BlockchainFX (BFX) is positioning itself as a crypto-native trading "super app" that lets users seamlessly move across crypto, for...

Best Crypto Wallets for September 2025 – Top Bitcoin Wallets Compared

47 mins

47 mins This guide helps beginners choose the right wallet provider for their needs. We rank and review the 10 best crypto wallets for 2025.

Best Wallet leads our picks of best crypto wallets in September 2025. It combines non custodial security, multi chain coverage, built in swaps, and a presale launchpad in one app. MetaMask and Trust Wallet also make the cut for EVM and mobile users, thanks to strong dApp connections and simple setup.

In our methodology we score wallets on security and custody, chain and token support, user experience, DeFi and dApp integration, pricing, and reputation. We weigh these factors to rank the top options and map them to common use cases.

This guide shows our top choices and helps you pick the wallet that fits how you invest, trade, and store assets.

11 Best Crypto Wallets to Use in September 2025

Here’s a curated list of the best crypto wallets for investors in 2025:

- Best Wallet – The Overall Best Crypto Wallet App for iOS and Android Users

- MetaMask – The Most Popular Browser Wallet for Ethereum and EVM-Based Tokens

- Trust Wallet – Globally Popular Wallet App Supporting Over 100 Network Standards

- Exodus – Great Choice for Storing Digital Assets on Windows or Mac Software

- Phantom – Highly Rated Hot Wallet for Storing and Trading Solana Tokens

- Trezor Safe 5 – Best Hardware Solution for Investors With a Security-First Mindset

- Ledger Stax – Premium Hardware Wallet With E Ink Touchscreen and Multi-Asset Support

- Base App (formerly Coinbase Wallet) – A Good Option for First-Timers Seeking Non-Custodial Storage

- Electrum – The Best Open-Source Desktop Wallet for Safely Storing Bitcoin

- Zengo – Innovative Crypto Wallet App Leveraging Multi-Party Computation Security

- Binance Wallet – Best Option for Users Integrated Into the Binance Ecosystem

Reviewing the Best Bitcoin Wallets

Security, supported blockchains, user-friendliness, fees, and device types are just some considerations to make when choosing the best crypto wallet.

The following reviews cover everything you need to know about the top providers. Read on to make a smart and informed choice.

1. Best Wallet – Our Top Wallet Pick for Storing Cryptocurrencies on a Mobile Device

Best Wallet is a non-custodial mobile wallet for iOS and Android with a built-in launchpad for top crypto presales. It supports 60+ networks and thousands of assets with multi-wallet management, cross-chain swaps, and staking.

Users can set up a wallet with just their email address and buy crypto with a card or PayPal, where available. In the future, the team plans to add a portfolio management feature, launch a desktop wallet browser extension, and issue a crypto debit card.

Best Wallet Official Website. Source: Best Wallet

Best Wallet is suitable for you if:

- You demand full custody of your crypto assets, but still want Face ID or biometric convenience

- You actively buy, swap, or manage tokens across dozens of blockchains from your phone

- You prioritize privacy and prefer a wallet that doesn’t require personal information or KYC

- You want an all-in-one mobile solution to access Web3 apps, token presales, and DeFi tools

- You’re looking for a balance between security, speed, and ease of use in a non-custodial setup

Best Wallet is not suitable for you if:

- You prefer wallets with a long track record and millions of existing users, like MetaMask or Trust Wallet

- You need a fully developed browser extension today, not one that’s still in active development

- You mostly manage your portfolio from a desktop and rely on browser-based tools

- You want built-in customer support or recovery services offered by custodial platforms

| Type | Non‑custodial mobile wallet |

| Chains | 60+ blockchains (supports 1,000+ cryptos including BTC, ETH, SOL, BNB) |

| Standout Use | Instant swaps via built‑in DEX, fiat purchases, and launchpad/presale access |

| Best For | Active mobile users seeking full control, privacy (no KYC), and Web3 access |

| Fees | Free app with zero service or DEX fees; only network/gas charges apply |

Visit Best Wallet Official Website

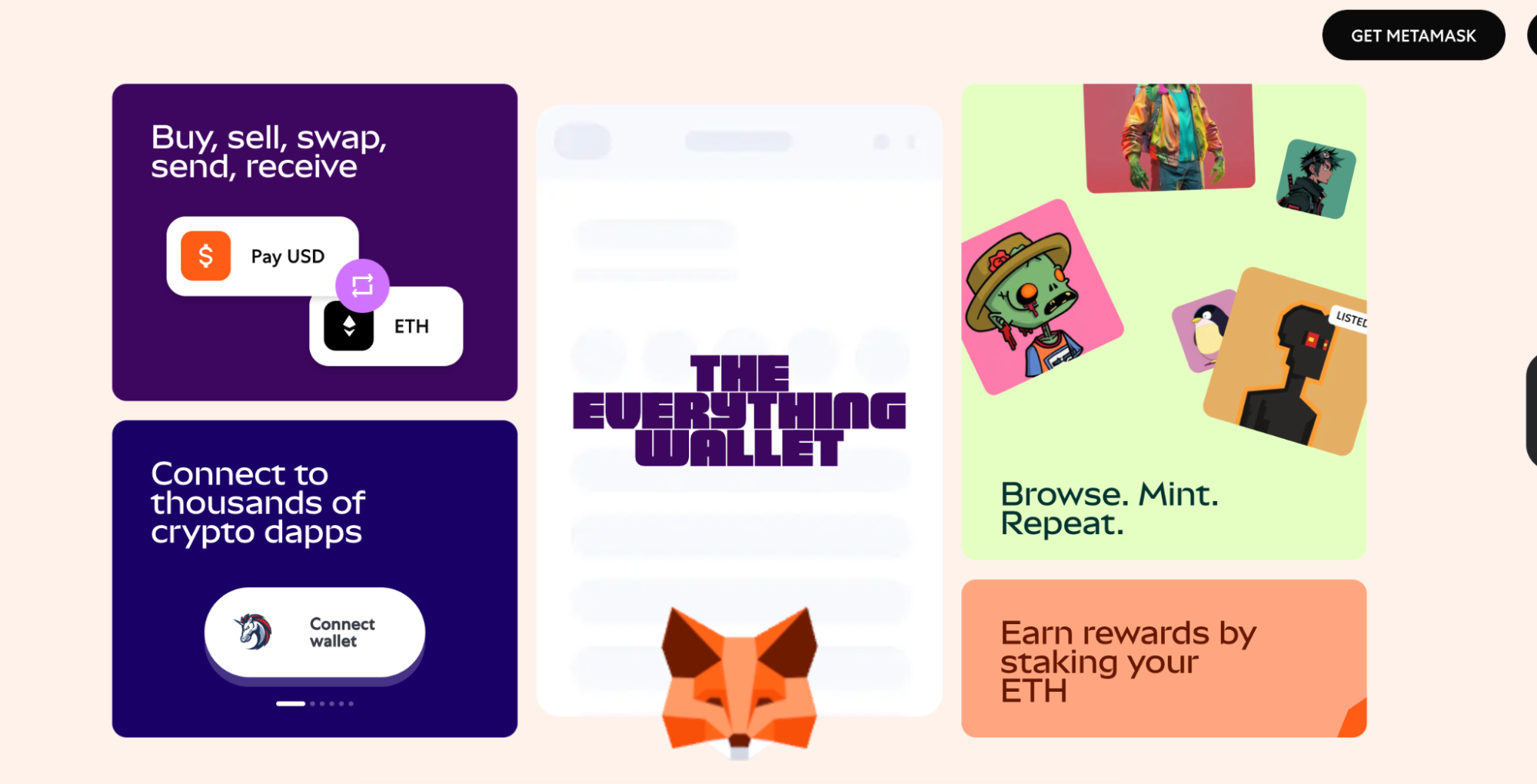

2. MetaMask – Top-Rated Hot Wallet Extension With Over 100 Million Users Worldwide

MetaMask is a non-custodial wallet available as a browser extension. It supports ERC-20 and BEP-20 tokens and Layer 2 networks like Base and Blast, but not Bitcoin, XRP, or Litecoin.

Features include built-in token swaps with fees paid in the selected token, NFT support, fiat on-ramps, and staking for ETH and Polygon with yields of about 1.88% APY on Ethereum and 9.41% APY on Polkadot (as of September 23, 2025). In select markets, a prepaid card powered by Mastercard is available.

MetaMask Official Website. Source: MetaMask

MetaMask wallet is suitable for you if:

- You want a trusted, browser-based wallet compatible with Chrome, Firefox, and Safari

- You’re mostly working with Ethereum and EVM-compatible networks like Polygon, Arbitrum, or BNB Chain

- You’re a beginner looking for a user-friendly interface and simple token swaps

- You prefer covering gas or swap fees directly from your existing wallet balance

- You also want mobile access. MetaMask offers apps for both iOS and Android

MetaMask wallet is not suitable for you if:

- You need support for Bitcoin, Litecoin, or other non-EVM cryptocurrencies

- You’re looking to minimize fees when buying crypto with fiat. MetaMask’s fiat on-ramps can be expensive

- You want a wallet with built-in support for multiple Layer 1 ecosystems beyond Ethereum

| Type | Non-custodial browser & mobile wallet |

| Chains | EVM chains (ETH, BNB, Polygon, Arbitrum, etc.) |

| Standout Use | DeFi, dApps, NFT access, token swaps |

| Best For | Ethereum & EVM users interacting with Web3 |

| Fees | Free (network fees + swap service fee ~0.875%) |

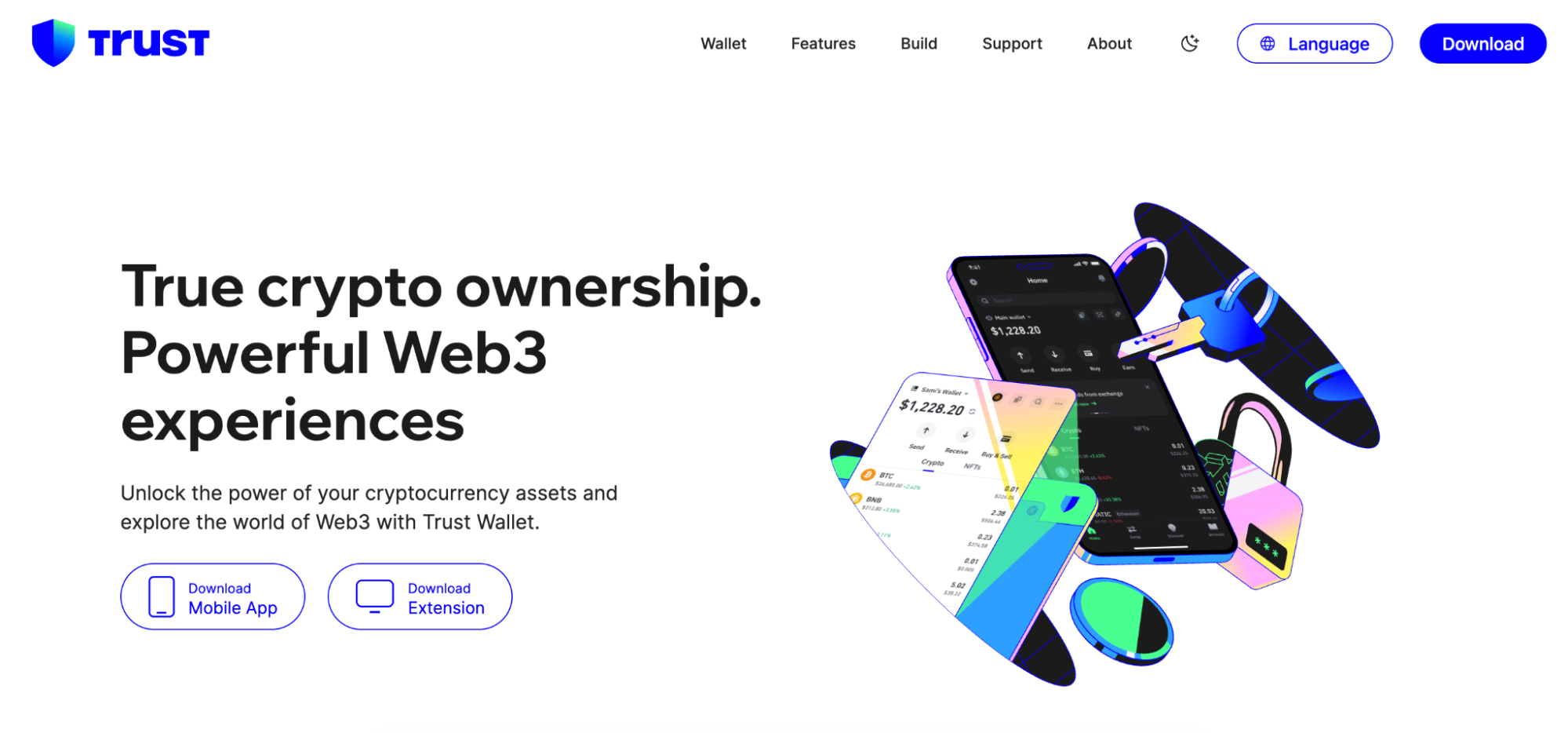

3. Trust Wallet – One of the Best Crypto Wallets for Managing a Diversified Portfolio

Trust Wallet is a non-custodial mobile wallet suited to diversified portfolios. It supports over 100 blockchains and Layer 2s, including Bitcoin, Ethereum, Solana, BNB Chain, and newer ecosystems such as Sui, Base, Blast, and Mantle. A built-in dApp browser and WalletConnect enable quick access to apps like Uniswap, Aave, Raydium, and NFT marketplaces.

Security relies on encrypted, on-device private keys with a PIN or biometrics required to open the app, but there is no native two-factor authentication. Instant swaps and fiat purchases are available via third-party providers and may include additional fees.

Trust Wallet Official Website. Source: Trust Wallet

Trust Wallet is suitable for you if:

- You want broad asset support. Trust Wallet works with 100+ blockchains and Layer 2 networks

- You value strong mobile security with biometric logins and encrypted private keys

- You’re looking for an easy-to-use wallet that’s beginner-friendly right out of the box

- You prefer a widely adopted solution.Trust Wallet is trusted by over 200 million users globally

- You need a versatile app that handles NFTs, DeFi, and cross-chain assets in one place

Trust Wallet is not suitable for you if:

- You primarily hold legacy coins like XRP or Dogecoin, which have limited support in the app

- You plan to use the browser extension extensively. It currently offers a subpar user experience

- You want to avoid high fees when purchasing crypto with a credit card through in-app providers

| Type | Non-custodial mobile & browser wallet |

| Chains | 100+ (BTC, ETH, BNB, SOL, Polygon, etc.) |

| Standout Use | Multi-chain storage, NFT support, in-app swaps |

| Best For | Users seeking all-in-one mobile wallet with wide asset support |

| Fees | Free (network fees; third-party fees for fiat purchases) |

4. Exodus – Free and Secure Crypto Storage via User-Friendly Desktop Software

Exodus is a non-custodial desktop wallet for Windows and macOS that emphasizes ease of use and broad asset coverage. It supports more than 50 networks with custom token support, including Bitcoin, Ethereum, Solana,a wide range of top meme coins.

The desktop app lets users track their portfolio with real-time pricing, stake selected coins, and use fiat on-ramps through cards and e-wallets. Exodus also has apps for iOS and Android, plus a browser extension, though the extension gets mixed reviews.

Exodus Official Website. Source: Exodus

Exodus is suitable for you if:

- You prefer managing your crypto from a desktop and want a polished experience on Windows or Mac

- You’re looking for a user-friendly wallet with support for 50+ networks and built-in portfolio tracking

- You want to retain control of your private keys, encrypted locally on your device

- You’re new to crypto and appreciate intuitive design with free core features

- You value the reliability of a well-established wallet that’s been around since 2015

Exodus is not suitable for you if:

- You need a top-rated browser extension. The Chrome version currently holds a 3.5/5 rating

- You plan to buy crypto with a credit card and want to avoid high transaction fees

- You’re primarily a mobile-first or Web3-native user seeking advanced DeFi and dApp access

| Type | Non-custodial desktop & mobile wallet |

| Chains | 50+ (BTC, ETH, SOL, BNB, AVAX, etc.) |

| Standout Use | Multi-asset storage, portfolio tracking, in-app swaps |

| Best For | Users who prefer managing crypto on desktop or mobile with sleek UI |

| Fees | Free (network fees apply; swap spreads may apply) |

5. Phantom – Free Mobile and Browser Wallet for the Solana Ecosystem

Phantom is a non-custodial wallet that started on Solana and has grown into a multi-chain app and extension. It supports Solana, Ethereum, Bitcoin (Ordinals/BRC-20), Polygon, Base, and Sui, with built-in swaps via Solana DEXes like Raydium and Jupiter. Legacy coins such as Dogecoin and Litecoin aren’t supported.

The mobile app holds a 4.7 rating on Google Play from 110K reviews and over 10M downloads (September 2025), making Phantom a strong choice for trading Solana meme coins, while also offering solid multi-chain flexibility.

Phantom Official Website. Source: Phantom

Phantom is suitable for you if:

- You’re active in the Solana ecosystem and want a top-tier wallet for trading SOL-based meme coins

- You regularly use Solana DEXs like Raydium or Jupiter. Phantom offers seamless integration

- You want a sleek, mobile-friendly wallet that also supports Bitcoin, Ethereum, Sui, Base, and Polygon

- You value a highly rated user experience. Phantom consistently scores well on both iOS and Android

- You’re looking for a fast, lightweight wallet that combines DeFi, NFTs, and multi-chain access

Phantom is not suitable for you if:

- You hold or plan to trade legacy assets like XRP or Dogecoin. Support is limited or missing

- You rely on browser extensions for day-to-day crypto management. Phantom’s extension still needs UX improvements

- You want to minimize fiat on-ramp costs, buying crypto with a credit card comes with steep fees

| Type | Non-custodial browser & mobile wallet |

| Chains | SOL, ETH, Polygon, Base, Bitcoin, Sui |

| Standout Use | Solana DeFi, NFT support, multi-chain swaps |

| Best For | Solana-first users who also want EVM & BTC access |

| Fees | Free (network fees only; fiat purchases via MoonPay/Banxa include fees) |

6. Trezor Safe 5 – Multi-Currency Hardware Wallet With Institutional-Grade Security

Trezor Safe 5 is a touchscreen hardware wallet that keeps your private keys offline and requires on-device confirmation for each transaction. It features a 1.54-inch color screen with haptic feedback, an EAL6+ Secure Element, PIN protection, and an optional passphrase. Backups can be 12, 20, or 24 words, with the option to split them using Advanced Multi-share.

Asset support is available through Trezor Suite and third-party apps, covering thousands of coins including BTC, ETH, and SOL. Pricing is $169, while the Safe 3 is $79 and the Model One $49.

Trezor Safe 5 Official Website. Source: Trezor

Trezor Safe 5 is suitable for you if:

- You prioritize maximum security and want your private keys stored offline on a dedicated hardware device

- You prefer physically verifying each transaction via PIN to prevent unauthorized access

- You want peace of mind knowing your wallet can be recovered using a backup passphrase if lost or stolen

- You need support for major crypto networks like Bitcoin, Ethereum, and other top assets in one place

- You’re looking for a high-end hardware wallet from a trusted brand in crypto security

Trezor Safe 5 is not suitable for you if:

- You’re on a budget. More affordable Trezor models like the Safe 3 or One may meet your needs

- You frequently trade crypto and want to avoid high fees in platforms like Trezor Suite

- You prefer mobile-first or software-only solutions without the need for physical hardware

| Type | Non-custodial hardware wallet |

| Chains | 8,000+ (BTC, ETH, ADA, DOT, LTC, etc.) |

| Standout Use | Offline storage, PIN protection, seed backup |

| Best For | Long-term holders prioritizing security |

| Fees | One-time device cost; network & exchange fees apply |

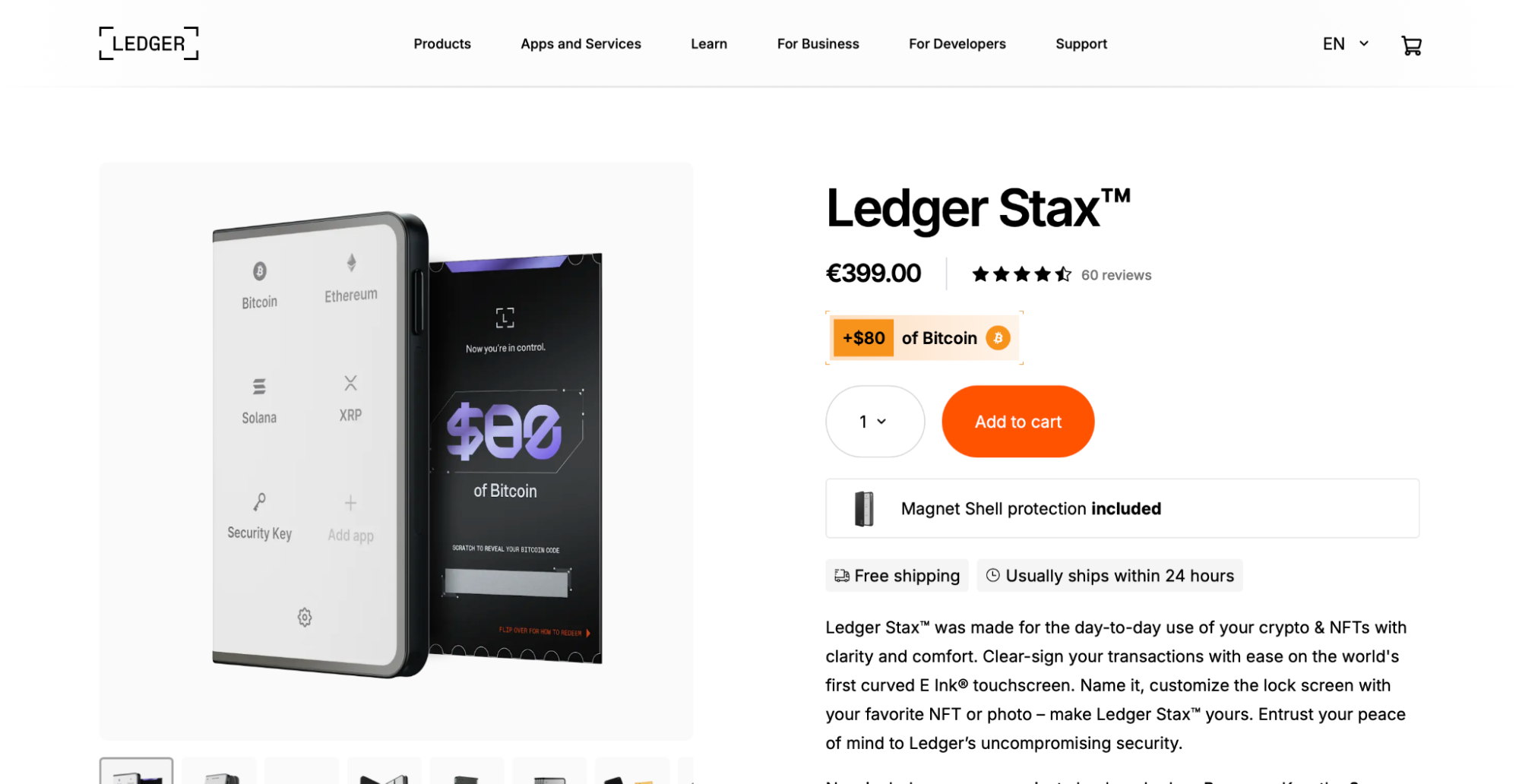

7. Ledger Stax – Advanced Cold Wallet for Long-Term Crypto Security

Ledger Stax is Ledger’s premium hardware wallet, created in collaboration with Tony Fadell, the former Apple designer behind the iPod. It features a 3.7-inch curved E Ink touchscreen, pairs with Ledger Live app on desktop and mobile via Bluetooth 5.2 or USB-C, and keeps private keys offline inside a CC EAL6+ Secure Element for on-device review and confirmation.

Ledger Live supports 500+ coins and Ethereum/Polygon NFTs, with thousands more via third-party wallets. Users can buy, swap, and stake through partners, use optional recovery services like Ledger Recovery Key, and the device costs $399 (September 2025).

Ledger Stax, a premium hardware wallet with an E Ink touchscreen. Source: Ledger.

Ledger Stax is suitable for you if:

- You want maximum security through cold storage with a physical device

- You hold large amounts of crypto for long-term investment

- You prefer a user-friendly hardware wallet with a modern touchscreen interface

- You need compatibility with a wide range of tokens and blockchains

- You value portability, with Bluetooth support for mobile connection

Ledger Stax is not suitable for you if:

- You prefer a free mobile or web wallet without hardware costs

- You mainly trade actively and need fast in-app swaps or DEX access

- You don’t want to manage seed phrases or private key backups

- You require customer recovery services typical of custodial exchanges

| Type | Hardware cold wallet (non-custodial) |

| Chains | 5,000+ coins and tokens supported via Ledger Live and external apps |

| Standout Use | Secure offline storage with touchscreen, Bluetooth, and NFT support |

| Best For | Long-term holders and investors seeking maximum security |

| Fees | One-time purchase of device; no ongoing wallet fees (network fees apply) |

Visit Ledger Stax Official Website

8. Base App (Coinbase Wallet) – One of the Most User-Friendly Non-Custodial Crypto Wallets

Base App (formerly Coinbase Wallet) is a non-custodial wallet for iOS and Android. Following Coinbase’s July 2025 rebrand, it became an “everything app,” combining wallet basics with social features, chat, and mini-apps. It supports Ethereum, Solana, and all EVM networks by default, while the mobile app also supports Bitcoin, Dogecoin, and Litecoin, making it an entry point to the Base ecosystem.

Users can explore dApps and mini-apps, trade, manage NFTs, and add funds via fiat on-ramps such as Coinbase Onramp or partners. Self-custody requires no account or KYC, but on-ramps and cash-outs rely on regulated providers and may prompt identity verification.

Base App Official Website. Source: Coinbase

Base App (Coinbase Wallet) is suitable for you if:

- You’re a beginner looking to explore self-custody without compromising on ease of use

- You want full control of your private keys while using a trusted name in the crypto space

- You need support for major networks like Bitcoin, Ethereum, Solana, Dogecoin, and EVM chains

- You prefer a free wallet with no added fees on gas or transactions

- You want built-in access to popular dApps like SushiSwap, OpenSea, and Uniswap right out of the box

Base App (Coinbase Wallet) is not suitable for you if:

- You need complete anonymity: fiat purchases can compromise privacy

- You expect customer support to help recover assets. Base App is non-custodial and offers no recovery assistance

You’re uncomfortable managing your own keys and prefer a more hands-off, custodial experience

| Type | Non-custodial mobile & browser wallet |

| Chains | BTC, ETH, SOL, DOGE, and all EVM-compatible chains |

| Standout Use | dApp access, NFTs, multi-chain support |

| Best For | Beginners exploring self-custody with familiar UX |

| Fees | Free (network fees; fiat purchases may include third-party fees) |

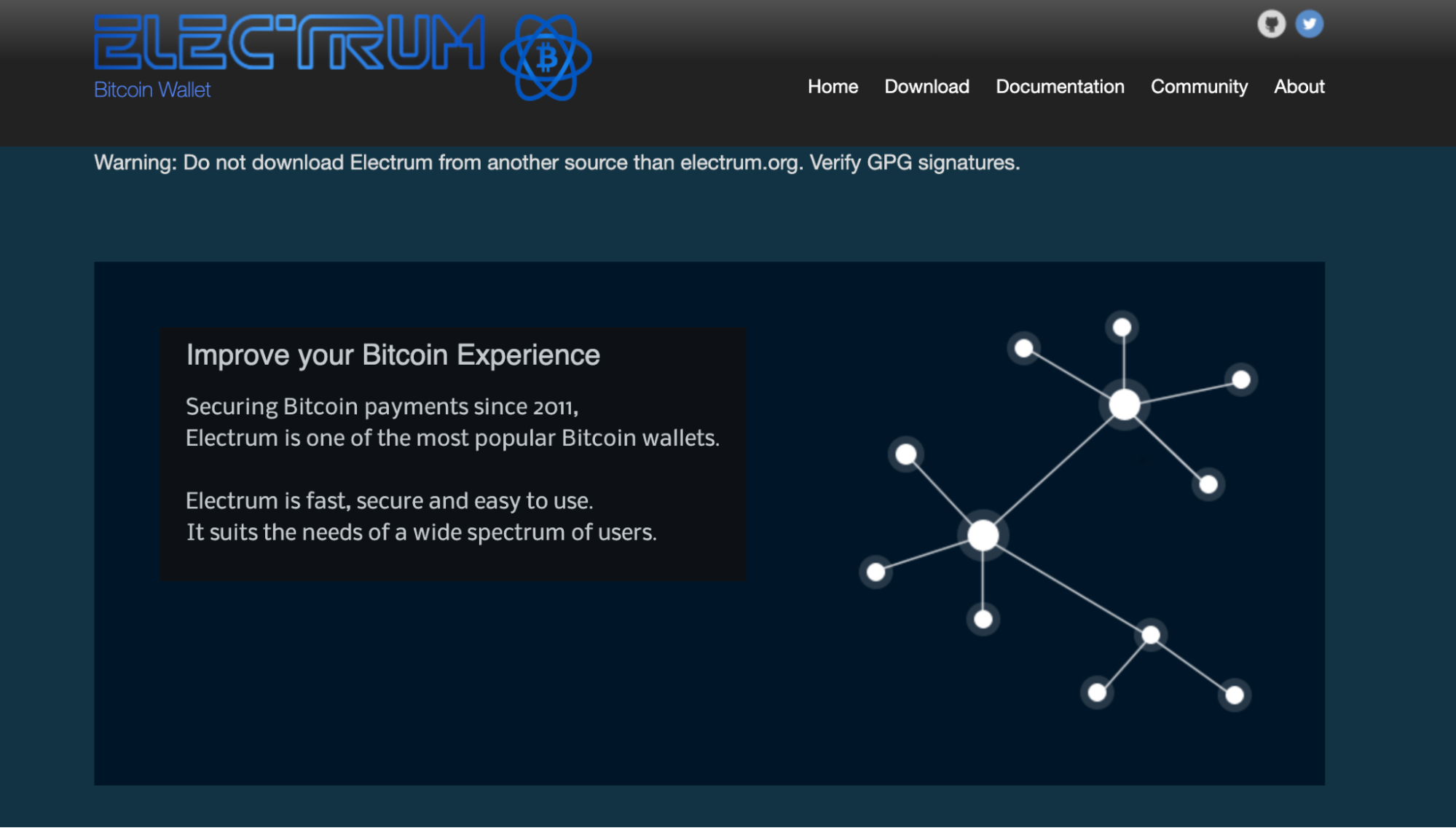

9. Electrum – One of the Original Bitcoin Desktop Wallets Aimed at Long-Term Holders

Electrum is an open-source desktop wallet built exclusively for Bitcoin, available on Windows, macOS, and Linux. It is non-custodial with keys stored locally, and it deliberately leaves out extras like token swaps and fiat on-ramps to keep the focus on secure BTC storage. Setup is quick, and the interface is lightweight.

Electrum also supports pairing with hardware wallets or creating an offline wallet with a watch-only companion for day-to-day viewing and sending.

Electrum Official Website. Source: Electrum

Electrum is suitable for you if:

- You’re a Bitcoin maximalist looking for a reliable, self-custodial wallet built specifically for BTC

- You want full control of your funds using open-source software on Windows, Mac, or Linux

- You value advanced security features like multisig and view-only wallet modes

- You prefer a lightweight desktop wallet with fast performance and decentralized server infrastructure

- You want a proven wallet that’s been around for over a decade and is completely free to use

Electrum is not suitable for you if:

- You need support for other cryptocurrencies besides Bitcoin

- You want access to Web3 features like token swaps, staking, NFTs, or dApps

- You prefer mobile-first or all-in-one wallets with multi-chain capabilities

| Type | Non-custodial desktop & mobile wallet |

| Chains | Bitcoin only |

| Standout Use | Lightweight, fast, privacy-focused BTC storage |

| Best For | Bitcoin users who want full control and advanced features |

| Fees | Free (customizable network fees) |

10. Zengo – Multi-Party Computation Wallet With Split Private Keys and 3FA Backup

Zengo is a non-custodial mobile wallet that replaces seed phrases with Multi-Party Computation (MPC), splitting key shares between your device and Zengo’s servers to eliminate single points of failure. Account recovery relies on three factors: 3D face biometrics, a cloud-stored recovery file, and an email magic link.

Zengo supports Bitcoin, Ethereum, BNB Chain, Dogecoin, Tron, Tezos, Polygon, Arbitrum, Optimism, and Base. The core wallet is free, while Zengo Pro adds a Web3 Firewall with real-time risk alerts and Theft Protection, which ties withdrawals (and optional Web3 approvals) to FaceLock verification.

Zengo Official Website. Source: Zengo

Zengo wallet is suitable for you if:

- You want cutting-edge security through MPC, which eliminates single points of failure

- You prefer a keyless setup where wallet recovery is possible via email, biometrics, and encrypted cloud backup

- You’re looking for a mobile-only wallet with strong user reviews and a sleek interface

- You value peace of mind with advanced recovery tools that don’t rely on seed phrases

- You’re open to paying for premium features like priority support or advanced security layers

Zengo wallet is not suitable for you if:

- You need support for the Solana ecosystem: Zengo currently doesn’t support it

- You want full access to all features without a subscription fee

- You rely on desktop or browser-based tools: Zengo is mobile-only

| Type | Non-custodial mobile wallet (MPC-based) |

| Chains | BTC, ETH, MATIC, DOGE, BNB, and more |

| Standout Use | Keyless recovery, biometric login, MPC security |

| Best For | Users seeking simple, secure, seedless crypto access |

| Fees | Free basic use; swap and fiat services include fees; Pro plan optional |

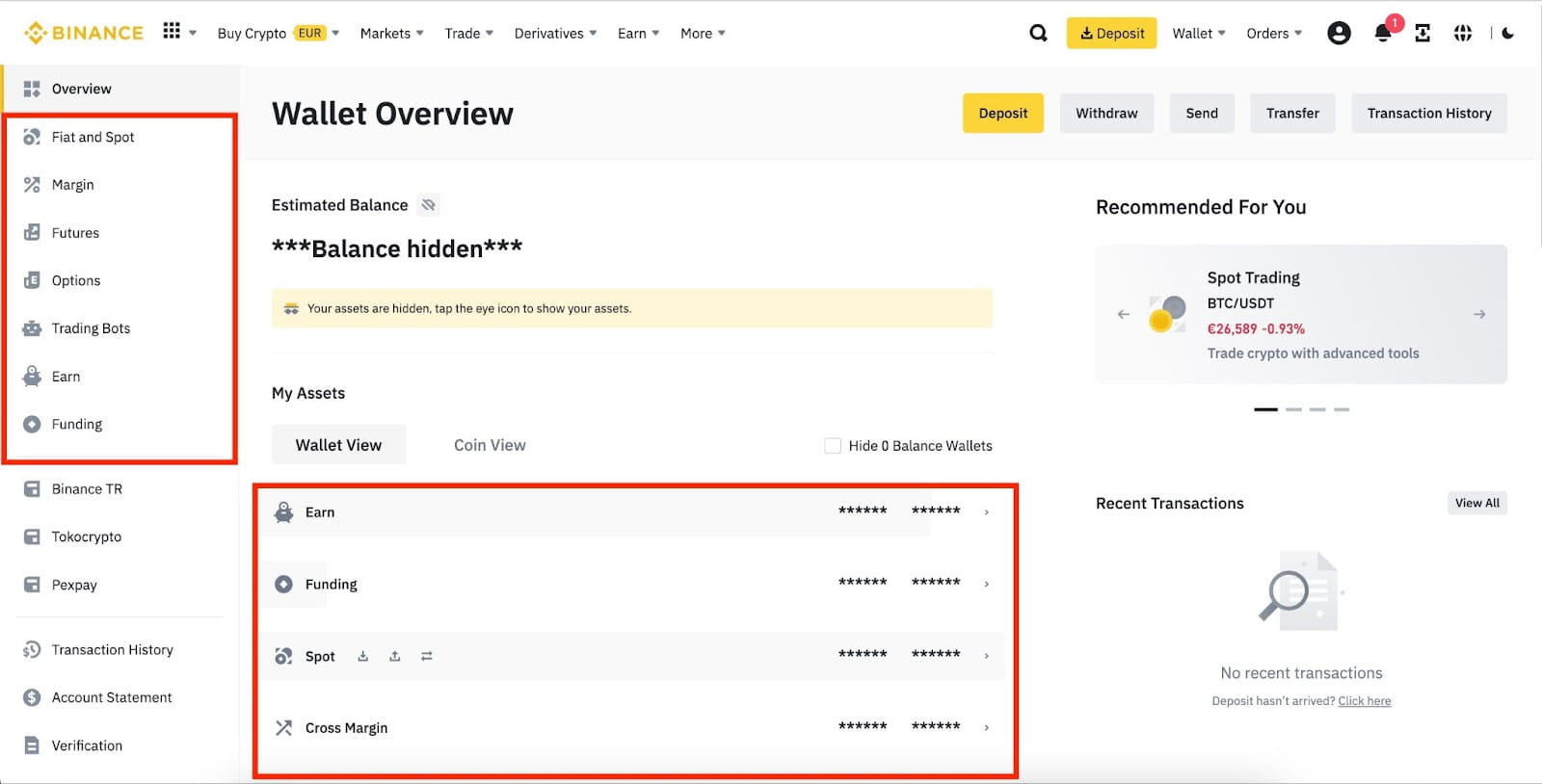

11. Binance Wallet – Best Wallet for Users Already in the Binance Ecosystem

Binance Wallet is the Web3 self-custody wallet inside the Binance app. It uses Multi-Party Computation (MPC) to remove seed phrases, with an Emergency Export option for full raw-key control. It connects to multiple chains and dApps with built-in DEX access, cross-chain swaps, Megadrop rewards, and Alpha for early-stage token discovery.

In Aug–Sep 2025, Binance launched a Chrome extension in beta and began phasing out the older BNB Chain Wallet extension. Fiat on-ramps and staking features run through Binance Earn or partners and require a verified Binance account.

Binance Wallet Overview. Users can manage Spot, Margin, Futures, Options, Earn, and Funding balances in one place. Source: Binance Wallet

Binance Wallet is suitable for you if:

- You already trade or hold crypto on Binance and want an integrated wallet experience

- You prefer a mix of custodial and non-custodial options with advanced security settings

- You value fiat on-ramps and staking services built directly into the wallet

- You want to manage assets across mobile, web, and extension in one ecosystem

Binance Wallet is not suitable for you if:

- You want a fully non-custodial wallet where you alone control private keys

- You avoid centralized exchanges and prefer decentralized solutions like MetaMask or Best Wallet

- You’re looking for a lightweight mobile app without exchange-linked features

- You prefer wallets without mandatory KYC requirements

| Type | Exchange-linked wallet (custodial + non-custodial options) |

| Chains | 300+ blockchains and thousands of tokens (BSC, ETH, BTC) |

| Standout Use | Integration with Binance exchange, staking, fiat on-ramps |

| Best For | Binance ecosystem users seeking trading + wallet in one |

| Fees | Free app; Binance standard trading and transfer fees apply |

Visit Binance Wallet Official Website

Key Takeaways on Crypto Wallets

- Crypto wallets store digital assets like Bitcoin and Ethereum, with device types including desktop software, mobile apps, web browsers, and hardware devices.

- Non-custodial wallets are recommended as they provide complete control of the digital assets being stored.

- In contrast, third parties manage custodial wallets, so transactions require authorization before approval.

- While wallets are primarily used to send, receive, and store cryptocurrencies, many offer additional features like credit card purchases, instant swaps, and staking.

- Irrespective of the wallet type, the most important factor is security. Look for safety nets like two-factor authentication and biometrics for a secure experience.

Top Crypto Wallets Compared

The best crypto wallets in 2025 are compared below:

| Crypto Wallet | Wallet Type | Device Type | Supported Chains | Price | Exchange Integration |

| Best Wallet | Hot | Mobile | 60+ including Bitcoin, Ethereum, and Solana | Free | Yes – native DEX |

| MetaMask | Hot | Browser extension, mobile | Ethereum and all EVM networks including Base and Linea | Free | Yes – third-party support |

| Trust Wallet | Hot | Browser extension, mobile | 100+ blockchains and networks including Bitcoin and Ethereum | Free | Yes – third-party support |

| Exodus | Hot | Desktop, mobile, browser extension | 50+ including Bitcoin, BNB Chain, and XRP | Free | Yes – third-party support |

| Phantom | Hot | Browser extension, mobile | Solana, Bitcoin, Ethereum, Sui, and several EVM networks | Free | Yes – third-party support |

| Trezor Safe 5 | Cold | Hardware | 20+ including Bitcoin, Solana, and Cardano | $169 | Yes – third-party support |

| Ledger Stax | Cold | Hardware (E Ink touchscreen, Bluetooth, USB-C) | 5,000+ including Bitcoin, Ethereum, Solana, XRP, and NFTs | $399 | Yes – third-party support |

| Base App | Hot | Browser extension, mobile | Bitcoin, Ethereum, Solana, Dogecoin, and all EVM networks | Free | Yes – third-party support |

| Electrum | Hot | Desktop, mobile (Android only) | Bitcoin | Free | No |

| Zengo | Hot | Mobile | Bitcoin, Dogecoin, TRON, Ethereum, and several EVM networks | Free | Yes – third-party support |

| Binance Wallet | Hot | Mobile, web, browser extension | 300+ blockchains and thousands of tokens (BSC, Ethereum, Bitcoin, etc.) | Free | Yes – native Binance exchange |

Best Crypto Wallet by Use Case

Whether you’re focused on DeFi, Bitcoin security, or trading meme coins, some wallets are better suited for specific goals. Here’s a quick guide to help you choose:

| Use Case | Wallet | Why |

| Mobile DeFi | Best Wallet | 60+ chains, DEX |

| Desktop portfolio | Exodus | 50+ chains, clean UI |

| EVM & dApps | MetaMask | Browser, DeFi native |

| All-in-one mobile | Trust Wallet | 100+ chains, simple UI |

| Solana trading | Phantom | SPL, swaps, NFTs |

| PIN-confirmed txs | Trezor Safe 5 | PIN, offline, backup |

| Easy self-custody | Base App | Major coins, dApps |

| Bitcoin storage | Electrum | BTC-only, open-source |

| Hardware security | Ledger Stax | Offline, 15K+ assets |

| Keyless recovery | Zengo | MPC, biometrics |

| CEX-to-Web3 bridge | Binance Wallet | MPC, dApp browser, on or off ramp |

How We Chose the Best Crypto Wallets – Our Methodology

To identify the best crypto wallets for 2025, we followed a structured, data-backed review process that prioritized both objective performance metrics and real user needs. Our methodology combines technical analysis, user feedback, security audits, and hands-on testing to deliver recommendations across different use cases.

1. Security and Custody Model (35%)

Security is the foundation of any crypto wallet. We focused on wallets that offer robust protection for private keys, whether through non-custodial architecture, MPC, or hardware isolation. Wallets had to support encrypted local storage or secure recovery options like seed phrases, biometrics, or PIN-based authentication. We penalized wallets with known vulnerabilities or weak recovery models.

2. Chain and Token Support (15%)

With multichain activity on the rise, wallets were assessed for their ability to support major Layer 1 and Layer 2 networks, including Bitcoin, Ethereum, Solana, Polygon, BNB Chain, and newer chains like Base or Sui. We gave preference to wallets that allow users to manage a diverse portfolio, including meme coins, NFTs, and stablecoins, without needing multiple apps.

3. User Experience and Accessibility (15%)

Ease of use is key, especially for newcomers. We evaluated onboarding flows, interface clarity, swap functionality, and mobile vs. desktop experience. Wallets like Exodus and Base App (Coinbase Wallet) scored highly for clean UI and beginner readiness, while Best Wallet and Phantom excelled in mobile DeFi access.

4. DeFi and dApp Integration (15%)

We tested each wallet’s ability to interact with decentralized applications, DEXs, NFT marketplaces, and staking protocols. MetaMask, Phantom, and Best Wallet performed well here due to native integrations and reliable connection with platforms like Uniswap, Jupiter, and OpenSea.

5. Pricing and Fees (10%)

All wallets were reviewed for hidden costs, such as fiat on-ramp fees or network fee markups. We highlighted those that offer core features for free (like Electrum or Base App) and flagged wallets with high purchase or swap fees.

6. Reputation and Longevity (10%)

Finally, we factored in each wallet’s track record, reviews from trusted crypto platforms, open-source status, and developer activity. Longstanding wallets like Electrum, MetaMask, and Trezor earned extra points for reliability and community trust.

Together, these criteria shaped our final list, ensuring a balance between security, usability, and performance across wallet types.

What is a Crypto Wallet?

A crypto wallet is a digital tool that allows you to securely store, send, and receive cryptocurrencies. Whether you’re holding Bitcoin, Dogecoin, or Solana, a wallet is essential for managing your digital assets and interacting with blockchain networks.

Think of it like a bank account, but for crypto, not fiat. The key advantage, especially when using a non-custodial wallet, is that you retain full control of your funds and private keys. This means no centralized third party (like an exchange) can access your assets or block transactions.

Crypto wallets don’t just store tokens, they also unlock access to the broader blockchain ecosystem, including decentralized apps, token swaps, and NFTs.

Without a personal wallet, you’ll need to rely on custodians such as exchanges like Binance or platforms like Webull. In those cases, they control the private keys, limiting your ability to move funds freely. By contrast, non-custodial wallets eliminate that counterparty risk, giving you full ownership and flexibility.

How do Crypto Wallets Work?

Beginners might find crypto wallets intimidating at first, especially when exposed to complex terms like non-custodianship and private keys.

We’ll now explain how wallets work in more detail, ensuring even complete newbies have a firm understanding.

Wallet Addresses

Wallet addresses are like bank account numbers, allowing users to receive cryptocurrencies from another location. The address will be unique to your crypto wallet, generated when installing it for the first time.

Example of Wallet Address. Source: Best WalletWallet addresses are usually long and complex, containing upper/lowercase letters and numbers.

For example, here’s what a Bitcoin wallet address looks like:

- 3PXBET2GrTwCamkeDzKCx8DeGDyrbuGKoc

Now, wallet addresses can only be used to receive cryptocurrencies, so you can safely provide them to others. However, wallet addresses are transparent, meaning anyone can see the respective balance.

For example, the above Bitcoin wallet address belongs to Binance. It contains over 45,000 Bitcoin, which is equivalent to several billion dollars. However, while wallet addresses are transparent, they’re not tied to your personal identity.

Wallet addresses are also required when transferring cryptocurrencies to another person. So, you set up the transfer within the online crypto wallet, paste the receiver’s address, and confirm. The transaction is executed immediately, assuming a self-custody wallet has been chosen.

Private Keys

We mentioned private keys many times when reviewing the best crypto wallets. Private keys are the secret password for the wallet and are unique to the user. Keeping private keys offline is paramount, as whoever holds them has full control of the wallet balance.

Private keys are also required to authorize transactions, such as sending cryptocurrencies to another person.

This is where custodianship comes into the equation:

- Non-custodial wallets ensure that only the user can access the private keys. This is like storing assets in a safe, with only the owner knowing its combination.

- Custodian wallets are more aligned with traditional bank accounts. The custodian holds the private keys, so transactions must be approved before they’re authorized.

However, it’s important to remember that private keys are highly sought-after by crypto hackers. A successful breach will mean the hacker can access the wallet and withdraw the funds. There will be no accountability, as wallet hacks are anonymous.

Backup Passphrase

You should also understand the role of backup passphrases when choosing the best crypto wallet. Most providers offer a 12-word passphrase, which, just like private keys, is unique to the wallet.

Backup passphrases enable users to recover the wallet balance if access is no longer possible.

- For example, suppose you’re using a desktop wallet, but the laptop storing it is stolen.

- You could download the same software wallet and import the backup passphrase.

- The original wallet balance will now be available on the new device.

Just like private keys, keeping the backup passphrase secure is paramount. Misplacing it will mean the wallet funds are stolen remotely.

Why Do You Need a Crypto Wallet

You should now have a solid understanding of how crypto wallets work, including the role of public addresses, private keys, and backup passphrases.

Next, we’ll explain why a crypto wallet is a must, rather than keeping digital assets on a centralized platform.

Storing Cryptocurrencies

The primary function of a wallet is to store cryptocurrencies. The purchased assets will remain in the wallet balance until you’re ready to sell. This could be several years when investing in long-term projects. Or a few days or weeks when trading speculative meme coins.

Cryptocurrency in the Wallet. Source: Exodus

Either way, cryptocurrencies operate on the blockchain, so they can only be held in wallet addresses. If you’re not in control of the respective address, this means somebody else is holding the cryptocurrencies (like an exchange), which invariably invites counterparty risks.

Sending and Receiving Cryptocurrencies

Wallets are also required when completing transactions. All transfers are done on a wallet-to-wallet basis, irrespective of where the sender and receiver are based.

For example:

- When receiving cryptocurrencies, you need to provide the sender with your unique wallet address. This is like providing a bank account number to an employer, allowing them to execute the transfer.

- When sending cryptocurrencies, you need the receiver’s unique wallet address. This works the same as receiving funds, but in reverse.

Now, it’s important to note that cryptocurrencies operate on a specific network. Using the wrong network will mean a loss of funds. For example, Bitcoin can only be transferred to another Bitcoin wallet address. Sending Bitcoin to an Ethereum address will be a costly mistake.

Connecting to dApps

The best crypto wallets unlock a wealth of decentralized finance (DeFi) services. Wallet holders can transact without needing to trust third parties or reveal their identities. All transactions, whether you’re buying cryptocurrencies or earning passive income, are conducted from the wallet balance.

- For example, suppose you’re holding ETH in an Ethereum wallet.

- Connecting the wallet to Uniswap means you can trade ETH for millions of other cryptocurrencies (known as ERC20 tokens, which operate on the Ethereum blockchain).

- You can also deposit that ETH into an Aave lending pool, allowing you to earn interest.

- You can also use that ETH on OpenSea to buy NFTs.

Crucially, you can only access DeFi platforms when using a non-custodial wallet. This is because transactions must be approved via the private key, which isn’t possible when using a third-party custodian.

Portfolio Tracking and Management

Crypto wallets are also needed to seamlessly track and manage portfolios, especially when holding assets from multiple networks. For example, you wouldn’t want Bitcoin and Solana stored in one wallet and XRP and Litecoin in another. It becomes too challenging to manage.

The best crypto wallets support dozens of networks, ensuring all investments can be managed from one place. Moreover, you can normally view real-time portfolio data, such as how much individual cryptocurrencies are worth. This is displayed in the preferred currency, such as USD or GBP.

Some crypto wallets come with built-in trading tools, too. This means underperforming tokens can be swapped without needing to use a centralized exchange. However, understanding fees before proceeding is important, especially if the wallet uses third-party services.

Crypto Wallet Types at a Glance

| Wallet Type | Internet Connection | Key Ownership | Best For |

| Hot Wallet | Always connected | You (non-custodial) or third party | Active use, DeFi, quick access |

| Cold Wallet | Offline | You (non-custodial) | Long-term storage, high security |

| Custodial Wallet | Online | Third party (e.g. exchange) | Beginners, convenience |

| Non-Custodial Wallet | Online or offline | You | Full control, DeFi, self-custody |

Types of Crypto Wallets

A crypto wallet is a digital tool that lets you store, send, and receive cryptocurrencies securely and on your terms. But not all wallets are the same. Choosing the right type of wallet depends on how you plan to use your crypto and how much control you want over your private keys.

Below, we break down the core wallet categories: hot vs cold, and custodial vs non-custodial, so you can make the right decision for your needs.

Hot vs Cold Wallet

Selecting between a hot and cold wallet is often a trade-off between security and convenience.

Hot Wallets – Best for Active Crypto Investors

Hot wallets are always connected to the internet, so transacting becomes seamless. Options include mobile apps, browser extensions, and desktop software. Opening any of these wallets ensures immediate access to the funds.

For example, the best crypto wallets are often made for iOS and Android smartphones. This means you can send and receive funds no matter where you’re located. Hot wallets are also crucial when using DeFi features, such as trading, staking, and lending.

However, hot wallets, considering they’re internet-ready 24/7, are constantly exposed to hacking attempts. Whether it’s a virus, malware, keylogger, or phishing, a hacked hot wallet will result in its contents being drained.

Cold Wallets – Best for Storing Large Amounts

Cold wallets are designed with a security-first mindset. The private keys are stored within a physical device, which is never connected to the internet. By extension, this eliminates online hacking attempts.

After all, hardware devices can’t be compromised remotely if they’re not internet-ready. Transactions are usually confirmed via a USB-C cable or Bluetooth. The user physically enters a PIN on the device before any transactions are authorized.

SafePal cold wallet in action, entering a recovery word on the device for offline key storage and transaction signing. Source: SafePal

This means the wallet funds are safe even if the hardware device is stolen. Recovery is possible remotely by entering the backup passphrase from another wallet (hot or cold). However, while cold wallets provide institutional-grade security, they’re cumbersome for active traders to manage.

- For example, suppose you’re on a long daily commute and read about a new meme coin.

- You want to buy that meme coin, but can’t do so until you get home. This is because the transaction can only be verified on the hardware device itself.

- The meme coin markets are fast-paced, so the opportunity could have been lost by the time wallet access is available.

Now compare the experience when using a mobile Bitcoin wallet app. No matter where they’re located, it takes seconds to execute a trade. Especially when using a feature-rich provider like Best Wallet. It has a built-in exchange, allowing users to swap millions of cryptocurrencies near-instantly.

Custodial vs Non-Custodial Wallet

Choosing between a custodial and non-custodial wallet is an even more important choice. This determines who holds and controls the private keys.

Custodial Wallets – Allow a Third-Party to Control Your Private Keys

Experts strongly discourage using custodial wallets, since you’re entrusting your cryptocurrencies with a centralized third party. The majority of custodial wallets are offered by exchanges, with popular providers including Gemini, Binance, and Kraken.

Here’s an overview of how custodial wallets work:

- Suppose you buy Bitcoin with a credit card on Gemini.

- That Bitcoin is then added to your Gemini wallet. You can view the Bitcoin balance at any time by logging into the Gemini account.

- However, only Gemini has control of the wallet’s private keys.

- So, if you want to transact, you need to place a request and wait for Gemini to approve it.

- Only then will the Bitcoins be released.

The issue is here control. Unlike non-custodial wallets, you can’t freely make transfers, let alone connect with DeFi ecosystems. While Gemini is a legitimate exchange with enhanced security, the same thing was said about FTX before it went bankrupt.

Crypto exchanges can also be hacked, which could impact any stored assets.

Non-Custodial Wallets – Truly Build Crypto Wealth Through Private Key Ownership

The only way to truly own your cryptocurrencies is with a non-custodial wallet. Once you download the preferred wallet, the private keys will be encrypted and stored on your mobile or desktop device. Nobody else, including the provider, can access the private keys.

You can send and receive cryptocurrencies at any time, permission from third-party custodians isn’t needed. Moreover, you won’t get a KYC request with threats of account closure. Any stored cryptocurrencies are yours to store, transfer, or trade.

However, there is a drawback to consider. While having full control is a major perk, you’re also solely responsible for security. Mistakes will be costly, such as connecting the wallet to a malicious platform. Stolen funds will be unrecoverable, so following wallet best practices is a must (which we cover shortly).

How to Pick a Crypto Wallet

Hundreds of crypto wallet providers exist. This covers non-custodial and custodial providers, spread across mobile apps, desktop software, browser extensions, and hardware devices.

You also need to consider security, supported networks, and any preferred features like credit card support.

Let’s take a deeper dive into the key considerations when choosing the best crypto wallet.

Wallet Type and Custodianship

We’ve already explained the different wallet types and why non-custodianship is always the best solution. These are, however, the most important metrics, so spend some time assessing which option is best.

For example, those storing millions of dollars in Bitcoin should get a hardware device like the Trezor Safe 5. However, those looking to actively trade Solana meme coins will prefer a hot wallet app like Best Wallet.

Available Networks and Supported Cryptocurrencies

The best crypto wallets support a wide range of cryptocurrencies and network standards. This makes it easy to actively store and trade tokens across different ecosystems.

List of Available Networks and Supported Cryptocurrencies. Source: Best Wallet

Otherwise, you’d need to manage multiple wallets, which doesn’t make sense if everything can go through a single provider. In most cases, if a particular network is supported, so are all secondary tokens.

- For example, Best Wallet supports the Solana network, so by extension, it can store millions of SPL tokens.

- It also supports Ethereum and BNB Chain, so it’s compatible with all ERC20 and BEP20 tokens.

- Best Wallet is also compatible with Bitcoin, XRP, Arbitrum, Base, Litecoin, Dogecoin, and much more.

However, not all wallets are compatible with such a broad selection of networks. Some, such as Electrum, only support Bitcoin.

Security

You should spend ample time understanding the wallet provider’s security measures. Assuming a non-custodial wallet is selected, the private keys should be encrypted, ensuring nobody but you can view them. They should also be stored exclusively on your device, making it secure to sign transactions online.

However, encryption alone isn’t enough. The best crypto wallets have additional safeguards like two or three-factor authentication, facial ID, multisig permissions, and address whitelisting. Specific security controls can vary depending on the crypto wallet type.

Key Features

Many investors want access to additional features when choosing the best Bitcoin wallet. For example, many wallets come integrated with exchange services. The benefit is that cryptocurrencies can be traded directly in the wallet interface.

MetaMask Wallet. Source: MetaMask

Another feature to look for is fiat integration. This enables users to buy cryptocurrencies with everyday payment types. Common examples include Visa, MasterCard, PayPal, and local bank transfers.

Staking is another sought-after feature. This is a passive income tool for idle crypto balances, allowing you to earn interest directly from the wallet.

Pricing

You won’t need to pay fees to install a wallet unless you’re purchasing a hardware device. Prices vary depending on the manufacturer and model type, but even $79 now covers the Ledger Nano S Plus, a good price considering its robust security.

No fees are required when receiving or storing cryptocurrencies, regardless of the wallet type. However, you should check what fees apply when transferring funds. The best crypto wallets fetch prices from the respective network, meaning no additional charges.

For example, if the Ethereum network quotes 0.0027 ETH, that’s exactly what the wallet provider should charge. You should also evaluate fees for non-basic services like staking or token swaps.

How to Get a Crypto Wallet

After choosing the best crypto wallet, the next step is getting everything set up.

Here’s an overview of the required steps when using a hot wallet:

- Step 1: Download the Wallet. First, download the chosen wallet to your device, whether that’s a desktop or mobile. Using a non-custodial wallet means the private keys are immediately encrypted and stored on the same device.

- Step 2: Secure the Wallet. Depending on the wallet provider, you’ll likely be asked to choose a PIN/password or biometrics. Writing down the backup passphrase is also crucial.

- Step 3: Transfer Cryptocurrencies. Click the required network for the cryptocurrencies you want to deposit. For example, ERC20 tokens like Shiba Inu and Tether should be sent to an Ethereum wallet address. Copy the unique address shown and proceed with the transfer.

Follow these steps when using a cold wallet:

- Step 1: Purchase a Hardware Wallet. First, you’ll need to purchase a hardware wallet directly from the manufacturer. This ensures you’re buying a legitimate wallet that hasn’t been tampered with.

- Step 2: Download the Wallet’s Software. Even cold wallets need software to execute transactions. For example, Ledger uses Ledger Live while Trezor has the Trezor suite. Ensure you’re downloading the software directly from the manufacturer’s website.

- Step 3: Secure the Wallet. Now complete the security steps, such as choosing a PIN and writing down the backup passphrase.

- Step 4: Transfer Cryptocurrencies. Finally, transfer cryptocurrencies to the cold wallet, following the same steps as above. This means selecting the right network, copying the unique wallet address, and completing the transaction.

How to Check a Bitcoin Wallet is Safe

Safety should always be the priority when choosing the best wallet for crypto.

Here’s what to check when selecting a provider:

- Public Reviews: Researching public reviews is one of the most effective safety strategies. The best crypto wallets have positive reviews across multiple platforms. Reviews should have validity, meaning they’re based on thousands of independent ratings.

- Open-Source: The safest crypto wallets are open-source. This means the wallet’s code is publicly viewable, allowing the developer community to scrutinize it. Open-source wallets also benefit from fast patches when vulnerabilities are discovered.

- Always go Directly to the Source: Whether you’re buying a hardware device or downloading a free browser-based wallet, always go directly to the source. Never obtain a wallet from a third party – it could be fake. This means any cryptocurrencies deposited could be immediately compromised.

- Audits: Some wallets have been audited by reputable security firms, adding an extra layer of credibility.

- Time in the Market: Another safety check is to assess when the wallet was launched. Established wallets are often preferred, considering they have a longer track record. You should also avoid wallets that have previously witnessed a hack.

Wallet Best Practices to Avoid Costly Mistakes

No crypto wallet is 100% immune to hacks or mistakes. Following wallet best practices is a must.

Here’s what you need to know:

- Backup Passphrase: The best crypto wallets provide a backup passphrase when getting started. It’s usually 12 randomly generated words. You must write this down on a sheet of paper, ensuring the correct order is followed. One of the biggest mistakes made by beginners is storing the backup passphrase online (like on a Google Drive document). Doing so could mean the wallet credentials are hacked remotely.

- Using Separate Devices: If possible, it’s always best to use a separate device specifically for storing and managing cryptocurrencies. You’ll vastly reduce the risks of downloading viruses or clicking malicious links, as the device will only be used for crypto.

- Use Two-Factor Authentication: A secondary device also increases the effectiveness of two-factor authentication. A code will be sent to the primary device when verifying transactions (e.g., an SMS). This means both devices would need to be compromised for a hacking attempt to succeed.

- Using the Right Network: Another common mistake is sending cryptocurrencies to the wrong network. For example, sending Ethereum to a Solana address. There will be no means to recover the funds when incorrect networks are used, so always double-check before confirming a transaction.

Crypto Wallet Market Trends & Analysis (September 2025)

In September 2025, the crypto wallet space saw key developments impacting both user security and product functionality. From advanced trading capabilities and enhanced recovery tools to major security warnings, this section covers the most relevant news shaping the wallet ecosystem.

Whether you’re a seasoned trader, a hardware wallet user, or someone just entering the space, our curated insights explain what these updates mean for you, and how they might influence broader market trends. Stay ahead with expert-backed analysis on wallet innovation, threats, and shifts in user behavior.

NPM Package Hack Targeted Crypto Wallets, Minimal Losses Reported

On September 8, a phished maintainer account (“qix”) pushed malicious updates to ~18 widely used npm packages such as chalk and debug. The payload attempted to swap recipient addresses in browser-based crypto transactions, targeting BTC, ETH, SOL, TRX, LTC, and BCH.

Packages were patched around 15:15 UTC and compromised versions disabled; Security Alliance tracked total confirmed theft at roughly cents to under $50.

Why it matters: Even with tiny realized losses, the incident shows how dependency chains can endanger software wallets and dapps. Users relying on hardware confirmation and final-screen checks were substantially safer, underscoring the value of explicit on-device verification.

MetaMask Adds Social Login via Google and Apple

MetaMask introduced “Social login,” letting users create, back up, and restore a self-custody wallet with a Google or Apple account plus a password. Under the hood, MetaMask uses a Threshold Oblivious Pseudorandom Function and distributed key management with split key-shares, so no single party can reconstruct your Secret Recovery Phrase. Password hygiene remains critical.

Why it matters: Smoother onboarding for non-crypto natives without turning MetaMask into a custodial product can expand self-custody adoption. The trade-off shifts risk from seed-storage mistakes to password practices and account security.

Ethereum Foundation Prioritizes Wallet UX in 1TS Phase 2

The Ethereum Foundation opened the next stage of its Trillion Dollar Security initiative, centering on a Minimum Security Standard for wallets, grants to Walletbeat, and concrete fixes for blind signing.

The plan pushes human-readable transaction decoding, wider use of the Verifier Alliance (VERA) database, EIP updates to improve signing clarity, transaction simulation, and an open vulnerability database for pre-deployment checks. A June baseline report mapped six security domains the ecosystem must improve.

Why it matters: A common wallet standard and better signing UX reduce user error, help institutions meet audit requirements, and cut exploit surface at the application edge. If adopted widely, this could become a de facto quality bar for retail and enterprise wallets.

Google Play Updates Policy for Custodial Crypto Wallets

Starting October 29, Google Play will introduce new rules for apps offering custodial crypto services. Developers will need to obtain licenses in more than 15 jurisdictions, including the U.S. and the EU.

In the U.S., providers must register with FinCEN as Money Services Businesses (MSBs). In the EU, they are required to secure a CASP license. These obligations also mandate AML programs and user verification.

Following backlash from the crypto community on X, Google clarified that the policy will not apply to non-custodial wallets: “We are updating the Help Center to provide clarity on this matter,” the company stated.

Why it matters: This update signals Google’s stricter stance on custodial services while maintaining a distinction for non-custodial wallets. It raises compliance costs for developers and could limit the availability of certain apps, but it also underscores regulators’ growing influence on digital asset infrastructure. The move aligns with broader global enforcement trends, from the U.S. to South Korea, where 17 foreign exchanges were recently blocked from Google Play.

James Howells Tokenizes Legal Claim to Lost 7,500 BTC Wallet

British IT engineer James Howells, known for accidentally discarding a hard drive holding 7,500 BTC back in 2013, is launching a token to assert legal ownership of the lost crypto. Dubbed Ceiniog Coin (INI), the asset will represent one satoshi per token (total supply: 800 billion) and is expected to debut by late 2025.

Why it matters: After a decade of failed excavation attempts at a Welsh landfill, including offers to buy the site, plans involving AI and robot dogs, and a lawsuit, Howells is shifting strategies. By anchoring a new payments ecosystem to his BTC claim, he seeks to revive the narrative around one of crypto’s most infamous lost wallets. While the actual drive remains unrecovered, the case highlights novel approaches to asserting digital asset rights, especially amid growing legal recognition of crypto holdings.

Conclusion

Choosing the right wallet is an important step when investing in the crypto markets. Non-custodial wallets are always recommended, ensuring you own and control the purchased crypto assets.

We found that Best Wallet is a solid choice in 2025, especially if you prefer managing cryptocurrencies on a user-friendly app. Security features include biometrics, and over 60 networks are supported. Best Wallet also offers staking rewards and instant token swaps.

FAQs

What is the best crypto wallet?

How do I create a Bitcoin wallet?

Are crypto wallets anonymous?

Is my money safe in a crypto wallet?

How do I pick a crypto wallet?

Do I need a wallet to buy crypto?

What is a cold wallet in crypto?

Are cold wallets better than hot wallets?

Which crypto wallet has the lowest fees?

Should I pick a non-custodial crypto wallet?

How many crypto wallets should I have?

References

- A Timeline of Cryptocurrency Exchange FTX’s Historic Collapse (ABC News)

- The Biggest Crypto Exchange Hacks: How to Make Sure You Protect Your Crypto Against Hacks (Kaspersky)

- Hot vs. Cold vs. Warm Wallets: Which Crypto Wallet is Right for me? (Fireblocks)

- What Are Crypto Wallets and How Do They Work? (Bloomberg)

- Wallet Security: Best Practices For Keeping Your Crypto Safe (Hacken)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

BlockchainFX sets out to defragment the crypto world by being the very first crypto-native trading super app, aiming to bring toge...

Want to trade Tron futures long and short with leverage? Read our beginner’s guide on how to trade TRX futures safely in 2025.

Fact-Checked By:

Fact-Checked By:

Tony Frank

Crypto Editor, 81 postsTony Frank is an accomplished cryptocurrency analyst, author, and educator whose work bridges the gap between complex blockchain technology and accessible, actionable insights for global audiences. Over the past decade, he has emerged as a respected voice in the rapidly evolving world of digital assets, combining technical expertise with a talent for storytelling to help readers navigate everything from Bitcoin’s monetary philosophy to the intricacies of decentralized finance (DeFi). Tony earned his Bachelor’s degree in Economics and Finance from the University of Melbourne, where he developed a deep interest in monetary systems and market structures. He later pursued a Master’s degree in Blockchain and Digital Currency from the University of Nicosia, one of the first academic institutions to offer accredited programs in cryptocurrency studies. Before focusing full-time on blockchain, Tony worked as a financial analyst for a multinational investment firm, covering emerging technologies and alternative asset classes. His early exposure to macroeconomic policy, global market behavior, and fintech innovation laid the foundation for his later work in crypto research and writing. Tony’s expertise spans multiple sectors of the blockchain industry, including cryptocurrency fundamentals, altcoin market cycles, DeFi and web3 trends and regulatory landscapes. Tony combines on-chain data analysis with macroeconomic research, providing readers with both the technical “how” and the market “why” of cryptocurrency movements.