airdrop) |

| Chain | Solana |

| Amount Raised | Not applicable |

| Current Exchanges | Backpack Exchange, Kraken, Crypto.com, various Solana DEXs. |

| Coinbase Wallet Support | Yes |

| Custody Support | Yes |

| Coinbase Roadmap | No |

| Regulatory Profile | Decentralized exchange aggregator; operates within DeFi ecosystem on Solana. |

| Listing Signals | Coinbase Custody support, high market cap (~$1.4B) and trading volume, influential airdrop. |

| Coinbase Fit | Strong contender. Potential hesitation factors include the FDV vs. Market Cap (due to future airdrops) and potential competition with Coinbase’s own exchange offerings. |

6. Wall Street Pepe (WEPE) — Pepe Token with Potential and Staking

WEPE is a meme coin that models itself after Pepe the Frog and Wall Street outsiders like Jordan Belfort. It unites people in recognizing rigged elements in TradFi and aims to build an army of supporters.

The WEPE token army. Source: Wall Street Pepe

Having exited presale in early 2025, the token has dropped 60% from its all-time high. However, it has also begun to garner attention and price action due to recent developments, including its listing on Crypto.com and CoinMarketCap, and the token becoming available on Solana.

WEPE also recently tweeted about an NFT drop for holders, to serve as a reward but also as a way to spread awareness of the project. On the project’s X, there is a lot of engagement with polls about the coin’s future pinned to the top.

Most memes take at least a few months to gain momentum, and while vesting schedules may cause selling pressure, viral spread can counteract it.

| Category | Meme Coin / Community Utility |

| Launch Date | Early 2025 |

| Chain | Ethereum (ERC-20), Solana |

| Amount Raised | $73.88 million |

| Current Exchanges | Crypto.com, Uniswap, XT.COM, KCEX, Blynex |

| Coinbase Wallet Support | Yes |

| Coinbase Roadmap | No |

| Regulatory Profile | Audited |

| Listing Signals | Recent listings on Crypto.com and other exchanges, availability on Solana, NFT plans, strong community engagement on X. |

| Coinbase Fit | Moderate. Its anti-establishment narrative, community strength, multi-chain presence, and significant presale raise could position it for consideration. |

7. Best Wallet (BEST) — Multi-Chain Crypto Wallet Token

Best Wallet is a multi-chain, non-custodial crypto wallet token designed to simplify and secure presale and token management — two significant pain points in the market today. Built to integrate Fireblocks MPC-CMP technology, Best Wallet offers users a unique experience: presale participation and management directly within the wallet app. Combined with exclusive staking, fee discounts, governance, and iGaming perks, BEST utility extends well beyond a typical wallet token.

Wallet Best Wallet Official Website. Source: Best Wallet

The platform already boasts a growing U.S. and global user base, over $14.43M raised through presales, and a powerful Upcoming Tokens feature designed to become the go-to tool for presale buyers.

With increasing community momentum, ERC-20 compatibility, and a compliance-first approach, Best Wallet aligns well with trends seen in upcoming Coinbase listings, giving BEST strong potential to appear among Coinbase’s new tokens in 2025.

Project Snapshot:

| Category | Multi-chain Wallet Utility / DeFi |

| Launch Date | TBA |

| Chain | Ethereum (ERC-20) |

| Amount Raised | $14.43M |

| Current Exchanges | Currently in presale |

| Coinbase Wallet Support | No |

| Coinbase Roadmap | No |

| Regulatory Profile | KYC-compliant presale, audited smart contracts |

| Listing Signals | ERC-20, growing U.S. user base, DeFi wallet innovation, transparent tokenomics |

| Coinbase Fit | U.S. consumer appeal + strong DeFi wallet niche + compliant presale framework |

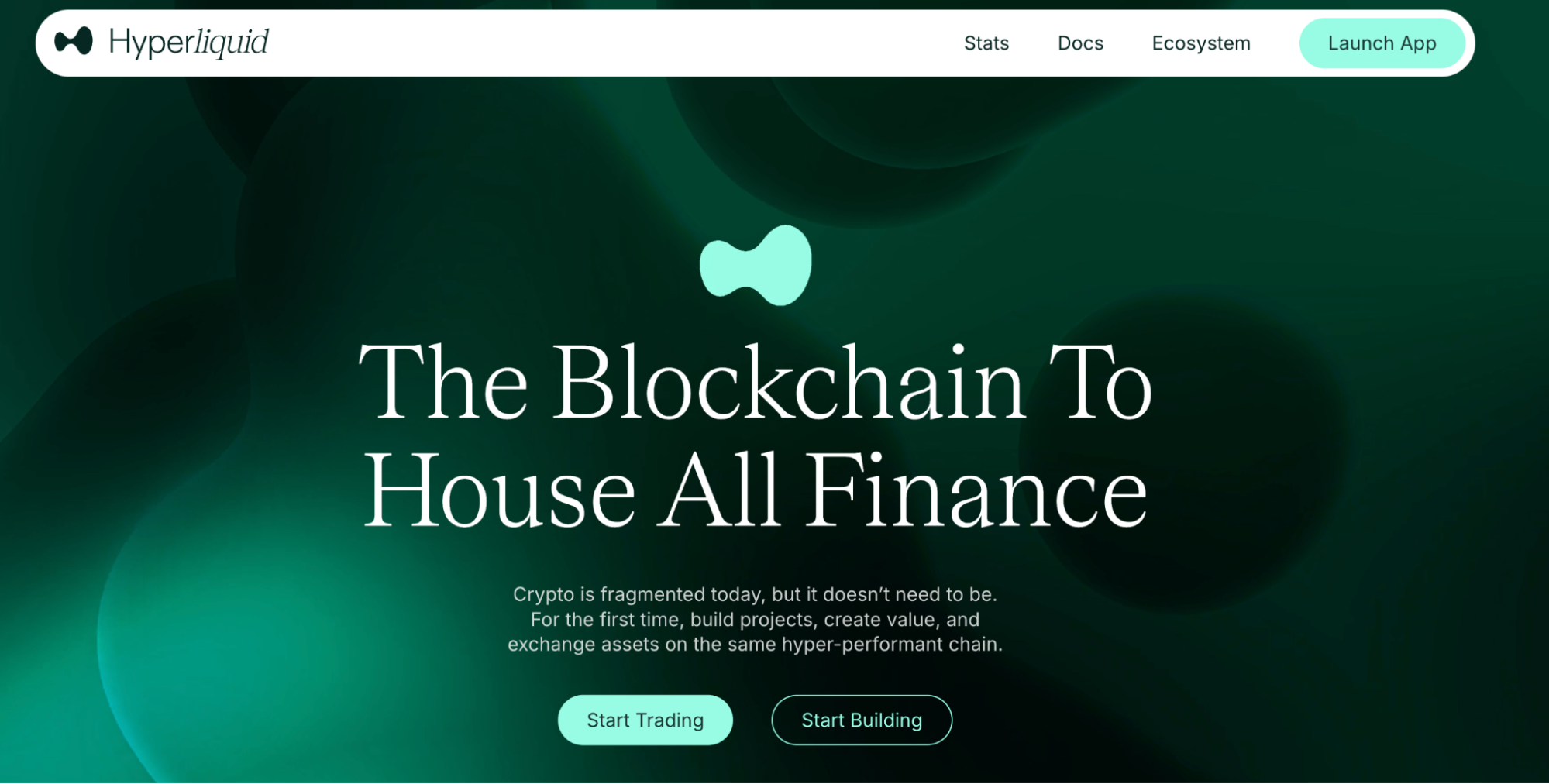

8. Hyperliquid (HYPE) — EVM Blockchain and Decentralized DEX and Perpetual Platform

Hyperliquid launched in 2023 as a decentralized perpetual futures trading platform and now also comprises a Layer 1 blockchain. The token, HYPE, made history as one of the biggest airdrops. Released in 2024, the HYPE HYPE $38.23 24h volatility: 4.2% Market cap: $12.76 B Vol. 24h: $430.33 M airdrop is currently worth around $11B. This secured significant public support and interest. No tokens were reserved for VCs or private funding rounds, making HYPE potentially resilient against market manipulation.

The Hyperliquid Foundation homepage. Source: Hyperliquid

Following its DEX success, Hyperliquid released HyperEVM, an Ethereum-compatible Layer 1 facilitating enhanced trading speeds. HyperEVM has a TVL of $2.5 billion, placing it among the top ten blockchains by market capitalization, on par with Avalanche and Sui. HYPE utility includes governance, staking, trading, and HyperEVM gas fees.

Because Hyperliquid HYPE $38.23 24h volatility: 4.2% Market cap: $12.76 B Vol. 24h: $430.33 M is a DeFi and futures protocol, Coinbase may have resisted listing HYPE due to regulatory issues. Additionally, Hyperliquid does not require KYC. However, Paul Atkins, SEC chair, recently called for an “innovative exemption” proposal for DeFi protocols, aligning with Trump’s vision for the US as “crypto capital”.

This exemption is intended for Q4 2025, and if it proceeds, it may set the stage for a Coinbase listing.

Project Snapshot:

| Category | EVM Blockchain / Decentralized Exchange (Perpetual Futures) |

| Launch Date | DEX: 2023; HyperEVM Mainnet: February 18, 2025 |

| Chain | Hyperliquid Layer 1 (HyperBFT consensus), Ethereum-compatible (HyperEVM) |

| Amount Raised | HYPE airdrop ~ $11B in value |

| Current Exchanges | Hyperliquid DEX (main trading venue); HYPE token traded on some CEXs (e.g., Kraken, Bitget) and DEXs (e.g., Uniswap – for swaps) |

| Coinbase Wallet Support | Yes (EVM-compatible wallets, including Coinbase Wallet, are supported for connecting to trade on Hyperliquid) |

| Coinbase Roadmap | No |

| Regulatory Profile | Cons: Decentralized; operates without KYC; offers higher leverage than CFTC-approved platforms. Pros: Proactive CFTC submissions |

| Listing Signals | Large HYPE airdrop, no VC/private rounds, high TVL, top 10 blockchain by market cap, EVM compatibility, potential for SEC “innovation exemption.” |

| Coinbase Fit | High potential if “innovation exemption” for DeFi goes ahead. Aligns with Coinbase’s interest in scalable L1s and growing market traction. |

9. SUBBD (SUBBD) — Content Monetization Token with Web3 Creator Ecosystem

SUBBD is a Web3-native content monetization token designed to help creators own, manage, and monetize their audiences across social and decentralized platforms. Built to support AI-driven fan engagement, tokenized creator communities, and cross-platform rewards, SUBBD stands at the intersection of SocialFi, DeFi, and Web3 creator economies — a fast-rising trend among upcoming Coinbase listings. The project already enables innovative use cases: creator loyalty tokens, fan rewards, and on-chain Proof-of-Support.

SUBBD Official Website.Source: SUBBD

With a growing community of crypto-native creators and users in the U.S., KYC-compliant tokenomics, and an ERC-20 structure, SUBBD mirrors the emerging patterns of content-focused tokens making their way onto mainstream exchanges.

As the SocialFi and fan-token ecosystems gain institutional traction, this new presale crypto aligns with Coinbase’s evolving listing priorities, positioning SUBBD among the new coins worth watching in 2025.

Project Snapshot:

| Category | Web3 Creator Economy / SocialFi / DeFi |

| Launch Date | TBA (Presale currently underway — main launch expected Q4 2025) |

| Chain | Ethereum (ERC-20) |

| Amount Raised | $932.04K in presale |

| Current Exchanges | TBA |

| Coinbase Wallet Support | No |

| Coinbase Roadmap | No |

| Regulatory Profile | KYC-compliant token sale, designed for U.S.-friendly compliance |

| Listing Signals | ERC-20, compliant tokenomics, strong U.S. creator community traction, alignment with SocialFi trends |

| Coinbase Fit | Mirrors prior SocialFi and fan-token trends (e.g. Audius), aligns with U.S.-driven Web3 creator economy focus |

10. SpacePay (SPY) — Utility-focused Token Powering Crypto Payments for the Real World

SpacePay is a contactless crypto payment platform that aims to bring digital assets into everyday commerce, both online and in-store. The project stands out for its real-world utility, enabling integrations that allow physical retailers and merchants to accept crypto as easily as a credit card. With a focus on point-of-sale (POS) systems and global merchant partnerships, SpacePay aims to drive mass-market crypto adoption.

SpacePay Official Website. Source: SpacePay

From an investor’s perspective, SpacePay is gaining early momentum in its presale phase, driven by its practical value proposition and favorable market timing. As more consumers seek crypto payment options, this project is well-positioned to ride the next wave of real-world blockchain utility.

It offers KYC-compliant tokenomics, a clear roadmap, and a growing U.S. user base—all relevant signals for a Coinbase listing. Best suited for early adopters, crypto-payment enthusiasts, and investors looking for utility-focused projects.

Project Snapshot:

| Category | Payments / DePIN |

| Launch Date | TBA |

| Chain | Ethereum, Base, Avax, Matic, BNB |

| Amount Raised | $1,138,190 |

| Current Exchanges | Currently in presale |

| Coinbase Wallet Support | TBA |

| Coinbase Roadmap | No |

| Regulatory Profile | KYC-compliant |

| Listing Signals | Real-world utility, presale traction, U.S. appeal |

| Coinbase Fit | Mirrors historical listings with utility-based use cases (like USDC, COTI) |

11. World Liberty Financial (WLFI) — Bridging TradFi with DeFi and Connected to the Trump family

World Liberty Financial originated as a project for voting on the future of DeFi, with notable figures including Tron founder Justin Sun investing heavily. The project now states that its mission is to help people access financial opportunities outside of TradFi, while strengthening the dollar.

They plan to offer access to DeFi-based lending and borrowing, through platforms like Aave, and its recently launched stablecoin USD1. USD1 will be key and can be used for cross-border payments DeFi platform participation.

World Liberty Financial USD1 features. Source: World Liberty Financial Homepage

WLFI’s mission is mainly targeted at sovereign investors and major institutions, though it appears that individuals will also be able to use USD1.

WLFI token holders can propose and vote on the mission and future of World Liberty Financial. Crucially, WLFI is not currently tradeable, and was only purchasable when it was first released. However, the WLFI team has recently announced that this may change in 2025. If the upcoming WLFI vote to make it tradable passes, then this token is one to watch.

Although WLFI may not match up with the usual listing criteria of Coinbase, the listing of Trump coin was in contrast to Coinbase’s usually apolitical nature, suggesting that exceptions can be made for a project like World Liberty Financial.

Project Snapshot

| Category | TradFi-DeFi Bridge / Decentralized Banking Platform |

| Launch Date | October 2024 |

| Chain | Ethereum, Solana |

| Amount Raised | Over $550 million |

| Current Exchanges | Private presale only. Currently not publicly tradable |

| Coinbase Wallet Support | No |

| Coinbase Roadmap | No |

| Regulatory Profile | KYC-compliant presale, strong political ties (Trump family involvement), may face scrutiny over conflicts of interest. |

| Listing Signals | Potential vote for public transferability, high-profile political connection |

| Coinbase Fit | Speculative: While generally conflicting with Coinbase’s apolitical stance, the listing of Trump Coin suggests exceptions for politically-linked assets. |

New Coinbase Listings for August 2025

Coinbase regularly adds new tokens to its platform, providing investors with access to fresh market opportunities. Here’s a list of some coins that have just been added to the platform or roadmap.

| Coin | Category | Chain | Volume (7-day average) | Market cap |

| BankrCoin (BNKR) | AI Agent / Memecoin | Base Network | $140,700,000 | $47,620,000 |

| Jito Staked SOL (JITOSOL) | Liquid Staking / DeFi | Solana | $395,780,000 | $3,260,000,000 |

| Metaplex (MPLX) | NFT Infrastructure | Solana | $63,910,000 | $136,700,000 |

| ENA (ENA) | Synthetic USD token | Ethereum | $6,702,850,000 | $3,150,000,000 |

Expert Insights & Predictions on Coinbase Listings

Our data-driven research reveals that Coinbase’s new listings consistently follow clear patterns. The exchange prioritizes tokens with strong regulatory clarity, Coinbase Wallet integration, and solid U.S. market demand.

The typical path we observe begins with Coinbase Wallet support, and then it may progress to a full exchange listing. This phased approach helps manage compliance and liquidity risks.

Wallet support means that Coinbase has made the necessary technical changes needed to support the token on its CEX. However, it’s important to note that there are hundreds of coins on the decentralized Coinbase Wallet, and many coins there will not be listed on the exchange.

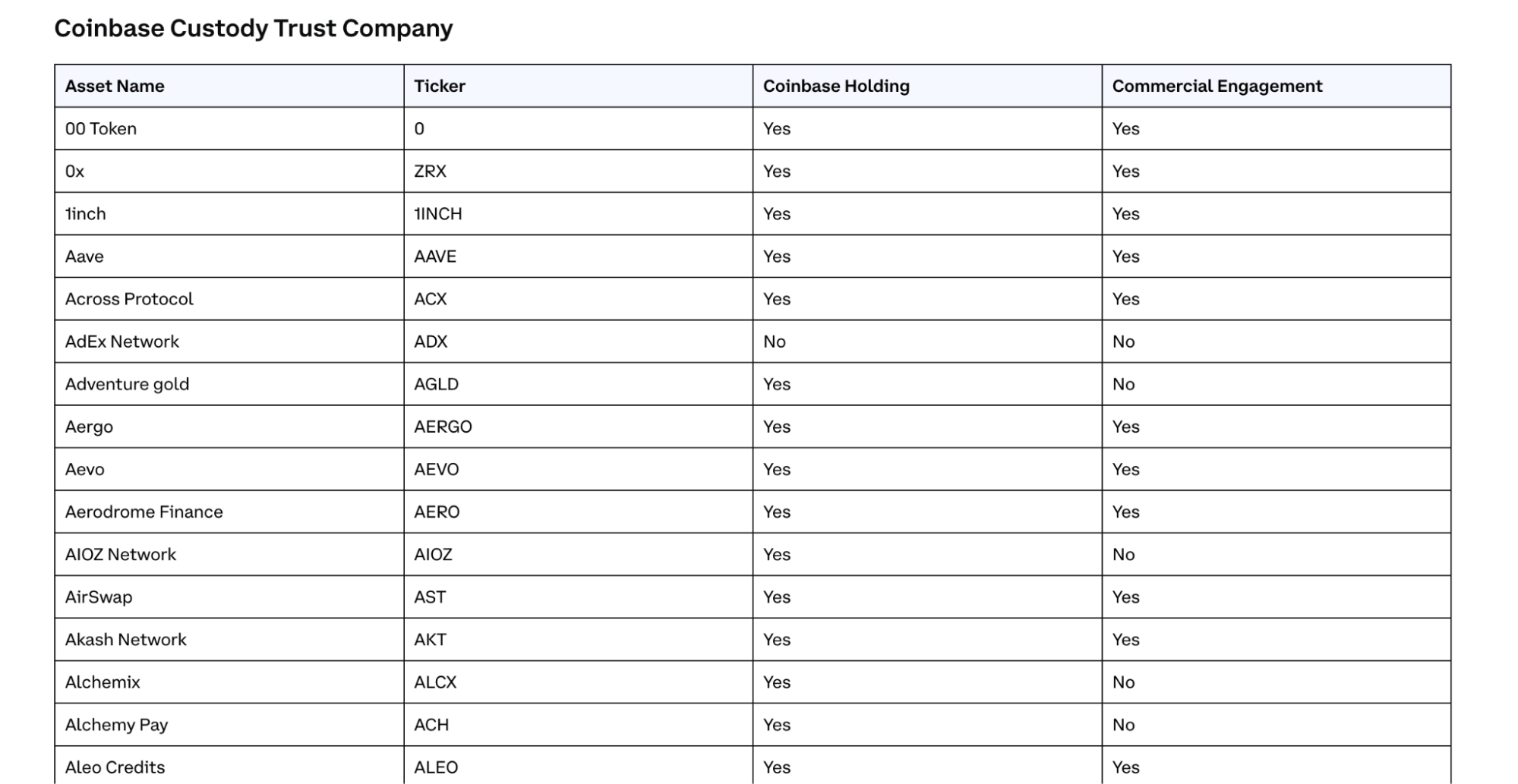

In the past, tracking Coinbase Custody integration was a way to infer a potential exchange listing, but Coinbase no longer officially publishes data to retail traders on what is being integrated into Custody.

However, it’s still possible to discover assets under Custody by checking the legally required Digital Assets Disclosures Page under the Coinbase Custody Trust Company section. Similarly, the Coinbase roadmap used to serve as a place to discover coins under consideration, but as of 2025, Coinbase states that only coins that are going to be listed will be mentioned in the roadmap.

Looking ahead, several key narratives are shaping the upcoming Coinbase listings in 2025. According to Coinbase’s 2025 Market Outlook and recent institutional surveys, AI-driven utility tokens, Layer 2 networks, and real-world asset (RWA) tokenization are the most promising sectors. These trends reflect growing demand for scalable blockchain infrastructure and tokenized versions of traditional financial assets — a space where institutional capital is rapidly moving.

Meme coins are another very popular sector of crypto. Therefore, memecoin that display a lot of traction and longevity are also likely candidates for listing on Coinbase. The recent listing of Fartcoin is a case in point.

A chart showing growing activity on Layer 2s. Source: Coinbase’s 2025 Market Outlook

A table of the rapidly growing ecosystem of crypto AI coins. Source: Coinbase blog

Based on this analysis, we expect Layer 2 tokens, AI tokens, tokenized stablecoins, DeFi coins, DePIN, and RWA-backed assets to lead the next wave of Coinbase listings coming soon. In particular, investors should watch for tokens that demonstrate early Wallet / Custody signals in these categories, as these have historically been strong predictors of expected Coinbase listings.

How We Picked These Upcoming Coinbase Listings (Our Methodology)

Our editorial team employs a structured, data-driven approach to compile this list of upcoming Coinbase listings for 2025. While no listing is guaranteed, we look for repeatable, observable signals that have historically preceded past listings on Coinbase.

Here’s how we selected the coins featured in this guide:

1. Coinbase Roadmap & Public Disclosures

We reviewed Coinbase’s official Roadmap page and the Digital Asset Disclosure Page. Tokens that appear here will shortly be listed on the Coinbase exchange. In the past, a Roadmap inclusion simply meant the asset was a potential for listing, with no guarantees. But this has changed, and as of 2025. If the asset is announced on the Roadmap, it means it will definitely be listed. Tokens that appear in Custody, on the other hand, represent early interest and technical onboarding and are being evaluated internally, but don’t confirm a listing.

2. Coinbase Decentralized Wallet & Custody Support

Coinbase often begins by adding tokens to its self-custodial wallet and/or institutional custody platform before a full exchange listing. This step enables Coinbase to test demand, assess technical integration, and evaluate regulatory alignment. Tokens with ERC-20 or SPL standards and clean tokenomics tend to progress through these stages more quickly.

3. Major Exchange Traction (CMC & CG Tracking)

We tracked which tokens have gained traction on other major centralized exchanges (CEXs), such as Binance, Bybit, and MEXC. Listings on multiple tier-1 or tier-2 platforms often serve as a credibility check, demonstrating that a project meets the minimum technical and compliance standards. We use CoinMarketCap and CoinGecko to measure exchange activity and liquidity.

4. Sector Momentum: What’s Trending in 2025

Coinbase prioritizes tokens in high-demand sectors. For 2025, the trends gaining traction in listings are:

- AI & machine learning tokens

- Layer 2 scaling solutions

- Real-world assets (RWAs)

- Trading bots & telegram utilities

- Modular blockchain infrastructure

- Interoperability protocols

- Meme coins with significant community support

We gave additional weight to tokens operating in these categories.

5. U.S. Regulatory Readiness

Coinbase, being a U.S.-regulated exchange, is highly selective about compliance. We evaluated whether each project:

- Follows KYC/AML best practices

- Is U.S.-team based or U.S.-friendly

- Has public audits or regulatory disclosures

What are the Coinbase Listing Criteria?

Our analysis shows that the exchange considers a combination of legal, technical, and market factors before determining which tokens are added to the platform. Their goal is to add coins that are safe, reliable, and in demand, not just the latest hype.

Based on Coinbase listing criteria and patterns we’ve seen in past Coinbase new listings, here’s what matters most:

Wallet & Custody Integration

Most tokens first appear in Coinbase Wallet or Custody before hitting the exchange. This acts like a trial run — if the token works well and checks out legally, it’s one step closer to a full listing.

Regulatory Clarity & Compliance

Coinbase only lists coins that play by the book. Tokens need to follow U.S. regulations (AML, OFAC checks, and more) and offer transparency around ownership and operations.

Market Demand & Liquidity

A token won’t make the cut if nobody wants to trade it. Coinbase looks for coins with strong volume, active communities, and enough liquidity to support healthy trading.

Institutional & Developer Interest

Projects backed by big investors or active developer ecosystems receive a boost. Currently, AI tokens, Layer 2 networks, interoperability platforms, DeFi, and real-world asset (RWA) projects are attracting significant attention, as reflected in the upcoming Coinbase listings trends.

Technical Soundness

Tokens must meet Coinbase’s technical standards. ERC-20, SPL, ARC-20, and select Layer 2 tokens are the most common. If a project has complex or unusual architecture, it may face delays due to the extra work needed to integrate it with Coinbase.

Tokenomics & Governance

Coinbase avoids tokens with shady setups. They prefer fair distribution, decentralized governance, clean audits, and minimal risk of manipulation — all important when evaluating Coinbase’s new tokens in 2025.

What is The Coinbase Listing Process for New Cryptocurrencies

Understanding the Coinbase listing process can give investors a valuable edge when tracking upcoming Coinbase listings. While Coinbase’s new listings often seem sudden, there’s usually a clear sequence that tokens follow before being fully tradable on the exchange.

The typical process looks like this:

Coinbase Wallet support → Coinbase Custody Inclusion → Roadmap announcement → Limited Exchange listing → Full Exchange listing.

Many tokens first appear in Coinbase Wallet, followed by listing on Coinbase Custody — a service for institutional clients. These integrations serve as a signal, but are not a guarantee that a token will reach the exchange.

While Coinbase no longer formally declares its Custody assets (except to institutions), we found a workaround on the Digital Assets Disclosures Page. Users can scroll down to the “Coinbase Custody Trust Company” section and check which assets are held in custody. Users can check if coins are listed on Coinbase Exchange by searching on Google or another search engine.

However, there is a caveat: the Digital Assets Disclosure Page is, according to Coinbase, updated quarterly. However, at the time of writing, more than three months have passed since the last update. Therefore, most coins with high potential in Custody are already listed.

Top tip: When checking if an asset has been listed on Coinbase, don’t rely on pasting the token name into your Coinbase dashboard, particularly if you are located outside the US. This is because it may be tradable in another location, but not yours. Use a search engine instead and look for the Coinbase blog.

Assets in Coinbase Custody. Source: Coinbase Digital Assets Disclosure.

What happens when an asset is being trialled?

Suppose the token passes compliance and technical reviews. In that case, it may enter the exchange in phased rollouts — often starting with limit orders only, restricted availability in certain regions, or gradual opening of trading pairs. It’s important to note that Coinbase never confirms potential listings in advance, and many tokens with Wallet or Custody support do not progress to a full Coinbase exchange listing.

For investors tracking how to get listed on Coinbase and identifying Coinbase’s new tokens 2025, watching these signals can help spot opportunities, but always with caution, as not every token completes the journey to full listing.

How Often Does Coinbase Add New Coins?

Coinbase does not follow a fixed schedule — listings are driven by each token’s regulatory, compliance, and technical readiness, not by preset timing. As a result, Coinbase’s new listings sometimes happen multiple times in a month, while at other times, weeks may pass with no additions.

In January 2025, Coinbase CEO Brian Armstrong tweeted that with more tokens available than ever before, Coinbase needs to speed up its listing process. He suggests that this may look more like moving from an allow list to a block list with automated scans. Coinbase is still working on this, but we can conclude that Coinbase listings will become more permissive and expansive, with a greater number of tokens eligible for listing by default.

Coinbase’s recent acquisition of LiquiFi supports this intent, making it easier for new projects to launch coins in a way that complies with all the regulatory and technical requirements.

Coinbase regularly updates its Roadmap page, which signals upcoming Coinbase listings. There are typically just a few days in between the Roadmap announcement and listing. To stay ahead, you can track official sources like the Coinbase Blog, Coinbase Assets Official X Page, and CoinbaseSupport for the latest Coinbase roadmap updates and real-time listing news.

Now that you know how often Coinbase new listings appear, let’s explore why these listings matter — and what impact they can have on token prices and market visibility.

Why Coinbase Listings Matter (and What Is the Coinbase Effect?)

Many investors track Coinbase’s new listings closely — and for good reason. Being listed on Coinbase can offer significant advantages for crypto projects. But why do Coinbase listings matter so much?

The key benefits of a Coinbase listing include enhanced trust and visibility, especially in the U.S. market. Coinbase is one of the most regulated and compliant exchanges globally, making it a gateway for many retail and institutional investors. A listing often signals that a project meets high technical and legal standards, which can boost credibility.

Additionally, a Coinbase listing pump — known as the Coinbase Effect — is a well-documented phenomenon. Tokens often experience short-term price spikes, on average around 91%, after being listed on Coinbase, due to sudden exposure to millions of new potential buyers. For example, Shiba Inu (SHIB) and Arbitrum (ARB) both saw notable price increases following their listings on Coinbase.

A graph showing the 5-day token price performance after Coinbase listing in comparison to other exchanges. Source: Yahoo Finance

While not every listing guarantees a pump, inclusion on Coinbase remains one of the most valuable milestones for any crypto project, and a key reason why savvy investors monitor Coinbase’s new listings and their potential market impact.

How to Track Coinbase Listings Before They Go Live

While Coinbase doesn’t confirm listings in advance, there are new listing signals, and public tools that may help you find new Coinbase listings early.

Below, you can find a list of our research-driven suggestions on how to track new potential coins to be listed on Coinbase.

Signals That Coinbase May List a Token

Certain Coinbase listing signals often appear before a full listing. The strongest signs that a coin will be listed include Coinbase Wallet support and a listing on Coinbase Custody. These are often early steps in Coinbase’s process. Other good signals: strong U.S. regulatory alignment, high market capitalization, strong community support, and listings on major centralized exchanges. While not guaranteed, these patterns are worth tracking.

Where to Find New Coinbase Listings First

To find new Coinbase listings, start with the official Coinbase Roadmap and Digital Asset Listings pages — tokens often appear there before an exchange listing. Also, follow the Coinbase Blog. For faster updates, many investors use Coinbase alerts via Twitter bots, DEX tracker bots, and crypto listing calendars. To see what coins are listed on the Roadmap, follow @CoinbaseAssets on X. Additionally, if you follow a project on their Telegram group, they may give advance notice of a Coinbase listing. However, with so many new crypto projects emerging daily, this can be challenging, and you may encounter false rumors.

How to Set Up Coinbase Listings Alerts

Setting up Coinbase new listings alerts helps you act early. Here’s how to do it:

- Start by following @CoinbaseAssets on X.

- Set Google Alerts for “Coinbase new listing” or “Coinbase new coin alert.”

- You can also join Telegram bots that track Roadmap updates.

- Finally, use Coinbase Watchlist listings to get in-app notifications when tokens go live.

Coinbase New Listings Notifications

Here’s how to set up Coinbase’s new listings notifications:

Mobile:

- Follow @CoinbaseAssets with push alerts

- Add tokens to your Coinbase Watchlist

- Use Telegram alert bots like CoinMarketCap

Desktop:

- Set Google Alerts (e.g. “Coinbase listing tracker”)

- Use browser tools like CoinMarketCap Watchlist

- Check the Coinbase Roadmap and Blog regularly

These simple tools help you stay ahead of new coin alerts and listing updates.

Coinbase Wallet Listings vs Exchange Listings

Understanding the difference between Coinbase Wallet and Coinbase Exchange listings is crucial for tracking a token’s progress toward a full listing.

A Coinbase Wallet listing means a token is supported in the Coinbase Wallet app — a self-custody tool that allows users to store, send, and receive tokens directly, and can interact with the BASE blockchain. This integration indicates that the token has passed initial technical checks (such as EVM or SVM compatibility), but it is not currently tradable on the Coinbase Exchange. Still, it often serves as a first signal that a token is on Coinbase’s radar.

The Coinbase Wallet is similar to a decentralized self-custody wallet such as Best Wallet, Phantom, or MetaMask. The user holds the private keys and must look after them. If the private key is lost, there is no way to recover the wallet – hence the term ‘self-custody’.

A Coinbase Exchange listing, by contrast, means the token is fully tradable on the Coinbase trading platform, complete with order books, liquidity, and access through standard Coinbase user accounts. If a user loses their password to their Coinbase Exchange account, the support team can assist them in recovery.

In many cases, tokens first appear in Coinbase Wallet before eventually being listed on the Exchange, but not always. For example:

- SHIB was supported in Coinbase Wallet months before it became tradable on the Exchange in 2021.

- IMX (Immutable X) was added to Wallet and Custody first, then listed with full trading support.

- BONK, a Solana meme coin, appeared in Wallet before being added to the Exchange as user demand surged.

This Wallet-first strategy gives Coinbase time to evaluate regulatory, technical, and market readiness before committing to a public listing.

Coinbase Wallet vs Exchange Listings — Key Differences

| Feature | Coinbase Wallet | Coinbase Exchange |

| Purpose | Self-custody and storage | Buying, selling, and trading |

| Availability | Wallet app only | Coinbase.com or the mobile app |

| Token support | Broader, earlier-stage tokens | Curated, trade-ready tokens |

| Listing signal | Often, a first step | Final step with liquidity support |

| Example tokens | BONK, SHIB (pre-listing), IMX | SHIB, IMX, ARB |

Tracking Coinbase Wallet support is a smart way to get ahead of potential Exchange listings — but it’s not a guarantee.

Check official support pages to track real-time status:

You can also refer to Coinbase’s official guide on listing prioritization:

Pros and Cons of Buying Coins Before a Coinbase Listing

Here’s a quick look at the early crypto investing pros and cons when considering whether to buy before a Coinbase listing:

Pros

- Potential upside from the Coinbase Effect — prices often spike when a coin lists on Coinbase.

- Early entry point — buying pre-listing can mean lower prices.

- Liquidity boost — Coinbase listings often drive higher trading volume and awareness.

Cons

- Listing delays or cancellations — not all tokens with signals will be listed.

- Low liquidity pre-listing — harder to enter/exit large positions.

- Misleading rumors — not all Coinbase presale strategy tips are accurate; many coins are hyped without real progress.

- Regulatory risks — unlisted tokens may face compliance challenges or legal uncertainty.

As with any strategy, buying ahead of Coinbase new listings comes with both potential rewards and risks, so how should you approach these opportunities overall?

Conclusion — Are These Coinbase Listings Worth It?

As we’ve explored, a Coinbase listing can offer major visibility, trust, and potential price momentum for a token. Many Coinbase 2025 listings will likely benefit from the exchange’s strong U.S. presence and institutional reach.

However, not every project is guaranteed success, and not every Coinbase coin is legit simply because it appears on the platform. Each listing carries its own set of risks, ranging from regulatory hurdles to market volatility.

The most effective approach is to stay informed: monitor official listing signals, follow key market trends, and conduct your own due diligence before investing.

FAQs

What coins will Coinbase add next?

Where does Coinbase announce new listings?

How do I find upcoming Coinbase listings?

How often does Coinbase list new coins?

Does a Coinbase Wallet listing mean a coin will be listed on the exchange?

What is the Coinbase Effect, and is it real?

Is it smart to buy coins before they list on Coinbase?

How do I get notified when Coinbase adds a new coin?

References

- Asset Listing Process (Coinbase)

- Coinbase Exchange Listing Prioritization Process and Listing Standards (Coinbase)

- 2025 Crypto Market Outlook (Coinbase)

- Increasing Transparency For New Asset Listings on Coinbase (Coinbase)

- Coinbase Blog (Coinbase)

- What Types of Crypto Does Wallet Support (Coinbase)

- Coinbase Effect Means Average 91% Token Price Gains (Yahoo Finance)

- Messari Monthly June 2025 Report (Messari)

- Upcoming Coinbase Listings (Ico Bench)

- Potential New Coins Coming to Coinbase (Economic Times)

- Top 10 Upcoming Coinbase Listings in 2025 (Coinpedia Markets – Medium)

- Coinbase Reports $2.3 Billion Revenue and Regulatory Progress in Q4 2024 (BeInCrypto)

- Coinbase’s Calvert: Staying ‘Token Agnostic’ For New Listings (Bloomberg)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Looking for the best low cap crypto in 2025? Our detailed research methodology has revealed some undervalued coins with high growt...

This guide explains how to buy SUBBD token, a content subscription platform that merges artificial intelligence (AI) with blockcha...

34 mins

34 mins

Otar Topuria

, 13 postsOtar Topuria is a crypto writer on Coinspeaker with over 3 years of experience in <strong> fintech and cryptocurrency analysis </strong> . He focuses on market movements and investment trends, exploring the narratives behind their patterns. His work has also appeared on Insidebitcoins. Before specializing in crypto, he contributed to the IT sector by writing technical content about software development and emerging technologies. With a master’s degree in comparative literature, he developed analytical precision and the skills to break down complex concepts into clear ideas. Otar is particularly interested in <strong>early-stage project discovery and crypto trading</strong>, bringing a deep understanding of market dynamics to his content.