Tron (TRX) price forecast for 2025–2030 with insights on token utility, growth drivers, market trends, and long-term investment ou...

Personal Finance: Complete Guide for Managing Your Money

Last Updatedby José Oramas · 11 mins read

If you want to learn more about personal finance, take a look at this guide that we’ve prepared for you.

Knowing how to administrate and manage your money wisely is always a good idea. From the smallest area to the largest, well-managed resources are essential aspects of your life. The more information you have about personal finance, the better prepared you are for different situations.

What Is Personal Finance?

The behavior of money is an essential aspect of the economy, relevant to the management of resources. Finance is a branch of economics responsible for studying money management. Understanding this matter will help you to make intelligent decisions regarding financial resources.

Through time, this area of the economy developed resources and tools to address monetary decisions to bring benefits – both in individual matters such as what goods to buy – to even state affairs, like project financing.

Among the aspects that finance takes into account, the following stand out:

- Investment profitability

- Debt management

- Control of loss of money due to inflation,

- Assessing the risks of tangible and intangible assets.

In this sense, personal finance is the use of those principles to manage your resources.

Personal finance deals with how individuals or families manage their resources throughout their lives. Besides income and expenses, it includes the financial tools you dispose of to optimize your money management.

Types of Personal Finance

What are the types of personal finances? The main objective of personal finance is to help individuals make informed decisions and optimize resource management contemplates being able to achieve a series of sub-objectives, among which are:

- Income

- Control of expenses

- Investments

- Savings

These elements correspond to how we relate to our environment through money – with the management and administration of incomes, expenses, planning, savings, and investing over time – considering financial risks and future events in your life.

Income

You can understand income as all the profits added to your budget. Thus, income is both monetary and non-monetary elements that accumulate and consequently generate a consumption-profit circle. Generally, it appears in gross figures – without deductions – and become net when you pay your taxes.

Control of Expenses

Financial expenses are all those that derive from obtaining financing or ownership of any financial liability. They affect both companies and individuals.

One of the most common financial expenses is the interest rate paid on debts – which allows the lender to make a profit, expressed as a percentage, based on the current amount the lender gave to the borrower. Interest rates can vary depending on the type of financing chosen and the creditworthiness of the borrower.

Investments

Investing is a challenging part of personal finance. Investments are risky, so before we start, never stake capital you can’t afford to lose.

Investments consist of staking part of your capital in stocks, commodities, or similar, to profit in the long run. In economics, we identify resources as associated costs. The primary resources are land, time, labor, and capital. Everything that needs the use of any of these four resources to obtain a profit is an investment.

When you invest, you assume an opportunity cost by renouncing those resources in the present to achieve future benefits. But these benefits are uncertain, meaning there is a risk. It is necessary to have had an income previously saved part of this income to invest in.

You can make different types of investments. There is no single classification that is better than another – there are several, all valid and useful depending on your situation. The economic meaning of investment, whatever its type, is governed by four fundamental factors: performance, risk, liquidity, and term.

- Performance (Return): The return is what we get in exchange for investing. It is usually measured in terms of profit or profitability, although it does not have to be that way.

- Risk: Refers to uncertainty. Nothing in economics is 100% certain. We must always work with assumable risk in case the investment turns the other way around.

- Liquidity: The ability to convert an investment into money with minimal losses.

- Time: this is the third fundamental variable. We can expect a return but depending on the time it takes to obtain it, will it compensate for the investment?

Paying attention to these four factors, although it may seem obvious, is not so common. Many investors tend to focus only on the first factor – how much will I earn? You must pay close attention to the first two as well, especially risk.

Knowing if an investment is better than another is difficult. In essence, it will depend on the preferences of each investor. Some will consider that profitability of 50% is good while others will settle for 10%. Moreover, take into account your aversion to risk and your patience.

Savings

Saving is the portion of the income you don’t consume. You reserve that capital out of any risk to cover a future need or contingency. You can even leave it as an inheritance. In essence, saving is the percentage of income that the person does not spend or invest in.

In many cases, it is necessary to seek a financial advisor as saving is an essential element of a family, but it is only achievable through good planning.

But people tend to confuse saving and investing. We call savings the money that we keep to dispose of it in the future. We give up spending it in the present, putting it in a safe and risk-free place that generates interest. You save when you keep your money in cash, when you keep it in a bank account, or a deposit, for example.

On the other hand, we call investment the money you don’t spend, but you use it to bring you extra money in the future. We associate investing with the purchase of goods or financial assets, hoping to make a profit. This extra profit is associated with risking your money in exchange for compensation. You can invest your money in several things, from something immaterial, like education, to financial assets, like stocks, bonds, or mutual funds.

How to Set Short-Term and Long-Term Goals?

Planning personal finances and setting short and long-term goals requires an analysis process that has several stages:

- Evaluation: Know your current situation. What kind of income do you have? What is its level? What are your expectations for future changes?

- Set goals: Identify and prioritize short and long-term financial goals, such as monthly purchases, buying a house, saving for retirement, etc. For instance, if you’re planning to invest, keep in mind the timelines associated with them: short-term investments last less than a year – medium-term between 1 to 3 years, and long-term last more than three years.

- Planning: Define a strategy about how you can achieve your objectives and what are the appropriate financial instruments for it.

- Execution: Carry out the financial plan considering adjustments in case of sudden events.

- Monitoring and reassessment: Monitor compliance with the plan, verify if there are relevant changes in the initial conditions, and evaluate if an adjustment or change in the financial plan is necessary.

Another essential aspect is analyzing your financial tools. Individuals and families have a wide variety of financial instruments that help them to manage their resources, which are:

- Banking: Check your bank accounts, savings accounts, consumer loans, credit cards, debit cards, etc.

- Investment: Stocks, mutual funds, bonds, etc.

- Insurance: Life, accident, health insurance, savings insurance, etc.

The choice of each type of instrument depends on your situation and your preferences. To set short, medium, and long-term goals, it is essential to monitor financial obligations and allocate a percentage of resources to a savings fund.

Make Your Budget

Let’s face it, most people don’t plan their budgets. But to set short, medium, and long-term goals, you have to make one. There are digital tools you can use like apps, or an Excel document for your budget, which is the preferred tool for most people. No matter which option you choose, make sure it fits your lifestyle.

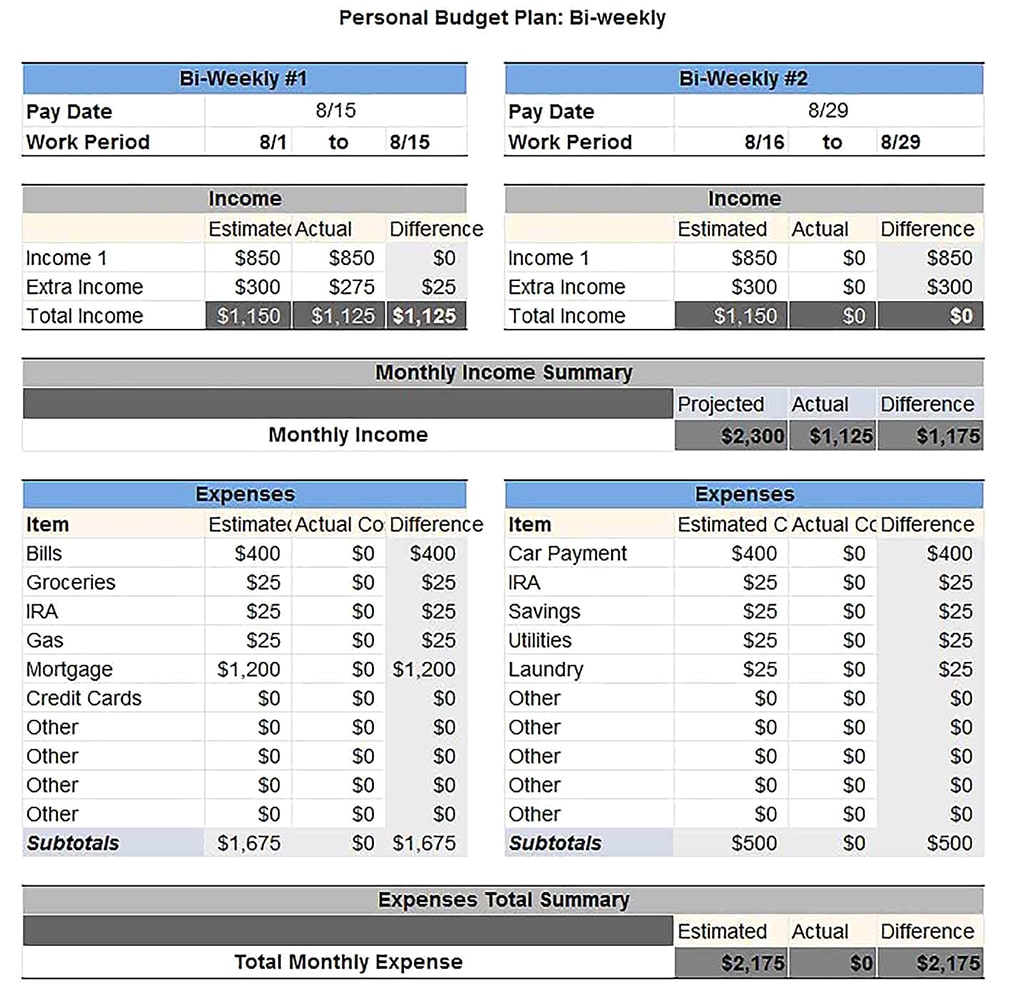

Here’s an example of a budget:

Photo: culturopedia

Likewise, you need to update your budget each week to ensure you’re not spending more than you earn and that you save for your financial goals.

Pay Down Your High-Interest Debt

If you have balances on multiple cards, be sure to always pay at least the minimum on each – then pay off the balance in full, one card at a time. You should focus first on high-rate debt if your high rates in your credit cars are overwhelming you.

Focus on paying one debt at a time and consider paying your credit card with the highest interest first. Review the interest rate section of your statements to see which credit card charges the highest interest rate, and focus on paying that debt first.

If you decide to consolidate, keep in mind that it is essential to control your expenses to avoid accumulating new debt. Consolidating your debt allows you to combine several high-interest balances into one with a lower rate, so you can pay off your debt faster without increasing the amounts of payments.

Here are two common ways to consolidate debt:

- Take advantage of a low-interest rate balance transfer to move your debt off high-interest rate cards. Keep in mind that balance transfer fees are often 3 to 5 percent, but the savings from a lower interest rate are often greater than the balance transfer fee. Always include that factor when considering this option.

- If you have equity in your home, you may be able to use it to pay off card debt. A home equity line of credit can offer you a lower interest rate than what your cards charge. Keep in mind that closing costs often apply, but an added benefit is that interest payments on home equity loans are tax-deductible.

Adjust your budget priorities and start by classifying your monthly expenses like food, transportation, housing, and entertainment. Your credit card statement can be a useful tool. Many card issuers separate them by category. Look for areas that you can narrow down – then take the available money you have and apply it to pay your debt.

Save for Retirement

Saving for your retirement is not complicated if you manage your finance correctly. Investments are essential at this point, and long term investments can give good saving funds for your retirement.

Start planning your retirement with your savings and investments. You can consider saving 20% of your monthly income for your retirement plan. Consider this: if you let the years go by, the more money you have to save for a better retirement. Someone in his 20s saves 10% of income, while a person who starts at 30 must save 20%.

Saving in a Roth IRA is a good option as well. The IRA – Individual Investment Arrangement – is a retirement account that allows you to choose where do you want your money invested. One key benefit of these accounts is they help you save money on taxes for your retirement. There’s a time difference for tax breaks between Roth and Traditional IRA accounts, but you can pick whichever you prefer.

Borrow Smart

The money involved and the ways to finance expenses can be overwhelming if you’re preparing for college. Even if you qualify for a scholarship with awarded money, you should evaluate your student loans to cover the gaps in costs.

Paying your student loan while you’re still in college can reduce the overall outstanding debt you will have after graduation. Any private or unsubsidized federal loan can raise interest while your child continues in college. So it can be beneficial to pay at least the interest while the loans are deferred so that they don’t add up to the full amount. Also, you need to understand all the terms of the loan – and pay particular attention to due dates, how payments are applied, and whether additional costs or fees are charged.

You must repay everything you borrow with interest, so borrow what you need. Your loans come with interest and fees, even if you don’t finish college or get a job afterward. Students need to have a debt cancellation plan before graduation. Credit history will have a positive impact on your credit score if you make payments on due time.

Conclusion

Managing money is not a difficult task. However, some people have difficulties optimizing their resources according to the different obligations and responsibilities they have at home, like basic needs, payment of services, income, and other expenses.

You must learn to manage your personal finance responsibly, making way for independence and using your decision-making capacity correctly.

This guide explains how to buy TOKEN6900, a new meme coin project with an attractive market capitalization. Learn how to join the ...

Pepe Coin surged in popularity after its 2023 launch. This article covers market trends, price forecasts, technical signals, and h...