Tim Draper calls the SEC decision preemptory and too far-reaching and says regulation for the sale of coins to investors needs to be light.

The Securities and Exchange Commission (SEC) has informed market participants that Initial Coin Offerings (ICOs) are subject to the same requirements of the federal securities laws as traditional securities sales. The Report of Investigation recently published by the SEC underlines the necessity to register offers and sales of distributed ledger or blockchain technology-based securities as well as securities exchanges providing for trading in these securities unless they are subject to exempt.

The announcement has generated some excitement in crypto community.

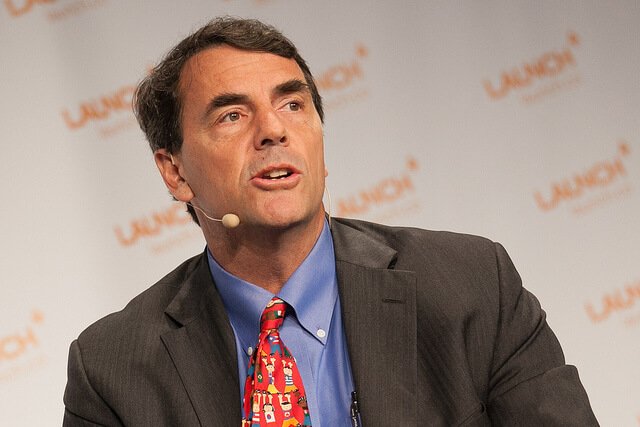

Tim Draper, venture capitalist and a founder of Draper Associates and Draper University, commented on the SEC decision having published an open letter to the SEC via Facebook.

Draper called the decision preemptory and too far-reaching. He thinks it is much more rational to exempt tokens issued prior to October 30 of this year as non-security instruments. It apparently concerns his own ICO of Bancor that is expected to inspire a sense of innovation in a land of opportunity.

Draper agrees to some regulation

Draper says rational, still light regulation is necessary for the sale of coins to investors. Before the SEC announced its decision, the idea of regulation had been up in the air among other investment groups.

Draper has come up with a number of guidelines to manage the status of tokens as securities:

- Registration with the SEC is obligatory if a token is intended for investment and revenue goes to company development

- Registration with the SEC is not needed if a token is intended for societal transformation and revenue goes to the support and development of the token

The SEC’s Office of Investor Education and Advocacy has also issued an investor bulletin intended to inform investors about necessary protection that federal securities laws provide if virtual coins or tokens are securities. Investors should be aware of red flags of investment fraud bearing in mind that new technologies may be used to violate investment schemes.

Tim Draper won his first 2,000 bitcoins at the auction organized by the US Marshals Service back in 2014.

Most recently, Draper supported a new token called Credo having bought 10% of all Credo tokens in the ICO. Credo is designed to tackle the problems of email spam, which cost the global economy around $20 billion per year. “Token offerings allow entrepreneurs a new way to transform society. They are doing everything from banking the unbanked to streamlining how people transact business to helping secure people’s identities. Credos solve the SPAM problem, allowing legitimate advertisers to pay to connect, while allowing people to put value on their time and attention”, he said.

Earlier, Draper invested in Skype, Baidu, Hotmail, and Tesla Motors.