Identifying the best crypto to mine in 2026 depends on your hardware, electricity costs, and risk tolerance.

Discover the best undervalued stocks to invest in, according to sell-side analyst ratings and other financial metrics.

According to analysts, HYLQ Strategy Corp. is one of the best undervalued stocks to buy right now. Despite delivering 290% gains in the past year, the investment holding company trades over 60% below its 52-week high.

Undervalued companies are the key focus for many investors. They trade below their perceived value, allowing investors to purchase shares at a discounted price.

This guide helps you choose undervalued equities for your investment portfolio. Read on to discover cheap stocks in 2026.

Best Undervalued Stocks Key Takeaways

- Undervalued stocks are publicly traded companies with a share price below their perceived value.

- Stocks are undervalued for several reasons, including poor quarterly performance, cyclical trends, or overall market sentiment.

- Buying undervalued equities lets investors secure a discount from their 52-week or all-time high.

- Many stocks are perceived to trade at undervalued prices, yet not all of them will return to their expected share valuations.

- According to experts, the best practice is to diversify across 20-30 individual stocks to reduce volatility and mitigate long-term risk.

Best Undervalued Stocks to Invest In Reviewed

In our view, these are the 10 best undervalued stocks to buy right now:

- HYLQ Strategy Corp. (CSE: HYLQ): Top-Performing Investment Holding Company Trading 60% Below Its 52-Week High

- Sol Strategies Inc. (CSE: HODL): Small-Cap Solana Investor and Staking Validator With an ARK Investment Partnerships

- AT&T Inc. (NYSE: T): Strong Phone Subscriber Growth With a 4% Running Dividend Yield

- Micron Technology Inc. (NYSE: MU): Undervalued AI Stock Trading at an Attractive P/E Ratio

- Sezzle Inc. (NASDAQ: SEZL): Interest-Free Loans for the Consumer Market With Unprecedented Growth Potential

- Waters Corp. (NYSE: WAT): Leading Supplier of Scientific Instruments and Software for Laboratories

- Walt Disney Co. (NYSE: DIS): Blue-Chip Entertainment Stock Rated a Strong Buy by Sell-Side Analysts

- Nike, Inc. (NYSE: NKE): Global Apparel Giant Recently Upgraded to Overweight by JPMorgan

- Duolingo Inc. (NASDAQ: DUOL): Strong Subscriber Uptrend With a 37% Discount From the 52-Week High

- Qualcomm Inc. (NASDAQ: QCOM): High-End chip Manufacturer for Android Smartphones and Wireless Technology

Best Undervalued Stocks to Invest In Reviewed

Independent research and due diligence are essential when investing in undervalued stocks. The term “undervalued”, in itself, is subjective, as whether a stock trades above or below its perceived value remains a matter of opinion.

Read on to explore the top cheap undervalued stocks, according to Wall Street analysts.

1. HYLQ Strategy Corp. (CSE: HYLQ): Digital Asset Investment Holding Company With a Nano-Cap Valuation

HYLQ Strategy Corp. is the first undervalued company to research. The Canadian investment holding company invests in emerging and disruptive technologies like remote payment systems and online gambling solutions. It also invests heavily in the digital asset revolution, including cryptocurrencies, blockchain, and smart contracts.

HYLQ Strategy Corp. stock 12-month performance. Source: Google Finance

The firm frequently dollar-cost averages into the HyperLiquid (HYPE) platform, with existing holdings recently surpassing 25,387 tokens. According to press releases, management holds HYPE for long-term price appreciation, as well as access to broader HyperLiquid ecosystem projects, known as “decentralized applications”.

As a publicly traded holding firm, shareholders gain exposure to all of HYLQ Strategy Corp.’s investments. Most holdings are privately owned startups, which retail clients cannot directly access due to regulatory and financial restrictions. The firm’s strong financial position allows it to invest in undervalued companies before they become mainstream concepts.

HYLQ Strategy Corp. remains one of the best cheap stocks for low-cap investors. It trades on the Canadian Securities Exchange (CSE) with a CAD 20.9 million market capitalization (approximately $15.2 million), and has delivered 12-month returns of over 290%. The shares are, however, undervalued, with HYLQ trading 60% below the 52-week high.

| Undervalued Stock | HYLQ Strategy Corp. |

| Ticker | HYLQ |

| Core Business | Investment holding company |

| Primary Stock Exchange | CSE |

| Market Cap | CAD 20.9 million |

| 12-Month Performance | 290% |

| 52-Week Low / High | $1.25 / $4.19 |

| Running Dividend Yield | No dividend policy |

2. Sol Strategies Inc. (CSE: HODL): Undervalued Solana Blockchain Pure-Play with a Potential NASDAQ Listing

Sol Strategies Inc. is a trending CSE-listed stock with the ideal combination of strong fundamentals and an undervalued share price. The firm invests exclusively in Solana (SOL), which many analysts consider to be the best crypto to buy in 2026, making it a popular pure-play for digital asset growth.

Sol Strategies Inc. stock 12-month performance. Source: Google Finance

SOL, which has risen by nearly 22,000% since its 2020 launch, provides access to the broader Solana Program Library (SPL) ecosystem. Secondary SPL projects operate in every Web 3.0 industry imaginable, from decentralized finance and gamification to asset tokenization.

Sol Strategies Inc. holds over 420,000 SOL, giving it direct exposure to undervalued SPL projects. Its institutional status also provides priority access to top token releases or even crypto presales in the early fundraising stages, providing the firm with a preferential cost basis and low valuation.

The Canadian company also offers Solana validation services. This enables retail and institutional clients to stake SOL, with Sol Strategies Inc. responsible for security and operational tasks. It earns a small, passive percentage of the staking rewards, adding to the firm’s overall share value. A key client is ARK Invest, the investment management company founded by Cathie Wood.

HODL’s recent successes, including strong price performance and strategic partnerships, mean the shares may be listed on the NASDAQ exchange by the end of 2025. Although the HODL price is up 835% in the past year, it trades 74% below the 52-week high, making it one of the best undervalued stocks to buy now.

| Undervalued Stock | Sol Strategies Inc. |

| Ticker | HODL |

| Core Business | Solana investing and staking |

| Primary Stock Exchange | CSE |

| Market Cap | CAD 251 million |

| 12-Month Performance | 835% |

| 52-Week Low / High | $0.14 / $6.12 |

| Running Dividend Yield | No dividend policy |

3. AT&T Inc. (NYSE: T): Top Telecommunications Stock with a Strong Yet Undervalued Share Price

AT&T Inc. is a U.S.-based telecommunications company operating in several core divisions, including broadband, mobile network coverage, and wireless internet services.

AT&T Inc. stock 12-month performance. Source: Google Finance

The firm’s most recent quarterly guidance shows AT&T Inc. added almost 401,000 new wireless phone subscribers, smashing Bloomberg estimates by over 100,000. Taking full advantage of competitor price increases, the company saw a 3.52% revenue increase, translating to a 25.1% rise in net income. With over $10.5 billion in cash and short-term investments, T shares remain one of the best undervalued stocks for dividends.

While it lost its “aristocrat” status in 2022 due to the firm cutting its dividend payment for the first time in 35 years, the running yield today is over 4%. This is in addition to a top-performing share price, with AT&T Inc. rising by over 46% in the past 12 months.

Verizon Communications Inc., one of AT&T Inc.’s fiercest rivals, has produced less than 6% gains over the same period. Even so, the T share price trades with an undervalued price-to-earnings (P/E) ratio of just 15.7 times.

| Undervalued Stock | AT&T Inc. |

| Ticker | T |

| Core Business | Telecommunications |

| Primary Stock Exchange | NYSE |

| Market Cap | $197 billion |

| 12-Month Performance | 46% |

| 52-Week Low / High | $18.64 / $29.19 |

| Running Dividend Yield | 4% |

4. Micron Technology Inc. (NYSE: MU): AI Hardware Manufacturer with a Robust Balance Sheet

Micron Technology Inc. appeals to value investors seeking exposure to the artificial intelligence (AI) sector. Unlike other AI-centric companies such as NVIDIA Inc. and Palantir Technologies Inc., MU shares trade at a fair and arguably undervalued P/E ratio of just 20.17 times.

Micron Technology Inc. stock 12-month performance. Source: Google Finance

The firm manufactures storage chips, which are core requirements in AI hardware found in graphics cards, smartphones, and desktop devices.

Share price growth was sluggish over the past year (3% gains), but MU is up 26% in the prior six months. This strong momentum extends to recent quarterly performance.

Micron Technology Inc. reported a 36.56% revenue increase to $9.3 billion, and a significant net income boost of nearly 468%. Analysts also cite the AI stock’s robust balance sheet. The NYSE-listed company has over $2.2 billion in free cash flow, allowing for continued expansion and product development.

| Undervalued Stock | Micron Technology Inc. |

| Ticker | MU |

| Core Business | AI hardware manufacturer |

| Primary Stock Exchange | NYSE |

| Market Cap | 124 billion |

| 12-Month Performance | 3% |

| 52-Week Low / High | $61.54 / $129.85 |

| Running Dividend Yield | 0.4% |

5. Sezzle Inc. (NASDAQ: SEZL): FinTech Innovator with Significant Global Growth Potential

While Sezzle Inc. is a growth company and one of the best-performing shares in recent times, some analysts argue it remains an undervalued FinTech stock.

Sezzle Inc. stock 12-month performance. Source: Google Finance

The firm specializes in interest-free loans for the consumer market. Customers make online and in-store purchases and spread the payment value over four installments. Sezzle Inc. uses behavioral intelligence instead of relying solely on background and credit checks, ensuring a broad client base. It earns money from retail commissions, charged on the initial payment.

Sezzle Inc. has secured notable partnerships with Amazon, Walmart, and other blue-chip companies and continues to expand into new markets. In addition to the U.S., Canada, and Australia, it now targets Brazil and India, potentially adding an extra one billion consumers to its growing portfolio.

SEZL shares are up almost 975% in the past year, giving the FinTech company a $4.8 billion market capitalization. Unprecedented revenue and income growth make SEZL one of the top undervalued stocks to buy today.

| Undervalued Stock | Sezzle Inc. |

| Ticker | SEZL |

| Core Business | Consumer-facing lending services without interest |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $4.8 billion |

| 12-Month Performance | 975% |

| 52-Week Low / High | $11.67 / $186.74 |

| Running Dividend Yield | No dividend policy |

6. Waters Corp. (NYSE: WAT): High-End Lab Tools with a Recent Merger Suggest an Undervalued Stock Price

Waters Corp. specializes in scientific equipment and software for laboratories, with key industries including battery materials, pharmaceuticals, and food safety. It also has growing revenues in the clinical research and environmental safety spaces, ensuring the firm has a diversified product portfolio.

Waters Corp. stock 12-month performance. Source: Google Finance

One of its core technologies is mass spectrometry, which analyzes and quantifies molecules based on their weight. Researchers also cite the company’s Empower software. It helps laboratories become regulatory compliant with data privacy laws and provides the firm with recurring subscription income.

As reported by the Wall Street Journal, Waters Corp. recently secured a merger agreement with Becton Dickinson and Co., with the deal doubling WAT’s total addressable market to approximately $40 billion. Although the markets have yet to react with any strong buying momentum, Morningstar analysts rate WAT shares as one of the best undervalued stocks to watch. The stock trades almost 9% below the perceived fair value, and a much higher 28% below the 52-week high.

| Undervalued Stock | Waters Corp. |

| Ticker | WAT |

| Core Business | Scientific equipment and software for laboratories |

| Primary Stock Exchange | NYSE |

| Market Cap | $18 billion |

| 12-Month Performance | -6% |

| 52-Week Low / High | $279.62 / $423.56 |

| Running Dividend Yield | No dividend policy |

7. Walt Disney Co. (NYSE: DIS): Global Entertainment Conglomerate with 12-Month Gains of 30%

Walt Disney Co. stock has underperformed global benchmarks for several years. Market commentators cite poor management strategy and underwhelming production value as the key drivers. CEO Bob Iger’s aggressive expansion plans, including a $30 billion investment in its core Disneyland and Disney World theme parks, may mark the turning point.

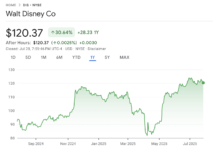

Walt Disney Co. stock 12-month performance. Source: Google Finance

Walt Disney Co.’s strong financial standing ensures management achieves its growth objectives without delay. Cash and short-term investments stand at $5.85 billion, as per the most recent earnings call. Of that figure, a healthy $2.8 billion is in free cash flow.

Sell-side analysts rate DIS stock a strong buy, with a 12-month average price forecast of $134 and an upper target of $148. DIS also has a modest P/E ratio of 24.5 times and growing share price momentum, with the stock up 30% in the prior year. At current prices, the shares are almost 40% below the $197 all-time high, witnessed after the post-COVID recovery.

| Undervalued Stock | Walt Disney Co. |

| Ticker | DIS |

| Core Business | Entertainment and media conglomerate |

| Primary Stock Exchange | NYSE |

| Market Cap | $216 billion |

| 12-Month Performance | 30% |

| 52-Week Low / High | $80.10 – $124.69 |

| Running Dividend Yield | 0.8% |

8. Nike, Inc. (NYSE: NKE): Reshaped Business Strategy with Sensible Inventories and New Product Releases

Founded in 1964, Nike, Inc. is an apparel giant and the world’s largest sneaker manufacturer. Despite its subpar performance over the prior five years (18% share price loss), JPMorgan recently upgraded NKE shares to “overweight”. The sentiment upgrade also boosted 12-month price targets from $64 to $93 per share, reflecting a 17% upside from current prices.

Nike, Inc. stock 12-month performance. Source: Google Finance

Analysts at JPMorgan cite Nike, Inc.’s new product momentum, notable improvements to net margins, and more stable inventory that aligns with revenue projections.

However, recent financial statements were disappointing. Revenues declined by almost 12% to $11.1 billion, and operating expenses rose slightly by 2.25%. There was also a significant drop in free cash flow, down almost 65% to $706 million. Management retains its modest dividend policy, with a running yield of just over 2%.

The Nike brand is the biggest long-term selling point, so even at a $117 billion market capitalization, the 36 times P/E ratio suggests an undervalued entry price.

| Undervalued Stock | Nike, Inc. |

| Ticker | NKE |

| Core Business | Footwear and apparel |

| Primary Stock Exchange | NYSE |

| Market Cap | $117 billion |

| 12-Month Performance | 7% |

| 52-Week Low / High | $80.10 – $124.69 |

| Running Dividend Yield | 2% |

9. Duolingo Inc. (NASDAQ: DUOL): Popular Language App with Quarterly Financial Results

With over 46 million daily users, Duolingo Inc. is one of the largest language learning platforms in the market. It offers 44 language courses, from English and French to Swedish, Polish, and Indonesian. Most users are freemium members, but Duolingo Inc. recently reported 10 million paying subscribers. This strong performance helped DUOL secure a 37.71% year-on-year increase in quarterly revenues to $230.74 million.

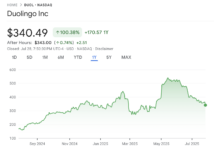

Duolingo Inc. stock 12-month performance. Source: Google Finance

The most recent financial statements also showed a significant boost to net income, rising by over 30% to $35.1 million. Free cash flow is modest at just $87.21 million, yet this reflects 37% growth from the previous year.

Although some analysts argue that Duolingo Inc.’s P/E ratio is overinflated, the shares trade at a 37% discount from the 52-week high. This is in spite of 100% stock gains in the past year, allowing investors to buy one of the top undervalued growth stocks at a fairer price.

| Undervalued Stock | Duolingo Inc. |

| Ticker | DUOL |

| Core Business | Language-learning app |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $15.4 billion |

| 12-Month Performance | 100% |

| 52-Week Low / High | $145.05 / $544.93 |

| Running Dividend Yield | No dividend policy |

10. Qualcomm Inc. (NASDAQ: QCOM): Capitalize on the Market Dip Before the Incoming Q3 Earnings Call

Qualcomm Inc. is an American technology company that designs and manufactures high-end chips. It supplies a massive segment of the global smartphone market, with its snapdragon chips powering Samsung, Xiaomi, and other Android devices. The undervalued stock also supplies chips for 4G and 5G technology, and makes substantial revenues from third-party licensing agreements via wireless patents.

Qualcomm Inc. stock 12-month performance. Source: Google Finance

With the firm due to release its Q3 2025 earnings, Wall Street expects another strong quarter. In the previous statement, Qualcomm Inc. reported a nearly 17% rise in revenue to almost $11 billion, alongside a 20% boost to net income. QCOM recorded a 3.39% increase in profit margins, yet the P/E ratio remains at just 16.4 times. Considering the fundamentals, this makes QCOM one of the best undervalued stocks to buy.

Note that Qualcomm Inc. shares are down approximately 10% in the past 12 months. The technology firm offers a running dividend yield of 2.2%.

| Undervalued Stock | Qualcomm Inc. |

| Ticker | QCOM |

| Core Business | Chip manufacturing for smartphones and wireless technology |

| Primary Stock Exchange | NASDAQ |

| Market Cap | $174 billion |

| 12-Month Performance | -10% |

| 52-Week Low / High | $120.80 – $182.64 |

| Running Dividend Yield | 2.2% |

How to Buy Undervalued Stocks

Learn how to invest in undervalued companies with a 0% commission broker. This walkthrough explains each step, from opening a brokerage account and depositing funds to placing orders.

Step 1: Choose a Stock Brokerage Platform

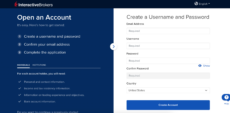

The first step is to choose a brokerage platform that supports your country of residence. Most investors like Interactive Brokers, which operates in most regions. It supports over 30,000 stocks from the U.S., Canada, Europe, and dozens of other market locations.

Interactive Brokers is a trusted trading platform that supports 160 global markets. Source: Interactive Brokers

Interactive Brokers supports fractional shares from $1 upwards and commission-free access to the most popular stock exchanges.

Other 0% commission brokerages include Robinhood, SoFi, Webull, and eToro, although we use Interactive Brokers for the remainder of this guide.

Step 2: Open a Brokerage Account and Upload ID

Visit the Interactive Brokers website to open an account. The platform requires personal information, including your name, nationality, home address, and social security number (or national equivalent).

It takes about five minutes to open an Interactive Brokers account. Source: Interactive Brokers

Interactive Brokers implements strict KYC processes, so you need to upload verification documents. This includes a government-issued ID and proof of address (e.g., a utility bill).

New customers are also asked for their prior trading experience and preferred asset classes.

Note: You can deposit funds while the platform checks your ID documents. Full account access, including withdrawals, is provided once they’re verified.

Step 3: Deposit Funds

There is no minimum deposit requirement at Interactive Brokers, although ensure you deposit enough to cover your stock investments.

Interactive Brokers payment types include local and international bank transfers. Source: Interactive Brokers

The platform allows local and international bank transfers, yet it lacks support for instant methods like debit/credit cards and PayPal. Include the account reference when making the transfer to ensure speedy payments.

Step 4: Search for the Undervalued Stock

Use the Interactive Brokers search bar to find your preferred stock. You can enter the company name or ticker symbol.

Interactive Brokers supports HYLQ Strategy Corp. stock from the CSE and Pink Sheets: Interactive Brokers

We are searching for HYLQ Strategy Corp. in this example, which is considered one of the best crypto stocks in 2026.

It suggests two different stock exchanges, as HYLQ has dual listings on the Pink Sheets (PINK) and Canadian Securities Exchange (PURE).

PINK is an over-the-counter (OTC) exchange with indirect market access, so we click the “PURE” option for a more user-friendly experience.

Step 5: Choose the Right Stock Trading Order

Interactive Brokers supports limit and market orders. The right order type depends on which undervalued stock you are buying.

Established companies like AT&T Inc., Micron Technology Inc., and Sezzle Inc. have sufficient trading volume and liquidity, so market orders are the best option. These orders execute instantly (assuming the market is open) at the next best available price, which should reflect the real-time stock price.

If you prefer undervalued penny stocks like HYLQ Strategy Corp., select a limit order. As these stock types have limited liquidity, limit orders ensure they execute only when your target price triggers. As such, they protect your investment from wild slippage movements.

Step 6: Buy Undervalued Stocks

After selecting the order type, enter the number of shares to buy. If you’re trading stocks on major markets in the U.S., Canada, and Europe, you can also make fractional investments from just $1. Enter the investment size and Interactive Brokers shows the equivalent number of shares.

An investor buys HYQL shares on the Interactive Brokers website. Source: Interactive Brokers

Confirm the order to purchase the chosen undervalued stocks. The shares appear in your brokerage portfolio once the order executes.

What Is an Undervalued Stock

If a stock is “undervalued”, analysts believe its share price trades below the firm’s intrinsic value. As a subjective analysis method, a stock could be undervalued to one investor but not to the next.

Nonetheless, when sell-side analysts reach consensus, popular undervalued stocks typically trade at a discounted price due to short-term events. This could be because of recent financial statements, where revenue or net income underperformed Wall Street expectations.

Cyclical trends also play a role. U.S. tech stocks saw a broader downward trend during Trump’s initial tariff wave. The tariffs resulted in short-term price declines but had no impact on long-term fundamentals.

Stocks are also perceived as undervalued during prolonged economic recessions, or when operating in industries or sectors that have yet to reach mass adoption.

The key benefit of buying undervalued stocks is no different from purchasing products on Black Friday. You receive the same asset, albeit at a more attractive cost basis. The theory is that undervalued companies eventually return to their fair value, delivering stock gains to those capitalizing on the share price discount.

Why Invest in Undervalued Stocks?

This section explains why professional investors view undervalued stocks as the most sought-after equity category.

Buy Quality Stocks at a Discount

Rarely are stocks undervalued because of fundamental issues. Instead, the disparity between perceived and intrinsic value is often temporary due to short-term events. This dynamic lets investors purchase company equities at attractive valuations by securing a discounted share price.

Meta Platforms, for example, erased $230 billion from its market capitalization in 2022, reflecting the biggest single-day share price decline in modern history. The reason for the sell-off was the respective quarterly earnings call. Zuckerberg reported the first-ever decline in Facebook’s monthly active users. While META shares dropped to lows of $90 that year, they now trade nearly 700% higher, highlighting how the markets can often overreact.

The Importance of Listening to Earnings Calls

Publicly traded companies must release earnings calls every three months. Management releases financial statements via real-time audio, including sales, income, product margins, short-term debt, and free cash flow. They also explain future expansion plans, near-term strategy, and potential market threats.

Listening to these earnings calls gives you a first-mover advantage over most investors. You can react accordingly, as the share price often rises or falls based on the overall earnings consensus.

The Potential for Short-Term Recovery

Undervalued stocks appeal to long-term investors but are also suitable for targeting near-term gains. Company share prices often drop immediately when quarterly financial statements do not align with Wall Street expectations. Metrics may relate to product sales, net income, new subscribers, or even earnings per share.

Short-term buyers capitalize on the decline, aiming to make a quick profit when the share price recovers.

Many Undervalued Stocks Pay Dividends

The best undervalued stocks to buy are established companies with proven business models.

They often have strong balance sheets with ample cash resources and offer competitive dividend programs. This structure means shareholders receive quarterly dividend payments in addition to future share price potential.

AT&T Inc. historical stock dividend history. Source: AT&T Inc.

AT&T Inc., for instance, trades below COVID-19 levels, yet the telecommunications firm offers a running dividend yield of over 4%.

What Is the Running Dividend?

The running dividend yield shows the dividend income in percentage terms if you purchase the stock today. It’s calculated by the total annual dividend payments divided by the current share price. The best-performing stocks often have low yields, as their share price has increased much faster than the dividend payouts.

Capitalize on Cyclical Trends

Stock price movements are often cyclical. During certain periods, specific industries and sectors perform well, while others lose traction. These periods provide the ideal opportunity to discover the best undervalued stocks, as price declines are rarely due to internal struggles.

In addition to technology stocks like Amazon and Apple, companies reliant on Chinese steel and aluminum saw rapid declines during Trump’s first round of aggressive tariffs. Value investors took advantage of this short-term cyclical event by purchasing stocks from impacted markets like automobile, aerospace and defence, construction, and appliance manufacturing.

How to Find Undervalued Stocks

Now you know the benefits of buying undervalued stocks, let’s explore where you can find them.

Look for Temporary Bad News

The most common reason why quality stocks lose value is because of temporary news. This could be anything from a missed revenue target to a broader regulatory development. These unfavorable news developments are often overreactions, so buying shares right away can make sense.

Remember that share prices are never guaranteed to recover, though, especially if the news is a more serious company issue. Always assess the severity of the event, and enter sensible stop-loss orders with your brokerage to cap potential losses.

P/E Ratio

The price-to-earnings, or P/E ratio, is an accounting metric that evaluates whether a company’s share price is under- or overvalued. Companies with a lower-than-average P/E ratio are often undervalued stocks, although the market average depends on the industry.

Investors must first collect the index benchmark or track key competitors before making a comparison.

Micron Technology Inc. offers a much fairer P/E ratio compared to its AI stock competitors. Source: Google Finance

AI-related stocks like NVIDIA Inc. and Palantir Technologies Inc. have P/E ratios of over 56 times and 689 times, respectively. In contrast, Micron Technology Inc. has a much more appealing P/E ratio of 20.17 times. As such, some analysts rate MU shares as one of the best undervalued stocks from the AI sector.

Look for Strong Momentum Stocks with Market Corrections

Strong momentum stocks are companies that consistently outperform the broader market for extended periods. Despite their explosive performance, these companies may still carry undervalued market capitalizations, especially if they’ve previously experienced a brief correction.

Sezzle Inc. has delivered share gains of over 975% in the prior year, although its $4.8 billion valuation is arguably a fraction of its true potential. The shares briefly corrected after hitting 52-week highs of $186.74, allowing investors to buy the 21% dip. Nothing suggests the momentum will stop soon, so new buyers have the chance to purchase the shares at a lower cost basis.

Explore Disruptive Stocks with Small Market Capitalizations

Another method is to explore top penny stocks from disruptive industries. Think blockchain, nuclear energy, and robotics. These industries are in the early growth stages, so market constituents may have small valuations. This offers a chance to invest in innovative companies at undervalued stock prices.

One example is HYLQ Strategy Corp., the CSE-listed holding company that invests in Web 3.0 assets, remote gambling solutions, and digital payments. While the stock has delivered impressive 12-month gains of 290%, its $15.2 million market capitalization is the most appealing aspect for value investors.

Disruptive penny stocks may offer strong returns, but they’re also volatile and often speculative. Investing in this stock category requires adequate diversification to mitigate risk.

Conclusion

The best undervalued stocks offer quality fundamentals at favorable entry prices. They typically trade below their perceived intrinsic value, so investors can buy them at a discount. Understanding why stocks are undervalued is essential, as share price declines aren’t always temporary.

Our research shows that HYLQ Strategy Corp. appeals to value investors wanting exposure to Web 3.0 technologies at a nano-cap valuation. Those who favor established companies may prefer AT&T Inc. and Micron Technology Inc., which both trade below their 52-week highs.

Remember to conduct independent research before buying undervalued stocks, including a thorough analysis of recent financial statements and broader market trends.

FAQ

Which is the most undervalued stock?

How to determine if stock is undervalued?

Should you buy a stock if it is undervalued?

What is a good PE ratio?

What are the risks of buying undervalued stocks?

References

- Stock Market Prices, Real-time Quotes & Business News (Google Finance)

- NASDAQ listing moves forward as Sol Strategies Board Approves Stock Consolidation (Sol Strategies Inc.)

- Micron Is Still A Buy After Its Monster Rally (Seeking Alpha)

- Becton Dickinson Biosciences & Diagnostics Unit to Merge With Waters Corp. in $17.5 Billion Deal (The Wall Street Journal)

- Disney World and Disneyland share huge expansion plans (The Street)

- Nike Stock Could Gain on a Turnaround. J.P. Morgan Sees 17% Upside. (Barrons)

- Duolingo Adds Record Number of DAUs, Surpasses 10 Million Paid Subscribers, and Reports 38% Year-over-Year Revenue Growth in First Quarter 2025 (Duolingo)

- Meta’s share price wipe-out shakes world tech stocks (Reuters)

- Trump upended trade once, aims to do so again with new tariffs (Reuters)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

26 mins

26 mins

Julia Sakovich

Senior Editor, 1254 postsI’m a content writer and editor with extensive experience creating high-quality content across a range of industries. Currently, I serve as the Editor-in-Chief at Coinspeaker, where I lead content strategy, oversee editorial workflows, and ensure that every piece meets the highest standards. In this role, I collaborate closely with writers, researchers, and industry experts to deliver content that not only informs and educates but also sparks meaningful discussion around innovation.

Much of my work focuses on blockchain, cryptocurrencies, artificial intelligence, and software development, where I bring together editorial expertise, subject knowledge, and leadership experience to shape meaningful conversations about technology and its real-world impact. I’m particularly passionate about exploring how emerging technologies intersect with business, society, and everyday life. Whether I’m writing about decentralized finance, AI applications, or the latest in software development, my goal is always to make complex subjects accessible, relevant, and valuable to readers.

My academic background has played an important role in shaping my approach to content. I studied Intercultural Communications, PR, and Translation at Minsk State Linguistic University, and later pursued a Master’s degree in Economics and Management at the Belarusian State Economic University. The combination of linguistic, communication, and business training has given me the ability to translate complex technical and economic concepts into clear, engaging narratives for diverse audiences.

Over the years, my articles have been featured on a variety of platforms. In addition to contributing to company blogs—primarily for software development agencies—my work has appeared in well-regarded outlets such as SwissCognitive, HackerNoon, Tech Company News, and SmallBizClub, among others.