LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

This guide explores the best cheap stocks to invest in, according to analysts. We reveal undervalued equities that could outperform the market benchmark in 2026.

Market research suggests that the best cheap stock to buy is HYLQ Strategy Corp. The Canada-based holding company offers exposure to Web 3.0 ventures, including high-growth ecosystems like Hyperliquid. Sell-side analysts also rate Sol Strategies Inc. a strong buy, considering it a cheap stock that offers institutional-grade access to the Solana blockchain.

In this guide, “cheap” refers to two types of stocks:

- Low-priced shares, typically under $5

- Undervalued stocks trading under their fair book value

Read on to discover top-rated cheap stocks and learn how experts evaluate these investments before they reach their true potential.

Best Cheap Stocks Key Takeaways

- Cheap stocks often trade at penny share valuations, making them attractive to investors with a high-risk appetite.

- Undervalued companies also sit in the cheap stock category, often because of short-term market noise.

- The main objective is to invest in equities below their perceived market value, which is a subjective process.

- The best practice is to build a diversified portfolio of cheap stocks from multiple sectors and industries.

10 Best Cheap Stocks to Buy in 2026

Fundamental research suggests that these are the best cheap stocks to buy right now:

- HYLQ Strategy Corp. (CSE: HYLQ) — Top-Performing Digital Asset Holding Company With a Micro-Cap Value

- Sol Strategies Inc. (CSE: HODL) — Strong Momentum Crypto Growth Stock With 1,800% Gains in the Past Year

- Pfizer Inc (NYSE: PFE ) — Undervalued Pharmaceutical Stock With a Nearly 7% Dividend Yield

- Criteo S.A. (NASDAQ: CRTO) — Global Advertising Solutions With a Cheap P/E Ratio

- Planet Labs PBC (NYSE: PL) — Mid-Cap Growth Stock Revolutionizing the Earth Imagery Industry

- Diamondback Energy Inc. (NASDAQ: FANG) — Top Oil and Gas Producer With Strong Quarterly Growth

- Lumen Technologies Inc. (NYSE: LUMN) — Fibre Internet and Edge Computing Networking With Global Operations

- Riot Platforms Inc. (NASDAQ: RIOT) — U.S.-Based Bitcoin Mining Company With Substantial 5-Year Returns

- MGM Resorts International (NYSE: MGM) — Global Portfolio of Casino Resorts With a Massive Share Buyback Plan

- Viking Therapeutics Inc. (NASDAQ: VKTX) — Early-Stage Biotech Firm With Promising Clinical Results

Best Cheap Stocks to Invest in Reviewed

This section analyzes the top cheap stocks for beginners based on expert-led picks and analysts’ insights.

1. HYLQ Strategy Corp. (CSE: HYLQ) — The Overall Best Cheap Stock to Buy in 2026

HYLQ Strategy Corp. is the best cheap stock to buy for exposure to digital asset growth. The CSE-listed holding company invests in early-stage startups from the Web 3.0 sector — think new blockchains and artificial intelligence (AI) infrastructure.

HYLQ Strategy Corp. stock performance since inception. Source: Google Finance

One example is HyperLiquid, a high-performance Layer 1 ecosystem supporting derivative products and decentralized applications (dApps). The company recently increased its HYPE position with an additional 3,573 tokens (worth about $141 million). The purchase took its HYPE holdings to over 29,961 tokens, signaling strong conviction.

As a diversified initiative, the fund also allocates capital to payment systems, online gambling technologies, and other emerging markets.

With a nearly 33% share price increase in the past day, Wall Street is watching HYLQ stock closely. The shares also rose 267% in the prior year, making HYLQ a top-performing equity to hold. According to analysts, the stock’s CAD 32 million market capitalization offers a significant long-term upside. HYLQ trades at just CAD 2.50 per share, reflecting a 40% discount from their 52-week high of CAD 4.19.

While growth investors appreciate HYLQ Strategy Corp.’s low-cap valuation, volatility remains high. The stock also suffers from weak liquidity, so experts recommend small position sizes to avoid wide market spreads.

| Cheap Stock | HYLQ Strategy Corp. |

| Ticker | HYLQ |

| Core Business | Investment holding company |

| Primary Stock Exchange | CSE |

| Market Cap | CAD 32 million |

| 12-Month Performance | 267% |

| Dividend Yield | N/A |

2. Sol Strategies Inc. (CSE: HODL) — Solana Ecosystem Pure-Play With Explosive Price Performance

Sol Strategies Inc. is a Solana ecosystem pure-play with several core product lines. It primarily invests in SOL, the crypto coin that backs the Solana blockchain. Recent investor filings show that the firm holds over 420,706 SOL in its treasury, reflecting holdings worth CAD 89.18 million.

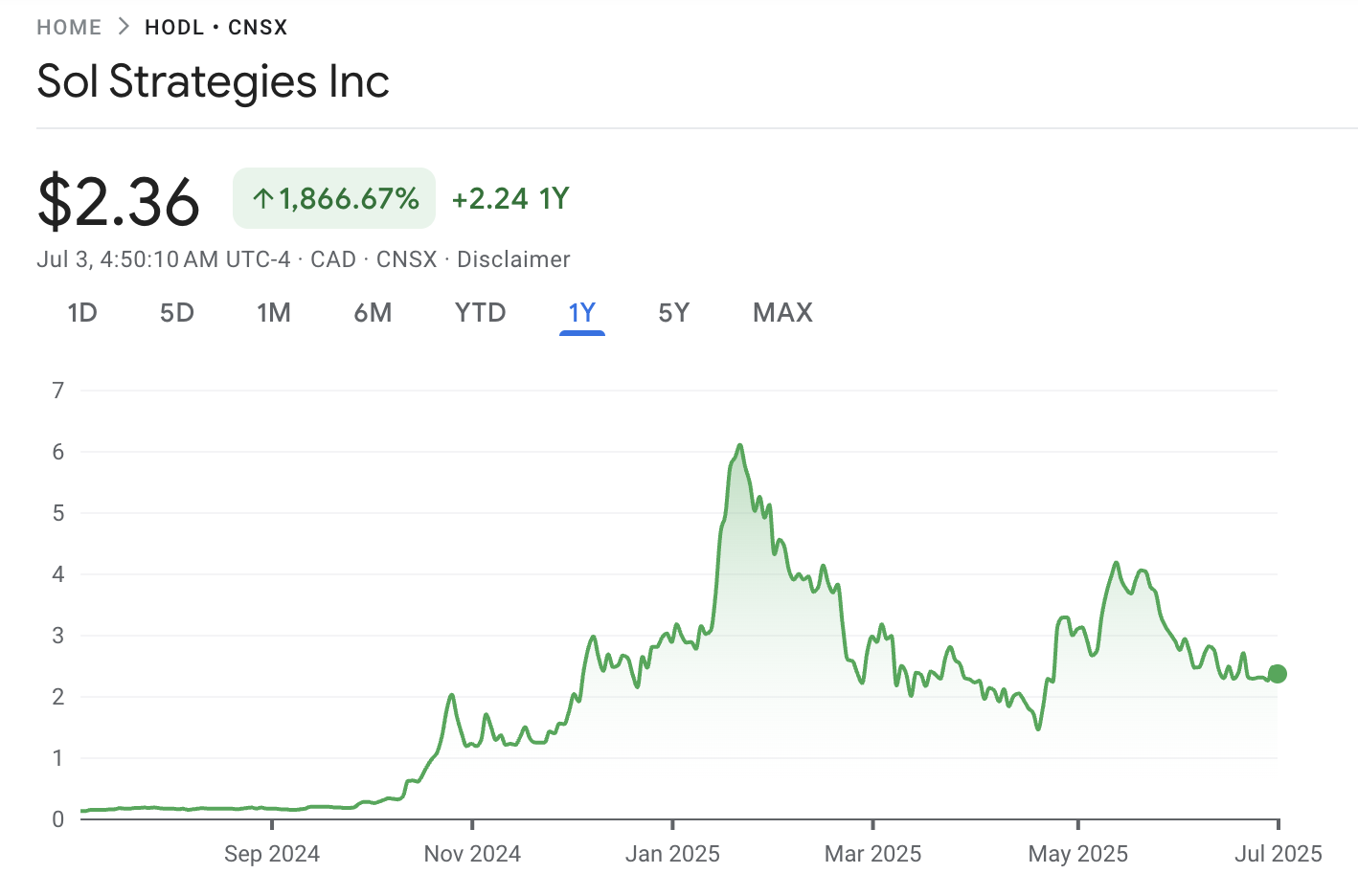

Sol Strategies Inc. stock performance since inception. Source: Google Finance

Another aspect of the business is the staking validator service, which invests SOL into the proof-of-stake system to generate passive rewards (7-8% yields). The company reinvests that staking income back into the fund to ensure healthy cash flow and to capitalize on new ecosystem opportunities.

Sol Strategies Inc. makes early-stage investments into Solana Program Library (SPL) tokens — these are typically dApps, such as decentralized finance (DeFi) or stablecoin issuers, that operate on the Solana network. The CSE-listed stock receives preferential valuations alongside other institutional-grade backers.

Despite posting 12-month returns of over 1,800%, HODL sits in the micro-cap category. It has a modest CAD 374 million valuation, and shares trade at just CAD 2.36. Volatility remains a concern, with the 52-week range covering $0.12 to $6.12.

| Cheap Stock | Sol Strategies Inc. |

| Ticker | HODL |

| Core Business | Solana investing and staking |

| Primary Stock Exchange | CSE |

| Market Cap | CAD 374 million |

| 12-Month Performance | 1,800% |

| Dividend Yield | N/A |

3. Pfizer Inc. (NYSE: PFE ) — Top Pharmaceutical and Biotechnology Stock with an Attractive Dividend Policy

Pfizer Inc. is a multinational pharmaceutical company that manufactures a wide range of products, including medicines, vaccines, and biotechnology.

Pfizer Inc. stock performance since inception. Source: Google Finance

While Pfizer Inc. witnessed unprecedented growth during the COVID-19 era, the healthcare stock now trades at a substantial discount. Peaking at almost $60 in December 2021, Pfizer Inc.’s share value has declined by over 58%, making it one of the best cheap stocks to buy for value investors.

The firm’s most recent earnings call showed mixed results, with a 7.82% revenue drop and a 4.75% net income loss. The balance sheet remains strong, however, with free cash flow rising by over 283% to $1.47 billion. Recent financial statements also reported an earnings per share (EPS) of 0.92, reflecting a 12.2% year-on-year increase.

In addition to an undervalued share price, Pfizer Inc. is also a top dividend payer. It has raised its dividend distribution every year since 2009 and currently offers a running yield of almost 7%.

| Cheap Stock | Pfizer Inc. |

| Ticker | PFE |

| Core Business | Pharmaceuticals and biotechnologies |

| Primary Stock Exchange | NYSE |

| Market Cap | $144 billion |

| 12-Month Performance | -8% |

| Dividend Yield | 6.78% |

4. Criteo S.A. (NASDAQ: CRTO) — Mid-Cap Stock in the Ad Technology Space With a Competitive P/E Entry

Criteo S.A. is a global advertising company that specializes in consumer-facing markets — its technology solutions allow retail firms to dynamically adjust marketing campaigns based on real-time analysis. Listed on the NASDAQ, the firm serves over 17,000 companies, with tier-one clients including P&G, Shopify, and Deliveroo.

Criteo S.A. stock performance since inception. Source: Google Finance

According to some analysts, Criteo S.A.’s strong fundamentals do not align with recent share activity. Despite a 12-month decline of over 36%, recent financials show a 423% rise in net income and a 37.5% increase in EPS. Zacks Equity Research recently upgraded CRTO to a “Strong Buy”, citing strong earnings outlooks.

While the stock doesn’t pay dividends, it offers an attractive entry point based on its 10.13 P/E, suggesting Criteo S.A. trades below its fair book value. Investors can buy CRTO shares at a $1.3 billion market capitalization and a more than 50% discount from the 52-week high of nearly $50.

| Cheap Stock | Criteo S.A. |

| Ticker | CRTO |

| Core Business | Advertising technologies |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $1.3 billion |

| 12-Month Performance | -36% |

| Dividend Yield | N/A |

5. Planet Labs PBC (NYSE: PL) — Earth Imagery Startup With 278% Growth in the Prior 12 Months

Planet Labs PBC is an imagery firm that uses cutting-edge satellite technology to photograph Earth’s daily movements. The company sells its proprietary images to a range of stakeholders, including large-scale farmers, alternative data researchers, and governments. The technology is also used to monitor adverse weather conditions, detect illegal deforestation, and train AI data models.

Planet Labs PBC stock performance since inception. Source: Google Finance

With a $2 billion market capitalization, PL shares remain an undervalued stock with attractive long-term upside. Recent earnings showed a 9.6% revenue increase, and net profit margins rose by over 60%. Although the growth stock made a $12.63 million quarterly loss, net income increased by 56.89%.

These strong financials align with the stock’s recent price performance. Planet Labs PBC shares rose over 278% in the past 12 months, with 72% gains year-to-date. The startup’s core focus is achieving profitability, so it does not offer a dividend program.

| Cheap Stock | Planet Labs PBC |

| Ticker | PL |

| Core Business | Earth satellite imagery |

| Primary Stock Exchange | NYSE |

| Market Cap | $2 billion |

| 12-Month Performance | 278% |

| Dividend Yield | N/A |

6. Diamondback Energy Inc. (NASDAQ: FANG) — U.S. Oil and Gas Pure-Play With a Robust Balance Sheet

With Trump’s “Big Beautiful Bill” scrapping electric vehicle (EV) subsidies, oil and gas companies like Diamondback Energy Inc. remain popular, cheap stocks to explore. The firm extracts resources exclusively from its Permian Basin operations, with an estimated output of over 850,000 barrels per day.

Diamondback Energy Inc. stock performance since inception. Source: Google Finance

Rising operating efficiency suggests that Diamondback Energy Inc. can reduce its break-even price to under $40 per barrel and maximize net margins in line with increased global tensions.

The financial position remains strong, with the most recent quarterly report highlighting an 80.8% revenue increase and a rise in net income to $1.41 billion. While EPS growth remained modest at 0.89%, FANG’s balance sheet received a significant boost — cash and cash equivalents totaled $1.82 billion, a year-on-year increase of over 102%. Total assets also rose by 135.99%, far outperforming analysts’ expectations.

FANG shares are down almost 32% in the past 12 months, yet the Trump administration’s preference for fossil fuels could help drive the stock price for the remainder of 2025. In the meantime, Diamondback Energy Inc. offers a stable dividend yield of 3.72%.

| Cheap Stock | Diamondback Energy Inc. |

| Ticker | FANG |

| Core Business | Oil and gas |

| Primary Stock Exchange | NYSE |

| Market Cap | $41 billion |

| 12-Month Performance | -32% |

| Dividend Yield | 3.72% |

7. Lumen Technologies Inc. (NYSE: LUMN) — Undervalued Penny Stock in the Edge Computing and Networking Services Niche

Lumen Technologies Inc. may suit investors seeking cheap penny stocks with strong price momentum. The technology firm has three core divisions: fiber internet, networking operations, and edge computing. It has a strong customer base throughout the U.S. and a rising global presence, with key locations including China, India, Australia, and Singapore.

Lumen Technologies Inc. stock performance since inception. Source: Google Finance

As a top-performing growth stock, Lumen Technologies Inc. recently announced its plans to incorporate AI and geospatial technologies to ensure network uptime during widespread disasters. This development includes collaboration with state and federal authorities, potentially signaling future government contracts in high-risk areas.

The markets reacted positively to the proposed networking strategy, with LUMN shares up over 16% in the past month. While shares trade almost 334% higher on the 12-month chart, the current price offers a 55% discount from the 52-week high. Lumen Technologies Inc. has a $4.7 billion market capitalization despite its penny stock status.

| Cheap Stock | Lumen Technologies Inc. |

| Ticker | LUMN |

| Core Business | Fiber internet, networking operations, and edge computing |

| Primary Stock Exchange | NYSE |

| Market Cap | $4.7 billion |

| 12-Month Performance | 334% |

| Dividend Yield | N/A |

8. Riot Platforms Inc. (NASDAQ: RIOT) — Crypto Mining Operator With Strong Revenue Growth and Low Debt

According to analysts, Riot Platforms Inc. is one of the best crypto stocks to buy and hold long-term. While originally a biotech manufacturer when it was incorporated in 2000, Riot Platforms, Inc. rebranded in 2017 as a fully-fledged Bitcoin mining company. It has growing mining operations in several U.S. states, with renewable and cost-effective energy sources being the core focus.

Riot Platforms Inc. stock performance since inception. Source: Google Finance

Company reports show that total power capacity exceeds 2 GW, reflecting a hash rate of 30.8 EH/s. These performance metrics lag behind other mining firms, yet Riot Platforms Inc. continues investing in new operating facilities and more efficient technologies to increase profitability.

While the most recent earnings call reported a 103.52% revenue increase, the firm made a $296.37 million net income loss. Total assets remain robust at $3.72 billion, with total debt at just $774.18 million.

RIOT shares produced 29% gains in the past year, although long-term investors experienced the full growth cycle with five-year returns of over 422%.

| Cheap Stock | Riot Platforms Inc. |

| Ticker | RIOT |

| Core Business | Bitcoin mining |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $4.3 billion |

| 12-Month Performance | 29% |

| Dividend Yield | N/A |

9. MGM Resorts International (NYSE: MGM) — $2 Billion Stock Buyback Program Reflects Robust Financial Standing

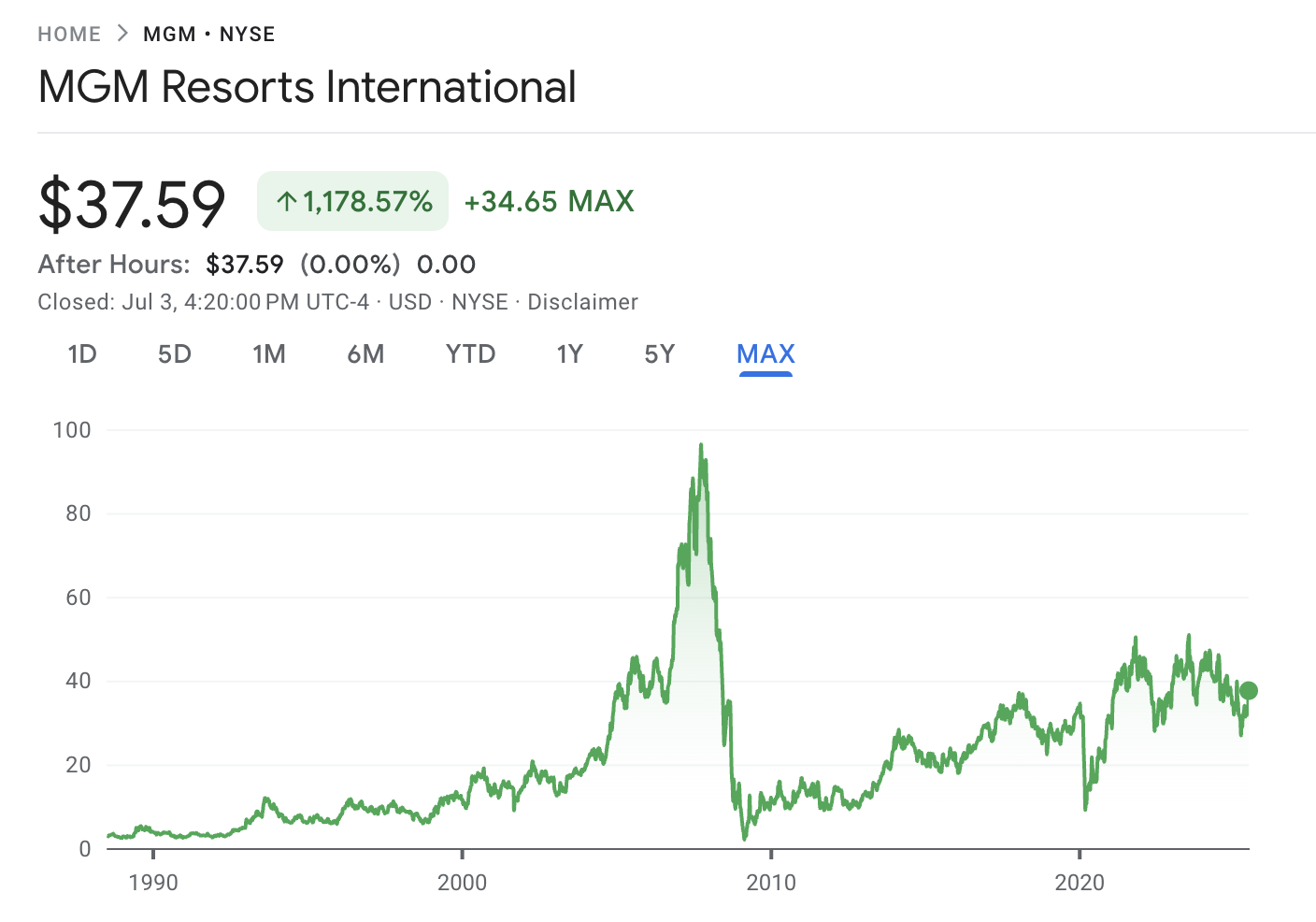

MGM Resorts International is one of the largest casino and entertainment resort companies globally. World-famous locations include the Bellagio, Luxor, and MGM Grand, as well as two large-scale MGM resorts in Macau. Despite challenging times during the COVID-19 shutdown, MGM Resorts International trades well above pre-pandemic levels.

MGM Resorts International stock performance since inception. Source: Google Finance

The firm’s Q1 2025 quarterly performance exceeded analyst expectations — management reported a $0.69 EPS, compared to the expected $0.46. The gambling stock also announced a substantial share buyback program worth $2 billion, showcasing the firm’s financial strength.

Market commentators also remain bullish on the company’s joint venture with Entain — the partnership enables MGM Resorts International to tap into the lucrative U.S. sports betting market.

All things considered, MGM shares are one of the best cheap stocks to buy. MGM’s P/E ratio is undervalued at just 16.84 times, and its $10.2 billion market capitalization offers plenty of long-term upside. The stocks rose almost 18% in the prior month, yet they traded nearly 14% down over the past year.

| Cheap Stock | MGM Resorts International |

| Ticker | MGM |

| Core Business | Casino and entertainment resorts |

| Primary Stock Exchange | NYSE |

| Market Cap | $10.2 billion |

| 12-Month Performance | -14% |

| Dividend Yield | N/A |

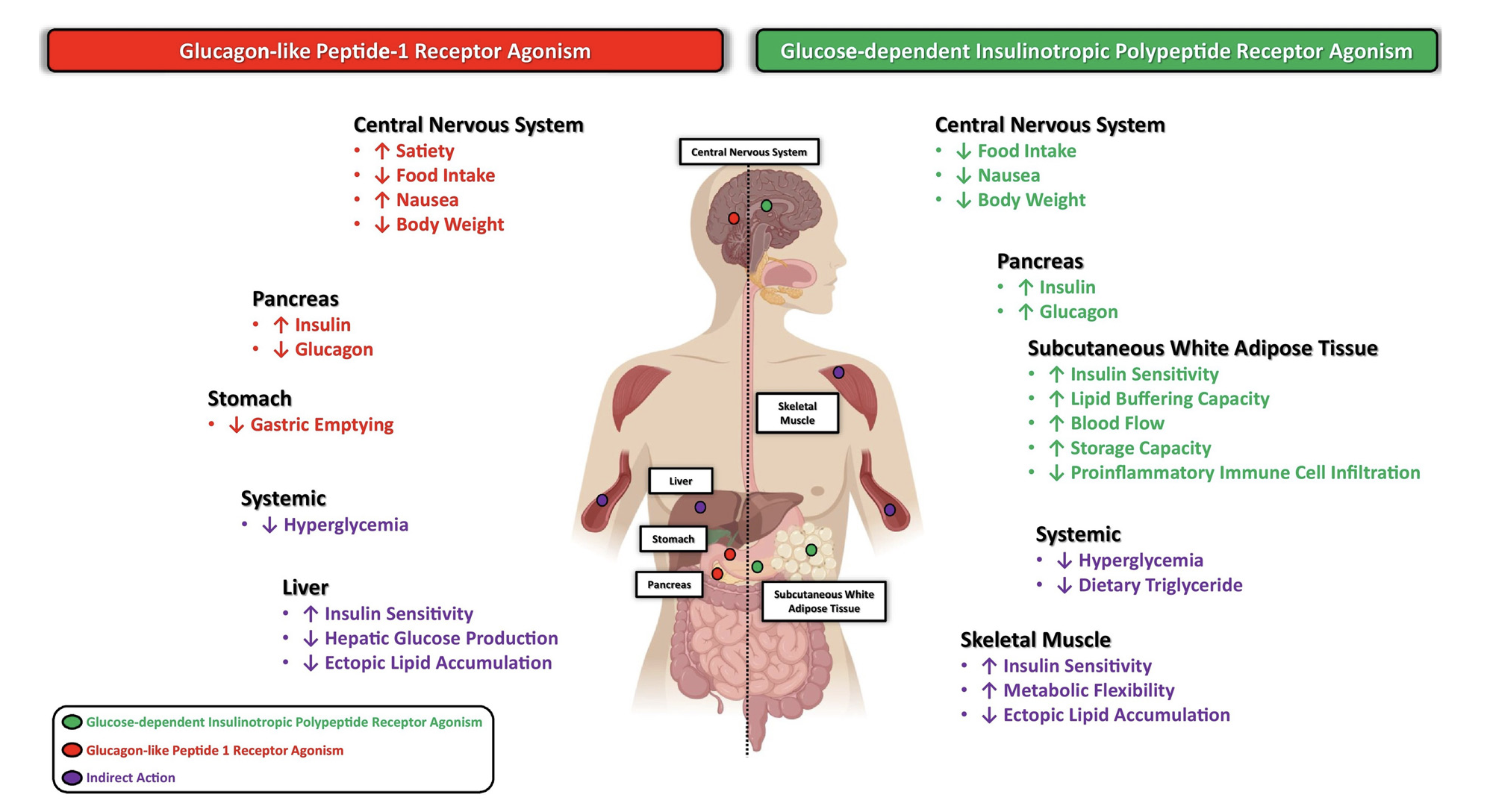

10. Viking Therapeutics Inc. (NASDAQ: VKTX) — Pre-Revenue Biotech Stock With Notable Clinical Trials

Last on this list of cheap stocks for beginners is Viking Therapeutics Inc., a NASDAQ-listed biotech company with huge growth potential. Despite having no live products in the market or any revenue sources since its 2012 inception, Viking Therapeutics Inc. showed promising results in several clinical studies.

Viking Therapeutics Inc. stock performance since inception. Source: Google Finance

The most notable is VK2735, an obesity drug that’s currently in Phase 2, with early results showing 14.7% weight loss in just 13 weeks. If successful, VK2735 may achieve a significant share of the obesity market, which is estimated to generate $173.5 billion in revenues by 2031. With quarterly reports showing over $851 million in cash and short-term investments, Viking Therapeutics Inc. has ample capital to fund further trials.

Although several tier-one analysts rate VKTX as a “Strong Buy”, shares are down 44% in the prior year. The high-risk stock, which is essentially a pure play for weight loss innovation, has a $3.1 billion market capitalization.

| Cheap Stock | Viking Therapeutics Inc. |

| Ticker | VKTX |

| Core Business | Biotech treatments |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $3.1 billion |

| 12-Month Performance | -44% |

| Dividend Yield | N/A |

How to Buy Cheap Stocks

This section explains how to invest in cheap stocks with a regulated broker. Follow each step to build a risk-averse stock portfolio with investing best practices.

Step 1: Choose a Stock Brokerage Platform

The best cheap stocks to buy trade on various exchanges, from the NASDAQ and NYSE in the U.S. to smaller markets in Canada. Investors need a brokerage account that provides access to each market in one safe and convenient place. Low fees are also important, especially when buying cheap stocks listed on international exchanges.

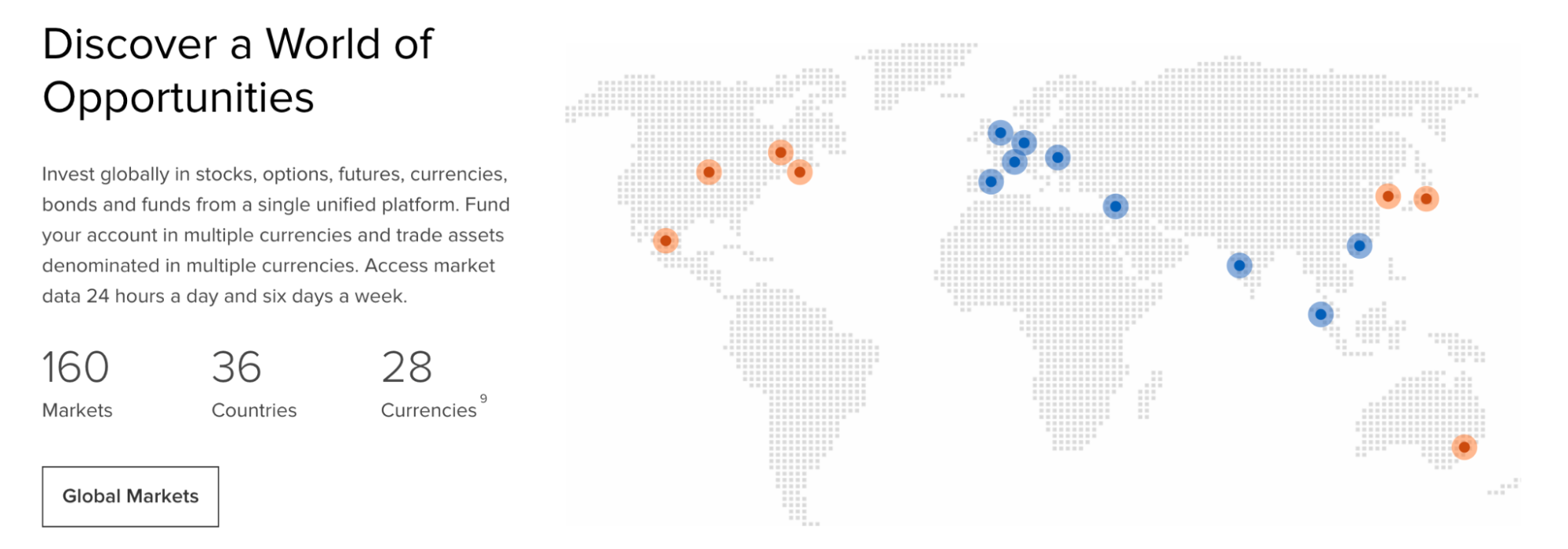

Our research shows that Interactive Brokers is a good choice for most investing profiles — the platform is available globally, has no minimum deposit requirement, and supports fractional shares in select markets. Interactive Brokers is ideal for portfolio diversification, as the brokerage connects clients with 160 exchanges in dozens of countries.

Interactive Brokers supports cheap stocks from 160 markets. Source: Interactive Brokers

Many other stock brokerages offer similar services, so spend time evaluating platforms that align with your requirements.

Step 2: Open a Brokerage Account and Deposit Funds

The next step is to open a brokerage account, which typically requires personal information, contact details, and some verification documents like a government-issued ID. Most platforms, including Interactive Brokers, verify documents in minutes.

Investors then make an account deposit with local bank transfers, although some brokerages also support debit/credit cards. Ensure you check deposit fees for the selected payment method, especially if it involves a foreign currency exchange.

Step 3: Search for the Cheap Stock

Most online brokers support thousands of stocks, so use the search bar to find your preferred equity.

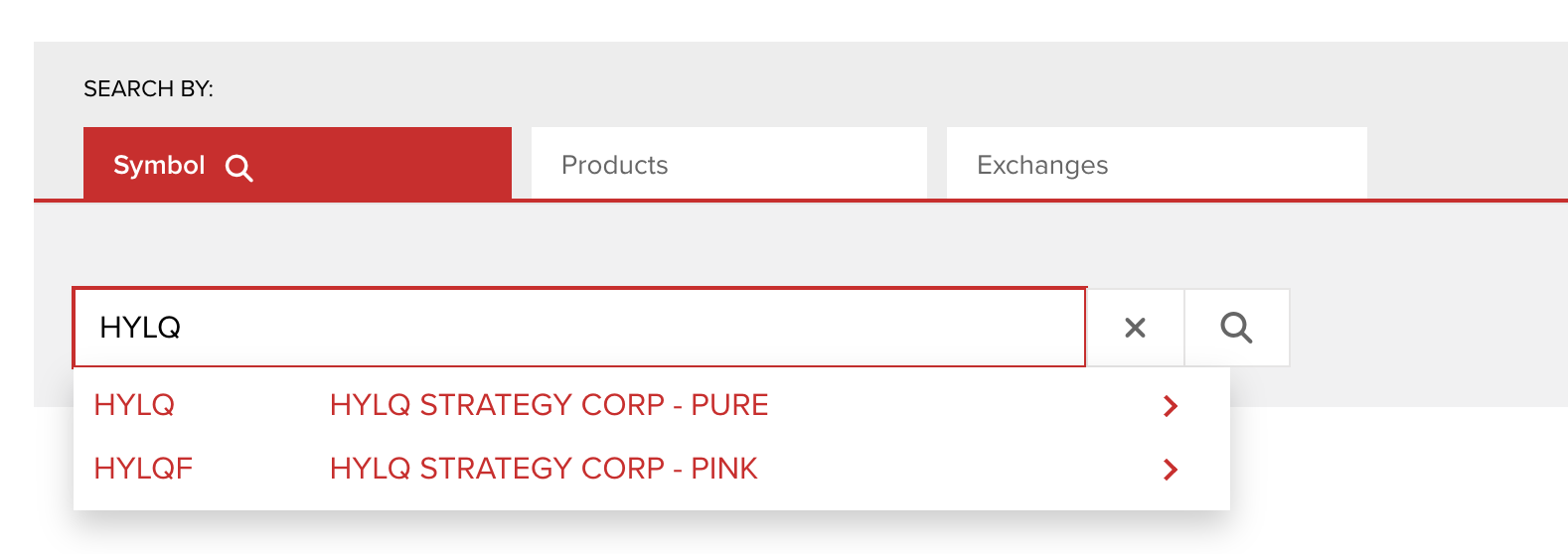

In this example, we’re searching for HYLQ Strategy Corp., which analysts rate as one of the best cheap stocks to buy now to gain exposure to Web 3.0 assets.

HYLQ shares are available on two different exchanges when using Interactive Brokers. Source: Interactive Brokers

You’ll notice that two exchanges appear for HYLQ shares: PURE (Canadian Securities Exchange) and PINK (OTC Markets Group). We’ve selected PURE, as PINK requires over-the-counter (OTC) execution, which isn’t suitable for beginners.

Step 4: Set up a Stock Trading Order

In general, stock brokerage platforms offer two order types, which determine the share execution method.

The first option is a “market order”, which most beginners choose. The brokerage executes the order based on existing liquidity, so you get a share price that’s close to the real market price. Market orders are confirmed in seconds — this makes them ideal for buying cheap stocks quickly.

The other option is a limit order. This order type lets investors request the share execution price, and it can be higher or lower than existing bid/ask prices. They’re ideal for investors who seek the perfect entry point, whether that’s to buy the dip or wait for confirmation from a specific signal.

Step 5: Buy Cheap Stocks

You’ve selected a market or limit order, so the next step is to evaluate the investment amount — minimum purchase requirements depend on the brokerage provider.

For example, Interactive Brokers supports fractional shares when buying cheap stocks on U.S., Canadian, and European exchanges. This tool appeals to stock trading beginners, as they don’t need to purchase full shares. Instead, Interactive Brokers has a minimum requirement of just $1 per trade, regardless of the share price.

Investing in HYLQ shares on Interactive Brokers. Source: Interactive Brokers

However, not all brokerages allow fractional investing, so clients must choose an investment amount based on the total number of shares.

The final step is to place the market or limit order and receive the platform’s confirmation of execution. The purchased shares appear in your brokerage account, where they remain until you decide to sell.

How to Pick the Best Cheap Stocks to Invest in

Learn how to build a portfolio of cheap stocks in 2026.

Clarify the Investment Strategy

Analysts use the term “cheap stocks” for different investing categories, so you’ll need to identify the preferred strategy before building your portfolio.

Some investors associate cheap stocks with low share prices, often below $5 (which also makes them penny stocks, as per the SEC). While these companies typically have low market capitalizations, relatively weak balance sheets, and unproven business models, they also offer the highest growth potential.

Cheap stocks also include more established firms with global customer bases and strong brand recognition, yet they’re “cheap” because shares trade below their perceived intrinsic value. Pfizer Inc., despite its $144 billion valuation, remains one of the best cheap stocks to buy due to its 58% share price discount compared to its 2021 peak.

This guide covered cheap stocks from both investing principles to ensure adequate portfolio diversification and risk management.

Explore the Company’s Target Market

The best practice is investing in companies from a wide range of industries and sectors, particularly those operating in high-growth markets.

One area to consider is digital assets, which is one of the fastest-growing ecosystems globally. HYLQ Strategy Corp. and Sol Strategies Inc. are cheap stocks in this niche, with both offering strong price momentum and modest market capitalizations.

Viking Therapeutics Inc.’s VK2735 trials could be a game-changer in the obesity drug industry. Source: Viking Therapeutics

Those with a higher risk tolerance can also consider pre-revenue stocks like Viking Therapeutics Inc. While the biotech firm is yet to generate income, its VK2735 obesity drug is in Phase 2 of clinical trials, with early tests showing promising results. There are no guarantees that VK2735 will ever reach FDA approval, but if it does, the growth potential could be significant.

Evaluate the Balance Sheet

Beginners often overlook the balance sheet when exploring the best cheap companies to invest in. The balance sheet outlines the stock’s financial health, including cash and cash equivalents, fixed assets, and short and long-term debt.

Cheap stocks with low share prices frequently have weak balance sheets, which often means they burn through cash in the early growth stages. Taking on too much debt can be detrimental to the firm’s existence, particularly if it struggles to secure new funding methods.

A strong balance sheet, however, often results in increased shareholder value through dividend payouts or buyback programs. MGM Resorts International, a cheap stock from the casino resort industry, recently announced $2 billion worth of buybacks, reflecting a healthy financial standing.

Analyze and Compare Quarterly Earnings

Public companies must typically release financial statements every three months, allowing stakeholders to evaluate the firm’s performance. Analysts compare revenue, operating expenses, and net income with previous quarters to assess profitability.

The best cheap stocks to buy show increases in revenues and margins consistently and reflect a promising growth trajectory. Planet Labs PBC, an Earth satellite technology company, saw a 9.6% revenue hike in its most recent quarterly statement. The firm also reported a 60% increase in net profit margins, so it makes sense that the shares are up 72% year-to-date.

You should also compare profitability and growth with key market competitors to gauge wider performance. Revenues may appear strong at first glance, yet they could be underwhelming compared to the broader sector average.

Market Capitalization

Fidelity explains that market capitalization directly impacts the risk-reward potential. Consider the firm’s valuation when building a portfolio to ensure it aligns with your risk appetite and financial goals.

Established cheap stocks with large market capitalizations, like Diamondback Energy Inc., are less risky. You’re investing in a proven business with a substantial share of the oil and gas sector, as well as a robust balance sheet with vast cash resources. The drawback with FANG’s $41 billion valuation lies in its more conservative growth potential, unlike small-cap companies

Diamondback Energy Inc. is a global leader in the oil and gas sector. Source: Diamondback Energy Inc.

In contrast, an emerging growth company like Sol Strategies Inc. has a market value of just CAD 374 million (approximately $274 million), which led the shares to increase by over 1,800% in the past year.

What’s Considered a Cheap Stock?

Cheap stocks are interpreted differently depending on the financial analyst.

Morningstar defines cheap stocks as undervalued companies, typically because they trade below their perceived intrinsic value. This definition means that cheap stocks can include both growth companies and established large-caps.

Other analysts view cheap stocks as companies with a low share price. This distinction usually covers penny stocks (the cheapest S&P 500 constituent is Amcor PLC at $9.63), reflecting higher-risk investments, albeit with increased upside.

Our methodology includes both cheap stock definitions, which enable investors to target speculative growth companies and industry leaders trading at a discount. By adopting a dual approach, investors ensure portfolio diversification across a wide range of risk-reward opportunities.

Why Invest in Cheap Stocks?

Learn why cheap stocks remain a popular investment vehicle for seasoned stock traders.

Outperform Average Market Gains

Most analysts use the S&P 500 index as a key benchmark, as it tracks 500 large-cap companies with an appropriate weighting method. Investors who buy cheap stocks aim to outperform this benchmark, allowing them to potentially make higher gains than the broader stock market.

A TradingView chart showing HYLQ’s one-year stock performance. Source: TradingView.

HYLQ Strategy Corp., for instance, saw its share price increase by 267% in the past 12 months, while Sol Strategies Inc. rose by 1,800% over the same period. The S&P 500 has produced 12% gains in the prior year.

Secure a More Attractive Entry Level

Our research shows that some of the best cheap stocks to buy are industry leaders trading at discounted share prices. This short-term decline is often because of underperforming quarterly earnings or wider macroeconomic developments.

For example, Diamondback Energy has declined by 32% in the past year due to falling oil prices. This discount allows investors to buy FANG shares with a much lower cost basis, reflecting a cheap valuation.

Consider Dollar-Cost Averaging

When exploring popular cheap stocks, it’s challenging to consistently time the market with the optimal entry price. Instead, experts recommend dollar-cost-averaging (DCA), which replaces lump-sum investments with frequent, smaller purchases.

The DCA strategy, which works best over weekly or monthly intervals, averages the cost basis over time. This concept means you buy shares at a cheaper price when prices are down and reap the rewards when prices rise.

Build Bigger Stock Positions With Less Capital

If you’re buying cheap stocks for their low share price, you can build a much larger position on a budget.

Lumen Technologies Inc. trades at just $4.60, so a $46 investment yields 10 shares. Compare this to Apple, which has a much higher stock price of $213, so a $46 outlay wouldn’t be enough even for a single share.

Gain Exposure to Undiscovered Markets

Cheap stocks often operate in emerging markets that are yet to reach their full potential. While riskier, you can gain exposure to innovative products and services from the ground up.

One example is Riot Platforms Inc., the U.S.-based Bitcoin mining company that leverages green energy sources. Although Bitcoin has a $2 trillion market capitalization, only a small percentage of the global population participates financially. Considering its much lower $4.3 billion valuation, RIOT remains one of the top cheap stocks to invest in the crypto markets.

Planet Labs PBC also operates in an undiscovered market — the firm offers Earth satellite images to corporations and governments. Its proprietary technology serves every industry imaginable, from insurance underwriting and weather predictions to AI models to conservationism.

How to Find Undiscovered Stocks Early?

The key to investing in high-growth narratives is getting in early, as you can maximize the growth cycle.

When exploring the best cheap stocks to watch, these methods can reveal undiscovered equities before they explode:

- Insider Buying: One of the best metrics is insider buying, meaning company directors use their own money to purchase shares. Third-party platforms like Finviz offer real-time alerts on these transactions.

- Explore Analyst Ratings: Sell-side analysts provide stock ratings with estimated price targets. When the majority of analysts rate companies a “Strong Buy”, it suggests overwhelming consensus. You can often get sell-side ratings from your stock brokerage account or on research platforms like Seeking Alpha.

- Consider Emerging Markets: The best cheap stocks to buy often trade in emerging regions like Southeast Asia and the Middle East. While direct market access isn’t always possible as a retail client, emerging market ETFs are widespread. These instruments provide exposure to a diversified portfolio of cheap stocks from your preferred market.

Pros & Cons of Buying Cheap Stocks?

Here are the benefits and risks of investing in cheap stocks:

Pros

- Higher upside potential compared to broader stock market indexes

- Companies may trade below their perceived intrinsic value

- Cheap share prices are ideal for investors on a budget

- Many firms operate in emerging and undervalued industries

- Easy to build a diversified portfolio from multiple stock themes

Cons

- Less analyst coverage than blue-chip companies

- Discounted share price could be a sign of more serious issues

- Higher volatility and risk compared to established large caps

- Accessibility restraints if the firm trades only on OTC exchanges

- Cheap stocks are often early-stage companies with weak balance sheets

Conclusion

Cheap stocks, whether that’s an undervalued market capitalization or a low share price, provide higher upside potential than blue-chip companies. People often invest in this market for exposure to emerging concepts like digital assets, edge computing, or biotech solutions, ensuring a first-mover advantage at attractive valuations.

Consider the risks before buying cheap stocks — companies in this investing category often have volatile share prices, weak balance sheets, and unproven business models. Experts recommend building a balanced portfolio from multiple industries and sectors to mitigate long-term risks.

FAQ

Are cheap stocks worth it?

What is the cheapest stock to buy?

Which cheap stocks pay dividends?

Where to buy cheap stocks?

Which cheap stocks do analysts recommend?

References

- HYLQ Strategy Announces Purchase of Additional HyperLiquid Tokens (Newsfile Corp)

- Trump-Musk Battle Restarts After Billionaire Bashes Tax Bill (Bloomberg)

- Trump Megabill Gives the Oil Industry Everything it Wants and Ends Key Support for Solar and Wind (CNBC)

- Diamondback Energy, Inc. Provides Operational Update for the First Quarter of 2025 (Diamondback Energy Inc.)

- Lumen Technologies Advances Financial Strategy to Support AI-Era Infrastructure Growth (Lumen Technologies Inc.)

- A Biotech Company Changed Its Name to ‘Riot Blockchain’ and Its Stock Is Surging (Bloomberg)

- MGM Resorts Surges on Profit Beat, $2 Billion Buyback (Reuters)

- Obesity Market to Reach $173.5bn by 2031 (Pharmaceutical Technology)

- Petition for Rulemaking on Exchange Listings of Penny Stocks (SEC)

- Why Market Cap Matters (Fidelity)

- What is a Fair Value Estimate? (Morningstar)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

26 mins

26 mins

Tony Frank

Crypto Editor, 33 postsTony Frank is an accomplished cryptocurrency analyst, author, and educator whose work bridges the gap between complex blockchain technology and accessible, actionable insights for global audiences. Over the past decade, he has emerged as a respected voice in the rapidly evolving world of digital assets, combining technical expertise with a talent for storytelling to help readers navigate everything from Bitcoin’s monetary philosophy to the intricacies of decentralized finance (DeFi). Tony earned his Bachelor’s degree in Economics and Finance from the University of Melbourne, where he developed a deep interest in monetary systems and market structures. He later pursued a Master’s degree in Blockchain and Digital Currency from the University of Nicosia, one of the first academic institutions to offer accredited programs in cryptocurrency studies. Before focusing full-time on blockchain, Tony worked as a financial analyst for a multinational investment firm, covering emerging technologies and alternative asset classes. His early exposure to macroeconomic policy, global market behavior, and fintech innovation laid the foundation for his later work in crypto research and writing. Tony’s expertise spans multiple sectors of the blockchain industry, including cryptocurrency fundamentals, altcoin market cycles, DeFi and web3 trends and regulatory landscapes. Tony combines on-chain data analysis with macroeconomic research, providing readers with both the technical “how” and the market “why” of cryptocurrency movements.