LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Best Wallet is our top pick for the best crypto exchange for beginners in 2026. Here you can buy over 1,000 cryptos instantly, store them safely, and skip the KYC hassle, all from one mobile app.

Best Wallet comes in first, MEXC comes in second with zero fees on limit orders, and PrimeXBT earns third place with futures trades and a wide range of assets.

We deposited real money, executed thousands of trades, and stress-tested every major feature in over 100 exchanges to find the best crypto exchanges for beginners in 2026, ranking the top 10 providers by core metrics. Discover which Bitcoin and altcoin exchanges offer the best service and learn how to get started in under five minutes.

Key Takeaways for Top Crypto Exchanges

- Best Wallet is our top recommended crypto exchange for beginners. It’s a non-custodial wallet and exchange in one app that supports over 1,000 crypto and does not require KYC.

- No single exchange is perfect and different platforms excel in different dimensions (low fees, regulatory compliance, advanced tools, etc.).

- Many exchanges embed fees in spreads or via commissions. Fiat deposit/withdrawal fees can be especially expensive (averaging 3–5%), so users should check those carefully.

- Exchanges offering high leverage or derivatives come with elevated risk and are suitable only for experienced users.

- Some features are region-restricted. US clients in particular, may face limitations or need to use specialized regulated versions of exchanges.

The 10 Best Crypto Exchanges for Beginners in 2026

According to our extensive research, these are the best crypto exchanges for 2026:

- Best Overall – Best Wallet

- Best for Altcoin Access – MEXC

- Best for Futures and High Leverage – PrimeXBT

- Best Regulated US Exchange – Binance

- Best for Meme Coin Traders – CoinEx

- Best for Localized Payment Methods – Bybit

- Best for Security and Self-Custody – OKX

- Best for Small Account Minimums – BloFin

- Best for Spot Trading – KCEX

- Best for P2P Trading – BingX

Best Bitcoin Exchanges Reviewed

Read on to explore the top 10 crypto exchanges in more detail. Learn which exchanges offer the lowest fees, the widest range of markets, and the overall best user experience.

1. Best Wallet – Best Overall

Best Wallet offers a mobile app where users can buy Bitcoin and over 1,000 other cryptocurrencies with debit/credit cards, e-wallets, and local bank transfers. The exchange doesn’t have know-your-customer (KYC) requirements, so you can invest in digital assets instantly without needing to upload documents.

Users can swap cryptocurrencies within the mobile app – this provides access to millions of markets from popular ecosystems like Ethereum, Solana, and Base. Platform fees are built into quoted exchange rates, which Best Wallet sources from over 100 liquidity partners.

Best Wallet app doubles as a self-custody wallet. This feature ensures cryptocurrencies are stored safely and that users transact without needing approval from third parties. The wallet and exchange offer multiple security tools, including custom PINs, biometrics, and two-factor authentication (2FA).

Editor’s Take:

“Best Wallet genuinely impressed me as an all-in-one solution. You get an exchange and self-custody wallet in one app, so your crypto stays in your control from day one. No KYC hassle, over 1,000 coins available, and the security tools are solid. If you’re new to crypto and want a simple and useful platform, this is where I’d start.”

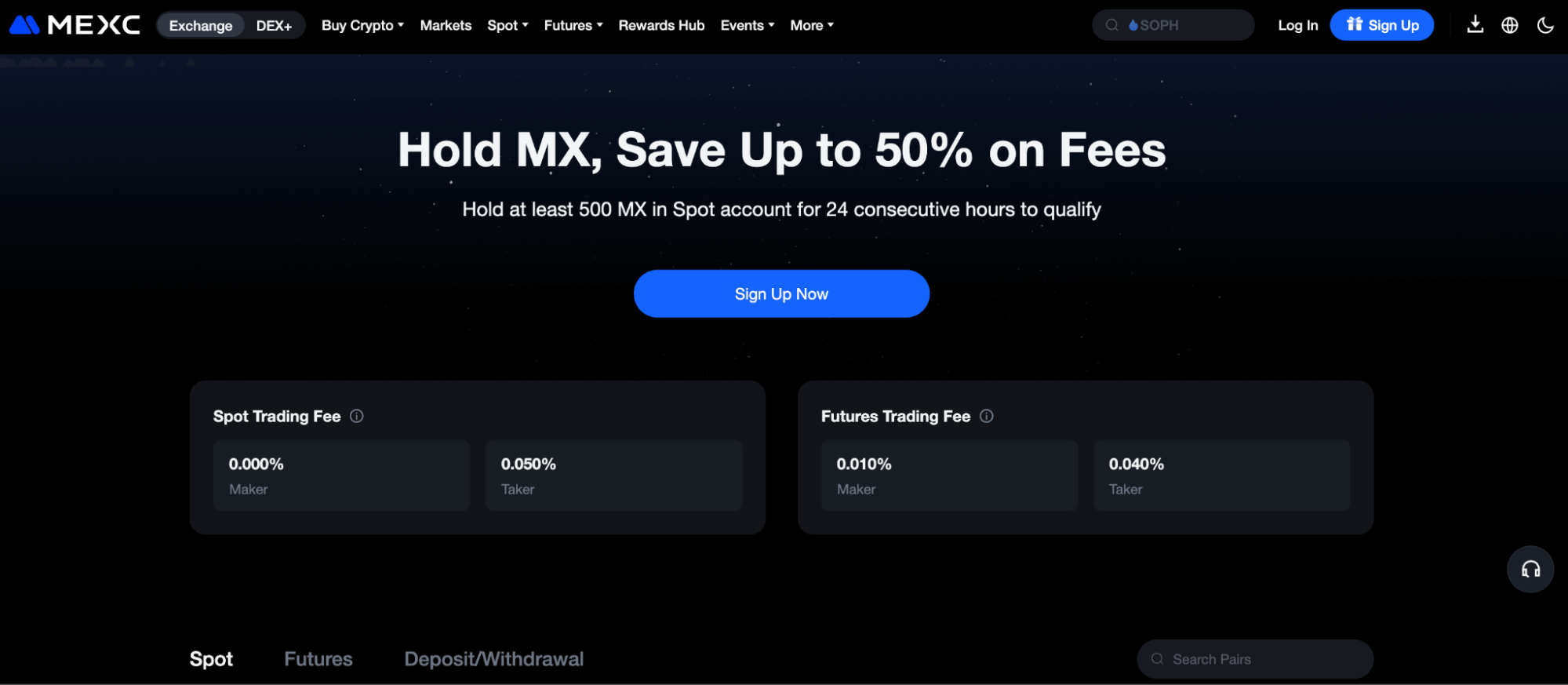

2. MEXC – Best for Altcoin Access

MEXC is a good choice for crypto investors who prioritize altcoins, including Ethereum, Dogecoin, Avalanche, and Solana. You can buy cryptocurrencies instantly with local currencies and payment methods, including Visa, MasterCard, and Google/Apple Pay. Another option is MEXC’s peer-to-peer (P2P) exchange, which supports over 100 deposit types and allows buyers to trade directly with sellers from their home country.

The exchange also provides leverage of up to 500x, offers competitive interest rates on crypto deposits, and a native app for iOS and Android. Spot trading users get 0% commissions when they place limit orders, and 0.05% for market orders. The platform also supports perpetual futures, with commissions set at 0.01% and 0.04% for limit and market orders, respectively.

Markets cover the best altcoins to buy, including Ethereum, Dogecoin, Avalanche, and Solana. The exchange also provides leverage of up to 500x, offers competitive interest rates on crypto deposits, and a native app for iOS and Android.

Editor’s Take:

“MEXC is hard to beat if altcoins are your focus. The selection is massive and those zero-fee limit orders are a nice bonus. That said, it’s a custodial platform, so you’re trusting them with your keys. Great for variety and cost-conscious trading, but I’d recommend moving larger holdings to a personal wallet.”

3. PrimeXBT – Best for Margin Trading

PrimeXBT operates differently from a standard exchange, in that it is a CFD platform built for traders who want exposure to price movements without owning the underlying asset. This allows for very aggressive leverage (up to 100x on cryptocurrencies like Bitcoin and Ethereum, and up to 1000x on Forex pairs).

The platform also integrates traditional markets, where users can fund accounts with crypto (BTC, ETH, USDT) and then trade foreign exchange, or commodities like gold and oil, or stock indices alongside their digital assets, and the ‘Covesting’ module lets users automatically copy the strategies of top-performing traders on the platform, sharing a percentage of the profits.

Trading fees are competitive, generally 0.05% for cryptocurrency pairs, though, since this is margin trading, you have to watch out for overnight financing rates if positions are held past the daily cutoff. The interface is customizable, offering advanced charting tools and multiple order types for executing complex strategies.

Editor’s Take: “PrimeXBT is a powerhouse, but if our eyes not one necessarily for beginners. The ability to trade gold or the S&P 500 using your Bitcoin balance is a fantastic feature that you won’t find on standard exchanges. Just respect the leverage, as a high margin can wipe out your account as fast as it grows. So use this for short-term speculation, not long-term holding.”

4. Margex – Best for Futures and High Leverage

Margex is a derivatives exchange that offers perpetual futures on 55 markets, including the penny cryptocurrencies like Dogecoin and Shiba Inu.

The exchange has a small margin requirement of just 1% on large-cap markets, so a $100 account balance is amplified to $10,000 in trading capital.

Futures trading fees are 0.019% and 0.06% for market makers and takers, respectively, and funding charges apply to leveraged positions every eight hours.

Margex also lets users buy Bitcoin and other popular cryptocurrencies with fiat money. The platform supports 152 payment methods, and the minimum deposit is just $5. They can also access copy trading features, staking rewards, and educational guides on how to analyze and trade crypto.

Editor’s Take:

“Margex is a beginner-friendly platform if you want to try futures trading with almost no risk, as you can get started with just $5. The fees are fair and the platform doesn’t overwhelm you. My concern is that it’s not regulated anywhere. Fine for learning the ropes, but I’d keep my stakes low and my expectations realistic.”

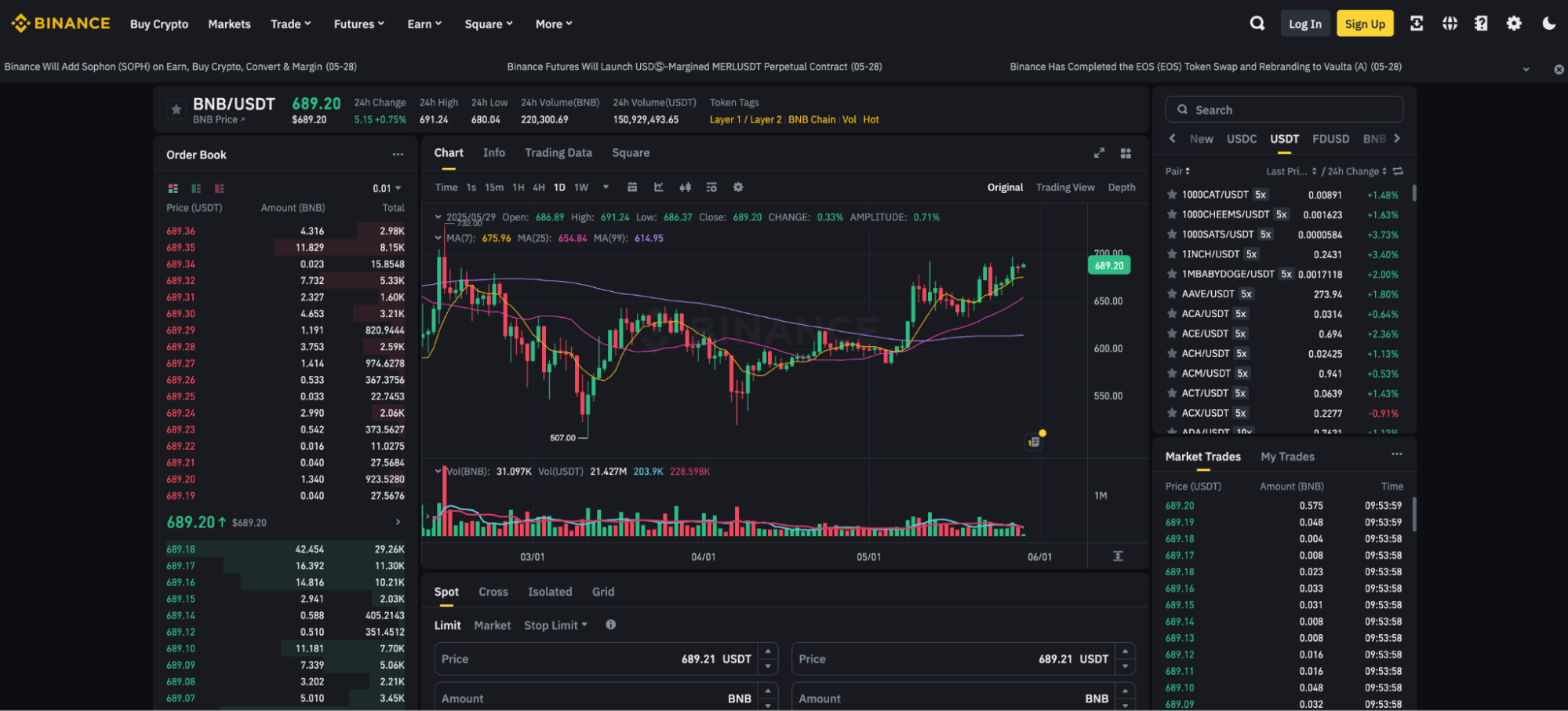

5. Binance – Best Regulated US Exchange

Binance is the most popular exchange in the market with over 275 million registered traders. It counts the US as a major market via Binance.us and supports 500 cryptocurrencies and 2,000 markets, which cover spot trading, perpetual and delivery futures, options, and leveraged tokens.

The exchange is commonly used by active day traders who seek tight spreads, deep liquidity, and access to high-level trading tools. Analysis features include technical indicators, drawing tools, and custom charting areas.

Binance is highly accessible, with desktop software for Mac, Windows, and Linux, as well as a mobile app for iOS and Android. It also offers standard browser-based trading, and all platform options connect to the same Binance account.

Editor’s Take:

“Love it or hate it, Binance sets the standard for crypto exchanges. You get access to 500+ coins, tight spreads, and a trading interface that does it all. However, if you’re just starting out, and depending on where you live, some features might be locked.”

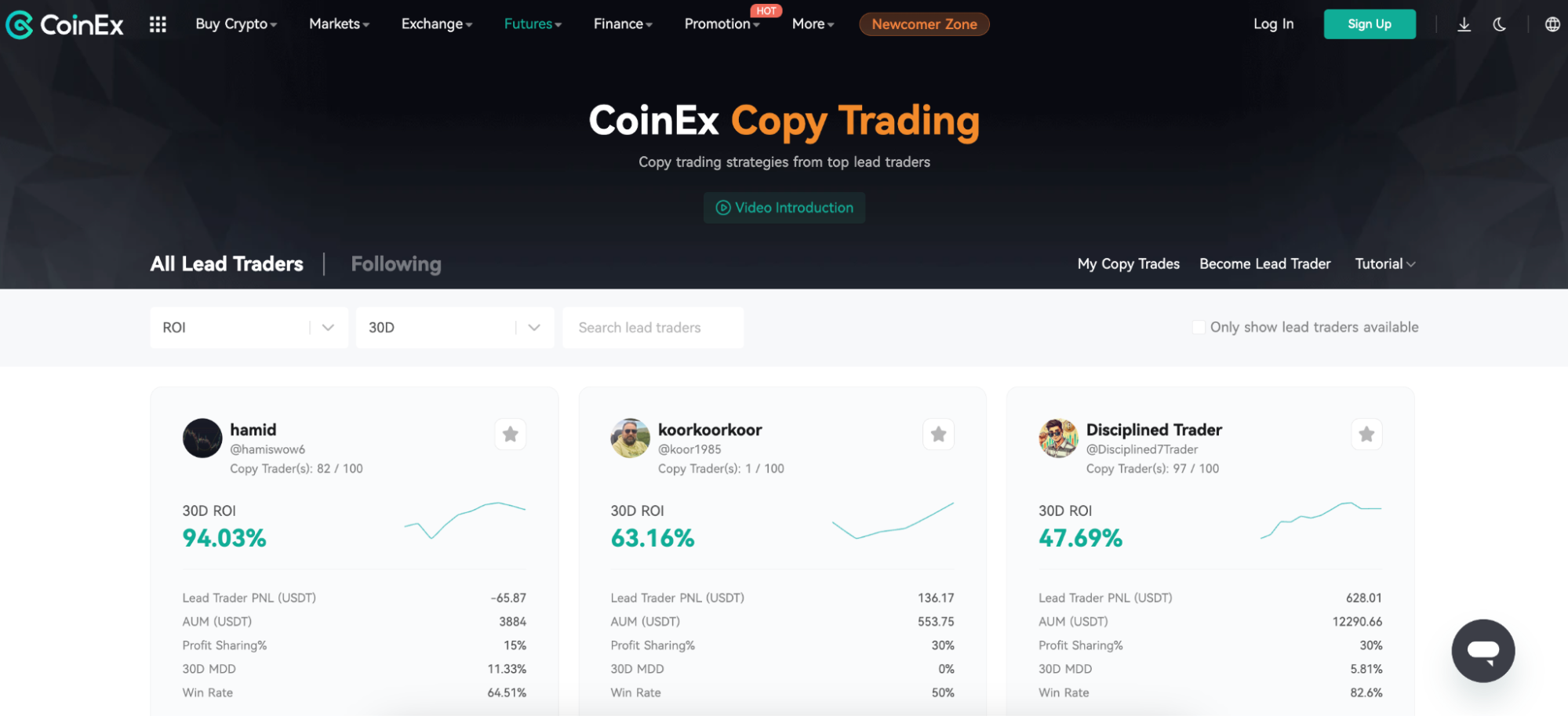

6. CoinEx – Best for Meme Coin Traders

Launched in 2017, CoinEx supports over 1,300 cryptocurrencies, including some of the best meme coins in 2026 like Pepe, OFFICIAL Trump, and Fartcoin.

Its copy trading feature lets investors mirror experienced pros, with buy and sell orders replicated in real-time. There are over 200 copy traders to choose from, and each specializes in perpetual futures. The copy trading tool has a profit-sharing fee that ranges from 10% to 50%.

CoinEx offers auto-invest tools that let users build custom investment strategies, such as dollar-cost averaging or buying the market dip. Users can also deploy spot grid bots, which capitalize on market fluctuations and consolidation periods.

Editor’s Take:

“If you’re hunting meme coins, CoinEx has you covered with over 1,300 tokens. The copy trading feature is actually pretty helpful for beginners who want to follow someone else’s moves. My issue? But with no licenses and above-average costs, I wouldn’t put anything here that I’m not prepared to lose.”

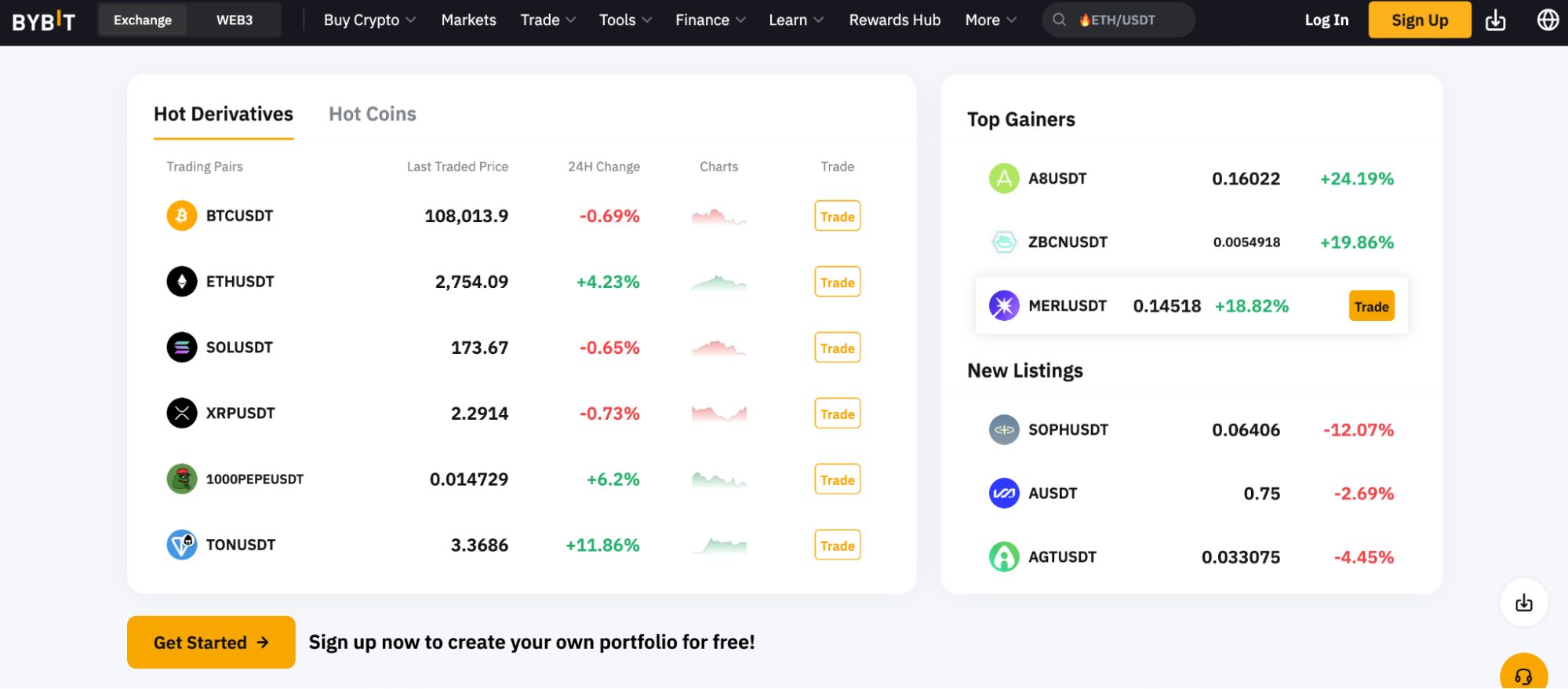

7. Bybit – Best for Localized Payment Methods

Bybit is now the second-largest crypto exchange for daily trading volume. It supports fiat payments across over 60 currencies, and deposit types include Visa, MasterCard, local transfers, SEPA, and Google/Apple Pay. The P2P exchange has over 600 additional payment choices, and fees are often below the global spot price.

The platform offers a huge range of products, including over 1,900 listed cryptocurrencies, and derivative instruments include options, pre-market trading, and delivery futures with 200x leverage.

Investors have a wide range of earning tools at their disposal, from fixed and flexible savings accounts to dual investments and liquidity mining. These products allow users to earn competitive APYs on their crypto balances.

Editor’s Take:

“On paper, Bybit looks great with a huge coin selection, 600+ payment methods through P2P, and solid tools for earning passive income. But they got hacked for $1.5 billion earlier this year, which is not easy to ignore. And if you’re in the US, UK, or Canada, you’re locked out anyway.”

8. OKX – Best for Security and Self-Custody

The tier-one exchange OKX has recently expanded into the U.S. market, giving American users a secure and regulated way to invest in cryptocurrencies. The platform supports hundreds of leading assets, including Bitcoin, Ethereum, Cardano, Arbitrum, and Dogecoin, and makes purchasing digital assets simple through instant, fee-free ACH transfers. Users can also fund accounts using Visa and MasterCard debit or credit cards, or through P2P services that provide an even broader range of local payment options.

Security is a central focus for OKX. The exchange maintains robust regulatory compliance, uses cold storage for most user funds, and offers self-custody through the OKX Wallet, allowing users to manage their own private keys and interact directly with Web3 dApps if they choose.

Trading fees are competitive, with makers paying 0.08% and takers 0.1% per trade, alongside volume-based discounts for active traders. Users outside the U.S. also gain access to advanced features such as copy trading, automated trading bots, and up to 100x leverage.

Editor’s Take:

“I like that OKX doesn’t cut corners on security. Most funds are in cold storage, there’s a self-custody wallet if you want full control, and they’ve gone through the trouble of getting licensed in the US. You’ll need to complete KYC before you can trade, which some people won’t love, but that’s the tradeoff for a more secure platform.”

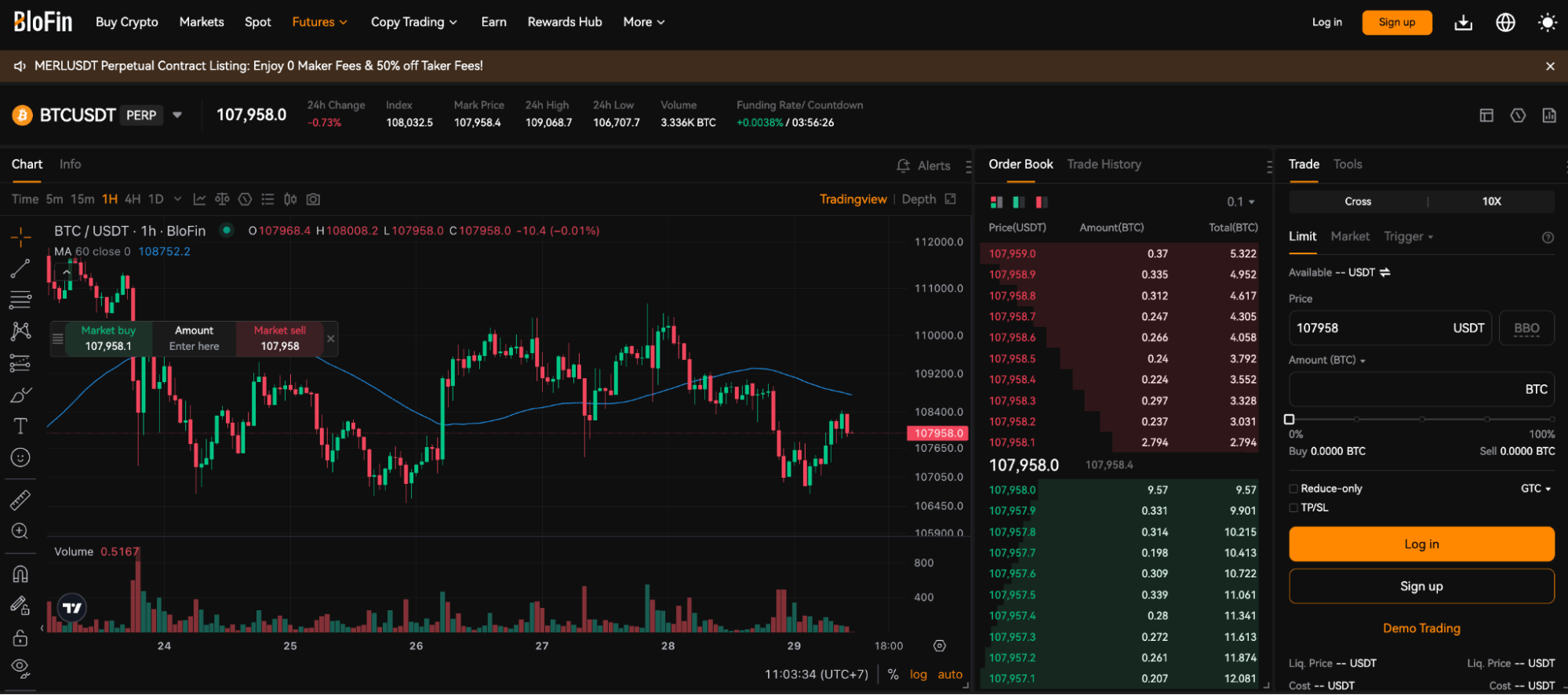

9. BloFin – Best for Small Account Minimums

BloFin was designed with beginners in mind. The retail-friendly platform offers a free demo trading account with unlimited virtual funds and real-time market movements. Novice traders learn how to read pricing charts, use technical indicators, and place orders without risking their own funds.

The exchange also has a comprehensive education section that includes a free trading academy. Once newbies get comfortable with the BloFin platform, they can deposit real money with a debit/credit card – the minimum requirement is just $15.

It supports over 470 coins, and investing categories include meme coins, DeFi, RWA, infrastructure, and GameFi.

Editor’s Take:

“BloFin does some things well. The demo trading is helpful, the education section is solid, and they’ve been around since 2019. But the lack of serious regulation and mixed user reviews about withdrawals make me hesitant. It might be fine if you’re just starting out.”

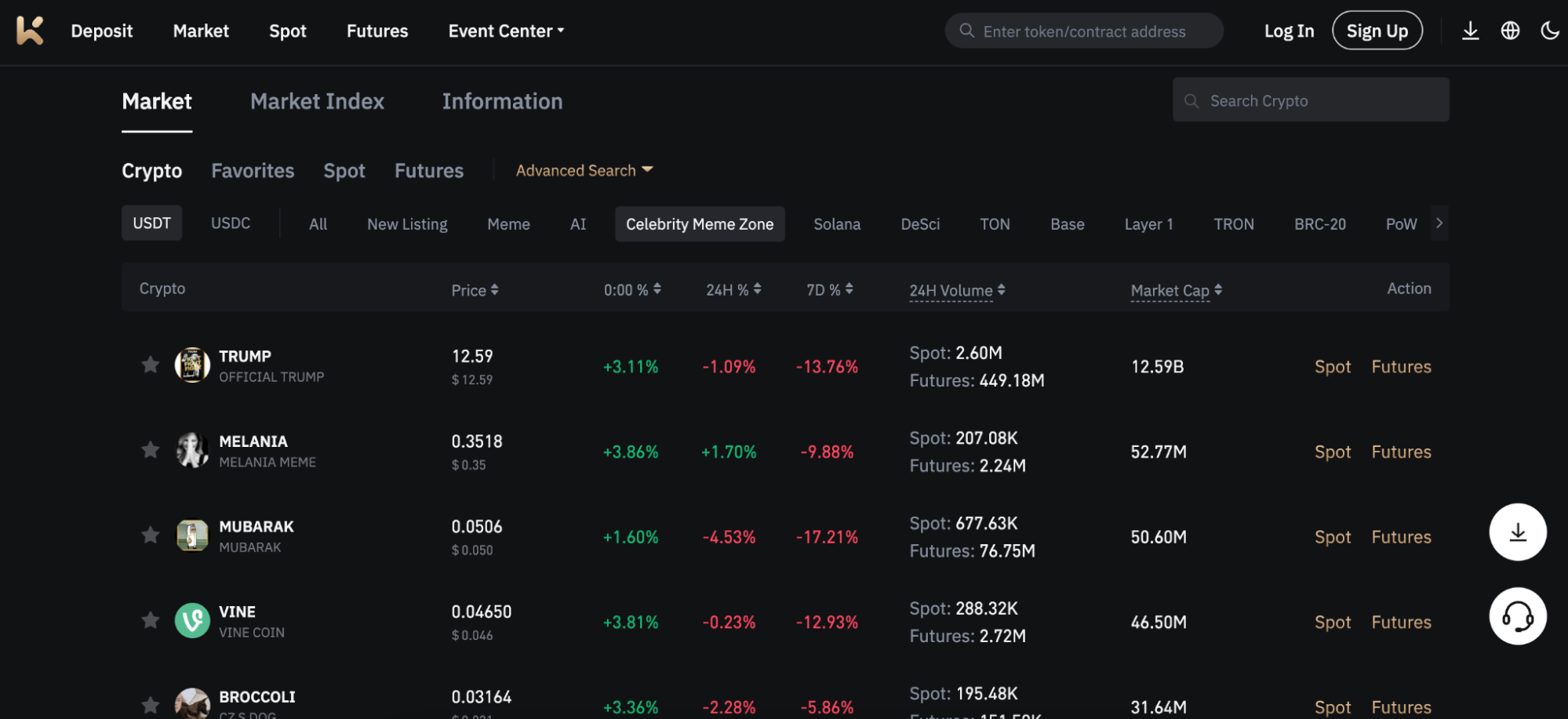

10. KCEX – Best for Spot Trading

KCEX is popular with crypto investors who have a high appetite for risk. The exchange supports over 350 speculative meme coins from a range of narratives, including market leaders like Dogecoin, dogwifhat, Pepe, and Bonk. It also has a dedicated section for celebrity meme coins, including those linked to Donald Trump, Melania Trump, and Dave Portnoy.

You can also trade more serious blockchain projects like Cardano, Bitcoin, Sui, Tron, and BNB, as well as top artificial intelligence (AI) coins like Render and Virtuals Protocol.

KCEX also stands out in the fee department, with no commissions charged on spot trades or futures limit orders. Traders only pay fees when placing market orders on perpetual futures, and even then, it’s only 0.01% per slide.

Editor’s Take:

“I want to like KCEX because the fees are genuinely competitive. But the number of users reporting frozen funds and withdrawal nightmares is alarming. Add in no proof of reserves and offshore registration, and I can’t recommend it with confidence.”

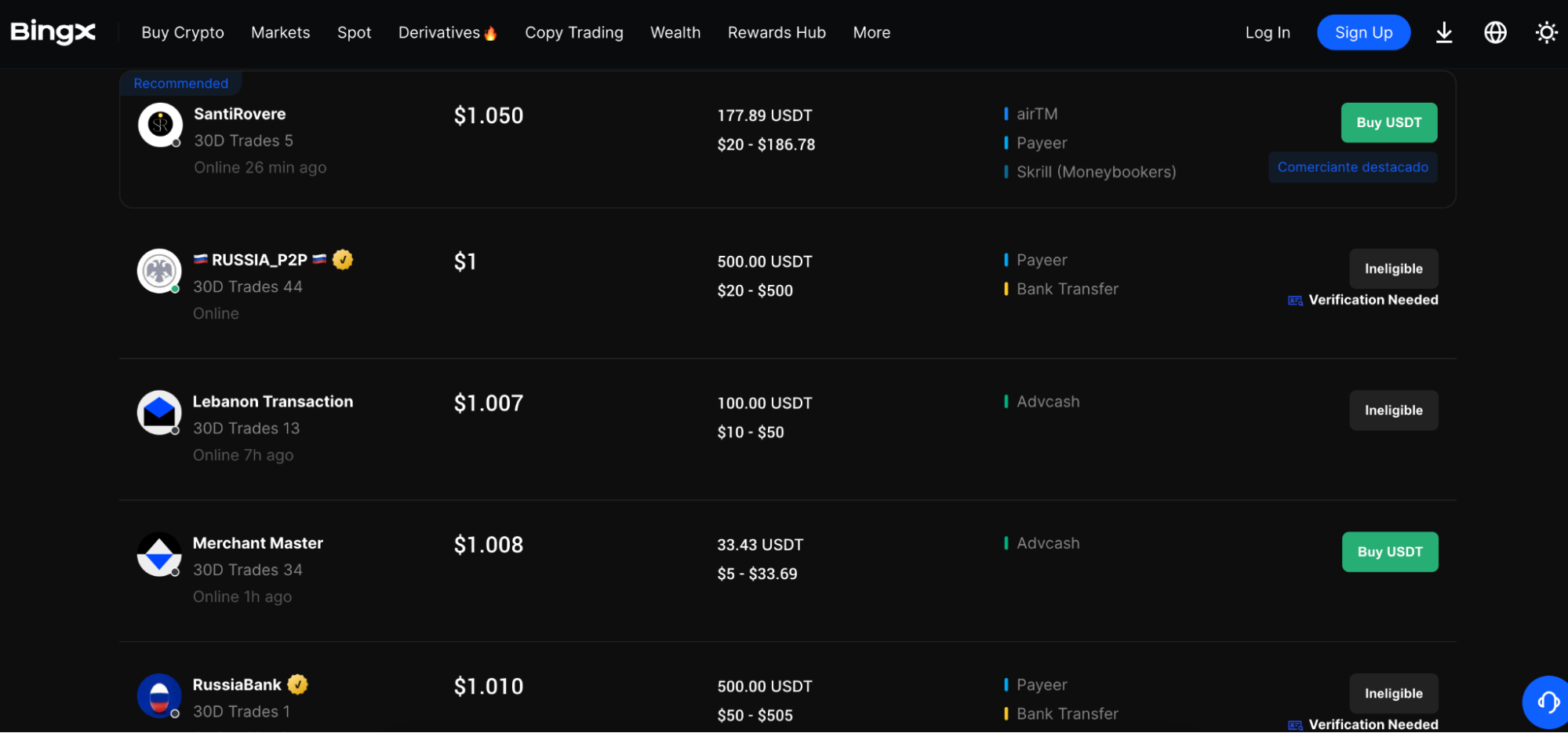

11 BingX – Best for P2P Trading

BingX offers a P2P exchange that supports over 300 payment methods, including local transfers and e-wallets. P2P traders can buy USDT in over 65 fiat currencies, and many sellers have small minimum requirements of just $5.

The exchange ensures safety through a P2P escrow system, to which sellers transfer funds before the buyer makes payment.

Account holders can also use the instant buy feature to purchase cryptocurrencies with Visa or MasterCard. Instant and fee-free bank transfers are available in select regions, including Europe and Australia.

After depositing funds, traders can access over 1,000 trading markets at commissions of just 0.1% per slide.

Editor’s Take:

“BingX built its reputation around P2P trading, and honestly, it does that part well. The payment flexibility is hard to beat and the escrow setup adds a layer of trust. But card fees run high and it’s off-limits to American users. If you need P2P specifically, it’s worth a look. Otherwise, there are broader options out there.”

Compare the Best Crypto Exchanges

| Rank | Exchange | Coins Supported | Fees (Spot) | KYC Required | Wallet Type | Best For |

| 1 | Best Wallet | Varies (depends on the wallet solution highlighted) | Varies | Depends on provider | Non-custodial / Self-custody | Secure storage & self-custody |

| 2 | MEXC | 2,300+ | 0% (spot) | No (basic use) | Custodial wallet | Altcoin variety & low fees |

| 3 | PrimeXBT | 100+ (crypto, forex, indices, commodities via CFDs) | 0.05%–0.2% (varies by asset) | 0.05%–0.2% (varies by asset) | Custodial (trading platform) | Leverage trading & multi-asset exposure |

| 4 | Margex | ~50 | 0.19% maker / 0.19% taker | No strict KYC | Custodial wallet | No-KYC trading & leverage |

| 5 | Binance | 350+ | 0.1% maker / 0.1% taker | Yes (mandatory in most regions) | Custodial wallet + Trust Wallet integration | Liquidity & global reach |

| 6 | CoinEx | 800+ | 0.2% flat | No (basic use) | Custodial wallet | No-KYC trading & mid-cap coins |

| 7 | Bybit | 400+ | 0.1% maker / 0.1% taker | Yes (KYC needed for full access) | Custodial wallet | Derivatives & active trading |

| 8 | OKX | 350+ | 0.08% maker / 0.1% taker | Yes (tiered) | Custodial + Web3 wallet | Advanced trading & DeFi access |

| 9 | BloFin | ~350 | 0.1% maker / 0.1% taker | Yes | Custodial wallet | Institutional-grade security |

| 10 | KCEX | ~200 | 0.1% maker / 0.1% taker | No (basic use) | Custodial wallet | Simple interface & new users |

| 11 | BingX | 700+ | 0.075% maker / 0.075% taker | Yes (varies by region) | Custodial wallet | Copy trading & social features |

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is an online platform where users can buy, sell, and trade digital assets such as Bitcoin, Ethereum, and stablecoins. These exchanges match buyers and sellers while displaying real-time prices. The two main types of exchanges are Centralized Exchanges (CEXs) and Decentralized Exchanges (DEXs).

CEXs act as intermediaries, managing transactions and custody of user funds. They typically offer strong liquidity, advanced tools, and customer support, but users must trust the platform with their assets and may sometimes have to complete Know Your Customer (KYC) verification. The exchanges listed in this article are all CEXs.

DEXs operate on blockchain networks without intermediaries. Users trade directly from their wallets, keeping full control of their private keys. While DEXs enhance privacy and self-custody, they can have lower liquidity and fewer fiat payment options. Examples of DEXs include Uniswap or PancakeSwap.

Note: The exchanges featured in the article are all CEXs because they are generally better suited for beginners. CEXs handle custody of user funds, provide intuitive interfaces, and offer robust customer support, making it easier for new users to navigate trading, deposits, and withdrawals. While DEXs give full self-custody, their complexity can be challenging for those just starting in crypto. CEXs strike a balance between accessibility, security, and convenience for newcomers.

How Do Crypto Exchanges Work?

A crypto exchange is a place where buyers meet sellers. You want Bitcoin, someone else wants to sell theirs, and the exchange acts as an intermediary.

Most exchanges use an order book, a running list of everyone who wants to buy and everyone who wants to sell, along with the prices they’re willing to accept. When a buyer’s price matches a seller’s price, the trade happens automatically. You don’t need to find the other person or negotiate a price, because the system handles everything.

One more thing that’s important to keep in mind is that when you buy some crypto through a centralized exchange, the platform holds it for you. Your funds are stored in their wallets, which is completely fine for day-to-day trading, but if the exchange gets hacked or goes under, your funds could disappear with it.

If you’re holding significant funds, it might be better to move a large chunk of it into a cold storage to keep it safe.

How to Get Started on a Centralized Crypto Exchange

- Sign Up

First things first. You need an account. Head to the exchange, punch in your email, set a password, and you’re in.

Some platforms might require you to finish KYC, which stands for Know Your Customer. You upload a photo of your ID, sometimes a selfie, and wait for approval. Once you’re verified, you get access to higher limits and the full range of features.

- Add Funds

Now you need money in your account. Bank transfers are the cheapest route, but you might wait a few days for the funds to clear. Cards get you in faster, though you’ll pay for that convenience with fees that can run 2-4% on top of your deposit.

P2P is another option if your exchange supports it, and it lets you buy directly from another user however you both agree to settle up. If you already have crypto somewhere else, you can skip the fiat step entirely. Just send it to your deposit address on the exchange and you’re ready to trade.

- Make a Trade

This is the part you came for. Find the coin you want, decide how much you’re buying, and place your order. Market order if you want it done now, limit order if you want to wait for a better price.

The whole thing takes seconds once you get the hang of it. Your new crypto shows up in your exchange balance right away.

- Lock Down Your Account

This is the boring part that people skip and later regret. Turn on two-factor authentication before you do anything else. It’s one extra step at login that makes your account significantly harder to compromise.

After that, poke around the security settings. Whitelist your withdrawal addresses so your crypto can only go where you’ve already approved, and turna on time locks if they’re available. The goal is to create enough friction that even if someone gets into your account, they can’t actually take anything before you notice.

- Withdraw Your Crypto

Once you’re done trading, you have a choice. Leave your crypto on the exchange or move it somewhere safer. If you want to trade with it again, its easier to keep it on the platform, otherwise, its safer to move it to personal cold wallet.

Just paste your wallet address, double-check it, confirm the withdrawal, and wait. Depending on the network, it could arrive in minutes or take an hour. Either way, once it’s in your own wallet, it’s yours. No exchange can freeze it, lose it, or lock you out.

Are Crypto Exchanges Safe to Use?

Crypto exchanges are generally safe when using reputable platforms, practicing good security hygiene, and understanding where responsibility lies: with the platform on CEXs and with the user on DEXs.

Leading CEXs like Binance, OKX, or Coinbase implement multi-layered security, including cold storage, two-factor authentication (2FA), encryption, and proof-of-reserves audits to verify user balances. However, because centralized exchanges hold custody of funds, they remain vulnerable to hacks or operational risks, and users are often advised to withdraw long-term holdings to self-custody wallets.

DEXs, by contrast, eliminate custodial risk since users keep control of their keys. Yet, they introduce smart contract vulnerabilities and lack formal customer support.

Regulated mainstream crypto exchanges are largely safe, but the platform’s structure, reputation, and user practices have to be taken into account.

How to Choose a Safe and Trusted Crypto Exchange

Follow these best practices to ensure you’re using a legitimate Bitcoin exchange:

- Assess Trading Volumes and Users: The best crypto exchanges attract significant volumes, with OKX, Binance, and MEXC users trading billions of dollars every day. These platforms have millions of active traders and an overall solid reputation.

- Evaluate Account Security Features: Legitimate platforms offer a wealth of account security tools, from 2FA and device whitelisting to withdrawal time locks.

- Cold Storage: Exchanges should keep the vast majority (95%+) of client-owned cryptocurrencies in cold storage wallets. This security system mitigates the risks of remote hacks.

- Check Proof of Reserves: Since the FTX bankruptcy, proof of reserves has become the industry norm. Ensure reserves have been audited by reputable companies and that they’re held in liquid assets like Bitcoin and USDT.

How Do Crypto Exchange Fees Work?

Every exchange takes a cut. The question is how much and where.

Most platforms use what’s called a maker-taker model. If you place a limit order that sits on the order book and waits to be filled, you’re a maker. You’ve added liquidity to the market, and the exchange rewards that with lower fees.

If you place a market order that fills right away against someone else’s order, you’re a taker. You’ve removed liquidity, so you pay a bit more.

The difference isn’t huge, usually a few hundredths of a percent, but it adds up if you trade often.

Your fees can also drop based on how much you trade. Most exchanges run tiered structures where your rate gets better as your 30-day volume climbs. Casual users won’t notice much of a difference, but active traders can save a decent chunk over time.

Trading fees aren’t the whole picture though. Deposits can cost you, especially with cards. Withdrawals almost always carry a fee, sometimes flat, sometimes based on network congestion. And if you’re converting between currencies or swapping one coin for another, there’s usually a spread or fee baked into the rate.

Payment method matters can make a difference as well. Credit cards are fast but expensive because exchanges eat the chargeback risk and pass that cost to you. On the other hand, bank transfers take longer but come in cheaper.

How to Use a Cryptocurrency Exchange in 2026

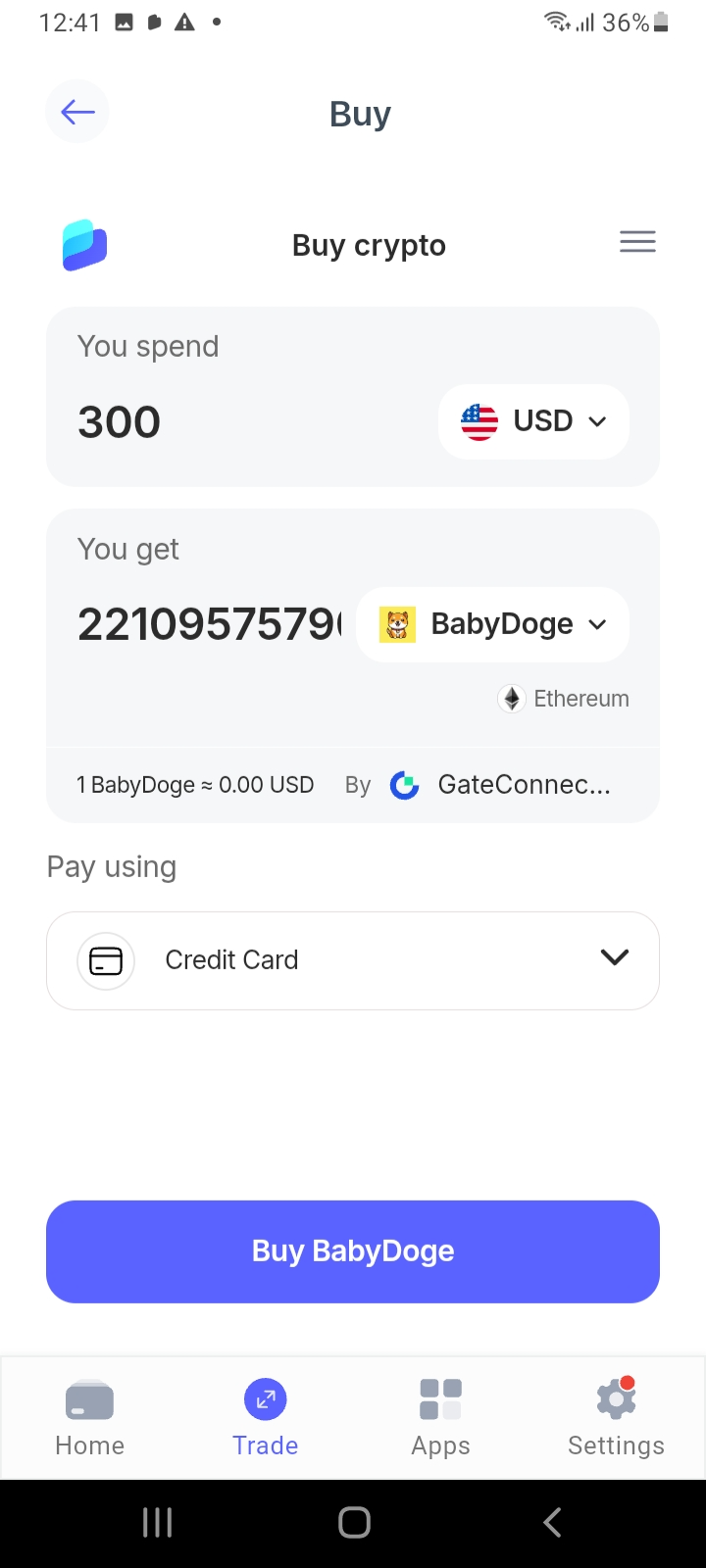

This section explains how to buy cryptocurrencies on the Best Wallet app – our overall top pick for beginners.

- Step 1: Download the iOS or Android App: Go to the Best Wallet website and download its mobile app.

- Step 2: Secure the App: Activate all security features before you buy digital assets, including biometrics and 2FA. Write down the 12-word backup passphrase in case you lose your smartphone.

- Step 3: Choose a Crypto to Buy: Best Wallet supports the best cryptocurrencies to buy, with over 1,000 markets available. Tap “Trade” and “Buy” to explore the app’s supported assets.

- Step 4: Enter the Purchase Requirements: After choosing a coin, select the currency and payment method, and type in the purchase amount.

- Step 5: Complete Payment: The app redirects you to the final confirmation screen – check everything is correct, enter the payment details, and confirm the order. The purchased coins will appear in your wallet balance almost instantly.

- Step 6: Store Crypto: Best Wallet is also a self-custody wallet, so you can store your cryptocurrencies safely until you decide to cash out.

Methodology – How We Picked and Ranked the Best Cryptocurrency Exchanges

We tested 100+ crypto exchanges, including deposits, trading, core features, and withdrawals. We evaluated each platform on desktop and mobile devices to assess the overall user experience. The team then analyzed key variables by their importance, starting with safety, licensing, and security features like 2FA, proof of reserves, and cold storage.

Note: The “Best” classifications (e.g., Best for Low Fees, Best for Beginners, Best for Advanced Trading, etc.) are not investment recommendations. They’re intended to help readers identify each exchange’s primary strengths, ideal use cases, and overall value proposition.

The Coinspeaker team determined these categories through a combination of documented platform features and, where possible, direct analysis and limited hands-on testing of each exchange. This process allows us to highlight what each platform appears best suited for based on its functionality, user experience, and positioning within the market.

Our evaluation of crypto exchanges is based on the following weighted criteria:

Regulation (25%)

Licensed and regulated exchanges provide the safest environment for crypto investing, reducing risks of fraud and ensuring compliance with local laws.

Fees (20%)

Competitive trading fees and low deposit/withdrawal costs are critical for maximizing investor returns.

Tradable Cryptos (15%)

A broad selection of supported cryptocurrencies enables investors to diversify portfolios and access niche markets.

Wallet Security (12%)

Platforms with built-in, secure wallets make it easier and safer to store digital assets without relying on third-party solutions.

Tools, Features and Apps (15%)

Advanced trading tools such as copy trading, demo accounts, automated bots, and technical indicators help traders of all levels navigate volatile markets. A user-friendly mobile app for iOS and Android lets traders monitor markets and trade securely on the go.

Payment Methods (8%)

Easy fiat on-ramps, including Visa, MasterCard, and popular e-wallets, are important, especially for first-time investors.

Customer Service (5%)

Reliable support, ideally 24/7 with live chat, ensures quick resolution of issues and builds trust with users.

Conclusion

After extensive research, we rank Best Wallet as the top cryptocurrency exchange app for 2026. It combines the convenience of an exchange with the security of a self-custody wallet, giving users full control over their assets while still making it easy to buy, sell, and store crypto in one place.

The app, available on both iOS and Android, offers a clean and intuitive interface while supporting 1,000+ coins, including major assets like Bitcoin and Ethereum as well as emerging tokens. Users can invest in cryptocurrencies in under two minutes without needing to provide personal information or ID documents.

Looking ahead, Best Wallet is also well-positioned for the next wave of Web3 adoption. Its built-in self-custody approach lays the foundation for seamless access to decentralized finance (DeFi), NFTs, and other emerging blockchain applications. This future-ready design makes Best Wallet not only the best choice for 2026, but also a strong gateway into the evolving digital asset ecosystem.

FAQ

Which cryptocurrency exchange is best?

What is the safest crypto exchange?

Which crypto exchange has never been hacked?

What is the most trusted site to buy crypto?

How to know if a crypto exchange is safe?

What happens if a crypto exchange goes bust?

References

- Top 10 Countries Using Binance Exchange (Binance Square)

- Global crypto exchange OKX pushes into U.S. market with trading and wallet offering (CNBC)

- Crypto’s biggest hacks and heists after $1.5 billion theft from Bybit (Reuters)

- FTX cleared to repay billions to customers after bankruptcy plan approval (Reuters)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

26 mins

26 mins

Filip Stojanovic

, 45 postsI’m a crypto content strategist and writer who helps Web3 projects tell their story, build trust, and grow engaged communities in an increasingly competitive space. I’ve worked with presale tokens, exchanges, blockchain startups, and crypto marketing agencies, shaping content strategies that not only explain complex concepts but also inspire confidence, attract investors, and drive adoption.

My experience spans a wide variety of formats, from whitepapers, token launch campaigns, and pitch decks to thought leadership articles, technical documentation, and in-depth guides. Before diving into Web3, I built my expertise in B2B SaaS writing. This structured, analytical approach now underpins my work in crypto, allowing me to bring clarity and credibility to projects in a space often criticized for hype and jargon.

I’m especially interested in how blockchain innovation translates into real-world utility. My recent work explores the evolving role of DeFi protocols, NFT ecosystems, and next-generation infrastructure in reshaping industries and creating new opportunities for both businesses and individuals.