This Vortex FX (VFX) price prediction guide explores prices predicted through 2026, 2030, and 2036, looking at the potential heigh...

Best Anonymous and No-KYC Crypto Exchanges in January 2026

31 mins

31 mins Compare the best anonymouse (no-KYC) crypto exchanges of 2026. Explore platforms like Best Wallet, Margex, and BloFin, offering private, high-speed trading without identity checks.

Based on our 2026 research and detailed selection methodology, which evaluated trading volumes, user privacy standards, KYC thresholds, security measures, and overall user experience, Best Wallet, Margex, and BloFin stand out as the top no-KYC, anonymous crypto exchanges today.

Best Wallet enables anonymous DEX trading across 60+ blockchains. Margex supports high-leverage perpetual futures with no ID required, while BloFin allows advanced futures and bot trading with up to 150x leverage and no KYC below a 20,000 USDT limit.

According to our survey and analysis of on-chain behavior, over 38% of privacy-conscious traders now prefer exchanges with tier-free onboarding and fast withdrawals. In a tightening regulatory environment, no-KYC platforms are becoming essential for users seeking control, accessibility, and anonymity in crypto trading.

Key Takeaways for Top No-KYC Crypto Exchanges

- Best Wallet supports trading on 60+ blockchains with zero KYC and full wallet custody, ideal for anonymous DEX users.

- Margex enables 100x leveraged futures trading without KYC and offers multiple bonuses for new traders.

- BloFin provides 500+ futures pairs, automated bots, and up to 150x leverage with a 20,000 USDT withdrawal cap for unverified users.

- KCEX offers up to 30 BTC daily withdrawals and 0% spot trading fees, no KYC required for base access.

- Bitunix stands out with high withdrawal limits (500,000 USDT) and 125x leverage, tailored for pro-level traders.

Top 10 No-Kyc Crypto Exchange List for January 2026

- Best Wallet DEX – Fully non-custodial, multi-chain trading across 60+ blockchains with no KYC ever required.

- Weex – Fast-growing exchange combining pro-level tools and optional KYC for advanced functionality.

- Margex – No-KYC perpetual futures platform with clear fee structure and up to 100x leverage.

- BloFin – High-liquidity exchange supporting 400+ assets with tier-free trading for small accounts.

- KCEX – Feature-rich platform offering deep liquidity and generous promos with no KYC for base usage.

- BingX – Widely accessible exchange with support for 1,000+ assets and limited KYC requirements for casual users.

- Bitunix – Simple, KYC-free onboarding with high withdrawal limits and leverage up to 125x.

- MEXC Global – No-KYC trading on 1,500+ cryptocurrencies with deep liquidity, copy trading, and launchpad access.

- Bybit – Leading derivatives platform with Lite Mode spot trading without KYC and up to 100x leverage for verified users.

- CoinEx – Straightforward no-KYC exchange with 700+ assets, spot and futures markets, and CET token discounts on trading fees.

Best Anonymous (No-KYC) Crypto Exchanges for Private Trading – Reviews and Analysis

Before we cover all the information you need on no-KYC exchanges, let’s review the top 7 platforms you should consider joining.

1. Best Wallet DEX – Non-custodial Mobile Exchange for Cross-chain DeFi Trading without KYC

Best Wallet is a non-custodial mobile wallet integrated with a decentralized exchange (DEX), allowing users to trade thousands of crypto assets across 60+ blockchains without undergoing KYC verification.

It’s primarily designed for privacy-conscious traders who value complete control over their funds, as well as for mobile-first users seeking on-the-go access to DeFi tools, staking, and token swaps. The platform also appeals to early adopters of niche or trending meme tokens, as it often lists assets unavailable on centralized platforms.

Best Wallet ecosystem interface showing multiple features, including buy, store, swap, and stake options, with support for over 60 blockchain networks. Source: Best Wallet

Based on our use, Best Wallet stands out for its simplicity and breadth of supported networks. The DEX experience is clean and integrated directly within the app, removing the need to rely on separate DeFi protocols.

We particularly liked the ability to swap across chains and stake tokens directly from the interface. However, it’s still an evolving platform: some features, like advanced order types or external wallet integrations, are not yet available. Compared to more mature DEXs or hybrid exchanges, Best Wallet is less suited for active day trading or high-frequency users due to limited charting and execution tools.

Key functionalities: trading thousands of tokens across 60+ blockchains, built-in decentralized exchange and DeFi tools, cross-chain swaps, staking, portfolio management.

Best Wallet is a good fit for:

- Traders seeking full anonymity

- Users who prefer mobile-first non-custodial trading

- Investors in emerging or low-cap tokens

Best Wallet is not a good fit for:

- High-frequency traders who need advanced tools

- Users who prefer desktop interfaces or centralized order books

| Feature | Details |

| KYC Requirement | No KYC to trade |

| Withdrawal Limits | Unlimited (non-custodial) |

| Supported Assets | Thousands across 60+ chains |

| Leverage | None |

| Trading Fees | Varies by network liquidity provider |

| Custody | Non-custodial |

| Security Features | Recovery phrase, user-owned keys, contract audits |

| Mobile App | iOS & Android |

2. Weex – High-Volume No-KYC Exchange with 200x Leverage and 1,700+ Trading Pairs

Weex is a centralized exchange that offers both spot and derivatives trading with up to 200x leverage. It operates with a no-KYC policy for basic use, requiring only an email to start trading. While some promotions and advanced features require verification, casual users can access most core functions anonymously.

Weex futures trading interface showing BTC/USDT perpetual contracts with real-time charting, order book, and leverage options. Source: Weex

In our assessment, Weex is a high-volume exchange with a wide range of trading pairs (1,700+) and decent execution speeds. Its main strengths are leverage and the breadth of markets.

However, trading fees are relatively high: 0.10% for spot and up to 0.08% for futures. The platform also relies on task-based bonuses, many of which require identity checks.

Compared to competitors, Weex is more aggressive in leveraging but less appealing for users sensitive to fees or looking for unrestricted rewards.

Key functionalities: leverage up to 200x, 1,700+ trading pairs, cold storage and insurance, task-based bonuses for active traders.

Weex is a good fit for:

- Users interested in high-leverage margin trading

- Traders seeking broad asset selection

- Those who only need basic functionality without KYC

Weex is not a good fit for:

- Traders seeking low fees

- Users who want to access all bonuses without identity verification

| Feature | Details |

| KYC Requirement | No KYC for basic trading |

| Withdrawal Limits | Tiered; basic limits without KYC |

| Supported Assets | 600+ coins, 1,700+ trading pairs |

| Leverage | Up to 200× on futures |

| Trading Fees | Spot: 0.10% / Futures: 0.02–0.08% |

| Custody | Custodial |

| Security Features | 2FA, cold storage, user fund insurance |

| Mobile App | iOS & Android |

3. Margex – No-KYC Crypto Derivatives Platform with Up to 100x Leverage and Copy Trading

Margex is a custodial crypto derivatives exchange focused on simplicity and privacy. It allows users to trade perpetual futures with up to 100x leverage without completing KYC, making it a suitable choice for traders who prioritize anonymity but still want access to advanced trading instruments.

The platform also features copy trading and staking, which broadens its appeal to both beginners and more experienced users interested in passive strategies.

Margex copy trading dashboard displaying top-ranked strategies with trader equity, ROE, and follower counts. Source: Margex

According to our experience, Margex delivers a smooth user interface and straightforward onboarding; you can start trading with just an email. We appreciated the platform’s clear fee structure (0.019% maker, 0.06% taker) and competitive leverage options.

Copy trading works well, with transparent trader profiles and simple allocation settings. However, the platform’s spot trading options are limited, and higher withdrawal limits require verification, which partially undermines the no-KYC appeal. Compared to other no-KYC exchanges, Margex feels more polished in terms of UX but less flexible in asset coverage.

Key functionalities: perpetual futures trading with leverage up to 100х, copy trading, staking, transparent fee model, risk management tools, cold storage.

Margex is a good fit for:

- Traders focused on leveraged perpetual futures

- Users looking for a no-KYC exchange with a clean UI

- Beginners interested in copy trading features

Margex is not a good fit for:

- Spot traders seeking a wide asset variety

- Users who want high withdrawal limits without verification

| Feature | Details |

| KYC Requirement | No KYC to trade |

| Withdrawal Limits | Moderate (exact limits not published) |

| Supported Assets | 50+ coins including BTC, ETH, XRP |

| Leverage | Up to 100× on futures |

| Trading Fees | Maker 0.019% / Taker 0.06% |

| Custody | Custodial |

| Security Features | 2FA, cold storage, address whitelisting |

| Mobile App | iOS & Android |

4. BloFin – Tiered No-KYC Centralized Exchange with Automated Trading Bots and 150x Leverage

BloFin is a centralized crypto exchange that caters to high-volume traders looking for tiered no-KYC access to spot and futures markets. Operating since 2019, it offers over 500 futures pairs, 250+ spot pairs, and leverage of up to 150x.

With additional features like copy trading, automated trading bots, and a reward system, BloFin targets semi-professional users who want more advanced features without mandatory identity checks.

BloFin’s copy trading dashboard highlights top-performing traders with ROI, drawdown, and Sharpe ratio metrics, helping users choose strategies to follow. Source: BloFin

Based on our experience, BloFin’s platform is rich in functionality and relatively easy to navigate. The tiered KYC system is fair; users can withdraw up to 20,000 USDT per day without verification. Futures fees are competitive, and automated bots are helpful for hands-off strategies.

However, the interface might feel overwhelming to beginners, and some promotions are gated behind full KYC. Compared to other no-KYC options, BloFin stands out for its automation tools and withdrawal flexibility, but falls short for those who want completely unrestricted access.

Key functionalities: 500 futures pairs and 250+ spot pairs with leverage up to 150х, automated trading bots, copy trading, rewards program.

BloFin is a good fit for:

- High-volume traders seeking advanced features

- Users interested in futures and bot trading

- Traders comfortable with tiered KYC systems

BloFin is not a good fit for:

- Users who want full platform access without verification

- Beginners looking for a simplified trading experience

| Feature | Details |

| KYC Requirement | No KYC for basic trading |

| Withdrawal Limits | Up to 20,000 USDT/day without KYC |

| Supported Assets | 400+ coins, 500+ futures pairs |

| Leverage | Up to 150× on futures |

| Trading Fees | Spot: 0.01% / Futures: 0.02–0.05% |

| Custody | Custodial |

| Security Features | 2FA, IP whitelisting, cold wallets |

| Mobile App | iOS & Android |

5. KCEX – Ultra-low Fee No-KYC Exchange with 500+ Assets and High Withdrawal Limits

KCEX is a relatively new centralized exchange launched in 2021, offering over 500 crypto assets and competitive trading fees. The platform is designed for users who want access to both spot and futures markets without undergoing KYC for basic use.

Withdrawals up to 30 BTC/day are allowed without verification, which makes KCEX one of the more lenient no-KYC options in terms of limits.

KCEX spot market interface showing live prices, trading volume, and market cap for major cryptocurrencies including BTC, ETH, XRP, and SOL. Source: KCEX

According to our testing, KCEX offers excellent value for cost-conscious traders. Zero fees on spot trades and just 0.01% for futures are rare even among KYC platforms. The interface is clean, though not as feature-rich as some rivals.

A notable drawback is that many bonuses and rewards are tied to full KYC, and the exchange lacks advanced trading tools. Still, its flexible withdrawal limits and competitive fees make it a strong no-KYC contender.

Key functionalities: low fees, 500+ assets for spot and futures trading, leverage up to 200x, withdrawals up to 30 BTC per day without verification.

KCEX is a good fit for:

- Users seeking high withdrawal limits without KYC

- Cost-sensitive traders wanting ultra-low fees

- Those interested in both spot and futures trading

KCEX is not a good fit for:

- Traders who want access to bonuses without KYC

- Users who need advanced charting and analytics

| Feature | Details |

| KYC Requirement | No KYC for basic trading |

| Withdrawal Limits | Up to 30 BTC/day without KYC |

| Supported Assets | 500+ cryptocurrencies |

| Leverage | Up to 200× on futures |

| Trading Fees | Spot: 0% / Futures: 0.01% |

| Custody | Custodial |

| Security Features | Cold storage, account protection layers |

| Mobile App | iOS & Android |

6. BingX – Social and Copy Trading Platform with 1,000+ Assets and No-KYC Access

BingX is a global trading platform known for its robust copy trading features and support for over 1,000 crypto assets. It allows users to access most core functionalities, including spot, futures, and P2P trading, without KYC, as long as balances remain within certain limits. This makes it ideal for casual users, beginners, and copy traders looking to avoid identity verification.

BingX offers trading bonuses and vouchers that can be applied to futures positions, giving users extra leverage and rewards while trading on the platform. Source: BingX

In practice, BingX performs well for social trading. The copy trading interface is user-friendly, and performance metrics are transparent. Leverage up to 150x is available, which appeals to more aggressive strategies. That said, the platform has some friction: customer service is often rated poorly, and TrustPilot scores are low.

Additionally, full functionality (like higher withdrawals) does eventually require verification. Compared to peers, BingX offers great asset diversity and social tools but weaker customer support.

Key functionalities: copy trading and social trading, support for over 1,000 crypto assets, leverage of up to 150х.

BingX is a good fit for:

- Copy traders and social trading enthusiasts

- Users interested in spot and futures without full KYC

- Traders who want access to a large number of assets

BingX is not a good fit for:

- Users who prioritize responsive support

- High-volume traders who want high withdrawal limits without KYC

| Feature | Details |

| KYC Requirement | No KYC for basic use |

| Withdrawal Limits | Tiered; low without KYC |

| Supported Assets | 1,000+ coins |

| Leverage | Up to 150× on futures |

| Trading Fees | Spot: 0.01% / Futures: 0.02–0.05% |

| Custody | Custodial |

| Security Features | 2FA, withdrawal whitelist, multi-tier protection |

| Mobile App | iOS & Android |

7. Bitunix – High-Leverage No-KYC Exchange with 700+ Pairs and Advanced Charting Tools

Bitunix is a high-leverage exchange that caters to experienced traders who want access to advanced tools without submitting personal identification. With up to 125x leverage, support for 700+ trading pairs, and generous withdrawal caps for unverified accounts, it is among the most flexible no-KYC platforms in its tier.

The Bitunix VIP program rewards high-volume traders with reduced spot and futures trading fees. Source: Bitunix

From our evaluation, Bitunix performs strongly in terms of the feature set. Charting tools (including the K-Line Ultra App) are above average for a CEX, and daily withdrawal limits up to 500,000 USDT are more than enough for most traders.

However, its trading fees are higher than average (up to 0.1% for takers) and its interface can be slightly clunky on mobile. Compared to alternatives, Bitunix is a solid pick for power users but less competitive for fee-conscious traders.

Key functionalities: leverage up to 125х, over 700 pairs, advanced charting tools, copy trading, withdrawals up to 500,000 USDT/day for unverified accounts.

Bitunix is a good fit for:

- Advanced traders looking for high leverage and tools

- Users needing high no-KYC withdrawal limits

- Traders who want deep market access with copy trading

Bitunix is not a good fit for:

- Beginners or mobile-first traders

- Users focused on minimizing fees

| Feature | Details |

| KYC Requirement | No KYC for basic trading |

| Withdrawal Limits | Up to 500,000 USDT/day without KYC |

| Supported Assets | 400+ coins, 700+ pairs |

| Leverage | Up to 125× on futures |

| Trading Fees | Spot: up to 0.08% / Futures: up to 0.06% |

| Custody | Custodial |

| Security Features | 2FA, reserve fund, cold storage |

| Mobile App | iOS & Android |

8. MEXC Global – No-KYC Crypto Exchange with Extensive Spot & Futures Markets and Copy Trading

Launched in 2018, MEXC Global has grown into one of the most recognizable centralized exchanges, offering flexible, no-mandatory-KYC access for basic trading.

Serving millions of users worldwide, the platform supports hundreds of spot and derivatives pairs, with a strong focus on rapid token listings, often adding trending or newly launched assets ahead of competitors.

MEXC Global platform dashboard with MX/USDT chart, live order book, and market overview. Source: MEXC

MEXC has positioned itself as a go-to destination for traders seeking variety, early investment opportunities, and efficient execution. The platform offers competitive fees and a broad altcoin selection, but maximum withdrawal limits and access to certain promotional events still require identity verification. It may limit appeal for traders seeking a completely unrestricted experience.

Key functionalities: hundreds of spot and futures pairs, up to 100x leverage, intuitive copy trading tools, staking, Launchpad, and Launchpool programs.

MEXC Global is a good fit for:

- Traders seeking broad altcoin exposure without KYC

- Users interested in early-stage token listings

- Beginners and advanced copy traders

MEXC Global is not a good fit for:

- Investors preferring full self-custody solutions

- Users unwilling to provide KYC for higher limits

| Feature | Details |

| KYC Requirement | No KYC for basic trading |

| Withdrawal Limits | Up to 30 BTC/day without KYC |

| Supported Assets | 1,500+ coins, 2,000+ trading pairs |

| Leverage | Up to 100× on futures |

| Trading Fees | Spot: 0.0%–0.2% / Futures: 0.02%–0.06% |

| Custody | Custodial |

| Security Features | 2FA, cold storage, anti-phishing codes |

| Mobile App | iOS & Android |

9. Bybit – Feature-Rich Derivatives Exchange with No-KYC Lite Mode

Founded in 2018, Bybit has quickly secured its place among the top global exchanges thanks to deep liquidity in derivatives markets and advanced trading tools for professional users. The platform offers a “Lite Mode” for traders who want to access spot markets without completing full verification, maintaining a smooth user experience, and fast execution.

Bybit Copy Trading Classic dashboard showing top-performing traders ranked by ROI and follower profit. Source: Bybit

While full KYC is required for perpetual contracts, higher withdrawals, and advanced features, Lite Mode still provides access to highly liquid pairs and essential analytics.

Compared to other no-KYC exchanges, Bybit stands out for its institutional-grade infrastructure, stable order execution, and extensive educational resources.

Key functionalities: Lite Mode, perpetual contracts with up to 100x leverage, advanced charting via TradingView integration, copy trading marketplace.

Bybit is a good fit for:

- Beginners seeking a simple spot trading option without full KYC

- Derivatives traders looking for a mature, liquid platform

- Users requiring advanced charting and analysis tools

Bybit is not a good fit for:

- Traders wanting completely unrestricted futures access without KYC

- Users looking for non-custodial trading solutions

| Feature | Details |

| KYC Requirement | No KYC for Lite Mode (spot trading only) |

| Withdrawal Limits | 20,000 USDT/day without KYC |

| Supported Assets | 400+ coins, 600+ trading pairs |

| Leverage | Up to 100× on futures |

| Trading Fees | Spot: 0.1% / Futures: Maker 0.01%, Taker 0.06% |

| Custody | Custodial |

| Security Features | 2FA, cold storage, insurance fund |

| Mobile App | iOS & Android |

10. CoinEx – Straightforward Spot and Futures Trading without Mandatory KYC

Launched in 2017, CoinEx is a Hong Kong–based exchange known for its simplicity and accessibility. Unlike many top-tier platforms, CoinEx does not enforce mandatory KYC for standard trading, giving users direct access to spot and derivatives markets with a quick sign-up process. This makes it a popular choice for traders who value anonymity and fast onboarding.

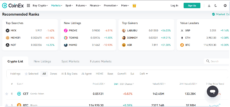

CoinEx’s trading interface features recommended ranks, new listings, and top gainers, along with a simple crypto dashboard. Source: CoinEx

While KYC can unlock higher withdrawal limits and participation in certain promotional events, the core exchange remains fully usable without verification. Its broad asset coverage, relatively low fees, and support for futures up to 100x leverage make it competitive among no-KYC platforms.

Compared to other options, CoinEx stands out for its clean user experience, consistent liquidity, and commitment to keeping KYC optional for everyday trading activities.

Key functionalities: spot trading with hundreds of pairs, perpetual contracts with leverage, easy-to-use web and mobile interface, native CET token for fee discounts.

CoinEx is a good fit for:

- Traders looking for a no-KYC alternative with spot and futures markets

- Users seeking low fees and CET token rewards

- Investors who prefer a simple and straightforward interface

CoinEx is not a good fit for:

- Traders who require advanced institutional-grade tools

- Users who want decentralized, non-custodial solutions

| Feature | Details |

| KYC Requirement | Optional – no KYC for trading |

| Withdrawal Limits | Up to 10,000 USD/day without KYC |

| Supported Assets | 700+ cryptocurrencies |

| Leverage | Up to 100× on futures |

| Trading Fees | Spot: 0.2% (reduced with CET) |

| Custody | Custodial |

| Security Features | 2FA, cold storage, anti-phishing codes |

| Mobile App | iOS & Android |

Best No KYC Crypto Exchanges 2026 Compared

To see how our top picks measure against each other, we’ve prepared a comparison table with a few key aspects you’ll want to know about:

| Exchange | Supported Assets | KYC Policy | Withdrawal Limit | Leverage |

| Best Wallet | 60+ chains, several thousand tokens | No KYC | Unlimited (non-custodial) | No leverage |

| Weex | 600+ | No KYC for basic use; KYC needed for full access | Medium | Up to 200x |

| Margex | 50+ | No KYC for basic trading | Moderate | Up to 100x |

| BloFin | 400+ | No KYC for basic use; tiered KYC for perks | Medium | Up to 150x |

| KCEX | 500+ | No KYC for basic trading; optional for bonuses | Medium | Up to 200x |

| BingX | 1,000+ | No KYC for low-volume use; full KYC for perks | Medium–High | Up to 150x |

| Bitunix | 400+ | No KYC for basic trading | High | Up to 125x |

| MEXC Global | 1,500+ | No KYC for basic trading; optional for higher limits | High | Up to 100x |

| Bybit | 400+ | Lite Mode for spot trading without KYC; full KYC for derivatives | Medium | Up to 100x |

| CoinEx | 700+ | Optional – no KYC for trading | High | Up to 100x |

How We Chose and Evaluated Anonymous Crypto Exchanges – Our Methodology

Selecting the best no-KYC crypto exchanges in 2026 requires more than simply scanning for platforms that skip identity verification. Our goal was to identify exchanges that not only protect user privacy but also offer robust functionality, credible security, and practical trading experiences. To achieve this, we applied a multi-layered evaluation framework based on six key criteria:

1. No-KYC Policy Verification

First and foremost, we independently verified the no-KYC status of each exchange. This included:

- Testing account creation and withdrawal thresholds without submitting personal documentation.

- Reviewing official documentation, terms of service, and FAQ pages.

- Cross-referencing user reports, audits, and updates from trusted sources like CoinGecko, CoinMarketCap, and specialized crypto privacy communities.

We excluded platforms that:

- Required KYC for withdrawals or after reaching low thresholds.

- Had inconsistent or vague policies regarding KYC triggers.

- Recently announced plans to implement mandatory identity checks.

2. Privacy and Anonymity Features

We assessed each exchange’s commitment to privacy beyond KYC, looking at:

- Support for privacy-preserving coins (e.g., Monero, Zcash).

- Integration with non-custodial wallets and Tor-enabled access.

- Optional registration or use of temporary deposit addresses.

- Lack of invasive browser tracking or third-party analytics.

Exchanges that offered advanced privacy tooling, such as CoinJoin integration or native mixers, received higher scores.

3. Trading Volume and Market Liquidity

To ensure practical usability, we examined real trading volume and liquidity depth across major pairs:

- Data was sourced from both centralized platforms (via public APIs) and DEX aggregators.

- We gave preference to platforms with deep liquidity in BTC, ETH, USDT, and privacy coins.

- Exchanges with frequent slippage or wash trading indicators were deprioritized.

We only included exchanges where trades above $1,000 could be executed without major price impact.

4. Security and Custody Risks

While no-KYC exchanges are often non-custodial, we still analyzed:

- History of hacks, downtime, or suspicious withdrawals.

- Open-source smart contracts (for DEXs) and external audits.

- Withdrawal timeframes and cold storage strategies.

Exchanges with full proof-of-reserves or robust multisig custody received higher trust ratings.

5. User Interface and Accessibility

We tested each exchange’s platform directly across desktop and mobile interfaces, evaluating:

- Onboarding friction (e.g., whether it requires email or wallet-only sign-in).

- Clarity of fee structures and trade execution speed.

- Availability of tools like limit orders, charts, and API support.

Preference was given to platforms that remained functional under high traffic, offered responsive design, and provided access from restricted regions (without geofencing or forced VPN blocks).

6. Community Trust and Transparency

Finally, we examined the exchange’s reputation within the privacy-focused crypto community:

- Active participation in forums such as Reddit’s r/Bitcoin and r/privacytoolsIO.

- Transparent communication via social channels and open-source contributions.

- Responses to user complaints, downtime disclosures, and update frequency.

Exchanges that ignored support tickets or received repeated reports of fund freezes were excluded, even if they passed technical requirements.

By combining these dimensions into a weighted scoring model, we prioritized platforms that truly align with the ethos of self-sovereign trading, where users can exchange digital assets without exposing sensitive personal data. Only exchanges that met or exceeded our benchmarks across at least four categories made it into the final list.

What Is a No-KYC Crypto Exchange?

A no-KYC exchange does not require its customers to complete the standard KYC verification process, where you need to provide:

- Government-issued documentation, like a passport or driver’s license, that verifies your identity and age

- Proof of address, like a utility bill

- A selfie for further identity verifications (sometimes)

KYC is a standard requirement that trading platforms like crypto exchanges usually impose, and it’s there to ensure there’s no money laundering involved and that the traders are real people from the jurisdictions where the exchange is registered to operate.

No-KYC exchanges can come in different shapes and forms:

- Full no-KYC exchanges: require little to no personal information, often just an email.

- Tiered KYC exchanges: offer depositing, basic trading features, and withdrawals with limits without having to go through KYC, while they require complete verification to unlock the full suite of functionalities and increase limits.

- Decentralized exchanges (DEXs) inherently privacy-focused and require no personal details, making them no-KYC by default. They facilitate peer-to-peer trading and let you use your own wallets.

Anonymous crypto exchanges that don’t require KYC tend to offer the same services as other exchanges, while also providing added benefits:

- Simplified registration procedure

- Higher privacy and near-anonymity

- Availability in highly restrictive jurisdictions

These are also some of the main reasons people choose to go no-KYC, along with not having to present personal and banking data. Many users also feel these exchanges are more in line with the decentralized nature of cryptocurrencies.

Moreover, they are helpful in some specific use cases. For instance, traders interested in small or infrequent trades find them more convenient because they don’t need to go through KYC for low trading activity. Furthermore, traders who want to test out platforms also find no-KYC exchanges a better choice.

Is It Legal to Use Non-KYC Crypto Exchanges in 2026?

There’s no straightforward answer to this because the laws differ for each jurisdiction. In addition, the legality of these platforms is constantly evolving, just like everything else in the realm of crypto.

However, there are some commonalities between countries. For instance, much of the Western world restricts or bans no-KYC exchanges; usually, only tiered KYC exchanges are allowed. The US, EU countries, Canada, Australia, Japan, and South Korea all have strict KYC requirements.

Only a few nations, notably China, ban exchanges and cryptocurrency in general. Most other countries either have no regulations or have relatively lax laws regarding cryptocurrencies and exchanges.

It’s worth adding that DEXs that don’t use fiat currency at all are not subject to KYC rules and are available worldwide. However, they tend to avoid countries with explicit bans or strict requirements. That’s why many no-KYC and decentralized exchanges don’t allow people from the US to join.

Benefits and Risks of Using No-KYC Crypto Exchanges

Everything in the crypto realm comes with benefits and risks, and no-KYC exchanges are no exception. Let’s start with the benefits:

- High privacy: The most significant advantage of a no-KYC exchange is the increased privacy that stems from you having to provide very little personal information to start trading.

- Higher speed: Even though trading itself isn’t faster, the time it takes to reach that point is significantly shorter. You don’t have to provide extensive information or wait for the platform to verify your documents.

- Better accessibility: No-KYC exchanges, especially DEXs, are more broadly available, especially in regions with higher restrictions.

And now, let’s cover the risks:

- Scams. The anonymity of no-KYC exchanges makes them attractive targets for scammers who list fake investment schemes and fraudulent cryptos. Users don’t get the same level of protection as on KYC exchanges when they get scammed.

- Hacks and security vulnerabilities. Some no-KYC exchanges have lax security measures, making them prime targets for hacks and other security breaches. Unless that exchange has an insurance policy, you’re unlikely to get your funds back in case of a breach.

- Lower user protection. Even though reputable no-KYC exchanges offer high user protection, the lack of KYC is a downside because law enforcement can’t do much to help you if there is an issue.

How to Choose the Best No KYC Crypto Exchange in 2026

If you’re still wondering where to buy crypto without KYC, there are a few key considerations you need to make to determine which no-KYC platform is safe and right for you. Let’s explore them:

- KYC limitations. Since many non-KYC exchanges use a tiered system where only specific functionalities are unlocked for unverified users, it’s important to check what is available. Focus on the withdrawal limits, as these tend to be very low on some no-KYC exchanges and might not be enough for you.

- Supported cryptocurrencies. The best non-KYC exchanges have many supported coins, usually in the hundreds. The same goes for trading pairs in both spot and futures trading.

- Security. You need to check that the no-KYC exchange employs top security measures since they’re not typically legally required to implement these. This is especially the case with DEXs. It’s thus best to go for reputable platforms with good ratings and user feedback.

- Fees. It’s crucial to check the fees involved, especially trading fees. Compare the maker/taker fees on spot and futures trading between the no-KYC exchange you’re considering and several reputable KYC exchanges to ensure they are equal or even lower. Also, check the fees for when you withdraw crypto, which tend to vary between cryptocurrencies.

- Availability. Even though no-KYC exchanges are more broadly available than their counterparts, many still don’t operate in certain jurisdictions, like the US, due to complex rules. It’s essential to check that the exchange you’re considering is available in your country.

- Check for red flags. The biggest red flags that should make you stay clear of a no-KYC exchange include anonymous or undisclosed owners, unrealistically high yields, lack of transparency, poor interface quality, limited or fake online presence, sudden changes in fee structure or key policy, and inflated trading volumes.

How Do I Trade Cryptos Anonymously on No-KYC Exchanges?

We’ve prepared a quick step-by-step guide to help you learn how to buy crypto without KYC. Here’s how anonymous trading works:

1. Pick a wallet and set up an account

You can choose any non-custodial software wallet, or pick the top pick on our list, Best Wallet, which is also one of the best non-KYC crypto exchanges because it includes a high-quality, integrated DEX. Visit its official site and download the app to start. Follow the instructions for setting up your non-custodial wallet and write down your recovery phrase.

Best Wallet homepage showcases its fully anonymous, non-custodial crypto wallet with built-in trading and swap features. Source: Best Wallet

2. Set up a VPN or Tor for added privacy

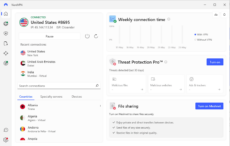

If you’re highly privacy-focused, install and keep a VPN running while trading. Top choices include NordVPN, ExpressVPN, Surfshark, Proton VPN, TunnelBear, and IPVanish.

You can also opt for Tor, the open-source platform for enhanced privacy and anonymity that uses onion routing to make it difficult for others to trace you to a specific location. It’s also often used to access the dark web.

NordVPN desktop interface displaying active connection to a US server, recent connections list, security features, and file sharing options. Source: Nord VPN

3. Pick a no-KYC exchange and start trading

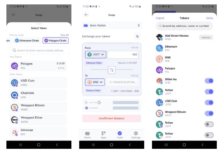

The last step is to choose an exchange without KYC. You can also continue using Best Wallet because it has an integrated DEX, which doesn’t require you to go through identity verification.

To start trading, you’ll need to transfer crypto to Best Wallet if you already have it, and if not, use the app to purchase some with fiat. Once you’re done, you can start trading in the Best Wallet DEX that covers thousands of cryptocurrencies.

In-app interface of Best Wallet, demonstrating multi-chain token selection, seamless asset swaps, and portfolio management features. Source: Best Wallet

Are Non-KYC Crypto Exchanges Here to Stay in 2026?

No-KYC exchanges are affected by the ever-changing legal landscape surrounding them and the rest of the crypto market.

Counter-Terrorist Financing (CTF) and Anti-Money Laundering (AML) continue to advance and become more stringent, negatively impacting non-KYC exchanges. The model these exchanges use is a gray area in many jurisdictions.

Western countries, especially the US, compel crypto exchanges to register, which requires them to implement AML and KYC programs. This is another reason why most non-KYC exchanges use a tiered system where higher limits and more functionalities are available only to verified users.

All this uncertainty means that the number of no-KYC crypto exchanges will likely decrease in the coming years, as evidenced by the fact that even some DEXs now require at least some KYC checks, even though they operate with crypto only.

Should You Use a No-KYC Crypto Exchange Today?

No-KYC crypto exchanges garner much attention, regardless of whether they’re full or partial non-KYC platforms. The latter shows just how sought-after this feature is, since CEXs are certainly not required to offer no-KYC trading. In fact, they must do the opposite.

If you’re interested in joining one and are unsure which crypto exchange does not require KYC, you can always go for our top choice, Best Wallet.

It’s a non-custodial mobile wallet with an integrated no-KYC exchange that lets you trade thousands of cryptos from 60+ chains. The DEX integrates Onramper, which allows you to use fiat to purchase coins, and Best Wallet DEX strives to offer the best exchange rates and lowest processing fees.

FAQ

What is a no-KYC crypto exchange?

Are no-KYC exchanges legal in 2026?

What are the risks of trading on no-KYC exchanges?

Can I withdraw funds from a no-KYC exchange?

Do decentralized exchanges (DEXs) require KYC?

Can U.S. residents use no-KYC crypto exchanges?

How do I choose the best no-KYC crypto exchange?

References

- The KYC process explained (SWIFT)

- Custodial vs Non-Custodial Wallets (Crypto.com)

- What Are Crypto Wallets and How Do They Work? (Bloomberg)

- Hot vs. Cold vs. Warm Wallets: Which Crypto Wallet is Right for me? (Fireblocks)

- Is Your Wallet Snitching On You? An Analysis on the Privacy Implications of Web3 (Cornell University)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

BMIC (BMIC) is a presale project that wants to create quantum-resistant security for crypto wallets and digital assets. The team s...

Wondering how to buy crypto but not sure where to start? Our beginner's guide explains how and where to invest in digital assets l...

Tony Frank

Crypto Editor, 49 postsTony Frank is an accomplished cryptocurrency analyst, author, and educator whose work bridges the gap between complex blockchain technology and accessible, actionable insights for global audiences. Over the past decade, he has emerged as a respected voice in the rapidly evolving world of digital assets, combining technical expertise with a talent for storytelling to help readers navigate everything from Bitcoin’s monetary philosophy to the intricacies of decentralized finance (DeFi). Tony earned his Bachelor’s degree in Economics and Finance from the University of Melbourne, where he developed a deep interest in monetary systems and market structures. He later pursued a Master’s degree in Blockchain and Digital Currency from the University of Nicosia, one of the first academic institutions to offer accredited programs in cryptocurrency studies. Before focusing full-time on blockchain, Tony worked as a financial analyst for a multinational investment firm, covering emerging technologies and alternative asset classes. His early exposure to macroeconomic policy, global market behavior, and fintech innovation laid the foundation for his later work in crypto research and writing. Tony’s expertise spans multiple sectors of the blockchain industry, including cryptocurrency fundamentals, altcoin market cycles, DeFi and web3 trends and regulatory landscapes. Tony combines on-chain data analysis with macroeconomic research, providing readers with both the technical “how” and the market “why” of cryptocurrency movements.