In order to create a strong financial market, strict regulatory base must be implemented within the cryptocurrency environment.

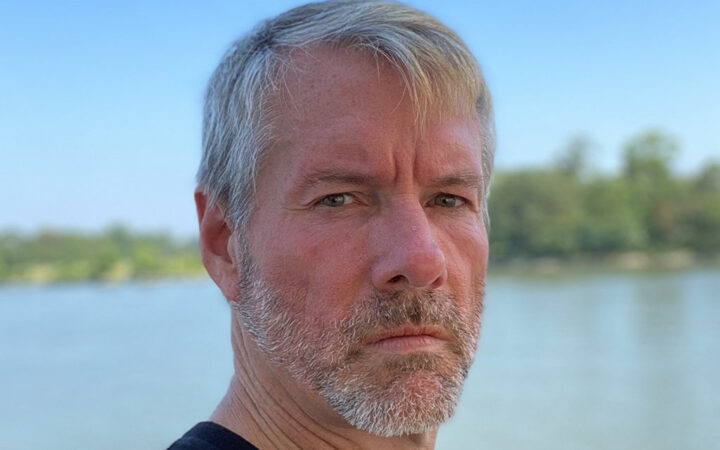

Michael Novogratz, a somewhat legendary figure, a $3.2 bln investor and former manager of the multi-billion dollar investment firm Fortress, predicts that the cryptocurrency market can reach $5 trillion by 2022.

Novogratz speaks positively about Bitcoin and Ethereum, the key digital currencies of the $100 bln market. Not to sound hollow, Novogratz reveals that 10 percent of his net worth, which at least accounts for hundreds of millions of dollars, is invested in a diverse portfolio of cryptocurrencies including Bitcoin, Ethereum and Litecoin.

“The Nasdaq got to $5.4 trillion in 1999, why couldn’t it be as big? There’s so much human capital and real money being poured into the space and we’re at the takeoff point,” said Novogratz.

Novogratz underlines the necessity of strict regulatory base within the global cryptocurrency exchange market that can really turn it into a major financial market. As for now, many markets including Japan, China, South Korea, Australia, the Philippines, Singapore and Hong Kong among others have introduced necessary regulation to encourage people use digital currencies.

China that has one of the leading cryptocurrency markets in the world is now planning to develop reasonable regulation for smaller markets such as the initial coin offering (ICO) market that has gained increasing interest from investors since the beginning of 2017.

It is obvious that the cryptocurrency market and most of cryptocurrencies are still in the early stages of development. Ari Paul, portfolio manager for the University of Chicago’s $7.5 bln endowment, supposes that only major currencies such as Bitcoin, Ethereum, Litecoin and Ethereum Classic are likely to survive while others will apparently decline in value.

“Most cryptos, like most companies, will eventually be worth zero. This is the nature of competition. Buy and hold is a strategy, not safety,” he said.

Bitcoin has been leading the cryptocurrency market so far. But the formula that takes into account the growth of the real world economy alongside the digital one demonstrates that everything can change and makes some surprising claims.

Besides, recent statistics shows that Bitcoin, although has been holding its market cap dominance of more than 90% for quite a long, dropped below 80% before falling even below 50%. Meantime, two other digital currencies, Ripple and Ethereum, demonstrated fast growth in market capitalization lately, which caused bitcoin dominance to drop under the threshold.

Generally speaking, such cryptocurrencies as Ethereum, Litecoin and Ethereum Classic have gained much attention from both individual and institutional investors recently. All of them differ in strategies, philosophies, monetary policies and purpose. For instance, Ethereum, creates an intermediary-free network of applications providing an infrastructure for decentralized autonomous organizations (DAOs) and decentralized applications (DApps). Meanwhile, Ethereum Classic is more similar to Bitcoin in the sense that it has a fixed and deflationary monetary supply.