SpectroCoin Is Driving Crypto Lending to Mainstream

SpectroCoin is bringing crypto lending to the mainstream and supports more coins beyond ETH.

SpectroCoin is bringing crypto lending to the mainstream and supports more coins beyond ETH.

Usually, when Bitcoin is making impressive moves, many who has FOMO may take a dive into storing up on the coin, while this may complement the recent moves, its impacts may not be long-lasting.

BTC is an asset that appears to be attracting a lot of attention to a specific class of investors. The millennials, mostly, are recognizing the pioneer cryptocurrency as an alternative safe-haven asset.

Binance’s enigmatic chief executive Changpeng Zhao (CZ) says that Central Bank digital currency is a threat to Bitcoin.

The RBI Coin will facilitate payment and interbank settlements while also helping to limit cash handling and helps different companies in the Raiffeisen banking network in liquidity management.

The blockchain technology can be relied upon as it is vast and tamper-proof, moreover, anybody can verify the data on the chain.

Over the years since its inception, USDT has provided unique services that most digital assets fall short of.

The new referral program of StormX provides a win-win opportunity for both existing as well as future users. The existing users can earn up to $1000 for each referral. On the other hand, new users will benefit from the platform’s cashback rewards system.

On Thursday, October 22nd, BTC corrected after the preceding aggressive growth; nonetheless, the market still hopes for a new wave of growth. The coin is generally trading at $12,807 USD.

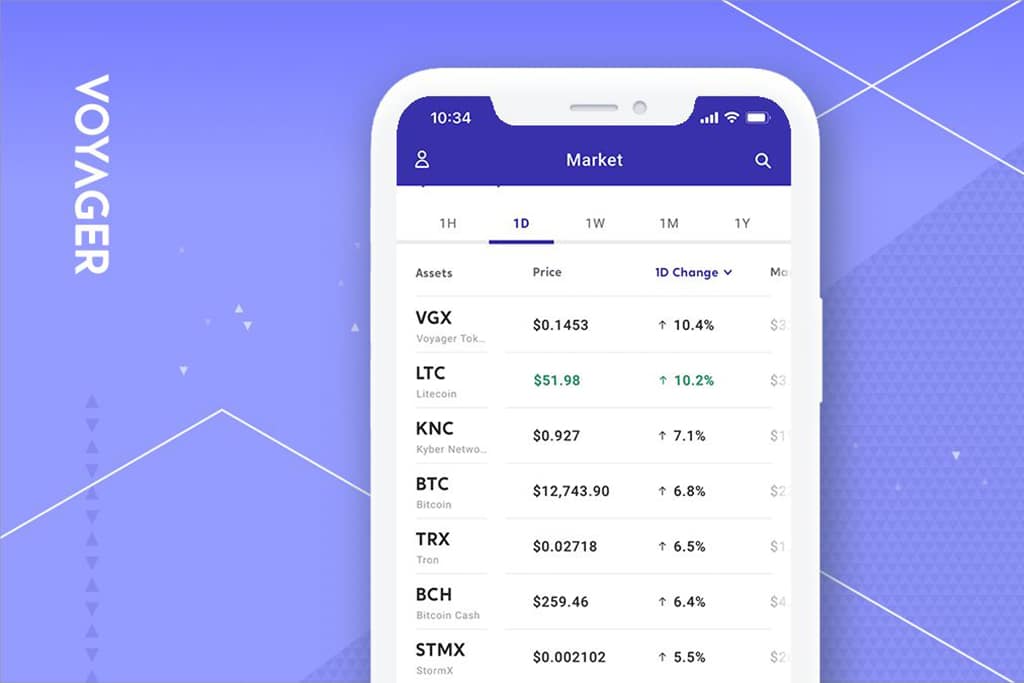

As part of the deal, the LGO and VGX token holders can swap their holdings to the new token that will come with decentralized finance (DeFi) features along with the function of staking rewards.

It has been revealed that Shares of Canada’s first publicly listed Bitcoin fund increased by 30% since its launch in April.

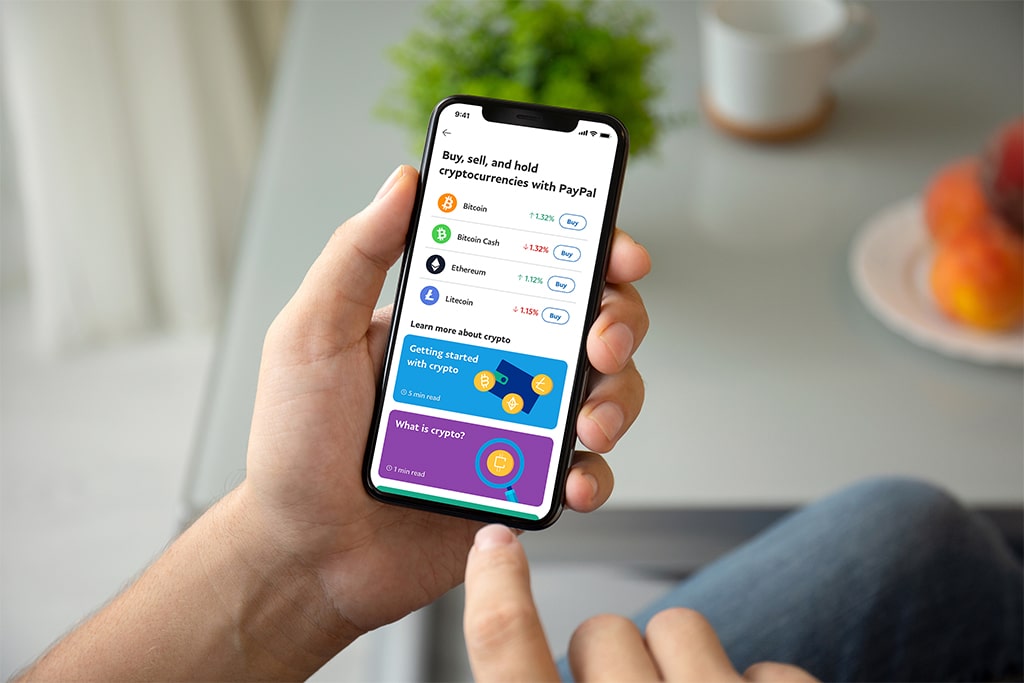

PayPal’s big announcement of offering cryptocurrency trading services has taken the financial world by storm. It’s about time that every major global bank will possibly provide support for the world’s largest cryptocurrency.

Bitcoin is remarkably popular for many reasons. While many people see it as a means of facilitating cash transactions, others have tagged it as a security with the potentials to yield great returns.

In the future, PayPal plans to work with global central banks to further tap on digital assets’ capabilities.

To promote the launch of four new trading pairs, Bybit is offering users a discount on trading fees and is running a lottery program to incentivize participation.