This guide explores the best cheap stocks to invest in, according to analysts. We reveal undervalued equities that could outperfor...

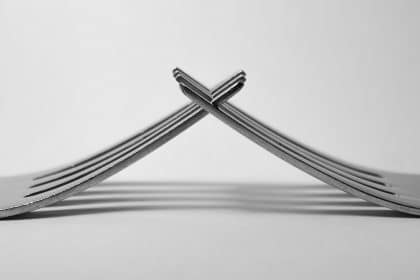

Soft Fork vs Hard Fork: Detailed Guide

Last Updatedby Ibukun Ogundare · 6 mins read

Forks have become a powerful tool used in blockchain development. They help in solving various issues suggested by blockchain users. The guide below describes two types of forks: soft and hard forks.

Every system requires an upgrade or change at a particular point. There is a frequent need to introduce an additional feature or correct a minor defect in the setup. Several computer software developers fix bugs and frequently roll out updated versions of their wares. Blockchain users can also propose to effect some changes to a blockchain even though the blockchain system is an immutable digital ledger technology (DLT). A fork is a set of actions needed to change a blockchain. There are two types of forks: the soft fork and the hard fork.

Forks as Evolution of Blockchain

Since 2008, the blockchain system has remained a permanent and immutable system. Users must adhere to the tenets of the blockchain, there was no room for complaints. Bug issues, unauthorized transactional activities, and security loops are unfixable on the system. Fortunately, a spectacular transformation occurred in 2016 when the founder of Ethereum (ETH), Vitalik Buterin, introduced the fork process. He implemented it to reverse the stolen fund of a project launched on Ethereum. After that, the fork became a powerful tool used in blockchain development. It helped solve various issues suggested by blockchain users.

Understanding Soft Forks

A soft fork is a backward-compatible method of adding a new set of rules to a blockchain network without forcing the nodes and miners to upgrade to the current blockchain version. However, the blockchain requires many nodes and miners to switch to the upgraded version. This type of fork allows for interaction between the old and new blockchains.

A perfect example of a soft fork is SegWit (Segregated Witness) of Bitcoin (BTC). The fork was activated in 2017 to fix transaction malleability and help Bitcoin scale. Participants on the Bitcoin blockchain agreed to resolve some trivial challenges of the chain. Some of these issues included insufficient block size and slow transactional speed of the chain. As a solution, they introduced the SegWit to free up space that could hold up more transactions on the chain. The new blockchain accepts several transactions within 1MB at a faster rate, speeding up the transaction verification process.

Understanding Hard Forks

Unlike soft forks, hard forks create a different blockchain pathway parallel to the original blockchain. Here, the upgrade requires all existing nodes and miners to join the new chain; this fork is backward-incompatible. The old and new chain function independently with no form of interaction between them. Blockchains can implement hard forks to patch up security flaws, add new trading features, change the entire version of the cryptocurrency or reverse transactions.

After the SegWit soft fork, some Bitcoin nodes complained about the inability of the network to accept larger transactions. These nodes and developers created a separate blockchain called Bitcoin Cash (BCH). They designed the Bitcoin Cash network to accept transactions of up to 32MB. Bitcoin Cash successfully sits at 30 in market cap rankings. The developers of Bitcoin Cash hope traders will abandon the Bitcoin blockchain because of its high transaction fees. Later, Bitcoin Cash split into two groups: Bitcoin Cash ABC and Bitcoin Cash SV. Each fraction of Bitcoin Cash had its different objectives. One part of the fraction wants to maintain the system, and the other plans to increase the block size from 32MB to 128MB. Other Bitcoin hard forks performed include Bitcoin Gold (BTG), Bitcoin Diamond (BTCD), Classic, Unlimited, and so on.

In 20I6, Decentralized Autonomous Organization (DAO) launched on the Ethereum network. The DAO raised over $150 million from its fundraising activity. After the launch of DAO, hackers stole over $60 million in Ethereum from investors. Ethereum created a new blockchain to help the original owners retrieve the funds from the hacker’s wallet address. Besides that, they performed a soft fork to prevent the hackers from transferring the funds from their wallets.

Soft Forks vs Hard Forks

A blockchain is at liberty to choose its preferred fork. Notably, a hard fork is incompatible with the previous blockchain version while a soft fork is compatible with the old version. Hard fork completely changes the blockchain protocol, requiring all nodes to upgrade to the new version. Meanwhile, a soft fork only requires an optional upgrade to the current version. Unfortunately, developers could easily manipulate miners to validate transactions against the regulations of the blockchain. A hard fork makes a blockchain vulnerable to fund-losing and double spending occurrences. There could be discord in a community if the hard fork is contentious. A well-planned hard fork can ensure general adoption. Most times, a blockchain community can perform soft forks with no social rift. However, many blockchain developers and nodes prefer the hard fork.

Benefits of Forks for Investors

There are several advantages of forks. It has provided a pathway to alter the blockchain, an immutable digital ledger technology. A fork allows for the progressive development of a blockchain. The fork also allows traders and investors to agitate for enhanced blockchain performance. It provides the avenue to increase its storage and speed capabilities. After a successful hard fork, investors will receive an equivalent amount of the original crypto in the new currency.

Unfortunately, the fork process is vulnerable to dump attacks from crypto whales and large investors. They can buy up large amounts of the native token before the fork and gain a larger amount after the fork. As expected, the fundamental impact increases the price of the parent crypto. These whales then sell off the pre-acquired tokens, plummeting the tokens’ price. It is an unjust way of benefiting from a fork. However, some blockchains can suspend trading activities before the fork begins.

Recently, Ethereum completed a shift from its proof-of-work mechanism (PoW) to proof-of-stake (PoS). In contrast to PoW, PoS provides a more secure, less energy-intensive, and improved platform for implementing new scaling solutions. Interestingly, traders can now trade at relatively low gas fees. Ethereum halted all trading activities a few hours before the merging occurred. Perhaps, Ethereum’s action was because of the flying speculations of a pump in the price after the process.

Conclusion

A good deal of software, games, and systems require timely upgrades to their mode of operation. This routine does not exempt the blockchain network. Forks allow the blockchain to implement suggested upgrades. Blockchain developers, miners, and nodes can improve the efficiency and productivity of the blockchain through a fork.

Hard forks and soft forks play essential roles in the maintenance and upgrade of a decentralized network. Forks also help to tighten the security of a blockchain.

FAQ

What is a fork?

A fork is an action carried out to cause a change on a blockchain. It generates two progressive blockchains. The interaction between the blockchains depends on the type of fork carried out. A fork can be hard or soft.

Who determines a fork formation?

The developers, miners, nodes, investors, and the general community determine the reason and the type of fork to be performed. A fork formation is a problem-solving activity that helps to fix security issues, add new features, and implement other noteworthy upgrades.

What is a soft fork?

A soft fork implements a new set of rules to the blockchain without altering the existing blockchain protocol. Some miners and nodes can choose not to upgrade their software to the current version of the blockchain. The new blockchain interacts with the previous chain.

What are the examples of soft forks?

Bitcoin’s segregated Witness (SegWit) is an example of a soft fork. A soft fork occurs when the block size of the chain is reduced from 1000Kb (1MB) to 800Kb. Participants who decline an upgrade to their software can see new transactions as valid.

What is a hard fork?

A hard fork is a permanent change in a blockchain’s protocol. The protocol functions independently. There is no form of interaction with the original blockchain. Every node and miner must upgrade their software to validate transactions on the new blockchain.

What are the examples of hard forks?

There are several examples of blockchain hard fork. The Bitcoin network has undergone several hard forks, of which Bitcoin Cash is the most popular. Fractional cryptocurrencies resulting from Bitcoin hard fork include Bitcoin Gold, Bitcoin Diamond, Bitcoin Classic, and Litecoin, among many others. Another example of a hard fork is the Ethereum hard fork. It helped the blockchain reverse DAO’s stolen funds.

What is the key difference between soft and hard forks?

While hard forks are incompatible with the original blockchain, soft forks are compatible with the original blockchain. Hard fork ensures all nodes and miners upgrade to the current version. It is optional for a node or miner to upgrade after a soft fork.

Which fork is more beneficial: soft fork or hard fork?

It is very controversial as many blockchain users and developers claim the soft fork and hard fork perform different functions. However, a well-planned hard fork has proved to be more beneficial; the new codes never clash with the existing regulations. A hard fork eliminates the uncertainty that comes with fragmentation. The success of a hard fork solely depends on the agreement of the blockchain community. Many miners often fail to upgrade their software after a soft fork. Sometimes, soft forks are manipulative.

Tron (TRX) price forecast for 2025–2030 with insights on token utility, growth drivers, market trends, and long-term investment ou...

This guide explains how to buy TOKEN6900, a new meme coin project with an attractive market capitalization. Learn how to join the ...