This guide explains how to buy TOKEN6900, a new meme coin project with an attractive market capitalization. Learn how to join the ...

Best Crypto to Stake in 2025: Top Staking Coins for Passive Income

Last Updatedby Otar Topuria · 26 mins read

Find the best staking cryptocurrencies in 2025 offering high APYs and passive income. From Bitcoin Hyper’s 480% APY to established networks like Polkadot, discover top staking opportunities across presale projects and proven blockchain networks.

Disclaimer: Cryptocurrencies are considered high-risk investments. This article serves for informational purposes only. It should not be perceived as financial advice. By reading our website, you acknowledge and accept our terms and conditions. Our content may include affiliate links through which we may earn a commission.

TOKEN6900, Snorter Bot, and Bitcoin Hyper are the best crypto to stake in 2025, offering APYs ranging from 55% to 600% while bringing innovative utility to the finance, Telegram trading, and Bitcoin ecosystem sectors, respectively.

According to our research across hundreds of proof-of-stake networks, these three projects combine high staking rewards with strong fundamentals and real-world utility. TOKEN6900 leads with a 607% APY as the first transparent satirical finance platform. Snorter Bot provides a 258% APY as Telegram’s first comprehensive trading suite, and Bitcoin Hyper delivers a 480% APY as the pioneering Bitcoin Layer 2 solution.

Our methodology and analysis reveal that the highest-performing staking opportunities in 2025 balance attractive yields with project sustainability, technological innovation, and growing user adoption.

Best Crypto to Stake Key Takeaways

- TOKEN6900 launched with $5M hard cap as the first satirical finance platform, offering 600% staking APY through “Brain Rot Vault” with 7+ million tokens already staked

- Bitcoin Hyper leads with 480% APY as the first Bitcoin Layer 2 network, raising $1.6M in presale while unlocking DeFi for the $1.5 trillion Bitcoin ecosystem

- Snorter Bot offers 258% APY for Telegram trading automation with 85% rugpull detection accuracy and $1.2M+ already raised across 60 presale stages

- BTC Bull Token provides 55% APY with Bitcoin-linked airdrops at $150K/$200K price targets and $7.3M raised from Bitcoin maximalists

- Established networks like Polkadot deliver 16.8% APY with proven stability, while Avalanche offers 6.7% APY with zero slashing risk for conservative investors

Best Crypto Staking Coins to Watch in July 2025 – Top Picks

We carefully curated a selection of this month’s most promising staking opportunities, combining high reward potential with solid project fundamentals. Here is the list.

- Inspired by SPX6900 & early 2000s internet culture

- 80% supply in fair launch presale ($5M cap)

- Fixed-supply meme coin, no utility or minting

- Fastest meme coin sniper on Solana and EVM

- Multichain Telegram bot with lowest fees and instant execution

- Snipe new tokens before bots and whales

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

- Bitcoin-Linked Airdrops

- Token Burns at BTC Milestones

- Ethereum-Based Smart Contract

- Exclusive in-app access to vetted crypto presales

- Staking rewards with an annual percentage yield (APY) of up to 152%

- Upcoming Best Card enables crypto spending at millions of merchants with cashback

- AI-Powered Virtual Influencers

- 20% APY Staking Rewards

- VIP perks: livestreams, BTS content, credits, and more.

Top 10 List of Best Coins for Staking in 2025

- TOKEN6900 – Anti-S&P 500 satirical meme coin with 607% APY and “brain rot finance” transparency

- Snorter Bot – Telegram trading bot ecosystem with 258% APY

- Bitcoin Hyper – Bitcoin Layer 2 rollup offering 480% staking rewards

- BTC Bull Token – Bitcoin-linked meme coin with 55% APY and deflationary burns

- Best Wallet Token – Next-gen wallet with 102% presale staking APY

- SUBBD – AI-driven content platform with 20% fixed APY

- Polkadot – Blockchain interoperability protocol offering 16.8% historical rewards rate

- Avalanche – High-performance blockchain with 6.7% APY and no slashing risk

- Algorand – Pure Proof-of-Stake blockchain with 5.70% APY and no lock-up periods

- Polygon – Ethereum’s leading scaling solution with 4.95% staking APY and near-zero transaction fees

Best Crypto to Stake – Analysis and Reviews

Here’s our detailed analysis of each staking opportunity, covering everything from APY potential to lock-up requirements and platform security.

1. TOKEN6900 – Revolutionary Satirical Finance Ecosystem

TOKEN6900 redefines meme coin investing through its “Peak Brain Rot Theory” and transparent zero-utility approach. The project positions itself as the “anti-S&P 500” alternative, offering pure “collective delusion as liquidity” without hiding behind fake roadmaps or AI buzzwords. With one extra token than SPX6900 (930,993,091 vs 930,993,090), TOKEN6900 claims objective superiority while embracing early 2000s nostalgia and complete financial honesty.

TOKEN6900 presale dashboard. Photo: TOKEN6900

- Why It’s Good for Staking: Currently offering 607% APY with over 7 million tokens already staked, the project’s sustainable $5M hard cap and 80% presale allocation create scarcity.

- Suitable For: Anti-establishment traders, satirical finance enthusiasts, and meme coin speculators who value transparency over utility promises.

- Staking Options: Live “Brain Rot Vault” staking with flexible withdrawal terms and progressive price appreciation from $0.0064 to $0.007125 across presale stages.

- Community Growth: Viral social media momentum with growing crypto influencer mentions and strong engagement from terminally online traders seeking honest meme investments.

- Lock-Up Period: Flexible staking terms with 30-day vesting after the token generation event, allowing gradual withdrawal or full redemption plus accumulated rewards.

| Category | Satirical Finance / Meme |

| Chain | Ethereum |

| Staking APY | 607% |

| Lock-up | 30-Day Vesting |

| Platform | Presale, Ethereum DEXs |

| Market Cap | More than $65K |

| Community | Growing Base of Followers |

2. Snorter Bot – Advanced Telegram Trading Suite

Snorter Bot transforms Telegram into a trading platform with high sniping capabilities for new token launches. The project’s detection algorithms identify rugpulls and honeypots with 85% accuracy, while automated copy trading features let users mirror successful strategies from proven meme coin traders.

Snorter crypto trading bot. Photo: Snorter

- Why It’s Good for Staking: Currently offering 258% APY for presale participants with reduced trading fees dropping from 1.5% to 0.85% for SNORT holders. Early presale pricing across 60 stages provides built-in appreciation potential before exchange listings.

- Suitable For: Active traders and meme coin investors seeking automation tools with high staking rewards.

- Staking Options: Multi-stage presale staking with progressive price increases and fee reduction benefits.

- Community Growth: Explosive early growth with $1.37M already raised, and rapidly expanding Telegram community with viral social media momentum.

- Lock-Up Period: Flexible terms with early withdrawal options during the crypto presale phase.

| Category | Trading Bot |

| Chain | Solana (Ethereum Coming) |

| Staking APY | 258% |

| Lock-up | Flexible |

| Platform | Telegram, DEX |

| Market Cap | $1.37M |

| Community | Growing Telegram Users |

3. Bitcoin Hyper – First Bitcoin Layer 2 Network

Bitcoin Hyper is a breakthrough in Bitcoin scaling technology, introducing the first Layer 2 network built on the Solana Virtual Machine (SVM). The project unlocks DeFi capabilities for Bitcoin holders by combining Bitcoin’s security with Solana’s transaction speed and low fees, potentially activating the $1.5 trillion Bitcoin ecosystem for smart contracts and decentralized applications.

Bitcoin Hyper. Source: Bitcoin Hyper

- Why It’s Good for Staking: Currently offering 480% APY with sustainable tokenomics backed by transaction fee revenue, over 109 million HYPER tokens have already been staked during the presale phase.

- Suitable For: Bitcoin maximalists seeking DeFi exposure, Layer 2 technology believers, and high-yield staking enthusiasts wanting Bitcoin ecosystem participation.

- Staking Options: Immediate presale staking with a decreasing APY model that rewards early participants while maintaining long-term sustainability.

- Community Growth: Almost 15,000 Telegram and X followers, with growing engagement from the Bitcoin community.

- Lock-Up Period: Tiered system with early withdrawal penalties to ensure network stability.

| Category | Bitcoin Layer 2 |

| Chain | Bitcoin/SVM Hybrid |

| Staking APY | 480% |

| Lock-up | Tiered System |

| Platform | Presale, Bitcoin L2 |

| Market Cap | $1.89M |

| Community | Almost 15K on Telegram and X |

4. BTC Bull Token – Bitcoin-Linked Rewards System

BTC Bull Token creates an original meme coin ecosystem that directly links holder rewards to Bitcoin’s price performance. Unlike traditional meme coins that rely on speculation, BTCBULL implements real Bitcoin airdrops when BTC reaches specific price targets ($150K, $200K) and features deflationary token burns at key Bitcoin milestones, starting from $125K.

BTC Bull Token. Source: BTC Bull Token

- Why It’s Good for Staking: Currently offering 55% APY with over 1.9 billion tokens already staked, a unique combination of staking rewards, Bitcoin airdrops, and deflationary burns creates multiple value creation mechanisms.

- Suitable For: Bitcoin maximalists seeking leveraged exposure, meme coin traders wanting utility, and yield farmers attracted to Bitcoin-correlated rewards.

- Staking Options: Dynamic APY staking with automatic Bitcoin airdrop distribution through Best Wallet integration at predetermined BTC price milestones.

- Community Growth: Strong presale momentum with $7.98M raised, approaching 10,000 X followers and 3,500 Telegram members with growing institutional interest.

- Lock-Up Period: Flexible staking terms with early withdrawal options during the presale phase.

| Category | Meme/Bitcoin Hybrid |

| Chain | Ethereum (ERC-20) |

| Staking APY | 55% |

| Lock-up | Flexible |

| Platform | Presale, DEX |

| Market Cap | $7.98M |

| Community | 10K X / 3.5K Telegram |

5. Best Wallet Token – Next-Generation Crypto Wallet

Best Wallet Token powers a crypto wallet ecosystem that combines secure non-custodial functionality with an integrated DEX and “Upcoming Tokens” launchpad for presale discovery. The platform has processed over $13.68M in presale investments while maintaining a 4.5-star rating across app stores and securing 500,000+ downloads.

The Best Wallet Presale website. Photo: Best Wallet

- Why It’s Good for Staking: Currently offering 102% APY for presale participants with $13.5 million raised, token holders receive quantifiable benefits, including 30% transaction fee reductions and priority presale access.

- Suitable For: Security-conscious investors, presale hunters seeking early access, multi-chain users, and passive income seekers through staking aggregation.

- Staking Options: Presale staking with 8% of the total supply allocated for rewards and 10% for exchange liquidity to ensure sustainable growth.

- Community Growth: 500,000+ app downloads with almost 79,000 X followers and 50,000 Telegram members.

- Lock-Up Period: Flexible staking terms with early withdrawal options for active wallet users.

| Category | Wallet Infrastructure |

| Chain | Multi-chain Support |

| Staking APY | 102% |

| Lock-up | Flexible |

| Platform | Best Wallet App |

| Market Cap | $13.68M |

| Community | 79,000 X followers and 50,000 Telegram members |

6. SUBBD – AI-Powered Content Creation Platform

SUBBD transformed the content creator industry ($85 billion industry according to Forbes) by merging AI technology with blockchain monetization, connecting over 2,000 verified influencers with a combined following of 250 million fans. Unlike traditional platforms that retain 50% or more of creator earnings, SUBBD enables direct fan-to-creator payments while offering AI tools, including AI-generated influencers, voice notes, and video generation.

SUBBD presale. Photo: SUBBD

- Why It’s Good for Staking: Fixed 20% APY with $734.95K raised. The platform already serves 2,000+ active influencers with proven market demand, offering immediate real-world utility beyond speculation.

- Suitable For: Content creators, AI technology investors, Web3 enthusiasts seeking utility-driven projects, and investors wanting exposure to the intersection of AI and creator monetization.

- Staking Options: Presale staking with a 7-day withdrawal period after token launch, plus VIP content access and platform benefits for stakers during the holding period.

- Community Growth: 2,000+ verified influencers actively promoting with 250 million combined follower reach, 78,000 X followers, and 19,000 Telegram members.

- Lock-Up Period: Seven days post-launch with immediate access to platform benefits during the staking period.

| Category | AI Content Creation |

| Chain | Multi-chain Support |

| Staking APY | 20% |

| Lock-up | 7 Days Post-Launch |

| Platform | SUBBD App |

| Market Cap | $734.95K |

| Community | 250M Platform Followers, 78,000 X, and 19,000 Telegram followers |

7. Polkadot – Future of Blockchain Interoperability

Polkadot operates as a Layer 0 protocol designed to connect and secure multiple blockchains, enabling smooth interoperability between private and public networks, oracle services, and various protocols. The platform’s Nominated Proof-of-Stake (NPoS) consensus mechanism allows token holders to participate in network security while earning competitive staking rewards.

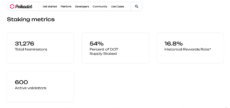

Polkadot staking dashboard. Source: Polkadot

- Why It’s Good for Staking: Currently offering a 16.8% historical rewards rate with 54% of the DOT supply actively staked by 31,276 nominators. The NPoS system distributes rewards equally among validators regardless of stake size.

- Suitable For: Blockchain interoperability believers, long-term crypto investors seeking stable returns, and users wanting exposure to the multi-chain ecosystem.

- Staking Options: Direct nomination with 1 DOT minimum through pools, validator operation with 250+ DOT, or hardware wallet integration through Ledger with 254 DOT minimum requirement.

- Community Growth: 600 active validators securing the network with over 31,000 nominators participating.

- Lock-Up Period: A 28-day unbonding period for direct staking, providing security against long-range attacks while maintaining network stability.

| Category | Interoperability Protocol |

| Chain | Polkadot |

| Staking APY | 16.8% |

| Lock-up | 28 Days |

| Platform | Native Dashboard |

| Market Cap | $5.3B |

| Community | 1.5M followers on X, and 23K on Telegram |

8. Avalanche – High-Performance Blockchain Validator

Avalanche is a high-performance blockchain platform designed for scalability, featuring near-instant transaction finality through its unique Avalanche Consensus Mechanism. The network enables the creation of interoperable Layer 1 blockchains while maintaining low hardware requirements and offering slashing-free staking rewards.

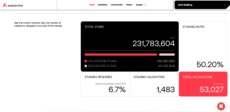

Avalanche staking metrics. Source: Avalanche

- Why It’s Good for Staking: Currently offering 6.7% APY with no slashing risk, making it one of the safest staking environments available. With 231.7 million AVAX staked across 1,483 validators and a 50.20% staking ratio.

- Suitable For: Risk-averse investors seeking steady returns without slashing penalties, developers building scalable applications, and validators wanting low hardware requirements.

- Staking Options: Direct validator operation with 2,000 AVAX minimum, delegation to existing validators with no minimum requirement, or third-party platforms offering flexible terms and instant liquidity.

- Community Growth: 1,483 active validators with 53,027 total delegations.

- Lock-Up Period: Flexible unbonding periods depending on staking method, with some platforms offering instant liquidity while maintaining reward eligibility.

| Category | High-Performance Blockchain |

| Chain | Avalanche |

| Staking APY | 6.7% |

| Lock-up | Flexible |

| Platform | Native Wallet |

| Market Cap | $7.3B |

| Community | 1.1M followers on X, 32K+ on Telegram |

9. Algorand – Pure Proof-of-Stake Innovation

Algorand is an energy-efficient, quantum-secure blockchain with instant finality, consistently high throughput of 10,000 TPS, and low fees. The platform’s Pure Proof-of-Stake (PPoS) consensus mechanism enables participation without traditional validator requirements, while offering real-time rewards distributed every 2.8 seconds as blocks finalize.

Algorand staking dashboard. Source: Algorand

- Why It’s Good for Staking: Currently offering 5.70% APY with no slashing risk and no lock-up periods, making it one of the most accessible staking environments. With 3,717 mainnet nodes and 1.88 billion ALGO staked online.

- Suitable For: Security-conscious investors seeking slashing-free rewards, users wanting instant liquidity without lock-up periods, and participants interested in network governance through direct voting rights.

- Staking Options: Solo staking with a 30,000 ALGO minimum for direct participation, liquid staking through ecosystem applications for smaller holdings.

- Community Growth: 1,927 online accounts with 1,607 accounts above 30K ALGO threshold.

- Lock-Up Period: No lock-up required – staked tokens remain in user wallets while participating in consensus, providing maximum flexibility and instant liquidity.

| Category | Pure Proof-of-Stake |

| Chain | Algorand |

| Staking APY | 5.70% |

| Lock-up | None |

| Platform | Native Wallets |

| Market Cap | $1.5B |

| Community | 230K+ followers on X and Telegram |

10. Polygon – Ethereum’s Leading Scaling Solution

Polygon is the most widely adopted Ethereum scaling technology, offering EVM compatibility with fast transactions at near-zero gas fees. The platform’s Proof-of-Stake consensus mechanism secures a thriving ecosystem of 28,000+ contract creators and over 219 million unique addresses, processing 2.44+ billion transactions with an average cost of ~$0.015.

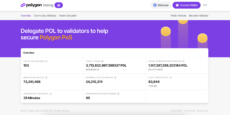

Polygon staking dashboard. Source: Polygon

- Why It’s Good for Staking: Currently securing 3.7 billion POL across 103 total validators with over 1.1 billion POL already distributed in rewards, the network maintains a 95% performance benchmark with consistent 29-minute checkpoint intervals.

- Suitable For: Ethereum users seeking lower transaction costs, DeFi participants wanting fast settlement times, and validators interested in securing the most adopted Layer 2 scaling solution.

- Staking Options: Delegate POL to validators through the native staking dashboard, participate in validator operations, or use third-party platforms offering liquid staking solutions.

- Community Growth: Massive ecosystem with 219+ million unique addresses, 1.17+ million deployed smart contracts, and $12.80+ billion in NFT sales.

- Lock-Up Period: Standard delegation unbonding periods with checkpoint-based reward distribution every 29 minutes for consistent yield generation.

| Category | Ethereum Scaling |

| Chain | Polygon PoS |

| Staking APY | Variable |

| Lock-up | Standard Terms |

| Platform | Native Dashboard |

| Market Cap | $10.2B |

| Community | 2M followers on X, 53K on Telegram |

Staking Crypto Presale and Launch Timelines

Understanding project timelines helps you plan your staking strategy and maximize rewards during different phases. Presale projects offer higher APYs during their initial coin offering phase but carry greater risk, while established networks provide proven stability with immediate liquidity.

| Token | Launch Date | Presale Status | APY | Type |

| TOKEN6900 | July 2025 | Active | 607% | Presale |

| Snorter Bot | May 2025 | Ongoing | 258% | Presale |

| Bitcoin Hyper | May 2025 | Active | 480% | Presale |

| BTC Bull | February 2025 | Ongoing | 55% | Presale |

| Best Wallet | November 2024 | Active | 102% | Presale |

| SUBBD | April 2025 | Presale Phase | 20% | Presale |

| Polkadot | Live | Already Launched | 16.8% | Established |

| Avalanche | Live | Already Launched | 6.7% | Established |

| Algorand | Live | Already Launched | 5.70% | Established |

| Polygon | Live | Already Launched | 4.95% | Established |

Best Staking Coin for Your Investment Style

If you are interested in investing your tactics may be very different from someone else’s. Staking methods can be based on your risk tolerance, investment timeline, and return expectations. In the list below, you will find a simplified characterization of each project.

| Coin | Investor Profile | Narrative | Platform |

| TOKEN6900 | Satirical Finance Enthusiasts | Anti-establishment meme coin | Presale, Ethereum DEXs |

| Snorter Bot | Active Traders | Telegram trading automation | Telegram Bot |

| Bitcoin Hyper | Bitcoin Maximalists | Bitcoin Layer 2 innovation | Presale, Bitcoin L2 |

| BTC Bull | Bitcoin Believers | Bitcoin-linked rewards | Presale, DEX |

| Best Wallet | Presale Hunters | Next-gen wallet ecosystem | Best Wallet App |

| SUBBD | Creator Economy | AI content platform | SUBBD Platform |

| Polkadot | Interoperability Believers | Multi-chain protocol | Native Dashboard |

| Avalanche | Risk-Averse Investors | No slashing blockchain | Native Wallet |

| Algorand | Flexibility Seekers | No lock-up staking | Native Wallets |

| Polygon | Ethereum Users | Layer 2 scaling solution | Native Dashboard |

Why 2025 Is Big for Crypto Staking

Crypto staking has entered a new phase of maturity and mainstream adoption in 2025, driven by several factors that make this year good for passive income strategies. According to Reuters, the US Treasury Secretary’s projection of stablecoin growth is expected to be $2 trillion by 2028. These numbers, combined with clearer regulatory frameworks emerging globally, have created an environment where both institutional and retail investors feel confident entering staking markets.

The institutional adoption wave continues accelerating, with major corporations adding staking assets to their treasury portfolios. Corporations like GameStop and MicroStrategy have added $1.75 billion+ in Bitcoin exposure this year, while traditional financial institutions launch regulated staking products. This institutional validation provides the infrastructure and legitimacy that staking markets needed to mature beyond early adopter phases.

Technology improvements across major networks have also helped the staking experience. Ethereum’s successful transition to Proof-of-Stake and the emergence of liquid staking protocols have eliminated many traditional barriers like high minimum requirements and lock-up periods. Ethereum staking now offers competitive yields ranging from 2.07% to 4.53% APY across various platforms, while maintaining the security and decentralization that institutional investors demand.

Market dynamics in 2025 also favor staking as traditional savings accounts continue offering minimal returns while inflation concerns persist. Staking provides higher returns compared to traditional financial instruments, making it an essential component of modern portfolio diversification strategies. The growing advancement of staking platforms, combined with improved user experiences and security measures, has made staking accessible to mainstream investors who previously found the technical requirements prohibitive.

How We Picked These Crypto Staking Projects – Our Methodology

Our selection process for the best crypto staking opportunities combines quantitative analysis with qualitative assessment across multiple critical dimensions. We evaluated over 100 staking projects using a scoring system that balances recent performance with future perspectives.

Staking APY Analysis: We assessed annual percentage yields across different platforms and staking methods, adjusting for inflation rates and reward sustainability. Projects offering extremely high APYs underwent additional scrutiny to verify tokenomics and reward mechanisms.

Our analysis considered both current rates and historical consistency to identify projects with stable reward generation, ranging from presale opportunities with triple-digit returns to established networks with proven track records.

Platform Quality and Security: We evaluated the staking platform’s technical infrastructure, security audits, and operational track records. This includes assessment of smart contract audits, validator performance metrics, slashing risk management, and platform uptime statistics. Projects with institutional-grade security measures and transparent operations received higher scores, whether they’re emerging presale projects or established networks like Polkadot and Avalanche.

Project Fundamentals and Utility: We analyzed the underlying technology, use cases, development activity, and market positioning of each project. This evaluation includes examining whitepapers, development roadmaps, partnership announcements, and real-world adoption metrics. Projects with clear utility beyond speculation and active development communities scored higher, from Telegram trading automation to Bitcoin Layer 2 scaling solutions.

Lock-up Terms and Flexibility: We assessed the accessibility and flexibility of staking terms, including minimum requirements, withdrawal periods, and penalty structures. Projects offering multiple staking options, reasonable minimums, and flexible terms received preference, as these factors significantly impact investor experience and capital efficiency. This ranges from no lock-up periods on Algorand to presale staking with early withdrawal options.

Community and Ecosystem Strength: We evaluated community engagement metrics, social media presence, developer activity, and ecosystem partnerships. Strong communities often indicate project longevity and provide early warning signs of potential issues. Projects with active, engaged communities and growing ecosystems received additional consideration in our final rankings, whether through verified influencer networks or validator participation.

What Is Crypto Staking?

Crypto staking involves locking up cryptocurrency holdings to support the operations and security of a blockchain network in exchange for rewards. In essence, staking involves locking up a certain amount of cryptocurrency in a wallet to support blockchain operations, similar to earning interest in a traditional savings account, except staking involves active participation in network validation or governance activities.

In other words, crypto staking is like putting your money in a high-yield savings account, but instead of a bank paying you interest, a blockchain network pays you rewards for helping keep it running smoothly.

Staking cryptocurrency is a hands-on approach to generating passive income. When you stake tokens, you essentially become a validator (or supporting validators) who verify transactions and maintain network consensus. In return for this service, the network distributes newly minted tokens or transaction fees as rewards.

The process works through Proof-of-Stake (PoS) consensus mechanisms, where validators are chosen to create new blocks based on their stake size and other factors like randomization. Unlike Proof-of-Work mining, which requires expensive hardware and energy consumption, staking only requires holding the native cryptocurrency. This makes staking more environmentally friendly and accessible to regular investors.

Crypto Staking Rewards Explained

Crypto staking rewards are usually calculated in terms of APY (annual percentage yield), which is the interest earned over one year based on the amount of cryptocurrency staked. The APY varies significantly across different projects, depending on factors like network demand, total staking supply, and underlying tokenomics. Here is how APY is calculated:

APY Formula. Photo: Investopedia

Rewards typically come from two primary sources: newly minted tokens created through inflation and transaction fees collected from network users. Some networks use a fixed inflation schedule, while others adjust rewards based on total staking participation. When fewer tokens are staked, individual rewards increase to promote more participation, and vice versa.

Staking in Proof-of-Stake (PoS) networks generates rewards primarily from transaction fees. Some projects offer rewards from a dedicated reward pool integrated into the network’s tokenomics. The distribution frequency varies by network, with some paying daily, weekly, or per epoch (a specific time period in blockchain operations).

Understanding real vs. nominal yields is crucial for staking success. While a project might advertise 100% APY, high inflation rates could mean the token’s purchasing power decreases faster than rewards accumulate. Our analysis always considers inflation-adjusted returns to provide accurate profitability assessments.

How Do You Stake Crypto?

Getting started with crypto staking involves a four-step process. The specific requirements vary depending on your chosen cryptocurrency and platform.

Step 1: Choose Your Staking Cryptocurrency

Select a Proof-of-Stake cryptocurrency that aligns with your risk tolerance and return expectations. Consider factors like APY, lock-up requirements, minimum stakes, and project fundamentals.

Step 2: Select Your Staking Platform

You can stake crypto on various platforms, including crypto exchanges, wallet providers, and dedicated staking platforms. Centralized exchanges like Binance and Coinbase offer user-friendly staking with customer support, while decentralized protocols like Lido provide non-custodial options with potentially higher yields.

Step 3: Stake Your Tokens

Transfer your chosen cryptocurrency to your selected platform and follow their staking process. This typically involves selecting a validator (for delegation) or joining a staking pool. Some platforms offer “one-click” staking, while others require more detailed setup depending on your technical preferences.

Step 4: Monitor and Earn Rewards

Once staked, your tokens begin earning rewards according to the network’s distribution schedule. Most platforms provide dashboards to track your staking performance, accumulated rewards, and current APY. You can typically compound your earnings by re-staking rewards automatically.

What Are the Risks of Staking Crypto?

While staking can be a good opportunity for passive income, several risks require careful consideration before committing your funds to any staking protocol or platform. Let’s break the down:

Smart Contract and Technical Risks

Decentralized staking platforms rely on smart contracts that could contain bugs or vulnerabilities. Even audited contracts can have undiscovered flaws that hackers might exploit. Also, validator software bugs or configuration errors could result in slashing penalties, where a portion of your staked tokens gets permanently destroyed.

Market Volatility and Price Risk

Higher yields often come with increased risk, and the crypto market is famously volatile. While you earn staking rewards, the underlying token’s value could decline significantly, potentially resulting in net losses despite positive APY. This risk is particularly pronounced with newer projects offering extremely high yields.

Lock-up and Liquidity Constraints

Many staking arrangements require tokens to remain locked for specific periods, during which you cannot sell or withdraw them. Being bonded with a 28-day unbond or even a 3-day unbond could mean you miss the window to sell during market crashes. This liquidity risk can be costly during volatile market conditions.

Platform and Counterparty Risks

Centralized staking platforms could face regulatory issues, technical problems, or even bankruptcy, which could affect your staked assets. While some platforms offer insurance coverage, protection isn’t universal. Decentralized platforms eliminate counterparty risk but introduce smart contract risks and require more technical knowledge.

Validator Performance and Slashing

If you fail to maintain your node properly, you could lose money. Ethereum has mild penalties for downtime and harsher ones for double-signing, while Polkadot can slash validators for misbehavior or extended downtime. Even when delegating to validators, their poor performance or malicious behavior could affect your rewards.

Regulatory and Tax Implications

Staking payouts are usually taxed as ordinary income on the day they hit your wallet, with that amount becoming the cost basis for any future sale. Changing regulations could impact the legality of staking or its tax treatment, requiring careful record-keeping and potential adjustments to strategy.

Pros & Cons of Staking Crypto Coins Explained

After reading through all the information about crypto staking, let’s combine the advantages and disadvantages in the segment below:

Pros of Crypto Staking

- Passive Income Generation – Earn regular rewards without active trading or technical expertise required

- Network Participation – Support blockchain security and decentralization while earning compensation

- Compound Growth Potential – Reinvest rewards to accelerate portfolio growth through compounding effects

- Superior Returns – Higher returns compared to traditional financial instruments like savings accounts or bonds

- Environmental Benefits – Proof-of-Stake consensus is more energy-efficient than Proof-of-Work mining

- Governance Rights – Many staking tokens provide voting rights in protocol governance decisions

- Portfolio Diversification – Access different risk/return profiles across various blockchain ecosystems

Cons of Crypto Staking

- Lock-up Periods – Funds may be inaccessible for extended periods, limiting financial flexibility

- APY Fluctuation – Rewards can decrease as more participants join staking pools or network conditions change

- Slashing Risk – Potential permanent loss of staked tokens due to validator misbehavior or technical issues

- Technical Complexity – Some staking methods require technical knowledge and ongoing maintenance

- Platform Risk – Dependence on third-party platforms introduces counterparty and security risks

- Regulatory Uncertainty – Changing regulations could impact the legality of staking or tax treatment

- Market Volatility –Token price declines can offset staking rewards, resulting in net portfolio losses

Final Verdict – Is Staking Crypto Worth It in July 2025?

Based on our analysis, crypto staking presents compelling opportunities for most investors in July 2025, provided they match their strategy to their risk tolerance and investment timeline.

The key to success in 2025 is diversification across different risk categories rather than putting everything into one project. A balanced portfolio might include 70% in established networks for stability and 30% in high-yield presales for growth potential.

Current market conditions strongly favor the adoption of staking. Traditional savings accounts offer practically nothing, while staking provides meaningful returns ranging from 3% to 607% APY. Additionally, liquid staking solutions have addressed the old lock-up issues that previously deterred investors.

With the right strategy and proper diversification, crypto staking has become a crucial tool for building wealth in 2025. Just match your choices to your risk tolerance and investment timeline.

References

- Smart Contracts – Solana

- Bitcoin price history – TradingView

- Solana Layer 2 Scaling Solutions

- Stablecoin demand – Reuters

- About APY – Investopedia

FAQ

What is the best crypto to stake in 2025?

What is the most profitable staking crypto?

Is crypto staking worth it in 2025?

Which crypto gives the highest staking rewards?

Is staking better than just holding crypto?

What is the best crypto wallet for staking?

Which platforms offer the best crypto staking in 2025?

Where can I stake ETH or SOL safely?

What are the tax implications of staking crypto?

Pepe Coin surged in popularity after its 2023 launch. This article covers market trends, price forecasts, technical signals, and h...

Looking for the best play-to-earn crypto games in 2025? Start with fan-favorites like Axie Infinity and Harry Hippo - and discover...