LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

Based on our testing, Best Wallet is the top P2P platform for most users in 2026. You get access to over 1,000 cryptos, 100+ payment methods, and you don’t need to provide any ID documents.

For traders with different needs, MEXC supports 4,000+ trading pairs after your P2P purchase completes, and OKX’s Block Trade feature helps large buyers get better rates on orders over $10,000.

Peer-to-peer (P2P) platforms allow users to buy cryptocurrency directly from local sellers. P2P platforms often support hundreds of payment methods and currencies, and often have less onerous KYC requirements than centralized exchanges.

We analyzed over 50 peer-to-peer platforms to come up with a list of the best P2P crypto exchanges in 2026, ranking the top platforms for trading fees, purchase methods, delivery times, and available assets. Learn how P2P trading works and how to stay safe when completing orders.

Key Takeaways for P2P Crypto Exchanges

- Privacy vs convenience: Some platforms like Bisq and HodlHodl prioritize privacy and no-KYC trading. Others like Binance and Remitano offer ease of use and faster trades, but require identity verification.

- Liquidity matters: High-volume platforms like Binance and KuCoin provide deep liquidity. This marks them ideal for larger trades. Smaller or decentralized platforms may have slower matching.

- Payment options: The number and variety of payment methods vary widely. Platforms with 100+ payment types are more flexible globally.

- KYC and limits: No-KYC trading is limited on most mainstream exchanges, while fully decentralized platforms require no verification but may have lower liquidity.

- Best use cases: Beginner-friendly platforms like Remitano and BingX are good for small and quick trades. Professional traders may prefer Binance, OKX, or KuCoin for large-volume trades and advanced markets.

The Top 10 P2P Crypto Exchanges in 2026

Our analysis identifies the following as leading P2P Bitcoin exchange platforms:

- BestWallet – Best for users who want privacy, self-custody, and broad access to many coins.

- Binance – Best for people who want high liquidity, many payment methods, and low or zero fees on peer-to-peer trades

- MEXC – Best for traders who want portfolio diversification

- KuCoin – Best for users who want a friendly, secure P2P platform with support for multiple cryptos and fiat currencies

- OKX – Best for larger traders or users wanting a reliable exchange with many payment options

- Bybit – Best for those looking for reduced seller rates

- BingX – Best for beginners who want quick access to USDT

- Bisq – Best for privacy-focused users who want a fully decentralized, no-KYC way to trade

- HODLHODL – Best for those who value non-custodial trades and anonymity

- Remitano – Best for new or casual traders who want a simple platform with escrow protection

7 Best Peer-to-Peer Crypto Exchanges Reviewed

Below you’ll find extensive reviews of the top peer-to-peer platforms. Read on to choose the best P2P cryptocurrency exchange.

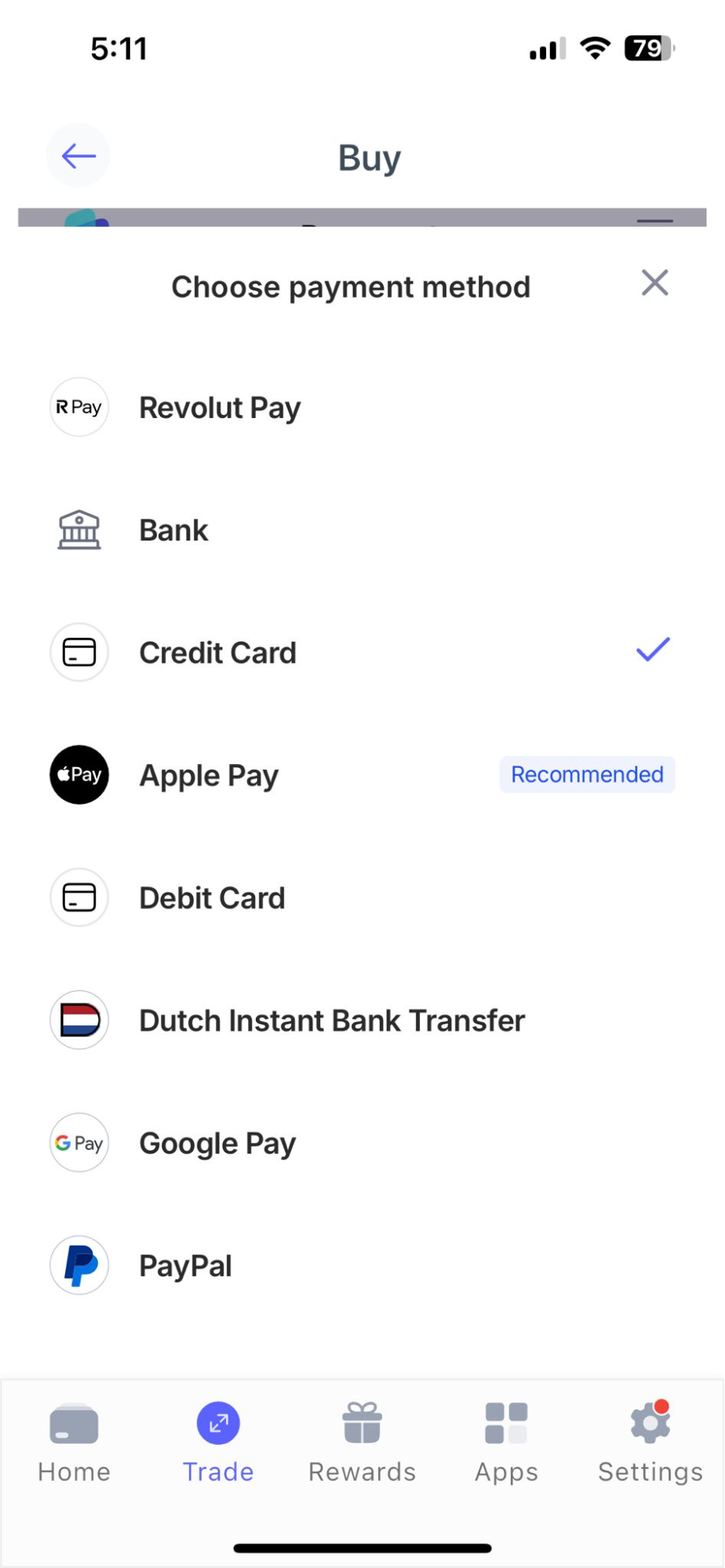

1. Best Wallet – Top Anonymous Crypto App with Instant Fiat Purchases and Low Fees

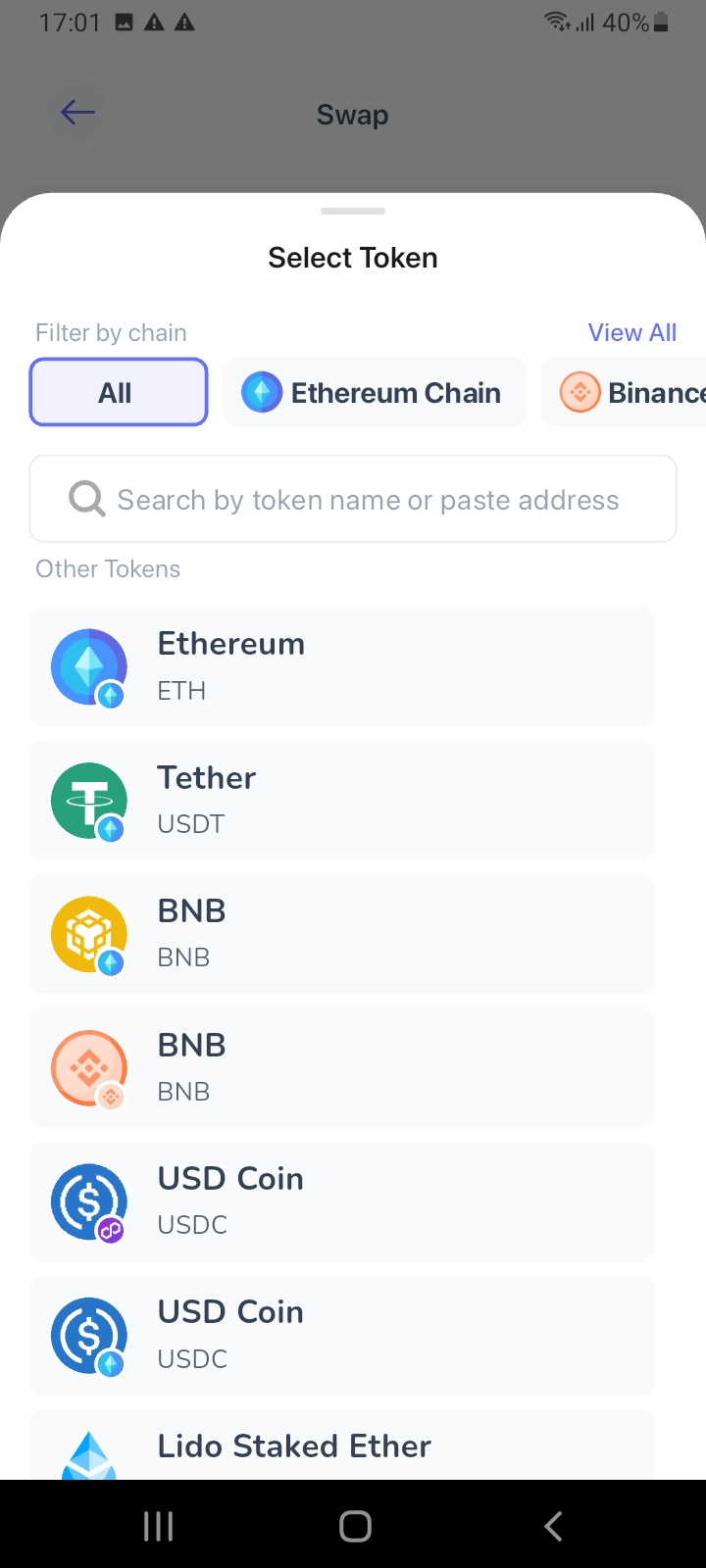

Best Wallet is a popular crypto app for iOS and Android that offers an anonymous trading experience. The app serves as both a non-custodial wallet and an exchange. Users can buy over 1,000 cryptocurrencies instantly using bank transfers, debit and credit cards, and e-wallets such as Google Pay and Apple Pay.

Users get the best market fees, as Best Wallet sources exchange rates from hundreds of liquidity providers. Once the P2P payment is processed, cryptocurrencies are safely stored in the wallet balance – security controls include biometrics and two-factor authentication via SMS. Other Best Wallet features include a token Launchpad and instant token swaps.

| Available P2P Coins | 1,000+ |

| Payment Types | 100+ |

| Local Currencies | 30+ |

| Mobile App | Yes – iOS and Android |

| KYC? | No |

| Core Features | The most extensive range of supported P2P coins. Buy crypto anonymously with 30+ currencies. The app stores purchased coins in a self-custody wallet. |

Editor’s experience: Using BestWallet felt straightforward and fast. Setting up the wallet was quick, and buying crypto with a debit card was almost instant. The tokens appeared in my wallet within minutes. Swapping between coins was also simple, and the app’s interface made it easy to manage multiple tokens across different blockchains. I did miss having a desktop version and some more advanced trading tools, but overall, it’s great for casual traders.

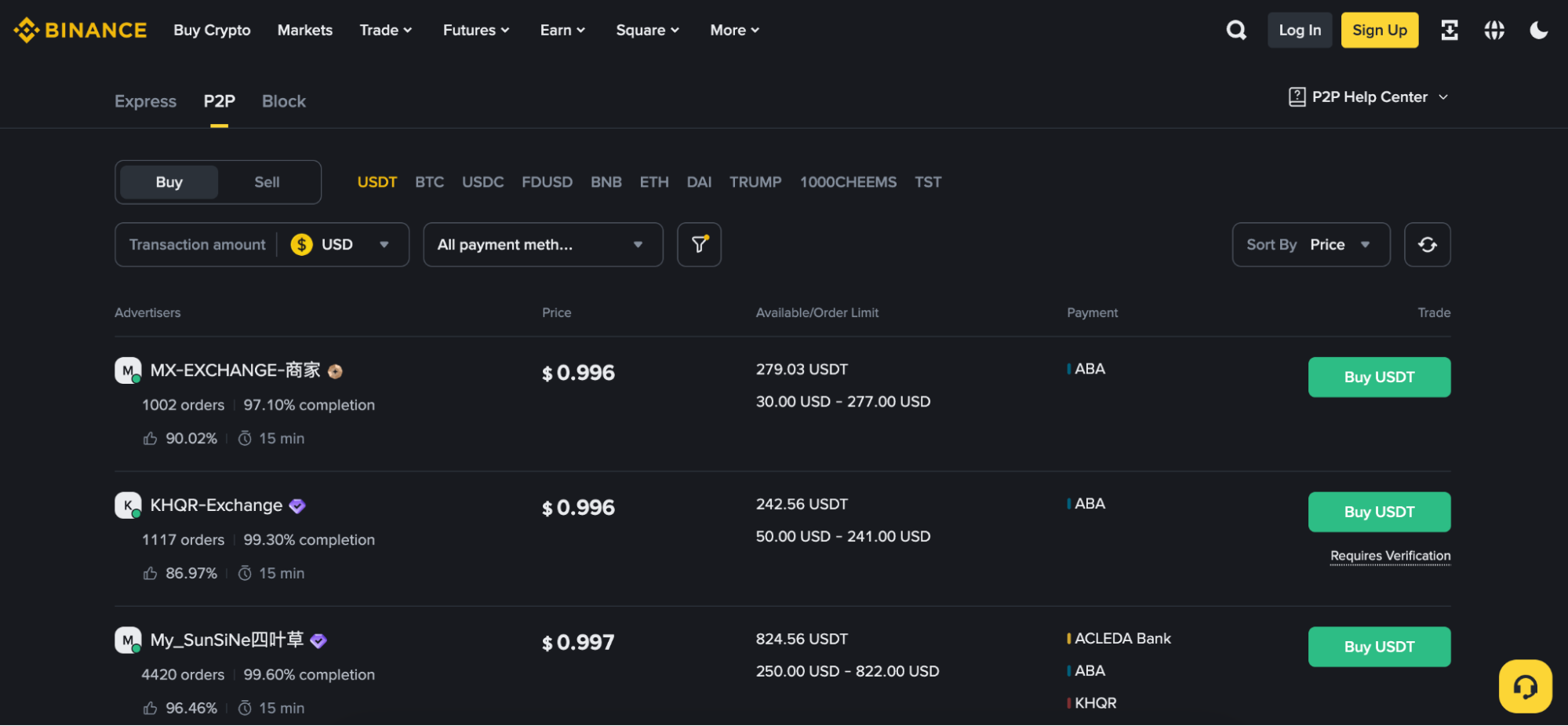

2. Binance – Access Thousands of Dollars Worth of USDT Below the Spot Price

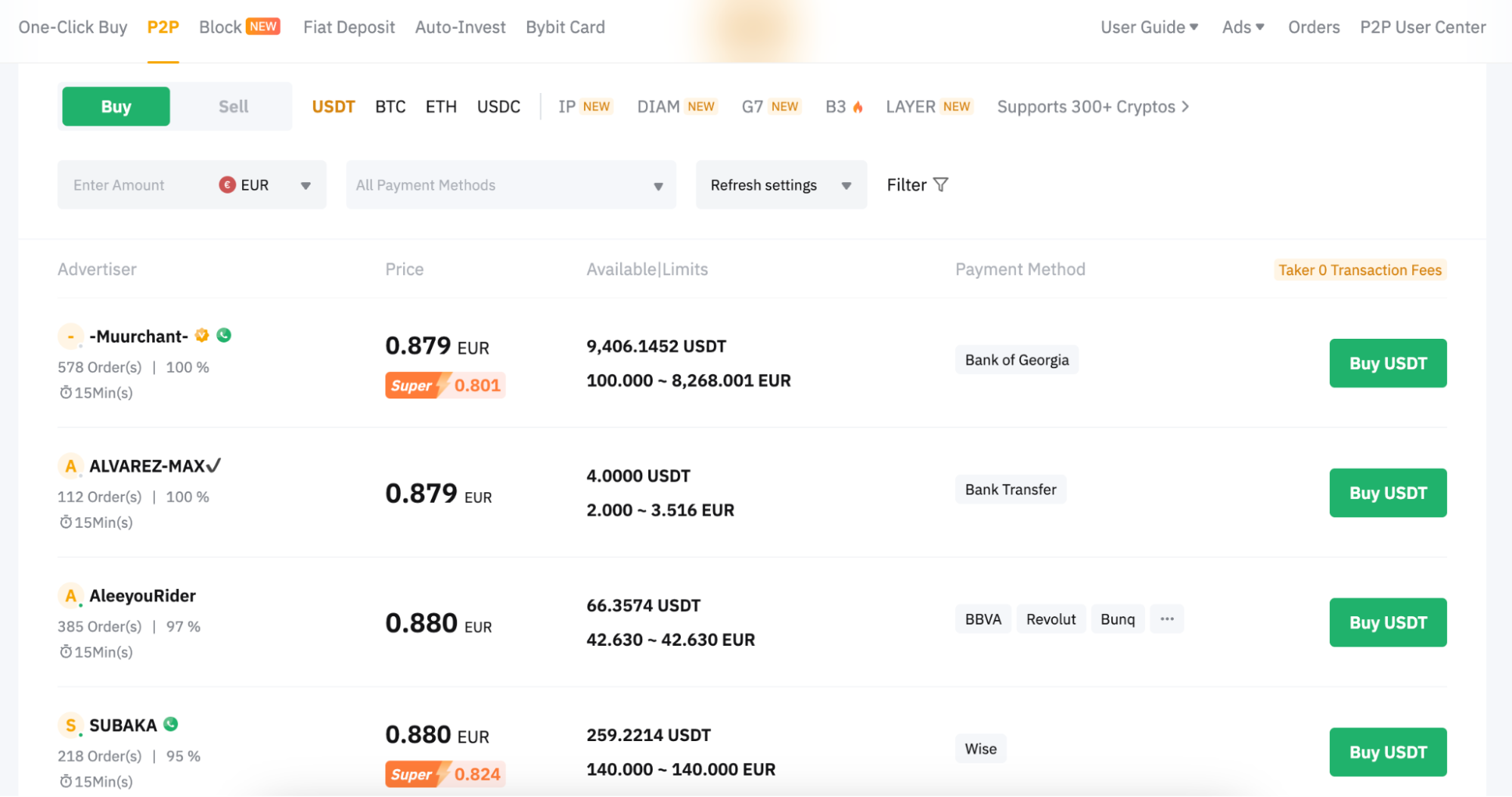

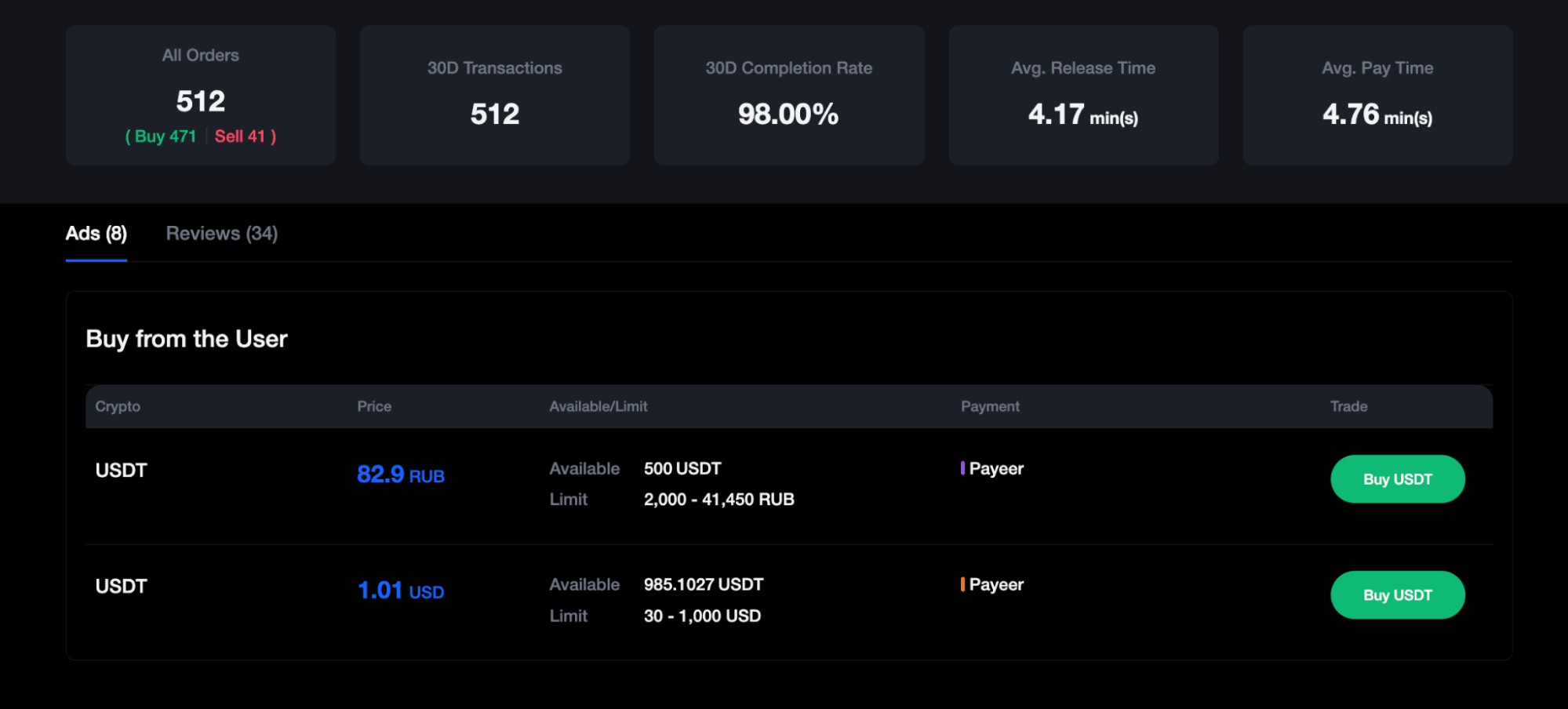

Binance users can purchase USDT on its P2P platform below the market price – multiple trading partners offer thousands of dollars worth of liquidity at sub-$1 per token.

This is happening on a platform that processes over 7.5 million P2P transactions annually, with the exchange dominating 39.8% of global spot trading volume in 2025.

This price dynamic lets users secure arbitrage opportunities, as P2P rates are locked in while buyers complete payment.

P2P traders have over 800 payment methods to choose from across over 100 currencies, including popular e-wallets like Skrill and Neteller. Binance ensures safe trading via a P2P escrow system, and both buyers and sellers must go through a KYC process before they get started.

| Available P2P Coins | USDT, USDC, Bitcoin, Ethereum, Dai, FDUSD, BNB, OFFICIAL TRUMP, 1000CHEEMS, and Test |

| Payment Types | 800+ |

| Local Currencies | 100+ |

| Mobile App | Yes – iOS and Android |

| KYC? | Yes |

| Core Features | Many P2P sellers offer USDT below the spot price. The P2P dashboard supports 10 cryptocurrencies. The average trade time is just 15 minutes. |

Editor’s experience: Using Binance’s P2P platform felt secure and efficient. Setting up my account was straightforward, though KYC was required, which takes longer than anonymous apps. Once verified, buying USDT below the spot price was simple. The escrow system made trades feel safe. It’s ideal for high-volume traders who want deep liquidity, though if you seek minimal verification, you may find it less appealing.

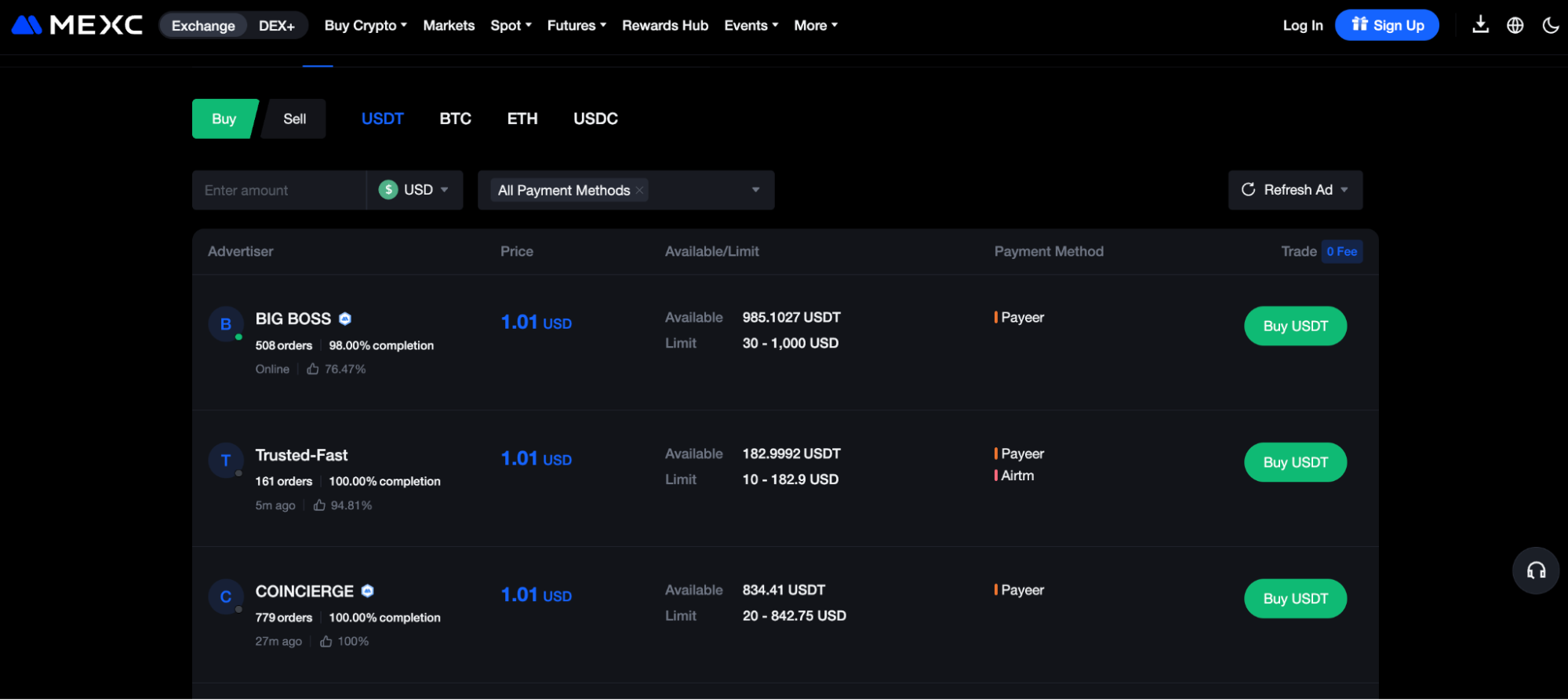

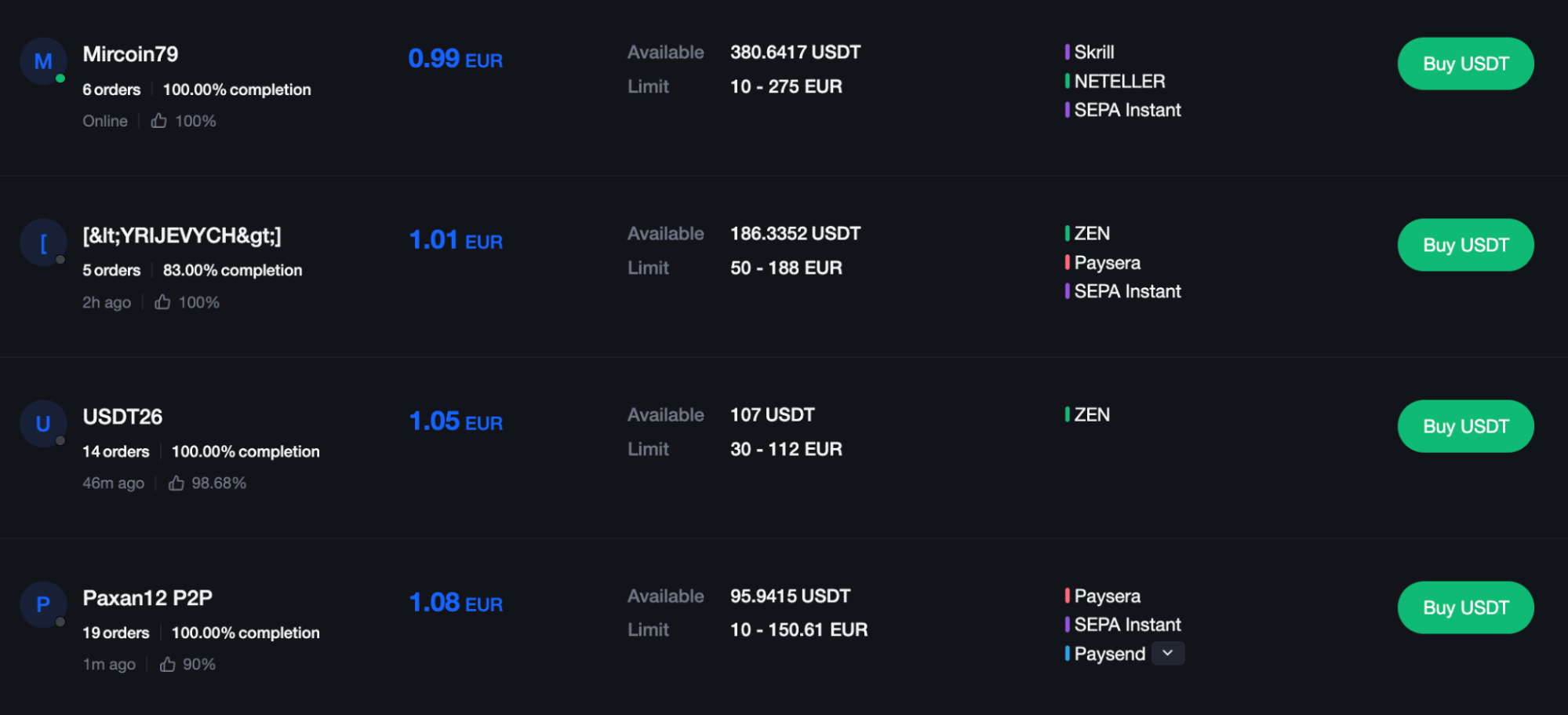

3. MEXC – The Best Option for Portfolio Diversification with 4,000+ Supported Crypto Pairs

MEXC’s P2P crypto marketplace offers a no-KYC experience – users open an account with an email or mobile number only.

While the P2P platform supports USDT, USDC, Bitcoin, and Ethereum, the main MEXC exchange has over 4,000 trading pairs. Markets include traditional spot trading and crypto derivatives with leverage of up to 500x.

No additional fees are charged when buying cryptocurrencies from P2P sellers, and exchange rates are typically just above the global spot price. Limits are lower than on other platforms, so MEXC is a better fit for those who want to buy small amounts.

| Available P2P Coins | USDT, USDC, Bitcoin, and Ethereum |

| Payment Types | 100+ |

| Local Currencies | 25+ |

| Mobile App | Yes – iOS and Android |

| KYC? | No (up to 20,000 USDT daily) |

| Core Features | P2P buyers access over 4,000 trading markets. Avoid KYC when withdrawing under 20,000 USDT daily. The main exchange offers institutional-grade liquidity. |

Editor’s experience: Using MEXC was quick and easy. I could set up an account with just my email and start trading small amounts immediately. Buying crypto via P2P was smooth, without extra fees and with generally fair exchange rates. The app is intuitive, though daily limits and lower liquidity make it better for casual traders rather than high-volume pros.

4. KuCoin – A Flexible and Low-Fee P2P Option with Broad Crypto/Fiat Support

KuKoin’s P2P marketplace allows users to trade popular cryptocurrencies like BTC, ETH, USDT, USDC, and KCS directly with peers. The platform supports 100+ payment methods across 30+ fiat currencies. This way, it gives flexibility for local transfers, cards, and digital wallets.

KuCoin charges zero trading fees on P2P transactions. The cost to you is whatever markup the seller sets. Buyers and sellers benefit from escrow protection until both sides confirm payment, which helps reduce the risk of fraud.

The broader KuCoin exchange also supports 900+ cryptocurrencies, spot and futures trading, staking, lending, and trading bots.

| Available P2P Coins | USDT, USDC, Bitcoin, Ethereum |

| Payment Types | 100+ |

| Local Currencies | Dozens of fiat currencies are supported across many regions |

| Mobile App | Yes – Web+Mobile app available for iOS and Android |

| KYC? | KYC is required for most features since 2023. Identity verification and face scan are needed for full P2P and withdrawals. |

| Core Features | No P2P trading fees, escrow-protected peer-to-peer trades, flexible payments and fiat support, access to wide crypto markets. |

Editor’s experience: Using KuCoin P2P felt simple and flexible. I browsed listings in my fiat currency, picked a seller accepting a payment method convenient for me, and appreciated that there was no trading fee. Switching between P2P and spot trading was seamless.

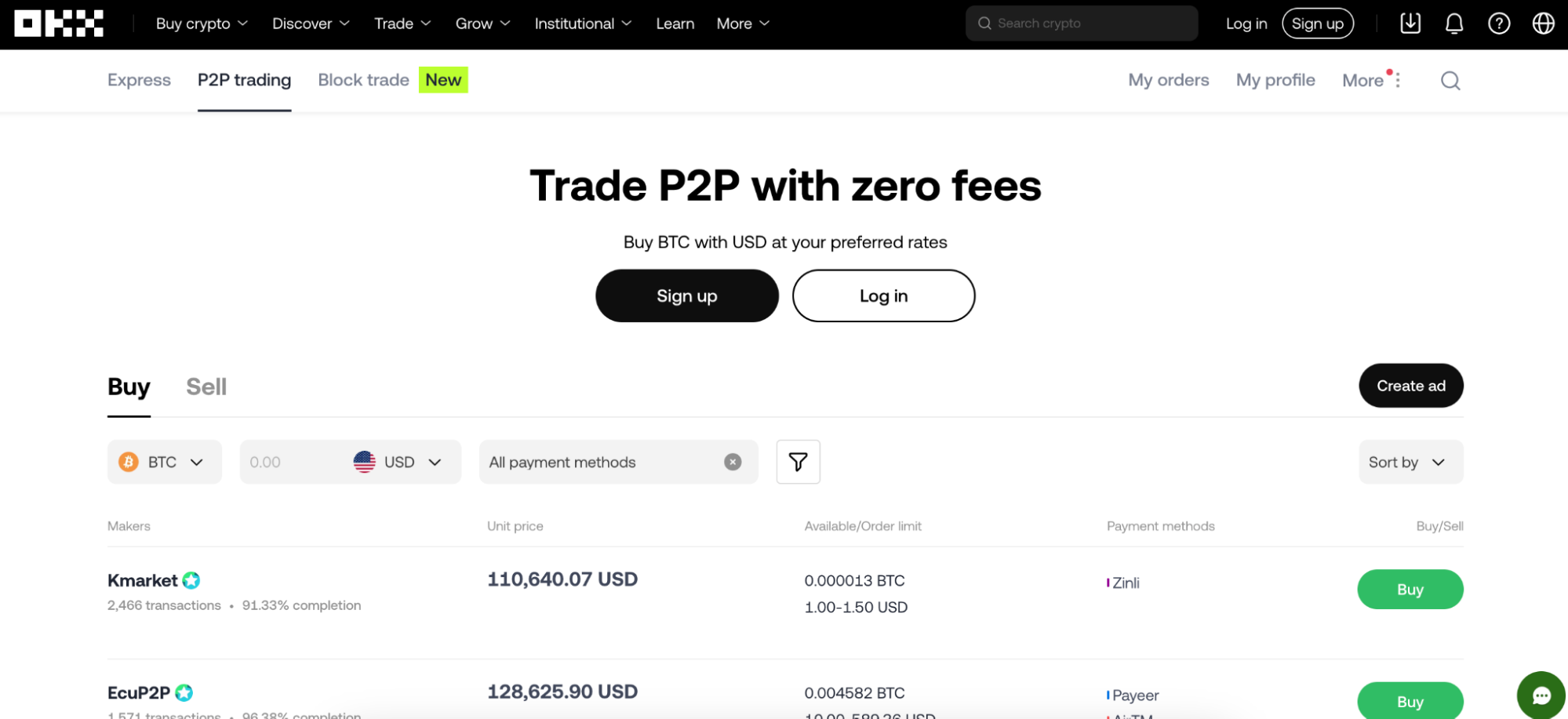

5. OKX – A Great Option for P2P Traders Who Want to Purchase Large Amounts ($10,000+)

OKX is the go-to exchange for P2P traders with significant purchase requirements. Its Block Trade feature targets large-scale investors who need to buy over $10,000 worth of digital assets – in a market that’s projected to hit $16 trillion by 2034. The feature ensures that traders minimize the price impact and get the most competitive exchange rates without relying on over-the-counter (OTC) brokers.

The peer-to-peer crypto exchange supports USDT, USDC, Bitcoin, and Ethereum. Traders can choose from over 900 payment methods, including local and international transfers, e-wallets, and popular banking apps such as Revolut and Cash App. Once the assets are delivered to OKX, users can access hundreds of other markets, including spot trading, delivery futures, and options.

| Available P2P Coins | USDT, USDC, Bitcoin, and Ethereum |

| Payment Types | 900+ |

| Local Currencies | 100+ |

| Mobile App | Yes – iOS and Android |

| KYC? | Yes |

| Core Features | Buy over $10,000 worth of cryptocurrencies at top market prices. Choose from over 900 payment types. Access derivative products after finalizing the P2P trade. |

Editor’s experience: Using OKX for large P2P trades felt professional and reliable. The Block Trade feature made purchasing over $10,000 smooth, with good rates and minimal market impact. I also appreciated the wide range of payment options and the secure escrow system, which gave confidence when moving large sums. The mandatory KYC means it is not ideal for people seeing full anonymity, though.

6. Bybit – Cost-Effective P2P Trading with No Markups and Free Voucher Discounts

Bybit is the world’s second-largest crypto exchange after Binance. It commands daily trading volumes of several billion dollars, and the platform recently surpassed 71 million users. The peer-to-peer suite supports USDT, USDC, Bitcoin, and Ethereum, and buyers have over 600 deposit options, including mobile payments, local transfers, and PayPal. The platform also offers more favorable exchange rates when claiming a super voucher. The drawback is that vouchers require users to complete KYC verification.

Users who prefer anonymity can withdraw up to 20,000 USDT daily without providing personal information or ID documents.

| Available P2P Coins | USDT, USDC, Bitcoin, and Ethereum |

| Payment Types | 600+ |

| Local Currencies | 60+ |

| Mobile App | Yes – iOS and Android |

| KYC? | No (up to 20,000 USDT daily) |

| Core Features | Offers more competitive exchange rates when users complete KYC. Rates lock in while the buyer completes payment. Supports over 600 deposit methods. |

Editor’s experience: Using Bybit’s P2P platform was smooth and cost-effective. Setting up an account and buying crypto up to the 20,000 USDT daily limit without KYC is quick. Claiming vouchers is also easy once you are verified. The trades process fast here, and there is a variety of payment options that make transactions convenient. Full KYC is required to access some discounts.

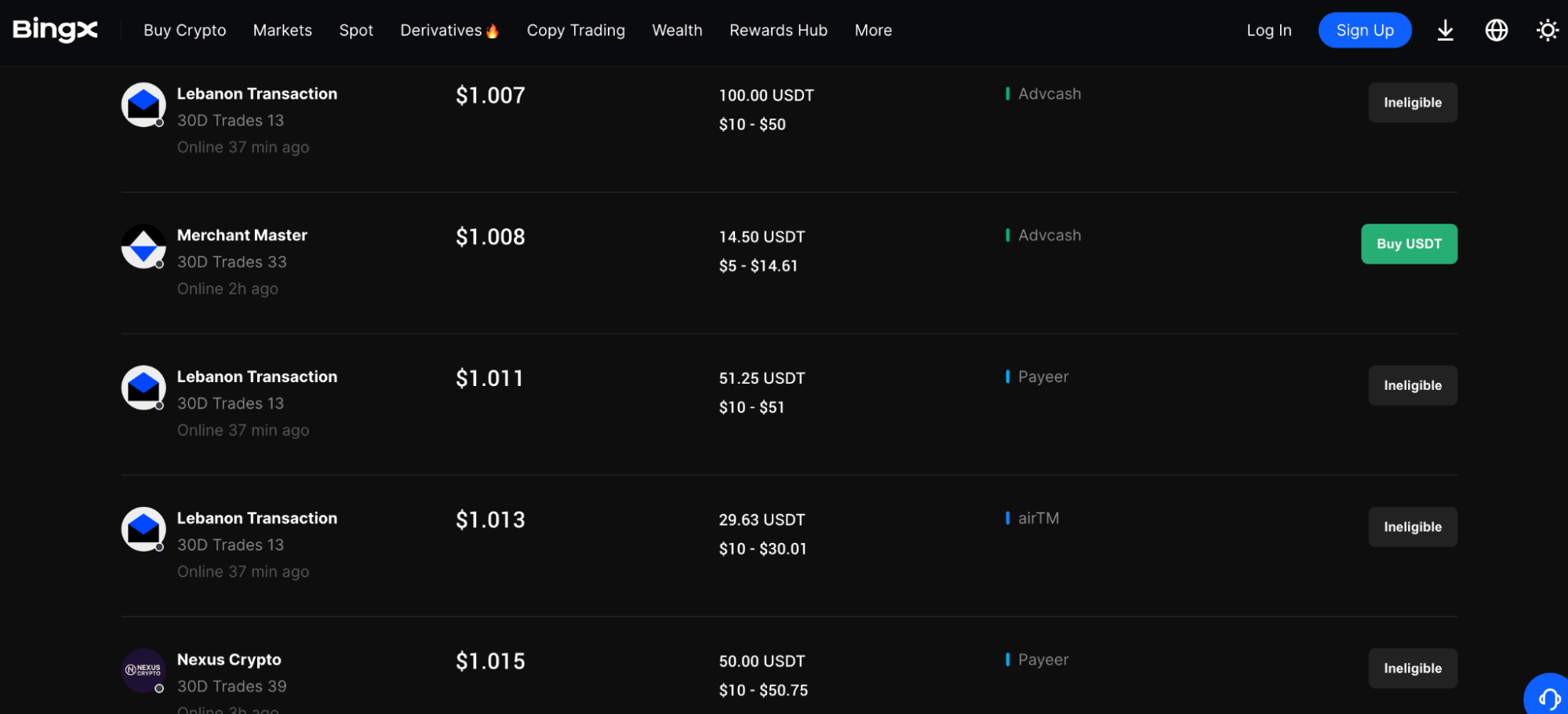

7. BingX – Purchase USDT in Under 10 Minutes to Access a Huge Range of Trading Features

BingX’s P2P crypto exchange supports just one asset – USDT, yet it remains one of the best options to access the broader markets. BingX supports over 1,000 cryptocurrencies, including spot trading and perpetual futures with leverage of up to 125x. Automated tools include grid bots and copy trading.

The P2P exchange supports over 300 payment types and over 65 fiat currencies. Local methods include mobile transfers, LINE Pay, and Wing Money.

Most peer-to-peer sellers have a minimum purchase requirement of just $10, and upper limits often exceed several thousand dollars.

| Available P2P Coins | USDT |

| Payment Types | 300+ |

| Local Currencies | 65+ |

| Mobile App | Yes – iOS and Android |

| KYC? | No |

| Core Features | Most P2P trades complete in under 10 minutes. Small minimums of about $10. The main exchange offers automated tools, spot markets, and derivatives. |

Editor’s experience: Using BingX was fast and beginner-friendly. I could buy USDT via P2P in under 10 minutes, with small minimum amounts making it easy to test trades. The app’s interface is clean. Switching from P2P to spot or copy trading felt simple. I also appreciated the variety of automated tools like grid bots, though advanced P2P traders might find the options a bit limited.

8. Bisq – Fully Decentralized, No KYC P2P Exchange

The Bisq platform is a peer-to-peer crypto exchange that runs as desktop software (no central servers) and lets you trade cryptocurrencies directly with other users. There is no registration, no identity checks, and no general custody. Your funds basically stay in your hands.

Trades at Bisq are secured via a 2-of-3 multi-signature escrow system, and the network routes traffic over Tor for privacy and censorship resistance.

| Available P2P Coins | Bitcoin and some alt/crypto pairs |

| Payment Types | Bank transfer, fiat transfer, crypto |

| Local Currencies | Multiple (depends on user listing offers) |

| Mobile App | No, desktop client only |

| KYC? | No, no identity verification required |

| Core Features | Decentralized order book, full privacy and anonymity, peer-to-peer trades, multi-sig escrow. |

Editor’s experience: Using Bisq feels like going back to crypto’s roots. There is no sign up, no KYC, just peer-to-peer trades over Tor. It gives a sense of real privacy. I never had to hand over ID, and funds always stay in a wallet I control. That being said, trades tend to be slower and liquidity thinner compared to the big exchanges. Often you will wait longer to find a matching offer, and the fees can make small trades inefficient.

9. HODLHODL – Non-Custodial Global P2P Platform for Bitcoin

HodlHodl is a peer-to-peer crypto exchange that emphasizes privacy and control. Trades are non-custodial (you keep your funds), and the platform doesn’t require KYC, just an email to start. It uses multi-signature escrow to secure trades, which helps reduce fraud risk. It supports a variety of fiat currencies and global payment methods.

| Available P2P Coins | Mostly Bitcoin, some offers for other coins depending on sellers |

| Payment Types | Multiple: bank transfers, PayPal, cash, e-wallets |

| Local Currencies | Many: supports a broad range of fiat currencies |

| Mobile App | Web-based and works via browser |

| KYC? | No – no mandatory identity verification for standard traders |

| Core Features | Non-custodial P2P trading, multi-sig escrow, privacy-focused, customizable offers. |

Editor’s experience: Using HodlHodl gave me a crypto ownership vibe because of the no KYC and the fact that funds stayed with me. Escrow protects deals until both sides confirm. It feels simpler than a fully decentralized client like Bisq, but still very privacy-focused. Now, liquidity isn’t always huge, so you will need patience to find a match.

10. Remitano – Easy and Beginner-Friendly P2P Exchange for Fiat – Crypto

Remitano is a P2P exchange that serves many regions, especially in Asia and Africa (but it is accessible globally). It aims to make buying and selling crypto, including Bitcoin, Ethereum, and USDT, accessible with fiat via local payment methods.

Remitano offers escrow protection to secure the trades and has a relatively simple interface, which makes it ideal for newcomers to crypto.

| Available P2P Coins | Bitcoin, Ethereum, USDT |

| Payment Types | Bank transfers, e-wallets, local payment methods, mobile payments |

| Local Currencies | Broad: supports many fiat currencies around the world depending on region |

| Mobile App | Web and mobile-friendly interface |

| KYC? | Yes: Remitano adheres to KYC/AML standards in many cases |

| Core Features | Escrow-protected P2P trades, fiat-crypto pairing, beginner-friendly interface |

Editor’s experience: Remitano felt very easy to use and is good for first-timers. You can pick a payment method that works in your region and trade fiat for crypto without much effort. The escrow system gives security, and the interface is intuitive enough that I didn’t need to be a crypto vet. On the flip side, compared to big exchanges, liquidity here can be spotty.

What Is P2P Exchange?

P2P crypto exchanges support peer-to-peer transactions – users purchase digital assets directly from sellers rather than on centralized exchange order books. The P2P concept enables users to settle trades in domestic currencies and use local payment methods, such as local transfers and e-wallets.

In terms of trading fees, the best P2P crypto exchanges let sellers choose their preferred rates. Merchants that require a quick sale often set rates below the global spot price, providing buyers with a discount.

How Do P2P Bitcoin Exchanges Work?

The escrow safeguard sits at the heart of P2P trading. Escrow systems ensure sellers deposit the required cryptocurrencies into the exchange’s wallet, which are locked while the buyer makes payment. The seller confirms they’ve received the funds, and the P2P platform transfers the crypto assets to the user’s wallet.

P2P Crypto Exchanges vs Standard Exchanges

While most P2P platforms are backed by traditional exchanges, the crypto trading process differs.

Here’s how peer-to-peer and standard exchanges compare.

Crypto Prices

P2P sellers choose the exchange rate that they wish to offer – this can be more or less competitive than the actual market price.

Standard exchanges use the order book system, which means prices are determined by market forces. Market makers ensure prices align with global spot rates.

KYC Requirements

Traditional centralized exchanges have increased their focus on KYC enforcement since the U.S. fined Binance $4 billion for money laundering failures. The result is that major exchanges require users to upload a government-issued ID when they buy cryptocurrencies with fiat money.

Peer-to-peer exchanges bypass these requirements, as buyers and sellers conduct trades directly. Platforms merely provide escrow services, meaning they don’t directly hold client funds. This makes the P2P system ideal for those who favor privacy and anonymity.

Supported Markets

Popular exchanges like MEXC and Bybit support thousands of cryptocurrencies across spot and futures markets. Yet, the same exchanges list just four crypto assets on their respective P2P platforms.

BingX users face similar challenges – P2P buyers can only purchase USDT while the main exchange supports over 1,000 coins.

The P2P framework helps investors enter the broader crypto ecosystem with fiat money, which is why it supports so few markets.

Payments and Currencies

When using a P2P Bitcoin exchange, you have access to a significant range of payment methods and currencies.

Users based in countries with limited exchange support can easily buy digital assets with local bank transfers, mobile payments, and domestic e-wallets. Transactions settle in the national currency, so buyers avoid foreign exchange fees.

Major exchanges, which support a global audience, typically offer fiat services in major currencies like USD, GBP, and EUR, and payments are limited to debit/credit cards. This lack of support for non-major payments alienates users outside of the developed world.

Liquidity

While peer-to-peer cryptocurrency exchanges rarely publish daily volumes, our research indicates that they account for a fraction of traditional spot trading markets.

For instance, platforms like MEXC, Binance, and OKX handle billions of dollars in transactions every day, yet the top P2P traders average volumes of only several thousand dollars. This directly impacts liquidity levels, whereas significant investments require multiple P2P sellers to meet the full requirement.

Peer-to-Peer Crypto Exchanges vs OTC Exchanges

Peer-to-peer crypto exchanges connect buyers and sellers, so both parties avoid centralized exchanges or intermediaries. Sellers choose their exchange rates, and buyers are free to purchase assets from their preferred merchant. P2P providers support a wide range of currencies and local payment types, making it more convenient to send and receive money.

The peer-to-peer concept is generally a good fit for casual users with small trading requirements, as liquidity levels are limited. It’s also popular with traders who favor anonymity, as many P2P platforms offer anonymous accounts.

OTC exchanges serve large-scale traders – typically those investing six or seven figures. The process requires a centralized broker to complete due diligence on the individual, including their purchase requirements and proof of the source of funds. The broker negotiates rates with tier-one liquidity providers, locks in the price, and waits for the buyer to transfer capital.

While OTC traders receive industry-leading prices, the trade-off is substantial account minimums, comprehensive Know Your Customer (KYC) identity verification, and payment methods limited to bank wires.

Is P2P Crypto Trading Secure?

P2P exchanges are generally safe, as the escrow framework ensures secure transactions. After the buyer chooses a merchant and accepts the displayed price, the seller must transfer the digital assets to the escrow wallet, which is controlled by the P2P platform. The platform instructs the buyer when it’s safe to send payment to the seller.

Another safeguard is that some exchanges require sellers to complete a KYC verification process, which deters scammers. Platforms also let buyers leave feedback after completing a trade, so future users can focus on sellers with positive reviews and an established track record.

P2P trading isn’t completely risk-free, though. Buyers should report sellers who request to complete trades outside of the platform and ensure they maintain adequate records, such as screenshots of chats and proof of payment. Ensure you use a strong account password and if available, activate two-factor authentication.

Methodology – How We Picked and Ranked the Best P2P Cryptocurrency Exchanges

We reviewed over 50 crypto exchanges with active P2P trading services, examining deposits, peer-to-peer transactions, escrow functionality, and withdrawals. Each platform was tested on both desktop and mobile devices to evaluate the overall P2P trading experience, including ease of listing offers, responding to buyers/sellers, and completing trades securely.

Our team focused on variables most relevant to P2P trading, starting with security and escrow mechanisms, followed by payment method variety, transaction speed, liquidity, and user experience. Licensing and compliance were also considered to ensure that P2P users operate in safe and regulated environments.

Note: The “Best” classifications (e.g., Best for Low Fees, Best for Beginners, Best for Advanced P2P Trading) are not investment recommendations. They are intended to highlight each exchange’s strengths in peer-to-peer trading, ideal use cases, and overall functionality.

The evaluation was based on a combination of documented platform features and hands-on testing where possible, specifically focusing on P2P trading flows, dispute resolution, and escrow reliability. This approach allows us to identify which platforms are most suited for secure, efficient, and user-friendly P2P cryptocurrency trading.

P2P Trading Availability and Liquidity – 30%

We prioritized exchanges that actively support P2P trading for major cryptocurrencies such as Bitcoin, Ethereum, and stablecoins. This includes assessing the range of tradeable assets, the number of active buy/sell offers, and overall market depth. High liquidity ensures that users can complete transactions quickly without experiencing significant price slippage, making it a critical factor for a smooth and reliable P2P trading experience.

Payment Options and Regional Accessibility – 20%

We evaluated the diversity of fiat payment methods available for P2P trades, including bank transfers, credit/debit cards, digital wallets, and local payment apps. Additionally, we assessed the platform’s availability across multiple countries and regions to ensure users worldwide can access P2P trading conveniently. Platforms with broad regional coverage and multiple payment options score higher, as these factors directly impact usability and flexibility.

Fee Structure and Cost Transparency – 15%

We compared the fees associated with P2P trading, including maker/taker fees, deposit/withdrawal costs, and any hidden charges. Platforms offering minimal or zero fees for P2P transactions were rated higher, as lower costs improve the value and accessibility of peer-to-peer trading. Transparent fee structures were also prioritized to reduce surprises and enhance trust for users.

Security and Escrow Mechanisms – 25%

Security is a key consideration in P2P trading due to the inherent counterparty risk. We examined how each platform safeguards trades through escrow services, robust dispute resolution processes, identity verification (where required), and fraud prevention measures. Exchanges with strong escrow systems, clear dispute handling, and effective risk mitigation were rated higher, as they minimize the chance of loss or fraud during P2P transactions.

Ease of Use and User Support for P2P – 10%

We assessed the overall usability of the P2P trading interface, including the clarity of instructions, simplicity of listing offers, responsiveness of notifications, and speed of completing trades. Availability and responsiveness of customer support for P2P issues were also factored in. Platforms that allow users to trade seamlessly with minimal friction scored higher in this category.

How Do I Start P2P Crypto Trading?

Here’s a step-by-step guide on how buy cryptocurrencies safely from peer-to-peer Bitcoin exchanges:

- Step 1: Choose a Platform – The first step is to select a suitable peer-to-peer exchange. Best Wallet is a good choice – it supports over 100 payment methods and more than 1,000 coins, and trades are typically settled within two minutes.

- Step 2: Download the Best Wallet App – Visit the Best Wallet website, download the app, and complete the security steps (e.g, create a PIN and activate biometrics).

- Step 3: Fill the Purchase Form – Click “Trade”, “Buy”, and select the crypto you want to buy. Choose the currency, amount, and purchase method.

- Step 4: Enter the Payment Details – To complete the trade, enter the payment details and confirm. The app processes the payment instantly and transfers the cryptocurrencies to your wallet balance.

Conclusion

Top peer-to-peer cryptocurrency exchanges provide a secure, anonymous, and convenient way to purchase digital assets. You use local currencies and domestic payment methods, and trade directly with sellers in the same country.

Consider Best Wallet when selecting a P2P exchange. Best Wallet offers over 1,000 coins at industry-leading trading fees, and payment types include bank transfers and e-wallets. The Best Wallet app is free, non-custodial, and secure.

Visit Best Wallet

References

- Bybit Is Now the World’s Second-Largest Crypto Exchange (Bloomberg)

- Crypto’s Biggest Hacks and Heists After $1.5 Billion Theft From Bybit (Reuters)

- KuCoin Pleads Guilty, Agrees to Pay Nearly $300 Million in US Crypto Case (Reuters)

- Binance and CEO Plead Guilty to Federal Charges in $4B Resolution (U.S. Department of Justice)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Fact-Checked by:

Fact-Checked by:

23 mins

23 mins

Nadica Metuleva

, 47 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.