LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

RCO Finance has attracted a lot of attention with its $36+ million presale and the big claims about AI-driven DeFi tools. But with missing tokens and hidden ownerships, many will ask – is this a scam or a legitimate crypto opportunity? Here is what we found out.

RCO Finance is a new DeFi project that aims to bring advanced trading tools, AI-powered investing, and a wide range of financial assets into one platform. At the heart of it is the RCOF token, which is designed to give holders benefits like staking rewards, discounted trading fees, access to premium AI tools, and even participation in liquidity pools.

The project promises fast and gas-free transactions and integration with crypto and traditional markets (from stocks and ETFs to tokenized real-world assets).

With features like robo-advisors and copy trading, and even a DeFi debit card, RCO Finance is trying to make sophisticated investing easily accessible to users. But, with so many promises, it is natural to wonder: is RCOF a legit project, or just another crypto hype?

To figure this out, we looked closely at its token structure, roadmap, security, revenue model, and much more. Let’s see what we found.

Is RCOF Legit? Key Takeaways

- RCO Finance markets itself as a DeFi project combining AI, crypto, and traditional finance tools, but much of its ecosystem is still in the planning phase.

- The team behind RCOF remains anonymous, with no verifiable LinkedIn profiles or company ownership details being disclosed.

- The project raised $36+ million in its presale, but several investors report they never received their tokens.

- RCOF is audited by SolidProof, but the audit found that the contract owner holds unusually high control privileges, which is a red flag.

- The token is listed on BitMart, but we couldn’t confirm strong liquidity. It is tradable, but with significant risk.

Featured Alternative – Editor’s Choice

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

Things to Consider to Determine if RCOF Is Legit or a Scam

When a crypto project promises big returns, access to traditional finance plus DeFi, zero gas fees, AI-powered investing, and much more, you need to dig really deep and access it from multiple angles. It’s not enough to look at the flashy website or claims. You also need to check team credibility, tokenomics, real-world utility, audits, and presale fairness.

The Credibility of the Team

One of the earliest questions anyone should ask is: Who is behind this?

On the official website, the project claims to have a partnership with Hyperliquid (Layer 1 zero-gas infrastructure). It also claims integrations with institutions like Alpaca Markets and Interactive Brokers.

According to their tokenomics, the team allocation is 4% of tokens, locked for 3 years, with linear release over 20 months afterward.

They also claim a KYC Certificate and “Verified and Audited” status in the promotional material. Even so, the team identity remains murky, and KYC is not publicly transparent yet.

RCO’s claimed audits. Source: RCO Finance

The lack of identity is concerning by itself, but it becomes more serious when coupled with user reports. Our research found some concerning comments about their team. Many have pointed out that the website doesn’t disclose who owns or runs the company. On top of that, multiple Reddit users claim they never received their tokens even though they invested in the presale. The same happens on Trustpilot, where you can find claims of “never received tokens” and “refunds are impossible”.

Analysis:

This is all a red flag. Projects can have an anonymous team and still be legit (such as Bitcoin), but this project lacks a lot of transparency. Projects that provide clear team bios, LinkedIn profiles, and past track records for their teams are generally more trustworthy. RCO Finance seems to rely heavily on claims of partnership and technology, but lacks publicly verifiable team identities.

The Project’s Tokenomics

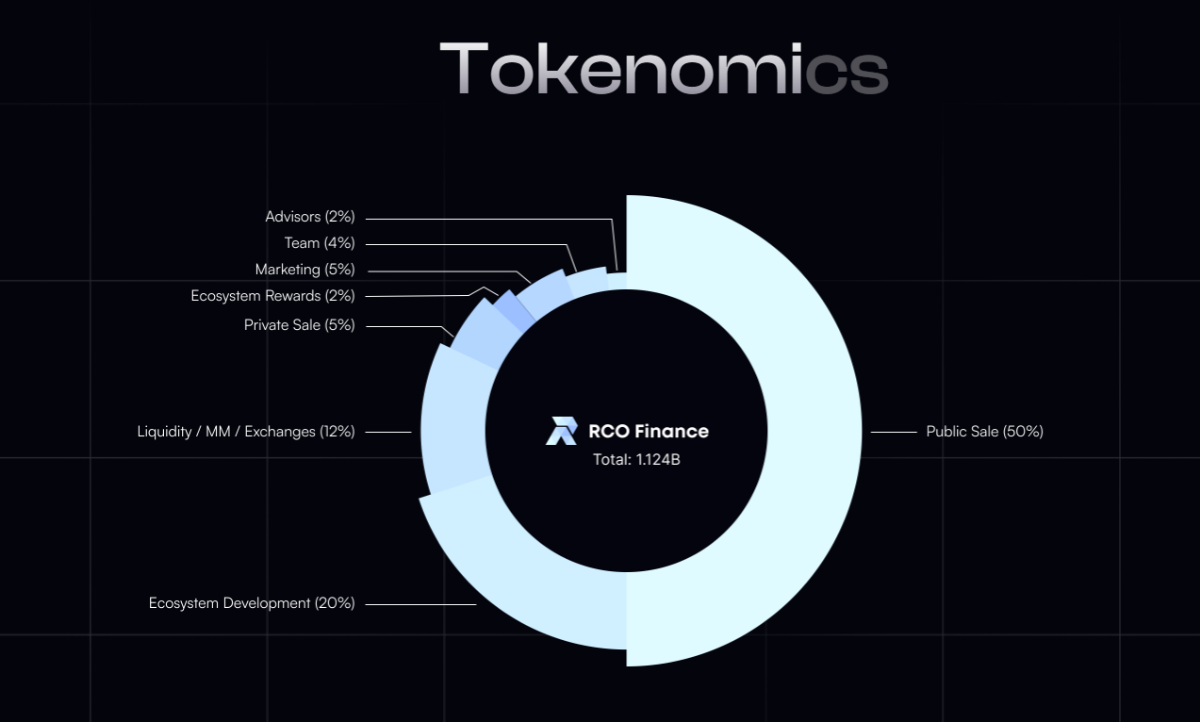

RCO Finance’s native token RCOF has a total supply of 1.124 billion tokens. The tokens are distributed across various allocations. According to the tokenomics, half of the supply (50%) is reserved for the public sale, while smaller portions are set aside for the team (4%), advisors (2%), marketing (5%), liquidity and market making (2%), and ecosystem development (20%).

RCO Finance tokenomics. Source: RCO Finance

RCO Finance also applies a 1% tax on buy transactions and a 4% tax on sales, generating revenue for the ecosystem. In return, the platform promises up to 30% of daily revenue shared with stakers, divided evenly between token rewards and a buyback-and-burn mechanism to make the token deflationary.

According to their whitepaper, the tokens are locked for three years, with a gradual release schedule to prevent immediate sell-offs.

From a design standpoint, these tokenomics appear to be well-balanced and strategic. The large public sale allocation promotes decentralization, and long lock-up periods for the team and advisors can reassure investors.

However, we found inconsistencies with this information. The audit by SolidProof states that the contract owner has the power to set buy/sell fees up to 25%, exclude addresses, and toggle tax collection. This means that, even if the tokenomics look fair on paper, the team likely holds significant control behind the scenes, which can create many opportunities for manipulation.

Analysis:

The tokenomics superficially look decent: large public allocations, locking for the team, and burn mechanisms. But the marketing hype, combined with reports of presale issues, raises concerns. So, tokenomics checkboxes are ticked, but the actual implementation might allow for disastrous loopholes.

What Is RCOF’s Real-World Utility?

One of the things that stands out most about RCOF is the utility they promise. They promise AI-powered robo advisors, copy trading, access to 120,000 assets across 12,500 classes, a DeFi debit card, etc. If even a tiny fraction of this works as advertised, the platform could be compelling.

RCO Finance’s proposed utility. Source: RCO Finance

Still, we found a few things you need to know about:

- The vast majority of features are still in the future/roadmap phase. The features like the AI robo advisor and the debit card are not fully deployed yet.

- The token is not yet listed on major exchanges, which means that liquidity and trading are yet to be tested. It was listed on BitMart in October 2025, but it doesn’t have strong liquidity at this point.

- The zero gas / Hyperliquid integration claim is bold but lacks third-party verification.

Analysis: At this point, RCO Finance’s utility is more promise than reality. This doesn’t prove that the project is a scam, though. Many projects are built gradually. Still, you should treat their roadmap as highly speculative until the milestones are publicly delivered.

Audits from Reputable Security Companies: Yes or No?

Security audits from reputable, independent auditors are important for any crypto project. RCOF has undergone at least one audit by SolidProof, which is a known blockchain auditor. However, while having an audit is good, the reports raise cautionary signs. SolidProof’s audit states that they audited only one token contract and did not audit all associated contracts. They also flagged the issue with the owner being able to set the team wallet address arbitrarily. This could potentially be used for “honeypot” type exploits.

Analysis: The fact that someone audited the contract is positive because it means it passed many basic checks. But not all parts of the project were audited, and some potentially problematic privileges are reported to remain in the hands of the owner.

Fairness and Transparency of the Presale

The presale raised over $36 million before it ended. According to their website, they listed the token on the BitMart exchange since the presale ended, which is the next stage for new projects.

RCO Finance’s homepage. Source: RCO Finance

RCOF is currently listed on BitMart, allowing users to trade the token against USDT.

Still, users have claimed they never got their tokens even though the presale ended. Domain analysis tools like ScamAdviser now rate the project’s website as low trust, with hidden WHOIS and negative reviews flagged.

Analysis:

All of this suggests that, while the presale is presented as open and fair, it might favor the insiders who control those keys. The absence of liquidity on exchanges, coupled with complaints about undistributed tokens and low domain-trust scores, points to a lack of transparency behind the scenes.

About RCOF: Analyzing the Project

RCO Finance, often shortened to RCOF, presents itself as a next-generation decentralized trading and investment platform designed to merge traditional finance with decentralized finance through artificial intelligence.

According to the official materials on their website and whitepaper, the project plans to remove intermediaries like banks and brokers by using AI-powered automation to handle portfolio management and trading.

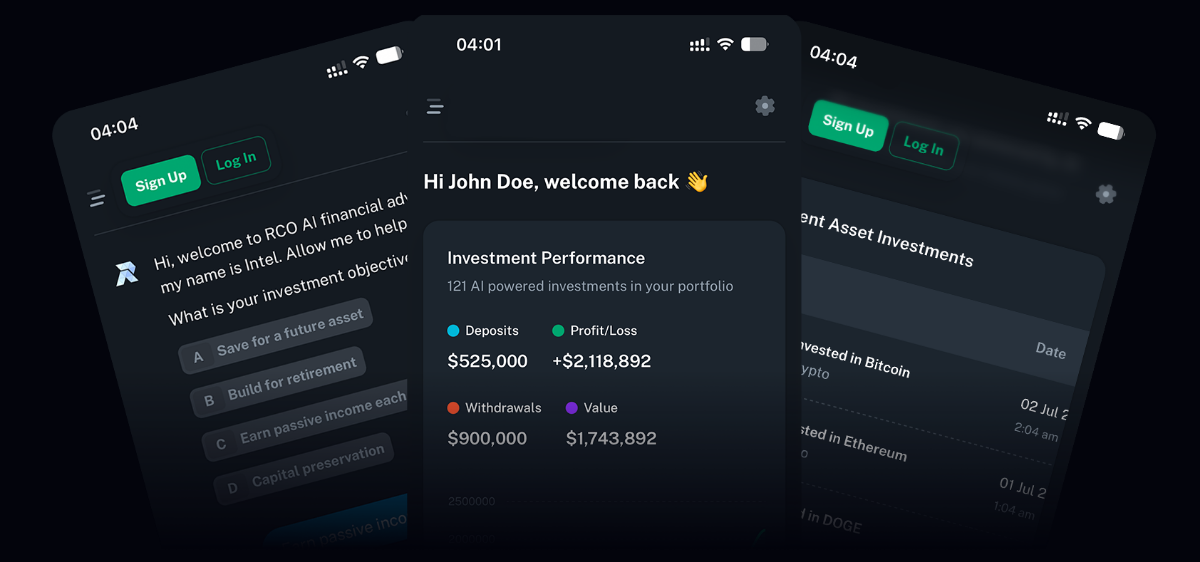

RCO Finance’s claimed AI utility. Source: RCO Finance

The company promotes its ecosystem as an all-in-one platform where users can trade, invest, and access tokenized real-world assets like ETFs, options, and commodities, without a middleman.

One of the project’s main selling points is its AI-driven robo-advisor, which is said to analyze real-time market conditions and automatically execute trades for maximum efficiency.

RCOF’s Roadmap

According to the project’s roadmap, four phases go over a 12-month target period from presale launch:

- Phase I (Ignition): Whitepaper and website launch, platform setup, smart contract audit, and security check.

- Phase II (Creation): Community building, presale starts, platform launch, presale scaling.

- Phase III (Launchpad): Presale closure, beta testing, listing on major aggregators, increased marketing, ecosystem development, and token launch on a DEX.

- Phase IV (Ultimate): Launch DeFi card, listing on centralized exchanges, expand liquidity pools, further audits, and launch lending protocols.

On paper, this roadmap covers the key elements we’d expect in a crypto project: audit, token listings, product rollout, and more. The project is still in its early stages, but since the listing phase is a bit vague, the roadmap is more of a marketing pitch and less of a guarantee.

Marketing Strategies Used

Looking at how RCO Finance has marketed itself so far, several patterns appear. Some are standard, but others are slightly concerning. The project has put a strong emphasis on early-investor rewards like multiple rounds of presale with layered bonuses, claims of 300%+ returns, and large “raise numbers”. This is common for new projects and is aimed at building FOMO.

To catch people’s attention, they have used big claims and promises like “Access to 120,000 assets” and “zero gas trading infrastructure”. Many of these promises will be extraordinarily difficult to implement, especially if it wants to operate in regulated regions like the United States or Europe.

Additionally, they have utilized logos such as Bitmart in their marketing banners, indicating upcoming listings. They’ve also mentioned top-tier security and audits to build trust.

Such marketing hype is very common in crypto. However, projects that rely heavily on hype rather than verifiable achievements often carry greater risk. Many analysts have flagged RCO Finance specifically for this reliance on hype. The large promise of returns and big numbers is classic promo style. If the execution doesn’t prove out, investors will get burned.

Legality and Presale Compliance

Regulatory compliance is one of the most critical and most difficult areas to examine in the crypto world. Regardless of how tasty the promise looks, if a project lacks regulatory clarity or doesn’t have a fair presale structure, the risk is much higher.

RCO Finance says it will operate under the EU regulatory framework (Markets in Crypto-Assets or MiCA) when applicable. The presale claims show open participation and describe the burn mechanics and vesting. Still, we are yet to see how real this is, since audit reviews highlight some contract risks (honeypot vulnerability and owner having fee control).

How to Buy RCOF

According to the official website and the presale documentation, RCO Finance tokens (RCOF) were initially available through the presale, which has now closed.

In late October, RCOF was listed on BitMart, a relatively large centralized exchange, though trading volume has been quite low for a token with so much presale momentum. The token is tradable on the decentralized exchange Uniswap, though the platform flags the token as a potential honeypot scam.

If you want to buy RCOF on BitMart, follow the steps below:

- Create and verify an account on BitMart. Complete any required KYC verification.

- Go to Assets -> deposit in your BitMart account. Deposit any currency supported for trading pairs with RCOF.

- Go to the spot market and search for RCOF/USDT

- Place a buy order. Enter the amount of RCOF you wish to buy and confirm the purchase.

Comparing RCOF to Other Presale Projects

To really judge whether RCOF is credible or just another scam or overhyped presale, it also helps to compare it to other presales that make similar promises. Let’s take a look at some famous presales on the market right now.

Bitcoin Hyper

Bitcoin Hyper is one of the top trending crypto presales on the market right now. It is positioning itself as a Layer 2 solution for Bitcoin, using the Solana Virtual Machine to bring smart contracts and high throughput to the BTC ecosystem. Basically, it promises to mix Bitcoin’s security with modern DeFi functionality.

Bitcoin Hyper presale homepage. Source: Bitcoin Hyper

So far, Bitcoin Hyper has pulled in tens of millions in its presale, which is still ongoing. Its pricing is staged, with early stages being cheaper and the price increasing as more tokens sell.

Compared to RCOF, Bitcoin Hyper gives the impression of a better-organized, more technically grounded project. RCOF markets itself around buzzwords like “multi-asset access”, while Bitcoin Hyper’s vision stays focused on improving an existing ecosystem.

Hyper also has visible progress: verifiable fundraising numbers, quite a lot of media coverage, and a highly engaged community. By contrast, RCOF has hidden WHOIS data and many user complaints, which create uncertainty about the project.

PEPENODE

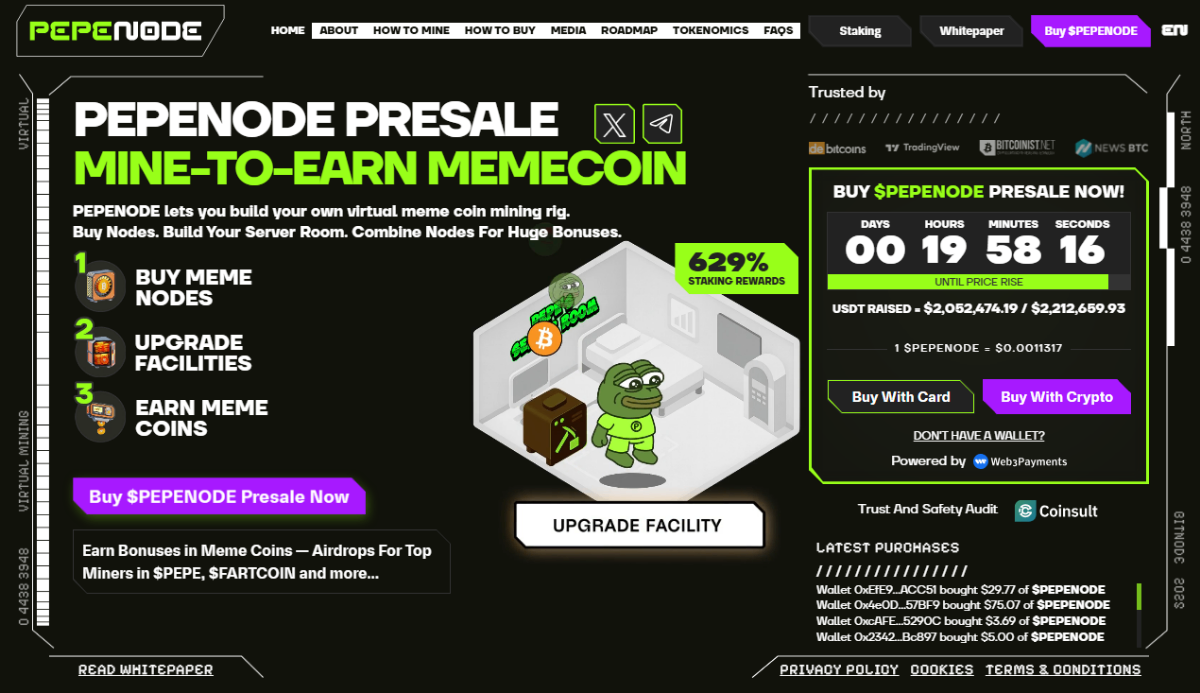

PEPENODE takes a different approach. This is a GameFi and meme-powered ecosystem where users can “mine-to-earn” tokens through a gamified platform. It combines entertainment with blockchain mechanics and rewards participants through staking, mining simulations, and leaderboards.

PEPENODE presale homepage. Source: PEPENODE

In its presale, the project has raised around $2 million so far, offering transparent updates on how each phase is progressing. Despite it being a meme-themed token, it has real community engagement, as well as detailed tokenomics. Their tokenomics show allocations between presale, liquidity, and rewards pools, something RCOF never fully disclosed.

Even though PEPENODE is a smaller project, it comes across as more open and community-driven.

Verdict: Is RCOF a Scam or Legit?

After we took a peek at RCO Finance’s whitepaper, its presale details, and went through a lot of available public information, we find it hard to call the project fully legitimate at this stage. RCOF promotes itself as a cutting-edge AI trading and DeFi ecosystem, but the lack of transparency and delivery after the $36 million presale raises serious concerns.

The project’s official roadmap has seen delays in some areas. RCOF is now listed on BitMart, which allows users to trade the token. Still, prospective investors should always check liquidity and trading conditions. There are many reports from investors claiming they never received their tokens after contributing to the presale and Uniswap flags the token as a potential honeypot scam. These are all major red flags for crypto projects.

When compared to other active presales like Bitcoin Hyper and PEPENODE, RCOF looks much weaker. Those projects, while still speculative, have clear communication with investors, active communities, and transparent token sale progress.

At this point, RCOF appears to have more signs of a potential scam than a legitimate crypto project. Until the team proves its credibility and gains liquidity on exchanges, you should treat it with extreme caution and strongly consider staying away from it entirely.

FAQ

What is RCOF?

Is RCOF a legitimate project?

Has RCOF been audited?

Can I buy RCOF now?

References

- Tokenomics 101: What Is Tokenomics in Crypto – Coinbase

- RCO Finance Review – AI Crypto Goldmine or Just Another Scam – Jessesingh

- Reddit Conversation about RCO Finance – Reddit

- Trustpilot Comments on RCOF – Trustpilot

- Token Allocation of RCO Finance – RCO Finance Whitepaper

- Buyback and Burn: What Is It – Tokenomics Learning

- RCO Finance Info – SolidProof Audit

- What Are Honeypot Scams in Crypto – Crypto.com

- Is RCOF Finance a Scam – Scamadviser

- RCOF Roadmap Explained – RCOF Whitepaper

- Markets in Crypto-Assets Regulation (MiCA) – ESMA

- BitMart Will List RCO Finance – BitMart.Zendesk

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

15 mins

15 mins

Nadica Metuleva

, 47 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.