Identifying the best crypto to mine in 2026 depends on your hardware, electricity costs, and risk tolerance.

This guide will provide you with information about our Merlin Chain (MERL) price predictions through 2030, analyze its growth potential, and outline the risks associated with investing in the token.

Only a handful of new crypto projects seem to actually want to make radical changes to the basic tenets of blockchain tech. Merlin Chain is one of those standout projects, aiming to remake Bitcoin with lessons we have learned over the past decade. Launched in 2024, this native-Bitcoin Layer 2 was built to stretch Bitcoin beyond its original boundaries. It does so by supporting protocols such as BRC-20, BRC-420, Bitmap, and others, all while leveraging zero-knowledge rollups to boost scalability.

So, when you have such an ambitious ecosystem, what happens to its native token, MERL? In this article, we will detail our full Merlin Chain (MERL) price prediction to hopefully help you make the best educated decisions for yourself.

Merlin Chain (MERL) Price Estimation: Key Takeaways

- Token launch and supply: MERL has a total supply of 2.1 billion, with staged unlocks across ecosystem participants, private investors, advisors, team members, and public sale. The initial trading began after the Layer 2 fair launch.

- Current price and market activity: MERL is actively traded on major exchanges, including OKX, Kraken, and Bitvavo. The daily trading volumes have consistently exceeded millions of dollars, reflecting strong market interest.

- Technology and ecosystem: Merlin Chain is a native Bitcoin Layer 2 solution with zkEVM, ZK-Rollups, decentralized oracle networks, and fraud-proof modules.

- Adoption drivers: Integration with BTC wallets through Particle Network, developer tools, and upcoming Layer 3 applications boosts user accessibility.

- Cautions and risks: The price’s performance will depend heavily on broader market conditions, adoption rate, and execution of the expansion plans for the ecosystem.

| Year | Bullish Estimate | Moderate Estimate | Bearish Estimate |

| 2026 | $0.50 | $0.35 | $0.25 |

| 2027 | $0.75 | $0.50 | $0.30 |

| 2030 | $1.00 | $0.70 | $0.40 |

Featured Alternative – Editor’s Choice

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

Merlin Chain (MERL) Detailed Price Prediction 2026-2030

Merlin Chain (MERL) has shown a lot of resilience in the crypto market. It has maintained a position among the top 150 cryptocurrencies by market capitalization with a market capitalization of over $340 million.

The project has a very innovative approach, combining Bitcoin’s security with Ethereum’s smart contract capabilities, which places it in a unique spot in the blockchain ecosystem. However, like all cryptocurrencies, its future prices are subject to many factors, which we will discuss below.

2026: Stabilization and Strategic Developments

By 2026, Merlin Chain is expected to focus on consolidating its early growth. Following the mainnet launch and the “Merlin’s Seal” staking events, as well as the release of tools like Merlin Phantom, a new BTC asset exchange protocol, the project will likely try to stabilize its ecosystem.

- Bullish scenario ($0.50): If Merlin Chain successfully expands its ecosystem through strategic partnerships and an increased adoption of its zkEVM technology, as well as improved developer tools, the price could see a modest increase.

- Moderate scenario ($0.35): In the absence of some major market catalysts, the price will likely stabilize around $0.35-$0.40, reflecting the token’s steady adoption and usage.

- Bearish scenario ($0.25): If the project faces some challenges like a delayed development or reduced market interest, the price might decline to $0.30 or lower.

2027: Growth and Market Integration

By 2027, Merlin Chain could move into a growth phase. If cross-chain operability improves and the platform gets more integrated into dApps, its adoption can grow.

- Bullish scenario ($0.75): If Merlin Chain’s technology integrates broadly into decentralized applications, and if we witness increased cross-chain operability, the price could rise more than expected, driven by higher demand and usage.

- Moderate scenario ($0.50): A more realistic scenario is this one, which would depend on continued, but gradual adoption.

- Bearish scenario ($0.30): If adoption rates plateau or the project struggles to differentiate itself from the competition, the price might hover around $0.30-$0.40.

2030: Maturity and Ecosystem Expansion

By 2030, Merlin Chain could reach maturity as a blockchain infrastructure platform. If development, adoption, and partnerships continue to progress, the token could benefit a lot.

- Bullish scenario ($1.00): Assuming Merlin Chain becomes a major name in blockchain infrastructure, with widespread use in decentralized finance (DeFi), non-fungible tokens (NFTs), and enterprise applications, the price could reach $1 or even more.

- Moderate scenario ($0.70): A continued, but measured adoption could see the price stabilize between $0.60 and $0.80, indicating a strong presence in the market.

- Bearish scenario ($0.40): In the event of technological problems or failure to capture significant market share due to competition, the price might even decline at this point.

What Is Merlin Chain?

Merlin Chain (MERL) is a project designed to expand the capabilities of Bitcoin by layering advanced blockchain technologies on top of it. Rather than trying to replace Bitcoin, Merlin aims to boost its native assets, protocols, and basically the user potential via a Layer 2 network.

The core of the project is a Bitcoin-centric L2 that supports smart contracts, tokens, cross-chain assets, and much more. It does all this while leveraging Bitcoin’s security as the settlement layer.

Merlin Chain was launched in January 2024, backed by Bitmap Technology, a company known for developing BRC-420, Bitmap.Game, and other Bitcoin-native protocols. In early 2024, Merlin launched the “Merlin’s Seal” staking event to boost user participation, as well as liquidity.

Architecture of Merlin Chain

| Module | Purpose and Functionality | Notes |

| ZK-Rollup Network | Bundles many transactions off-chain, then publishes proofs to Bitcoin | Uses zero-knowledge proofs to compress transactions and maintain integrity |

| Decentralized Oracle Network (DON) | Acts as the bridge to the Bitcoin base layer, handling proof submission and data validation | Sequencer/oracle nodes collate compressed data and proofs, then submit or publish them to Bitcoin |

| Fraud Proofs Based on Bitcoin | Allows challenge-response verification of state/transactions | In case of suspected incorrect submissions, the verifiers request leaf scripts or proofs from provers to test correctness |

| Data Availability | Ensures that the compressed/rolled-up transaction data and proofs are published and accessible | Merlin is working with projects like Celestia and Nubit to make DA verifiable and public |

| Two-Step ZKP Submission Mechanism | Splits proof publishing into stages to optimize security and reduce attack vectors | This mechanism requires provers to submit hashes first, full ZK proofs after, all with timing constraints to avoid manipulation |

Merlin Chain is built from multiple components that interact with each other, each of which is important for its operation. Let’s take a look at the key modules. Since Merlin is built using the Polygon CDK (Chain Development Kit), it also supports many EVM-style features like smart contracts, opcodes, and precompiles, making it easier for Ethereum developers to transition.

Features of Merlin Chain

Let’s take a quick look at the key features of the project.

Support for Bitcoin Protocols and EVM Compatibility

One of Merlin’s most distinct traits is its support for different Bitcoin-native protocols and standards, including:

- BRC-20 (token standard)

- BRC-420

- Bitmap

- Atomicals

- Pipe, Stamp

These allow existing Bitcoin-based assets and systems to bridge into the Merlin Chain and be used in smart contracts and DeFi.

On top of that, Merlin supports most Ethereum Improvement Proposals (EIPs), opcodes, and precompiles, which gives developers a familiar environment for deploying smart contracts.

PoS and Staking

Merlin is upgrading to a Proof-of-Stake (PoS) model to expand decentralization. Once active:

- MERL token holders can stake to participate in network security

- The system aims for a 7-day withdrawal period for staked funds

- Validator nodes will be more accessible

MERL staking page. Source: MerlinChain

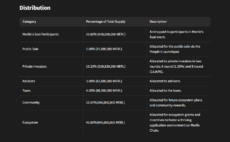

The Token (MERL) Use Cases and Tokenomics

MERL is a native token in the Merlin ecosystem. The total supply of MERL is 2.1 billion tokens. The funding and the token distribution have been public, including allocations to the ecosystem, community, team, and more.

MERL has multiple roles in Merlin’s ecosystem:

- Governance: Holders of MERL can vote on major protocol proposals, upgrades, and decisions that shape the ecosystem.

- Staking: MERL can be staked to help secure the network (e.g., via collator roles or validator nodes). Stakers earn rewards and support decentralization.

- Transaction fees: MERL is usable to pay fees. Though the native gas token on the L2 is “Merlin_BTC” (a BTC-like representation), MERL also has a role in gas payments in certain wallet contexts.

- Collateral and liquidity: MERL can be used as native liquidity in the ecosystem, as collateral for lending, and as part of DeFi protocols within Merlin.

- Delegation/collator participation: Token holders can delegate their MERL to collators (network nodes) or run collators themselves, depending on permission, therefore helping with network operations.

To better understand the pressure on price and token dynamics, we need to understand how MERL is distributed and released over time. Here is the distribution plan for the token based on the project’s official whitepaper:

MERL tokenomics table. Source: MerlinChain Docs

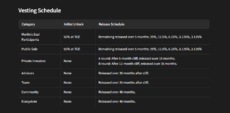

The tokenomics page in the whitepaper also lists the vesting schedule for the token:

MERL vesting schedule table. Source: MerlinChain Docs

Why Investors Are Looking at Merlin Chain

Merlin Chain has quickly drawn the attention of retail and institutional investors, and there are several good reasons why this is happening.

A True Bitcoin Layer 2 with zkEVM Compatibility

Merlin chain bridges Bitcoin’s security and liquidity with the flexibility of Ethereum’s ecosystem. It uses zero-knowledge proofs (zkEVM) to make Bitcoin programmable. This makes it one of the first projects to expand Bitcoin’s functionality beyond payments, introducing DeFi, NFTs, and smart contracts without the need to leave the network’s base layer.

Strong Ecosystem Growth

Since the project launched in 2024, it has gained fast adoption. Its total value locked (TVL) surpassed $3 billion in just weeks after launch. Multiple projects, such as MerlinSwap, UniCross Rune Bridge, and the Merlin AA wallet, are already live or in active development.

Multi-Utility Token with Real Use Cases

MERL is more than a governance token. It is used for staking and delegation to collators. It can pay gas fees (especially within the AA wallet framework). It supports governance voting for ecosystem decisions, and fuels DeFi activity, serving as collateral and liquidity across dApps. This abundance of utility within the Merlin ecosystem could help boost the token’s value over time.

Audited and Transparent Project

Merlin Chain’s infrastructure has been audited by ScaleBit and the team released its findings publicly, which not all Layer 2 projects do. Combine this with clear tokenomics and a well-defined vesting schedule, and the project has a much more transparent profile than many, if not most, early-stage projects.

Risks of Investing in Merlin Chain

No token, especially one in the Layer 2 sector, is without risks. Investors should be aware of the challenges that come with investing in this project, too.

High Token Inflation from Unlocks

MERL’s 48-month vesting schedule for ecosystem and community tokens means a continuous supply release through 2028. This could support long-term development, but it also introduces a risk of sell pressure if market demand doesn’t scale at the same pace.

Execution and Adoption Risk

Merlin will need to justify its high valuation. To do so, its zkEVM likely must attract significant dApp usage and an abundance of developers porting their apps to the network. If the chain doesn’t secure enough adoption, its utility-driven demand (staking, gas, governance) could stagnate. This could potentially keep the prices in the moderate or even the bearish zones.

Strong Competition

Merlin Chain operates in a crowded market of L2 and modular blockchain solutions. Ethereum L2s like Arbitrum, Optimism, and zkSync, as well as Bitcoin L2s like Stacks and BEVM, are all targeting similar goals. They are all aiming for faster, cheaper, and more scalable transactions tied to major networks and only a handful will likely be able to claim enough market share to thrive.

Technical Complexity and Security Risks

zkEVM-based systems and Bitcoin bridges add complexity. Any vulnerabilities in zero-knowledge proof generation or cross-chain bridges here could lead to major exploits or loss of funds.

How Merlin Chain Stands Out among Trending Presales

The crypto market is constantly changing. Every few weeks, new presale tokens promise to be the next big thing. While presales like Bitcoin Hyper and others attract attention for their innovation and hype-driven marketing, it is important to compare them to projects that have already proven their scalability and utility.

Merlin Chain is now past the presale stage. As such, it offers a clearer picture of what real adoption and infrastructure progress looks like.

Bitcoin Hyper

Bitcoin Hyper is a presale project aiming to become a Layer 2 for Bitcoin, built using the Solana Virtual Machine (SVM) to offer high throughput and scalability combined with Bitcoin’s security. Its presale has raised over $24 million to date, attracting significant investor interest.

This project is similar to Merlin in that both are Bitcoin-focused L2 ambitions to enable smart contracts, bridge assets, and extend Bitcoin’s utility beyond “store of value”.

But the differences are very notable. Bitcoin Hyper is building on SVM rather than a native zkEVM model, and it is still in presale. Merlin is already an active ecosystem that handles and bridges real assets. This likely means that Bitcoin Hyper has more growth potential, but it also introduces significantly greater risks.

Conclusion: Who Should Consider Investing in Merlin Chain?

Merlin Chain is likely best suited for investors who believe in the future of Layer 2 scaling solutions and want exposure to projects that drive real utility in blockchain. Its focus on zkEVM technology, Bitcoin Layer 2 integration, and developer-friendly infrastructure makes it appealing to long-term holders who prioritize fundamentals over hype.

That said, like any other crypto asset, MERL carries its share of risks, like market volatility and evolving competition in the Layer 2 space. Short-term traders may not find it less suitable, as its price growth is expected to track adoption and network progress. Unlike many other coins, the predictions are not based on pure speculation alone. However, it’s vital to do your own research and never invest more than you can lose.

FAQ

Is Merlin Chain still in presale?

What is the current price of the MERL token?

What factors could influence Merlin Chain’s price in the future?

Is Merlin Chain a good investment?

Where can I buy MERL tokens?

References

- Merlin Chain (MERL) Price, Chart, Market Cap, and Info – CoinMarketCap

- Merlin Airdrop Tutorial: Teach You Step by Step How to Play Merlin Chain – BinanceSquare

- Understanding Merlin Chain: A Comprehensive Overview – Messari

- What Is the Polygon CDK? The 5-Minute Explainer – ThirdWeb

- What Is an Ethereum Improvement Proposal (EIP) – Coinbase

- What Is a Validator Node and How to Run It – Cherryservers

- Tokenomics Allocation and Vesting – Merlin Chain Official Whitepaper

- Understanding Total Value Locked (TVL) in Cryptocurrency and DeFi – Investopedia

- Merlin Chain Audit Report – ScaleBit

- What Is the Solana Virtual Machine (SVM) – CoinGecko

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

Fact-Checked by:

Fact-Checked by:

14 mins

14 mins

Nadica Metuleva

, 43 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.