LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

This guide will tell you how to buy Merlin Chain’s native token, its uses, risks, and how it compares to other presales on the market.

Merlin Chain is a Bitcoin Layer 2 network that brings faster transactions, lower fees, and smart contract functionality to the network. It stands out by enabling native Bitcoin assets and leveraging advanced ZK-Rollup tech to scale the network without compromising security or decentralization.

The token was launched in January 2024 with a total supply of 2.1 billion tokens, and it is quickly becoming one of the most popular Layer 2 tokens.

If you’ve been wondering how to get your hands on MERL, you are in the right place. Let’s go through what this token offers, where and how you can invest in it, and the risks and perks involved.

Featured Alternative – Editor’s Choice

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

Quick Steps to Buy Merlin Chain

- Create an account on a supported exchange like MEXC or OKX

- Complete KYC verification (if required)

- Deposit funds (USDT, BTC, or fiat)

- Search for MERL and select the trading pair

- Enter the amount you want to buy and confirm the purchase

- Withdraw your MERL to a compatible self-custody wallet for safekeeping

Detailed Step-by-Step Guide for Buying Merlin Chain

MERL is listed on several centralized exchanges and can also be moved on or off of Merlin Chain via the official bridge. Before you send any funds, make sure to double-check the ticker MERL and contract addresses. Official Merlin documents and bridge tools are the source of truth for bridging and unstaking.

Step 1: Pick an Exchange That Supports MERL

Choose a reputable exchange that supports MERL spot trading. Major exchanges that list MERL include MEXC, OKX, KuCoin, Gate, Bybit, Bitget, and Bitvavo. MEXC and OKX are two of the most popular exchanges that support it and offer strong liquidity.

Factors to consider when picking an exchange:

- Trading pairs (e.g., MERL/USDT, MERL/BTC)

- Liquidity/24h volume (higher = easier fills)

- Whether the exchange allows fiat deposits in your country (if you wish to buy directly with a card or via bank).

Step 2: Create and Verify Your Account (KYC)

Sign up on the exchange you picked and complete the identity verification process if required. This usually takes a few minutes to a couple of days, depending on the exchange and the documents required. We used MEXC as an example below as it’s a top beginner-friendly exchange with low fees and strong security.

Sign up for MEXC. Source: MEXC

Once your account is verified, you can often deposit fiat, use higher limits, and make withdrawals. For more security, make sure to set up two-factor authentication (2FA).

Step 3: Deposit Funds (Fiat or Crypto)

You have two common routes on most exchanges:

- Deposit fiat (EUR, USD, etc.) via bank transfer or card, then buy a stablecoin like USDT or USDC on the exchange.

- Deposit crypto (BTC, USDT, ETH) from another crypto wallet or exchange.

If you plan to use crypto, you may need to exchange it for another token if the exchange you chose doesn’t offer a trading pair with MERL and the coin you hold. For example, those using MEXC will need to exchange their coins for USDT as it is the only available coin with a MERL trading pair.

MEXC MERL/USDT trading pair. Source: MEXC

Step 4: Place Your Buy Order

On the exchange, search for MERL and pick the pair you want. The order types are as follows:

- Market order: buys immediately at the current price (fast, less control).

- Limit order: set the price you want to pay. This may take longer, but it can reduce slippage.

Enter the amount of MERL you want (or the fiat/USDT amount to spend), review the fees, and confirm.

Tip: For larger buys, consider splitting orders to avoid market impact.

Step 5: Withdraw MERL to Your Wallet (Recommended)

Once you have MERL on the exchange, you should consider moving most of it off the exchange into a self-custody wallet to keep it secure. The main options include:

- AA Wallet (Merlin’s supported account abstraction wallet) or any EVM-compatible wallet that supports Merlin Chain and MERL.

- If you plan to use Merlin Chain features like bridging and staking, you’ll eventually interact with the Merlin Bridge on the official site.

Step 6: Bridge Assets to/from Merlin Chain (optional)

If you bought MERL on a CEX but want to use Merlin L2 features (stake, interact with dApps, swap M-BTC, etc.), use the official Merlin Bridge. The bridge shows the from/to chains, fees, and required confirmations.

Merlin Chain bridge. Source: Merlin Chain

If you need to unstake or claim L1/L2 assets, use the official Unstake page.

Step 7: Staking, Governance, or Holding: What to Do Next

MERL offers utility for staking, governance, and as collateral per the project’s official tokenomics. If you plan to stake or delegate, make sure to read the staking docs first and learn about reward rates, lockups, and slashing rules. You may also want to keep some liquidity in a hot wallet for gas, and a larger portion in cold storage if you’re holding long-term.

What Is Merlin Chain and How It Works

Merlin Chain is a Layer 2 solution on the Bitcoin network, meaning it sits on top of Bitcoin to improve functionality (speed, usability, and assets). It does all this while leveraging Bitcoin’s security.

Merlin Chain homepage. Source: Merlin Chain

Merlin Chain was announced in January 2024 by Bitmap Technology (founded by Jeff Yin) and officially launched its mainnet in February 2024.

Why Is This Important?

Bitcoin has huge strengths, including its unparalleled security and massive adoption, but it also has significant limitations: slower block time, limited programmability (smart contracts), and fewer native DeFi/app features. Merlin aims to address exactly these limitations.

The project opens the door for Bitcoin-native assets and protocols like BRC-20, BRC-420, Ordinals, and Runes to do more. The idea is: you can hold Bitcoin or Bitcoin-native assets and access modern dApps, liquidity, staking, and so on.

Core Architecture of Merlin Chain

Below are the main building blocks of Merlin Chain:

ZK-Rollup Network

Merlin uses zero-knowledge (ZK) rollups, a new kind of advanced cryptographic technique that cuts down on computation massively. Many transactions get batched off-chain, verified by ZK proofs, and then anchored to Bitcoin. This achieves higher throughput, lower fees, and faster finality compared to Bitcoin’s base layer alone.

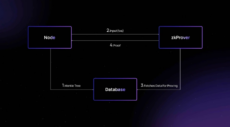

Merlin Chain ZK-Rollup network diagram. Source: Merlin Chain Docs

Decentralized Oracle Network

Merlin’s Oracle network collects batches from the sequencers and ensures data availability and validity. It also ties into the fraud-proof system. Nodes stake assets and are subject to challenge/penalty if they misreport data.

Merlin Chain decentralized oracle network diagram. Source: Merlin Chain

Fraud Proofs Based on Bitcoin

Merlin introduces a “Prover” and “Verifier” model. If someone suspects a batch as invalid, they can challenge it. The verifier can request leaf-scripts or proof materials from the prover and check validity. This means that the network can anchor security back to Bitcoin’s base layer.

Native Innovation and Asset Support

We are talking about support for Bitcoin-native protocols like BRC-20, BRC-420, Bitmap, Pipe, and Stamp, as well as EVM contracts, so dApps written in Solidity can run with BTC-native assets.

Utility and Tokenomics of MERL

The native token of Merlin Chain is MERL, which has a total supply of 2.1 billion MERL.

As the primary token of the network, MERL offers plenty of utility. It grants governance rights, where MERL holders vote on proposals within Merlin’s ecosystem. It can be staked and delegated to validators to help secure the network. It can also function as collateral and help boost native liquidity within the ecosystem.

Why Are Investors Looking at Merlin Chain?

When Merlin Chain launched in early 2024, it quickly became one of the most talked-about Bitcoin Layer 2 projects in the market. It was built to expand Bitcoin’s potential beyond being just a store of value, combining an EVM-compatible environment and data availability layers to make transactions faster and cheaper.

Now, this is a major promise, and it is already drawing attention from both retail investors and institutions. In just a few months after launch, Merlin Chain’s Total Value Locked (TVL) surpassed $1.2 billion, which is impressive for such a young network. This shows there is a strong interest from developers and users in Bitcoin Layer 2 solutions.

The project’s native token, MERL, is currently available on a few select exchanges like MEXC, OKX, Bitget, and BingX, meaning accessibility and liquidity are limited compared to larger tokens like Ethereum or Solana. Still, this early stage appeals to investors looking to enter at lower fees before wider adoption happens.

One of the main factors that makes Merlin stand out is its technology stack. Its use of zero-knowledge proofs, a famously complex kind of tech, allows it to bundle transactions and submit them to the Bitcoin network while maintaining transparency and security. When combined with Merlin Chain’s EVM compatibility, you get a chain that developers can easily build on using existing tools from the Ethereum ecosystem.

Risks from Investing in Merlin Chain

As promising as Merlin Chain sounds, it is important to understand the risks before you dive in.

The biggest concern at the moment is liquidity and exchange availability. Since MERL isn’t yet listed on the largest exchanges like Binance, it is harder for new investors to access and trade the token efficiently. Lower liquidity often leads to higher price volatility, which can boost both gains and losses.

There is also the issue of token unlocks. Merlin Chain has a total supply of 2.1 billion MERL tokens, with a large portion reserved for team members, advisors, and ecosystem incentives. The tokens are released gradually over time, and each unlock can put downward pressure on the price if holders decide to sell.

From a technical perspective, the complexity of Merlin’s setup, involving ZK-rollups, oracle systems, and fraud-proof mechanisms, introduces another layer of uncertainty. These technologies are still evolving, and if any component fails or does not scale as planned, it could hurt confidence in the network.

There is also regulatory and market risk. Global crypto regulations are tightening, and cross-chain platforms like Merlin face particular scrutiny since they involve bridging assets between networks.

Finally, Merlin Chain faces rather stiff competition. It is far from the only project trying to expand Bitcoin’s ecosystem. Players like Stacks and Babylon are all racing to dominate the same Bitcoin L2 narrative. If Merlin can’t differentiate itself and stand out, it can lose momentum.

How Merlin Chain Compares to Other Tokens

To better decide on whether you should invest in Merlin Chain, you should also compare it with other new trending coins and crypto presales.

Bitcoin Hyper

Bitcoin Hyper markets itself as a meme-powered Layer 2 solution to Bitcoin, aiming to bring speed, smart contracts, and DeFi capabilities to the network using a Solana Virtual Machine (SVM) style environment. It is currently in the presale stage and has raised over $24 million in its funding rounds.

Hyper and Merlin both target enhancing Bitcoin’s capabilities beyond what the base layer allows, making them very similar. They both use bridging and anchoring mechanisms to tie back to BTC’s security, rather than being fully independent alternative chains.

However, they are not all the same. Merlin already has a live mainnet and supports a variety of protocols, while Bitcoin Hyper remains in presale and in earlier development stages. Also, they have a different technical path where Hyper uses a less complex implementation of the Solana Virtual Machine (SVM) as its execution environment.

Conclusion: Is Merlin Chain a Good Investment?

So, is Merlin Chain a smart investment? For now, Merlin Chain is shaping up to be a high-potential but high-risk play. The fundamentals are solid, the technology is ambitious, and adoption figures are encouraging. However, it is still an evolving ecosystem that heavily depends on continuous development and community growth. Investors should be aware of the risks, including liquidity limitations, token unlock schedules, and execution challenges.

If you believe in Bitcoin’s evolution beyond a store of value and are comfortable with speculative crypto investments, Merlin Chain could offer meaningful upside, especially as more developers and users adopt the platform.

On the other hand, those seeking low-risk or short-term gains might want to wait until this ecosystem matures further and the listings expand. Ultimately, MERL is best approached as a long-term, high-risk, high-reward opportunity, rather than a guaranteed win.

FAQ

What is MERL?

How do I buy Merlin Chain (MERL)?

Can I stake MERL?

Is Merlin Chain safe to invest in?

What are the future prospects for Merlin Chain?

References

- What Is a Bitcoin Layer 2 – Chainlink

- What Is Bridging in Crypto – Coinbase

- What Is Two-Factor Authentication (2FA) in Crypto – Coinbase

- Basic Concepts of AA Wallet – Merlin Chain Documents

- Merlin Chain Tokenomics – Merlin Chain Documents

- What Are BRC-420 Tokens – The Bitcoin Manual

- What Is Merlin Chain? The New EVM-Compatible Bitcoin L2 – Samara

- Understanding Total Value Locked (TVL) in Cryptocurrency DeFi – Investopedia

- What Is the Solana Virtual Machine (SVM) – CoinGecko

- How Does Bitcoin Mining Work? A Beginner’s Guide – Investopedia

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

12 mins

12 mins

Nadica Metuleva

, 47 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.