Identifying the best crypto to mine in 2026 depends on your hardware, electricity costs, and risk tolerance.

Explore the top crypto copy trading platforms in 2026, based on our research into fees, supported assets, and trader performance data.

According to our research combining on-chain trading data, investor surveys, and platform performance metrics, Binance, Bybit, and OKX stand out as the best crypto copy trading platforms in 2026.

These exchanges offer a wide selection of proven traders to follow, competitive fee structures, and intuitive tools that let beginners mirror experienced investors in minutes. The copy trading market has grown sharply this year, with rising retail adoption and stronger performance transparency attracting new participants.

For those seeking a passive, data-driven way to gain exposure to Bitcoin and other crypto assets, these platforms provide a compelling balance of accessibility, asset variety, and risk management features.

Key Takeaways for Crypto Copy Trading Platforms

- MEXC offers the industry’s largest copy trading pool with over 21,000 verified traders and access to 4,000+ markets.

- Binance hosts more than 2,300 spot traders and supports nearly 2,000 crypto pairs with institutional-grade liquidity.

- Margex specializes in perpetual futures with leverage up to 100x and its Smart Follow feature for identical trade execution.

- BloFin provides no-KYC copy trading with daily withdrawals up to 20,000 USDT and 980+ traders to follow.

- OKX stands out for its automated trading bots, offering hundreds of 24/7 strategies alongside traditional copy trading.

The Top 10 Crypto Copy Trading Platforms in a Nutshell

Listed below are the best crypto copy trading platforms for 2026:

- Binance – The World’s Largest Crypto Exchange With 2,300+ Spot Traders to Copy

- Bybit – Leading Derivatives Exchange With 750+ Markets and Advanced Copy Trading

- OKX – A Great Choice for Copying Automated Crypto Bots Around the Clock

- BingX – Social Exchange With Flexible Copy Trading for Spot and Futures

- Crypto.com – All-in-One Crypto Platform with Strong Mobile Focus

- MEXC – Our Overall Top Pick for Copy Trading Cryptocurrencies in 2026

- Margex – The Best Option for Copy Trading Perpetual Futures With 100x Leverage

- BloFin – No-KYC Copy Trading With Daily Withdrawals of up to 20,000 USDT

- PrimeXBT – Multi-Asset Trading Platform With Crypto, Forex, and Commodities

- CoinEx – One of the Best Copy Trading Sites for Gaining Exposure to Meme Coins

Reviewing the 10 Best Crypto Copy Trading Platforms in 2026

Multiple factors determine whether copy trading is profitable, including the range of supported traders and their preferred markets, strategies, and risk tolerance.

Platform variables matter too, from available digital assets, leverage, commissions, spreads, and deposit methods.

Let’s explore the top platforms in more detail. Read on to answer the question: What is the best platform to trade crypto?

1. Binance – Choose From Over 2,300+ Verified Spot Market Traders

Binance, with over 270 million users and $8.4 trillion in total volume for Q1 2025, offers a highly comprehensive copy trading platform. The exchange hosts over 2,300 traders who specialize in the spot markets, a great option for those who want to avoid high-risk, leveraged products like perpetual futures.

The copy trading dashboard is clear and user-friendly. Users can find traders by the ROI, Sharpe Ratio, assets under management, and other key filters. The top traders charge 10% in profit-sharing fees, and investors also pay standard commissions of 0.1% per slide.

Binance’s Spot Copy Trading interface allows users to follow top-performing traders, view ROI and portfolio metrics, and copy trades with a single click. Source: Binance

Binance’s spot trading platform supports nearly 2,000 crypto pairs, including many of the most popular meme coins. It also offers automated trading bots, which are also passive investing tools, but unlike copy trading, you mirror algorithms that operate 24/7.

While users in some countries can deposit funds with debit/credit cards, non-supported regions can use Binance’s peer-to-peer (P2P) platform. If you prefer other exchanges, check our list of the best P2P platforms.

| Copy Trading Pool | 2,300+ |

| Markets | 2,000+ |

| Copy Trading Instrument | Spot and perpetual futures |

| Fees | Profit share (set by traders) and standard trading commissions |

| Mobile App | Yes |

| Suitable For | Beginners & Intermediate Traders |

Pros:

- A great option to copy traders from the spot markets

- Offers almost 2,000 spot trading pairs

- Also supports futures trading with high leverage

- Provides access to institutional-grade liquidity and tight spreads

- Pay a maximum commission of 0.1% per slide

Cons:

- Copy trading features aren’t available in all countries

- Some nationalities can only deposit fiat money on the P2P exchange

2. Bybit – Advanced Derivatives Exchange with 750+ Markets

Bybit has become one of the leading derivatives exchanges, offering over 750 markets across crypto futures and perpetual contracts. Its copy trading platform allows beginners to follow seasoned Master Traders, while advanced users can access detailed analytics, execution reports, and flexible margin settings.

Profit-sharing typically ranges between 10% and 15%, and followers also pay standard trading commissions.

Bybit’s copy trading dashboard highlights top traders, performance metrics, and both Classic and Pro modes. Source: Bybit

Bybit’s strength lies in derivatives copy trading, making it well-suited for users who want exposure to perpetual futures with high leverage. In addition, the exchange supports grid bots and other automated tools that provide 24/7 passive investing options.

| Copy Trading Pool | 300+ |

| Markets | 750+ |

| Copy Trading Instrument | Perpetual futures and trading bots |

| Fees | Profit share (10-15%) and trading commissions |

| Mobile App | Yes |

| Suitable For | Intermediate & Advanced Futures Traders |

Pros:

- Wide selection of perpetual contracts across major cryptos

- Master Trader leaderboard with transparent ROI data

- Advanced risk management and order types

- Supports both manual and automated copy trading

Cons:

- Smaller copy trading pool than Binance or MEXC

- Higher risk due to focus on leveraged futures

3. OKX – Mirror an Automated Crypto Copy Trading Bot 24 Hours Per Day

Launched in 2017, OKX is a regulated crypto exchange with over 20 million users. It provides traders with deep liquidity, tight spreads, and a full suite of analysis tools.

Although the platform offers traditional copy trading services, OKX is also a market leader for automated trading bots. Investors use bots to enjoy a passive experience 24 hours per day, seven days per week. Bots are pre-programmed and, unlike human copy traders, don’t suffer from fatigue or trading emotions.

The exchange supports hundreds of bot strategies, ranging from grid snipers and swing trading to arbitrage and HODL. There are also smart recurring bots that automatically buy cryptocurrencies at market dips.

OKX’s Trading Bots page showcases automated strategies, including grid, DCA, arbitrage, and signal bots. Source: OKX

In addition to over 1,000 spot markets, OKX also supports a wide range of derivative products, including almost 300 perpetual and delivery futures.

There are no fees when users copy automated bots; users only cover the standard commissions of 0.1% per slide for spot trading or 0.05% for derivative contracts.

| Copy Trading Pool | 590+ |

| Markets | 1,300+ |

| Copy Trading Instrument | Spot, perpetual futures, and delivery futures |

| Fees | Standard trading commissions only |

| Mobile App | Yes |

| Suitable For | Beginners & Advanced Traders |

Pros:

- The best crypto copy trading platform for automated bots

- Bot trading strategies include martingale, arbitrage, and swing trading

- No additional fees to copy bots, standard commissions only

Cons:

- All accounts must complete KYC verification

- Debit/credit card payments average 2-3%

- Some trading features are a better fit for experienced pros

4. BingX – Social Exchange with Flexible Copy Trading

BingX is a social trading exchange with over 5,000 copy traders and support for both spot and futures markets. Its copy trading feature is designed for accessibility, enabling users to mirror trades with either a fixed margin or position ratio.

This flexibility helps beginners manage risk more easily, while experienced investors can diversify across multiple strategies.

BingX offers trading bonuses and vouchers that can be applied to futures positions. Source: BingX

The platform supports leverage up to 150x on perpetual futures, with profit-sharing fees set individually by traders. BingX also emphasizes community-driven investing, offering social features such as trader profiles, rankings, and transparent performance metrics.

| Copy Trading Pool | 5,000+ |

| Markets | Hundreds (spot & futures) |

| Copy Trading Instrument | Spot and perpetual futures |

| Fees | Profit share (set by traders) and standard commissions |

| Mobile App | Yes |

| Suitable For | Beginners & Intermediate Traders |

Pros:

- Large and diverse pool of traders to follow

- Flexible copy trading modes (fixed margin or position ratio)

- High leverage options for advanced traders

- Social trading features with detailed trader stats

Cons:

- Less regulatory oversight than tier-one exchanges

- Profit-sharing fees vary widely by trader

5. Crypto.com – All-in-One Crypto Platform with Strong Mobile Focus

Crypto.com is a well-established crypto exchange that offers spot trading, derivatives, staking, and a wide range of crypto-related financial services, positioning itself as an all-in-one ecosystem combining trading, payments, and rewards under one brand.

Instead of traditional profit-sharing models, strategy leaders trade their own capital while followers mirror positions automatically, paying standard trading fees. This structure removes performance fees but places greater emphasis on transparency, with detailed metrics such as ROI, drawdowns, and historical performance available before following a trader.

Crypto.com’s copy trading tools are deeply integrated into its mobile app, allowing users to discover, follow, and manage strategies directly from their phones. Source: Crypto.com

The platform is particularly appealing to beginners exploring copy trading for the first time, thanks to its clean interface and simplified strategy selection. While advanced traders may find fewer customization options compared to dedicated copy trading platforms, Crypto.com prioritizes ease of use and risk visibility over complexity.

| Copy Trading Pool | Not publicly available |

| Markets | Hundreds (spot & futures) |

| Copy Trading Instrument | Spot and perpetual futures |

| Fees | Standard fees |

| Mobile App | Yes |

| Suitable For | Beginners & Intermediate Traders |

Pros:

- Built-in copy trading with transparent strategy metrics

- No profit-sharing fees for copied trades

- Seamless mobile-first experience

- Part of a broader crypto ecosystem with staking and rewards

Cons:

- Fewer advanced controls than dedicated copy trading exchanges

- Smaller strategy selection compared to copy-trading-first platforms

- Futures tools less aggressive than high-leverage competitors

6. MEXC – The Best Place to Copy Seasoned Crypto Investors in 2026

MEXC is a tier-one crypto exchange with thousands of markets and a quick sign-up process. It offers the largest crypto copy trading pool in the market, having facilitated over 2 million positions for more than 50,000 investors.

MEXC lists the top traders to copy by various metrics, including the highest return on investment (ROI), total followers, and overall profit and loss. Clicking a trader reveals significant insights like daily trading performance, preferred cryptocurrencies, and average holding time. These metrics help investors make an informed decision based on their goals and risk tolerance.

MEXC’s copy trading platform showcases over 2 million completed trades and more than $1B in total copy trading volume. Source: MEXC

While MEXC doesn’t charge copy trading fees, traders have a profit share that averages 10% of the net gains. Investors also cover standard trading commissions, which range from 0% to 0.05% depending on the order type and market (e.g., futures or spot).

The copy trading platform accepts crypto and fiat payments, and instant deposit methods include debit/credit cards and e-wallets.

| Copy Trading Pool | 21,000+ |

| Markets | 4,000+ |

| Copy Trading Instrument | Perpetual futures |

| Fees | Profit share (set by traders) and standard trading commissions |

| Mobile App | Yes |

| Suitable For | Beginners & Experienced Futures Traders |

Pros:

- The overall best copy trading platform for crypto in 2026

- Choose from over 21,000 crypto traders

- Supports over 4,000 digital assets

- Profit share fees average 10%

- Standard trading commissions start from 0%

Cons:

- Some copy traders use high leverage

- The platform operates without any licenses

7. Margex – Copy Seasoned Futures Traders via Perpetual Contracts with 100x Leverage

Margex is a copy trading platform that features over 55 perpetual futures, ranging from Bitcoin and Chainlink to Ethereum, Dogecoin, and Solana. Derivative products attract leverage of between 25x and 100x, depending on the market, and copy traders can go long or short, allowing them to speculate on both rising and falling markets.

The provider offers a native crypto copy trading app for iOS and Android, allowing users to monitor traders and assess their profits and losses easily. While Margex has just 100+ traders to choose from, they’re all pre-vetted, which ensures the focus is on quality rather than quantity.

Margex promotes its copy trading feature as a simple three-step process — sign up, follow expert traders, and profit automatically. Source: Margex

Key features include Smart Follow, which ensures investors get the exact same trading conditions and spreads as the copy trader. Margex also offers a new form of liquid staking. Users earn yields on their account balances while still being able to use the funds for copy trading investments.

| Copy Trading Pool | 100+ |

| Markets | 55+ |

| Copy Trading Instrument | Perpetual futures |

| Fees | Profit share (set by traders) and standard trading commissions |

| Mobile App | Yes |

| Suitable For | Advanced Futures Traders |

Pros:

- Copy traders specialize in crypto derivatives

- Offers a proprietary app exclusively for copy trading

- Leverage limits range from 25x to 100x

- The Smart Follow feature protects investors from execution delays

Cons:

- Users have just 100+ copy traders to choose from

- The platform supports only 55+ futures markets

8. BloFin – Best Copy Trading Option for Investors Who Favor No-KYC Platforms

BloFin is a no-KYC crypto exchange that allows daily withdrawals of up to 20,000 USDT without personal information or government-issued ID. New customers register an account with an email address only, and security features include two-factor authentication, cold storage wallets, and Chainalysis’s monitoring.

The crypto copy trading dashboard supports over 980 experienced traders, most of whom charge profit-sharing fees of 10%, which aligns with the industry average. BloFin offers extensive data metrics to find the right trader, including maximum drawdown, Calmar Ratio, ROI, and total winning positions. The top traders also share their investment strategies and risk management practices.

BloFin’s copy trading dashboard highlights top-performing traders with key metrics, including ROI, drawdown, and Sharpe ratio. Source: BloFin

In terms of markets, BloFin supports hundreds of spot trading and derivative pairs, with a maximum leverage of 150x. The platform accepts instant crypto purchases with Visa, MasterCard, and e-wallets. The minimum deposit is just $15.

| Copy Trading Pool | 980+ |

| Markets | 470+ |

| Copy Trading Instrument | Spot and perpetual futures |

| Fees | Profit share (set by traders) and standard trading commissions |

| Mobile App | Yes |

| Suitable For | Beginners & Intermediate Traders |

Pros:

- No KYC requirements when withdrawing under 20,000 USDT daily

- Copy traders from the spot and derivative markets

- Maximum leverage of 150% on perpetuals

- Deposit fiat money from just $15

Cons:

- Staking rewards are well below the industry average

- Doesn’t hold any exchange licenses

- Daily volumes are minute compared to tier-one platforms

9. PrimeXBT – Invest in Copy Trading Portfolios Containing Different Asset Classes

PrimeBXT is a highly-rated trading platform that supports multiple asset classes, including cryptocurrencies, forex, commodities, indices, and equities. It’s a great option for investors who want to mitigate trading risks through market diversification: your portfolio could contain a mix of Bitcoin, gold, blue-chip stocks, and crude oil.

The copy trading pool supports about 100 experienced investors across a diverse range of trading strategies. You can view the win ratio, maximum drawdown, portfolio breakdown, and ROI to make an informed choice.

PrimeXBT highlights its copy trading service as a way for beginners to follow expert traders and for professionals to earn profit shares of up to 20%. Source: PrimeXBT

PrimeXBT offers some of the highest leverage limits in the market. Cryptocurrencies offer 200x leverage and 100x for major currencies like EUR/USD. The exchange also has small minimum deposit requirements of just $1. Visa and MasterCard are accepted payment methods, and fees are built into the quoted exchange rate.

The biggest drawback of PrimeXBT is its profit-sharing structure. Standard account holders keep just 60% of their profits, with the balance split between the platform and the trader.

| Copy Trading Pool | 100+ |

| Markets | 100+ |

| Copy Trading Instrument | Perpetual futures and spot CFDs for crypto, forex, commodities, indices, and equities |

| Fees | Profit share (up to 40%) and standard trading commissions |

| Mobile App | Yes |

| Suitable For | Advanced Multi-Asset Traders |

Pros:

- Follow traders from multiple financial markets

- Assets include crypto, forex, and commodities

- The minimum Visa and MasterCard deposit is just $1

Cons:

- Standard users keep just 60% of their copy trading profits

- CFD instruments are banned in some countries

- The copy trading pool is just 100+ traders

10. CoinEx – Beginner-Friendly Copy Trading Platform with Wide Meme Coin Support

CoinEx is a beginner-friendly exchange with a clean and simple layout, making it a great choice for first-time crypto investors. It’s one of the best options for those who want exposure to the lucrative meme coin space: CoinEX supports over 340 meme tokens, ranging from market leaders like Dogecoin and Pepe to more volatile projects like Solama, hehe, Doland Tremp.

Its copy trading tool supports about 200 traders, each specializing in perpetual futures with long and short strategies. The platform lets users set custom copy trading parameters, including maximum leverage, take-profit, and stop-loss limits.

CoinEx promotes its Copy Trading feature, allowing users to follow top lead traders and replicate their strategies with transparent ROI and performance metrics. Source: CoinEx

Users pay standard futures trading commissions of 0.03% or 0.05% for market and limit orders, respectively. Copy traders charge between 10% and 50% in profit-sharing fees, depending on their historical success and total followers.

Other CoinEx features include support for fiat deposits, pre-listing token markets, and demo trading facilities.

| Copy Trading Pool | 200+ |

| Markets | 1,900+ |

| Copy Trading Instrument | Perpetual futures |

| Fees | Profit share (set by traders) and standard trading commissions |

| Mobile App | Yes |

| Suitable For | Intermediate & Advanced Futures Traders |

Pros:

- The best crypto copy trading site for meme coin exposure

- Risk management tools include leverage caps and stop-loss limits

Cons:

- Copy traders can charge up to 50% in profit-sharing fees

- Some markets come with a 3x leverage limit

- The copy trading tool doesn’t support the spot markets

- Small-cap meme coins have low liquidity levels

Compare the Best Crypto Copy Trading Platforms in 2026

| Platform | # of Traders | Assets | Leverage | Fees |

| Binance | 2,300+ | Spot & Perpetual Futures (2,000+ pairs) | Up to 125x | Profit share (avg. 10%) + 0.1% spot / 0.02–0.05% futures |

| Bybit | 300+ | Perpetual Futures & Bots (750+ markets) | Up to 100x | Profit share (10–15%) + trading commissions |

| OKX | 590+ | Spot, Perpetual Futures, Delivery Futures (1,300+ markets) | Up to 125x | No extra fees for bots, standard 0.05–0.1% commissions |

| BingX | 5,000+ | Spot & Perpetual Futures | Up to 150x | Profit share (set by traders) + standard commissions |

| Crypto.com | 100M+ | Spot & Perpetual Futures | Up to 100x | Profit share (set by traders) + standard commissions |

| MEXC | 21,000+ | Spot & Perpetual Futures (4,000+ markets) | Up to 200x | Profit share (avg. 10%) + 0–0.05% commissions |

| Margex | 100+ | Perpetual Futures (55+ markets) | Up to 100x | Profit share (set by traders) + standard commissions |

| BloFin | 980+ | Spot & Perpetual Futures (470+ markets) | Up to 150x | Profit share (avg. 10%) + standard commissions |

| PrimeXBT | 100+ | Crypto, Forex, Commodities, Indices | Up to 200x crypto / 100x FX | Profit share (up to 40%) + built-in spreads |

| CoinEx | 200+ | Perpetual Futures (1,900+ markets) | Up to 100x | Profit share (10–50%) + 0.03–0.05% commissions |

Our Methodology for Picking the Top 10 Crypto Copy Trading Platforms

The top crypto exchanges offer copy trading services, so investors have many options when selecting a platform.

The research team focused on the following metrics to find out which platform is best for crypto trading.

Total Active Users

We prioritized platforms with the largest number of verified copy traders. This metric ensures users have ample choice when choosing a trader to copy, and that they invest funds into a strategy that aligns with their goals and risk appetite.

MEXC stands out, with the exchange offering access to over 21,000 copy traders. The available traders cover spot and perpetual futures markets, and trading strategies include scalping, day trading, and arbitrage.

Largest Pot of Supported Cryptos

Using a copy trading platform with a wide range of supported cryptocurrencies ensures investors allocate capital into their preferred markets. Some investors prefer lower-risk assets like Bitcoin and Ethereum, while others target volatile meme coins like dogwifhat and Bonk.

Consider the type of financial instrument that you want to invest in, too. Derivative products like perpetual, inverse, and delivery futures are a good fit for investors with a higher risk tolerance, as these markets attract high leverage. Spot trading is best for those with a stronger focus on risk management.

Cheapest Trading Fees

Most crypto copy trading platforms charge two sets of fees.

The first fee is the standard trading commission, which users cover whenever their selected trader enters or exits positions.

Platforms also charge profit-sharing fees: these are usually determined by the trader and average 10% of the net proceeds. This structure ensures investors only pay fees when the trader is profitable.

Beginner-Friendly Interface

Copy trading tools are largely aimed at inexperienced traders, so the top platforms offer a beginner-friendly interface that’s simple to navigate.

CoinEx highlights detailed trader profiles, showing ROI, profit sharing, win rate, and risk metrics for better decision-making. Source: CoinEx

Whether you’re using a mobile app or a desktop browser, selecting a trader and completing the investment should be seamless. Custom filters are an added bonus, as they enable users to find the perfect trader based on key metrics such as ROI and average trade duration.

Fastest Trade Execution Speeds

Newbies are often unaware of the importance of execution speeds in the cryptocurrency market. Even a slight delay in copying a trader’s order can be the difference between profit and loss, especially when trading small-cap markets with limited liquidity.

This is why Margex created its Smart Follow feature. It ensures users get the exact same trading conditions as the copy trader, including market prices and spreads.

Crypto Copy Trading Explained

Copy trading is an innovative investment tool that lets users “copy” experienced crypto traders, allowing them to mimic buy and sell positions passively. The concept is particularly popular with beginners who want exposure to the crypto markets but don’t have the required trading knowledge.

Copy traders handle the entire investment process, from researching the best cryptos to invest in and analyzing market trends to placing orders and setting risk management controls.

While the user automatically copies their chosen trader, investment sizes are proportionate to the amount invested. You can also customize your copy trading portfolio, such as setting leverage caps or maximum stop-loss limits. This system ensures that Bitcoin copy trading is suitable for all budgets, financial goals, and risk tolerances.

Here’s an example of how copy trading works with most crypto exchanges:

- The user allocates $300 into their chosen copy trader, who specializes in perpetual futures.

- The trader uses 15% of their account balance to place a DOGE/USDT buy order with 3x leverage.

- At the same time, the user automatically copies the same position but at a $45 trade size (15% of $300).

- The trader closes the position several hours later at a 60% net gain.

- The user also makes 60% but on a $45 investment, converting to a $27 profit.

What Are the Most Popular Crypto Copy Trading Features?

Top copy trading platforms offer a range of useful features to ensure users maximize their profit potential and minimize risk. Let’s explore these features in more detail.

Effective Risk Management Options

Copy trading tools do not guarantee financial success; you will lose money if the trader makes a loss. Many platforms offer customizable risk management tools that ensure copy trading positions align with the user’s risk tolerance.

One example is a maximum stop-loss limit, which automatically closes a trade if it declines by a certain amount (e.g., 10%). Users can often cap the amount of leverage applied to their trades, too, reducing the liquidation risks.

Performance Metrics

Selecting the right trader is the most important part of the crypto copy trading process.

Platforms like MEXC and Binance offer extensive performance metrics for each registered trader, including the historical profit and loss, trade frequency, average holding time, and number of followers. These providers also offer customizable filters, so you can focus on traders that align with your parameters.

BloFin provides in-depth performance analytics for copy traders, including ROI, PNL, win rate, and trade frequency. Source: BloFin

Note that data metrics are pulled directly from the trader’s account, ensuring they’re transparent and legitimate.

Social Trading Tools

Social trading is an extension of the copy trading concept. It’s synonymous with social media networks like Facebook, but for the crypto investment market.

You can post trading ideas and viewpoints, like or reply to other users, and even follow your favorite traders. The best crypto social trading platforms also provide social sentiment metrics; these insights show whether users are bullish or bearish on specific assets.

Simple Portfolio Management Tools

Portfolio tools let users view and manage their copy trading investments. They provide easy-to-understand metrics, such as 24-hour or overall profit and loss, as well as the top-performing traders.

Many tools also enable you to adjust position sizes, rebalance the portfolio, or add/remove specific cryptocurrencies.

How to Choose the Right Copy Trading Platform

Selecting the right copy trading platform in 2026 depends less on technical criteria and more on how well the service matches your personal goals, budget, and risk tolerance. Here are some practical tips to guide your choice as a user:

- Define Your Investment Goals: Are you looking for short-term speculation or long-term portfolio growth? Platforms like Binance with spot traders may suit conservative users, while Bybit or Margex can appeal to those comfortable with high-leverage futures.

- Check the Trader Community: A larger pool of traders, such as on MEXC or BingX, gives you more choice in finding strategies that align with your risk appetite. Look at ROI history, consistency, and drawdowns rather than just flashy gains.

- Evaluate Usability: Beginners often prefer clean, mobile-friendly dashboards (CoinEx, OKX), while advanced users may value custom filters, order settings, or bot integrations.

- Understand the Fee Model: Profit-sharing fees and trading commissions vary. Even small differences can erode returns over time, so compare structures carefully.

- Consider Security and Access: Prioritize platforms with strong account protection, transparent audits, and flexible deposit/withdrawal options. No-KYC exchanges like BloFin may offer privacy but come with added risks.

- Start Small and Diversify: Begin with a modest allocation, spread funds across several traders, and monitor performance before committing larger amounts.

The “best” platform is the one that balances features with your trading style. Whether you value simplicity, advanced tools, or regulatory oversight, aligning the platform’s strengths with your own objectives will help you get the most out of copy trading.

Getting Started With Crypto Copy Trading in 2026

This section explains how to start copying crypto traders in under 10 minutes.

The tutorial uses MEXC to illustrate the process, although the steps are similar to most other platforms.

Step 1: Open a MEXC Account

Visit the MEXC website to open an account.

MEXC offers sign-up bonuses and access to new token launchpools, such as Einstein (EIN). Source: MEXC

The exchange requires an email address or mobile number only; there are no KYC requirements unless you plan to withdraw more than 20,000 USDT per day.

Step 2: Choose the Best Crypto Traders to Copy

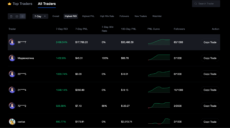

Click the “Copy Trading” button beneath the “Futures” tab, then scroll down and select “All Traders”. The exchange has over 21,000 copy traders, so you’ll need to use the available filters and tabs to find the right one.

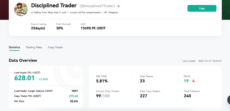

Top-performing traders on MEXC Copy Trading ranked by 7-day ROI and PNL. Source: MEXC

Search filters include the highest ROI, profit and loss, and win rate, plus total followers. You can also tap the “Top Traders” button to see the overall best-performing traders in the past week. Click a trader to view additional data metrics, such as trading frequency, preferred markets, maximum drawdown, and profit-sharing commission.

Step 3: Deposit Funds

Deposit some funds into the MEXC account once you’ve selected a trader to copy.

Buying crypto on MEXC in three simple steps: choose an amount, select a payment method, and receive USDT. Source: MEXC

MEXC supports both fiat and crypto deposits:

- Fiat: Click “Buy Crypto” to use a debit/credit card in your preferred currency. MEXC also offers peer-to-peer purchases, which support a much wider range of payment methods.

- Crypto: Go to your MEXC wallet, click the crypto you want to deposit, and transfer funds to the provided addresses.

Note: Purchase USDT if you’re buying crypto on MEXC, as it’s the copy trading platform’s primary currency.

Step 4: Set Your Crypto Copy Trading Parameters

Click the “Copy Trade” button next to the trader you want to copy. This final step is to complete the copy trading parameters.

First, switch on the “Auto Follow” button; this ensures you automatically copy the trader’s future buy and sell orders.

Leave the “All” button ticked if you want to copy the trader’s existing portfolio. Untick it if you only want to copy future trades.

Setting copy trading parameters on MEXC: select trading pairs, adjust trade amount, and configure risk controls. Source: MEXC

Now type in the amount of USDT to invest in the copy trader. Use the slider if you want to invest a specific portion of your account balance, such as 25% or 100%.

MEXC also offers custom risk management tools: specify the liquidation, take-profit, and stop-loss settings based on your risk tolerance.

Finally, click “Next Step”, confirm the investment, and that’s it. You’ll immediately start copying the trader.

Are Copy Trading Platforms Safe? Key Risks Explained

Crypto copy trading platforms can be relatively safe when using reputable, well-audited exchanges that implement strong security measures such as two-factor authentication, cold wallet storage, and transparent trader performance data. They offer an accessible way to participate in the market without active management.

However, risks remain. Poor trader performance, high leverage, and volatile market conditions can lead to significant losses. Platform-related risks include technical outages, liquidity issues, or even security breaches.

Copy trading also doesn’t remove the need for personal oversight – blindly following a trader can amplify mistakes. For balanced safety, choose regulated or well-established platforms, diversify across multiple traders, and apply your own risk controls.

Is Crypto Copy Trading Worth It in 2026?

In 2026, crypto copy trading continues to attract both beginners and time-constrained investors, offering a passive way to participate in the market without the need for deep technical knowledge.

By following experienced traders who handle research, market analysis, and execution, newcomers can gain immediate exposure to various strategies and assets. However, returns are never guaranteed – some copy traders underperform, and blindly relying on others can limit personal growth as an investor.

To maximize the potential benefits, it’s essential to diversify across multiple traders, asset types, and strategies, while monitoring and rebalancing your portfolio regularly.

After testing over 30 copy trading platforms this year, our research shows that Binance, Bybit, and OKX stand out as the top overall choices.

Binance offers over 2,300 verified spot traders and nearly 2,000 trading pairs. Bybit provides 750+ markets with advanced copy trading tools, and OKX combines traditional copy trading with hundreds of automated bot strategies.

For those approaching copy trading in 2026, choosing one of these leading platforms and applying disciplined risk management can turn it into a valuable long-term investment tool rather than a short-term gamble.

FAQ

Which platform is best for copy trading crypto?

Is crypto copy trading legal?

How much money do I need to start crypto copy trading?

References

- Copy Trading (Financial Conduct Authority)

- What Are Memecoins and Why Did Trump Launch One? (Bloomberg)

- What is a Stop Loss Order? How to Manage Risk in Trading (Saxo Group)

FAQ

Which platform is best for copy trading crypto?

MEXC is the best platform for crypto copy trading — it hosts over 21,000 traders, 4,000 markets, and access to customizable risk management tools. Other top platforms to consider include Binance, Margex, and BloFin.

Is crypto copy trading legal?

Yes, copy trading is legal in any country that allows crypto trading.

How much money do I need to start crypto copy trading?

While minimum copy trading investments depend on the platform, most allow users to get started with about $10.

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

Fact-Checked By:

Fact-Checked By:

28 mins

28 mins

Ibrahim Ajibade

, 374 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.