A new crypto presale, Remittix (RTX), wants to solve the problem of global remittance with a payment network that sends cryptocurr...

Best Low Cap Crypto in 2025: Top Undervalued Coins with Growth Potential

41 mins

41 mins Our analysis suggests that the best low cap crypto in 2025 is Bitcoin Hyper, a Layer 2 and DeFi solution for Bitcoin.

This project aligns with the continued institutional demand for BTC BTC $123 795 24h volatility: 0.2% Market cap: $2.47 T Vol. 24h: $69.20 B . The US government CLARITY and GENIUS Acts remove regulatory uncertainties, making DeFi an important sector for growth. Our research shows that FLUID FLUID $6.55 24h volatility: 0.2% Market cap: $502.94 M Vol. 24h: $6.90 M stands out due to its use case of crypto borrowing and lending.

The ETH price ETH $4 534 24h volatility: 0.3% Market cap: $548.10 B Vol. 24h: $37.65 B has risen significantly, so growth for ERC-20 coins is likely. PEPENODE, a low-cap ERC-20 meme coin, is a potential contender.

We selected these and other coins based on our detailed research methodology, which includes surveying over 60 coins, examining market signals, project communities, teams, tokenomics, use cases, and more.

Best Low Market Cap Crypto Coins to Watch in October 2025 – Top Picks

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Build your own virtual meme coin mining rig.

- 100% virtual and requires no additional computing power.

- Top miners get additional bonuses in Pepe, Fartcoin, and other meme coins.

- Fastest meme coin sniper on Solana and EVM

- Multichain Telegram bot with lowest fees and instant execution

- Snipe new tokens before bots and whales

- Exclusive in-app access to vetted crypto presales

- Staking rewards with an annual percentage yield (APY) of up to 152%

- Upcoming Best Card enables crypto spending at millions of merchants with cashback

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

Key Takeaways

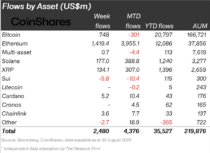

- A record $4.39B in net inflows went into ETFs in August 2025, according to CoinShares, creating a favorable environment for undervalued altcoins.

- Bitcoin Hyper, a BTC Layer 2, has raised $21.66M, indicating growth potential, as BTC BTC $123 795 24h volatility: 0.2% Market cap: $2.47 T Vol. 24h: $69.20 B rises.

- Maxi Doge and PEPENODE are likely to benefit from the growing memecoin market cap, now at $86.5B (CoinGecko snapshot, Sep 11, 2025).

- REI network and Hash AI are low-cap plays set to benefit from growing global adoption of AI, which has a CAGR of 35.9%, according to Founders Forum Group.

- Identifying top low-cap crypto opportunities requires finding strong use cases, transparent tokenomics, and active community engagement.

Top 11 Low Market Cap Crypto List in 2025

After analyzing the market and applying our detailed methodology, we have selected these 11 coins as promising for October [curyear] and beyond. Well-timed investments and risk diversification are key.

- Bitcoin Hyper (HYPER) – BTC Layer 2 scaling solution using Solana’s virtual machine

- Maxi Doge (MAXI) – Low-cap Dogecoin spin-off dedicated to building a degen trading community

- Fluid (FLUID) – DeFi platform offering lending, borrowing, and swaps

- PEPENODE (PEPENODE) – First mine-to-earn memecoin

- Snorter (SNORT) – Solana meme coin trading and sniping bot on Telegram

- REI Network (REI) – Gasless high-speed blockchain with AI integration

- Best Wallet (BEST) – Multi-chain and presale-focused crypto wallet token

- Hash AI (HASHAI) – AI-powered and optimized crypto mining company

- SUBBD (SUBBD) – Fan and influencer co-creation platform on web3

- SpacePay (SPY) – UK-based crypto payment processor (POS) solution

Best Low Cap Crypto Gems with Potential – Analysis and Reviews

Here are 11 of the best low-cap crypto that our analysis uncovered. These opportunities may be suitable for those seeking high-risk, high-reward, low-market-cap plays.

1. Bitcoin Hyper (HYPER) – First BTC Layer 2 Built on Solana

Bitcoin Hyper is a Layer 2 for Bitcoin based on Solana’s Virtual Machine (SVM). The project aims to reduce transaction fees and enable dApps, DeFi, and fast payments on BTCs. The team has built early prototypes that validate SVM execution inside the rollup model.

Bitcoin Hyper Tokenomics. Source: Bitcoin Hyper

HYPER is a utility token. Holders can stake it to earn APYs of 56%, participate in governance, and pay gas fees.

Bitcoin Hyper details:

- Why It’s Promising: HYPER is stepping in to fill the gap left by BTC’s lack of smart contracts

- Suitable For: BTC bulls, Layer 2 fans, DeFi and infrastructure plays

- Investment Narrative: Over $290B is locked in DeFi; HYPER positions Bitcoin to access part of it

- Caveats: There are several BTC Layer 2s on the market, including Stacks STX $0.60 24h volatility: 1.1% Market cap: $1.09 B Vol. 24h: $25.28 M , which brings competition

- Access: On the presale page with ETH, BNB, USDT (ERC-20 & BEP-20), and credit card

| Project | Bitcoin Hyper |

| Category | Bitcoin Layer 2 / DeFi |

| Chain | Proprietary (Bitcoin Layer 2) |

| Market Cap | $258.3M |

| Presale Price | $0.013065 |

| Amount Raised | $21.66M |

| Presale Ends In | Loading...

|

| Audited? | Yes (Coinsult, Hacken) |

| Status | Presale |

| Community | >16.2k across Telegram and X |

2. Maxi Doge (MAXI) – Low-cap Dogecoin Spin-Off Dedicated to Building a Degen Trading Community

Maxi Doge is a dog-based memecoin that satirizes the degen high-leverage trading culture. It draws on the narrative of established coins like Dogecoin DOGE $0.25 24h volatility: 2.0% Market cap: $38.44 B Vol. 24h: $3.00 B and Shiba Inu SHIB $0.000012 24h volatility: 0.5% Market cap: $7.37 B Vol. 24h: $291.17 M , but with a humorous gym-bro aesthetic.

Maxi Doge Presale. Source: Maxi Doge

The MAXI token offers staking opportunities, with an APY of 125%. Token holders will gain access to a community trading group. The website also mentions upcoming trading competitions to boost engagement.

Maxi Doge details:

- Why It’s Promising: Fully diluted low market cap of $37M. The roadmap mentions a MAXI leverage platform

- Suitable For: Meme coin traders, small cap flippers, Dogecoin investors, leverage traders, and stakers

- Investment Narrative: Dogecoin is among the top 10, showing the potential of dog-themed memecoins

- Caveats: Like most meme coins, MAXI may keep its momentum or lose traction over time

- Access: On the presale page with ETH, BNB, USDT, USDC, or a bank card

| Project | Maxi Doge |

| Category | Meme Coin |

| Chain | Ethereum |

| Market Cap | $37.6M |

| Price | $0.000261 |

| Amount Raised | $2.78M |

| Presale Ends In | Loading...

|

| Audited? | Yes, according to the whitepaper |

| Status | Presale |

| Community | Over 12k followers on X and Telegram |

3. Fluid (FLUID) – Multi-chain DEX, Lending and Borrowing DeFi Protocol

Fluid is a multi-chain DeFi protocol that provides decentralized lending, borrowing, and a DEX. Users receive APYs for supplying assets. The platform has substantial industry support and funding, backed by Coinbase Ventures, Animoca Ventures, Pantera Capital, and Standard Crypto.

Fluid Lending page offering 10% APR on lending Tether. Source: Fluid Homepage

The FLUID token grants holders governance rights, and rewards users who provide liquidity or stake assets. FLUID is used for transaction fees, and buy-backs and burns to help stabilize the price.

Fluid details:

- Why It’s Promising: FLUID’s larger market cap points to lower risk and moderate gains

- Suitable For: DeFi traders, borrowing plays, Solana, Ethereum, Base, and Arbitrum fans

- Investment Narrative: FLUID has $3B in total value locked (TVL). DeFi lending attracted $53B in Q2 2025

- Caveats: The price may face pressure from token unlocks

- Access: DEXs on Ethereum, Arbitrum, Polygon, and Base. CEXs like Bitget and MEXC

| Project | Fluid |

| Category | DeFi Protocol / Multi-chain DEX, Lending and Borrowing |

| Chain | Ethereum, Arbitrum, Polygon, Base, Solana via Jupiter Lend |

| Market Cap | Around $300 million |

| Price | FLUID $6.55 24h volatility: 0.2% Market cap: $502.94 M Vol. 24h: $6.90 M |

| Audited? | Yes, core contracts and liquidity layer are documented and designed for security |

| Status | Live and listed on multiple DEXs and CEXs (e.g., Uniswap v3, Bybit, OKX, MEXC, Gate, BitMart, LBank) |

| Community | 38k X followers |

4. PEPENODE (PEPENODE) – First Mine-to-Earn Memecoin

PEPENODE is a memecoin and virtual mining game on Ethereum where players manage server farms to earn tokens. It addresses the lack of utility of most memecoins by providing an engaging GameFi experience.

PEPENODE Official Website. Source: PEPENODE

According to the roadmap, the game will launch after the TGE. PEPENODE will let users build custom mining rigs, earn rewards, and take participate in PEPE PEPE $0.000010 24h volatility: 1.1% Market cap: $4.12 B Vol. 24h: $553.80 M and FARTCOIN FARTCOIN $0.67 24h volatility: 0.8% Market cap: $668.80 M Vol. 24h: $229.23 M airdrops. Now, PEPENODE offers staking with 794% APY for investors who purchase on Ethereum.

PEPENODE details:

- Why It’s Promising: GameFi experience with a live leaderboard and airdrops

- Suitable For: Gaming enthusiasts, APY hunters, memecoin traders, and early-stage investors

- Investment Narrative: The game is targeting the $91B memecoin market (CoinGecko, September 18, 2025)

- Caveats: Success will depend on keeping players engaged and attracting new miners, as rewards decrease over time

- Access: On the presale page with ETH, BNB, USDT (ERC-20 & BEP-20), and credit cards

| Project | PEPENODE |

| Category | Memecoin / Virtual Mining |

| Chain | Ethereum (ERC-20) |

| Market Cap | Presale phase (est. <$5M) |

| Price | $0.0010874 |

| Amount Raised | $1.68M |

| Presale Ends In | Loading...

|

| Audited? | Smart contract-based transparent mechanics |

| Status | Presale |

| Community | 8,632 holders and |

5. Snorter Bot (SNORT) – Sniping, Swapping, and Copytrading Bot on Solana

Snorter Bot is a Telegram-based tool providing fast execution when sniping Solana meme coins. According to the website, the bot will provide MEV and rug pull protection, copytrading and trading algorithms. The project aims to expand to other chains, such as Ethereum and Polygon.

Snorter Bot Tokenomics. Source: Snorter Bot

The SNORT token is a utility meme coin that provides holders with governance, access to discounts and special features, and can be staked at an APY of 113%

Snorter Bot details:

- Why It’s Promising: SNORT offers low swap fees and trading tools from the Telegram app

- Suitable For: Meme coin traders, DeFi Degens, Copy Traders, Solana meme narrative bulls

- Investment Narrative: Crypto bots could grow 14% yearly, driven by Solana dApps like bonk.fun

- Caveats: The team is anonymous, smart contract audits offer reassurance

- Access: On the presale website with ETH, USDT, USDC, BNB, SOL. Card options available

| Project | Snorter Bot |

| Category | Utility Meme Coin / Trading Bot |

| Chain | Solana, Ethereum, BNB (planned for Polygon, Base) |

| Market Cap | $49M |

| Price | $0.1065 |

| Amount Raised | $4.19M |

| Presale Ends In | Loading...

|

| Audited? | Yes (SolidProof and Coinsult) |

| Status | Presale (until October 20, 2025) |

| Community | Over 14,000 followers on X (Twitter) |

6. REI Network (REI) – Fast Gassless Blockchain Targeting AI and High-Speed Applications

REI Network, formerly GXChain, is a PoS blockchain offering a lightweight, gasless solution for dApps, improving the way AI and crypto work together. It is designed to support high-speed industries that use micropayments, such as GameFi.

REI network ecosystem dapps. Source: REI network

REI’s ecosystem currently comprises a range of dApps for staking, lending, swapping, NFTs, and stablecoins, social and messenger apps, and cloud computing for AI. REI holders can stake their tokens to help secure the network and earn up to 10% rewards, while also making on-chain transactions without gas fees.

REI Network details:

- Why It’s Promising: Low-cap coin with a strong community, facilitating the integration of AI, games, and DeFi

- Suitable For: AI investors, Blockchain Layer 1 fans

- Investment Narrative: REI is on trend, integrating blockchain and AI – a powerful narrative in 2025

- Caveats: This project has been in development for several years, but it remains at an early stage

- Access: On CEXs such as Binance, KuCoin, MEXC Global, or via crypto wallets

| Project | REI Network |

| Category | Blockchain Token / AI / GameFi / DeFi / NFT |

| Chain | Proprietary (EVM compatible) |

| Market Cap | Around $16M |

| Price | |

| Audited? | Yes, Coinscope |

| Status | Listed |

| Community | Active support with 130k X followers and over 46K Discord members |

7. Best Wallet (BEST) – Non-Custodial Wallet with a Focus on Presales

Best Wallet is a self-custody wallet with a DEX and bridge, designed to simplify access to presales with a built-in ICO launchpad. It supports 60+ blockchcains, enabling users to hold and swap tokens within the app.

The Best Wallet Ecosystem. Source: Best Wallet

Holders can stake BEST to earn 81% APY. In the future, they’ll get lower transaction fees and access to exclusive features. Binance’s TWT TWT $1.41 24h volatility: 1.7% Market cap: $588.76 M Vol. 24h: $44.55 M , the Trust Wallet token, is up over 33,000% since its all-time low (CoinGecko, September 11, 2025).

Best Wallet details:

- Why It’s Promising: A feature-rich product with 500K+ downloads on Google Play

- Suitable For: Meme coin traders, High risk/reward potential, Presale buyers, mid-long term plays

- Investment Narrative: The Delphi Digital ‘fat wallet thesis’ suggests that wallet providers will find new utilities and use cases

- Caveats: The Best Wallet app is unavailable in the UK for regulatory reasons

- Access: On the Best Wallet presale website, in ETH, USDT, USDC, BNB, SOL, and Cards

| Project | Best Wallet |

| Category | Utility Coin / Wallet Token |

| Chain | Ethereum (supports 60+ blockchains) |

| Market Cap | $253M |

| Price | $0.025745 |

| Amount Raised | $16.31M |

| Presale Ends In | Loading...

|

| Audited? | Yes (Coinsult) |

| Status | Presale |

| Community | Over 250,000 active monthly users, 64,246 presale holders |

8. Hash AI (HASHAI) – Crypto Mining Company Using AI to Maximise Short-Term Profit Opportunities

HashAI is a UK-based startup aiming to make crypto mining more effective with AI optimization and renting out rigs and nodes. Its Twitter displays videos of new mining hubs under production.

Hash AI homepage. Source: Hash AI dApp

Investors should note that the GoPlus smart contract scanner has identified the possibility for the token owner to modify the token, which could make it unsellable. However, HashAI has been KYC’d by Assure DeFi.

HashAI is an on-trend play with AI and RWAs, and has delivered gains of 30% or more during wider market rallies.

Hash AI details:

- Why It’s Promising: Hash AI claims to be deploying a lot of high-value miners, offering more token use cases

- Suitable For: AI and mining investments, RWA investors, high reward / high risk, short-term plays

- Investment Narrative: AI market is still wide open, VCs and retail investors seeking new tokens

- Caveats: Success depends on physical infrastructure under construction, with no guarantee of completion

- Access: On Uniswap (Ethereum); CEXs, including MEXC, Bitget, and BitMart

| Project | Hash AI |

| Category | Mining |

| Category | AI / Mining / RWAs |

| Chain | Ethereum (ERC-20), Multi-chain Layer 1 Blockchains |

| Market Cap | $30M |

| Price | [NC] |

| Audited? | Yes (As per project documentation/third-party mentions) |

| Status | Launched / Actively Traded |

| Community | Active (Regular updates, social media engagement, growing user base) |

9. SUBBD (SUBBD) – AI and Fan Content Creator Platform

SUBBD is a SocialFi project that connects a Web2 network of content creators to blockchain and AI. The platform aims to keep fees low and simplify content production with AI tools. It also lets fans generate AI content with influencer permission.

SUBBD presale details. Source: SUBBD

The project says its platform already connects 2,000 creators and 250K followers. The ecosystem runs on the SUBD token, which gives users access to premium content, livestreams and tools on the platform, and can be staked for APY.

SUBDD details:

- Why It’s Promising: SUBBD’s 250M creator network reach could make the coin undervalued if it shifts them to web3

- Suitable For: AI-powered plays, Content/Fan business models, Bridging web2 businesses into web3

- Investment Narrative: SUBBD tackles high social platform fees by using AI to cut costs and boost earnings for creators and fans

- Caveats: Competition from social media is huge. Success will rely heavily on marketing

- Access: On the SUBBD presale page

| Project | SUBBD |

| Category | AI / Creator Economy / Web3 |

| Chain | Ethereum |

| Market Cap | $56M |

| Price | $0.0566 |

| Amount Raised | $1.24M |

| Presale Ends In | Loading...

|

| Audited? | Yes (SolidProof and Coinsult) |

| Status | Presale |

| Community | Over 250 million followers (platform reach), 2,000 top influencers |

10. SpacePay (SPY) – Enabling Easy POS Crypto Payments for Retailers and Customers

SpacePay is a UK-based fintech developing a protocol for retailers to accept cryptocurrencies from customers using regular cards. No new hardware is required. The platform works alongside Moonwell, which facilitates easy onboarding and sending of fiat payments.

SpacePay’s explanation about their POS solution. Source: SpacePay

SpacePay’s business model is designed to benefit from the ongoing movement toward digital payments in everyday life, such as PayPal’s new ‘Pay with Crypto” service for merchants. SPY is the project’s utility token, providing a share of revenue from fees and governance rights.

SpacePay details:

- Why It’s Promising: SpacePay is offering a POS solution that could help integrate cryptocurrency spending into everyday life

- Suitable For: Payment processors, bulls on mass adoption of crypto, and TradFi to crypto bridge bulls

- Investment Narrative: Relaxed regulations and US laws like the GENIUS Act are driving mass crypto adoption

- Caveats: SPY has not been audited, and presale traction has been slower than anticipated

- Access: On the SpacePay official presale website using ETH, BNB, MATIC, AVAX, USDT, USDC, or a bank card

| Project | SpacePay |

| Category | Payment Processor / Fintech |

| Chain | ERC-20 |

| Market Cap | $108M |

| Price | $0.003181 (Tiered pricing, increases at each stage) |

| Amount Raised | Over $1.1 million |

| Audited? | Not yet audited |

| Status | Presale |

| Community | Over 70,000 followers on X (Twitter) |

Low Cap Crypto Presale and Launch Timelines

Here is a list of some of the best low-cap crypto currently in presale, offering a potential opportunity to get in early. The prices will increase as the launch timelines approach, as will the market cap.

| Token | Launch Date | Presale Status | Market Cap |

| Snorter | Q4 2025 | Ongoing | $46.85M |

| Bitcoin Hyper | Q4 2025 | Ongoing | $258.3M |

| PEPENODE | Q4 2025 | Ongoing | $479K |

| Best Wallet | Q1 2026 | Ongoing | $200M |

| SUBBD | Q4 2025 | Presale | $56M |

| Spacepay | Q1 2026 | Presale | $108M |

Why 2025 Is Big for Low Cap Crypto

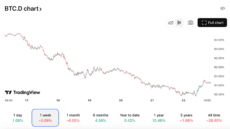

Price action shows that 2025 is a significant year for low-cap crypto, as BTC has been pushed to new all-time highs. This bull run has primarily focused on the appreciation of large-cap crypto like BTC, SOL, and XRP, but as we enter the second half of 2025, things are beginning to shift.

BTC dominance remains relatively high but is declining as investors take profits and rebalance into other smaller-cap coins, in an attempt to increase portfolio safety and create potential for greater gains.

Bitcoin’s dominance is decreasing on the weekly chart. Source: TradingView

While macro-political tensions have caused a shaky financial market at times in 2025, they have also presented opportunities to ‘buy the dip’. Either way, institutions continue to invest in Spot ETFs, while companies add crypto to their treasuries, ushering in new all-time highs.

More and more types of ETFs are being approved or pre-approved by the SEC, with BlackRock filing for a staking ETF for ETH. Our analysis shows that this wider momentum is capturing the attention of retail investors, which may help drive the altcoin season.

Record inflows for Ethereum spot EFTs in 2025. Source: CoinShares

Another reason for low-cap cryptocurrencies to grow in late 2025 is that VCs and large companies are emerging from a risk-averse stance and investing in early-stage companies.

DeFi Protocols, Telegram bots, meme-based tools, Layer 2s, and AI/virtual agents continue to drive retail attention. People are returning to web3, with lending platforms continuing to innovate and offer DeFi users ways to increase their investments through yields.

Some of the best opportunities can be found in low-cap crypto in 2025, though, of course, there are also risks, such as being unproven and with a high failure rate. Newer coins that have not experienced a previous bull run typically have fewer holders, resulting in less selling pressure and greater growth potential. A lower market capitalization means that fewer big buys and sells are needed to move the price, creating the possibility for bigger gains and losses.

To find the best low-cap coins, research and find on-trend narratives. Look for coins with promising teams and decent tokenomics. If people can get excited about an idea, it creates the hype it needs to push token prices higher, sometimes substantially. Look for previous coins that are similar and have performed well. Using coins with a market cap of under $200 million means a successful project can see gains of 10x to 100x or more.

Early Signs of Low Cap Crypto with High Potential

There are various signs that a low-cap crypto may have high potential, including being discussed, regulatory changes, and more. Here are things we look out for:

Trending Narratives

Trending narratives are usually everywhere, but they can be spotted in places such as Google Trends, Coinbase, Messari State of Crypto reports (and other prominent analysts), in letters from TradFi heads to their shareholders, on Crypto Twitter, and of course, which coins are continuously trending on social media and also in the charts.

A Bigger Cap Coin with a Similar Idea Is Mooning

This also relates to trends. If, for example, BTC or XRP is going up, but many people feel that they are too expensive to invest in, then this drives some investors to similar, smaller-cap coins.

Big Partnership or Hints at Institutional Adoption

For a company like SpacePay, for instance, a partnership with SWIFT or Mastercard can be huge. Although some partnerships are more active than others, any that bring tokens closer to fulfilling their use cases or being adopted by institutions should be noted.

Regulatory Issues or Changes

One of the reasons XRP is performing well currently is that, for years, it was hindered from reaching its full potential by regulations. The current US administration is more crypto-friendly, and changes like the CLARITY Act or the GENIUS stablecoin bill can provide clues about which coins are likely to move into the spotlight. Other countries also continue to adjust their crypto policies, which is also relevant.

High Community Engagement

Sometimes, a project takes off at the right moment. Suppose a project experiences strong community growth on social media or is consistently mentioned in crypto groups. This can be a sign that a low-cap crypto has high potential. Be aware of shillers who promote for money rather than belief.

Platform / Token Use Case

If a platform has a genuinely sought-after use case, and the tokenomics and token use cases reflect growth, this is another sign of high potential. High token utility, especially those with deflationary fee-burning mechanisms, is a way to push coin prices and demand higher.

Low Market Cap Crypto That Exploded in the Past and What We Can Learn?

Through an analysis of previous low-cap cryptocurrencies that have exploded, we can identify various themes. Meme power is strong, but timing is difficult. New technology is often risky but can also be highly profitable.

| Token | Launch Price (approx.) | Peak Price (approx.) | ROI (Launch to Peak) | Key Catalysts |

| Pepe (PEPE) | $0.000000001 (April 2023) | $0.00002803 (Dec 2024) | 62,070% | Tier-1 exchange listings, strong meme community support, and a deflationary mechanism |

| Bonk (BONK) | $0.000000001 (Dec 2022) | $0.00005825 (Nov 2024) | 54,080% | Solana ecosystem integration, widespread airdrops, and major exchange listings |

| Kaspa (KAS) | $0.0001699 (Nov 2021) | $0.207609 (Aug 2024) | 110,000% | Development of the GHOSTDAG protocol, high block rates, focus on scalability, and decentralization |

| SPX6900 (SPX) | $0.001318 (Aug 2023) | $2.05 (July 2025) | 115,449% | Community engagement, satirical branding, deflationary tokenomics |

Time: They took time to reach their all-time highs. PEPE PEPE $0.000010 24h volatility: 1.1% Market cap: $4.12 B Vol. 24h: $553.80 M achieved its all-time high of $0.00002803 in December 2024, approximately 19 months after its launch in April 2023. BONK BONK $0.000020 24h volatility: 2.3% Market cap: $1.54 B Vol. 24h: $362.02 M reached its peak of $0.00005825 in November 2024, about 23 months after its December 2022 launch. SPX6900 reached an all-time high of $2.05 in July 2025, approximately 23 months after its launch in August 2023.

New Concept: Kaspa KAS $0.0753 24h volatility: 2.0% Market cap: $2.02 B Vol. 24h: $63.30 M introduced an innovative concept utilizing DAG technology to empower small-scale miners, resulting in high community engagement, rising prices, and a notable pump following its listing on a tier 1 exchange.

These tokens were either memes or new ideas and technology that attracted significant community attention. Coins that make it to tier 1 and 2 CEXs often experience big pumps and increased demand.

How We Picked These Low-Cap Crypto Projects – Our Methodology

Our methodology included an analysis of over 60 small-cap currencies, ideally with a market cap of under $50M. We added a few notable exceptions with larger market caps for diversification, but most were kept under that level to maximize potential growth opportunities.

Projects can use Coinsult to check their coin: Source: Coinsult Github

We considered the growth rate of each coin, taking into account its community size and the rate of growth.

Social signals are considered, for example, FLUID attracting $2.5B in TVL, and SUBBD having access to influencers with a reach of 250 million fans.

The token use case is also a big factor. So we identified tokens that occupy important positions in their ecosystem or have mechanisms to stabilize the price, such as burning or fee generation. Coins with strong presale traction were also favoured.

Tokenomics play a significant role in our analysis, as they can either make or break a project or impact the timing and duration of investment. We considered the impact of various token unlocks and disqualified projects with unsustainable tokenomics.

Project narratives are essential for small-cap coins, so we considered coins in on-trend sectors such as AI, Layer 2s, trading, DeFi, and memecoins, as well as related presales. We also searched for older coins that are pivoting into new lucrative sectors or developing on blockchains with a larger reach.

Project transparency can be hard to find with low-cap crypto, but it’s something we considered and tried to present any potential risks that we saw. Projects that show consistent roadmap growth and have clear whitepapers are prioritized.

We noted audit statuses and KYC statuses where available, providing this information below the project details.

Liquidity and CEX support, as well as DEX support, were other factors that influenced our analysis. Many low-cap coins are not yet listed on Tier 1 and 2 exchanges, as pumps tend to follow afterward. We also measured liquidity on DEXes where possible, to ensure that it is possible to cash out from medium to large positions.

We considered the various risks associated with investing in low-cap projects and looked for coins with a potentially asymmetric risk-reward ratio.

What Is a Low Market Cap Crypto?

Low-cap market coins are tokens or crypto coins with market capitalizations of around $50-200 million. Tokens like this include Bitcoin Hyper, Fluid, REI Network and Maxi Doge.

Here’s a low-cap crypto explained:

It’s the token supply multiplied by the price of the coin, for example:

10 billion (token supply) x $1 (price) = $10,000,000

Let’s say we have a token called DOGG. If the price of our token is $1 and our token supply is 1 million. Then, the market capitalization of DOGG is $10 million.

What is the price range of a low-cap crypto?

In crypto, a low market capitalization is often considered to be around $50M or less, as these coins, while risky, offer early-stage entry into coins with a chance at high returns. However, due to the difficulty of finding good low-cap projects, we’ve also looked at coins with a market cap as high as $200M, which is still considered a low cap.

How do low market cap coins compare to traditional finance?

Market capitalization is similar, though not exactly the same, as a company valuation in traditional finance. The same principle applies to risk and reward.

Smaller, low-cap coins are comparable to smaller companies on the stock market. They are probably not well-known yet and don’t have a large investor base. However, both could have a lot of potential, provided investors are aware of the inherent risks associated with investing in early-stage businesses.

Smaller companies on the stock market often experience substantial rises in value following news that their company has discovered a valuable resource, developed a groundbreaking technology, secured a strategic partnership, or devised a lucrative business model. Many, though, peak and do not necessarily recover. There are no guarantees. Low-market-cap crypto coins can rise and fall in response to similar news and tend to be more volatile than traditional finance companies.

Risk/Reward Tolerance with low capitalization coins and companies

Bigger companies, such as NVIDIA, and cryptocurrencies like XRP have produced high yields and proven products that are in demand. Like any business model, they are sensitive to risks, such as competition. However, they are more likely to hold or even accrue value than to lose it, unlike many smaller, newer businesses.

This makes them a possibly safer bet than small-cap cryptocurrencies, or at least a lower risk-to-reward ratio. Due to their large valuations or market caps, the growth potential for high-cap investors is significantly smaller than for low-cap investors who entered at discounted prices during ICOs and investor rounds.

This is often why crypto gem hunters seek low-cap coins – they believe they can see undervalued potential.

With big-cap coins, there is another risk: many investors entered at a lower price, which can create selling pressure. While the growth potential can be lower, it can be more reliable. Any trading comes with risk, and price action is unpredictable, but these stocks are considered blue-chip.

Risks and Rewards of Low-Cap Crypto in Trading

low-cap crypto offer investors the chance to bet on promising companies and crypto platforms that could have the potential to grow substantially over a relatively short period.

However, the risk is higher, as they may be unproven or have a small community and small market share.

They may also face stiff competition from other cryptocurrencies in the market.

They do offer a potential for greater reward if their project is successful, for early backers. Up to 100x is possible with a low-cap crypto that explodes.

Why a Low-Cap Crypto Can Explode

Many low-cap crypto projects will be new ventures, with their future technology still in development. Others may be up-and-coming projects that are beginning to mature in the market, gain attention, or have recently pivoted into a new space, such as low- to mid-cap COTI, for example.

COTI has shifted from a payments chain and released a new privacy-focused Layer 2 using garbled circuits, bringing it in line with the trending regulatory compliant privacy narratives of 2025.

These kinds of statuses and developments can be a way for a low-cap crypto to gain attention and potentially explode.

Volatility

Newer low-cap crypto coins with a smaller holder base can be easily subject to dramatic fluctuations in price, both up and down. If a large holder decides to sell, then that can bring down the cost. However, if the token and platform gain new adoption, this can lead to a massive price increase.

Medium-sized buys can have a big impact on tokens with a market cap of less than $50M, for better or worse.

Social Virality

Social virality and community support are important ways for early-stage low-cap coins to grow. And community members may become very loyal and vocal on social media.

New ideas, technological breakthroughs, and strong community engagement can attract new users and influencers to promising low-cap altcoins, bringing more attention to potentially undervalued projects. If potential buyers see a lot of positive social mentions, they can feel incentivised to invest their capital.

Staking Rewards

Many new and early-stage coins and protocols offer high staking rewards, which is a way of increasing the size of your holdings. These are often provided for by a share of the tokenomics. The value, of course, depends on the coin’s future price action.

Token Burns

Token burns can help support or even increase the price of cryptocurrencies by reducing the supply. Both small and large projects often employ token burns, such as BNB or SHIB. But for smaller-cap coins, the effect is more dramatic.

Exchange Listings Impact

Many low-cap coins and ICOs launch on Web3 first, due to the lower barrier of entry. The price can fluctuate depending on market conditions, tokenomics, and various other factors. The ideal scenario is that the coin of choice rises due to increased demand and effective marketing, as new entrants discover the project; however, the result varies widely, with some coins rising dramatically and others falling dramatically.

The Coinbase and Binance Effect

As a coin gets more popular, it may be able to list on a CEX. If/when a coin is listed on Coinbase, Binance, or any other tier 1 or tier 2 centralized exchange, it will often cause a price pump. This gives the project a signal of seriousness, by passing through the rigorous criteria needed for regulatory compliance and other factors.

Still, like everything else, this is no guarantee of future success, but rather a guide to the common patterns observed in the crypto markets.

How to Buy Low Cap Crypto

For really new coins, the best way to find them is by checking new listings on CoinGecko, CoinMarketCap, DEXTools, or Jupiter Alpha. As they are decentralized, DEXtools and Jupiter will display more fresh pairs, but also some honeypot scam coins.

The new cryptocurrencies page on CoinGecko. Source: CoinGecko

Another option is to use a bot like Snorter, which can provide details of new coins and even assist you in buying safely (but ensure you trust the bot and use a new wallet).

Many Telegram channels utilize bots that list new pairs, some of which are free. You could even make your own TG channel and have new pairs get listed.

Choose a presale from their official website, or a DEX like Uniswap or Raydium, if the coin has recently launched.

Find presales and new coins via the Best Wallet App.

Now that you’ve found a coin you want to invest in, ensure your decentralized wallet, such as Best Wallet or Zerion, has funds. And if not, you can onramp via a CEX or in wallet.

The Best Wallet login page. Source: Best Wallet app

Enter your login details, then navigate to the DEX or website of your choice. Click ‘Buy $HYPER’ in the top right corner, then select ‘Wallet Connect’ or one of the suggested wallets: Best Wallet, MetaMask, or Base Wallet. ONLY ever connect to sites that you trust. When buying presales and new coins from new sources, consider using fresh wallets to ensure added security.

The top right corner features the ‘Buy HYPER’ option. Source: Bitcoin Hyper website

Check the token safety in advance by reviewing what DEXtools says about it, and enter the URL into TokenSniffer. Ensure you find the correct token address. One way is by looking at Coingecko. Click it, and it will be copied to your clipboard.

Click the number next to ‘Contract’. Source: CoinGecko

Then we get something like this:

- 0xe2cfd7a01ec63875cd9da6c7c1b7025166c2fa2f

Even if a coin passes all the checks, be aware that new coins are inherently risky and low liquidity issues can still arise.

You can check liquidity pool sizes using DEXtools and similar. If coins have been listed on an exchange, then liquidity is likely to be high enough.

Where to Buy the Best Low-Cap Crypto

Buying low-cap cryptocurrencies typically occurs through decentralized exchanges (DEXs) or during presales, often before they are listed on larger centralized exchanges (CEXs).

Decentralized Exchanges (DEXs)

These are the main venues for new or smaller tokens, enabling direct peer-to-peer trading. You’ll need a compatible decentralized wallet (e.g., MetaMask, Phantom) funded with the blockchain’s native cryptocurrency for gas fees.

- Ethereum-based: Uniswap, SushiSwap, Balancer

- Solana-based: Raydium, Jupiter, Orca, Phoenix

- BNB Chain (formerly BSC): PancakeSwap, ApeSwap

- Polygon: QuickSwap, Uniswap

- Avalanche: Trader Joe, Platypus Finance

Tier 1 Centralized Exchanges (CEXs)

These are the industry’s largest and most liquid exchanges. While low-cap projects typically don’t launch on Tier 1 exchanges, gaining a listing on one is a significant milestone that often indicates project maturity and wider recognition. Popular Tier 1 exchanges include:

Tier 2 Centralized Exchanges (CEXs)

These platforms often bridge the gap, listing emerging projects after they launch on DEXs but before they reach Tier 1 exchanges. Tier 2 exchanges include:

Discovery Tools

Identifying promising low-cap projects early is vital. Here are some tools to make that easier.

- DEXTools – Provides real-time charts, trading data, and analytics for DEX listings, including contract safety assessments.

- CoinGecko – Useful for tracking prices, market capitalization, and discovering emerging projects via its “Recently Added” and “Trending Coins” sections.

What Are the Risks of Investing in Low Cap Crypto?

The main risks of investing in a low-cap, crypto asset include volatility, liquidity issues, scams, project failures, and exchange risks. The unproven nature of many small crypto teams is another factor to consider. Here’s a summary of the most important risks to consider

Volatility

With a small-cap crypto, one of the biggest risks is volatility. Only a small amount of money is needed to make large swings in the token price. If a whale is waiting to sell a large amount of your token, the price could drop sharply. A coin may never recover.

Liquidity issues

Small-cap coins often have liquidity issues and fragmented liquidity. This means traders may fail to sell at the desired price or incur significant losses due to high slippage. In some cases, it may not even be possible to cash out a large position. Jupiter’s Dex Aggregator smart routing system helps to mitigate this, but is only usable on Solana.

Rugpulls

Small-cap crypto are often unproven, and the team may be planning a scam or rug pull. There are also many fake copycat websites. Always double-check that you find the correct company, token (by contract address), and socials. Due diligence is important, but nothing can completely protect you from this kind of risk, especially with new cryptocurrencies and unknown teams.

Business failure

Many good business ideas fail for various reasons. According to Exploding Topics, 45% of startups fail within the first five years. Even if the project is acting in good faith, with a capable team, the company behind the crypto may go out of business. With an inexperienced team from a smaller-cap company, the risks are even higher.

Smart contract vulnerabilities

Many small-cap cryptocurrencies are only available on decentralized platforms, which can lead to smart contract risks and vulnerabilities. If the project’s smart contracts are hacked or exploited, this could also result in the loss of funds that are usually unrecoverable.

Exchange risks

Exchanges can be a safer way to purchase low-cap coins, but they can also be hacked or exploited, as seen with Mt. Gox or FTX, and can freeze accounts indiscriminately, often with limited recourse to recover them.

Centralized exchanges may also delist small currencies without much warning if they fail to meet their expected volume and demand. You can bridge your currency out, but the delisting might result in a fall in value, and if you’re too late, you may miss the transfer window.

Pros & Cons of Best Low Cap Crypto Coins Explained

An analytical review should weigh upside and risk. For low-market-cap coins in 2025, here are the key considerations.

Pros of Low Cap Crypto

- High upside potential – small inflows can move price meaningfully if adoption grows.

- Early access to innovation – exposure to new protocols, dApps, and trends before they scale.

- Community-driven growth – engaged holders can accelerate development and awareness.

- Agility – smaller teams often pivot and ship faster than large ecosystems.

Cons and Risks of Low Cap Crypto

- High volatility – thin order books amplify rapid gains and losses.

- Low liquidity – slippage and harder exits at size.

- Scam exposure – pump-and-dumps, rug pulls, weak fundamentals are more common.

- Limited track record – immature codebases, few partners, uncertain viability.

- Regulatory uncertainty – evolving rules may restrict access or usage.

- Manipulation risk – whale activity can sway price in low-volume markets.

Is It Legal to Invest in Low Cap Crypto in 2025?

In most jurisdictions, individuals can legally buy and hold low-cap crypto, but issuers, exchanges, custodians, and marketing are regulated. The details differ by region, and several countries still restrict or prohibit certain activities. Always check local rules before transacting.

United States

Owning and trading crypto is generally lawful. Specific tokens may be securities if they meet the Howey “investment contract” test. The SEC’s FinHub framework explains how that analysis applies to digital assets.

Crypto can also fall under commodities oversight. U.S. courts and the CFTC recognize virtual currencies as commodities under the Commodity Exchange Act, giving the CFTC enforcement authority over derivatives and fraud/manipulation in spot markets.

For taxes, the IRS treats digital assets as property. New broker reporting via Form 1099-DA phases in for 2025 gross proceeds and 2026 basis reporting.

States can add licensing. New York’s BitLicense covers “virtual currency business activity,” but ordinary individuals buying or holding do not need a license.

United Kingdom

Buying and holding is permitted, but promotions to UK consumers are tightly regulated. From 8 October 2023, qualifying cryptoasset promotions must comply with FCA rules, including risk warnings, appropriateness checks, and authorization/approval requirements.

European Union

MiCA now provides an EU-wide rulebook for issuers and crypto-asset service providers. Stablecoin rules took effect on 30 June 2024; the broader CASP regime has been in place since 30 December 2024.

Investing in low cap crypto is legal, but services must be provided by authorized firms under conduct and disclosure requirements.

Asia

Requirements across Asian jurisdictions differ significantly, ranging from outright prohibitions to tightly licensed retail access with strict AML/KYC controls. The snapshots below cover key markets. Verify local rules before transacting.

- China. Mainland authorities deem crypto trading-related business activities illegal under a 2021 notice, and enforcement has reinforced the ban.

- India. Investing is permitted but subject to tax and AML regulations. Gains on “virtual digital assets” are taxed at 30% and 1% TDS on transfers since 2022. The FIU has enforced local registration against offshore exchanges and imposed penalties.

- Singapore & Hong Kong. Both permit retail access through licensed providers, subject to strict conduct and investor-protection requirements. MAS has issued custody and retail-risk rules for DPT service providers (Singapore). Hong Kong’s VATP regime, effective June 1, 2023, allows retail access on licensed platforms, subject to token listing and suitability safeguards.

Africa

No single framework applies uniformly across the continent, particularly for low-cap crypto trading and marketing. Two major markets help illustrate the spectrum.

- South Africa. Crypto assets are classified as financial products under the FAIS Act, which brings providers within the FSCA’s licensing and supervision framework. Authorities have approved dozens of CASP licenses.

- Nigeria. Following banking curbs in 2021, the CBN issued guidelines on December 22, 2023, allowing banks to service VASPs under AML controls. The SEC adopted digital-asset rules in 2022 and proposed amendments in 2024–2025 to strengthen the VASP regime.

Final Verdict – Is Low Cap Crypto Worth It in October 2025?

Low-cap crypto refers to tokens with relatively small market values, typically in the sub-$200M range. These assets are early stage and less widely held, which can create room for repricing if adoption accelerates. Advantages include earlier access to innovation, faster shipping teams, and the potential for asymmetric outcomes, balanced by higher volatility and liquidity risk.

Our top pick for October 2025 is Bitcoin Hyper (HYPER), a Bitcoin-focused Layer 2 aiming to make BTC useful in everyday apps with faster, cheaper transactions. It targets a real gap on Bitcoin and positions itself to route DeFi and payments activity to BTC. Note that HYPER is a presale token, which makes any upside strictly speculative and execution-dependent.

Two alternatives stand out for different reasons. Maxi Doge (MAXI) is a culture-first meme coin built around degen trading, where community and narrative can drive bursts of attention if the roadmap delivers. Fluid (FLUID) offers a live DeFi stack for lending, borrowing, and swaps across major chains, giving exposure to utility and on-chain activity rather than pure narrative. Both have thesis-driven appeal, but their risk profiles differ: MAXI is momentum-sensitive, while FLUID’s path depends on sustained usage and token design.

Our final advice? Treat every low-cap as high risk. Size positions conservatively, diversify across narratives, track presale traction, unlock schedules, audits, listings, and real user activity, and use secure wallets and reputable venues. And above all, never invest more than you can afford to lose.

FAQ

What is the best low cap crypto to invest in 2025?

Which low cap crypto has the most potential?

Are low cap coins riskier than large caps?

Where can I buy low market cap crypto?

How do I find promising low cap tokens?

What’s the difference between penny crypto and low cap crypto?

What does “microcap” mean in crypto?

Are low-cap AI tokens a good bet in 2025?

References

- Fluid Project Profile (Messari)

- Trending Cryptocurrencies (CoinGecko)

- Total Value Locked (TVL) Protocols (RWA) (DeFiLlama)

- Chart of the Week: Memecoin Index vs Bitcoin (CoinDesk Data)

- Investors Pour $727M into Spot Ether ETFs as Altcoins Pump (CoinTelegraph)

- Crypto Venture Capital Q1 2025 Report (Galaxy Research)

- US Crypto Policy Tracker: Regulatory Developments (Latham & Watkins LLP)

- Crypto Week: Market Insights (Betashares)

- What Is Bitcoin (BTC) Dominance? Chart Explained (Gemini Cryptopedia)

- H.R.3633 – 119th Congress (2025–2026): Digital Asset Market Clarity Act of 2025 (Congress.gov)

- AI Statistics 2024–2025: Global Trends, Market Growth & Adoption Data (Founders Forum Group)

- Top Meme Coins by Market Cap (CoinGecko)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

In this guide, we explain how to buy OZ tokens during the presale, what makes the project unique, and the risks involved in this e...

Want to trade Solana futures but need some expert-led guidance? Read our beginner’s guide on how to trade SOL futures safely in 20...

Fact-Checked By:

Fact-Checked By:

Otar Topuria

Crypto Editor, 21 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.