This guide explains how to buy TOKEN6900, a new meme coin project with an attractive market capitalization. Learn how to join the ...

Wealthfront Review: Key Features and Service Offerings

Last Updatedby Osaemezu Ogwu · 6 mins read

Check out the full review of the Wealthfront investment platform – it’s key features, best things about the platform, and things to improve.

Established in 2008, Wealthfront is one of the numerous automated investing platforms (also known as robo advisors) currently in existence. The platform offers millennials and older investors alike a platform with which they could grow their wealth via automated investing.

Wealthfront and other automated investing platforms have succeeded in democratizing automated investing, eliminating the need for investors to engage the services of sophisticated and often expensive personal investment advisors.

With a massive $11.5 billion in assets under management (AUM), Wealthfront provides its clients with cost-efficient access to a vast array of investment vehicles, highly functional planning tools, and numerous tax-saving investment strategies.

With a minimum of $500, anyone can take advantage of Wealthfront’s investment offerings and an investor also has the option of using a tax-deferred individual retirement account (IRA). Funds deposited on the platform goes straight into the custody of the Royal Bank of Canada (RBC).

Just like a host of other robo investment advisors on the market, Wealthfront employs the Modern Portfolio Theory (MPT) in formulating an automated asset allocation that puts into consideration the risk appetite and financial needs of the investor. Even after allocating the assets accordingly, Wealthfront continually carries out automatic rebalancing to ensure the allocation is 100 percent accurate.

Full Review

Wealthfront’s automated investment service is suitable for both new and expert investors looking to build their finances without necessarily hiring a professional investment advisor to do the job. Though Wealthfront charges users zero fees for the first $5,000 managed, subsequent investments attract a 0.25 percent fee.

The firm offers investors a 0.08 percent exchange-traded fund (ETF) expense ratio, while portfolios having the Wealthfront Risk Parity Fund may have an expense ratio of 0.11 percent.

Wealthfront offers investors a portfolio mix made up of ETFs from 11 asset classes and it supports a variety of account types including individual and joint non-retirement accounts, trusts, 529 college savings plans, cash accounts, Roth, traditional SEP, and rollover IRAs. On top of that, the firm charges no commissions for transfer, account closure, or annual management fees.

Investors can have access to a vast array of tools designed to make it easier for them to plan life events such as college, retirement, travel, and more. On top of that, Wealthfront customers can link their external investment accounts and they are also provided with a portfolio line of credit which allows them to get a certain amount of loan, using their portfolios as collateral

The firm offers its customers savings accounts with juicy interest rates plus an FDIC insurance of $1 million. For complaints, requests, and inquiries, customers can reach Wealthfront via phone from Monday-Friday 10 a.m to 8 p.m eastern, or through email.

Wealthfront’s Pros and Cons

Pros

- Wealthfront offers tax-loss harvesting for all account types

- Availability of stock-level tax-loss harvesting for accounts over $100k

- 529 Plan option

- Free financial planning – Wealthfront offers users a free financial planning service called Path.

- Interest-earning Cash Accounts – with just $1 can open a cash account that comes with a 0.26 percent interest rate.

- Zero account management cost for the first $5,000.

- Automatic rebalancing

Cons

- Fractional Shares not available – the barrier to entry is very high at Wealthfront.

- No discounts on large balances.

Best Things about Wealthfront

Referral Program: Wealthfront has put in place an attractive referral program that offers its existing customers a chance to get an additional $5,000 managed free of charge.

Customized Transfers: Unlike other robo advisors that require investors transiting from another advisor or existing brokerage to liquidate their portfolios and invest the cash in their platform, Wealthfront transfers the assets of such customers into a diversified portfolio over time, to help them reduce their tax bills. However, the firm still recommends that its users liquidate assets such as mutual funds or stocks which are incompatible.

Line of Credit: This innovative feature is a unique offering of Wealthfront. It makes it possible for investors to have a portfolio of over $100,000 to obtain a line of credit against their holdings. Customers can borrow up to 30 percent of the current value of their portfolios and the loans come with an APR of from 4.75 to 6 percent.

Smart Beta: the Wealthfront Smart Beta service is only available to investors with a portfolio worth $500,000 or more. The service helps customers to maximize their returns over market indexes.

Retirement Savings Planning: another strong point of Wealthfront is the retirement savings feature which enables investors to plan towards retirement. The firm carefully examines an investor’s internal and external accounts and designs the best plan that would help the investor reach their retirement goals.

College Planning: Interestingly, Wealthfront investors can easily plan towards their children’s college education via the app. All a customer needs to do is to pick a college of his choice and the Wealthfront app will calculate the exact amount of financial aid the investor is eligible to receive.

Home Planning: Wealthfront makes it possible for investors to save towards purchasing their dream homes, while also allowing them to get useful recommendations, mortgage estimates, and more, from experts.

Travel Holidays: this helps investors to map out time from their work schedules to embark on travels. Wealthfront calculator scans through an investor’s financial data and lets the customer know how much time they can take off work, as well as the impact of their absence on heir other financial goals.

529 College Savings Plan: This feature offers Nevada residents an opportunity to get a portfolio of $25,000 managed for free. The service attracts an all-in fee of between 0.43 to 0.46 percent per year. This is Wealthfront’s way of giving back to Nevada, as its 529 plan is domiciled in the state.

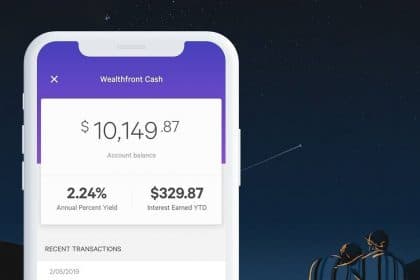

Cash Account: Wealthfront has introduced a cash account service that comes with FDIC insurance of up to $1 million, and it can be opened with just $1. On top of this, investors also receive a 0.35 percent interest.

Things to Improve

The major shortcomings of Wealthfront are that it does not cater to the needs of those interested in purchasing fractional shares and there are no large-balance discounts on the platform.

Conclusion

With a plethora of service offerings carefully designed to take care of a vast array of financial needs of forward-thinking investors, Wealthfront stands out from its pairs. The very competitive management fees also make it one of the most cost-efficient robo advisors on the market.

Pepe Coin surged in popularity after its 2023 launch. This article covers market trends, price forecasts, technical signals, and h...

Looking for the best play-to-earn crypto games in 2025? Start with fan-favorites like Axie Infinity and Harry Hippo - and discover...