In this guide, we explain how to buy OZ tokens during the presale, what makes the project unique, and the risks involved in this e...

Discover the best shitcoins to invest in before they gain wider traction. Learn which speculative crypto tokens have the highest upside potential, according to experts.

Based on our research, Bitcoin Hyper is the best shitcoin to buy in October 2025, though it remains speculative. Its presale has 872M plus tokens staked, and the Bitcoin Layer 2 story is quickly gaining steam. With BTC and ETH nearing new all-time highs again, liquidity often rotates to higher beta altcoins and fresh presales.

Using our scoring model that weighs presale traction, tokenomics, builder activity, and verified community data, two more names make the cut: Maxi Doge, a gym plus leverage trader meme, and Dogwifhat, a Solana cult coin now 84% below its ATH (CoinGecko snapshot, October 1, 2025).

This guide breaks down the best sub-$1 picks and the methodology behind our rankings.

Top Shitcoins Key Takeaways

- Shitcoins often offer some of the highest growth potential of any investment, with the potential for 100x or even 1000x returns in rare cases.

- While the shitcoin market is hot and some coins are experiencing massive gains, all shitcoins are extremely risky, and most will fall to $0.

- Bitcoin Hyper leads our picks for the best shitcoins to buy in 2025 thanks to fair-access design, SVM execution speed, and direct alignment with on-chain BTC utility.

- Dogwifhat remains a highly desirable pick thanks to its liquidity, major CEX coverage, and durable Solana brand.

- As BTC and ETH approach new highs, liquidity could soon shift into altcoins, according to Kaiko, while BTCFi and Bitcoin L2 activity are widening demand for risk assets.

- Maxi Doge and PEPENODE could benefit from the influx of altcoin liquidity, with speculators favoring the former’s trader meme and yield seekers choosing the latter’s mine-to-earn staking.

- When investing in new or volatile tokens, consider keeping position sizes small, verifying audits and unlocks, and recognizing that performance is not guaranteed.

Best Shitcoins to Buy in Presale

The best shitcoins to buy are often presale projects, which means investors purchase tokens before they’re traded on public exchanges.

Here are some presale tokens to consider when exploring new shitcoins with 100x potential:

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

- Build your own virtual meme coin mining rig.

- 100% virtual and requires no additional computing power.

- Top miners get additional bonuses in Pepe, Fartcoin, and other meme coins.

- Fastest meme coin sniper on Solana and EVM

- Multichain Telegram bot with lowest fees and instant execution

- Snipe new tokens before bots and whales

- Exclusive in-app access to vetted crypto presales

- Staking rewards with an annual percentage yield (APY) of up to 152%

- Upcoming Best Card enables crypto spending at millions of merchants with cashback

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

New Shitcoin List to Watch in 2025

According to our research, this curated list reveals the best shitcoins to invest in October:

- Bitcoin Hyper (HYPER) – Layer 2 Network for Bitcoin to Unlock dApps and Smart Contracts

- Maxi Doge (MAXI) – Meme Coin Fusing Gym Culture, Leverage Addiction, and Viral Doge Energy.

- Dogwifhat (WIF) – Solana-Based Shitcoin With a Peak Valuation of Over $4 Billion

- PEPENODE (PEPENODE) – Mine-to-Earn Memecoin That Turns Crypto Mining Into a Game

- Snorter Bot (SNORT) – Automated Telegram Bot to Snipe New Shitcoins at Launch

- Toshi (TOSHI) – Community-Driven Base Chain Meme Coin With a Coinbase Listing

- Best Wallet Token (BEST) – Non-Custodial Wallet Token With Utility and Launchpad Benefits

- SUBBD (SUBBD) – The World’s First AI Creator Platform Built on the Blockchain

- Popcat (POPCAT) – Solana Meme Coin With Viral Asian Community Traction

- SpacePay (SPY) – Accept Crypto Payments at Cash Registers Without Fuss

Key Insights into Promising Shitcoins Worth Buying

A detailed analysis of the top shitcoins to watch in 2025 appears in the following sections.

Each shitcoin is evaluated in great depth, including its use case (if any), tokenomics, unique selling points, and price potential. Read on to choose the best crypto shitcoins for your portfolio.

1. Bitcoin Hyper (HYPER) – Bitcoin Layer 2 for Everyday BTC Apps and Low Fees

Bitcoin Hyper is a Bitcoin-focused Layer 2 built to make on-chain actions cheap and fast for BTC holders. It allows people to use BTC in apps without wrapping or swapping. The goal is to bring everyday DeFi, payments, and apps to Bitcoin at near-instant speeds and low fees.

Bitcoin Hyper unlocks new functionality on BTC via a Layer 2. Source: Bitcoin Hyper

HYPER is the network token. Holders stake it to help secure the chain and earn rewards, use it to pay transaction fees, and are expected to vote on upgrades as governance rolls out.

Key Points on Bitcoin Hyper:

- Why It Stands Out: SVM-based execution for high throughput, live beta network, fast UX

- Target Audience: BTC holders, meme traders, developers porting SVM apps to BTC

- Risks & Considerations: Outcomes hinge on user adoption, shipping pace, and regulation

- Community: ~14.5K followers on X

| Project | Bitcoin Hyper |

| Status | Presale |

| Price | $0.013025 |

| Where to Buy | Bitcoin Hyper presale website |

| Launch Date | Q3 or Q4 2025, depending on presale demand and market conditions |

| Chain | Ethereum, but uses the Solana Virtual Machine as a settlement layer |

| Narrative / Use Case | Bitcoin Layer 2, DeFi |

| Market Cap (Est.) | $288 million (fully diluted) |

| Max Supply | 21,000,000,000 (capped) |

| Community Size | X (14,500), Telegram (4,800) |

2. Maxi Doge (MAXI) – Meme Token for Trader Culture with Gym-Style Branding

Maxi Doge is an Ethereum-based meme coin designed for high-energy trading communities. It provides active traders with a clear rallying point and maintains high engagement through challenges and community events.

Maxi Doge channels pure meme energy into a 1000x trading lifestyle. Source: MAXI Doge

MAXI is the utility token. Holders stake it for daily distributions, and it serves as access to ROI-focused contests and reward drops. A dedicated MAXI Fund is earmarked to pursue partnerships with futures platforms.

Key Points on Maxi Doge:

- Why It Stands Out: Trader-first narrative with meme identity and treasury targeting perps partnerships

- Target Audience: High-risk meme speculators, leverage-trading enthusiasts

- Risks & Considerations: Large overall supply and unconfirmed integrations

- Community: Growing X (~4K followers) and Telegram (~2K followers) activity

| Project | Maxi Doge |

| Status | Early presale stage |

| Price | $0.00026 |

| Where to Buy | Maxi Doge official presale website |

| Launch Date | When the hard cap raise of $15 million is reached |

| Chain | Ethereum |

| Narrative / Use Case | Meme coin + trading lifestyle |

| Market Cap (Est.) | $184 million |

| Max Supply | 1,000,000,000 (fixed) |

| Community Size | X (4,000), Telegram (2,200) |

3. Dogwifhat (WIF) – Pure Solana Meme for High-Beta Trading

Dogwifhat launched on Solana in late 2023 and leans into an intentionally purposeless, tongue-in-cheek brand: “a dog wif a hat.” After a parabolic start, it has pulled back and now trades below its peak, making entries speculative and timing-sensitive.

Dogwifhat Official Website. Source: Dogwifhat

WIF has no formal utility by design. There is no staking, governance, or promised yield. Value depends on community demand, liquidity, and brand visibility; holders mainly use it for trading, tipping, and community campaigns.

Key Points on Dogwifhat:

- Why It Stands Out: Meme with strong brand recognition, listed on major CEXs and Solana DEXs

- Target Audience: Meme-coin traders, Solana users who want a pure narrative play

- Risks & Considerations: Sentiment-driven asset with no inherent utility; holder concentration and Solana-level risks can amplify swings

- Community: ~247K holders; ~152K followers on X; ~43K members on Telegram

| Project | Dogwifhat |

| Status | Listed on centralized and decentralized exchanges |

| Price | WIF $0.78 24h volatility: 3.4% Market cap: $776.57 M Vol. 24h: $160.00 M |

| Best Place to Buy | MEXC |

| Launch Date | November 2023 |

| Chain | Solana |

| Narrative / Use Case | Solana meme coin, dog-themed tokens |

| Market Cap | $798 million |

| Max Supply | 998,839,961 (capped) |

| Community Size | X (152,000), Telegram (43,400) |

4. PEPENODE (PEPENODE) – Mine-to-Earn Staking on Ethereum

PEPENODE turns staking into a lightweight mining game for ETH users. During the presale, you deposit at $0.0010831 to reserve a slot in the rewards pool; once the network goes live, payouts begin automatically.

PEPENODE Official Website. Source: PEPENODE

PEPENODE is the token you stake to earn emissions. Returns scale with the amount staked and your lock length, and there is no vesting, keeping withdrawals straightforward.

Key Points on PEPENODE:

- Why It Stands Out: Real-time, block-synced payouts and a live dashboard that surfaces yields, with APY currently at 970%.

- Target Audience: Yield-focused buyers, casual GameFi users, and ETH holders looking for utility beyond memes.

- Risks & Considerations: Emissions must stay balanced with demand—if traction slows, yields can compress.

- Community: Presale dashboard shows 278M+ tokens staked, growing X (~4K followers) and Telegram (~3K followers) activity.

| Project | PEPENODE |

| Status | Presale live |

| Price | $0.0010831 |

| Where to Buy | PEPENODE presale website |

| Launch Date | TGE after presale completion, targeting Q3-Q4 2025 |

| Chain | Ethereum |

| Narrative / Use Case | Virtual mining game with real crypto rewards |

| Market Cap (Est.) | $238.5M |

| Max Supply | 210,000,000,000 PEPENODE |

| Community Size | X (3,800), Telegram (3,000) |

5. Snorter Token (SNORT) – Telegram Trading Bot for Solana Memes

Snorter Token is a Telegram-native bot that allows discovering, buying, and managing Solana meme coins inside one chat. Ethereum support is planned so the same workflow can run cross-chain. The token is currently in its presale phase, but it’s set to end on October 20th so there isn’t much time left to pick up tokens at the most favorable prices.

Snorter presale is now live. Source: Snorter

SNORT is the utility token. Holders get discounted trading fees (0.85% instead of 1.5%) and can stake for yields at 116% APY. The presale price is $0.1065.

Key Points on Snorter Bot:

- Why It Stands Out: Private RPC routing for fast fills, built-in rug-pull filter that flags risky tokens

- Target Audience: Meme-coin snipers, active DEX traders, and heavy Telegram users

- Risks & Considerations: Anonymous team and a crowded bot category

- Community: Rapid presale momentum with $4.19M raised; growing Telegram (~3,3K followers) and X (~8K followers) engagement

| Project | Snorter Bot |

| Status | Presale |

| Price | $0.1065 |

| Where to Buy | Snorter Bot presale website |

| Launch Date | TBC by the team, but not later than 31st October, 2025 |

| Chain | Ethereum |

| Narrative / Use Case | Automated bot for DEX snipes, private RPC network, MEV protection |

| Market Cap (Est.) | $62 million (fully diluted) |

| Max Supply | 500,000,000 (capped) |

| Community Size | X (7,900), Telegram (3,300) |

6. Toshi (TOSHI) – Cat Meme of the Base Network

Toshi is one of the earliest memes on Base, the Coinbase-backed Layer 2, positioned as the chain’s recognizable cat mascot. It offers straightforward exposure to the Base narrative, high activity, and growing liquidity, while leaning on simple, viral branding rather than complex roadmaps.

Toshi Official Website. Source: Toshi

TOSHI has minimal formal utility by design. Holders mainly use it for trading, tipping, and community campaigns. The value is driven by brand reach and Base-native demand rather than protocol fees or governance.

Key Points on Toshi:

- Why It Stands Out: Strong brand within the Base ecosystem; trading at discount to its ATH

- Target Audience: Meme-coin traders, investors who want a pure Base exposure via a recognizable token

- Risks & Considerations: Performance depends on Base flows and community attention

- Community: 100,000+ token holders; ~112,000 followers on X

| Project | Toshi |

| Status | Listed on centralized and decentralized exchanges |

| Current Price | TOSHI $0.00081 24h volatility: 6.5% Market cap: $338.47 M Vol. 24h: $44.93 M |

| Best Place to Buy | MEXC |

| Launch Date | August 2023 |

| Chain | Base |

| Narrative / Use Case | Base chain, cat-themed tokens |

| Market Cap | $314 million |

| Max Supply | 408,069,300,000 (capped) |

| Community Size | X (112,000), Telegram (23,000) |

7. Best Wallet Token (BEST) – All-in-One Non-Custodial Wallet

Best Wallet is a non-custodial crypto wallet that supports swaps across 60+ blockchains and has a built-in launchpad for early access to presales. It features modern account recovery and anti-phishing checks, so you keep control of your keys without juggling seed phrases.

The Best Wallet Presale website. Source: Best Wallet

BEST is the utility token. It unlocks fee reductions, boosted staking yields, and priority access to early sale stages.

Key Points on Best Wallet Token:

- Why It Stands Out: In-app tracking of tokens before launch, cross-chain swaps, staking at 83% APY

- Target Audience: Users who want everyday DeFi plus curated presales in one wallet

- Risks & Considerations: Success depends on converting active users into BEST holders after TGE

- Community: over 100K social followers

| Project | Best Wallet |

| Status | Mid presale stage |

| Presale Price | $0.025725 |

| Where to Buy | Best Wallet Token presale website |

| Launch Date | TBC by the team, but not later than 31st December, 2025 |

| Chain | Ethereum |

| Narrative / Use Case | Wallet token, utility, launchpads |

| Market Cap (Est.) | $4.56 billion (fully diluted) |

| Max Supply | 100,000,000,000 (capped) |

| Community Size | X (60,100), Telegram (43,100) |

8. SUBBD (SUBBD) – AI SocialFi Platform for Direct Creator Payouts

SUBBD is a creator economy app where fans pay artists directly with low fees and instant settlement. The workspace folds production and publishing into one flow, think voice cloning, image generation, and auto-scheduling, so creators ship more, faster, while fans unlock gated content and interactions.

SUBBD has a burgeoning network of creators. Source: SUBBD

SUBBD is the in-app currency. It’s used for tips, subscriptions, and paywalled posts, funds engagement rewards, and can be staked for yields at 20% APY. Long-term value rests on real creator adoption and sustained fan activity.

Key Points on SUBBD:

- Why It Stands Out: End-to-end stack – create, publish, monetize – with on-chain payouts and an integrated AI toolset.

- Target Audience: Web3-curious creators, communities that want tokenized access, and investors focused on the creator-economy theme.

- Risks & Considerations: Migrating talent from Web2 and maintaining active usage post-launch are the key tests.

- Community: 2,000+ onboarded creators with ~250M aggregate reach; over 45K social followers

| Project | SUBBD |

| Status | Early presale stage |

| Presale Price | $0.056575 |

| Where to Buy | SUBBD presale website |

| Launch Date | TBC by the team |

| Chain | Ethereum |

| Narrative / Use Case | Content subscription, AI |

| Market Cap (Est.) | $56.3 million (fully diluted based on the current presale price) |

| Max Supply | 1,000,000,000 (capped) |

| Community Size | X (40,400), Telegram (5,900) |

9. Popcat (POPCAT) – Solana Cat Meme with Cultural Reach

Popcat is a pure meme coin built around the iconic “popcat” feline. It’s intentionally utility-free and thrives on internet culture, giving traders a simple, recognizable brand for high-beta moves during meme rotations.

Popcat Official Website. Source: Popcat

POPCAT has no formal utility by design. Holders primarily trade, tip, and run community campaigns; value is attention- and liquidity-driven rather than tied to fees or governance.

Key Points on Popcat:

- Why It Stands Out: Recognizable cat meme, deep liquidity, broad exchange coverage

- Target Audience: Meme traders and Solana users who want a culture-first narrative play

- Risks & Considerations: If social traction fades, volatility and drawdowns can be severe

- Community: Strong footprint across Taiwan, Thailand, and the Philippines, over 100K social followers

| Project | Popcat |

| Status | Live and trading |

| Current Price | POPCAT $0.23 24h volatility: 1.2% Market cap: $230.16 M Vol. 24h: $33.14 M |

| Where to Buy | Bybit, Coinbase, MEXC |

| Launch Date | Q1 2024 |

| Chain | Solana |

| Narrative / Use Case | Global meme coin with Asian meme culture base |

| Market Cap | $225M |

| Max Supply | 979,970,000 |

| Community Size | X (99,800), Telegram (19,360) |

10. SpacePay (SPY) – Android POS Crypto Payments with Fiat Settlement

SpacePay enables crypto checkout at standard retail point-of-sale terminals by plugging an NFC tap and universal QR code into existing Android POS terminals. Shoppers pay from their wallets, while merchants receive local currency at the register, keeping the flow familiar and setup simple.

SpacePay brings crypto payments right to the cash register. Source: SpacePay

SPY routes settlements across the network, unlocks fee discounts for merchants, and funds adoption incentives. Scale now depends on processor and banking integrations, plus merchant onboarding in a market with strong incumbents.

Key Points on SpacePay:

- Why It Stands Out: Support for 325+ wallets, instant fiat conversion at checkout, 0.5% processing fee versus typical 2–3%.

- Target Audience: Retailers and payment providers; users who prefer wallet-based payments

- Risks & Considerations: Distribution relies on signing processors and banks at scale

- Community: ~20,000 registered users, over 75K social followers

| Project | SpacePay |

| Status | Early presale |

| Presale Price | $0.003181 |

| Where to Buy | SpacePay presale website |

| Launch Date | TBC |

| Chain | Ethereum |

| Narrative / Use Case | Crypto payments, real-world adoption |

| Market Cap (Est.) | $128 million (fully diluted based on the current presale price) |

| Max Supply | 34,000,000,000 (capped) |

| Community Size | X (71,200), Telegram (5,460) |

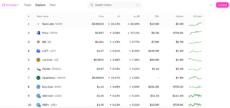

Best Performing Shitcoins Compared: Summary Table for 2025

Choosing the top shitcoins is a complex process, considering how many tokens exist in the market.

This table summarizes the best-performing shitcoins in 2025, according to analysts:

| Token | Status | Price Now | Market Cap | Category | Investor Fit |

| Bitcoin Hyper | Presale | $0.013025 | $269 million (estimated FDV) | Layer 2 (Bitcoin) | Backing Bitcoin’s entrance to the trillion-dollar DeFi sector |

| MAXI Doge | Early presale stage | $0.00026 | <$100,000 | Meme Coin, Trading Lifestyle, Satire | High-leverage degens, gymmaxxed traders, and meme coin addicts chasing 1000x |

| Dogwifhat | Live on exchanges | WIF $0.78 24h volatility: 3.4% Market cap: $776.57 M Vol. 24h: $160.00 M | $1.24 billion | Solana meme coin | Buying higher-cap shitcoins with multi-billion dollar potential |

| PEPENODE | Early presale stage | $0.001004 | Unknown | Mine-to-Earn Memecoin | Meme coin investors |

| Snorter Bot | Early presale stage | $0.1065 | $53 million (estimated FDV) | Automated bot for DEX snipes | Extracting value from the shitcoin markets without actively trading |

| Toshi | Live on exchanges | $0.0007258 | $292 million | Base network and cat-theme | Investing in the Base ecosystem narrative |

| Best Wallet Token | Mid presale stage | $0.025725 | $2.5 billion (estimated FDV) | Non-custodial wallet | Growth investors focused on utility-driven use cases |

| SUBBD | Early presale stage | $0.056575 | $55.7 million (FDV based on the current presale price) | AI and content subscription | Those who want exposure to AI cryptocurrencies |

| POPCAT | Live on exchanges | $0.43 | $424 million | Solana meme coin with Asian virality | Meme traders who value regional momentum and cultural relevance |

| SpacePay | Early presale stage | $0.003181 | $108 million (FDV based on the current presale price) | Real-world payments in retail | Real-world adoption advocates with practical utility |

Best Shitcoins Trends to Watch in 2025

Bitcoin set a new cycle ATH in mid-August near $124k, then spent September pulling back into the $110k–$118k range, a still-bullish backdrop historically associated with rotations into higher-beta assets, according to Barron’s.

Spot-ETF flows have remained net positive on several sessions this month, keeping fresh fiat pipes open even as prices consolidate – a key liquidity indicator for small caps.

Сasual traders hunting for penny crypto with 1000x potential typically focus on new shitcoins to buy, as these projects trade with small valuations.

The most common way to invest in low-cap shitcoins is via presale events, which you can follow on our ICO calendar. Participants buy tokens like Snorter Bot and Bitcoin Hyper before they’re added to exchanges, allowing them to get in from the ground up.

If an “alt season” develops, expect the usual order of operations: BTC strength → ETH and large caps → mid/small caps and memes. Narratives with current mindshare include ecosystem plays (Base/Linea/BNB), pet-themed memes, and utility-led buckets such as L2s, AI, and DeFi. Consider this, when deciding on the best crypto to buy.

What Are Shitcoins and Why Do People Buy Them?

Shitcoins are cryptocurrencies that typically have little to no use cases. They’re created to generate hype and FOMO rather than provide utility-driven value.

Shitcoin creators are usually anonymous, and they’re known to promote their tokens using speculative and price-centric language. Most traders buy shitcoins to make financial gains in the shortest time frame possible.

What Makes a Shitcoin?

Shitcoins are digital assets without fundamental value or long-term potential. The most common traits are a lack of token use cases, anonymous teams, and a nonexistent roadmap.

While most shitcoin projects fail to deliver returns, a small percentage of tokens produce unprecedented gains, often in a short period. For this reason, shitcoins attract billions of dollars in daily trading volume, with retail traders hoping to find that next 1000x gem.

Meme Coins vs Shitcoins

Meme coins and shitcoins are often used interchangeably to describe cryptocurrencies that lack inherent value, yet there are some subtle differences.

Meme coins often have massive communities, they hold tokens through bullish and bearish markets, actively promoting their projects and catching social media trends. Meme cryptocurrencies are also longer-term initiatives built to last, and some develop use cases as their communities mature.

Shiba Inu is a good example. While the project started as a speculative dog-themed token, its ecosystem now contains DeFi and metaverse features.

Shiba changed from a shitcoin to a functioning ecosystem. Source: Shiba

Shitcoins are generally low-quality projects created around a specific, short-term theme that quickly becomes irrelevant. The sole purpose is price speculation, and very few projects offer anything unique. However, shitcoins can produce explosive short-term growth, with early entry often delivering the highest returns.

Why Do Shitcoins Attract Buyers

Shitcoins attract significant investment because of the price potential they offer. High-risk, high-return traders seek much larger gains than Bitcoin and other large-cap cryptocurrencies can deliver. This is because the best shitcoins to buy have small valuations, allowing the token price to rise significantly over short time frames.

Shitcoins are also highly accessible, as most trade on DEXs like Uniswap and PancakeSwap. These platforms are inclusive, with no accounts or KYC verification needed.

Research shows that most shitcoin tokens also have huge token supplies. This dynamic often lets investors buy millions of tokens with a small purchase, giving the illusion of affordability.

That raises the question: Are shitcoins a good investment? The simple answer is that some shitcoin projects deliver rapid growth, but the key requirement is to invest long before the tokens achieve virality. This is why new presale events are often the best option when exploring profitable shitcoins.

How to Pick the Best Shitcoins in 2025

According to Coinbase CEO Brian Armstrong, over a million new cryptocurrencies are created every week. This market saturation makes it challenging to pick the best shitcoins.

We screen thousands of low-priced tokens with a simple weighted rubric. It keeps us honest, comparable across projects, and focused on signals that actually move price.

Market Cap

We start with size and tradability together. Low cap is a must for upside, but it has to come with real liquidity. We check circulating supply vs FDV, unlock schedules, pool depth, and basic slippage at common order sizes. The goal is room to reprice without trapping buyers.

Audits and Contract Health

No contract, no coin. We look for independent reviews from reputable firms (for example, Coinsult or CertiK), then read the basics ourselves. Mint functions, blacklist or tax switches, trading pauses, LP lock or burn, team wallets, multisig details. If the code is shaky, it fails here.

Tokenomics and Supply Design

Capped supply, clear allocations, and credible funding for liquidity, listings, and growth. Emissions, vesting, and any reward loop must make sense on-chain, not just in a PDF. We cross-check whitepaper claims against the audit and live contract parameters.

Narrative Fit

Capital follows stories. We favor tokens that sit where attention is flowing now, for example, Base or Solana ecosystems, Bitcoin L2, AI, and culture coins. Timing matters. Extra credit if the project bridges two strong narratives rather than echoing last month’s trend.

Social Velocity

We look for real, not rented, attention. X, Telegram, Discord growth, meme spread, repost ratios, and unique voices repeating the story. Tools can help surface spikes, but we always verify manually to avoid bot campaigns and recycled engagement pods.

Price Momentum and Market Structure

Clean structure beats noisy charts. We want higher highs with healthy pullbacks, consistent liquidity, and outperformance versus sector baskets. One giant candle on thin volume is a warning, not a win.

Early Utility and Product Signals

Most shitcoins ship vibes, not products. Any working piece earns points, for example a live bot interface (SNORT), a functioning staking dashboard or bridge (Bitcoin Hyper), or basic analytics that the community actually uses. We also track cadence of updates and public repos.

According to our methodology, we score each token across these inputs, weight the results, then surface the names with the strongest blend of upside, execution, and real attention.

Where to Buy Shitcoins

The best platform to buy shitcoins depends on various factors, such as whether the project is a presale or live crypto, the token standard (e.g., ERC-20 or BEP-20), and the team’s success in securing exchange listing approvals.

Presales

When you buy presale shitcoins, you make investments directly on the project’s website. The process is non-custodial, as participants connect a self-custody wallet (we have previously explored the best crypto wallets) and swap an accepted payment coin like USDT or ETH. The presale project sends your purchased tokens when the event ends.

DEXs

Post presale tokens, as well as shitcoins that creators launch via third-party platforms like Pump.Fun, almost always trade on DEXs. These exchanges are decentralized, so anyone can launch cryptocurrencies by adding funds to a liquidity pool.

Uniswap has become one of the key decentralized exchanges. Source: Uniswap

The token standard determines the chosen DEX, ERC-20 tokens generally trade on Uniswap, while BEP-20 tokens are listed on PancakeSwap. SPL tokens have access to a wider range of Solana DEXs, including Raydium, Orca, Jupiter, and Meteora.

CEXs

A small percentage of shitcoins secure listings with major centralized exchanges (CEXs), often because they’ve achieved virality, active communities, and significant trading volumes (which translates to large commissions for exchanges). Popular CEXs like MEXC streamline shitcoin purchases for retail clients by accepting credit cards and other traditional payment methods. CEXs also offer much higher liquidity compared to DEXs, helping traders buy and sell shitcoins at competitive prices.

The Importance of Crypto Wallets

Crypto wallets are fundamental when investing in shitcoin presales and DEX tokens. Investors need a non-custodial wallet to perform on-chain transactions and store their purchased assets. The top wallets offer a user-friendly experience and robust security features across multiple device types, including mobile apps and browser extensions.

The best wallet for shitcoins also depends on the token standard. Phantom is popular for investing in and storing Solana-based shitcoins, while MetaMask is preferred for Ethereum and EVM-Compatible tokens like Base and BNB Chain.

However, managing several crypto wallets is cumbersome, so a better option is to use a provider that supports multiple networks. As the best app for shitcoins, Best Wallet supports over 60 blockchains, including Ethereum, BNB Chain, Solana, and Polygon. Users can invest in shitcoins via approved presales, and the app also supports third-party DEX connections.

Best Wallet is the top choice for storing cryptocurrency across many blockchains. Source: Best Wallet

Here’s a summary of the best places to buy and store shitcoin tokens:

- MEXC: Supports over 4,000 tokens, and commissions start from 0%. The CEX accepts fiat payments, and it approves withdrawals almost instantly. No KYC requirements are needed for daily withdrawals of under 10 BTC.

- Best Wallet: The Best Wallet app for iOS and Android supports over 60 networks and comes with a built-in launchpad for vetted presale events. The free wallet offers non-custodial storage and access to dApps via WalletConnect.

- Uniswap: The best shitcoins to buy often trade on Uniswap, the largest DEX for Ethereum-based tokens. Uniswap typically commands over $1 billion in daily trading volumes.

How to Buy Shitcoins: A Step-by-Step Guide

Buying shitcoins, ultra-low-cap tokens often launched without utility, is a high-risk, high-volatility process that bypasses centralized exchanges. If you’re willing to proceed, here’s how to do it safely and efficiently.

Step 1: Set Up a Non-Custodial Wallet

You’ll need a wallet that supports Web3 and connects to decentralized exchanges (DEXes).

- Recommended wallets: Best Wallet, MetaMask, Trust Wallet

- Make sure to back up your seed phrase securely. If you lose it, your funds are unrecoverable.

Step 2: Fund Your Wallet with a Base Token

Most shitcoins are traded against popular base tokens like:

- ETH on Ethereum

- BNB on BNB Chain

- SOL on Solana

- MATIC on Polygon

Use a centralized exchange (e.g., Binance, Coinbase, Kraken) to buy the base token and withdraw it to your wallet.

Step 3: Find the Token Contract Address

Never search for the token name on a DEX, you may fall for a fake version. Instead:

- Visit the official project page or verified X (Twitter) post.

- Cross-check the contract address on CoinGecko, CoinMarketCap, or DexTools.

- Optionally, look it up on block explorers like Etherscan or BscScan to verify it’s active and trading.

Step 4: Use a DEX to Swap

Connect your wallet to a DEX that supports the relevant chain:

- Uniswap for Ethereum

- PancakeSwap for BNB Chain

- Raydium or Jupiter for Solana

- QuickSwap for Polygon

Then:

- Paste the token contract address to load it manually.

- Adjust slippage, many shitcoins require 5–10% due to built-in tokenomics.

- Review the price impact and confirm the swap only if the data looks reasonable.

Step 5: Add the Token to Your Wallet (Optional)

Most wallets won’t automatically display custom tokens.

- In MetaMask, click “Import Tokens” and paste the contract address.

- On mobile wallets, use the “Add Custom Token” option.

This step won’t affect your funds; it simply lets you view your balance properly.

Final Reminders Before You Buy

- Gas fees can vary widely depending on the network. Ethereum is often expensive; BNB Chain and Solana are cheaper.

- Always test with a small amount first, especially for brand-new tokens.

- Watch out for “honeypots”: tokens you can buy but not sell (see risk section above).

Buying shitcoins isn’t technically hard; the real challenge is navigating scams and extreme volatility. If you treat every step with caution and verify everything twice, you’ll at least avoid the most common traps.

Risks of Investing in Shitcoins

Shitcoin investments attract many risks that can result in financial loss.

These are key risks of shitcoins to consider before getting involved:

- Scams: While many shitcoin scams exist, rug pulls are the most common. The shitcoin founders hype the project to attract investment only to withdraw liquidity from the DEX pool. This rug pull crashes the market and leaves holders with worthless tokens. You can avoid a rug pull crypto by only investing in shitcoins with locked liquidity. As explained by the UK’s Financial Conduct Authority (FCA), other crypto investing scams include pump and dumps and honeypots. The honeypot scam lets founders create nefarious smart contract terms, such as having the ability to create unlimited new tokens or restrict investors from selling.

- Shitcoin volatility: The best shitcoins to invest in are small-cap tokens, making them highly volatile and speculative. While shitcoins can produce significant growth over extended periods, they can also lose the vast majority of their value within hours or even minutes. Portfolio diversification mitigates the risk of serious financial losses.

- Developer anonymity: Anyone can launch a shitcoin, so unlike traditional securities, anonymous founders are behind most projects. As a result, there is no accountability or investor recourse if the project turns out to be a scam.

- Lack of liquidity: Shitcoins with low market capitalizations offer the highest price potential, yet this means you’re investing in cryptocurrencies that lack sufficient liquidity. This risk leads to high slippage, which forces traders to accept unfavorable prices to get their orders executed. Liquidity improves as shitcoins attract higher trading volumes and centralized exchange listings.

Ultimately, shitcoins are extremely high risk, and most traders lose money, with only a small number of tokens producing sustainable growth. Always do your own research (DYOR) and never risk funds that you can’t afford to lose.

Are Shitcoins a Good Investment? Pros and Cons

Here’s a summary of the key advantages and drawbacks when exploring new shitcoins to buy:

Pros:

- Shitcoins can explode by thousands of percent when they surge

- Investors can achieve significant growth over short time frames

- The shitcoin market offers millions of tokens, supporting portfolio diversification

- Shitcoin investments can be made without minimum trade requirements

- Even small shitcoin positions can yield life-changing returns

Cons:

- The majority of shitcoins crash in value

- Investors must navigate shitcoin scams like honeypots and pumps and dumps

- Shitcoin founders are usually anonymous, which lacks accountability

- Most shitcoins trade on DEXs, which beginners may find complex to use

- Price gains are almost always short-lived, so traders must actively monitor the market

How to Reduce Risks When Investing in Shitcoins

While shitcoins are notorious for their volatility and speculative nature, not every investment has to end in a total loss. Careful due diligence and technical awareness can significantly reduce risks. Below are essential strategies to help protect your capital in the wild west of low-cap tokens.

1. Verify Liquidity and Market Depth

One of the easiest ways to get trapped is by buying a token with little or no real liquidity. Even if the price chart looks promising, you may not be able to sell without slippage or at all.

- Use platforms like DexTools, DexScreener, or Bogged Finance to inspect liquidity pools.

- Ensure the token has at least $100,000 in locked liquidity and that it’s locked or burned via a verified liquidity locker like Unicrypt or Team Finance.

- Check the bid-ask spread and volume. A token with thin market depth can easily crash with a few sell orders.

2. Audit the Smart Contract (or Know Someone Who Can)

Shitcoins are often deployed with malicious code or hidden vulnerabilities. Before investing, check:

- Mint functions: Can the devs mint unlimited tokens?

- Blacklist/whitelist functions: Can wallets be blocked from selling?

- Max transaction or wallet limits: These may be used to trap buyers.

- Use tools like TokenSniffer, GoPlus Security, or Smart Contract Auditor to run a quick scan. For more advanced analysis, consult developers who can read Solidity.

3. Avoid Honeypots and Rug Pulls

Honeypots allow you to buy a token but not sell it. Rug pulls drain the liquidity entirely, leaving holders with worthless assets.

- Test with a small buy and sell before investing a larger amount.

- Look at the token’s transaction tax structure. If there’s a 20% sell tax and it goes to a dev wallet, that’s a red flag.

- Monitor the top holders using platforms like Ethplorer or BSCScan. If one wallet controls a huge percentage of the supply, you’re at the mercy of their actions.

4. Scrutinize Celebrity Promotions and Influencer Hype

Not all endorsements are organic. In fact, most are paid. Many celebrities and influencers have been caught shilling tokens they were compensated to promote, without disclosing it.

- Look for disclosures like “#ad” or “sponsored”. If they’re missing, it’s likely not a transparent promotion.

- Verify whether the celebrity has any long-term involvement in the project (advisory role, equity, etc.).

- Be extra cautious when celebrities pump a coin at launch, this is often a coordinated exit strategy.

5. Treat Every Token Like a Potential Scam – Until Proven Otherwise

This mindset won’t make you cynical, it’ll keep you solvent. Assume every new meme coin or microcap is a potential trap until it passes multiple layers of scrutiny.

- Join the community, ask questions in the Telegram or Discord, and observe how devs respond to criticism.

- Avoid tokens where devs remain anonymous and refuse audits.

- Check if the project has a clear roadmap and realistic goals or if it’s just recycling buzzwords like “AI”, “DePIN”. and “next Dogecoin”.

Even in the highly speculative world of shitcoins, a disciplined approach can help you stay one step ahead of the next rug pull. Research is not optional; it’s your only edge.

Is It Legal to Invest in Shitcoins in 2025

In most places, you can legally buy and hold shitcoins. But issuers, exchanges, and even marketing are regulated. The details vary by region, and some countries maintain outright prohibitions. Always check local rules before transacting.

United States

Owning and trading crypto is generally lawful, but specific tokens can be treated as securities under federal law if they meet the Howey test. The SEC’s staff framework explains how “investment contract” analysis applies to digital assets, and the agency continues to actively enforce in this area.

Crypto can also fall under commodities oversight; the CFTC states that “Bitcoin and other virtual currencies” are commodities under the Commodity Exchange Act, which brings derivatives and certain spot-market practices within its remit.

Taxwise, the IRS treats digital assets as property, so gains are taxable and reportable on federal returns; new broker reporting rules are being phased in following the Infrastructure Act.

State rules can add licensing layers. For example, New York’s BitLicense regime requires a license to conduct “virtual currency business activity” with NY residents, though it doesn’t apply to ordinary individuals merely buying or holding.

United Kingdom

Buying and holding crypto is permitted, but promotions to UK consumers are tightly regulated. Since October 8, 2023, the FCA’s financial promotions regime requires compliant risk warnings, appropriateness checks, and FCA authorization or approval for marketing of qualifying cryptoassets, including shitcoins.

Europe

Across the EU, MiCA now provides a single rulebook for crypto-asset issuers and service providers. Stablecoin provisions began applying on June 30, 2024, and the broader CASP regime became fully applicable on December 30, 2024.

In practice, investing is legal, but services must be provided by authorized firms and follow disclosure and conduct rules. This applies equally to smaller-cap tokens and shitcoins.

Asia

Rules across Asia vary widely, from outright bans to licensed retail access with strict AML/KYC:

- China. Mainland China bans crypto trading and related business activities. The central bank’s 2021 notice declared such activities illegal, and courts have since reinforced these restrictions. Retail crypto futures trading has also been found unlawful in at least one 2025 court decision.

- India. Investing is allowed, but heavily conditioned by tax and AML regulations. Since 2022, gains on virtual digital assets are taxed at 30% with a 1% TDS on transfers. Cryptocurrency is also within India’s anti-money-laundering regime, and the Financial Intelligence Unit has enforced registration against offshore exchanges.

- However, Singapore and Hong Kong permit retail access under licensing regimes with strict consumer-protection and conduct requirements.

Africa

There is no continent-wide rule. Two large markets illustrate the range:

- South Africa. Crypto assets are declared “financial products”, and providers must be licensed by the FSCA under the FAIS Act. The authority has issued large numbers of CASP licenses and continues supervision.

- Nigeria. After banking restrictions in 2021, the central bank in December 2023 issued guidelines allowing banks to service VASPs under AML controls. The SEC set rules for offerings, exchanges, custodians, and VASPs. Amendments proposed in 2024–2025 further formalize this regime.

Do You Pay Taxes on Shitcoins in 2025?

Before you dive into shitcoins or any kind of crypto trading, it’s important to fully understand how your holdings will be taxed. Here’s a quick breakdown of some of the most important questions you might be asking yourself already.

Why Shitcoin Profits Are Taxable

While various jurisdictions treat crypto taxes differently, shitcoins (and all other cryptos) are often taxable because they are considered either property or investments. This isn’t a hard rule, however, as most countries have unique tax laws and regulations.

Generally, crypto is only taxed when a “taxable event” occurs. The exact rules can vary region to region, but they are often defined as moments when your trading activity creates a measurable profit or income. Common examples of taxable events include:

- Selling crypto for fiat currency

- Swapping one crypto for another (including stablecoins)

- Spending crypto on goods or services

- Earning coins through staking, mining, airdrops, or similar mechanisms

For the most part, simply buying and holding crypto is not taxable until you sell, swap, or spend your coins.

Shitcoin Tax Rules Across Regions

While many countries have somewhat similar tax laws that treat crypto like other kinds of property or investments, the rules can vary dramatically. For example, the Cayman Islands, the UAE, and El Salvador charge no taxes on cryptocurrencies. Others have more complicated tax laws, such as Germany’s, which normally taxes crypto, unless it has been held for more than 12 months.

In the United States, cryptocurrencies are taxed once a taxable event occurs, as described above. However, US investors can secure a significantly lower capital gains tax rate if they hold their coins for over a year. Australia uses a similar system, offering investors a lower tax rate if the coins are held for over 12 months.

These differences make researching your own jurisdiction’s tax rules and regulations absolutely essential for crypto traders. You may be able to secure much lower tax rates in certain regions if you know the basic ins and outs of their tax laws.

Action Steps for Shitcoin Traders

Now that we have explored some of the most important aspects of shitcoin taxes, here are vital action steps for traders to consider:

- Carefully research your jurisdiction’s tax laws and rates

- Keep detailed records of every single trade, including dates, amounts, and transaction IDs

- Determine whether you can slash your tax bill through long-term holding or other methods

- Consult a tax expert or find strong tax software to stay compliant

- Create a plan to keep your crypto taxes low while avoiding penalties

Cutting your tax bill down feels great, but it’s even more important to stay compliant with your country’s laws and regulations. Always take your crypto taxes seriously to pay less while avoiding fees or penalties.

Our Methodology – How We Picked the Best Shitcoins for 2025

Our approach to identifying the most promising shitcoins of 2025 combines on-chain data, community metrics, and speculative potential. Unlike traditional crypto rankings, we embrace volatility and lean into early-stage narratives with high-risk, high-reward upside.

Low-Cap Screening – Foundational Filter (30%)

We focused mainly on tokens with low market capitalizations. Low caps offer the asymmetric upside that defines true shitcoin plays. Projects must still show potential for liquidity growth and exchange exposure to be considered viable.

Community Virality and Meme Strength – Core Metric (20%)

In the shitcoin arena, community hype often outweighs fundamentals. We tracked Telegram and X (Twitter) velocity, meme propagation, influencer engagement, and bot activity. Tokens with rapidly expanding meme cultures or cult-like communities ranked higher.

Tokenomics Degeneracy vs. Creativity – Balanced Evaluation (15%)

We evaluated token distribution models, burn mechanisms, and reward systems – not just for sustainability, but also for creativity. Projects with humorous or ironic economic designs scored well if they showed strong meme synergy or community buy-in.

Development Signals – Secondary but Considered (10%)

While most shitcoins lack robust technical teams, we still reviewed GitHub activity, contract originality, and potential utility promises. Any project showing ongoing development, or the illusion of it, gained points, especially if combined with active community building.

Narrative Fit and Trend Hijacking – Opportunistic Factor (15%)

Projects that effectively piggybacked on dominant market narratives (AI, RWA, Layer 2, celebrity memes, political cycles) scored higher. Shitcoins thrive when they tap into trending sentiment, and our selections reflect that alignment.

Risk-to-Reward Profile – Final Gate (10%)

We conducted basic rug risk assessments, including contract audits (if available), dev wallet tracking, and past community behavior. Projects with clear red flags were excluded unless their short-term pump potential outweighed downside risk. Our goal is not to find safe bets, but to identify the most explosive asymmetric opportunities.

Conclusion

Shitcoins that achieve virality can yield life-changing returns over a short time frame, yet investors must use risk management practices to minimize potential losses. Ensure portfolio diversification, sensible stakes, and only consider projects with audited smart contracts and fair tokenomics.

Our research suggests that Snorter Bot is one the best shitcoins to buy, considering its ability to snipe up other meme coins while trading over Telegram. However, we are excited to see how all the coins on this list play out.

FAQ

What are the best shitcoins to buy in 2025?

Are shitcoins a good investment?

Which shitcoin will explode next?

Where can I find information about new shitcoins launching?

How do I buy new shitcoins?

What is the best platform to buy shitcoins?

Are shitcoins safe to invest in?

What is the difference between shitcoins and meme coins?

What are the risks of investing in shitcoins?

Where can I find shitcoin price predictions?

How can I buy shitcoins on Solana or BSC?

Why do people invest in shitcoins despite the risks?

References

- DEX Metrics (Dune Analytics)

- DeFi Fans Are Courting Traders in $7.2 Trillion Currency Market (Bloomberg)

- The AI Trade Has Blown Up in Crypto (Bloomberg)

- Hedge Funds Are Succumbing to Mind-Boggling Returns of Memecoins (Bloomberg)

- Trump’s Meme Coin Sparks More Than 700 Copycats Posing as Official Crypto (The Guardian)

- Staying the Course: Institutional Investor Outlook on Digital Assets (Ernst & Young)

- Shitcoins: are Pointless Cryptocurrencies a Scam or a Gamble? (The Guardian)

- Coinbase CEO Brian Armstrong says There are 1 million New Cryptocurrencies Created Every Week (Business Insider)

- Crypto Investment Scams (UK Financial Conduct Authority)

- Messari Research Reports (Messari)

- Altcoin Rally: This Time the Data’s Different (Kaiko)

- Solana Price (CoinGecko)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Want to trade Solana futures but need some expert-led guidance? Read our beginner’s guide on how to trade SOL futures safely in 20...

Our review analyzes the BullZilla presale, its fundamentals, and community activity to provide you with an informed price predicti...

43 mins

43 mins

Otar Topuria

Crypto Editor, 21 postsI’m a crypto writer and analyst at Coinspeaker with over three years of experience covering fintech and the rapidly evolving cryptocurrency landscape. My work focuses on market movements, investment trends, and the narratives driving them, helping readers what is happening in the markets and why. In addition to Coinspeaker, my insights and analyses have been featured in other leading crypto and fintech publications, where I’ve built a reputation as a thoughtful and reliable voice in the industry.

My mission is to demystify the crypto markets and help readers navigate the noise, highlighting the stories and trends that truly matter. Before specializing in crypto, I worked in the IT sector, writing technical content on software development, digital innovation, and emerging technologies. That made me something of an expert in breaking down complex systems and explaining them in a clear, accessible way, skills I now find very useful when it comes to unpacking the intricate world of blockchain and digital assets.

I hold a Master’s degree in Comparative Literature, which sharpened my ability to analyze patterns, draw connections across disciplines, and communicate nuanced ideas. I’m particularly passionate about early-stage project discovery and crypto trading, areas where innovation meets opportunity. I enjoy exploring how new protocols, tokens, and DeFi projects aim to disrupt traditional systems, while also evaluating their potential risks and rewards. By combining market analysis with forward-looking research, I strive to provide readers with content that is both informative and actionable.