What Whales Are Not Telling Us About Solana (SOL), Hedera (HBAR), Ripple (XRP), and PlutoChain?

/PlutoChain/ – HBAR, XRP, and SOL have faced notable price declines recently, but what whales aren’t openly discussing is that these dips may be an opportunity in disguise. With prices lower than usual, strategic investors might be quietly accumulating, preparing for a potential upswing.

Meanwhile, PlutoChain ($PLUTO) could catch the attention of whales, offering the first hybrid Layer-2 solution that could revolutionize Bitcoin’s ecosystem. This innovation aims to integrate smart contracts and decentralized applications (dApps) into Bitcoin’s network, transforming its role within decentralized finance (DeFi).

PlutoChain Could Pave the Way for Bitcoin’s Next Evolution

Bitcoin has dominated the digital asset landscape, but its limitations in scalability and functionality have restricted its growth. PlutoChain ($PLUTO) might change that by introducing a hybrid Layer-2 solution that could enable Bitcoin to support DeFi, NFTs, and dApps.

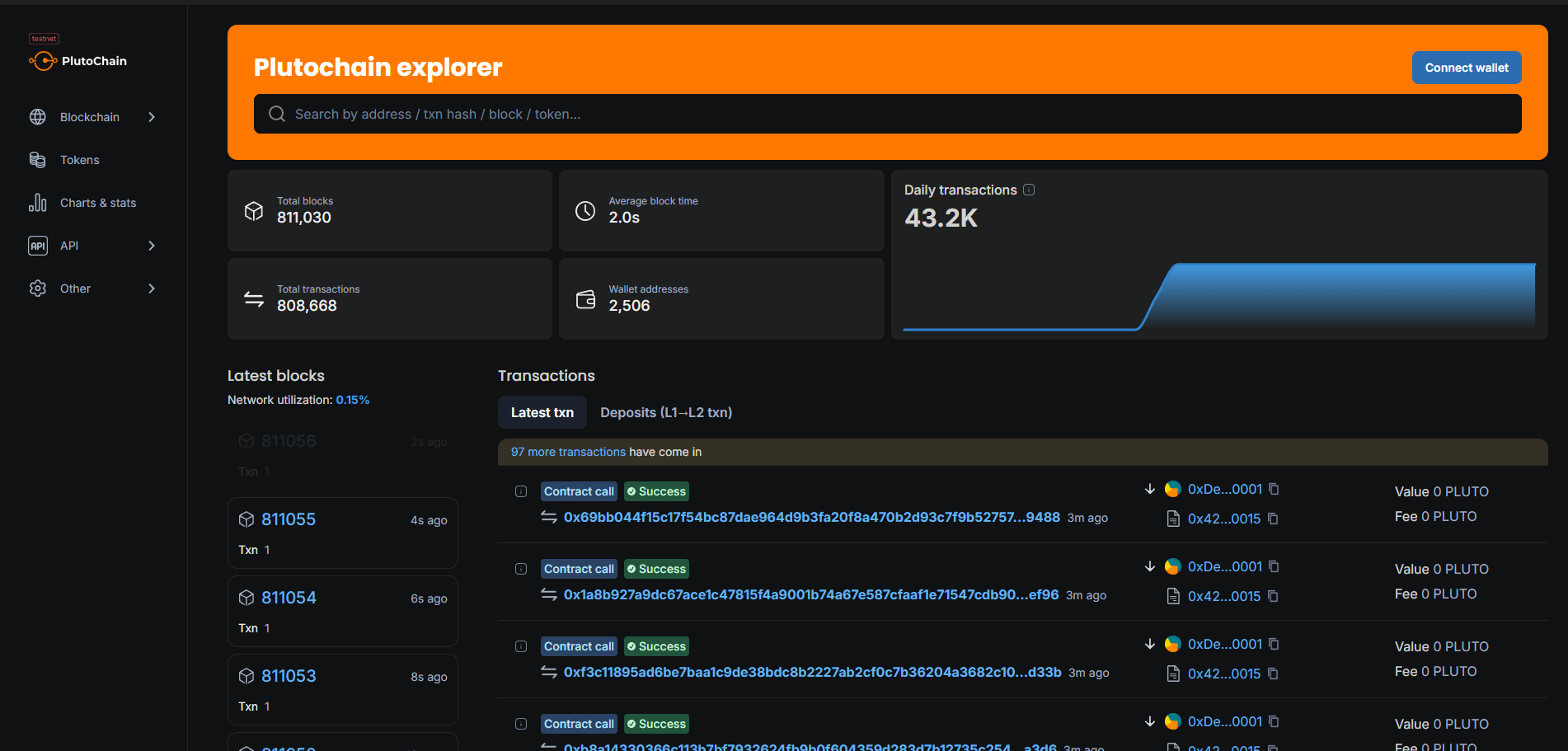

With an average block time of just two seconds, PlutoChain’s infrastructure could significantly enhance Bitcoin’s transaction speeds while reducing fees. This would be a dramatic improvement from Bitcoin’s current 10-minute block time, potentially making it a viable platform for decentralized applications.

A standout feature of PlutoChain is its Ethereum Virtual Machine (EVM) compatibility, which could allow developers to seamlessly migrate Ethereum applications to Bitcoin.

This integration could establish a direct link between Bitcoin and Ethereum, reducing dependency on networks like Solana and Cardano while fostering a robust Bitcoin-based DeFi sector.

Currently, only 0.13% of Bitcoin’s market cap is locked in DeFi, a stark contrast to Ethereum’s 10%. PlutoChain could change this dynamic by unlocking Bitcoin’s full potential.

Another key aspect of PlutoChain is its governance system, which enables users to have a say in its future development. The project has already demonstrated scalability, handling over 43,200 daily transactions during its testnet phase.

Security remains a top priority, with PlutoChain successfully passing audits from SolidProof, QuillAudits, and Assure DeFi.

By enhancing Bitcoin’s efficiency, security, and application range, PlutoChain could become a major force in blockchain innovation, moving beyond simply connecting networks to fundamentally expanding Bitcoin’s capabilities.

Solana’s Price Drop Hasn’t Deterred Whales

Solana ($SOL) has also seen a wave of whale accumulation, suggesting that major investors view the recent price drop as a prime buying opportunity. On-chain data shows that following its latest correction, whales have been shifting their holdings into SOL, potentially tightening supply and setting the stage for a future price rebound.

This confidence in Solana’s long-term value is rooted in its high-speed transactions and low fees, which continue to make it an attractive blockchain for developers and investors alike.

Is Whale Accumulation Signaling a Major Move for HBAR?

Hedera ($HBAR) has seen a surge in whale activity, with large-scale investors accumulating substantial amounts of the token. This increased interest is largely driven by Hedera’s expanding enterprise partnerships and its Hashgraph technology, which delivers fast, low-cost transactions.

Analysts speculate that this accumulation could be a precursor to a significant price movement. With growing institutional interest and increasing adoption, HBAR is being closely watched as a potential breakout asset in the next market cycle.

XRP Whales Are Unshaken by Legal Uncertainty

Despite Ripple’s prolonged legal battle with the SEC, whales continue to accumulate XRP. Recently, over 120 million XRP were scooped up during a market dip, causing a notable 6% price uptick.

Additionally, a large transfer of 300 million XRP from Binance to an unknown wallet hints at long-term holding strategies by major investors. These moves indicate that whales remain bullish on XRP’s future, regardless of regulatory uncertainty.

Final Words

Whale activity is sending strong signals across the crypto market. HBAR is seeing increased accumulation, hinting at a potential breakout. XRP remains a favorite among major investors despite ongoing legal battles, while SOL’s whale movement suggests confidence in its long-term growth.

However, PlutoChain could steal the spotlight. PlutoChain brings smart contracts, DeFi, and dApps to Bitcoin with EVM compatibility, fast transactions, and a proven testnet, positioning it as more than just another Layer-2 solution.

Please keep in mind that this article is not financial advice. All crypto tokens are volatile, and trading involves risk. Always do your own research and consult a qualified expert before joining any crypto venture. Mention of any tokens in this article does not guarantee future performance. Statements regarding the future carry risks and are not assured to be updated.

Disclaimer: This publication is sponsored. Coinspeaker does not endorse or assume responsibility for the content, accuracy, quality, advertising, products, or other materials on this web page. Readers are advised to conduct their own research before engaging with any company mentioned. Please note that the featured information is not intended as, and shall not be understood or construed as legal, tax, investment, financial, or other advice. Nothing contained on this web page constitutes a solicitation, recommendation, endorsement, or offer by Coinspeaker or any third party service provider to buy or sell any cryptoassets or other financial instruments. Crypto assets are a high-risk investment. You should consider whether you understand the possibility of losing money due to leverage. None of the material should be considered as investment advice. Coinspeaker shall not be held liable, directly or indirectly, for any damages or losses arising from the use or reliance on any content, goods, or services featured on this web page.