Crypto theft is more common than most traders think, and it rarely takes a sophisticated hack. A forgotten token approval, a poorl...

According to our research, the best decentralized crypto wallet for 2026 is Best Wallet, taking the #1 spot for its balance of security, ease of use, and multi-chain support.

Instead of relying on seed phrases, it uses biometric authentication and supports 50+ blockchains without KYC, making it both secure and hassle-free. Behind Best Wallet are Walletium and the Ledger Nano X, which both offer some of the strongest security measures in the market without making them clunky to use.

We tested over 50 decentralized wallets for security, features, and usability, using our methodology, to identify the top 10 picks, ranging from budget-friendly hardware options starting at $49 to advanced software solutions with institutional-grade encryption.

Key Takeaways on Decentralized Crypto Wallets

- Best Wallet tops our 2026 rankings by removing seed phrase vulnerabilities through biometric authentication across 50+ blockchains with zero KYC requirements

- Ledger Nano X offers premium hardware security with CC EAL5+ certification supporting 5,500+ cryptocurrencies, while Trezor Model One provides budget protection at $49

- MetaMask dominates Web3 with 100+ million users and supports 500,000+ tokens, making it the gateway for Ethereum-based DeFi and NFT interactions

- Cryptocurrency theft hit $3.4 billion in 2025, with individual wallet compromises surging to 158,000 incidents affecting over 80,000 unique victims

- North Korean state-backed hackers stole $2.02 billion in crypto in the last year alone, a 51% year-over-year increase, pushing their all-time total to $6.75 billion

Best Decentralized Wallets to Use in March 2026

We tried out dozens of popular crypto wallets of all types, including software wallets, hardware wallets, Bitcoin wallets, and everything in between. Based on our testing, we think these are the 10 best decentralized wallets to use today:

- Best Wallet – Overall best decentralized wallet with ample Web3 features

- Walletium – Web3 wallet platform featuring “mild staking rewards”

- Ledger Nano X – Best cold storage wallet for maximum token security

- Binance Wallet – All-in-one wallet for trading, staking, and more

- Trezor Model One – Most affordable hardware wallet

- OKX Wallet – Hot wallet with multi-chain support and security

- Margex – User-friendly platform with no-KYC signup

- Cypherock – Seedless cold wallet with advanced security

- Tangem – Tap-to-use wallet with multi-card security

- Zengo Wallet – Secure and user-friendly MPC cryptography wallet

- Ellipal – Secure hardware wallet with AIR gapped protection

Reviewing the Best Decentralized Crypto Wallets

Want to find out more about the top platforms in our list of decentralized wallets? We’ll explain what stood out about each of these wallets and why we think they’re great choices for you.

1. Best Wallet – Top Decentralized Wallet with a Range of Web3 Features

Best Wallet is our top-ranked choice for 2026 because it solves two major issues with crypto wallets: complex security setups and limited functionality. It replaces seed phrases with biometric and multi-factor security, supports 50+ blockchains, and lets you buy crypto with only an email. No KYC is required.

Built-in cross-chain swaps use Rubic’s tech to access 330 DEXs and 30 bridges, ensuring competitive rates without high exchange fees.

Best Wallet Main Page. Photo: Best Wallet

Best Wallet provides seamless Web3 integration, letting you stake tokens in-app, access early-stage projects through Upcoming Tokens, use the iGaming hub for crypto gambling, and earn up to 8% cashback with the Best Card when holding BEST tokens.

Editor’s Take: “Best Wallet gets a lot right for people who want one app to handle everything. The no-seed-phrase approach is a genuine improvement over traditional wallets, and the fact that you can buy crypto with just an email removes a lot of the friction that turns newcomers away. Mobile-only is a limitation, but if you’re comfortable managing crypto from your phone, this is one of the most complete packages I’ve seen.”

| Feature | Details |

| Wallet Type | Mobile-only software wallet (iOS, Android) |

| KYC Required | No – just an email address needed |

| Supported Blockchains | 50+, including Bitcoin, Ethereum, Solana, Polygon, BSC |

| Security | Biometrics, 2FA, advanced cryptography, no seed phrase |

| Top Features | Cross-chain swaps, staking, iGaming hub, token launchpad, Best Card |

| Native Token | BEST (for reduced fees and exclusive benefits) |

| Price | Free |

2. Walletium – Hybrid Telegram-Native Multi-Chain Wallet

Walletium aims to reduce the gap between traditional finance and Web3 by allowing users to manage their crypto portfolio through a simple Telegram chat window. One of the core features is its hybrid model, which lets you choose how to manage your private keys, offering both custodial and non-custodial options.

You do not have to download a separate wallet app, as it runs directly as a Telegram Mini App. It also works as a standalone web application, if you prefer.

Walletium lets users manage their crypto portfolio through a simple Telegram chat window. Source: Walletium

Users can earn daily rewards through the platform’s “Mild Staking” feature, which lets them stake assets to earn a daily reward in the form of TEX tokens, the wallet’s native token, with no lock-up period. The project claims to offer a projected daily return of about 0.3% to 9.6%, depending on liquidity demand.

Editor’s Take: “Walletium is ideal for Telegram-heavy users who want to manage all aspects of their Web3 portfolio in one place. The hybrid custody model is quite useful, especially for people who want quick access to some funds while keeping others under their own keys. The staking feature is interesting, but the projected rates do warrant a careful review before committing a huge amount.”

| Wallet Type | Hot wallet |

| KYC Required | No |

| Supported Blockchains | Multi-chain, including BTC, ETH, TON, BNB, TRX, SOL |

| Security | Hybrid key policy, 2FA, Telegram encryption |

| Top Features | Mild Staking, virtual cards, payment envelopes, hybrid custody |

| Native Token | TEX |

| Price | Free |

3. Ledger Nano X – Best Cold Storage Wallet for Maximum Security

The Ledger Nano X is one of the most popular hardware wallets in the crypto market, combining bulletproof cold storage security with mobile convenience through Bluetooth connectivity. It uses a CC EAL5+ certified Secure Element chip to keep private keys offline and safe from both online and offline attacks.

Ledger Nano X. Photo: Ledger

The device supports 5,500+ coins and tokens, supports up to 100 apps, and connects through Bluetooth or USB-C. Transactions are approved directly on its screen, and you can restore funds on a new device using a recovery phrase if lost. With the app Ledger Live, users can buy, sell, swap, and stake assets. Its built-in battery enables hours of cable-free mobile use, making it secure and portable.

Ledger Nano X offers robust offline security with Bluetooth convenience, but its higher price and past firmware vulnerabilities may concern some users.

Editor’s Take: “The Ledger Nano X has a solid reputation. Their Bluetooth feature makes it far more practical than most hardware wallets. That said, $149 is definitely on the higher end compared to competitors.”

| Feature | Details |

| Wallet Type | Hardware wallet (cold storage) |

| Connectivity | USB-C, Bluetooth (iOS and Android compatible) |

| Supported Assets | 5,500+ coins and tokens |

| Storage Capacity | Up to 100 apps simultaneously |

| Security | CC EAL5+ certified Secure Element chip, offline key storage |

| Top Features | Mobile Bluetooth access, Ledger Wallet integration (formerly Ledger Live), and staking support |

| Battery Life | Built-in rechargeable battery for mobile use |

| Price | $149 |

4. Binance Wallet – All-in-One Wallet for Trading, Staking, and More

Founded in 2017 by billionaire entrepreneur Changpeng Zhao, Binance is by far the largest cryptocurrency exchange globally. As of June 2025, CoinMarketCap reports that in terms of both user and trading volume, Binance has over $217 billion in daily transactions across spot and futures markets.

Binance Wallet Home Page. Photo: Binance Wallet

The platform has grown over the years, with over 280 million users, and now offers services in 100 countries, featuring a 40-language multilingual interface. Binance also offers a decentralized exchange (Binance DEX), an NFT marketplace, a crypto debit card, and services like lending, borrowing, and staking. However, Binance’s services are not available in certain regions, including the United States, Ontario (Canada), Iran, Cuba, and Crimea.

Editor’s Take: “If you’re already using Binance, this wallet makes a lot of sense for you. The integration with the exchange is smooth, and having staking, swaps, and NFTs in one place is convenient. The problem is that it’s heavily tied to Binance, so US users and anyone who wants broader dApp access might feel boxed in.”

| Feature | Details |

| Wallet Type | Self-custody mobile wallet |

| KYC Required | No- setup doesn’t require verification, but KYC is needed if you connect to the Binance exchange |

| Supported Assets | 500+ supported assets |

| Security | Non-custodial, MPC (multi-party computation) key management, cloud/QR backup, wrong-address detection, malicious contract alerts, and biometric login |

| Top Features | Smooth integration with Binance exchange, staking, cross-chain swaps, NFT support, dApp browser, DeFi access |

| Staking Options | Many cryptocurrencies supported with various staking options |

| Price | Free (fees apply for features) |

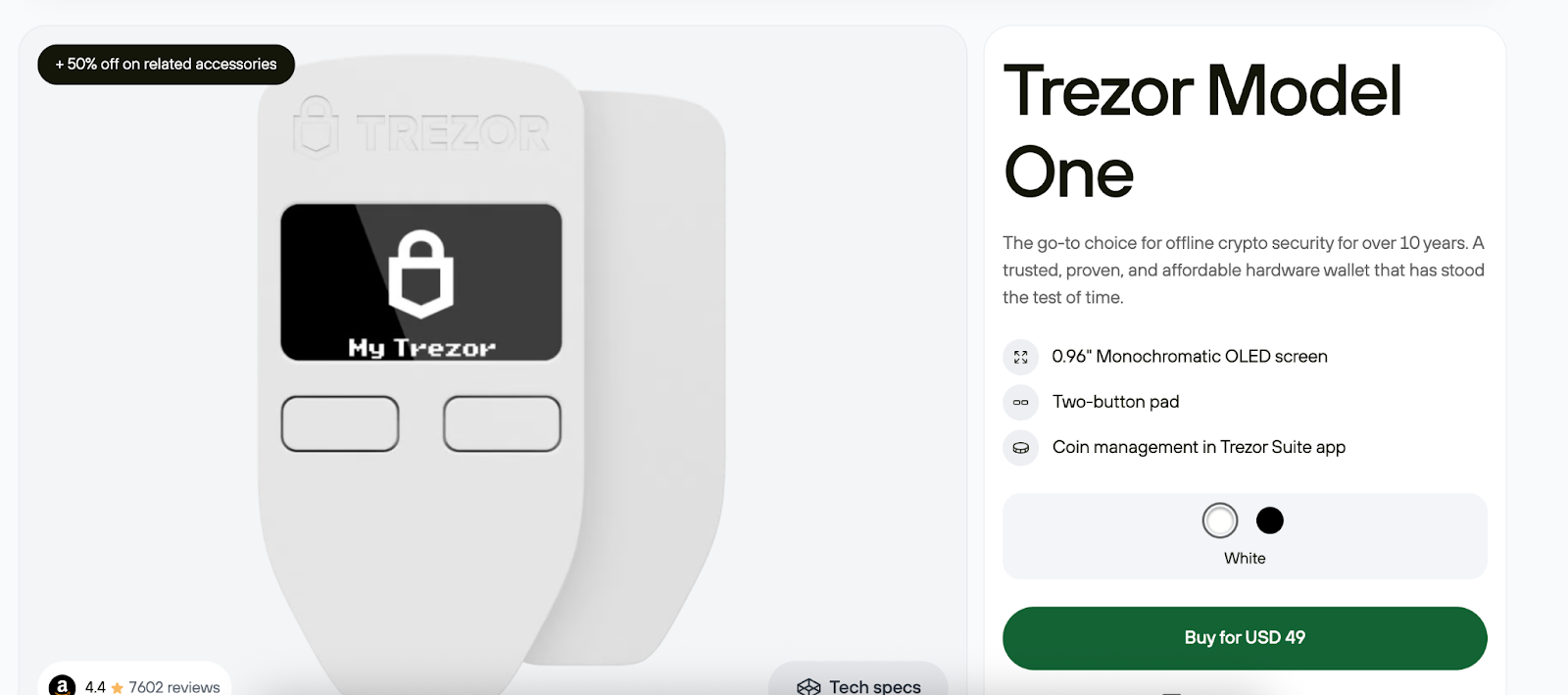

5. Trezor Model One – Most Affordable Hardware Wallet

The Trezor Model One, priced at $49, is the original hardware wallet from SatoshiLabs (2014), a leading hardware wallet firm that has secured millions of users’ crypto for over a decade. Despite its budget-friendly price, it offers enterprise-grade security with fully open-source firmware.

Trezor Model One. Photo: Trezor

The Trezor Suite app supports 1,200+ cryptocurrencies with buy, sell, trade, and portfolio tracking, while the device connects via USB and requires button confirmation. Security includes PIN protection up to 50 digits, optional passphrase encryption, tamper-evident packaging, and a 12-24 word recovery seed. However, Trezor Model One lacks support for some popular coins and NFTs, requires physical connection for transactions, and carries an unpatchable hardware vulnerability.

Editor’s Take: “At $49, the Trezor Model One is the cheapest way to get real hardware wallet security. It’s been around for over a decade, the firmware is open-source, and it does exactly what it’s supposed to do. Just don’t expect it to support every coin out there. If you hold Solana, XRP, or Monero, you’ll need to look at their pricier models.”

| Feature | Details |

| Wallet Type | Hardware wallet (cold storage) |

| Connectivity | USB (desktop and Android via OTG cable) |

| Supported Assets | 1,200+ cryptocurrencies |

| Display | OLED black & white screen |

| Security | Open-source firmware, PIN up to 50 digits, passphrase support |

| Top Features | Trezor Suite integration, tamper-evident packaging, 12-24 word recovery |

| Dimensions | 2.4×1.2×0.2 inches, 0.42 oz |

| Price | $49 |

For those interested in the Trezor hardware wallet line of products why not explore our full Trezor Safe 7 review to see what the latest Safe model has to offer for crypto users in 2026.

6. OKX Wallet – Hot Wallet with Multi-Chain Support and Security

Headquartered in Malta, OKX is a popular crypto exchange that was established in 2017 and changed its name from OKEx in 2021. Later in 2025, OKX introduced an independent OKX Wallet app that was solely aimed at Web3 and self-custody use cases, hence increasing accessibility.

OKX Wallet Home Page. Photo: OKX Wallet

Named as one of the top crypto exchanges by many experts, it allows users to exchange tokens between blockchains, manage cryptocurrency assets, and communicate with decentralized apps (dApps) – all without requiring an OKX exchange account.

The exchange provides a wide range of services, such as DeFi, staking, futures and options trading, margin, and spot trading. It supports over 400 digital assets and has more than 20 million registered users across 180 nations and regions. However, desktop users may find its app functionality less accommodating compared to mobile, and it is less secure than cold wallets.

Editor’s Take: “OKX Wallet covers a lot of ground, with 130+ blockchains, solid DeFi tools, and you don’t need an exchange account to use it. The tricky part is customer support, which users say is slow, and if you’re in the US, the wallet works but the exchange doesn’t. Worth considering if you want multi-chain flexibility, just go in with realistic expectations.”

| Feature | Details |

| Wallet Type | Self-custody hot wallet |

| KYC Required | Yes- for all levels |

| Supported Assets | 350+ supported assets |

| Security | Self-custody controls and sophisticated cryptographic safeguards, hardware integrations, preemptive contract checks, and optional keyless MPC wallets |

| Top Features | Multi-chain support, DeFi tools, exchange integration, wallet services, dApps integration |

| Staking Options | Offers three staking features with various cryptocurrencies |

| Price | Free |

7. Margex – User-Friendly Platform with No-KYC Signup

As a cryptocurrency trading platform, Margex was established in 2019, in order to offer a safe and convenient trading environment for its users. Since then, the wallet has grown internationally and currently serves over 500,000 registered users in 153 countries.

Margex Home Page. Photo: Margex

With Margex’s extensive perpetual futures offerings, users can speculate on cryptocurrencies easily without owning them directly. You can trade pairs of Bitcoin, Binance Coin, Tron, and Ethereum at Margex with leverage up to 100x, while other crypto pairs allow positions from 15x to 50x. The exchange also offers staking pools with up to 7% APY and a useful copy trading feature that is popular with beginners.

Margex’s user-friendly, privacy-focused platform attracts anonymous users, but its custodial, unregulated setup with limited features exposes them to security, control, and flexibility risks.

Editor’s Take: “Margex makes sense if you want to trade derivatives without going through KYC. The leverage is high, the copy trading works well for beginners, and getting started takes minutes. That said, it’s custodial and unregulated, so your funds are in their hands. I’d keep that in mind before depositing anything significant.”

| Feature | Details |

| Wallet Type | Hot wallet |

| KYC Required | No |

| Supported Assets | Over 55 supported assets |

| Security | Cold storage user funds, two-factor authentication, SSL encryption, and Distributed Denial of Service (DDoS) protection |

| Top Features | Multiple BTC, ETH, and altcoin pairs with up to 100x leverage, demo trading, and advanced order types. |

| Staking Options | Provides options for top cryptocurrencies with 5% APY |

| Price | Free |

8. Cypherock – Seedless Cold Wallet with Advanced Security

Cypherock X1 is a relatively new wallet in the crypto market, but it is already becoming a popular choice with traders. The X1 model includes four NFC-compatible smart cards, each the size of a regular credit card, as well as a vault (the device) with a screen and a joystick. Since the wallet is made to function “without a seed phrase”, it provides an alternative method to safeguard cryptocurrency and avoids some of the vulnerabilities associated with seed phrases.

Cypherock Home Page. Photo: Cypherock

According to Cypherock, your data is safe for at least 20 years and the setup is suitable for at least 500,000 NFC taps.

While Cypherock uses multi-signature technology to enhance security, making it attractive for users wanting strong protection, the setup complexity and reliance on multiple devices may discourage less tech-savvy individuals from adopting it.

Editor’s Take: “Cypherock takes a different approach to security, and I think it’s worth paying attention to. Instead of a seed phrase, your private key gets split across four NFC cards and the vault itself. Lose one card, you’re still fine. It’s clever, but the setup isn’t simple, and at $199, you’re paying for that extra peace of mind.”

| Feature | Details |

| Wallet Type | Hardware Wallet |

| KYC Required | No – has decentralised recovery process |

| Supported Assets | 9000+ cryptocurrencies supported |

| Security | EAL6+ security certification with no known hardware vulnerabilities, along with 3FA |

| Top Features | Seedless security, Tap-to-approve transactions, No single point of failure, Multi-wallet management (up to 4 keys) |

| Staking Options | Doesn’t support staking natively |

| Price | $199 |

9. Tangem – Tap-to-Use Wallet with Multi-Card Security

Like the Cypherock X1, Tangem harnesses NFC technology to validate cryptocurrency transactions on your smartphone. Instead of employing a conventional seed phrase, which is susceptible to loss or improper handling, Tangem makes use of several identical backup cards, typically two or three, each of which holds the same private key.

Tangem Home Page. Photo: Tangem

You can also buy the Tangem ring, an incredibly unique wearable cryptocurrency wallet, which holds the keys in a pair of two or three cards. Tangem’s contactless smart card wallet delivers a cold storage experience with strong physical security, yet its niche hardware form factor may limit widespread use and could be less convenient for frequent on-chain interactions.

Editor’s Take: “Tangem is about as simple as hardware wallets get. No cables, no charging, just tap your phone and go. The backup card setup makes sense, and losing one card isn’t the end of the world. It won’t satisfy heavy DeFi users, but for straightforward storage, it does the job well.”

| Wallet Type | Hardware Cold Wallet |

| KYC Required | No |

| Supported Assets | 6,000+ cryptocurrencies, along with multiple tokens |

| Security | Secure EAL6+ chip, multiple backup cards, optional seed phrase, and offline private key generation |

| Top Features | NFC-based transactions, open-source app available, and swapping options |

| Staking Options | Only works for Solana (SOL), Tron, Polygon (ex-MATIC) on ETH, Binance Smart Chain (BNB), and Cosmos (ATOM). |

| Price | $54.90- $160.00 |

10. Zengo Wallet – Secure and User-friendly MPC Cryptography Wallet

Zengo avoids seed phrase vulnerabilities using keyless Multi-Party Computation (MPC) cryptography – the same advanced technology that Coinbase uses – splitting your private key into two secret shares: one on your device, one on their servers.

Zengo Wallet Homepage. Photo: Zengo

ZenGo supports 380+ cryptocurrencies and NFTs across multiple blockchains. You can buy, sell, swap, stake, and manage assets in-app, with automatic inheritance transfers if your wallet becomes inactive.

It offers 3FA recovery, including email, 3D facial biometrics, and an encrypted cloud file, which ensures access even if your phone is lost. The wallet’s built-in Web3 firewall (ClearSign) protects against malicious dApps by rating transaction risks as green, yellow, or red.

Editor’s Take: “Zengo’s keyless approach is genuinely clever, and the recovery process is easier than most wallets out there. But you’re trading seed phrase anxiety for trust in their MPC system, and not everyone will be comfortable with that.”

| Feature | Details |

| Wallet Type | Mobile software wallet (iOS, Android) |

| KYC Required | No – email and facial biometric setup |

| Supported Assets | 380+ cryptocurrencies and NFTs |

| Security | MPC cryptography, 3FA recovery, no seed phrases, Web3 firewall |

| Top Features | Keyless security, inheritance planning, facial recognition, ClearSign protection |

| Recovery Method | 3FA (email + facial biometrics + cloud recovery file) |

| Price | Free |

11. Ellipal – Secure Hardware Wallet with AIR-Gapped Protection

Ellipal is an air-gapped wallet, which means it is always kept offline, with transactions sent and received via QR codes. It supports over 10,000 tokens across 40 blockchains, including NFTs on Ethereum and Polygon. Through WalletConnect and MetaMask, you can access 200+ decentralized apps, including DeFi platforms, NFT marketplaces, and staking services.

Ellipal Home Page. Photo: Ellipal

Unlike many hardware wallets, you can buy, sell, trade, and stake cryptocurrencies within the app. You can also manage several accounts, track rewards, and find staking opportunities. However, its bulkier design and lack of extensive dApp integration might reduce appeal for users seeking seamless connectivity and portability.

Editor’s Take: “Ellipal’s air-gapped setup is as secure as it gets. No Bluetooth, no USB, just QR codes. That’s great for paranoid holders, but the device itself is bulky and firmware updates are more annoying than they should be.”

| Wallet Type | Hardware Cold Wallet |

| KYC Required | Yes required |

| Supported Assets | 10,000+ cryptocurrencies |

| Security | EAL5+ & EAL 6+ certification, auto self-destruct, additional PIN and password protection |

| Top Features | Air-Gapped Security, Tamper-Proof Design, Integrated Web3 Services, Token Swapping |

| Staking Options | Cardano (ADA), Cosmos (ATOM), Polkadot (DOT), Kusama (KSM), Tezos (XTZ) |

| Price | $99 – $169 |

Top Decentralized Crypto Wallets Compared

After reviewing the best decentralized wallets, it is now time to collect and summarize the information. We created a table of comparison that will help you see their characteristics more clearly:

| Wallet | Type | Supported Assets | Key Features | Best For | Price |

| Best Wallet | Mobile Software | 50+ blockchains | Biometric auth, no seed phrases, cross-chain swaps, staking, iGaming hub | Privacy-focused users who want all-in-one functionality | Free |

| Walletium | Mobile Software | Multi-chain | Mild staking, daily rewards, no lock-up period, dynamic daily returns | Users who want to manage their crypto portfolio through Telegram | Free |

| Ledger Nano X | Hardware | 5,500+ coins/tokens | CC EAL5+ chip, Bluetooth, offline storage | Maximum security for long-term storage | $149 |

| Binance Wallet | Mobile/Web Software | 350+ assets, multi-chain | Seedless/keyless, DeFi, swaps, NFT, semi-custody option | Users seeking integrated exchange & wallet | Free |

| Trezor Model One | Hardware | 1,200+ cryptocurrencies | Open-source, OLED display, physical buttons | Budget-conscious users want hardware security | $49 |

| OKX Wallet | Mobile/Web/Extension | 40+ blockchains, 1000+ DApps | Account abstraction, cross-chain swaps, social recovery, NFTs | Web3 & DeFi users needing advanced features | Free |

| Margex | Centralized Exchange Derivatives Wallet | 50+, focus on trading assets | Cold storage, copy trading, up to 100x leverage, staking | Anonymous derivatives/copy traders | Free(except trading fees) |

| Cypherock | Hardware Wallet | 9000+ assets, multi-chain | Shamir’s Secret Sharing, seedless, multi-profile, inheritance | HNW users seeking advanced privacy & recovery | Paid (hardware device) |

| Tangem | NFC Hardware | 81+ blockchains, 13,000+ assets | NFC card, no battery, multisig, broad NFT support | Hardware wallet users needing highest chain support | Paid (Must buy hardware cards) |

| Zengo Wallet | Mobile Software | 380+ cryptocurrencies | MPC cryptography, no seed phrases, 3FA recovery | Users worried about losing seed phrases | Free |

| Ellipal | Air-Gapped Hardware | 50+ blockchains, 10,000+ assets | QR code tx signing, multi-layer auth, staking, NFT support | Offline users needing highest isolation | Paid (Need to buy hardware device) |

What Is a Decentralized Crypto Wallet?

A decentralized crypto wallet is a type of software that enables you to store cryptocurrency on your own devices without relying on a third party or centralized company for security or other services. They are also known as full self-custody wallets or non-custodial wallets, as they provide you with full control over your cryptocurrency.

What defines a decentralized wallet – as opposed to a centralized wallet – is who owns the wallet’s private keys. This is important because private keys are critical to accessing a wallet’s tokens.

With a decentralized wallet, you (the wallet owner) are in control of the wallet’s private keys. With a centralized wallet, on the other hand, you have access to the wallet, but a third party, such as a crypto exchange or broker, manages the private keys.

Centralized wallets are potentially problematic because if the exchange goes bankrupt or suffers a hack, you could potentially lose your cryptocurrency. There’s a common saying in the crypto world: “Not your keys, not your coins.”

This is what happened to account holders at FTX, the major crypto exchange that went bankrupt in 2022. Token holders had centralized crypto wallets managed by the exchange, and their funds were lost when the exchange went bankrupt.

Decentralized wallets eliminate this risk, but they do come with trade-offs. Taking responsibility for your wallet’s private keys means there’s no one to ask for help if you lose your keys. You can also send and receive crypto without oversight by a third party, which can allow you to do more in Web3 but also makes you more vulnerable to scams.

Benefits of Decentralized Bitcoin Wallets

Decentralized cryptocurrency wallets offer several benefits compared to centralized wallets, which is why they’re the most popular choice for crypto owners. Let’s dive into the benefits and explain how they work.

Total Control over Your Cryptocurrency

The biggest benefit of a decentralized crypto wallet is that you have complete control over your tokens and other digital assets, like NFTs. You can do whatever you like with your tokens — send and receive from any dApp, swap them through an exchange, stake them with a decentralized finance (DeFi) platform, and more. There’s no third-party custodian that can impose limitations on how you use your crypto.

This is especially important for making your tokens resistant to financial censorship. Not only can an exchange or similar crypto-related entity block your transactions, but neither can governments. Your tokens exist completely outside the traditional financial system.

Access to a Wider Range of Tokens

Most decentralized crypto wallets store a much wider range of tokens – from more blockchains – than most centralized wallets. That’s because centralized wallets typically only work with approved digital assets, such as the specific tokens that a crypto exchange offers for trading.

Decentralized wallets, on the other hand, support as many networks as possible to give you the greatest flexibility to explore Web3. For example, Best Wallet supports over 60 blockchains, while Trust Wallet supports more than 100.

Connectivity to Web3 and dApps

Another major benefit of decentralized wallets is that they enable you to connect to dApps across Web3. Because of this, decentralized wallets are also called DeFi wallets.

Many decentralized wallets have built-in marketplaces where users can explore dApps to connect to. Some of the most popular dApps include the decentralized crypto exchange Uniswap, the NFT marketplace OpenSea, and the DeFi platform Yearn.finance.

Decentralized apps can also connect to crypto presales, which gives investors the ability to buy emerging tokens before they launch on exchanges.

Full Anonymity

Whereas most centralized crypto wallets require KYC checks – which include ID verification and providing proof of address – most decentralized wallets do not. To sign up, you only need an email address or a username. You can buy and sell crypto completely anonymously without sharing any sensitive personal details.

No Custodian Risk

As we discussed above, decentralized wallets also eliminate risks that stem from putting someone else in charge of your wallet’s private keys. For example, your tokens aren’t at risk of a custodian going bankrupt or suffering a hack. You must still be mindful to keep your token safe, but the risk doesn’t stem from your wallet’s custodian.

Risks of Using a Decentralized Wallet

Decentralized wallets give you control, but that control comes with responsibility. There’s no bank to call if something goes wrong, no fraud department to reverse a bad transaction. Every mistake is permanent, and the threats are real. Here’s what you’re up against.

Seed Phrase Vulnerabilities

Your seed phrase is the master key to your entire wallet – lose it and access is gone forever; expose it and someone can drain your funds instantly. Around 20% of all Bitcoin is lost due to mishandled keys, often from people storing phrases in cloud services, photos, or notes apps. Scammers posing as support also trick users into handing them over.

Phishing and Wallet Drainer Attacks

Phishing and wallet drainer attacks remain one of the biggest threats in crypto. In 2025, individual wallet hacks hit 158,000 incidents, nearly triple 2022’s numbers, with at least 80,000 victims.

Malware You Won’t See Coming

Software wallets stay online and inherit any malware on your device, including clipboard hijackers that swap addresses, keyloggers, and screen-capturing tools. Fake wallet apps distributed outside official stores also trick users into entering private keys, giving attackers full access with one bad download.

Mistakes You Can’t Undo

Crypto transactions are irreversible. One typo, one wrong address, or one forgotten backup can mean permanent loss. Many users also approve malicious smart contract permissions without realizing it, unknowingly giving attackers control of their assets.

Smart Contracts Can Be Dangerous Too

dApps rely on smart contracts, and some request unlimited token approvals or contain vulnerabilities that attackers exploit. Rug pulls and flash loan attacks happen regularly, draining funds from users and protocols with almost no chance of recovery.

There’s No Customer Support

In decentralized systems, no one can reset your password, undo a scam, or restore lost access. If you lose your keys, approve a bad transaction, or interact with a buggy dApp, there’s no support team to fix it.

The Rules Keep Changing

Crypto regulations are evolving, creating uncertainty around taxes, KYC requirements, and how easily you can move between fiat and digital assets. Features that work today may fall into legal gray zones tomorrow, especially if you’re holding significant amounts or using wallets for business.

How We Ranked These Decentralized Wallets

We tested over 50 wallets before narrowing this list down. Some we ruled out in minutes, others took longer to evaluate.

Now, let’s see what are the most important questions that we asked during our reviews:

How secure is it? (25%)

Security got a big share because losing your crypto to a hack or exploit isn’t something you recover from. We looked at how each wallet handles private keys, what authentication options are available, and whether the code has been audited by anyone reputable.

We also paid attention to track record. A wallet can have all the right features on paper, but if users keep reporting drained funds or sketchy permissions, that tells you more than any spec sheet. We checked Trustpilot, Reddit, and crypto forums to see what people are saying about these wallets.

How many assets and chains does it support? (25%)

A wallet that only works with Ethereum won’t be of much use to you if you have some Solana, Bitcoin, and a handful of smaller tokens on the side. We looked at total chain support, how easy it is to add new networks, and whether the integration feels native or bolted on.

Some wallets claim huge numbers but make you jump through hoops to actually use them. We tested whether the advertised support holds up in practice.

How easy is it to use? (20%)

Nobody wants to fight their wallet just to send a transaction. We paid attention to setup time, navigation, mobile support, and whether the interface gets out of your way or makes everything harder than it needs to be.

We also watched for the annoying stuff. Confusing menus, buried settings, unclear error messages, buttons that don’t do what you expect. If a wallet felt frustrating to use, it lost points.

How well does it work with Web3? (20%)

A wallet that can’t connect to dApps is missing half the point. We tested compatibility with DeFi platforms, NFT marketplaces, and popular protocols. Some wallets make this seamless, others require workarounds or just don’t work at all.

Built-in browsers, swap functionality, and staking options all helped. The more you can do without leaving the app, the better.

What does it cost? (10%)

Most software wallets are free, but that doesn’t mean there aren’t costs. We looked at swap fees, network fee handling, and whether premium features are locked behind paywalls.

Hardware wallets have upfront costs, so we weighed whether the price matches what you’re getting. A $49 device that does 90% of what a $149 one does is worth knowing about.

How to Pick a Decentralized Bitcoin Wallet

There’s a lot to consider when choosing the best decentralized crypto wallet. We’ll break down the things you need to look for and highlight factors that help the top wallets stand out.

Security Measures

If a decentralized wallet isn’t 100% secure, you should never use it. That said, many wallets achieve security in different ways, so it’s important to know what to look for.

To start, consider whether you want a wallet with a seed phrase or not. Seed phrases can include 12 to 24 randomly generated words, and they are commonly used because they’re effective. However, you have to store your seed phrase somewhere safe, or else you could potentially lose access to your wallet forever if you lose your device.

We recommend only using wallets that support multi-factor authentication. Biometric authentication is best because it’s considered by experts to be highly secure. If biometric authentication isn’t available, look for wallets that are compatible with an authenticator app rather than those that rely on SMS authentication.

You should also consider additional features like multi-signature support. This requires you to use multiple devices to sign off on transactions, making it more difficult for an attacker to steal your tokens.

Finally, make sure that the code underlying a decentralized Bitcoin wallet is fully secure. We recommend sticking to decentralized wallets that are open-source, like MetaMask, or that have undergone third-party security audits.

Supported Cryptocurrencies and Assets

Another important thing to consider when choosing a crypto wallet is what types of digital assets it can actually store. Some decentralized Bitcoin wallets only store Bitcoin, but most support a wide range of altcoins as well.

Generally, we recommend using a wallet that supports at least 50+ blockchains, including all of the largest ones. Think carefully about what tokens you plan to use before choosing a wallet that has limited support.

It’s also worth thinking about whether you plan to buy and sell NFTs since many decentralized wallets support these digital collectibles. Compatibility for different NFT standards varies widely among wallets.

Apps and User Experience

Nearly all major DeFi wallets offer mobile apps for iOS and Android, making it easy to check your token balances and deploy your crypto assets on the go. Most also offer a web interface, and some offer browser extensions for Chrome and other major browsers. Desktop apps are less common but can be a nice feature for crypto users who want to manage their portfolios from a computer.

Web3 Features

Innovative Web3 features can take a crypto wallet from good to great. At a minimum, decentralized wallets should make it easy to stake your tokens to earn interest and offer a dApp library where you can connect to popular DeFi and other platforms. An integrated NFT marketplace is also a plus.

Ideally, wallets should vet the dApps they include in their libraries and offer some form of contract risk analysis. This significantly reduces the chances of connecting to a malicious dApp that could try to steal your tokens.

Swap Fees

A final thing to consider when choosing the best decentralized wallet app is how much the wallet’s built-in exchange charges to swap tokens. Fees can vary widely among different wallets, and they can add up quickly for active investors and crypto traders.

Be sure to also look for gas fee controls. Many wallets let you set maximum gas fees for your transactions, and some offer algorithms and alerts to help you minimize fees when trading cryptocurrencies.

Types of Decentralized Crypto Wallets

There are two main types of decentralized crypto wallets to be aware of: software wallets and hardware wallets.

Software wallets, also known as hot wallets, are solely pieces of software on your device that enable you to manage your cryptocurrencies. They are designed to be secure, but are always connected to the internet. This makes software wallets potentially more vulnerable to attack since someone with access to your wallet’s password could access your tokens at any time. (Multi-factor authentication is critical to ensure they also need physical access to your device.)

Hardware wallets, also known as cold wallets, use a combination of hardware and software to store your cryptocurrencies. Your tokens live on a physical device that is not connected to the internet. When you want to use your tokens for a transaction, the device can be connected (usually via USB or Bluetooth) to a mobile or desktop app, which in turn is connected to the internet.

Many crypto investors use both a software wallet and a hardware wallet in combination. The security of a hardware wallet is ideal for storing tokens that are long-term investments and don’t need to be swapped or traded frequently. The connectedness of a software wallet is ideal for tokens that might be transferred to a dApp or swapped in the near future. Just remember to keep your positions balanced across your wallets as they change over time.

How to Get a Decentralized Crypto Wallet

Ready to start using a decentralized wallet? We’ll walk through the steps for how you can download a wallet today and get started storing your crypto safely.

Step 1: Download a Wallet App

To get started, head to the website for the wallet you want to use. Download the wallet for your mobile device or browser.

Step 2: Create an Account

Open the wallet app and follow the prompts to create an account. Usually, you’ll need to provide an email address, username, and password.

Step 3: Write Down Your Seed Phrase

If your wallet provides a seed phrase, it’s important to write it down on a piece of paper and store it somewhere secure. You will need this seed phrase to restore your wallet on another device if you ever lose your device or your wallet password.

Step 4: Activate Multi-factor Authentication

Next, turn on multi-factor authentication. Different wallets offer different options, but fingerprint or facial recognition is best. Be sure to activate SMS authentication at a minimum.

Step 5: Buy, Sell, or Trade Crypto

Now your wallet is set up, and you’re ready to start buying, selling, or trading cryptocurrency. If you already have crypto in another wallet, you can easily import your tokens to your new decentralized wallet.

Are Decentralized Crypto Wallets Safe?

The first and most important thing we need to understand is that the safety of decentralized wallets depends entirely on implementation and user behavior, not the technology itself.

Decentralized wallets are simultaneously the most secure and most dangerous way to store crypto. They’re secure because no central authority can freeze your funds, and when properly implemented, the cryptography is virtually unbreakable. They’re dangerous because every security decision falls on you, and a single mistake can result in permanent loss.

Not all decentralized wallets are created equal. For example, no Zengo or other wallets that we mentioned above have been hacked or stolen, while some popular wallets have suffered multiple breaches. Open-source wallets aren’t automatically safer than closed-source ones since transparency gives attackers a blueprint to find vulnerabilities. What matters more is whether the wallet has undergone rigorous security audits and has a clean track record.

Traditional seed phrases are the biggest single point of failure in crypto security. In 2025, private key breaches and wallet takeovers accounted for approximately $1.71 billion of first-half losses alone, the dominant attack vector by value. Total crypto theft across the year reached $3.4 billion, concentrated in a small number of high-impact breaches, with three attacks alone accounting for 69% of all recorded losses.

Decentralized wallets transfer all responsibility from institutions to individuals, but most people aren’t equipped for this responsibility. Unlike traditional banking, there’s no fraud department to call when something goes wrong. Every transaction is final, every approval is permanent, and every mistake is costly.

Decentralized wallets are safe when used correctly, but “correctly” requires a level of security awareness that most users haven’t developed yet. The technology itself isn’t the problem – human behavior is.

Tips for Improving Security When Using DeFi Wallets

It’s essential to adopt a security-first approach when using a decentralized crypto wallet. Otherwise, you could fall prey to a scam or hack that results in a significant loss of tokens.

To help, we have five tips for how you can maximize your wallet’s security.

Activate Multi-Factor Authentication

If your crypto wallet offers multi-factor authentication – such as SMS authentication, an authentication code from an app, fingerprint unlock, or facial recognition – be sure to activate those security measures when setting up your wallet. These measures can make it much more difficult for an attacker to get into your wallet, even if they are able to steal your password.

Store Your Seed Phrase Offline

Many, but not all, DeFi crypto wallets use a seed phrase that represents your private key. You need the seed phrase to restore your wallet to another device if you lose your device or lose your wallet’s password.

When setting up your wallet, write down your seed phrase on a piece of paper and store it somewhere secure. Never store your seed phrase on your computer or in the cloud, where it could potentially be stolen. Don’t tell anyone where your seed phrase is located or show it to anyone.

If your wallet doesn’t use a seed phrase – Best Walle and Zengo Wallet do not – then your wallet’s recovery process typically involves your email address and a recovery file. So, be sure to keep your email secure as well.

Keep Your Tokens Offline

If possible, it’s a good idea to store your tokens offline in a hardware or cold storage wallet rather than a software or hot storage wallet. Hardware wallets are designed to keep your tokens disconnected from the internet, and they require physical access to your wallet to approve any transactions. This makes it much more difficult for remote attackers to steal your cryptocurrency through a hack, even if they have your wallet’s password.

We’ll dive into more detail about hardware wallets and how they work later in the guide.

Spread Your Tokens Across Multiple Wallets

Another good security practice, especially if you have a large amount of cryptocurrency, is to split your tokens up among several different wallets. This can include a mix of software and hardware wallets.

The advantage of this approach is that in the event your wallet is hacked and tokens are stolen, you only stand to lose some of your total cryptocurrency holdings. It’s extremely unlikely that any attacker could steal coins from multiple different wallets with different passwords and different security configurations.

Do Your Research Before Connecting to dApps

One of the most common ways that people lose tokens when using decentralized wallets is by connecting to malicious dApps. These could be outright scams in which you send tokens to another wallet for a service that doesn’t exist, while other malicious dApps are designed to take tokens from your wallet.

The solution in either case is to carefully research any dApps before you connect to them. Make sure the dApp is legitimate, and make sure you are connecting to the correct wallet or contract address. It’s also important to only click trusted links and to double-check URLs since lookalike links are a common technique used by scammers.

Conclusion

Choosing the best decentralized crypto wallet is essential. While these wallets offer control and Web3 access, they also require you to take full responsibility for security. The risks are real – from phishing attacks to lost seed phrases – but they’re manageable with proper precautions.

Based on our testing, Best Wallet stands out as the top choice for 2026, combining advanced security without seed phrases, comprehensive Web3 features, and user-friendly design. For maximum security, consider pairing it with a hardware wallet like the Ledger Nano X for long-term storage.

FAQ

What is a decentralized crypto wallet?

Are decentralized wallets safe?

What’s the difference between hot and cold wallets?

Do I need KYC verification for decentralized wallets?

What is a seed phrase, and why is it important?

Which wallet should beginners use?

How much does a decentralized wallet cost?

Can I use multiple wallets?

What cryptocurrencies can I store?

How do I connect to DeFi and Web3 apps?

What happens if I send crypto to the wrong address?

Do decentralized wallets charge fees?

Can I recover my wallet without a seed phrase?

How do I keep my wallet secure?

References

- Customers who trusted crypto giant FTX may be left with nothing (CNN)

- What to Do If You Connect to a Malicious dApp: Step-by-step Guide (Tangem)

- How Biometric Authentication Enhances Security (Token)

- Atomic Wallet Hack (Cointelegraph)

- About Phantom Wallet (TradingView)

- Lost Bitcoins (Investopedia)

- Crypto Seed Phrase Hacks (Cointelegraph)

FAQ

What does decentralized mean in crypto?

Decentralized refers to any crypto-related software that is not owned by a centralized entity. It can refer to decentralized wallets, which are owned by individuals who manage their own private keys. It can also refer to smart contracts, which run autonomously on a blockchain without requiring a centralized entity to manage them.

Are decentralized crypto wallets better?

Decentralized crypto wallets offer a number of advantages over centralized crypto wallets, the most important of which is full control over your tokens. No one can block your transactions or take tokens from your wallet without your permission. However, with a decentralized wallet, you are fully responsible for keeping your wallet secure, so there is some additional work and knowledge required.

What is the best decentralized crypto wallet?

Based on our testing, the best decentralized crypto wallet is Best Wallet. It supports more than 60 blockchains and offers multi-layered security options, plus has tons of Web3 features to help you get the most out of your cryptocurrency. We especially like Best Wallet’s Upcoming Tokens crypto launchpad, which lets you easily discover and invest in hot new crypto projects.

Are decentralized wallets secure?

Decentralized crypto wallets can be fully secure, but it’s up to you to keep your wallet safe. Only use trusted wallets that are open-source or have undergone security audits. In addition, you must keep your wallet’s seed phrase safe and activate multi-factor authentication to keep your decentralized wallet fully secure.

Is Binance a decentralized wallet?

Binance is a centralized crypto exchange that also offers a decentralized crypto wallet called Binance Wallet. Binance Wallet gives users full self-custody over their tokens, but it can be linked with a centralized Binance account to make buying and trading cryptocurrencies easier.

Is Coinbase a decentralized wallet?

Coinbase Wallet is a decentralized wallet. However, Coinbase the crypto exchange is centralized, and tokens held in a Coinbase account are held in centralized (also called custodial) wallets. You can link Coinbase Wallet to Coinbase to enjoy the benefits of a decentralized wallet while still using the centralized exchange to trade.

Is Trust a decentralized wallet?

Yes, Trust Wallet is a fully decentralized crypto wallet, also known as a self-custody or non-custodial wallet. It supports tokens and NFTs from more than 100 blockchains and offers a dApp library so users can take full advantage of Web3.

Is MetaMask a decentralized wallet?

Yes, MetaMask is a decentralized crypto wallet. It is one of the most popular decentralized wallet apps and supports all Ethereum-based tokens as well as tokens on BNB Smart Chain, Polygon, and Avalanche.

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

The team behind IPO Genie has not yet announced an end date for the presale.

Fact-Checked By:

Fact-Checked By:

39 mins

39 mins

Filip Stojanovic

, 45 postsI’m a crypto content strategist and writer who helps Web3 projects tell their story, build trust, and grow engaged communities in an increasingly competitive space. I’ve worked with presale tokens, exchanges, blockchain startups, and crypto marketing agencies, shaping content strategies that not only explain complex concepts but also inspire confidence, attract investors, and drive adoption.

My experience spans a wide variety of formats, from whitepapers, token launch campaigns, and pitch decks to thought leadership articles, technical documentation, and in-depth guides. Before diving into Web3, I built my expertise in B2B SaaS writing. This structured, analytical approach now underpins my work in crypto, allowing me to bring clarity and credibility to projects in a space often criticized for hype and jargon.

I’m especially interested in how blockchain innovation translates into real-world utility. My recent work explores the evolving role of DeFi protocols, NFT ecosystems, and next-generation infrastructure in reshaping industries and creating new opportunities for both businesses and individuals.