Identifying the best crypto to mine in 2026 depends on your hardware, electricity costs, and risk tolerance.

Our extensive research reveals the best platforms for crypto day trading. Learn where and how to day trade digital assets like Bitcoin, Ethereum, and Dogecoin.

Our research team tested a wide range of crypto day trading platforms to identify the best provider for 2026. Our research suggests that CoinFutures remains the top choice, since it offers a safe trading experience, diverse markets, and industry-leading leverage of 1000x.

Day traders buy and sell crypto pairs over short timeframes to make small but frequent profits. They never hold positions past standard trading hours to eliminate overnight risks. Traders rely on multiple sources to make informed decisions, including charts, indicators, and broader sentiment.

Read on to learn more about crypto day trading and discover the best platforms in the market.

Key Takeaways

- Day trading is a popular strategy for active traders seeking exposure to the crypto markets. Traders typically hold positions open for several hours.

- Traders require platforms with deep liquidity, tight spreads, and competitive fees to ensure profit viability.

- Due to the small profit margins targeted, crypto day traders often use leverage instruments like futures and options.

- The best crypto day trading platforms provide users with robust security mechanisms like two-factor authentication, regulatory approval, and cold storage.

- While traders reduce risk by closing positions before the session’s end, they also use stop-loss orders and bankroll management to minimize drawdown.

Top Crypto Day Trading Platforms: Ranked for 2026

Listed below are the best crypto day trading platforms, according to our market research:

- CoinFutures: The overall best platform to day trade crypto with high leverage

- Bybit: A great option for crypto spot trading with deep liquidity and low fees

- MEXC: Access 4,000+ digital asset trading markets in one safe place

- Coinbase: The safest platform choice for day trading beginners

- Margex: Top all-rounder with futures day trading, staking, and fee-free swaps

- Binance: Advanced trading platform with powerful charting features

- CoinEx: Popular with high-risk traders seeking diverse meme coin markets

- Kraken: Offers traditional margin accounts with a maximum leverage of 10x

- KCEX: 0% spot trading commissions for market makers and takers

A Closer Look at the Best Crypto Day Trading Providers: Full Reviews

Hundreds of exchanges and trading platforms let day traders speculate on cryptocurrencies like Bitcoin (BTC) and Dogecoin (DOGE). Our top picks provide a secure experience with low commissions, advanced trading tools, and exceptional customer service.

The following reviews help traders select the best crypto exchange for day trading.

1. CoinFutures: The Best Day Trading Platform for Leveraged Crypto Futures

CoinFutures provides the required framework for profitable day trading in a risk-averse environment. It offers futures markets across top coins like Bitcoin, Ethereum, Litecoin, and XRP, each of which is a contender to be the best crypto to buy in 2026. As a futures provider, the platform lets traders long and short the market. This flexibility is a core requirement when day trading.

Platform users trade cryptocurrencies with low upfront requirements. CoinFutures offers leverage of up to 1000x, which equates to just 0.1% of the total trade value. This dynamic helps entry-level traders control substantial position sizes without needing to deposit large amounts.

CoinFutures offers leverage of up to 1000x on popular altcoins like BNB (BNB). Source: CoinFutures

To reduce risk, CoinFutures limits the loss potential to the initial stake. It also supports risk-management tools like stop-loss orders, and the beginner-friendly dashboard helps users avoid costly mistakes. While CoinFutures does not offer demo trading facilities, the minimum futures trade is $1.

CoinFutures operates globally and removes traditional KYC requirements. New traders register without providing personal details or government-issued ID. The deposit process is fast and hassle-free, too. Users transfer crypto from a private wallet or deposit local money instantly via debit/credit cards or e-wallets (fiat payment rails may involve some KYC processes).

CoinFutures remains popular with crypto day traders for its long and short markets, high leverage, and low account minimums. Source: CoinFutures

CoinFutures, which operates under CoinPoker, ensures customer safety through licensing, proof of reserves, Fireblocks vaults, and encrypted payments.

Pros

- Beginner-friendly platform for day trading beginners

- Supports crypto futures with 1000x leverage

- Trade both directions via long and short orders

- Risk any amount from $1 upward

- Fast payouts via crypto withdrawals

- Security controls include licensing and cold storage

Cons

- Doesn’t support micro-cap tokens

- Users must provide basic personal information on fiat deposits

2. Bybit: Access 2,100+ Listed Cryptocurrencies via Spot Trading Markets

Bybit is a top-rated crypto exchange with tier-one trading volumes and significant platform liquidity. It’s one of the best options for spot trading, as Bybit supports a huge range of markets at competitive fees. The spot exchange lists over 2,100 cryptocurrencies, including top meme coins like dogwifhat (WIF), Pepe (PEPE), and Pump.fun (PUMP).

The exchange offers several options to day traders who require leverage to amplify their trading capital. The spot market supports margin accounts with 10x leverage, which is a good choice for real asset ownership. However, margin traders incur interest fees. Bybit supports perpetual futures, too. These contracts provide a maximum leverage of 200x with eight-hour funding cycles.

Bybit offers day trading markets for popular meme coins like dogwifhat. Source: Bybit

Derivative experts also consider Bybit one of the best leverage crypto trading platforms for options. As it offers diverse options chains for BTC, ETH, and Solana (SOL), crypto day traders enter positions with limited downside.

Regarding commissions, spot traders pay 0.1% per side for limit and market orders. Account fees are reduced for higher volumes. Derivatives have separate pricing structures. Perpetual futures traders pay 0.02% (makers) or 0.055% (takers).

Pros

- Trade over 2,100 cryptocurrencies via the spot exchange

- Spot traders pay just 0.1% per side

- Derivative products include margin accounts, futures, and options

- Most users trade without KYC requirements

Cons

- Limited regulatory approval from top licensing bodies

- Some listed markets experience extreme volatility

3. MEXC: Global Trading Platform with 4,000+ Supported Crypto Pairs

Founded in 2018, MEXC is one of the largest cryptocurrency exchanges globally for daily trading volume and liquidity. It accepts clients from most countries, and users are exempt from KYC requirements when they withdraw under 10 BTC per day.

The exchange lists over 4,100 digital assets and introduces new markets weekly. Day traders buy and sell a wide selection of markets, from new crypto projects with low market capitalizations to industry leaders like BTC and ETH.

MEXC’s spot and futures exchange supports brand-new cryptocurrencies with low market values. Source: MEXC

Some traders prefer MEXC’s spot trading platform for real ownership and instant order execution. It charges 0.05% on market orders, regardless of volume. Placing a limit order allows MEXC users to avoid spot commissions entirely.

If you seek leverage, MEXC lists over 900 perpetual futures markets. Traders get 500x leverage on BTC and ETH, and 300x on major altcoins like SOL and XRP. It lacks support for crypto options and delivery futures, which may be a drawback for some day traders.

Pros

- Access over 4,100 digital assets from the same exchange account

- Day trade via the spot exchange or futures platform

- No KYC requirements when you withdraw under 10 BTC per day

- Get 0% commissions on spot trading limit orders

Cons

- Doesn’t accept traders from the U.S.

- Using VPNs may result in account closure

4. Coinbase: Beginner-Friendly Exchange with Strong Licensing and Regulation

With over 100 million users, including a large number of U.S. clients, our research suggests that Coinbase is one of the best crypto day trading platforms for beginners. It offers a simple trading experience, since users buy cryptocurrencies instantly with local banking methods, debit/credit cards, and select e-wallets like PayPal.

Novice traders access Coinbase’s instant conversion tool to trade digital assets without relying on the spot exchange. They enter the respective cryptocurrencies and trade size, and the platform swaps those coins at the next best available price.

Despite charging high fees, Coinbase is the most beginner-friendly crypto day trading platform. Source: Coinbase

However, Coinbase charges high “convenience” fees. While it builds commissions into the exchange rate, they typically average 1-2%. The exchange also charges 3.99% on instant payment methods and spreads of about 0.50%.

Intermediate-to-advanced traders use the Coinbase Advanced platform. In addition to powerful trading tools like charts, order books, and indicators, it offers much lower commissions. Coinbase Advanced supports fiat pairs, too, such as BTC/USD and ETH/GBP.

Pros

- Ultra-simple day trading platform for beginners

- Trade coins and tokens without using the spot exchange

- Instantly buy cryptocurrencies with traditional payment methods

- Heavily regulated in multiple regions, including the U.S.

Cons

- Massive trading commissions and payment fees

- The basic platform provides limited analysis tools

5. Margex: Feature-Rich Platform with Leveraged Futures and Staking

Margex is a mid-tier exchange that supports perpetual futures markets. It streamlines the onboarding process with KYC-free accounts and near-instant crypto payments. Users also deposit funds with over 150 traditional methods, including Google Pay and Apple Pay.

Before day trading futures, Margex users may transfer their account balance into the staking pool. They earn competitive interest rates of up to 7% without locking the funds, since the staking balance remains available for margin collateral.

Margex offers 100x leverage on BTC and ETH perpetual futures markets. Source: Margex

As one of the top 100x crypto leverage platforms, Margex requires a 1% margin on BTC and ETH markets. The margin requirements rise to 2% or 4% on other crypto perpetuals.

In addition to futures trading, Margex offers fee-free token swaps on select assets. Platform users also access copy trading tools. The passive investing feature lets users replicate experienced traders without management fees, yet profit-sharing commissions apply.

Margex is available on standard browsers and a user-friendly app for iOS and Android.

Pros

- Use staking balances for futures trading collateral

- Staking pools yield up to 7% on top digital assets

- Day trade perpetual futures with leverage of up to 100x

- New users open accounts in less than a minute

Cons

- The payment team processes withdrawals once per day

- Margin requirements increase to 4% on less popular markets

6. Binance: High-Level Trading and Research Tools for Experienced Day Traders

We found that Binance is the best option for experienced crypto day traders with advanced trading strategies. It supports over 350 cryptocurrencies with high-level trading tools, including custom order book analysis, technical and economic indicators, heat maps, and API access for algorithmic systems.

Drawing tools include a wide range of options like trend lines, Fibonacci Retracement, arcs, and vertical lines for deep technical research. Seasoned traders place risk-adjusted orders like TWAP and ‘good ’til canceled’, and the exchange’s deep liquidity ensures quick execution.

Binance is popular with experienced day traders who seek advanced trading features. Source: Binance

In terms of trading instruments, Binance offers spot trading markets, as well as derivative products. Traders speculate on perpetual and delivery futures with leverage of up to 125x. The tier-one exchange also offers diverse options chains with competitive upfront premiums.

All Binance accounts require KYC verification documents, and traders in some regions cannot access derivatives. Deposit methods vary by country; some nationalities can use instant payment methods like debit/credit cards, while others must deposit cryptocurrency due to regulatory restrictions. Another option is Binance’s peer-to-peer platform, which operates in most countries.

Pros

- An advanced trading dashboard that suits seasoned day traders

- Supports over 350 coins and tokens

- Offers spot markets and derivative products with high leverage

- Handles more trading volume than any other crypto exchange

Cons

- Users in some countries face payment and product restrictions

- Traders must upload KYC documents before they deposit funds

7. CoinEx: Day Trade 300+ Meme Coins with Low Margin Requirements

CoinEx is our top pick for crypto day traders seeking exposure to meme coins. It lists over 300 meme coin markets, including popular projects like DOGE, Shiba Inu (SHIB), and WIF. Those with a higher risk appetite can trade low-cap meme coins. Markets in this category include Stool Prisondente (JAILSTOOL) and Stanly Cup Coin (STAN).

Platform users access leverage of up to 100x, although lower limits apply on more volatile markets. CoinEx also raises the margin requirements on large trading positions. For example, BTC/USDT perpetuals have an initial margin of 1% on 500,000 contracts, and 2% for the next 500,000.

CoinEx supports over 300 meme coins via spot trading and perpetual contracts. Source: CoinEx

CoinEx charges spot trading fees of between 0.1% and 0.2%, depending on the account tier. Holding its native exchange token yields discounted commissions. Perpetual futures follow the maker/taker framework, and they start at 0.03% and 0.05%, respectively.

Pros

- Features an extensive range of meme coins

- The trading platform requires a minimal learning curve

- Offers a fully optimized trading app for iOS and Android

Cons

- Leverage declines as trade values increase

- Slightly higher trading commissions than industry competitors

8. Kraken: Trade Hundreds of Spot Cryptocurrencies via Spot Margin Accounts

Kraken offers several day trading products that suit different investing styles. Traders who prefer spot trading markets but also require leverage may open a margin account. These accounts offer leverage of up to 10x on large-cap cryptocurrencies like BTC and BNB. Unlike perpetuals, traders own the coins and tokens they apply leverage to.

Margin trading requires daily interest payments, and traders cannot withdraw the position’s borrowed portion. Standard spot exchange markets offer the same products but without leverage.

Kraken offers margin accounts on leading cryptocurrencies with a maximum leverage of 10x. Source: Kraken

Another option on Kraken is to trade perpetual futures. It offers a maximum leverage of 50x, and users avoid interest fees. They may, however, incur funding rates every four hours depending on whether the exchange charges longs or shorts.

Kraken’s basic platform appeals to beginners who want to trade cryptocurrencies with fiat money. Since the exchange is heavily regulated, it offers fiat-denominated pairs in USD, GBP, EUR, and other major currencies.

Pros

- Regulated exchange that offers crypto margin accounts

- Buy and sell over 350 cryptocurrencies with leverage

- Trade crypto-to-fiat pairs with USD, EUR, and GBP

Cons

- Some users report waiting several days for customer service replies

- Instant buy orders incur high transaction fees

9. KCEX: Avoid Spot Trading Commissions Regardless of the Account Tier

KCEX stands out for its fee-free day trading services. Spot trading users get 0% commissions on both market and limit orders, no matter the account tier or 30-day trading volume. Unlike some exchanges, the commission-free feature covers all available cryptocurrencies rather than select pairs.

The spot exchange is highly extensive, as KCEX supports hundreds of altcoins. Traders filter markets by the narrative, like Tron ecosystem tokens, meme coins, or proof-of-work projects. It also offers an advanced search box that shows volume, market capitalization, and price performance. This tool helps crypto day traders find suitable markets for their risk-reward objectives.

As the cheapest crypto day trading platform, KCEX offers 0% commission spot trading. Source: KCEX

Alongside low fees and diverse market access, KCEX offers leveraged futures. It caps leverage limits at 125x and increases the initial margin requirement for non-major markets.

The platform lacks automated tools like bots and copy trading, as well as staking yields. KCEX runs as an unregulated day trading platform, so it allows no-KYC accounts with high limits. On the basic verification level, users may withdraw up to 30 BTC per day.

Pros

- Commission-free spot trading markets for all available pairs

- Advanced search tools to find cryptocurrency trading opportunities

- Unverified account holders may withdraw up to 30 BTC daily

Cons

- Operates without regulatory approval

- The 0% commission service doesn’t apply to futures

Top Crypto Day Trading Exchanges Compared by Core Metrics

Traders may review the table below, which compares the best crypto day trading platforms for 2026:

| Total Coins and Tokens | Day Trading Instrument | Max Leverage | Mobile App? | Max Spot Trading Fees | Max Futures Trading Fees | KYC? | |

| CoinFutures | 14 | Simulated futures | 1000x | Yes | N/A | Variable or commission-based | No |

| Bybit | 2100+ | Spot trading, perpetual futures, delivery futures, options | 200x | Yes | 0.1% | 0.055% | No |

| MEXC | 4,100+ | Spot trading, perpetual futures | 500x | Yes | 0.05% | 0.04% | No |

| Coinbase | 300+ | Spot trading, perpetual futures | 50x | Yes | Basic (built into the price), Advanced (1.2%) | Displayed in the user’s account | Yes |

| Margex | 55+ | Perpetual futures | 100x | Yes | N/A | 0.06% | No |

| Binance | 350+ | Spot trading, perpetual futures, delivery futures, options | 125x | Yes | 0.1% | 0.05% | Yes |

| CoinEx | 1,200+ | Spot trading, perpetual futures | 100x | Yes | 0.2% | 0.05% | No |

| Kraken | 350+ | Spot trading, perpetual futures, delivery futures | 50x | Yes | Basic (built into the price), Pro (0.4%) | 0.05% | Yes |

| KCEX | 790+ | Spot trading, perpetual futures | 125x | Yes | 0% | 0.1% | No |

An Overview of Crypto Day Trading

Crypto day trading is a strategy where traders buy and sell digital assets to capitalize on short-term volatility. The strategy requires traders to close positions before the end of the day, which ensures they avoid overnight risk exposure. Trades typically stay open for several hours, so the potential risk and reward is lower than traditional long-term investing.

Due to the lower profit margins available, day traders often use crypto leverage to amplify position sizes. Traders use crypto derivative products, such as futures, margin accounts, and options, because they have low margin requirements and enable both long and short trading.

Crypto Day Trading Explained: How Does It Work?

The crypto day trading strategy suits active traders with experience in technical analysis. Trade durations range from seconds to hours, but never more than a day. This dynamic requires day traders to rely on short-term trends and signals to make informed decisions.

Popular day trading indicators include the RSI, MACD, and stochastic oscillator. These indicators analyze existing price movement against historical trends like support and resistance levels. Once traders identify a potential signal, they enter a buy or sell order accordingly.

While less common, some day traders enter positions based on real-world news. A new partnership with a tier-one institution or a celebrity endorsement may encourage traders to buy the respective coin or token.

Unlike conventional crypto investing, day traders speculate in both market directions. They go long if they expect rising prices, and short when they’re pessimistic about price direction.

To day trade cryptocurrencies successfully, traders need access to a reliable trading platform with low fees. The platform should offer a wide range of charting and analysis tools, plus fast execution speeds and diverse market support. Tight spreads also matter, as day traders often target small profit margins.

Why Do Crypto Traders Use the Day Trading Strategy? Key Benefits Revealed

If you’re unsure whether crypto day trading is the right strategy, read on to explore its advantages.

24/7 Market Opportunities Across Thousands of Pairs

The digital asset markets operate 24 hours per day, seven days per week. The best crypto day trading platforms support thousands of markets, so active day traders always have pairs to trade.

During bullish cycles, day traders may speculate on volatile meme coins to capitalize on high sentiment. Similarly, they might short-sell meme coins when sentiment declines.

Day traders can trade a huge range of crypto pairs in a 24/7 trading environment. Source: TradingView

The strategy also suits sideways markets. When crypto prices consolidate for extended periods, long-term investors have limited trading opportunities. Yet day traders take advantage of consolidation periods by buying and selling the support and resistance zones.

Eliminate Overnight Risk

Crypto prices often rise and fall by significant amounts over short timeframes. Day traders reduce these risks by closing positions before the day’s end. They avoid exposure to overnight volatility, which ensures they remain in control of their trading bankroll.

When traders return to their trading account the following day, they avoid the emotional shock of unforeseen portfolio decline. They know exactly where the account balance stands, since they closed their crypto trades the previous night.

Amplify Day Trading Gains with Leverage

While cryptocurrencies remain a volatile asset class, pricing swings are more modest over short timeframes.

The scalping strategy, for instance, requires day traders to open and close positions over seconds or minutes. Even volatile meme coins rise and fall moderately over these rapid trade durations, which limits the upside potential. This is why many day traders apply leverage to amplify their profits.

A day trader who targets a 0.5% gain with 100x leverage boosts their potential returns to 50%, making the strategy significantly more lucrative.

Leverage also appeals to entry-level crypto day traders with limited funds. They can deposit small amounts and gain access to unprecedented trading capital. On CoinFutures, traders need a margin of just 0.1%, so they increase their exposure by up to 1000x.

Compounding Returns

The most successful crypto day traders use the bankroll management strategy. It enables them to simultaneously compound their returns and mitigate drawdown risk. The strategy determines the position size based on the bankroll percentage and balance.

A trader with consistent returns raises their stake over time while they keep the same percentage limit. This helps them grow their portfolio value organically without needing to deposit more funds.

What Are the Risks of Day Trading Crypto?

Crypto day trading strategies carry several risks, including:

- Opportunity Risks: The crypto markets move in extended cycles. When the markets are in risk-on mode, digital assets often increase in value for days or weeks. Day traders limit the growth potential, since they do not hold their positions open overnight.

- Full-Time Participation: Day traders spend countless hours analyzing price charts and broader market conditions. They also actively place buy and sell orders, with many traders entering multiple trades per day. This is a drawback for traders with existing full-time commitments like employment, as they can’t dedicate the required time.

- Technical Analysis is Complex: The day trading strategy largely relies on technical know-how. Traders require a deep understanding of technical and economic indicators and how to analyze and interpret chart signals. Without technical analysis skills, day traders are unable to make consistent profits.

- Transaction Fees: Day traders pay ongoing transaction fees that may impact their profit potential, particularly when they deploy ultra-short-term strategies like scalping. They must cover commissions, spreads, and derivative-related payments just to reach the break-even point.

Popular Crypto Day Trading Strategies to Try

Seasoned crypto day traders use various strategies to maximize profits and minimize risk. This section explores the most common day trading strategies for crypto traders.

Support and Resistance Trading

Support and resistance trading is a tried and tested strategy. Support reflects specific prices where an asset receives significant buying pressure, helping it to reverse a downward trend. Resistance works the same, but in reverse.

Once you’ve identified key support and resistance ranges, you enter buy and sell orders to capitalize on these pricing zones.

Day traders use CoinFutures to identify and trade support and resistance levels. Source: CoinFutures

The strategy is most effective during consolidation periods, since support and resistance are often tested multiple times over short timeframes.

Breakout Trading

Breakout trading also requires day traders to identify support and resistance levels. The key difference is that traders enter positions outside of the consolidation zone.

For example, suppose ETH/USDT trades between $3,300 and $3,500 for several weeks. The day trader places a buy order at $3,550 and a sell order at $3,250. Once the ETH/USDT price eventually exits from the zone, either the buy or sell order triggers, which enables the trader to profit from the breakout.

Scalping

Traders who apply the scalping strategy hold crypto positions open for minutes, and sometimes seconds depending on the analysis. The ultra-short-term strategy aims for tiny profit margins, typically in the 0.1% to 0.5% range.

Scalpers frequently place dozens of trades per day, and they rely on high leverage to amplify their small profit targets.

Another requirement is competitive fees. Scalpers choose the best crypto day trading platforms for tight spreads and low commissions to ensure viability.

News-Based Trading

Consider the news-based trading strategy if you don’t understand technical indicators and chart analysis. You enter buy or sell orders the moment a material news story breaks, depending on whether it’s bullish or bearish.

If a public figure endorses a new meme coin, it could become the next crypto to explode. Day traders who buy that meme coin early profit from the rally. Other news-related narratives include regulatory developments, partnerships, and institutional investment.

Benefits and Drawbacks of Crypto Leverage Crypto Day Trading

Here are the pros and cons of crypto day trading:

Pros of Crypto Day Trading

- Day traders access thousands of cryptocurrencies 24/7

- Significant market liquidity provides nonstop trading opportunities

- Avoid overnight exposure by closing trades before the session’s end

- Apply leverage to amplify day trading gains

- Trade long and short to capitalize on bearish, bullish, and sideways markets

Cons of Crypto Day Trading

- The majority of day traders lose money

- The strategy relies heavily on advanced technical analysis

- Research, chart monitoring, and order placement are time-intensive

- Traders may lose out on larger gains by closing positions early

Day Trading Crypto: Best Practices

Day trading provides ample profit opportunities, yet most traders lose money. Following proven best practices gives you the best chance of making frequent gains with a risk-averse mindset.

Here’s what to consider as a first-time crypto day trader:

- Bankroll Management: Limit your day trading positions to 1-2% of the total bankroll. This setup helps traders build their capital over time, reduce drawdown risks, and avoid chasing losses.

- Trade Liquid Pairs: Entry-level traders should initially trade large-cap pairs, since they attract the most liquidity. Examples include BTC, ETH, SOL, and BNB. These pairs are less volatile compared with the broader market, and their deep liquidity ensures tight spreads.

- Limit Leverage Multiples: While leverage turns small profits into significant returns, using high multiples makes liquidation more likely. Too many liquidated trades can drain your capital, even when using the bankroll management strategy. As a beginner, cap leverage limits to 10x.

- Stop-Loss and Take-Profit Orders: Always use stop-loss and take-profit orders when day trading crypto. These risk management orders protect positions from excessive losses and automatically close them when they reach the profit target.

- Master a Single Strategy: It’s best to focus on mastering one strategy, like breakout trading or scalping, rather than attempting to learn multiple. Using demo accounts that mimic real-time prices is an effective way to learn the strategy’s intricacies in a risk-free environment.

- Factor Fees Into Your Analysis: Beginners often forget to implement trading fees into their trade parameters. Even the best crypto day trading platforms apply commissions and spreads, which you must at least cover to make a profit.

Beginner’s Walkthrough on How to Day Trade Crypto (Step-by-Step Guide)

We explain how to day trade cryptocurrencies on CoinFutures in the following walkthrough. CoinFutures remains our top pick for entry-level traders. The user-friendly platform offers low trading minimums and margin requirements, plus instant execution and competitive fees.

Step 1: Open a CoinFutures Account

Visit the CoinFutures website to open an account. All that’s needed is an email, nickname, and password.

CoinFutures is a no-KYC trading platform that doesn’t collect personal information. Source: CoinFutures

CoinFutures emails a verification link to your address. Click it to verify the new account.

Step 2: Download and Install the CoinPoker Software

CoinPoker, a regulated gambling platform that launched in 2017, backs the CoinFutures brand. Traders must install the platform on a desktop or mobile device, which offers an easy day trading experience.

The CoinFutures platform offers a desktop and mobile trading experience. Source: CoinFutures

Open the CoinPoker software and log in to your account.

Step 3: Make a Deposit

Clicking the wallet icon in the top-right corner of the software takes you to the banking page.

Choose between a crypto or fiat deposit.

Accepted cryptocurrencies include BTC, USDT, BNB, SOL, and other popular altcoins. Deposits function like traditional markets and crypto exchanges, since you transfer coins or tokens to a unique wallet address.

CoinFutures accepts popular cryptocurrencies and fiat payment methods. Source: CoinFutures

If you prefer fiat deposits, CoinFutures accepts Google Pay, Apple Pay, Visa, MasterCard, and PIX.

Step 4: Browse Day Trading Markets

Exit the banking page and click on “Crypto Futures”. The platform takes you to the BTC/USDT trading market.

CoinFutures offers simulated futures markets on top cryptocurrencies. Source: CoinFutures

Click the drop-down list to explore other trading pairs. Avoid high-volatility markets like DOGE unless you’re an experienced trader.

Step 5: Choose the Trade Parameters

Once you’ve selected a crypto pair and performed market analysis, you can set up a trade.

CoinFutures supports long (“Up”) and short (“Down”) trading. Select your market direction via the trading dashboard. Enter the position size ($1 minimum) and choose the leverage multiple.

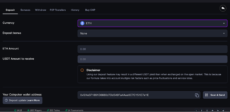

The above screenshot shows the CoinFutures trader risks $10 on an ETH/USDT long position with 5x leverage. If the price declines to $4,042.59, the platform liquidates the trade, and the user loses their $10 stake. Therefore, the next step explains how to set up a risk management order.

CoinFutures Bust Price

On CoinFutures, the liquidation level is called the “Bust Price”. The bust price is above or below the entry price based on the market direction. It shifts further away when you reduce the leverage, which is why experts recommend using modest multiples.

Step 6: Set Exit Parameters and Place a Day Trade

Click the “Auto” button and enter your stop-loss amount. You may enter the amount as a price level or in USD.

Risk-averse traders place stop-loss and take-profit orders on CoinFutures. Source: CoinFutures

CoinFutures supports take-profit orders, too. They let you lock in gains automatically if the markets trigger the target price.

Check the order details to ensure they’re correct, and click “Place Auto Bet” to confirm.

Ultimately, before you day trade cryptocurrencies for the first time, ensure you follow best practices like learning technical analysis and risk controls such as bankroll management and stop-loss orders.

Choosing the best crypto day trading platform is also essential. Traders need ultra-low commissions, margin facilities, and access to a wide selection of crypto pairs. CoinFutures is our overall top pick for day traders. It offers crypto futures with competitive fees, leverage of up to 1000x, and support for top digital assets like BTC, ETH, and SOL.

FAQ

Where do people day trade crypto?

What is the best crypto to day trade?

What hours are best for day trading crypto?

Is it legal to day trade crypto?

Can you make a living day trading crypto?

What is the best way to day trade crypto?

What crypto day trading fees do I need to consider?

What are the best crypto day trading indicators?

References

- What is Day Trading? Definition, Strategies, and Risks (Corporate Finance Institute)

- Crypto Leverage Trading: What Is It, How It Works, and Strategies (Gemini)

- Understanding Indicators in Technical Analysis (Fidelity Investments)

- What are ranges in crypto trading and how to use them? (Coinbase)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

Based on our research, the best short-term cryptocurrencies have deep liquidity, high volatility, and sustained positive market se...

VerifiedX (VFX) has officially launched, offering a Bitcoin-inspired decentralized network with unique on-chain features. Learn wh...

Fact-Checked by:

Fact-Checked by:

28 mins

28 mins

Ibrahim Ajibade

, 374 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.