BMIC is a presale project focused on quantum-resistant wallet security, whose team claims to be building infrastructure that will ...

Want to trade Solana futures but need some expert-led guidance? Read our beginner’s guide on how to trade SOL futures safely in 2026.

Traders buy and sell futures to profit from the rising and falling prices of Solana. As a derivative instrument, futures contracts offer low upfront requirements, allowing exchange traders to gain exposure to SOL price movements with a small fraction of the position value.

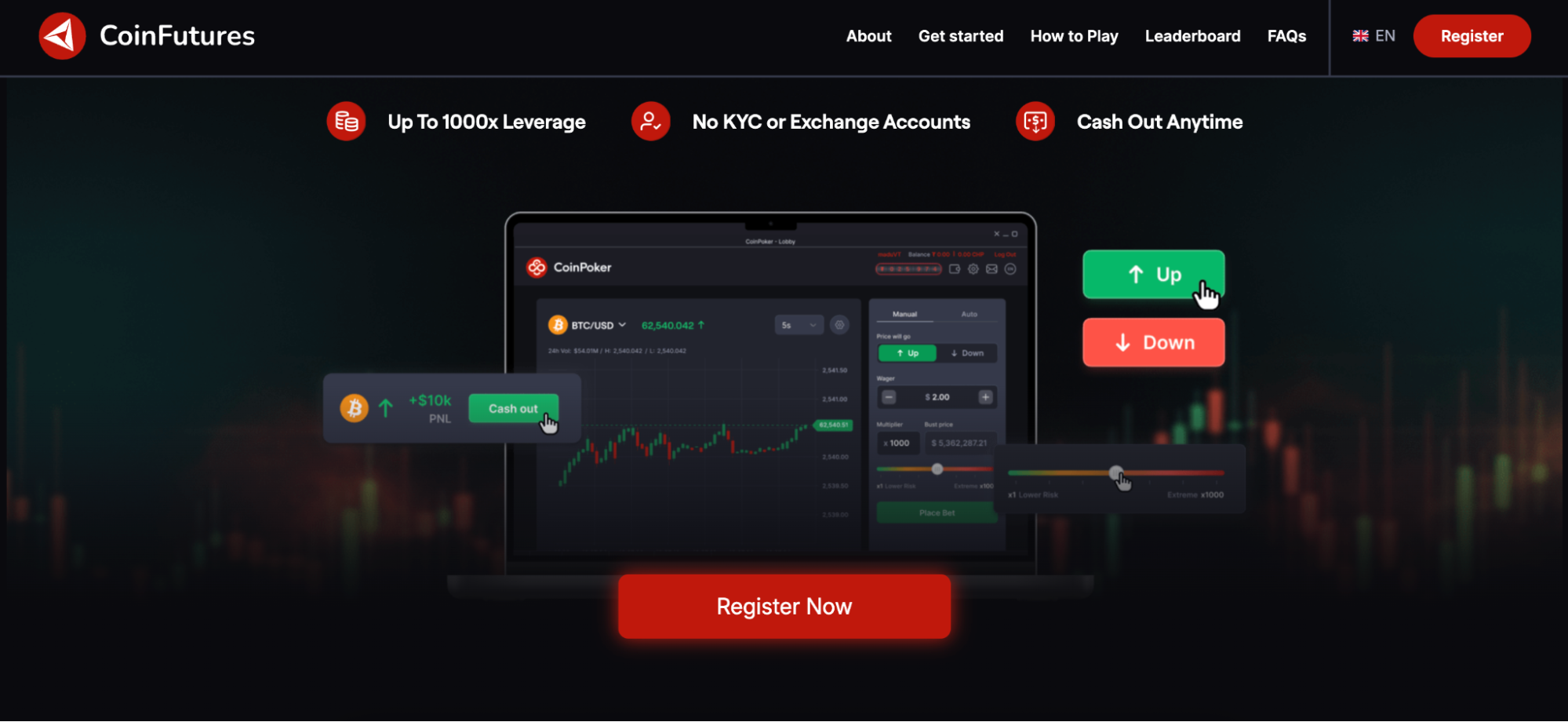

According to our platform research, we found that CoinFutures is the best place to trade Solana futures. Users trade simulated futures with a maximum leverage multiplier of 1,000x, and the no-KYC account setup eliminates cumbersome ID verification requirements.

Learn how to trade Solana futures in this extensive beginner’s guide. Discover safety best practices, including how to mitigate liquidation risk and select the right contract terms.

Key Takeaways

- Futures contracts offer exposure to Solana without requiring the purchase of actual SOL coins.

- Traders place buy and sell orders depending on whether they predict the SOL price to increase or decrease.

- As a major altcoin, the best Solana futures trading platforms offer leverage multipliers of up to 1,000x.

- Exchanges liquidate losing positions when they decline below the maintenance margin, making futures riskier than traditional spot trading.

- To choose a suitable platform, traders must consider licensing, user-friendliness, margin requirements, and settlement terms.

Top 6 Solana Futures Trading Platforms

To trade Solana futures in a safe environment, consider the following platforms:

- CoinFutures: Beginner-Friendly Futures Platform With SOL Leverage of up to 1,000x

- MEXC: Trade SOL Futures via USDT-M or Coin-M Perpetual Contracts

- KCEX: The Best Futures Provider for Low-to-Zero Trading Commissions

- Bybit: Popular Choice to Trade SOL Delivery Futures With Various Expirations

- CoinEx: Comprehensive Futures Ecosystem With User-Friendly Trading Tools

- Binance: World-Class Charting and Analysis Features With Deep Liquidity

Best Solana Futures Platforms Reviews

The top Solana futures platforms suit various trading profiles. Some stand out for their low commissions and margin requirements, while others offer advanced charting tools with ultra-fast execution speeds.

Read the following platform reviews to make an informed choice.

1. CoinFutures: Trade SOL Futures With 1,000x Leverage From $1

CoinFutures is a safe and licensed trading platform with native software for desktop and mobile devices. Users access top cryptocurrencies via derivative products, and popular markets include Solana, Bitcoin (BTC), XRP (XRP), and Ethereum (ETH). Simulated futures track SOL/USDT prices in real-time via audited algorithms, which enable instant execution without relying on other market participants.

The minimum futures trade requirement is $1, so CoinFutures ranks as a solid choice for beginners. The isolated-style margin facilities protect investors from uncontrolled losses. Traders risk an initial margin, which unlocks leverage multipliers of up to 1,000x. When positions are liquidated, they consume the initial stake only, the platform eliminates negative balance risks.

CoinFutures offers $1,000 in SOL/USDT exposure for every $1 wagered. Source: CoinFutures

When platform users set up orders in auto mode, they access stop-loss and take-profit orders. For added simplicity, traders state their exit parameters in USD. This structure populates SOL/USDT trigger prices automatically.

Regarding payments, CoinFutures supports digital asset deposits via external wallet transfers. It also enables fiat deposits via debit/credit cards, Apple/Google Pay, and PIX. Traders avoid KYC verification, as accounts link to an email address and nickname rather than the user’s personal identity.

CoinFutures offers futures trading accounts without KYC requirements. Source: CoinFutures

As one of the top no-KYC crypto exchanges, CoinFutures prioritizes client fund protection. Fireblocks, a regulated custodian for the world’s largest crypto stakeholders, stores account deposits in cold storage wallets with tier-one insurance and MPC security. The CoinFutures website displays proof of reserves with daily updates.

Pros

- Go long and short on SOL futures in a safe and licensed environment

- Access industry-leading leverage facilities of up to 1,000x

- Risk just $1 per futures position to preserve trading capital

- The isolated-style simulated derivatives ensure limited downside

- Deposit funds instantly via crypto and traditional payment methods

- Other popular futures markets include BTC, ETH, and XRP

Cons

- Excessive leverage multipliers increase liquidation risks significantly

- The platform doesn’t support copy trading features

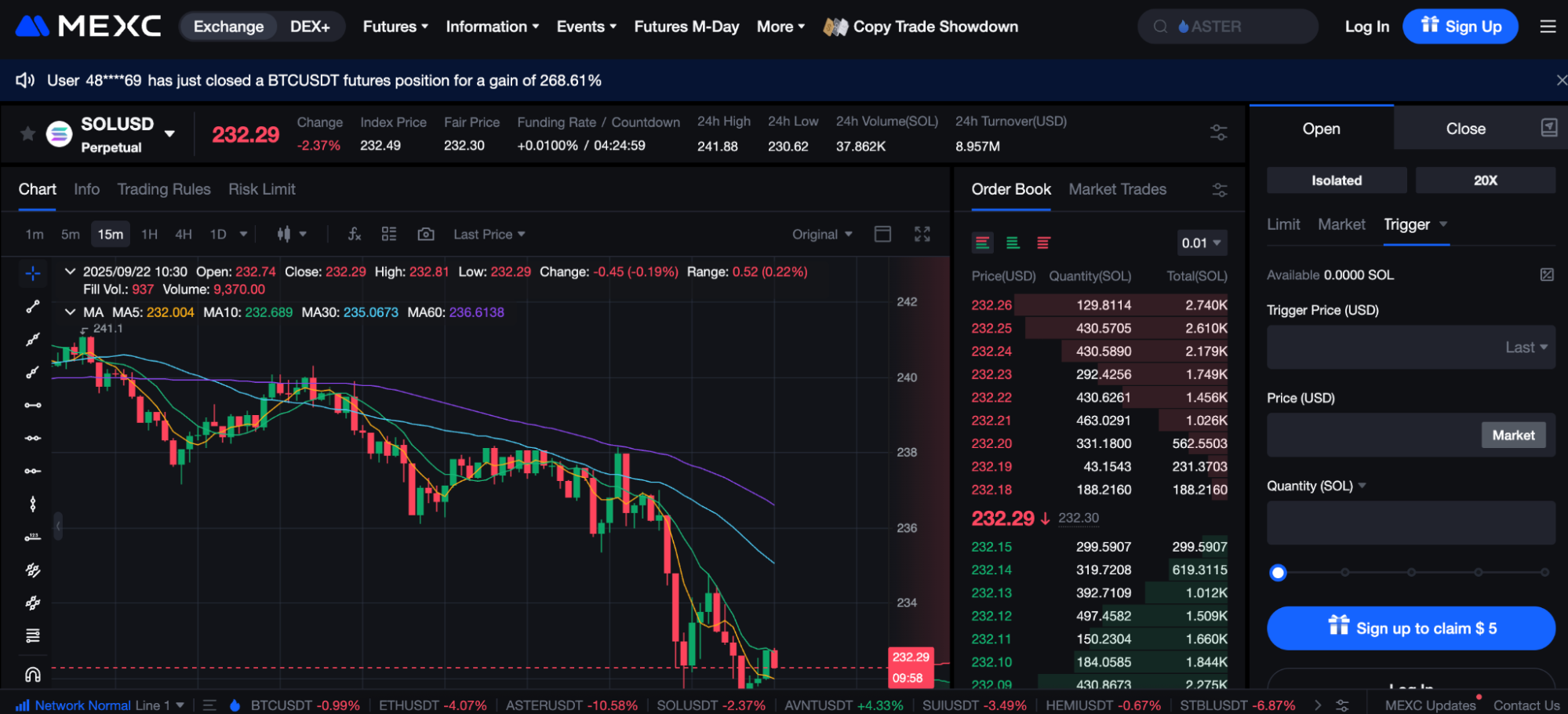

2. MEXC: Top-Rated SOL Futures Exchange With Linear and Inverse Settlement

Founded in 2018, MEXC is an offshore crypto exchange that offers thousands of spot and futures trading markets. Traders register without personal information, as MEXC collects only an email or mobile number. Exchange users retain their anonymity unless they cash out over 10 BTC within 24 hours.

MEXC offers two options when users set up a SOL futures position: linear or inverse contracts. Linear futures rely on Tether (USDT) for margin and contract settlement. Inexperienced derivative traders prefer this option, since profits and losses resemble conventional USD trading.

MEXC is a global exchange that offers Solana futures with USDT-M and Coin-M contracts. Source: MEXC

MEXC’s inverse contracts allow seasoned traders to post margin in SOL. When traders close their inverse positions, the exchange adjusts account balances in the same coin.

In terms of margin facilities, MEXC offers 300x leverage on SOL linear markets and 100x when traders use inverse contracts.

The provider supports a wide range of payment options, from debit/credit cards and SEPA transfers to hundreds of local methods via a peer-to-peer system.

Pros

- Popular spot and futures exchange with no-KYC accounts

- Trade Solana futures with leverage of up to 300x

- Choose between USDT-M or Coin-M contracts

- Place limit orders to secure 0.1% trading commissions

Cons

- The exchange provides no regulatory protections

- It reduces the leverage multiplier when position sizes exceed 580,275 USDT

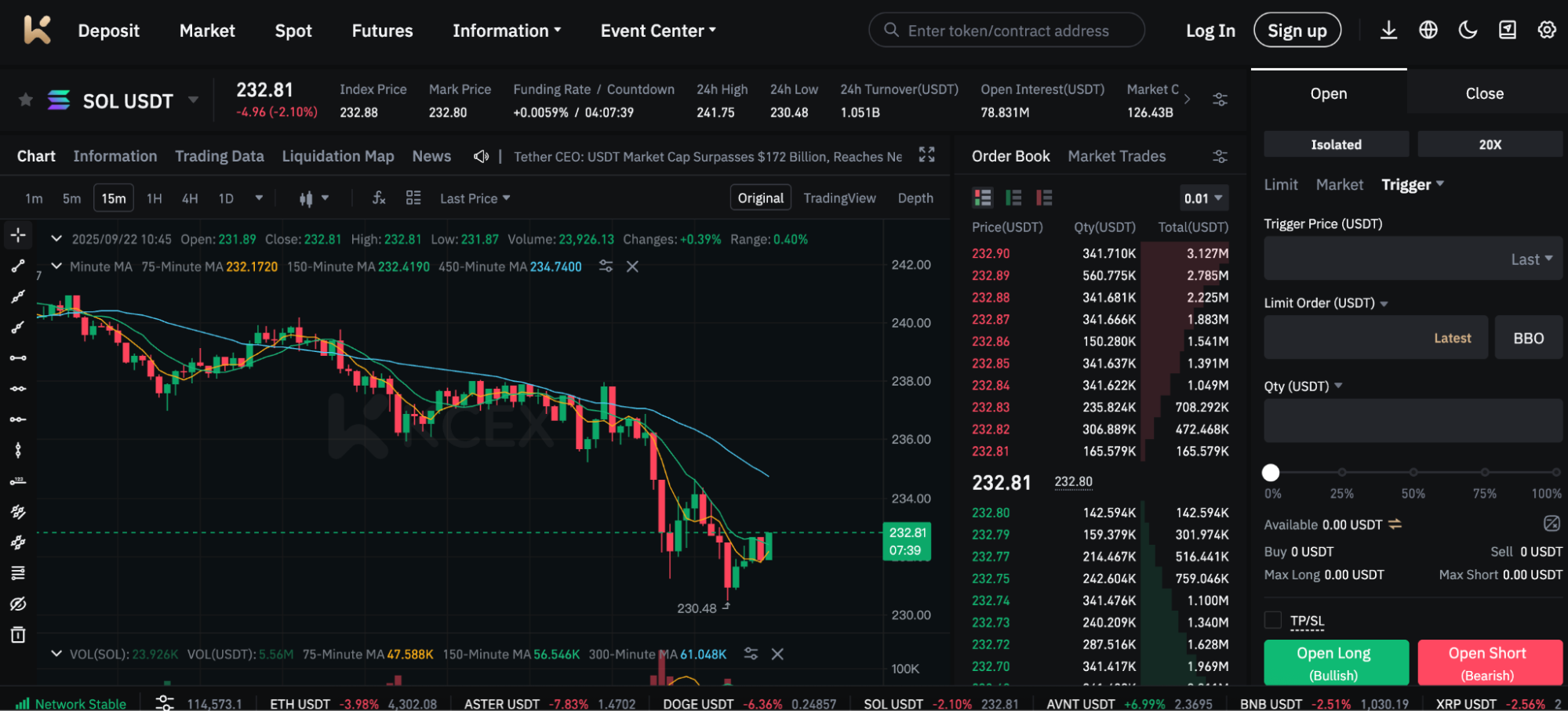

3. KCEX: Our Top Pick for SOL Traders Who Prioritize Low Trading Fees

KCEX is a mid-tier exchange with a large selection of futures trading markets, including the best cryptocurrencies to buy, like SOL and BTC.

Platform users buy and sell perpetual contracts with market-leading fees. Makers, who place limit orders, get 0% commissions, while takers incur fees of just 0.1% on their market orders. This generous commission structure applies to all KCEX account holders, as the exchange doesn’t require minimum monthly volumes.

Solana futures cover USDT and USDC (USDC) contracts with isolated or cross margin. The lack of SOL-backed contracts may be a drawback for some traders. KCEX caps the maximum leverage at 75x to mitigate exchange risk.

KCEX users trade Solana futures commission-free when they place limit orders. Source: KCEX

While KCEX operates as an unlicensed offshore platform, it protects user funds with cold storage solutions and two-factor authentication. Research shows that KCEX has avoided hacking threats since its inception.

Unlike many futures platforms, KCEX offers crypto-only payments. Traders transfer cryptocurrencies from private wallets without ID verification, and the exchange typically approves withdrawal requests in minutes.

Pros

- Trade SOL futures with 0% or 0.1% commissions

- Supports isolated and cross-margin contracts

- Account security includes cold storage and two-factor authentication

- Deposit and withdraw crypto without ID verification

Cons

- Users cannot add account funds with fiat money

- Doesn’t offer futures contracts that margin and settle in SOL

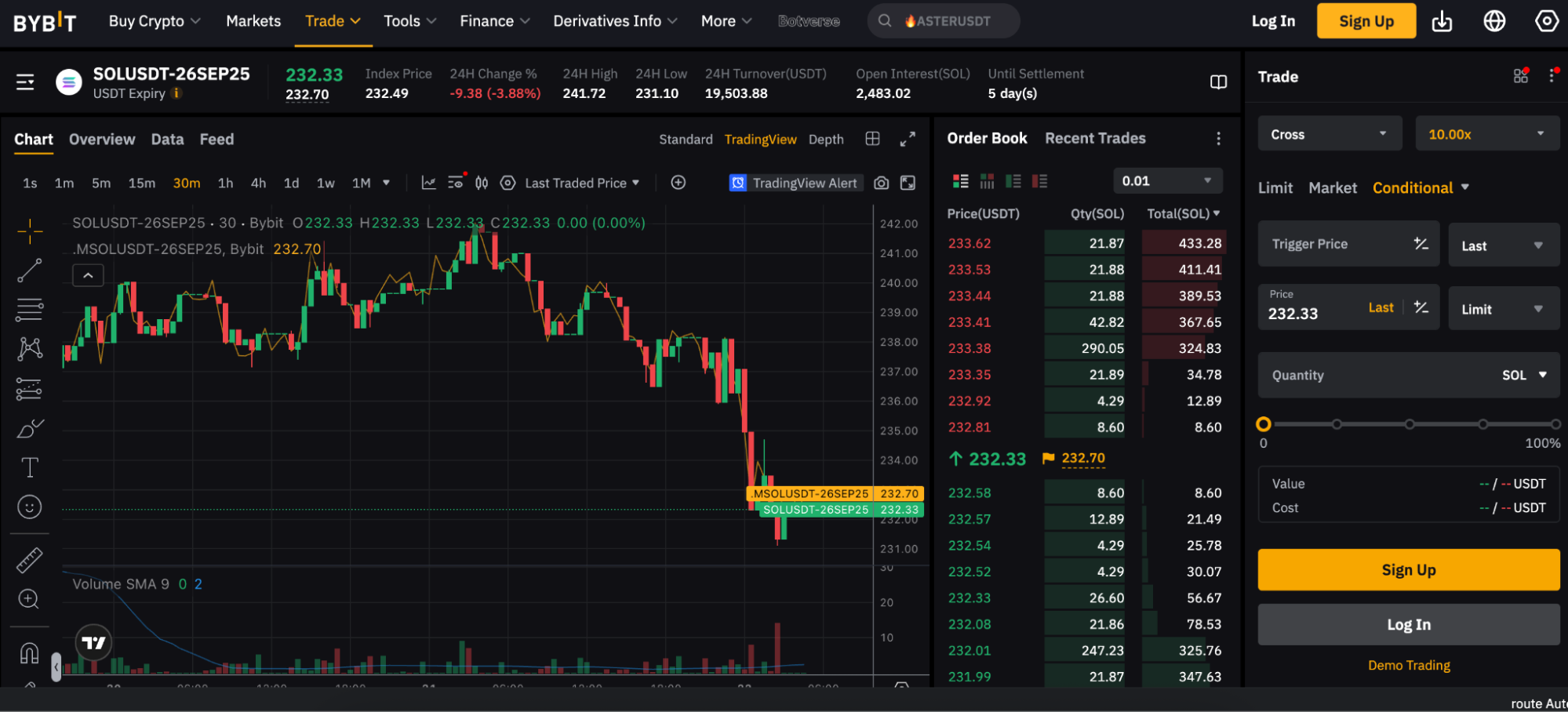

4. Bybit: Buy and Sell SOL Delivery Futures Without Funding Cycles

Bybit is a tier-one exchange and the second-largest platform for daily trading volume. It offers an extensive derivative ecosystem that covers futures and options across hundreds of pairs.

When trading Solana futures, traders access delivery contracts with various expiration dates. These derivatives differ from perpetuals, since traders avoid funding cycles. As such, contract holders remain in the market for longer periods without facing frequent charges.

Bybit is the best option to trade Solana futures contracts with expiration dates. Source: Bybit

The exchange also provides SOL markets through perpetual contracts, and traders choose between USDT or USDC settlement.

Both delivery and perpetual futures incur the same fee structure. Bybit uses the maker-taker model, and entry-level commissions start at 0.02% and 0.055%, respectively. As traders meet higher 30-day volumes, Bybit reduces the commission rate.

The maximum SOL leverage available is 100x, yet the exchange lowers those limits as market exposure reaches certain thresholds. Trading over 50,000 USDT on any single position reduces leverage to 90x and raises the maintenance margin to 0.56%.

Pros

- Buy and sell SOL futures with various expiration dates

- Delivery contracts enable users to avoid funding cycles

- Traders secure lower commissions when meeting 30-day volume targets

- The second-largest crypto exchange globally

Cons

- Increased regulatory pressure makes KYC mandatory in EU countries

- Higher margin requirements when SOL position sizes exceed 50,000 USDT

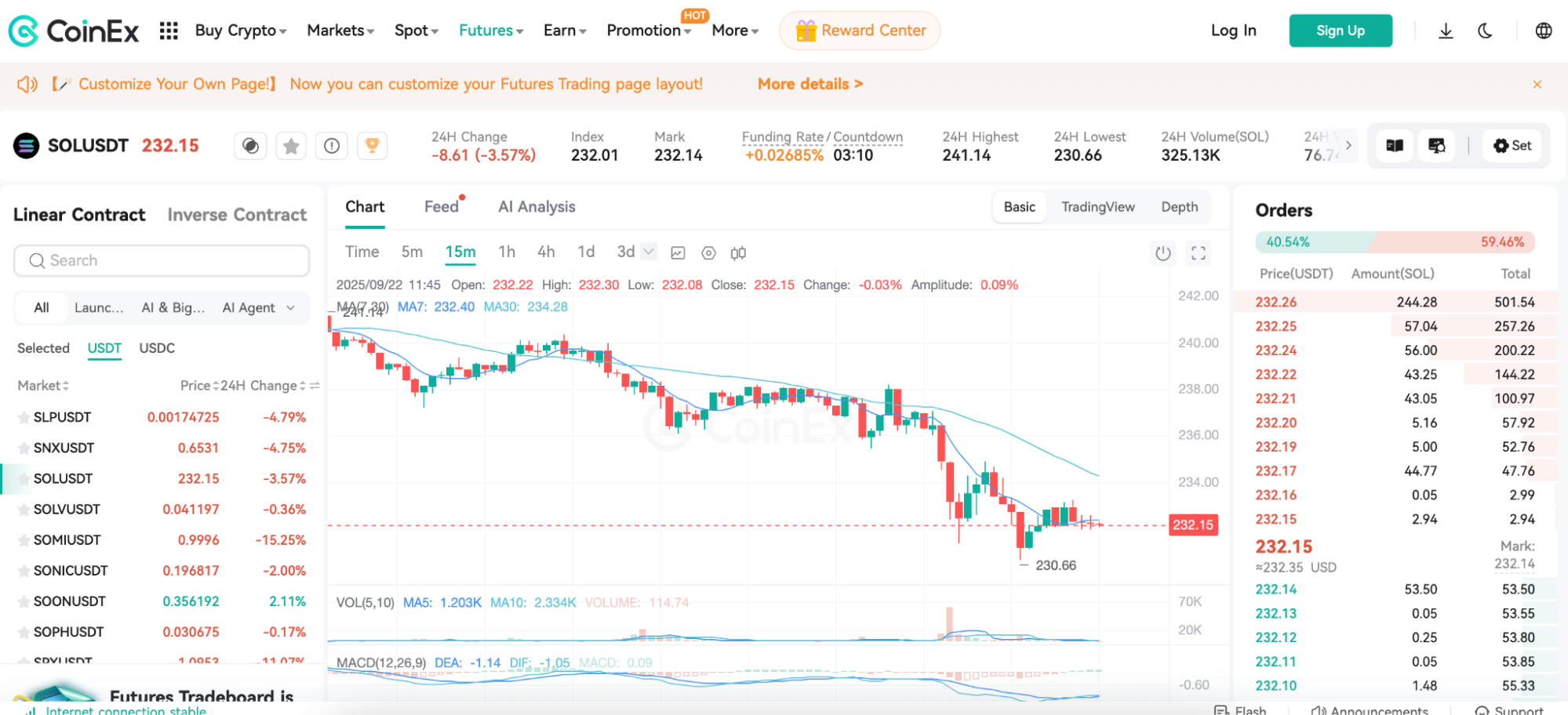

5. CoinEx: User-Friendly Trading Platform With Over 260 Derivative Pairs

CoinEx offers a smooth and user-friendly trading experience from the get-go. Traders register on the desktop website or mobile app with an email address only, and instantly deposit funds without KYC details. Payment methods include debit/credit cards and digital asset transfers. Unverified accounts withdraw up to $10,000 daily or $50,000 monthly.

Solana futures allow linear contracts only, and trades settle in USDT or USDC. With a minimum order amount of $0.05, CoinEx appeals to complete beginners, as well as algorithmic traders who snipe ultra-small price movements. The maximum leverage for SOL futures is 50x, with an initial margin of 1%.

CoinEx streamlines SOL futures trading with its beginner-friendly charting dashboard. Source: CoinEx

In addition to Solana, the futures platform supports over 260 other cryptocurrencies. Asset support includes the best meme coins, from Pepe (PEPE) and Shiba Inu (INU) to Brett (BRETT) and Bonk (BONK).

CoinEx users access a wide range of trading tools to enhance the trading process, including custom charting screens, technical indicators, and simulated demo accounts. Copy trading is available, too, which lets users invest capital into seasoned derivative traders.

Pros

- Minimum order size of $0.05 on SOL perpetual futures

- Easy-to-use charting tools for desktop and mobile users

- Access over 260 futures markets from one account

Cons

- The platform caps Solana leverage to 50x

- Mid-tier trading volumes lead to wider spreads

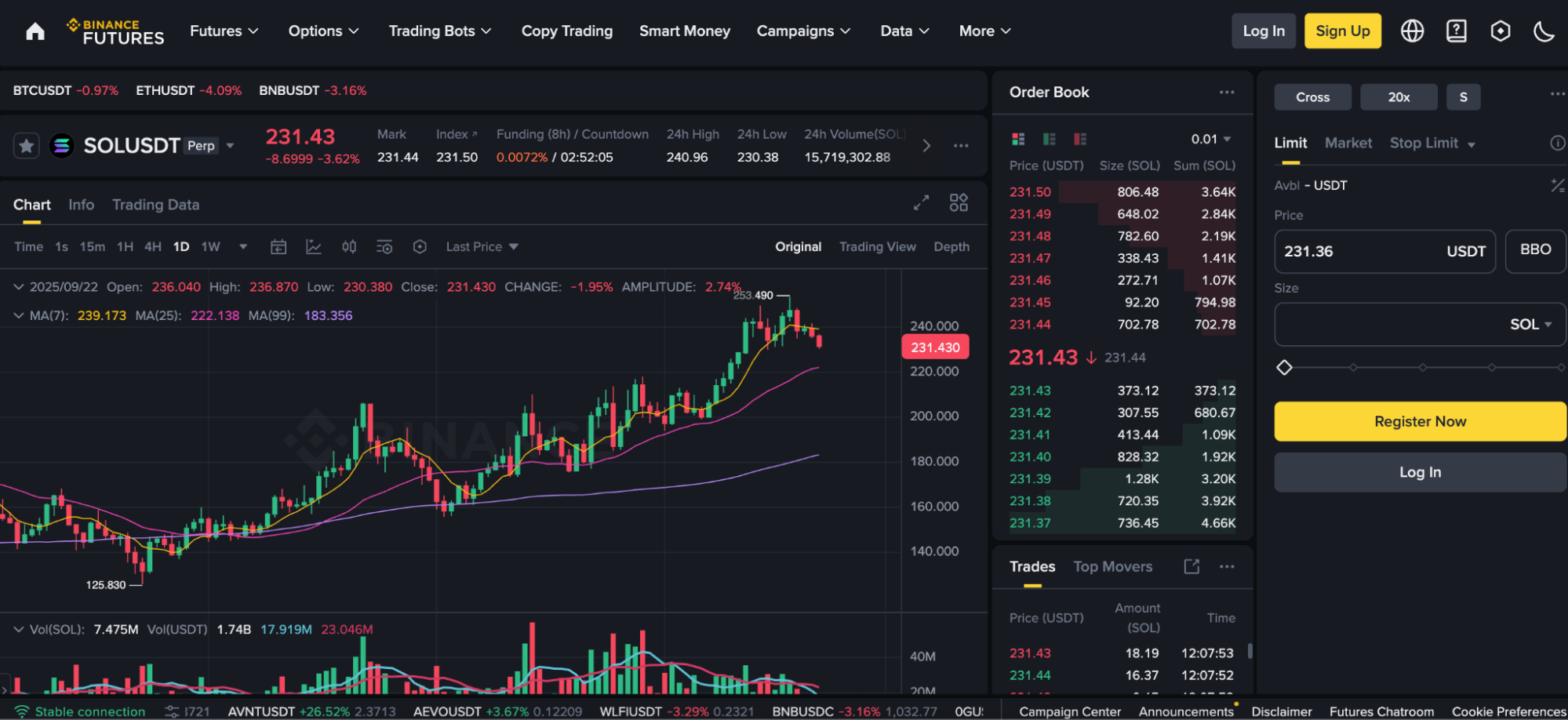

6. Binance: Best Futures Trading Platform for Advanced Charting and Trading Features

Binance remains a popular choice with experienced derivative traders. Its world-class analysis tools include over 100 technical and economic indicators with full chart customization. It also supports trend drawing tools and advanced order types, and users access the platform through dedicated desktop and mobile software. Binance is also accessible on standard web browsers.

The exchange lists multiple Solana derivative markets, including delivery futures with quarterly and bi-quarterly contracts. Perpetual futures pairs contract USDT and USDC with significant liquidity.

On Binance, users access perpetual and delivery SOL futures with a maximum leverage of 100x. Source: Binance

Leverage multipliers vary by the selected market. USDT-M perpetual contracts offer the highest limits at 100x. However, Coin-M delivery futures reduce those limits to just 20x. Similar to other online exchanges, Binance also increases margin requirements based on the notional trade value.

Trading fees also vary by key metrics, including whether traders hold BNB (BNB) and place limit or market orders. The platform caps futures commissions at 0.2% and 0.05% for makers and takers. While crypto deposits are fee-free, Binance charges variable commissions on fiat money payments.

Pros

- Top-rated trading tools with customizable charting screens

- The largest exchange for derivative liquidity and volume

- SOL futures contracts include perpetual and delivery markets

Cons

- Expiration contracts limit the SOL leverage to 20x

- Charges high debit/credit card fees in most regions

Solana Futures Exchanges Compared

Here are the top trading platforms compared by available Solana futures, leverage limits, settlement options, and other core factors:

| Supported SOL Futures | Settlement Options | Margin Options | Max SOL Leverage | Mobile App? | Max Futures Trading Fees | KYC? | |

| CoinFutures | Simulated | USDT | Isolated | 1,000x | Yes | Variable or commission-based | No |

| MEXC | Perpetual | USDT, USDC, SOL | Isolated and cross | 300x | Yes | 0.04% | No |

| KCEX | Perpetual | USDT, USDC | Isolated and cross | 75x | Yes | 0.1% | No |

| Bybit | Perpetual and delivery | USDT, USDC, SOL | Isolated and cross | 100x | Yes | 0.055% | No (non-EU users) |

| CoinEx | Perpetual | USDT, USDC | Isolated and cross | 50x | Yes | 0.05% | No |

| Binance | Perpetual and delivery | USDT, USDC, SOL | Isolated and cross | 100x | Yes | 0.05% | Yes |

What are Solana Futures?

Solana futures are financial derivatives traded between two or more counterparties. Market participants speculate long or short, based on whether they predict SOL prices will move higher or lower on a future date.

The most appealing aspect of trading futures is that derivative contracts require an initial margin rather than the full trade value. An exchange with a 2% margin requirement lets traders enter positions with just 2% of the position size. This framework unlocks unprecedented market exposure, since investors buy and sell SOL contracts with more than they could initially afford.

Solana futures come in various contract types, yet no derivative product provides real SOL ownership. Traders speculate on future prices only, and contracts typically settle in USDT. These contracts are called linear futures, or USDT-M at some platforms.

Some exchanges also offer Coin-M, or inverse, futures with SOL settlement, although these require a much deeper understanding of risk management.

How Does Trading Solana Futures Work?

Before buying and selling futures instruments, traders must select an appropriate contract type.

Exchange data confirms that perpetual futures remain the most popular option with SOL traders. These crypto-specific derivatives let holders speculate on Solana prices without expiration dates. While less common, some platforms also support delivery futures, typically with quarterly and bi-quarterly timeframes.

Traders choose between a buy or sell order when they enter the market. Their decision depends on whether they expect SOL to rise or fall.

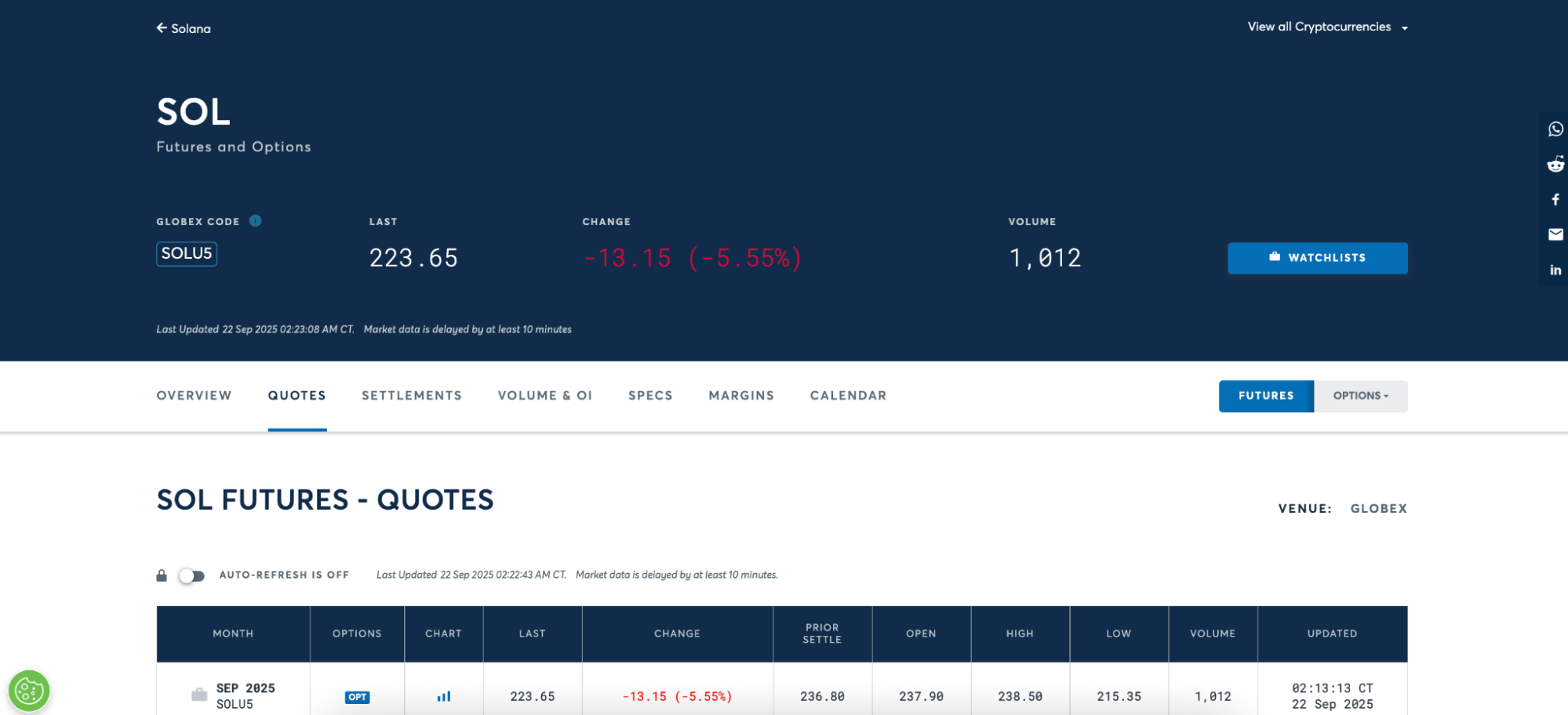

CME offers regulated Solana futures markets for institutional-grade investors. Source: CME

Futures platforms require an initial margin, which, unlike traditional spot exchanges, is always less than the total position size. Platform users also input a leverage multiplier that amplifies the initial margin.

For example, suppose you trade Solana futures on the CoinFutures platform, which offers leverage of up to 1,000x. You enter $50 as the initial margin and apply the maximum leverage available, so your market exposure increases to $50,000. A long position at 2% gains ordinarily yields a $1 profit on a $50 stake, yet with 1,000x leverage, those returns magnify to $1,000.

To protect users from excessive risk, the best crypto futures trading platforms have maintenance margin requirements. If the SOL futures trade declines below that figure, the platform liquidates it immediately. This outcome means the contract holder exits the market and loses only their initial margin.

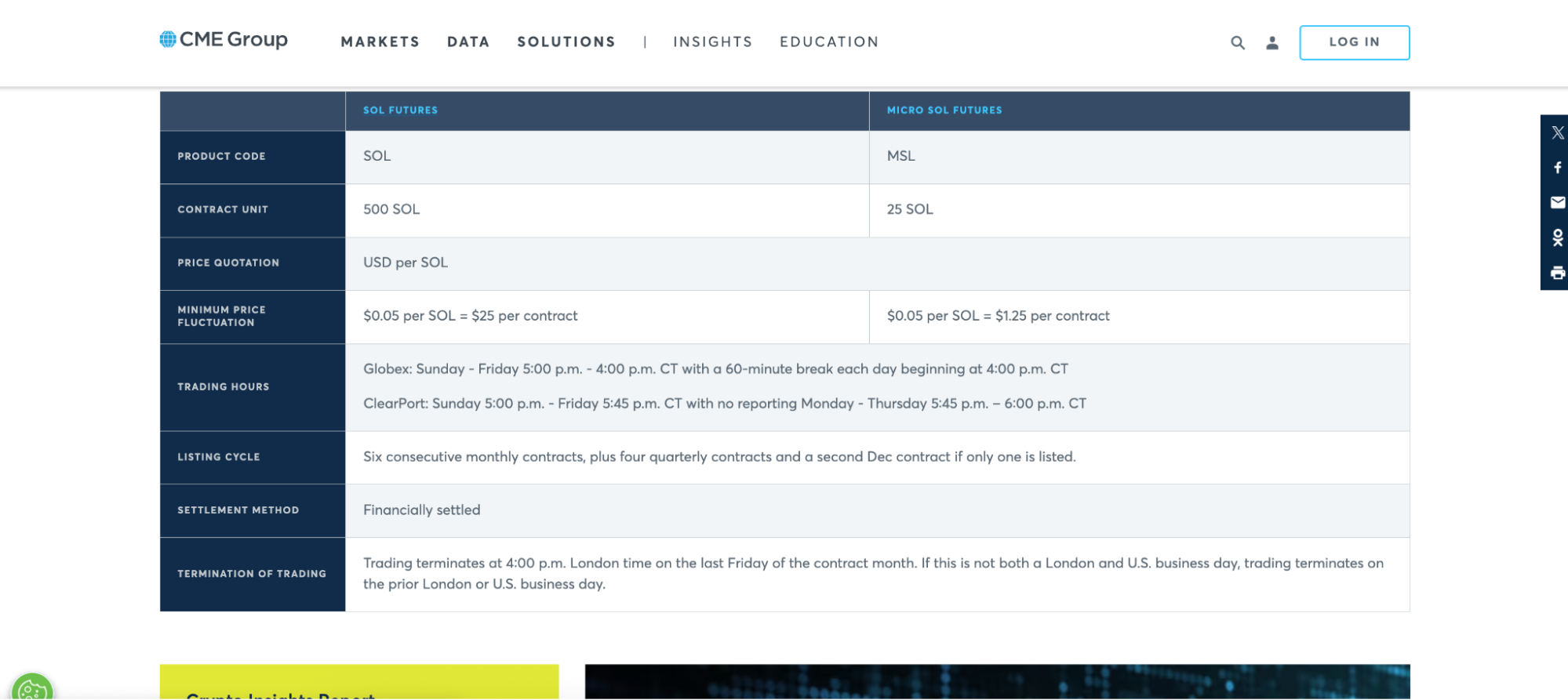

What are CME Solana Futures?

Chicago Mercantile Exchange (CME) is a regulated derivative exchange that launched Solana futures in Q1 2025. The CME provides SOL exposure for institutional clients, which allows them to bypass crypto exchanges and avoid managing private wallets.

CME offers delivery futures with expiration dates, yet margin requirements are substantial. Standard contracts require approximately $50,000 upfront, so traditional exchanges remain the most viable option for retail clients.

How to Trade Solana Futures for Beginners

Solana futures operate in a speculative and volatile market, making them considerably riskier than traditional investing. If you’re trading derivatives for the first time, using a beginner-friendly platform is essential.

Follow these steps to trade SOL futures on CoinFutures, which is the best option for inexperienced traders.

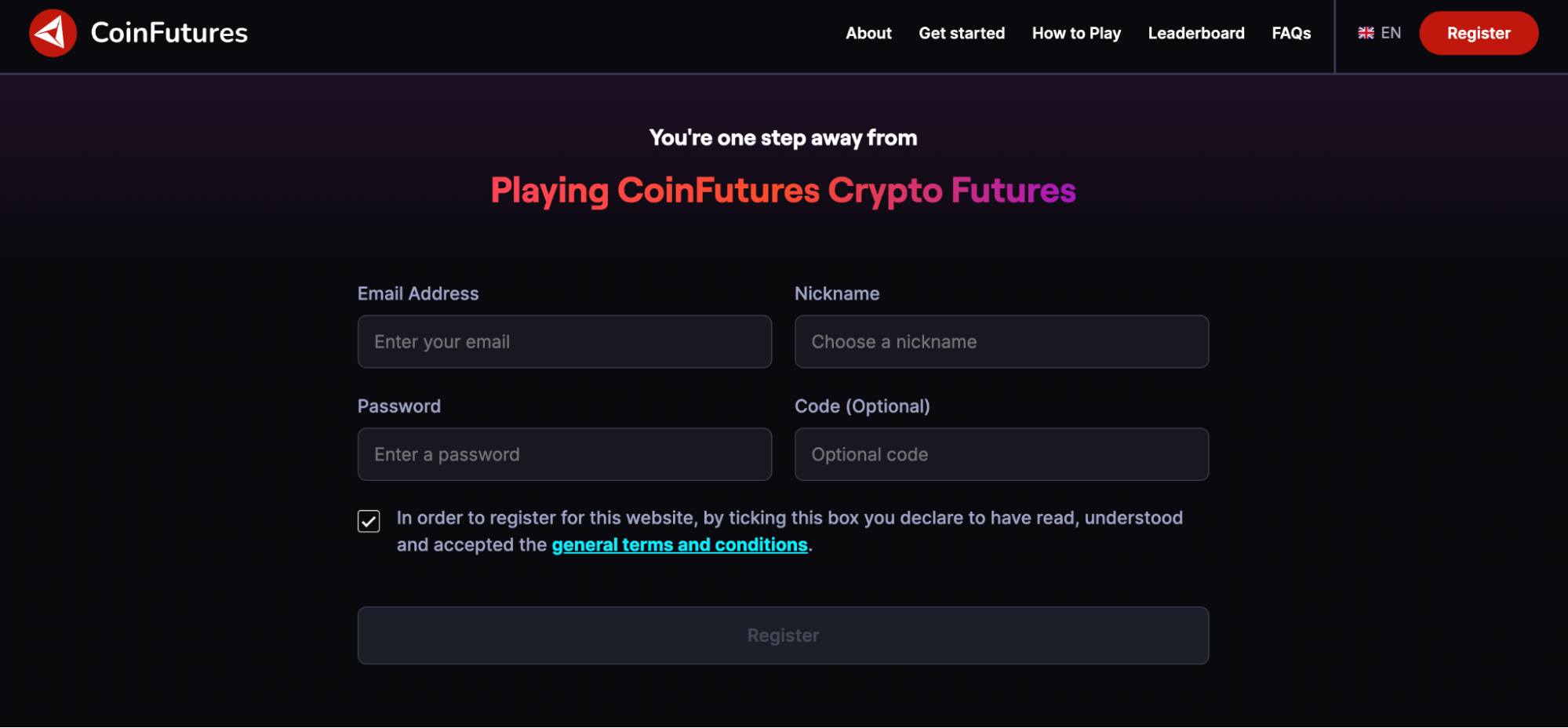

Step 1: Register a Futures Account

The first step is to visit the CoinFutures website and create a new account.

CoinFutures is a no-KYC futures platform available in most countries. Source: CoinFutures

Provide an email address, nickname, and password, and read and confirm the general terms and conditions.

Open your email account and click the “Verify Email” button.

Step 2: Download the Futures Trading Software

To trade Solana futures, download the platform’s native software. It offers a native interface for desktop and mobile devices, and both versions connect to the same account.

CoinFutures offers native trading software for desktop and mobile devices. Source: CoinFutures

Enter your email address and password to sign into your futures account. The system typically requires email confirmation for the first login request as a security measure.

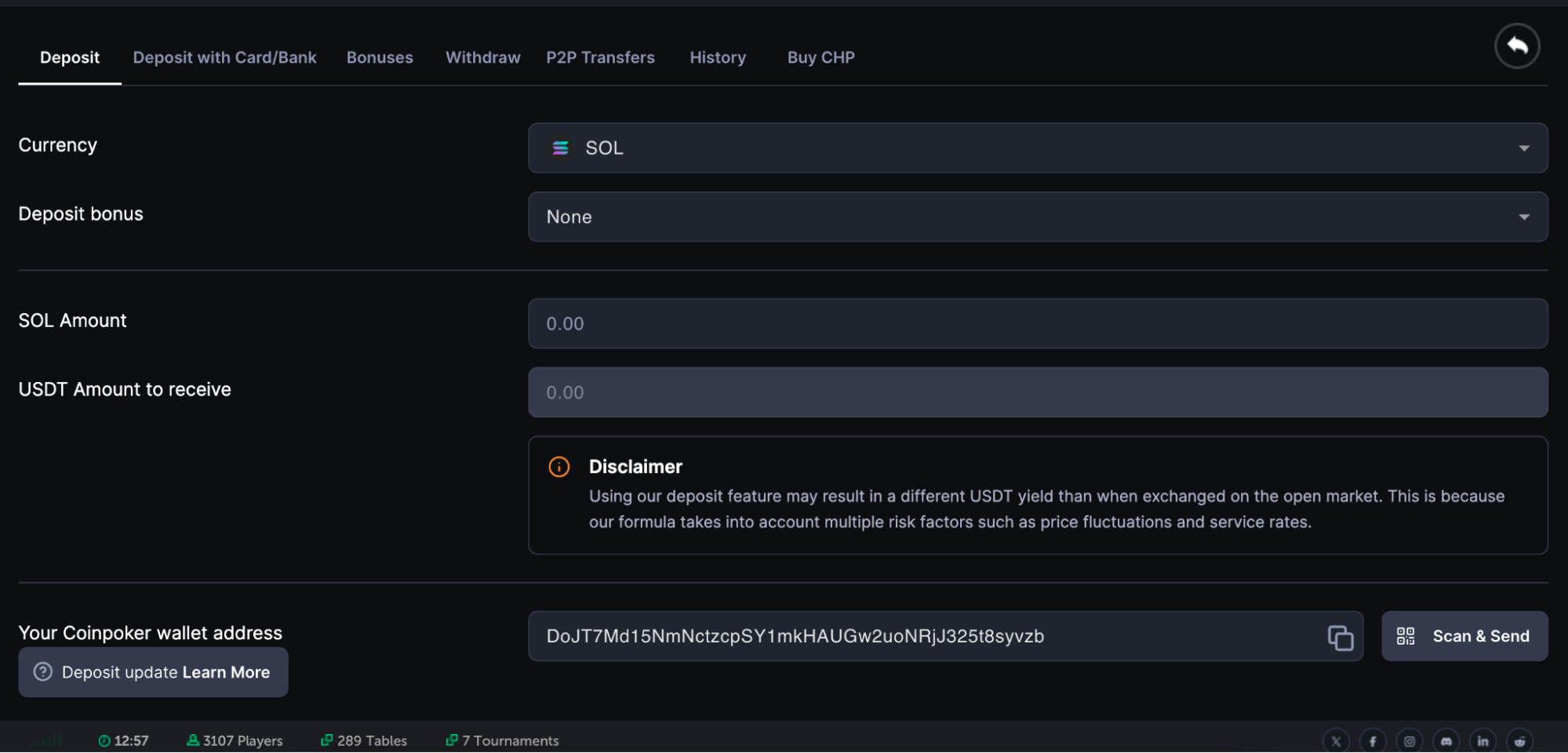

Step 3: Make a Deposit

In the top-right corner, click the wallet icon to populate the banking page.

Select the digital asset to deposit from a private wallet. Supported cryptocurrencies include SOL, USDT, USDC, BTC, and ETH, among others.

Click the copy icon to add the deposit address to your clipboard. Then complete the wallet-to-wallet transfer.

Using a mobile wallet? Select “Scan & Send” and scan the address’s QR code.

Note: Since the platform’s futures markets support USDT pairs, CoinFutures converts non-stablecoin deposits to USDT.

CoinFutures accepts popular fiat payment methods and crypto wallet transfers. Source: CoinFutures

Platform users may also deposit funds with traditional payment methods. Options include debit/credit cards, PIN, and Google/Apple Pay.

Switch the banking page to “Deposit With Card/Bank” and follow the on-screen instructions. CoinFutures processes fiat payments instantly.

Step 4: Go to Crypto Futures and Select SOL/USDT

Close the banking screen and select “Coin Futures”.

Besides SOL, CoinFutures also supports BTC, ETH, and other top altcoins. Source: CoinFutures

Then switch the trading pair to “SOL/USDT”.

Step 5: Choose the Trade Parameters

If you’ve decided whether you’re bullish or bearish on the SOL price, complete the trading dashboard.

To go long, leave the dashboard set as an “Up” order. Change it to “Down” to speculate on falling prices.

A CoinFutures trader risks $20 on a long order with 9x leverage. Source: CoinFutures

While CoinFutures uses “Wagers” instead of initial margin, the two concepts refer to the same outcome. This mechanism means the wager reflects the original stake, which is at risk of liquidation should prices move adversely.

The minimum wager size is $1, yet the platform lets users amplify this amount by up to 1,000x. Select the required multiplier, and evaluate the bust price before proceeding.

What is the Futures Bust Price?

While most exchanges require futures traders to monitor their maintenance margin balance, CoinFutures simplifies the process through bust prices.

The bust price is the exact SOL/USDT price traders face for liquidation. The platform adjusts that price based on the trader’s selected leverage multiplier and whether they trade long or short.

Trading with low leverage multipliers ensures sufficient distance between the entry and liquidation prices. However, as traders raise their leverage, that distance narrows.

Step 6: Set Exit Parameters and Place an SOL Futures Trade

The final step is to set exit orders to mitigate trading risks. CoinFutures executes these orders when SOL/USDT triggers the selected prices. Therefore, futures traders either cut their losses or secure gains.

CoinFutures enables futures traders to set stop-loss and take-profit orders. Source: CoinFutures

Select “Auto” and choose the stop-loss and take-profit levels in USD terms. The dashboard automatically converts that amount to SOL/USDT prices.

Review the order parameters and click “Place Auto Bet” to confirm.

Why Trade Solana Futures? Potential Benefits

Traders buy and sell billions of dollars' worth of SOL futures daily. Let’s explore why derivative contracts remain a popular way to gain exposure to Solana price movements.

Avoid Covering the Full Contract Value

Although futures platforms have varying minimum requirements, traders enter positions with a much smaller outlay compared with the overall trade size. Our research shows margin requirements start at 0.1%, so traders cover just $1 for every $1,000 in market exposure.

This structure benefits a wide range of trading profiles. Complete beginners, as well as those on a budget, risk small amounts while still having access to significant capital. It also helps investors become more capital efficient, since they can allocate the original deposit to a much wider range of positions.

Magnify SOL Profits With Leverage

While risk management is essential, leverage enables SOL futures traders to amplify their returns by substantial amounts. Leverage limits vary by exchange, yet our research confirms that market providers offer between 50x and 1,000x. As such, traders may magnify profitable positions by at least 50 times.

The leverage system particularly appeals to short-term traders who target small and risk-averse margins. Examples include the scalping and algorithmic strategies, which rely on leverage to boost marginal gains.

Trade SOL Price Movements in Both Directions

Futures track the SOL price without traders exchanging real SOL coins. Instead, traders exchange perpetual and delivery contracts. Their derivative nature unlocks market flexibility, since futures allow long and short trading.

Similar to the retail-friendly exchanges, the CME lets market participants trade Solana long and short. Source: CME

During a bearish market, Solana may experience prolonged price declines. Long-term investors either hold strong or cash out. During these periods, futures traders place sell orders, and if SOL drops below the entry price, the position generates a profit.

Significant Trading Volume and Liquidity

We analyzed exchange data and found that Solana futures volumes exceed traditional spot exchanges. This dynamic is because of leverage, since traders typically magnify their positions by large multipliers.

Trading in a high-volume environment benefits traders, as they access deep liquidity, tighter spreads, and reduced slippage risks.

Futures Hedging Offsets Adverse Price Movements

Although most traders buy and sell SOL futures for pure profit speculation, investors also use them as a hedging tool. The strategy protects investors from near-term uncertainty, as they short-sell futures contracts to protect existing positions against unfavorable price movements.

Contract holders offload their futures contracts as market sentiment becomes clearer, and any profits or losses are offset against the original investment.

Risks & Limitations of Solana Futures Trading

Correctly predicting the SOL price via futures contracts can produce massive gains, yet like all derivative instruments, they also present drawbacks.

Consider these risks and challenges before trading Solana futures:

- No Asset Ownership: Non-custodial ownership is one of crypto’s biggest perks, since investors own and control their assets away from centralized intermediaries. Solana futures, as a derivative product, provide no ownership. Traders generally buy and sell contracts through centralized platforms, which creates counterparty risks. Investors who prefer buying real SOL coins must use a spot trading exchange or brokerage.

- Liquidation Leads to Financial Losses: The risk-reward of Solana futures trading depends on the selected leverage multiplier. As trading with high limits makes liquidation more likely, traders risk serious financial losses. Each liquidation event causes the trader to forfeit their initial margin, and potentially more if using cross margin mode.

- Perpetual Futures Incur Funding Rates: Depending on whether futures prices are higher or lower than the SOL spot price, either long or short traders pay funding fees. This cycle happens every eight hours to ensure market correlation. If you incur funding fees, platforms take them from your margin balance. Too many charges could force liquidation.

- Derivatives Suit Active Crypto Traders: Solana futures trading is time-intensive. Traders often predict short-term price movements through technical analysis, so a firm understanding of charting indicators is crucial. Missing a market signal could be costly, especially when you consider SOL’s volatile pricing swings. If you’re unable to dedicate sufficient time to market research, traditional investing could be a better fit.

Top Considerations for Solana Futures Trading

As a first-time Solana futures trader, consider these factors to avoid unnecessary risks:

- Ensure the Platform Offers Isolated Margin Mode: To limit the downside potential, ensure you trade futures with a platform that offers isolated margin. This mechanism ensures liquidated positions do not exceed the initial margin. In contrast, cross margin puts the entire account balance at risk.

- Always Set Stop-Loss Orders: Derivative traders avoid liquidation by setting stop-loss orders. They place the execution level above or below the liquidation price, depending on the trade prediction. When the stop-loss order triggers, contract holders exit the market automatically, preventing further losses.

- Understand the Expiration Terms: Most Solana futures resemble perpetual or simulated contracts that never expire. Traders may close their positions at any time. Delivery futures, however, have expiration dates. If you hold contracts at expiration, you must settle the trade at the respective SOL price.

- Avoid the Temptation of Excessive Leverage: Winning futures trades can generate unprecedented profits when traders apply high leverage multipliers, yet the strategy makes liquidation likely. The more risk-averse approach is to trade with manageable leverage ratios. Over time, traders build their account balance organically and mitigate drawdown risks.

- Diversify Into Other Futures Markets: Successful futures traders typically diversify their capital into multiple markets, rather than hone in on any single asset. Besides Solana, consider trading other derivative markets like ETH, BNB, and BTC. Avoid futures markets with low liquidity, though, since these pairs carry significant volatility risk.

Solana futures provide traders with several benefits that remain inaccessible on traditional exchanges. Derivative contracts support long and short trading, substantial leverage multipliers, and the ability to hedge against short-term uncertainty.

After reviewing the best Solana futures trading platforms for 2026, CoinFutures is our top pick. Platform features include SOL/USDT leverage of up to 1,000x with a $1 minimum margin requirement. Traders register anonymously, and CoinFutures’ licensed framework ensures safety.

FAQs

What are Solana futures?

What’s the difference between Solana futures and options?

What are the advantages of trading Solana futures?

Do Solana futures have more risk than regular Solana trading?

What’s the minimum amount needed to trade SOL futures?

How can I trade Solana futures as a beginner?

What is the best platform to trade Solana futures?

References

- CME Solana Futures Specifications (Chicago Mercantile Exchange)

- Understanding Derivatives (National Institute of Securities Markets)

- What are Perpetual Futures? (Coinbase)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

BMIC doesn't have a fixed presale end date yet. The team said they want to keep things flexible and let demand dictate when it wra...

In this guide, we break down the LiquidChain presale timeline, including stage deadlines, token generation event (TGE) expectation...

Fact-Checked By:

Fact-Checked By:

23 mins

23 mins

Ibrahim Ajibade

, 369 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.