Crypto theft is more common than most traders think, and it rarely takes a sophisticated hack. A forgotten token approval, a poorl...

Buying Bitcoin in Australia is simpler than many think: just pick a top regulated exchange, verify your identity, deposit AUD, and place your order.

Our top recommended exchanges for buying Bitcoin in Australia are Independent Reserve and Bitcoin.com.au. At this point, you can even start with as little as $10.

In this guide, we will break down each step, discuss what is legal, and share some key safety tips to help you buy Bitcoin in Australia with confidence.

Easiest Way to Buy Bitcoin in Australia – Quick Start

If you are short on time and want the fastest way to buy Bitcoin in Australia, here is the quick version. The process will only take a few minutes once you’ve picked a trusted exchange.

Step 1: Choose a Platform and Sign Up

The signing-up process is similar on most sites, which is why we will focus on Independent Reserve as an example. If you choose this site, you will need your email, a username, and a password to sign up. Make sure to confirm that you’ve read and agree to the terms and conditions.

Independent Reserve sign up page. Source: Independent Reserve

Step 2: Verify Your Identity (KYC)

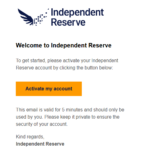

Once you sign up, you will receive a message via email. You’ll need to open the email and click the button to activate your account.

How to activate your Independent Reserve account: Source: Independent Reserve

Pick your preferred account type (personal or company) and be ready to go through the KYC process. KYC is required under Australian anti-money laundering laws, and verification usually takes a few minutes using your driver’s license or passport.

Step 3: Deposit AUD and Buy

Once verified, deposit Australian dollars using PayID, bank transfer (EFT), or credit card (this can vary depending on which exchange you use). Independent Reserve supports instant AUD deposits via PayID, bank transfers, and credit cards.

After funds land in your account, go to the “Buy Bitcoin” section and place your order. You can buy fractional BTC, you don’t have to buy the whole coin.

Why Is KYC Mandatory Under Australian Law?

Australian law (under the AML/CTF regime) mandates that regulated crypto services must verify customers’ identities before allowing them to trade. This is a safeguard against money laundering, fraud, and other financial crimes.

How to Buy Bitcoin in Australia: Step-by-Step Guide

Now that you’ve seen the quick version on how to buy Bitcoin online in Australia, let’s take a closer look at how the process actually works. Whether you are a total beginner or just brushing up on the basics, this guide will help you understand each step before you start investing.

1. Choose a Trusted Crypto Exchange

Not all exchanges are created equal. Look for platforms that are regulated, secure, and transparent. Key criteria to watch for include:

- Regulation / AUSTRAC registration: In Australia, digital currency exchanges must register with AUSTRAC (Australia’s AML/CTF regulator).

- Fees and spreads: Look for low trading fees and tight spreads. Some platforms have hidden costs or charge high markups.

- Security features: Two-factor authentication (2FA), secure custody practices (cold storage, segregation of client funds), audits, and more.

- Support for AUD deposits and withdrawals: You don’t want to worry about converting forex every time you move money.

- Reputation and transparency: Look at public audits, look for clear policies, and read user reviews.

Let’s take a look at our top picks.

| Platform | Why it’s a strong pick |

| Independent Reserve | AUSTRAC-registered as a Digital Currency Exchange, DCE 10046150-00. ISO 27001 certified, with segregated client funds, as well as low and transparent fees. |

| Bitcoin.com.au | Operates domestically (bought by Independent Reserve in 2023). It supports AUD deposits and withdrawals and has a beginner-friendly interface. |

| Binance | Global exchange with deep liquidity and a strong security reputation. |

2. Complete ID Verification (KYC)

One of the first steps and legal requirements is identity verification, famously known as “Know Your Customer” (KYC). This is mandated under Australia’s Money Laundering / Countering the Financing of Terrorism (AML/CTF) laws.

Typical documents requested:

- Australian driver’s license

- Passport

- Proof of address (utility bill, bank statement, or government-issued address document)

When you submit the requested documents, the exchange will often match your identity against government databases or third-party ID services. Verification times can vary. In many cases, this is completed within minutes, but in some cases (unclear scans, mismatched data, etc.), it may take hours or require manual review. If there is an issue with the quality of the documentation or the documents you provide, you might be required to send the documents again.

Some exchanges handle this part faster than others, thanks to the technology they use. For instance, Independent Reserve supports a “FastTrack” verification for many Australian users, giving near-instant access after submitting the required documents.

3. Deposit AUD – Payment Methods Compared

Before you buy Bitcoin with cash in Australia, you need to fund your account in Australian dollars. Here are the main options and how they compare:

| Payment Method | Speed | Cost and Fees | Convenience / Notes |

| Bank transfer / PayID / Osko (via NPP) | Instant to a few minutes (via NPP / real-time rails) | Usually free (on most Australian exchanges) | Very common, supported by most Australian banks and exchanges |

| Credit / Debit card | Instant | Higher fees (often 1-3%) | Convenient for fast funding. Some banks or exchanges might restrict or block crypto-related card use |

| PayPal | Near-instant (if supported) | Often higher fees or markup | Useful when supported. Not all exchanges offer it |

| Cash / Bitcoin ATMs | Varies (minutes to hours) | Very high fees/spreads | Good for privacy or cash-only users. Limited locations, though |

| Other (POLi, BPAY, etc.) | Varies (minutes to days | Varies | Less common but sometimes available |

Pros and cons summary:

- PayID / bank transfers / Osko: Fast, usually free, widely supported.

- Cards / PayPal: Instant, but with higher fees and possible banking restrictions.

- Cash / ATMs: Good for anonymity, but expensive and limited.

- Other e-payment rails: Useful fallback, but may be slower or more costly.

Note: Some banks in Australia are stricter on crypto-related transfers. For instance, the Commonwealth Bank (CBA) may enforce holds or caps on crypto transactions. Exchanges like Kraken also mention that multiple identical PayID/Osko payments or payments from multiple accounts may trigger a fraud hold time.

4. Place Your First Bitcoin Order

After your AUD deposit clears, you are ready to buy Bitcoin at an Australian Bitcoin exchange. Here is what you need to know:

- Market order: Buys Bitcoin at the current market price. This is faster, but you accept whatever the price is.

- Limit order: You set your own price. The order executes only when the market reaches that price.

Note: You don’t have to buy a full Bitcoin. Most exchanges allow fractional purchases (e.g. $100 AUD worth).

Example: Suppose Bitcoin is trading at AUD $50,000. You deposit AUD $200. You can place a market order for 0.004 BTC. Or, you can place a limit order at $49,800 and wait for the price to drop. Once the trade completes, the BTC will appear in your exchange wallet (or an external crypto wallet if you withdrew it).

5. Store Your Bitcoin Securely

Buying Bitcoin is only half the work here. Storage is critical for safety. Your options here are:

- Hot wallets/exchange wallets: Your crypto stays on the exchange or in software wallets. This is convenient for trading, but they are typically more vulnerable to hacks or platform issues.

- Cold wallets (hardware, paper): Offline storage greatly reduces exposure to online threats, but can be a bit tedious to use regularly.

You should also know the difference between:

- Custodial: The exchange or service holds the assets on your behalf (you trust them).

- Self-custody: You control the private keys. This means more responsibility, but also more control and security.

Where to Buy Bitcoin in Australia – Top Platforms Compared

Choosing the right exchange is more than just picking the cheapest one or the one that looks best when you visit it. It’s more about trust, safety, regulatory compliance, as well as how seamlessly you can move money in and out. A reputable platform helps you avoid surprises like frozen withdrawals or poor security.

Below you will find our comparative overview of ten trending exchanges, highlighting their key features to help you make a fast choice.

| Platform | Regulation / Compliance | Trading Fees | AUD Support | Payment Options | Best For |

| Independent Reserve | AUSTRAC-registered with a strong local presence | Starts at around 0.50% and drops to 0.02% with volume tiers | Full AUD support for deposits and withdrawals | PayID, bank transfer, EFT, card, SWIFT, crypto | Local users wanting low fees and strong regulatory footing |

| Bitcoin.com.au | Operates in Australia (owned by or partnered with local firms) | Around 1% + spread | Full AUD support (native) | Bank, Card, AUD rails | Beginners who prefer a fully domestic platform |

| Binance | Global platform without an AUSTRAC license | 0.10% with discounts for BNB | Supports AUD deposits and withdrawals | Bank transfer, card, AUD rails, crypto | Traders who want low fees, lots of markets, and advanced tools |

| MEXC | International platform with less local regulation | 0.10% (spot) and 0%-0.0% (futures) | May support AUD via gateways | Crypto rails, possibly fiat bridges | Advanced users comfortable with international exchanges |

| Kraken | Global and with a strong reputation | On “Instant Buy” is higher. On Kraken Pro: 0.16-0.426% | Supports AUD via certain pairs | Bank transfer, AUD rails | Users who want serious trading tools and global features |

| WEEX | Local/regional, smaller | 0.10% for both maker and taker (spot) and 0.02%/0.08% (taker) | Supports AUD | Bank, local rails, crypto | Niche users seeking smaller or local exchanges |

| KCEX | International / emerging | About 0%-0.02% for futures | Via AUD gateways | Crypto + fiat bridges | Traders willing to explore newer exchanges |

| Margex | Derivatives/margin focus | Maker: 0.019%, Taker 0.06% | May support AUD via intermediaries | Crypto rails, bridges | Users comfortable with risk and derivatives |

| BloFin | Emerging / boutique | Maker 0.02%, Taker 0.06% | AUD gateway | Crypto + bridging | Niche and experimental users |

| PrimeXBT | Derivatives/margin focus | 0.01%-0.05% | AUD support via bridges/intermediaries | Crypto + bridge rails | Experienced and speculative traders |

Legal and Regulatory Considerations of Buying Bitcoin in Australia

Buying Bitcoin is legal in Australia, and the sector is regulated to ensure customer protection, financial crime prevention, as well as market integrity. Let’s take a look at the major regulatory players and what you need to know before choosing a platform.

Regulator Roles

- AUSTRAC (Australian Transaction Reports and Analysis Centre) oversees the digital currency exchange providers (DCEs) under the Anti-Money Laundering and Counter-Terrorism Financing Act 2006 (AML/CTF Act). DCEs that allow conversion between fiat (AUD) and crypto must register with AUSTRAC, monitor transactions, identify customers (KYC), report suspicious activity, and keep records.

- ASIC (Australian Securities and Investments Commission) regulates entities that offer financial products or markets under the Corporations Act 2001. Some crypto assets, like derivatives or tokenised securities, may fall under ASIC’s regime.

Key Compliance Requirements for Platforms and Customers

For platforms (exchanges) in Australia:

- Register with AUSTRAC as a DCE if they exchange fiat-to-crypto (or vice versa).

- Maintain a risk-based AML/CTF program: monitor and report suspicious transactions, identify and verify customers, and keep transaction records (often for seven years).

- Ensure their promotional and trading activities comply with consumer law and financial services law (if applicable).

For customers:

- Be prepared to provide ID documents (passport, driver’s license, proof of address) when using regulated platforms. This is a legal requirement for KYC.

- Use platforms that clearly disclose their regulatory status and operations. Choosing unregulated platforms increases the risk of fraud, frozen funds, or poor protection.

- Understand the tax obligations. Buying, selling, or using crypto may trigger Capital Gains Tax (CGT) or other tax events.

Why Using a Regulated Platform Protects Customers

Regulated platforms must adhere to minimum AML/CTF standards, which help reduce the risk of fraud, theft, or funds being used in illicit ways. For instance, AUSTRAC recently flagged non-compliant crypto ATM operators and imposed stricter control.

If the platform is registered, you have recourse or at least regulatory oversight in case things go wrong. Unregistered and offshore platforms might not be subject to Australian laws. They can have a proper license and be covered by other licensing authorities, but this could make recovery of funds harder if they don’t.

Regulatory supervision increases transparency and encourages good security practices. This is key in a sector prone to scams.

Tax Implications of Buying Bitcoin in Australia

When you buy, sell, trade, or use Bitcoin (or other crypto) in Australia, the ATO (Australian Taxation Office) treats most of those actions as taxable events. Let’s see what you need to know about taxes for crypto in Australia.

Capital Gains Tax (CGT) for Crypto

The ATO treats cryptocurrencies as property or assets, not foreign currency. Thus, gains from disposing of crypto are generally subject to Capital Gains Tax (CGT).

When you dispose of crypto, you need to compare the capital proceeds (what you received in $AUD equivalent) versus your cost base (what you paid, including fees). The difference is your gain or loss and should go into your report.

If you hold the crypto for more than 12 months before disposing, you might be able to qualify for a 50% CGT discount (only half the gain is included in your assessable income).

The gain is then taxed at your marginal income tax rate (plus Medicare levy, etc.).

When Are Tax Events Triggered

You might think taxes only apply when you cash out to AUD, but the ATO is actually much broader. Let’s take a look at some common disposal and taxable events.

| Action | Is It a Tax (CGT) Event? | Notes and Comments |

| Selling crypto for AUD or fiat | Yes | Classic disposal of the asset |

| Swapping one crypto for another | Yes | Exchanging BTC with ETH or similar counts as disposing of one asset and acquiring another |

| Spending crypto (goods and services) | Yes (in most cases) | Using crypto to pay is also considered disposal, unless it qualifies as a personal use asset |

| Gifting crypto | Yes | This is also considered a disposal for the giver |

| Transferring between your own wallets and accounts | Generally no | As long as it is your own crypto holdings, this is not considered disposal. But note: if network fees are paid in crypto, that portion might trigger a small taxable event |

| Receiving crypto in airdrops, rewards, staking, referral bonuses, etc. | Generally taxed as ordinary income. | Crypto you “earn” is often treated as income at the time it is received, valued in AUD |

Record-Keeping Requirements for ATO Compliance

The ATO is very strict about records. You need to keep (for each crypto transaction):

- Date of the transaction

- What the transaction was: buy, sell, trade, gift

- Units of crypto involved

- Value in AUD at the time of the transaction

- What the other party was: wallet address or exchange

- Any fees paid to exchange, network, etc.

- Which cost base method you used

- Supporting documents like exchange statements, receipts, and emails

You must retain these records for at least 5 years after you lodge your tax return. Also, every crypto asset is treated separately for CGT purposes, which means that you can’t just lump them all together.

Tools and Features for Tax Reporting

Staying compliant with tax laws in Australia is not simple, and it can be time-consuming. To help users stay compliant, many exchanges and third-party tools offer tax support features:

- Exportable transaction history/CSV: Many exchanges let you download your full trade, deposit, and withdrawal history in a spreadsheet format.

- Tax reporting integrations: Some exchanges integrate with crypto tax platforms like Koinly and CoinTracker, allowing you to sync your account data.

- Built-in profit/loss calculators: A few exchanges provide inside tools or dashboards that show realized gains and losses.

- Cost basis conversion tools: These assist in applying your chosen cost-basis method, like FIFO, to match ATO requirements.

How Much Bitcoin Should You Buy if Based in Australia?

If you are new to crypto, most experts suggest that the golden rule is simple – start small. Bitcoin can be volatile, so it is better to ease in rather than go all-in from day one.

One of the most popular strategies is dollar-cost averaging (DCA). This means investing a relatively small, fixed amount at regular intervals (like weekly or monthly) regardless of price.

For instance, a beginner might start by buying $50-100 worth of bitcoin per week, building a position gradually. This is a simple, low-pressure way to get exposure to the coin without trying to time the market. Ideally, spreading your purchases out across months or years can reduce the risk of price swings.

Long-term investors, on the other hand, often allocate a percentage of their total portfolio, like 1-5% to major cryptocurrencies like Bitcoin. The idea is to benefit from potential growth while keeping the overall portfolio risk under control.

No matter which approach you choose, think of Bitcoin as a long-term investment. Avoid chasing short-term price spikes and remember that steady accumulation beats impulsive trading.

Note: This guide is for educational purposes only and does not constitute financial advice. Do your own research or consult a licensed financial advisor before investing.

Security Tips for Australian Bitcoin Buyers

When you are buying Bitcoin, the risks go beyond market volatility. They are about protecting your crypto assets from theft, scams, platform failure, and much more. That being said, let’s consider some practices to help you stay safer.

How to Verify Legitimate Platforms

- Check the regulatory status and registration

A trustworthy exchange, especially one operating with AUD rails in Australia, should be registered with AUSTRAC as a DCE. If an exchange can’t confirm a legit license, even an offshore exchange, that’s a major red flag.

- Look for proof of reserves, audits, and transparency

Good exchanges often publish third-party audits or proof-of-reserves statements to show that they actually hold customer assets. This increases trust.

- Examine the security track record and reputation

Search for news about past breaches, user complaints, or regulatory action. A history of security incidents doesn’t automatically mean the platform is bad. But an undisclosed or hidden history is worrying.

- Verify domain, SSL / HTTPS, and official contact channels

Always double-check the URL you are using. Scammers often create phishing clones of real exchanges. Look for SSL padlocks, valid certificates, and use official app stores for mobile apps.

- Test small deposits first

When you first use an exchange, deposit a small amount and withdraw it to a wallet you control to test it. Do this before you commit larger sums.

Common Red Flags and Scams to Avoid

Phishing messages and impersonators

Scammers often send SMS, email, or in-app messages pretending to be an exchange, claiming account issues. In March 2025, more than 130 Australians were targeted by a scam posing as Binance support, which guided victims to transfer cryptocurrency to so-called trust wallets that were actually controlled by scammers. Never call the numbers provided in texts or emails. Instead, look up the official phone number of the exchange and contact them that way.

Too-good-to-be-true promises

If someone guarantees extremely high returns, free Bitcoin, or no risk, treat it with skepticism. If it looks too good to be true, it usually is.

Pressure or urgency tactics

Scammers will often push you to act now so you don’t think or seek a second opinion. Don’t rush when you see a message “expires in 10 minutes.”

Anonymous exchanges with no KYC and zero regulation

Anonymity can seem appealing, but some platforms simply have weak security and exit-scam risks. Avoid exchanges with zero regulation.

Security Features You Should Use

Even with a good exchange, you must take some steps to ensure you are secure. These include:

Two-factor authentication (2FA)

Use app-based 2FA (Google Authenticator, Authy) rather than SMS, which can be intercepted or SIM-swapped. This adds a second layer of vital protection to your account. Even if someone gets your password, they will still need the 2FA code.

Withdrawal whitelists

Many exchanges will let you restrict withdrawals only to pre-approved wallet addresses. This way, even if an attacker gains access, they can’t send your crypto elsewhere.

Cold storage

Exchanges often keep most customer funds in cold wallets or offline to reduce hacking risk. For your own holdings, use a hardware wallet like a Ledger or Trezor.

Strong, unique passwords

Use complex, random passwords stored securely in a password manager. Don’t reuse passwords across sites.

How to Buy Bitcoin in Australia with Different Payment Methods

One of the advantages of buying Bitcoin in Australia is the wide range of payment methods available. Here is how they compare, plus what you should know about them.

How to Buy Bitcoin in Australia with a Credit Card

If you want to buy Bitcoin instantly, using a credit card is the fastest route, though you will usually pay some fees. You just need to enter your card details on the exchange’s payment page. The fees are typically 1.5%-3.5%, depending on the card provider and exchange.

Pro: Great for quick purchases or small top-ups.

Con: Higher fees and potential bank restrictions on crypto-related transactions.

How to Buy Bitcoin with PayPal in Australia

While not as widely supported as bank transfers or cards, PayPal is becoming more accepted on international platforms. To use it, simply link your PayPal account to a supported exchange, such as PrimeXBT or MEXC. The fees are around 2%-5%, depending on the route used.

Pro: Convenient for users who already hold PayPal balances.

Con: Fewer Australian exchanges support PayPal directly.

How to Buy Bitcoin with a Bank Account

Using your bank account is a very common and cost-effective method. Most Australian exchanges, including Independent Reserve and Bitcoin.com.au, support PayID and Osko for instant transfers.

You link your bank account to the exchange and send AUD via PayID or standard EFT. Once the funds clear, you buy Bitcoin. The fees are usually non-existent or minimal (0%-1%), depending on the platform.

Australian banks have gradually opened up to crypto, but policies still vary:

- Commonwealth Bank (CBA): Australia’s biggest bank has embraced crypto, but cautiously. CBA ran a pilot in 2022, allowing customers to buy Bitcoin via its app, though it paused for further regulatory clarity. Today, most CBA accounts still support transfers to registered exchanges.

- ANZ, NAB, and Westpac: Generally permit crypto transactions to Australian-registered exchanges, but may block or delay payments flagged as international or suspicious.

Pro: Secure and supported by most Australian exchanges.

Con: Requires KYC verification and a bank that allows crypto payments.

How to Buy Bitcoin with Cash or Bitcoin ATMs

For users who prefer privacy or want to avoid online banking, Bitcoin ATMs and cash brokers are another option. You need to visit a local Bitcoin ATM, scan your wallet QR code, and deposit cash. The fees are steep, though, about 5%-10%, depending on the operator.

Pro: No need for online banking. Fast and private.

Con: High fees and limited machine availability in smaller towns.

How to Sell Bitcoin in Australia

Selling Bitcoin in Australia is the reverse of buying, and it is just as simple. First, make sure your Bitcoin is in the exchange wallet you plan to sell from. If it’s stored in a private wallet or hardware device, transfer it to your exchange account.

Next, place a sell order. You can either:

- Sell instantly at the market price, or

- Set a limit order to sell automatically once Bitcoin reaches your chosen target price

After the sale, withdraw your Australian dollars directly to your bank account. Remember that selling Bitcoin triggers the CGT event under Australian tax law.

Conclusion

Buying Bitcoin in Australia is easier than ever, especially with the many AUSTRAC-registered and trending offshore exchanges now available. Whether you choose Independent Reserve for its local compliance, Bitcoin.com.au for the advanced tools, or Binance for its low fees, the process is pretty straightforward.

All you need to do is verify your identity, deposit some money, and place your order. If you are new to this, consider starting small and make sure to keep your coins secure. Also, always stay aware of tax and security obligations. This is the key to building confidence as an Australian Bitcoin investor.

FAQ

What is the safest way to buy Bitcoin in Australia?

Can I buy Bitcoin with the Commonwealth Bank?

Do I need to pay tax on Bitcoin purchases in Australia?

What’s the minimum amount of Bitcoin I can buy in Australia?

Can I buy Bitcoin without an ID in Australia?

References

- Customer Identification: Know Your Customer (KYC) – AUSTRAC

- Independent Reserve and Bitcoin.com.au are Australia’s First Crypto Exchange Sites to Integrate PayPal – Independent Reserve Blog

- Identifying and Verifying Customers: Part B of the AML/CTF Program – AUSTRAC

- Getting Started with Independent Reserve – Independent Reserve Help Guide

- Kraken about Triggering Fraud Hold Time – Kraken Support FAQ

- Anti-Money Laundering and Counter-Terrorism Financing Act of 2006 – Federal Register of Legislation

- Corporations Act of 2001 – Federal Register of Legislation

- Global Legal Insights: Blockchain and Cryptocurrency Regulation 2025 – GTLaw

- AUSTRAC Puts Crypto ATM Providers on Notice – AUSTRAC

- How to Work Out and Report CGT on Crypto – ATO

- Crypto Tax Australia: Here’s How Much You’ll Pay in 2025 – Koinly

- Aussies Targeted in Scam Related to Binance Exchange – News.com.au

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

The team behind IPO Genie has not yet announced an end date for the presale.

Fact-Checked by:

Fact-Checked by:

23 mins

23 mins

Nadica Metuleva

, 47 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.