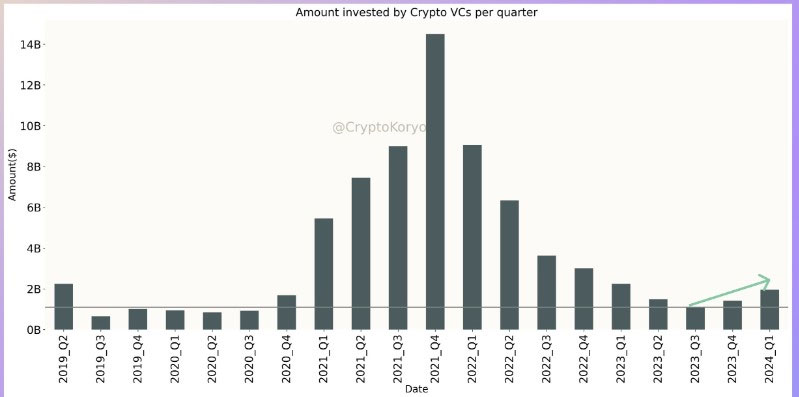

The first quarter of 2024 has marked a significant turning point for the crypto industry, with venture capital (VC) investments witnessing a substantial rebound, breaking a two-year downtrend.

According to data analyst Crypto Koryo, there has been a 38% increase in the funds invested, coupled with a 49% rise in the number of projects receiving funding, signaling a renewed confidence in the crypto space. This resurgence draws parallels to the investment patterns observed in the fourth quarter of 2020, preceding a massive influx of venture capital into the sector.

Photo: Crypto Koryo

Investment Highlights and Key Players

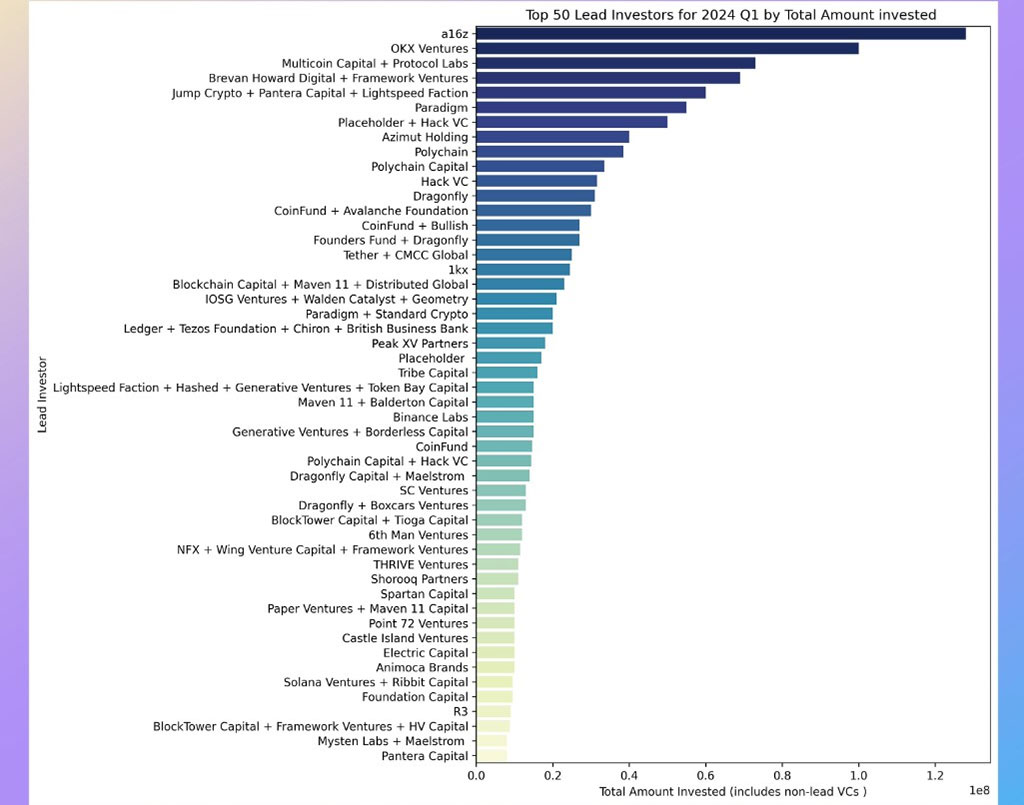

Photo: Crypto Koryo

VC funding has seen an impressive upsurge, with over $2 billion being injected into various projects, a 38% increase from Q4 2023. This period also saw an uptick in the number of projects funded, reaching 250. Notably, the investment landscape in March alone boasted an astonishing $1.1 billion across 180 investments, highlighting a month-on-month jump of 52.50%.

Leading the charge were crypto-native VCs like Andreessen Horowitz Crypto, OKX Ventures, Multicoin Capital, Paradigm, and Polychain, which dominated the investment sphere, marking a shift from previous quarters dominated by banks and non-crypto VCs.

Insights from the Front Lines

A cohort of nine prominent venture capitalists shed light on the driving forces behind this remarkable first quarter. With a total capital of $2.52 million raised across the crypto and blockchain sectors, the sentiment amongst investors is reminiscent of the enthusiasm seen in 2021. This investment spree is attributed to several factors, including landmark legal victories, burgeoning interest in DeFi platforms like Solana, and a general increase in demand for cryptocurrencies following regulatory approvals in the US.

Alex Felix, co-founder and chief investment officer at CoinFund, observed:

“During the first quarter, there was a careful optimism in the crypto venture capital funding environment, which marked a recovery from two challenging years of fundraising hurdles faced by both firms and fund managers.”

Where Are Investments Flowing?

The revived interest in crypto VC funding has spotlighted areas ripe for innovation and growth. Investments have surged in sectors ranging from DeFi and SocialFi to Bitcoin layer-2 solutions. Web3 gaming and AI-integrated blockchain technologies are also attracting significant venture capital attention, indicative of the market’s appetite for groundbreaking developments in the crypto space.

A Founder-Friendly Market

The competitive landscape has created a founder-friendly environment where entrepreneurs wield greater leverage in fundraising endeavours. This dynamic has resulted in accelerated deal-making, with investors keen on not missing out on promising opportunities. As a result, valuations have spiked, with pre-seed rounds seeing valuations under $10 million in crypto consumer spaces and sectors like crypto and AI reaching valuations upwards of $300 million.

A Promising Horizon for Crypto VC

As we advance through 2024, the early-stage funding space in crypto is expected to maintain its heat, driven by a combination of institutional interest and macroeconomic factors such as the upcoming Bitcoin halving and potential rate cuts in the US. However, the landscape remains dynamic, with regulatory developments poised to play a pivotal role. In conclusion, the first quarter of 2024 has reignited enthusiasm and optimism in the crypto venture capital space.