AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

What Are ICOs? Initial Coin Offering Explained for Crypto Investors

20 mins

20 mins ICOs remain a core fundraising method in crypto, offering early access to new tokens. This guide explains how ICOs work, their legal landscape, risks, and how to evaluate them in 2026.

An Initial Coin Offering (ICO) is a way for crypto projects to raise money by selling new digital tokens to early investors. Similar to an IPO in traditional finance, an ICO allows a team to fund development before launching a live product or listing the token on exchanges.

ICOs played a central role in early crypto innovation, and they still matter today as a gateway for open, decentralized fundraising. Ethereum itself was launched through an ICO in 2014, according to Cointelegraph, raising over $18 million and laying the foundation for the modern Web3 ecosystem.

In this guide, we’ll explain how ICOs work, their legal status, how to evaluate them safely, and what risks to consider, giving investors the context they need to navigate the ICO landscape in 2026.

How Do ICOs Work?

At its core, an Initial Coin Offering (ICO) is a fundraising mechanism for blockchain projects, where a team creates and sells a brand-new cryptocurrency token to early supporters. While the concept is simple, most ICOs follow a fairly predictable rhythm: set the vision, launch the tech, engage the community, and then distribute the tokens.

1. Fundraising Stage (Presale)

It usually starts with the project publishing a whitepaper, a document outlining the problem they want to solve, how the token will work, how many will exist, and how they’ll be distributed. The team also defines tokenomics, from initial pricing to allocation models.

Ethereum is one of the most famous examples of a successful ICO, raising $18 million in 2014. Source: Ethereum Official Website

A smart contract, often deployed on Ethereum, is then used to receive contributions in crypto like ETH or USDT. In this stage, community members are betting on the project’s potential, whether that’s real utility, a bold new idea, or simply the promise of future value.

2. Token Generation and Distribution

Once the sale window closes, the agreed-upon smart contract mints the tokens and sends them to contributors. This happens automatically on-chain, removing the need for a middleman. Projects typically reserve some tokens for the team, advisors, or community rewards, balancing early support with long-term incentives.

3. Listing on Exchanges

With tokens in circulation, the next milestone is getting them tradable. That could mean listing on a centralized exchange (CEX) like Binance or a decentralized one (DEX) such as Uniswap. Liquidity brings price discovery, but also volatility. Regulatory checks, technical integrations, and even the project’s reputation all influence whether and when a listing happens.

Key Components of an ICO

- Smart contracts: the backbone that enforces the sale’s rules, holds funds securely, and automates distribution.

- Tokenomics: the blueprint for supply, pricing, vesting schedules, and token utility.

- Community funding: the grassroots capital that comes directly from retail and early adopters, often forming the project’s first loyal base.

Pros and Cons of ICOs

Before participating in an ICO, it is important to consider both its potential benefits and its inherent risks.

Pros

- Early access to high-potential projects before they hit major exchanges

- Transparent, blockchain-verified fundraising

- Open to participants from most parts of the world

Cons

- Significant risk of project failure or outright fraud

- Minimal investor protections compared to traditional finance

- Regulatory gray areas in many countries

Types of ICOs (and Launch Variants)

Not all ICOs are built the same. The structure a project chooses often reflects its funding needs, the type of community it wants to build, and how quickly it hopes to get the token into circulation. Below are some of the most common formats investors might come across:

Public ICO

The most familiar version – open to anyone who meets the basic participation rules. Public ICOs are designed to reach as many contributors as possible, often relying on global marketing to attract both retail and institutional interest. One of the best-known examples is Ethereum’s 2014 ICO, which helped fund the platform long before it became a blockchain giant.

Private ICO

In contrast, private rounds are invitation-only. Typically reserved for venture capital firms, hedge funds, or high-net-worth individuals, these offerings happen before any public sale and may include discounted pricing or early access perks. Telegram’s early fundraising for its TON blockchain followed this model.

Whitelist / Community ICO

Here, participation is gated by a registration process, usually involving KYC checks or a pre-approval list. The idea is to block automated bots and reward genuine supporters with priority access. Many DeFi projects adopt this approach to keep early token distribution within their engaged community.

Fair Launch ICO

No backroom deals, no presale, no early allocations; every participant can buy tokens at the same time and under the same terms. Bitcoin’s release is the original fair launch story, but modern examples include community-first protocols like OlympusDAO.

Reverse ICO

Instead of starting from scratch, a company with an existing product or user base introduces a token to enhance or decentralize its services. In effect, it “retrofits” blockchain elements into a running business. Telegram’s halted TON project also fits this category.

ISPO / ISO (Initial Stake Pool Offering / Initial Staking Offering)

A popular innovation on the Cardano network, ISPOs let users support a project by staking existing tokens rather than investing capital directly. In return, participants earn the new project’s tokens. Both Meld and SundaeSwap used ISPOs to build momentum before any token sale took place.

Key benefits of ICOs, from cost efficiency and global investor access to flexible token structures and network-driven value creation. Source: ICO Bench

ICO vs IEO vs IDO vs STO (Comparison Table)

While ICOs remain a foundational model for token launches, alternative mechanisms have emerged to address regulatory, technical, and trust-related concerns. The table below outlines key differences between the main types of token offerings.

| Feature | ICO | IEO | IDO | STO |

| Launched via | Project website | Centralized exchange (CEX) | Decentralized exchange (DEX) | Regulated platform |

| KYC Required? | Sometimes | Always | Sometimes | Always |

| Token Type | Utility or hybrid | Utility | Utility | Security |

| Legal Oversight | Low–Medium | Medium | Low | High |

Each launch model serves different needs:

- ICOs offer independence and flexibility but come with greater risk and less oversight.

- IEOs provide credibility through exchange-led vetting but involve centralized control.

- IDOs focus on decentralization and community access, though they can be volatile and less regulated.

- STOs are fully compliant with securities laws, making them suitable for projects targeting institutional investors or operating in tightly regulated sectors.

Emerging Alternatives: The Rise of Points-Based Fundraising

While ICOs, IEOs, IDOs, and STOs still dominate the crypto fundraising landscape, a new contender is starting to gain traction – the points-based model.

Arthur Hayes, former CEO of BitMEX, highlighted the potential of points as a more adaptive and regulatory-friendly alternative. In this model, users earn points for interacting with a protocol rather than receiving tokens directly. These points may later be converted to tokens, but without a fixed vesting schedule or immediate legal implications.

According to Hayes, this structure avoids some of the regulatory burdens associated with ICOs and offers greater flexibility in token distribution. It also allows projects to incentivize real engagement while maintaining independence from venture capital. Though still experimental, points-based fundraising could become a go-to strategy for Web3 startups seeking mass adoption without immediate legal exposure.

MAXI Doge is an ICO showcasing the high-risk, high-reward culture of early-stage crypto investments. Source: MAXI Doge

At the same time, Hayes has also called for a return to the “glory days” of ICOs, not as a step backward, but as a means of restoring decentralized, retail-led innovation.

In his view, modern projects have become overly dependent on centralized exchanges and venture funding, often launching tokens with inflated valuations and limited circulating supply. ICOs, by contrast, offer permissionless access, faster token distribution via DEXs, and a more community-driven approach to fundraising.

Platforms like Pump.fun and Spot.dog, he argues, signal a revival of grassroots capital formation – one that embraces both risk and opportunity outside traditional financial rails.

ICO Pricing Models

When a project launches an ICO, one of the most important decisions is how to price its tokens. The chosen model can influence everything from fundraising speed to investor sentiment and long-term market stability. Broadly speaking, there are three common approaches:

Fixed Supply, Fixed Price

The project mints a set number of tokens and sells them at a predetermined price. This approach is straightforward and easy for investors to understand, offering predictability from day one. However, if the price is set too high or too low, it can create a mismatch between demand and supply, leading to unsold tokens or an immediate post-sale surge in secondary market prices.

Fixed Supply, Dynamic Price

Sometimes referred to as an auction model, this structure caps the total token supply but allows the price to adjust based on demand. The more buyers join in, the higher the price climbs, a mechanism seen in formats like Dutch auctions or bonding curves. It can generate competitive bidding and help the project capture more value if demand exceeds expectations.

Dynamic Supply, Fixed Price

Here, the token price remains constant, but the total supply is not fixed. The number of tokens sold depends entirely on how many investors participate. While this makes the process more inclusive (no one gets priced out due to bidding wars) it carries the risk of inflationary token economics if too many tokens are issued without matching demand for utility.

Bitcoin Hyper (HYPER) is a presale Layer 2 and meme-driven token aiming to combine high-speed transactions with the viral appeal of community-led crypto projects. Source: Bitcoin Hyper

How Many ICOs Are Successful (and How Many Fail)?

The track record of ICOs is a mixed bag with a small number becoming industry-defining successes and a much larger share fading into obscurity. Industry data paints a sobering picture:

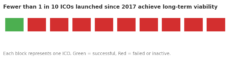

- Fewer than 1 in 10 ICOs launched since 2017 have gone on to achieve long-term viability.

- Around 45–55% collapse within their first year, either shutting down entirely, going dormant, or never managing to secure an exchange listing.

- From the boom years of 2017–2018, roughly 80% of projects are now inactive or trade with negligible liquidity.

Fewer than one in ten ICOs launched since 2017 achieve long-term success, with the vast majority collapsing or becoming inactive.

Yet the failures don’t erase the fact that a handful of ICOs have shaped the modern crypto landscape:

- Ethereum (2014). Raised $18 million and became the backbone of the smart contract economy.

- Filecoin (2017). Pulled in over $200 million to create a decentralized data storage network.

- Polkadot (2020). Secured $145 million (later relaunched) to enable cross-chain interoperability.

What set these apart wasn’t luck. They combined strong technical leadership, a clear and compelling value proposition, and the ability to rally an active, committed community, qualities that remain just as critical for ICO success in 2025.

Failure rates vary sharply by launch year, with over 75% of coins from 2014 now inactive, compared to less than 1% from 2021–2022. Source: ICO Bench

Why Some ICOs Succeed While Others Fail

The difference between a breakout ICO and one that vanishes within months often comes down to a handful of decisive factors:

- Timing the market. Launching during a bullish cycle can dramatically boost visibility and fundraising potential. In a bear market, even strong ideas may struggle to get noticed.

- Community strength. Grassroots enthusiasm often translates into staying power. Projects with active Discords, Telegram groups, or X (Twitter) engagement tend to weather market swings better than those with a passive or absent user base.

- Real product–market fit. Tokens tied to solutions that solve genuine problems or unlock new capabilities attract more sustainable interest than purely speculative plays.

- Thoughtful tokenomics. Balanced supply, clear vesting schedules, and meaningful utility encourage long-term holding rather than quick flips.

- Substance over hype. Best meme coins ICOs built solely on viral marketing may see a quick pump but rarely maintain value. By contrast, launches backed by technical merit and real-world utility often build resilience over time.

In 2025, many credible ICO teams are borrowing from structured frameworks like a16zcrypto’s “5 Rules for Token Launches”, which stress decentralization, conservative liquidity release, and strict lockup periods. These guardrails help reduce regulatory risk while preserving the long-term health of the project.

How to Evaluate ICOs and Avoid Scams

Jumping into an ICO without doing your homework is a quick way to lose money. A project’s legitimacy, transparency, and staying power can usually be gauged with a few critical checks. Think of the following as your investor’s pre-flight checklist:

Signs of a Legitimate ICO

- Audited smart contracts. Independent code reviews from reputable firms reduce the risk of security exploits and show the team takes safety seriously.

- A transparent, “doxxed” team. Founders and developers should have verifiable track records, relevant experience, and no history of shady projects.

- A clear whitepaper and roadmap. A legitimate project explains what it’s building, why it matters, and how it plans to get there – in plain language, not just buzzwords.

- Fair tokenomics. Healthy allocation models avoid dumping excessive tokens on the team or early backers, which helps prevent price manipulation later.

- Active, engaged community. Genuine conversation on Discord, Telegram, or X (Twitter) is a good sign. Dormant or bot-filled channels are not.

- No wild ROI promises. Real teams focus on delivering a product, not guaranteeing 10x returns.

Red Flags to Watch For

- Anonymous team with no history. If you can’t verify who’s behind it, assume the risk is high.

- Copy-paste content. A recycled whitepaper or a generic website is often a giveaway for rushed or dishonest launches.

- No product, no GitHub, no audit. A lack of technical transparency usually means there’s little to no real development happening.

The stakes are real. In 2024 alone, crypto investors lost over $500 million to rug pulls and memecoin scams, according to a CoinDesk report. These projects thrived on hype but delivered nothing of substance, a reminder that due diligence isn’t optional, especially when a token’s only selling point is its viral momentum.

Are ICOs Legal? A Look at Global Regulation

Whether an Initial Coin Offering (ICO) is legal depends almost entirely on where it’s launched. The deciding factor in most jurisdictions is whether the token is considered a security under local law. Some countries have embraced ICOs with clear guidelines, while others have imposed strict restrictions or outright bans.

United States

In the U.S., ICOs are allowed, but only if they comply with federal securities regulations. The Securities and Exchange Commission (SEC) treats most ICOs as securities offerings, which means they must either register or qualify for an exemption. The Howey Test is the SEC’s tool for determining if a token meets the definition of a security: an investment of money in a common enterprise with the expectation of profit from the efforts of others.

Many ICO teams attempt to navigate this by using exemptions such as Regulation D, which allows certain private placements without full SEC registration, but still comes with disclosure requirements and investor restrictions. Unregistered securities sales remain illegal, and the SEC has historically pursued enforcement actions against projects that fail to comply.

However, the regulatory tone shifted in 2025. After Donald Trump returned to the presidency, the SEC rolled back many of its enforcement actions targeting crypto projects. Lawsuits and investigations (particularly those related to token sales) were quietly dropped or put on hold, signaling a friendlier climate for digital asset ventures, according to Decrypt.

European Union

Across the EU, the regulatory picture is more unified thanks to the rollout of the Markets in Crypto-Assets (MiCA) framework. MiCA sets out licensing requirements and disclosure rules for crypto-asset issuers.

ICOs aren’t banned, but they must meet specific transparency standards, including publishing a compliant whitepaper and, in some cases, obtaining regulatory approval before launch.

Asia

Asia’s stance on ICOs is far from uniform:

- Japan: Legal but heavily regulated by the Financial Services Agency (FSA), requiring registration and adherence to investor protection measures.

- China: Completely banned, with authorities citing risks to financial stability and the potential for fraud.

- Singapore and Malaysia: Legal but generally classified as securities offerings, which means projects must comply with capital markets laws and receive approval from regulators such as the Monetary Authority of Singapore (MAS) or the Securities Commission Malaysia.

Are ICOs safe? Best Security Practices for ICOs

ICOs can be a gateway to high-potential blockchain projects, but they also carry real risks from sloppy coding to deliberate fraud. No token sale is ever completely risk-free, but certain security measures can go a long way toward protecting both the project and its investors.

For Developers: Security Measures to Build Trust

Teams that want to inspire confidence should treat security as a core part of the launch strategy, not an afterthought:

- Smart contract audits. Every contract handling contributions or token distribution should be reviewed by an independent cybersecurity firm. This helps catch exploits, logic flaws, or vulnerabilities before bad actors do.

- Multi-signature wallets. Funds should be stored in trusted crypto wallets that require multiple trusted signers for any transaction, reducing the chance of insider theft or a single compromised key draining the treasury.

- KYC and AML compliance. While controversial in some decentralized circles, implementing Know Your Customer and Anti–Money Laundering checks can lower legal risks, especially in stricter jurisdictions like the U.S. or EU.

- Robust website security. HTTPS encryption, a Web Application Firewall (WAF), and DDoS protection should be standard to prevent phishing attempts or site downtime during the sale.

- Clear refund and token claim processes. Participants need transparent instructions, ideally encoded in the smart contract, on how to claim tokens or get refunds if the sale is canceled or oversubscribed.

For Investors: What to Look For

Before sending funds, it’s worth checking:

- Publicly available smart contract audit reports from reputable firms

- Evidence of multi-sig wallets or other secure fund management practices

- A functional, well-secured website (no broken links, fake SSL certificates, or placeholder content)

- Transparent instructions for token claims and responsive support channels

- Legal disclaimers and a privacy policy that show awareness of regulatory obligations

Good security can’t guarantee a project’s success (plenty of well-audited ICOs have still failed) but it’s often a strong indicator that the team is professional, organized, and acting in good faith.

How to Find and Participage in ICOs

If you’re thinking about joining an ICO, approach it like any high-risk investment, with research, patience, and a plan. A structured process can help reduce the chance of costly mistakes.

- Research the Project. Read the whitepaper, evaluate the tokenomics, and verify the team’s background. Look for clear use cases, transparent goals, and realistic timelines.

- Set Up a Compatible Crypto Wallet. Choose a wallet that supports the token standard (e.g., ERC-20 for Ethereum-based ICOs). MetaMask, Trust Wallet, or Ledger are commonly used.

- Fund Your Wallet. Purchase crypto (typically ETH, USDT, or BNB) on a reliable exchange and transfer it to your personal wallet.

- Connect to the Project Site or Launchpad. Use the official ICO website or an affiliated launchpad. Double-check the URL to avoid phishing scams.

- Complete KYC or choose no KYC crypto exchanges. Some ICOs require identity verification before allowing participation. Follow the platform’s instructions and upload necessary documents.

- Purchase Tokens. Send funds via smart contract or web portal during the active sale window. Confirm the transaction details before finalizing.

- Store Tokens Securely. Once received, transfer your tokens to a secure wallet, ideally one with private key control or hardware-level protection.

Further Reading: See our list of current and upcoming ICOs. It includes project details, tokenomics, and participation guides.

Where Can You Trade ICO Tokens?

After an ICO concludes, tokens typically follow a multi-stage path before becoming widely tradable. The specifics depend on the project’s launch strategy, exchange partnerships, and token distribution model.

Post-ICO Token Lifecycle

- Exchange Listings. Many tokens debut on decentralized exchanges (DEXs) like Uniswap or PancakeSwap, allowing immediate peer-to-peer trading. Others may secure listings on centralized crypto exchanges (CEXs) such as Binance or Coinbase, depending on demand, compliance, and exchange criteria.

- Token Claim Portals. In some cases, participants must claim their tokens via the project’s website or launchpad portal, especially when vesting schedules or phased unlocks are in place. Tokens are not always distributed automatically.

- Vesting and Lock-up Periods. To prevent early dumping and align incentives, some projects impose vesting schedules, gradually unlocking tokens over weeks or months. Early investors or team members may face lock-up periods before they can trade.

- Liquidity and Volatility Risks. New crypto coins often experience low liquidity and high price volatility, making them susceptible to pump-and-dump schemes or sharp market corrections. Caution is advised when trading shortly after launch.

Whether a token becomes immediately tradable or enters exchanges later depends on how the project structures its release. Investors should track the official communication channels for listing announcements and token claim instructions.

Conclusion: Are ICOs Still Relevant in 2025?

Even with newer launch formats like IEOs, IDOs, and STOs making headlines, ICOs haven’t faded into history. They remain an important part of the crypto fundraising toolkit, offering flexibility, global accessibility, and a relatively low barrier to entry for projects looking to tap into a decentralized supporter base.

By 2025, the regulatory environment is slowly maturing in key markets such as the U.S. and the European Union. Still, uncertainties persist, and retail investors without deep experience in token sales continue to face both legal grey areas and security risks.

For developers, an ICO can be a powerful way to bootstrap innovation without giving up control to early institutional backers. For investors, it’s a high-risk, high-reward proposition that demands careful vetting, from scrutinizing tokenomics and verifying the team’s credentials to reading the whitepaper and understanding the applicable laws.

ICOs are very much alive in 2025. But in a landscape where hype often moves faster than regulation, caution, research, and transparency aren’t just recommended – they’re essential.

FAQ

What is an ICO?

Are ICOs legal?

What’s the difference between ICO and IDO?

Can you lose money in an ICO?

What is a reverse ICO?

Is ICO profitable?

Who funds an ICO?

Is a crypto ICO a good investment?

How many ICOs are scam?

References

- “Points Guard” is an essay on the new pseudo-ICO crypto fundraising (Arthur Hayes)

- “The Cure” is an essay about how to cure CEXually Transmitted Diseases by bringing back ICOs (Arthur Hayes)

- History of Crypto: The ICO Boom and Ethereum’s Evolution (Cointelegraph)

- Crypto Investors Lost Over $500M in Memecoin Rug Pulls and Scams in 2024 (CoinDesk)

- 5 rules for token launches (a16zcrypto)

- Trump’s SEC Is Ending Crypto Lawsuits and Investigations — These Are the Biggest (Decrypt)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

If you have been following VFX token, you probably noticed the same question popping up everywhere: when does Vortex FX token actu...

The VFX token is tied directly to Vortex FX, a regulated forex broker that’s already executing trades and publishing live trading ...

Tony Frank

Crypto Editor, 33 postsTony Frank is an accomplished cryptocurrency analyst, author, and educator whose work bridges the gap between complex blockchain technology and accessible, actionable insights for global audiences. Over the past decade, he has emerged as a respected voice in the rapidly evolving world of digital assets, combining technical expertise with a talent for storytelling to help readers navigate everything from Bitcoin’s monetary philosophy to the intricacies of decentralized finance (DeFi). Tony earned his Bachelor’s degree in Economics and Finance from the University of Melbourne, where he developed a deep interest in monetary systems and market structures. He later pursued a Master’s degree in Blockchain and Digital Currency from the University of Nicosia, one of the first academic institutions to offer accredited programs in cryptocurrency studies. Before focusing full-time on blockchain, Tony worked as a financial analyst for a multinational investment firm, covering emerging technologies and alternative asset classes. His early exposure to macroeconomic policy, global market behavior, and fintech innovation laid the foundation for his later work in crypto research and writing. Tony’s expertise spans multiple sectors of the blockchain industry, including cryptocurrency fundamentals, altcoin market cycles, DeFi and web3 trends and regulatory landscapes. Tony combines on-chain data analysis with macroeconomic research, providing readers with both the technical “how” and the market “why” of cryptocurrency movements.