10 Best Crypto Exchanges for Beginners in 2025

Best Crypto Exchanges For Beginners 2025

Last Updatedby Tony Frank · 21 mins read

10 Best Crypto Exchanges for Beginners in 2025

Over 800 cryptocurrency exchanges allow users to trade popular digital assets, including Bitcoin and Ethereum, meme coins and other speculative tokens. Beginners should select an exchange that offers a user-friendly experience, supports convenient payment methods, and provides responsive customer support.

We researched the best crypto exchanges in the market and ranked the top 10 providers by core metrics. Discover which Bitcoin and altcoin exchanges offer the best service and learn how to get started in under five minutes.

The 10 Best Crypto Exchanges For Beginners in 2025

According to our extensive research, these are the best crypto exchanges for 2025:

- Best Wallet — The Overall Best Exchange for Crypto Beginners in 2025

- MEXC — Our Top Pick for Crypto Investors Who Prioritize Low Trading Fees

- Margex — The Best Option to Speculate on Crypto Futures With Leverage

- Binance — Trade Nearly 500 Coins at the World’s Largest Crypto Exchange

- CoinEx — Popular Exchange for Copy Trading Tools and Staking Rewards

- Bybit — A Feature-Rich Exchange With Diverse Markets and Trading Tools

- OKX — Tier-One Exchange With Regulated Services for U.S. Residents

- BloFin — User-Friendly Platform With Demo Trading and Small Account Minimums

- KCEX — Gain Exposure to Hundreds of High-Risk High-Return Meme Coins

- BingX — One of the Top-Rated Crypto Exchanges for Peer-to-Peer Trading

Best Bitcoin Exchanges Reviewed

Read on to explore the top 10 crypto exchanges in more detail. Learn which exchanges offer the lowest fees, the widest range of markets, and the overall best user experience.

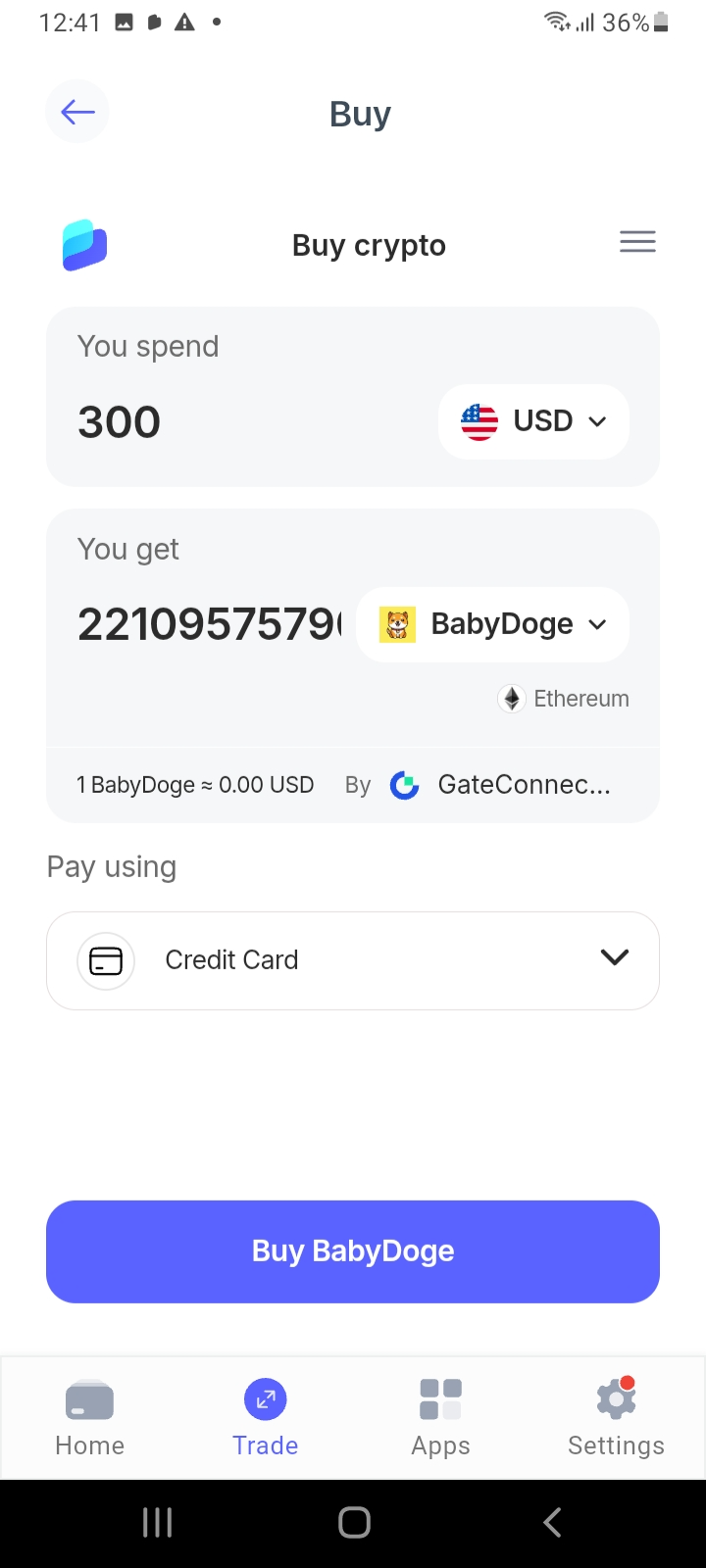

1. Best Wallet — Our Top Pick to Buy, Sell, and Trade Crypto on a User-Friendly App

Best Wallet offers a top mobile experience for crypto beginners. The app allows users to buy Bitcoin and over 1,000 other cryptocurrencies with debit/credit cards, e-wallets, and local bank transfers. The exchange doesn’t have cumbersome know-your-customer (KYC) requirements, so you can invest in digital assets instantly without needing to upload documents.

Users can swap cryptocurrencies within the mobile app — this provides access to millions of markets from popular ecosystems like Ethereum, Solana, and Base. Platform fees are built into quoted exchange rates, which Best Wallet sources from over 100 liquidity partners.

One of the standout features is that the Best Wallet app doubles as a self-custody wallet. This feature ensures cryptocurrencies are stored safely and that users transact without needing approval from third parties. The wallet and exchange offer multiple security tools, including custom PINs, biometrics, and two-factor authentication (2FA).

| No. Cryptos | 1,000+ |

| Fee to Buy Bitcoin | Sources the best market rates from liquidity partners — no additional fees |

| Proprietary Wallet | Yes — self-custody |

| Top Features | A top crypto exchange and wallet built into a mobile app. Instantly buy Bitcoin and altcoins with local payment methods. Offers a private, self-custody, and KYC-free experience. |

Pros

- The overall best crypto exchange for beginners in 2025

- Users can purchase over 1,000 digital assets with convenient payment methods

- The built-in swap tool supports millions of additional markets

- Automatically store cryptocurrencies in a self-custody wallet

- The iOS and Android apps are free to use

Cons

- No desktop software or browser extensions

- Trading fees are displayed only when the user sets up an order

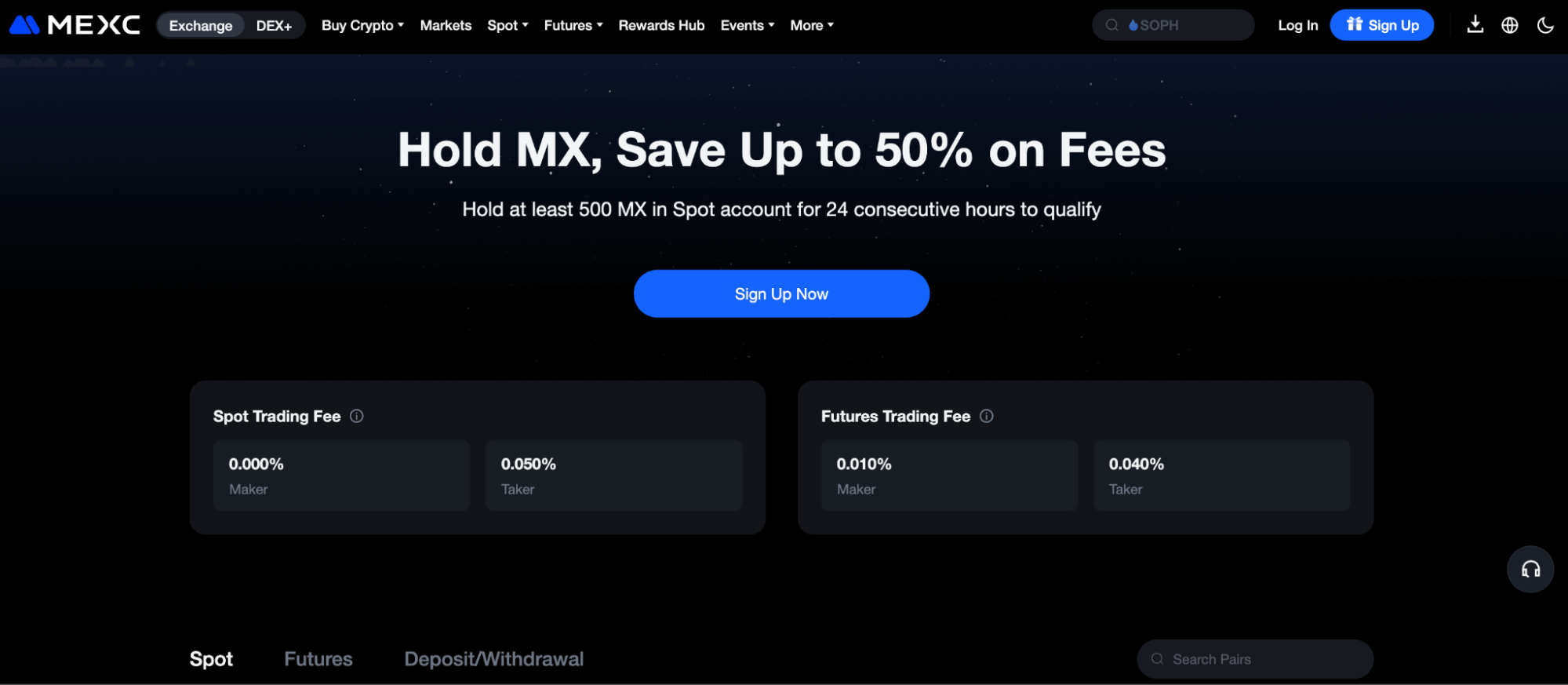

2. MEXC — The Cheapest Cryptocurrency Exchange in 2025 With Commissions Starting From 0%

MEXC is a good choice for crypto investors who prioritize low fees. Spot trading users get 0% commissions when they place limit orders, and 0.05% for market orders. The platform also supports perpetual futures — commissions are 0.01% and 0.04% for limit and market orders, respectively.

You can buy cryptocurrencies instantly with local currencies and payment methods, including Visa, MasterCard, and Google/Apple Pay. Another option is MEXC’s peer-to-peer (P2P) exchange, which supports over 100 deposit types and allows buyers to trade directly with sellers from their home country.

MEXC is one of the best crypto exchanges for supported markets, with over 4,000 trading pairs available. Markets cover the best altcoins to buy, including Ethereum, Dogecoin, Avalanche, and Solana. The exchange also provides leverage of up to 500x, offers competitive interest rates on crypto deposits, and a native app for iOS and Android.

| No. Cryptos | 4,000+ |

| Fee to Buy Bitcoin | Maximum commission of 0.05% (spot) and 0.04% (futures) |

| Proprietary Wallet | Yes — custodial |

| Top Features | The exchange lists over 4,000 crypto pairs. Trade spot and futures markets. Commission from 0% per slide. |

Pros

- The best low-cost exchange in the market

- Limit orders let users avoid spot trading commissions

- Supports a huge range of digital assets

- Users can buy cryptocurrencies with debit/credit cards and e-wallets

- The futures department offers 500x leverage on major pairs

Cons

- The built-in wallet offers custodial storage, so you don’t control private keys

- Leveraged products can lead to significant losses

3. Margex — Go Long or Short on Crypto Futures With a Minimum Margin Requirement of 1%

Margex is a derivatives exchange that offers perpetual futures on 55 markets, including the best penny cryptocurrencies like Dogecoin and Shiba Inu. Traders speculate on crypto prices without directly owning the underlying asset — they can go long or short and attempt to profit from rising and falling markets.

The exchange has a small margin requirement of just 1% on large-cap markets, so a $100 account balance is amplified to $10,000 in trading capital. Futures trading fees are 0.019% and 0.06% for market makers and takers, respectively, and funding charges apply to leveraged positions every eight hours.

Margex also lets users buy Bitcoin and other popular cryptocurrencies with fiat money. The platform supports 152 payment methods, and the minimum deposit is just $5. They can also access copy trading features, staking rewards, and educational guides on how to analyze and trade crypto.

| No. Cryptos | 55+ |

| Fee to Buy Bitcoin | Maximum commission of 0.06% |

| Proprietary Wallet | Yes — custodial |

| Top Features | Trade crypto futures with 100x leverage. Minimum debit/credit card deposit of $5. Offers a native copy trading app for iOS and Android. |

Pros

- Speculate on crypto prices with a 1% margin requirement

- Go long or short on all supported markets

- Low account minimums are ideal for beginners

- Competitive trading and payment fees

Cons

- Operates offshore without regulatory licenses

- Doesn’t accept clients from the US

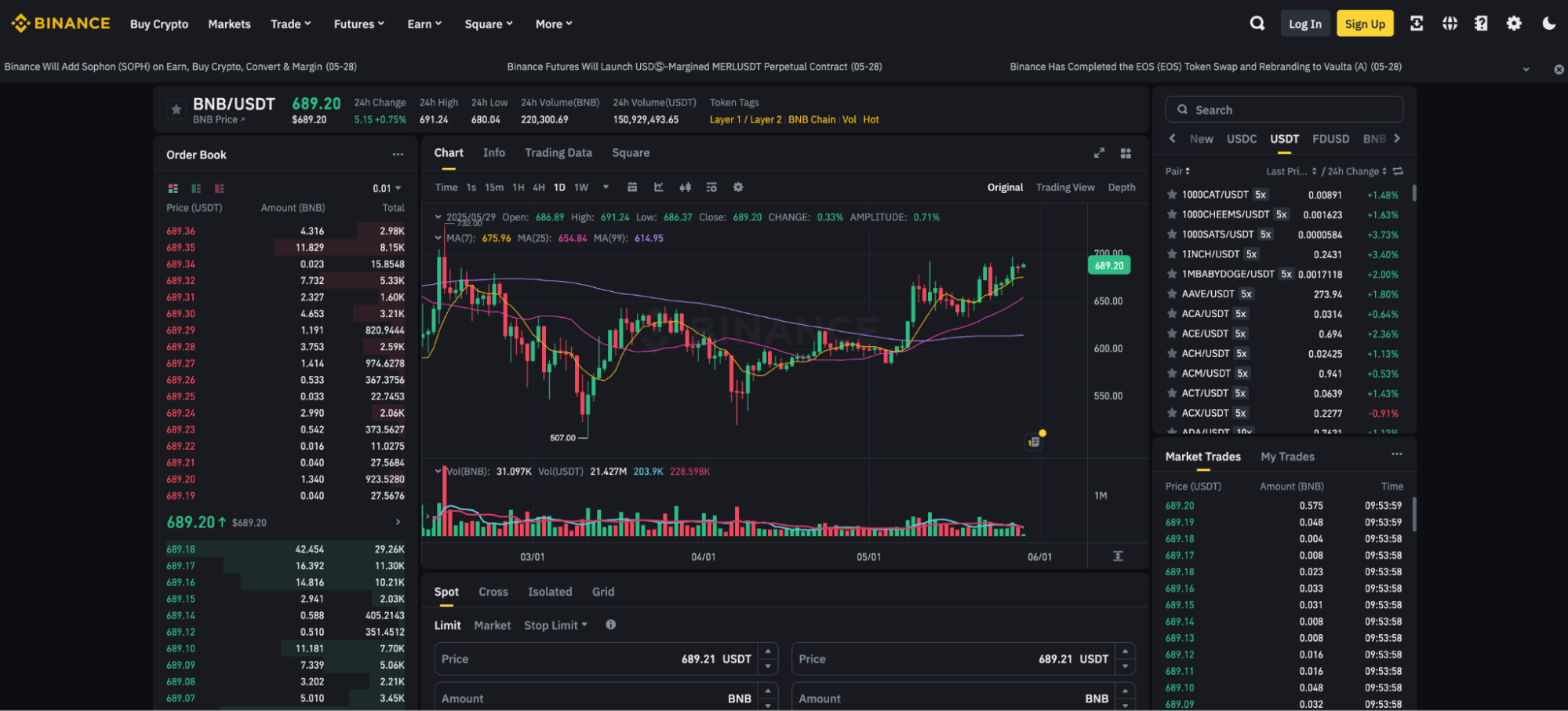

4. Binance — The Leading Bitcoin Exchange for Liquidity and Daily Trading Volumes

Binance is the most popular exchange in the market with over 275 million registered traders. It supports 500 cryptocurrencies and 2,000 markets, which cover spot trading, perpetual and delivery futures, options, and leveraged tokens. Users in some countries can buy digital assets instantly with various payment methods, including bank transfers and credit cards.

The exchange is commonly used by active day traders who seek tight spreads, deep liquidity, and access to high-level trading tools. Analysis features include technical indicators, drawing tools, and custom charting areas.

Binance is highly accessible, with desktop software for Mac, Windows, and Linux, as well as a mobile app for iOS and Android. It also offers standard browser-based trading, and all platform options connect to the same Binance account.

| No. Cryptos | 500+ |

| Fee to Buy Bitcoin | Maximum commission of 0.1% |

| Proprietary Wallet | Yes — custodial and self-custody options |

| Top Features | Attracts institutional-grade trading volumes. Supports almost 2,000 trading pairs. Offers a separate, regulated platform for US clients. |

Pros

- Charges entry-level commissions of just 0.1% per slide

- The charting dashboard is ideal for active crypto traders

- Deep liquidity ensures top market prices and spreads

- Offers a custodial and self-custody wallet

Cons

- Traders in many countries face product restrictions

- Some features are aimed at professional traders

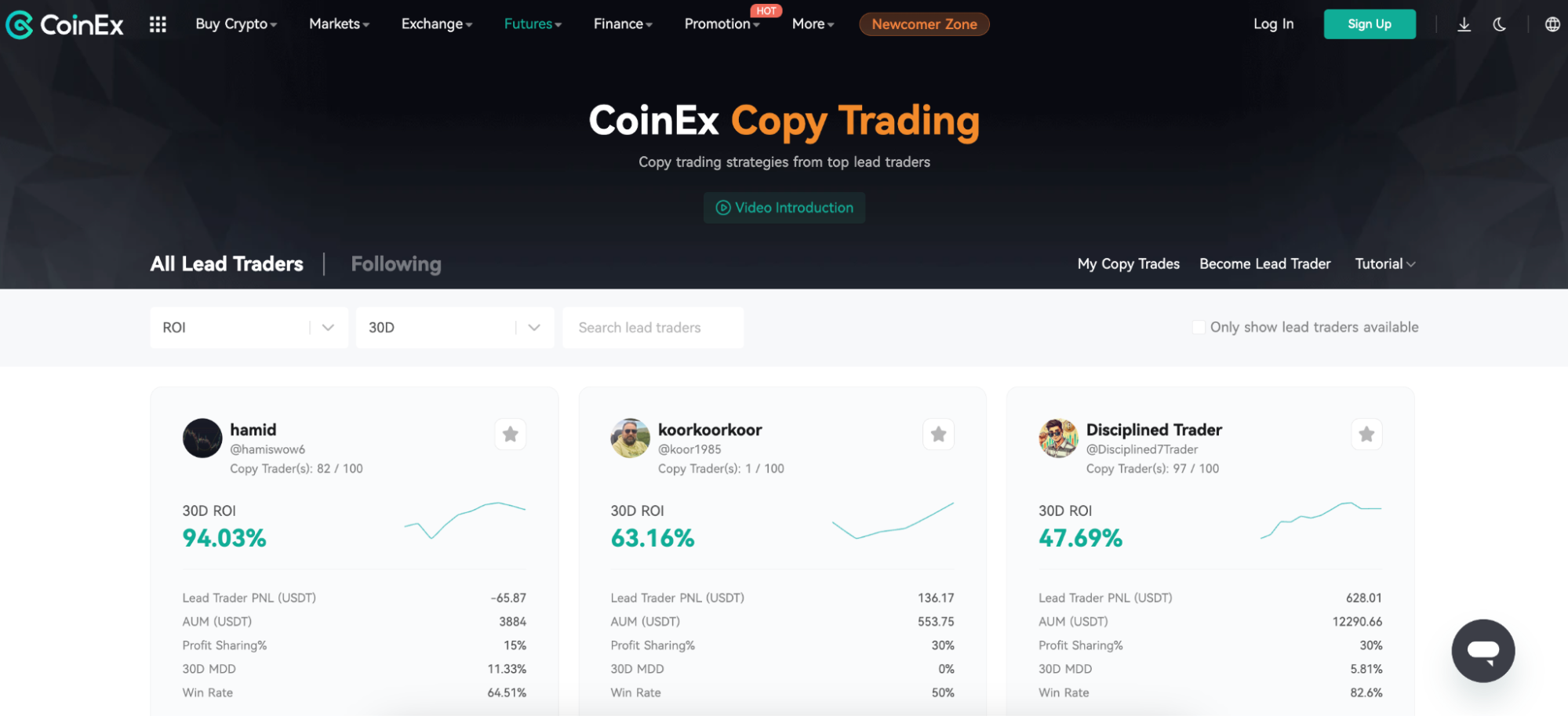

5. CoinEx — Popular Exchange for Copy Trading Tools and Staking Rewards

Launched in 2017, CoinEx supports over 1,300 cryptocurrencies, including the best meme coins like Pepe, OFFICIAL Trump, and Fartcoin.

The user-friendly platform is a great choice for accessing automated trading tools. Its copy trading feature lets investors mirror experienced pros, with buy and sell orders replicated in real-time. There are over 200 copy traders to choose from, and each specializes in perpetual futures. The copy trading tool has a profit-sharing fee that ranges from 10% to 50%.

CoinEx offers auto-invest tools that let users build custom investment strategies, such as dollar-cost averaging or buying the market dip. Users can also deploy spot grid bots, which capitalize on market fluctuations and consolidation periods.

The exchange also offers a free demo trading platform that mimics real-time market conditions. It’s a great way to learn how to trade digital assets without risking money.

| No. Cryptos | 1,300+ |

| Fee to Buy Bitcoin | Maximum commission of 0.2% |

| Proprietary Wallet | Yes — custodial |

| Top Features | Automated tools include copy trading, grid bots, and auto-invest strategies. Users can access over 1,300 coins. Earn up to 50% of trading fees when you provide liquidity. |

Pros

- The best crypto exchange platform for automated strategies

- Copy seasoned traders or deploy grid trading bots

- Earn rewards via staking and liquidity provision

- Supports over 1,300 coins

Cons

- Doesn’t hold any exchange licenses

- Wider spreads compared to tier-one platforms

- Spot trading fees are above the industry average

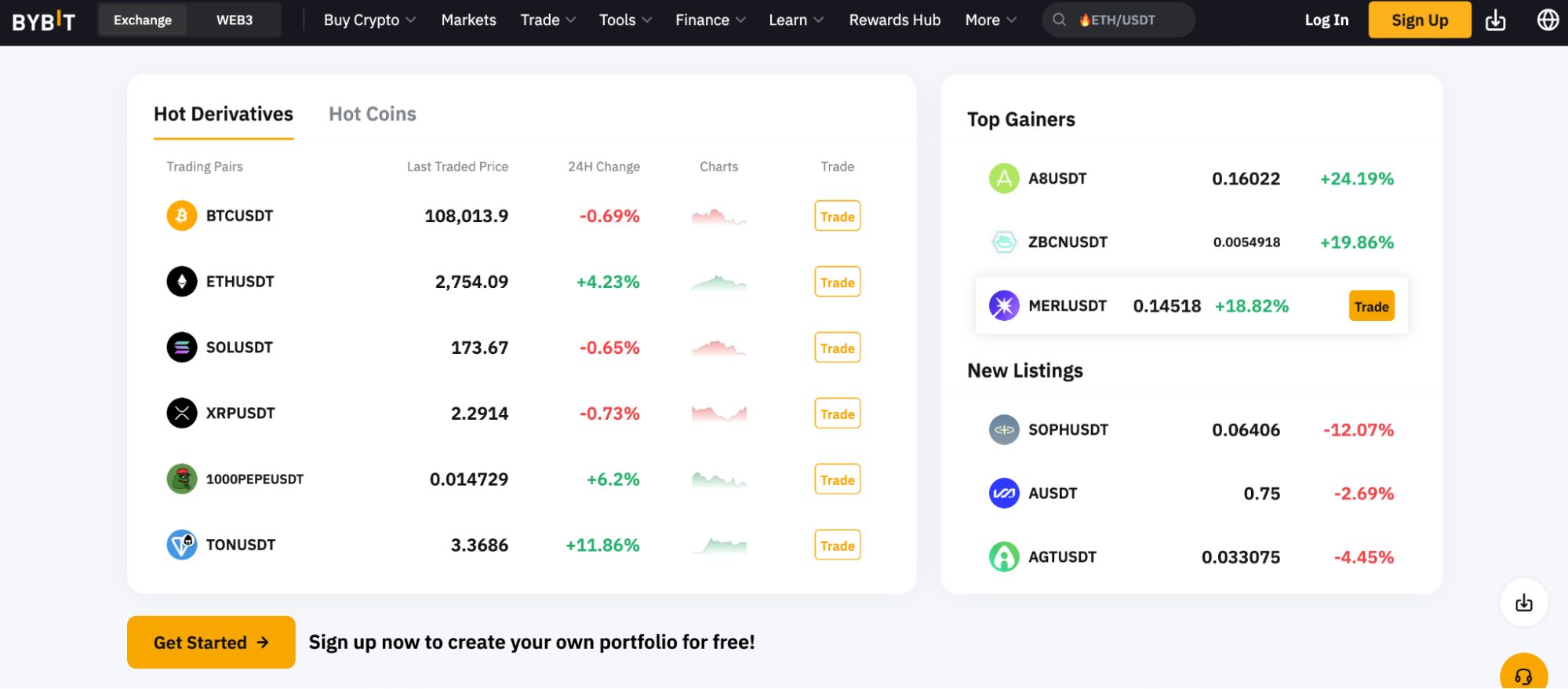

6. Bybit — Diverse Crypto Ecosystem With Advanced Analysis and Trading Features

Bybit has grown significantly in recent years — it’s now the second-largest crypto exchange for daily trading volume.

The platform offers a huge range of products, including over 1,900 listed cryptocurrencies, and derivative instruments include options, pre-market trading, and delivery futures with 200x leverage. Automated tools offer copy trading and pre-programmed bots that buy and sell digital assets 24/7.

Investors have a wide range of earning tools at their disposal, from fixed and flexible savings accounts to dual investments and liquidity mining. These products allow users to earn competitive APYs on their crypto balances.

Bybit supports fiat payments across over 60 currencies, and deposit types include Visa, MasterCard, local transfers, SEPA, and Google/Apple Pay. The P2P exchange has over 600 additional payment choices, and fees are often below the global spot price. Bybit also accepts fee-free crypto deposits with near-instant settlement.

| No. Cryptos | 1,900+ |

| Fee to Buy Bitcoin | Maximum commission of 0.1% |

| Proprietary Wallet | Yes — custodial and self-custody options |

| Top Features | Automated tools include copy trading, grid bots, and auto-invest strategies. Users can access over 1,300 coins. Earn up to 50% of trading fees when you provide liquidity. |

Pros

- One of the best crypto exchanges to earn high yields

- Passive investment products include savings accounts and liquidity mining

- Trading instruments include spot markets, futures, options, and pre-market tokens

- Offers no-KYC accounts with huge withdrawal limits

Cons

- Beginners may find the platform overwhelming

- Doesn’t accept traders from the U.S., Canada, or the UK

- The Bybit exchange was recently hacked for $1.5 billion

7. OKX — U.S.-Friendly Crypto Trading Platform With Free and Instant ACH Payments

The tier-one exchange OKX recently entered the U.S. market, allowing Americans to safely invest in cryptocurrencies in a regulated environment. The exchange supports hundreds of popular coins, from Bitcoin and Ethereum to Cardano, Arbitrum, and Dogecoin. It also supports leveraged products, but these aren’t available to U.S. clients.

U.S. residents can easily purchase digital assets via ACH transfer — transactions are instant and free. Other options include debit/credit cards from Visa and MasterCard, as well as P2P services, which offer a more extensive range of payment methods.

In terms of trading fees, makers and takers pay 0.08% and 0.1% per slide, and the platform offers discounts when users meet monthly volume milestones.

Those based outside of the U.S. can access additional features, including copy trading, automated bots, and leverage of up to 100x. OKX is also popular with institutional clients, with the platform offering over-the-counter (OTC) and custodial services.

| No. Cryptos | 350+ |

| Fee to Buy Bitcoin | Maximum commission of 0.1% |

| Proprietary Wallet | Yes — custodial and self-custody options |

| Top Features | Offers regulated crypto services for U.S. traders. Supports over 350 coins. A top-five platform for global trading volumes. |

Pros:

Pros

- One of the best crypto exchanges USA

- Free and instant ACH payments

- Users never pay more than 0.1% per slide

- Offers a self-custody wallet with instant token swaps

Cons

- Doesn’t offer leveraged products to U.S. clients

- Debit/credit card fees are higher than the market average

- Account holders must complete KYC before they can trade

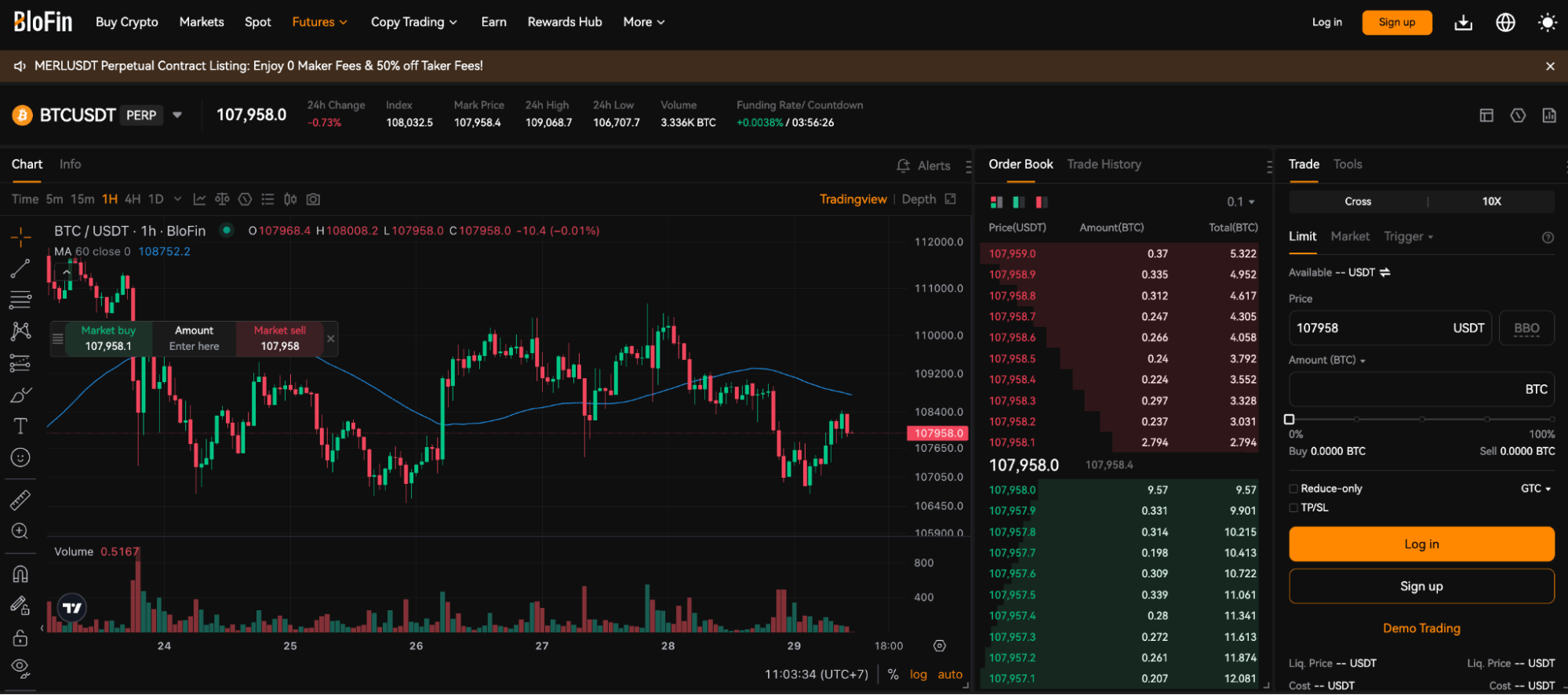

8. BloFin — Open a Free Demo Account to Master Crypto Trading

BloFin was designed with beginners in mind. The retail-friendly platform offers a free demo trading account with unlimited virtual funds and real-time market movements. Novice traders learn how to read pricing charts, use technical indicators, and place orders without risking their own funds.

The exchange also has a comprehensive education section that includes a free trading academy. Once newbies get comfortable with the BloFin platform, they can deposit real money with a debit/credit card — the minimum requirement is just $15.

BloFin is also a good choice for building long-term portfolios across a wide range of crypto markets. It supports over 470 coins, and investing categories include meme coins, DeFi, RWA, infrastructure, and GameFi. The free mobile app for iOS and Android makes portfolio management seamless, as users can buy and sell on the move.

| No. Cryptos | 470+ |

| Fee to Buy Bitcoin | Maximum commission of 0.1% |

| Proprietary Wallet | Yes — custodial |

| Top Features | Offers free demo trading accounts with unlimited funds. Educational tools include a trading academy. Get started with just $15. |

Pros

- Learn how to trade cryptocurrencies risk-free

- The demo platform comes without time limits

- Small account and trading minimums

Cons

- Advanced traders may find the platform too basic

- Copy trading tools only support perpetual futures

- Savings accounts offer low interest rates

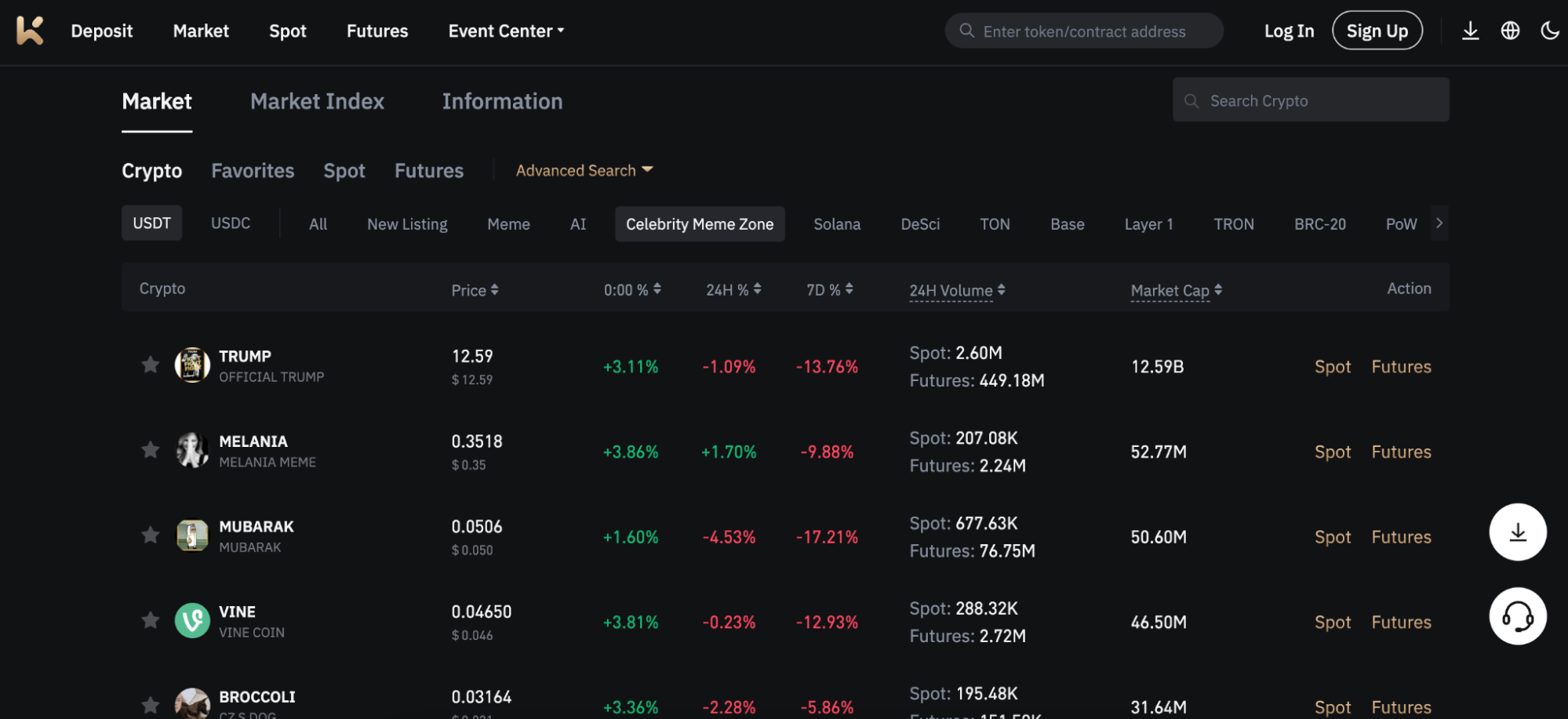

9. KCEX — The Best Crypto Platform to Trade Meme Coins With 100x Potential

KCEX is popular with crypto investors who have a high appetite for risk. The exchange supports over 350 speculative meme coins from a range of narratives, including market leaders like Dogecoin, dogwifhat, Pepe, and Bonk. It also has a dedicated section for celebrity meme coins, including those linked to Donald Trump, Melania Trump, and Dave Portnoy.

You can also trade more serious blockchain projects like Cardano, Bitcoin, Sui, Tron, and BNB, as well as top artificial intelligence (AI) coins like Render and Virtuals Protocol. All supported coins can be spot traded, and some extend to perpetual futures with various leverage caps.

KCEX also stands out in the fee department, with no commissions charged on spot trades or futures limit orders. Traders only pay fees when placing market orders on perpetual futures, and even then, it’s only 0.01% per slide.

| No. Cryptos | 870+ |

| Fee to Buy Bitcoin | Maximum commission of 0.01% |

| Proprietary Wallet | Yes — custodial |

| Top Features | Supports over 350 meme coins and hundreds of other cryptocurrencies. Only futures market orders attract commissions. |

Pros

- The best altcoin exchange for trading meme coins

- Other supported narratives include Pow, AI, and BRC-20

- New customers can register with an email or a mobile number only

Cons

- The mobile browser website is a bit clunky

- A better fit for short-term speculators than long-term holders

- It isn’t regulated by any government authorities

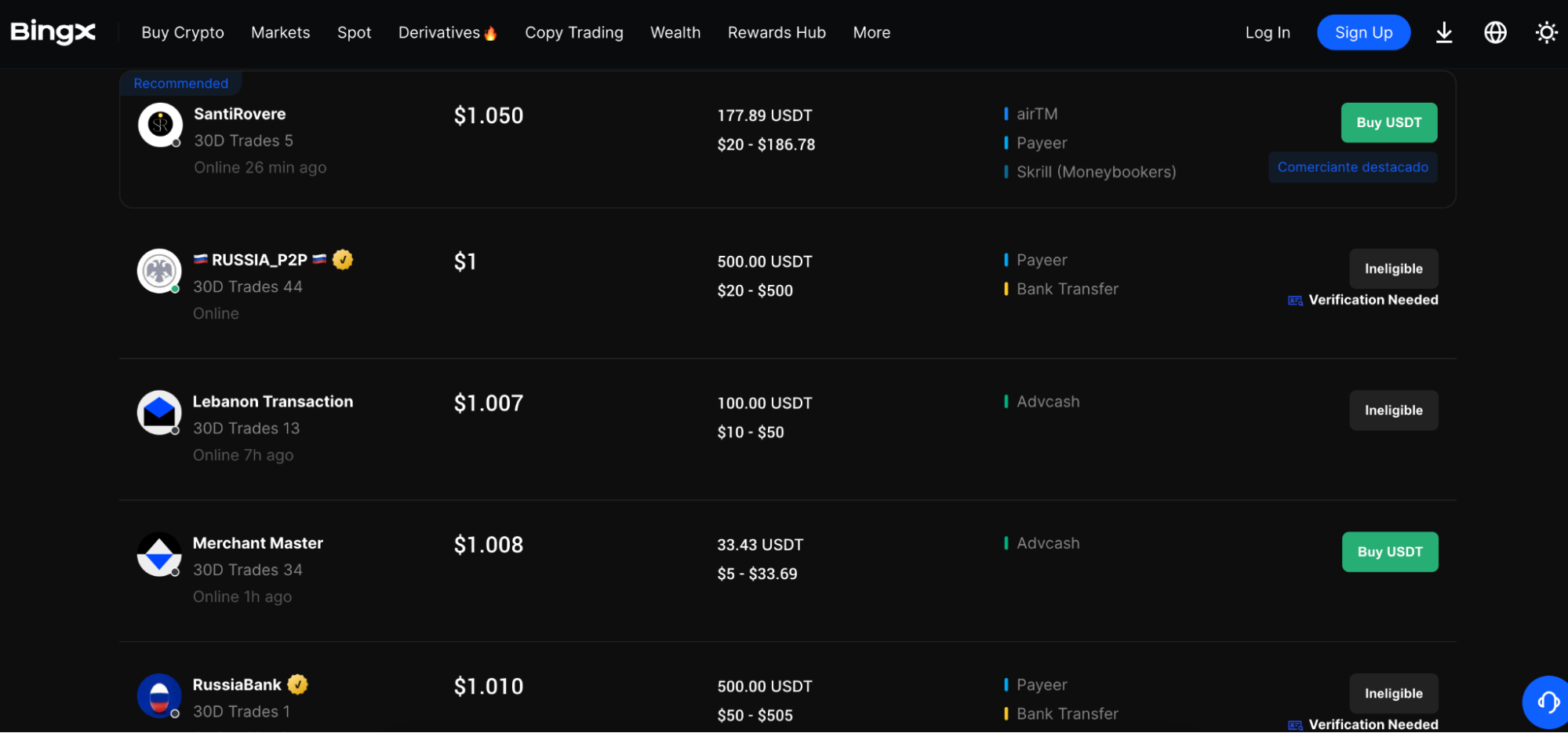

10. BingX — Buy Cryptocurrencies With 300+ Payment Types and 65+ Currencies

In addition to spot and futures trading, BingX offers a P2P exchange that supports over 300 payment methods, including local transfers and e-wallets. P2P traders can buy USDT in over 65 fiat currencies, and many sellers have small minimum requirements of just $5. The exchange ensures safety through a P2P escrow system, to which sellers transfer funds before the buyer makes payment.

Account holders can also use the instant buy feature to purchase cryptocurrencies with Visa or MasterCard. Instant and fee-free bank transfers are available in select regions, including Europe and Australia.

After depositing funds, traders can access over 1,000 trading markets at commissions of just 0.1% per slide. Those who meet the platform’s VIP requirements get lower trading fees and higher limits.

| No. Cryptos | 1,000+ |

| Fee to Buy Bitcoin | Maximum commission of 0.1% |

| Proprietary Wallet | Yes — custodial |

| Top Features | One of the best crypto exchanges for P2P trading. Purchase USDT with over 300 payment methods. Offers fee-free bank transfers in some regions. |

Pros

- A top-rated P2P exchange that supports over 65 currencies

- Competitive exchange rates and fast settlement times

- The primary exchange lists over 1,000 coins

Cons

- Debit/credit card fees are often 3% or more

- The platform isn’t available in the U.S.

- Low leverage limits on lower-cap futures markets

How We Ranked The 10 Best Cryptocurrency Exchanges

Our list of crypto exchanges was ranked based on these research metrics:

- Regulation: Licensed and regulated exchanges offer the safest investing experience.

- Tradable Cryptos: Having access to a wide range of crypto markets lets investors build diversified portfolios.

- Fees: We prioritized crypto exchanges with low commissions and competitive deposit and withdrawal fees.

- Wallet: Top platforms offer a built-in wallet for safe crypto storage.

- Tools & Features: Copy trading, demo accounts, automated bots, technical indicators, and other features help traders navigate the crypto markets.

- Payment Methods: Beginners typically need to deposit local currency when investing for the first time — popular exchange methods include Visa, MasterCard, and e-wallets.

- Customer Service: The best crypto exchanges offer 24/7 support via live chat and fast response times.

- Mobile App: An intuitive mobile app for iOS and Android ensures traders can buy and sell cryptocurrencies on the move.

Our Methodology When Reviewing Crypto Exchanges

We tested 100+ crypto exchanges, including deposits, trading, core features, and withdrawals. We evaluated each platform on desktop and mobile devices to assess the overall user experience. The team then analyzed key variables by their importance, starting with safety, licensing, and security features like 2FA, proof of reserves, and cold storage.

Our ranking system then researched secondary metrics like supported markets and products, account minimums, payment methods, and commissions. We included a crypto exchange for all investor profiles, from complete beginners to seasoned pros.

What is a Cryptocurrency Exchange?

A cryptocurrency exchange enables investors to buy and sell digital assets like Bitcoin.

Some platforms allow users to purchase cryptocurrencies instantly with popular payment methods like debit/credit cards, while others offer spot trading and futures markets. Exchanges make money from trading commissions and payment fees, similar to traditional brokerages.

How do Crypto Exchanges Work?

Users must open an account to get started with a crypto exchange, which may require personal information and ID documents. Some exchanges offer a KYC-free experience, so users can register with an email address or mobile number only.

To buy cryptocurrencies, investors usually use a debit/credit card and other popular deposit methods. It’s also possible to trade coins on exchanges, such as Bitcoin for XRP or Ethereum for Cardano. Traders must place limit or market orders, which attract trading commissions.

Experts recommend withdrawing digital assets from an exchange to reduce counterparty risks — keeping them in a self-custody wallet like Best Wallet is the safer option.

Are Crypto Exchanges Safe to Use?

Established and reputable crypto exchanges offer a safe experience. The top platforms handle billions of dollars in daily trading volumes, so they employ institutional-grade security systems. Safety controls often include cold storage wallets with multi-sig permissions, 2FA, biometrics, and whitelisted devices and IP addresses. Proof-of-reserves are important, too, as they ensure exchanges have sufficient reserves to cover customer balances.

However, exchanges also present counterparty risks like hacks, fraud, and client-fund mismanagement, which is why experts recommend keeping investments in a private wallet. Using a regulated exchange is also advised — these platforms are overseen by government authorities and adhere to licensing guidelines and audits.

How to Choose a Legit Crypto Exchange

Follow these best practices to ensure you’re using a legitimate Bitcoin exchange:

- Assess Trading Volumes and Users: The best crypto exchanges attract significant volumes, with OKX, Binance, and MEXC users trading billions of dollars every day. These platforms have millions of active traders and an overall solid reputation.

- Evaluate Account Security Features: Legitimate platforms offer a wealth of account security tools, from 2FA and device whitelisting to withdrawal time locks.

- Cold Storage: Exchanges should keep the vast majority (95%+) of client-owned cryptocurrencies in cold storage wallets. This security system mitigates the risks of remote hacks.

- Check Proof of Reserves: Since the FTX bankruptcy, proof of reserves has become the industry norm. Ensure reserves have been audited by reputable companies and that they’re held in liquid assets like Bitcoin and USDT.

How Do Crypto Exchange Fees Work?

The most popular crypto exchanges charge commissions when users buy and sell assets. 0.1% per slide is the industry average, and the commission is multiplied by the position size. Platforms also make money from the spread — this is the difference between the bid and ask prices of the respective trading pair.

Exchange users also pay deposit fees, with fiat payments being the most costly transaction (they average 3-5%).

Derivative products like futures and options attract funding rates, often charged every eight hours, and they’re multiplied by the full leveraged amount.

Ultimately, investors should assess all potential fees when exploring the best crypto exchanges — reputable platforms display their fee schedule to ensure transparency.

How to Use a Cryptocurrency Exchange in 2025

This section explains how to buy cryptocurrencies on the Best Wallet app — our overall top pick for beginners.

- Step 1: Download the iOS or Android App: Go to the Best Wallet website and download its mobile app.

- Step 2: Secure the App: Activate all security features before you buy digital assets, including biometrics and 2FA. Write down the 12-word backup passphrase in case you lose your smartphone.

- Step 3: Choose a Crypto to Buy: Best Wallet supports the best cryptocurrencies to buy, with over 1,000 markets available. Tap “Trade” and “Buy” to explore the app’s supported assets.

- Step 4: Enter the Purchase Requirements: After choosing a coin, select the currency and payment method, and type in the purchase amount.

- Step 5: Complete Payment: The app redirects you to the final confirmation screen — check everything is correct, enter the payment details, and confirm the order. The purchased coins will appear in your wallet balance almost instantly.

- Step 6: Store Crypto: Best Wallet is also a self-custody wallet, so you can store your cryptocurrencies safely until you decide to cash out.

Conclusion

After extensive research, we rank Best Wallet as the best cryptocurrency exchange app for 2025. Best Wallet is both an exchange and a self-custody wallet, making it a great choice for buying, selling, and storing cryptocurrencies in one safe place.

The iOS and Android app is user-friendly, and it supports over 1,000 coins, including Bitcoin and Ethereum. Investing in cryptocurrencies takes less than two minutes, as Best Wallet doesn’t request personal information or ID documents.

References

FAQ

Which cryptocurrency exchange is best?

Enter the answer in FBest Wallet is the overall best cryptocurrency exchange. The app offers over 1,000 markets, anonymous fiat payments, instant token swaps, and a non-custodial wallet for safe storage. .A.Q

What is the safest crypto exchange?

Experts consider Gemini as the safest crypto exchange for its robust regulatory framework and institutional-grade security, yet its high fees and extensive KYC processes are a drawback for many investors.

Which crypto exchange has never been hacked?

Best Wallet’s built-in exchange has never been hacked, thanks to its non-custodial and decentralized framework. Exchange users control their own private keys, which mitigates counterparty risks.

What is the most trusted site to buy crypto?

MEXC and Binance are trusted sites to buy cryptocurrencies — these platforms are used by millions of traders every day. Best Wallet and Margex are also trusted by the broader market.

How to know if a crypto exchange is safe?

Safe crypto exchanges are regulated and licensed, and offer security features like 2FA and whitelisting. Look for audited proof-of-reserves that are held in liquid assets and assess reviews from existing users.

What happens if a crypto exchange goes bust?

If an exchange goes bust, client-owned funds may be used to settle creditor debts, although this depends on the platform’s structure and jurisdiction. Avoid keeping large amounts in exchange accounts and instead store cryptocurrencies in a self-custody wallet.

Looking for the best Solana meme coins to buy in 2025? Discover top-performing tokens like Solaxy, Official Trump, and BONK with h...

Bitcoin Hyper ($HYPER) is a presale Layer 2 token combining meme appeal with DeFi utility. Powered by Solana VM and priced at $0.0...