$SOLX Sale Ends in 72 Hours – 35B Tokens Burned, $55M+ Funding Locked In

With only 72 hours remaining to buy below the listing price, Solaxy (SOLX) has intensified anticipation for its exchange debut by burning an additional 20 billion SOLX – pushing the total burn to 55 billion tokens, all ahead of its official launch.

This aggressive move boosts token scarcity and value, further strengthening confidence as Solaxy prepares to launch. The team recently released its updated launch schedule, confirming that token claims and the bridge activation will go live on June 23 – the same day this final purchase window closes.

There’s speculation that the exchange listing could also happen on or shortly after that date, though details remain under wraps. Given Solaxy’s $55 million in early-stage funding, some believe a tier-one exchange listing could be in the works – and that may explain the tight-lipped rollout.

What’s certain is this: buying SOLX in the next 72 hours means getting in below listing price, before the token hits the open market – a rare position of strength in a launch this size.

With SOLX currently priced at $0.001766, this may be the last time it’s available at this level – potentially marking it as the token’s all-time low in hindsight – especially if history repeats itself with the kind of post-listing surges we’ve seen from other high-profile launches.

Big Players Are Stacking SOL Positions as Developer Activity Surges

Solana has increasingly captured the attention of institutional investors, with DeFi Development Corp. emerging as one of the largest holders of SOL among public companies.

They are joined by Upexi and SOLol Strategies, the latter of which recently filed for a Nasdaq listing. As of late May, DeFi Development Corp. held approximately 620,000 SOL, Upexi held nearly 680,000 SOL, and SOLol Strategies reported holdings of around 420,000 SOL.

So, what’s driving these firms to accumulate significant positions in SOL?

In the case of DeFi Development Corp. the shift is particularly noteworthy. Formerly known as Janover, a real estate-focused company, it has since pivoted into the crypto space – rebranding and even acquiring its own Solana validator node as part of a broader commitment to the ecosystem.

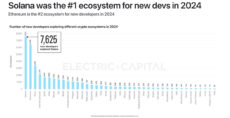

The likely catalyst for this institutional confidence is Solana’s developer momentum. While Ethereum still leads in total smart contract activity, analysts at Cantor Fitzgerald have noted a clear uptick in developer growth on Solana, signaling that the network is gaining serious traction among builders.

This is backed by findings from Electric Capital, which reported that in the past year, Solana attracted 7,625 new developers, surpassing Ethereum’s 6,456. It marked the first time since 2016 that another network outpaced Ethereum in new developer onboarding.

But it’s not just Upexi, SOLol Strategies, and DeFi Development Corp. taking notice. Major financial institutions behind Solana ETF filings – including Grayscale, VanEck, 21Shares, Bitwise, Canary Capital, and Franklin Templeton – are also increasing their exposure to the network.

Solana’s Surge in Capital and Developer Activity Finds Support in Solaxy

The reason new developers are increasingly building on Solana ultimately comes down to speed, cost-efficiency, and accessibility. Solana’s monolithic architecture enables high throughput and low transaction costs – all without relying on the fragmented patchwork of Layer-2 solutions that Ethereum depends on.

However, this design isn’t without drawbacks, as Solana’s history shows. Handling all activity on a single chain has, at times, led to network congestion, transaction failures, and even temporary outages during periods of peak demand.

But with a confirmed launch date of July 7, the solution is finally arriving: Solaxy.

As the first Layer-2 chain built for Solana, Solaxy is designed to act as the network’s scalability and stability layer – offloading excess demand, easing congestion, and helping ensure Solana performs reliably under pressure.

Unlike Ethereum’s Layer-2s, Solaxy isn’t trying to fix Solana – it’s built to support it. With more development, user activity, and institutional investment flowing in, Solana’s uptime is more critical than ever – and Solaxy is here to make sure it holds.

Solaxy will also introduce a suite of tools to support builders and users across the ecosystem. These include a bridge connecting Solana, Solaxy, and Ethereum, a native DEX called Neptoon, a public block explorer, a token launchpad named Igniter, and a developer-friendly knowledge base.

Combined, these form a complete Layer-2 infrastructure that not only enhances Solana’s throughput – but unlocks entirely new opportunities for real-time dApps, gaming, DeFi, and more.

With Its Base Established, Solaxy Aims to Show SOLX Can Rise Alongside Solana

Now that the foundation has been set, all eyes are on what comes next – and the big question is whether SOLX can replicate the kind of breakout gains that Solana once delivered.

The fundamentals are there. With a fully SVM-compatible Layer-2 architecture, Solaxy gives developers the space to build high-throughput apps without clogging the mainnet. It could even evolve into the testing ground for next-gen DeFi protocols, gaming platforms, and applications that push Solana’s limits.

The SOLX token is at the center of all this – powering transaction throughput, staking, and developer incentives. And with 55 billion SOLX now permanently burned – worth around $97.13 million at today’s price – supply is tightening at a crucial moment.

That burn represents a staggering 40% of the total supply, locking in a level of scarcity that’s rare at this stage of a project.

At dawn from the gateway to Mars, the launch of Starship’s second flight test pic.twitter.com/ffKnsVKwG4

— SpaceX (@SpaceX) December 7, 2023

If a major exchange listing follows, that kind of setup has historically triggered explosive price discovery.

The countdown’s already on.

Don’t Miss the Final Window to Enter SOLX Below Market Value

With just 72 hours remaining, this is the final opportunity to acquire SOLX below its listing price – a window that could prove pivotal for those seeking early-stage exposure.

For many, missing out on Solana’s early breakout was a hard lesson in timing. Today, Solaxy presents a similar moment – not as a competitor, but as a critical Layer-2 solution designed to address the very limitations holding Solana back from its full potential.

As the only project of its kind in the Solana ecosystem, Solaxy stands to play a key role in scaling the network’s future – and with that, the potential for SOLX to appreciate significantly as adoption increases.

To participate, visit the Solaxy website, connect a supported wallet, and purchase SOLX. Newly acquired tokens can be staked immediately, with the protocol currently offering a dynamic 76% APY based on pool activity.

For optimal performance, users are encouraged to use Best Wallet – the recommended noncustodial Web3 wallet with full presale integration and multichain support.

Stay informed by following Solaxy on Telegram and X.

Visit Solaxy.io

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.