LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

BlockchainFX (BFX) is positioning itself as a crypto-native trading “super app” that lets users seamlessly move across crypto, forex, stocks, ETFs, and more.

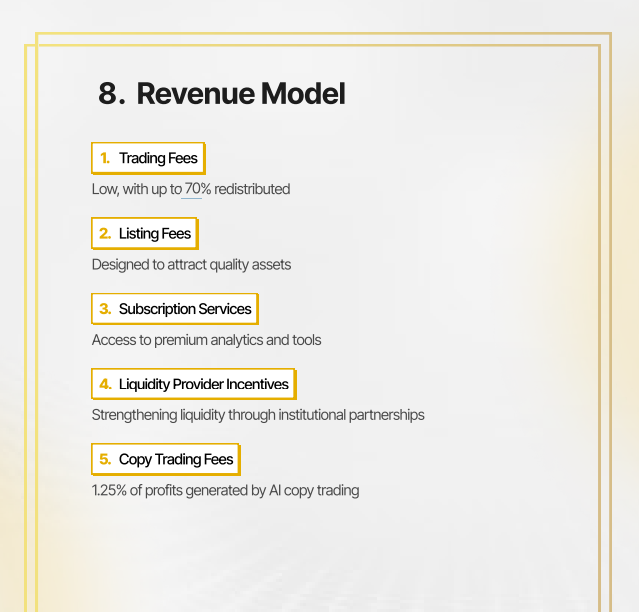

The team seems dead set on supporting its utility token, diverting up to 70% of platform fees to token holders through staking rewards, token burns, and token buybacks.

Exchange tokens have been quiet winners in the market cycle for quite some time now. Take, for instance, the Bitget token BGB, which pushed its way into the top 25. Hyperliquid’s HYPE became one of the fastest-growing newcomers, with billions in trading volume. Now, BFX is stepping into the spotlight with its presale.

The project looks very promising with its live beta platform and audits from CertiK and Coinsult. Still, in this article, we will dig deeper into its offerings, tokenomics, and how its price may fluctuate in the upcoming years.

Featured Alternative – Editor’s Choice

- First Bitcoin Layer 2 enabling fast, low-cost transactions

- Fixes Bitcoin’s speed and fee limitations with near real-time performance

- Enables a Bitcoin-native DeFi ecosystem

Key Takeaways: BlockchainFX Price Forecast

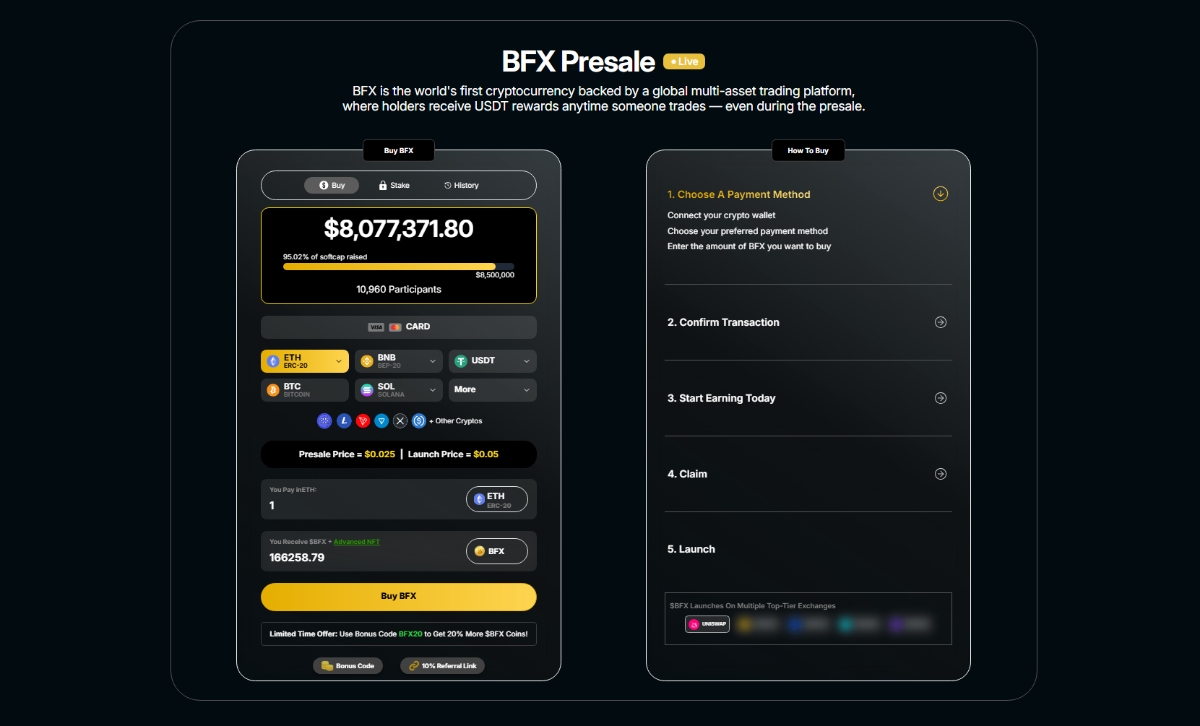

- BFX launched its presale at $0.025 per token, with a planned launch price of $0.05. The current stage is nearly sold out, and the next sale phase is expected to raise this price incrementally.

- If adoption mirrors other exchange tokens like BGB and HYPE, analysts suggest a potential for BFX to trade in the $0.50-$1 range within a few years. This, of course, depends heavily on broad market conditions and execution.

- BlockchainFX positions itself as a multi-asset super app, combining crypto, forex, stocks, ETFs, and commodities.

- The project has been audited by CertiK and Coinsult, with the team KYC-verified by Solidproof, giving it a stronger compliance profile compared to many presale tokens.

- Expansion plans include CEX listings, a BFX Visa card with global spending power, and an eventual push for a U.S. trading license.

BlockchainFX Price Prediction 2026-2030

Exchange tokens have shown us the upside when platforms succeed. Still, it is important to note that any BFX price prediction is ultimately just informed guessing. With that in mind, here is how the price could potentially pay out in 2026, 2027, and 2030.

2026 (Launch and Price Discovery)

Starting point

The presale lists BFX around $0.025 (the site currently shows $0.025 for the ongoing stage) with a stated launch price of $0.05. This implies a fully diluted value (FDV) of approximately $175 million at launch (3.5B total supply x $0.05).

BFX presale homepage. Source: BlockchainFX

Drivers to watch

We should watch for early listings and liquidity depth, actual user traction on the beta, and whether the fee-sharing model (up to 70% of fees) translates into visible on-chain payouts. Macro is choppy right now after a broad liquidation wave, so we should expect volatile opens.

Price outlook

- Base case: $0.04-$0.09 into/post-listing as float unlocks meet trading demand.

- Upside case: $0.10-$0.15 if early volumes are strong and multiple exchanges support the pair.

- Downside case: $0.02-$0.04 if liquidity is thin, or the market’s risk-off persists.

2027 (Execution vs. Competition)

Comparable anchors

In 2026, leading exchange tokens showed us what success looks like. BitGet’s token BGB sits in the multi-billion range, while Hyperliquid’s token HYPE has climbed double-digit billions.

What BFX must prove

BFX must prove real, sustained usage of the multi-asset super app it so promotes. It should also prove that the 70% fee-share is funded by real trading revenue and not just incentives. Regulatory clarity will also matter here, provided that the project truly bridges into the traditional financial markets.

Price outlook (scenario-based)

- Execution case (plausible): If BFX becomes a mid-tier venue with steady volumes and keeps distributing USDT/BFX rewards, a $0.50-$1.00 range is achievable within a few years. This equates to an FDV of $1.75B-$3.5B, which is below HYPE but around BGB’s ballpark now, which is ambitious, but not unheard of for a popular platform.

- Moderate case: Partial delivery (some assets live, modest volumes) would support $0.20-$0.45.

- Bear case: Execution of regulatory setbacks caps valuation near launch, $0.05-$0.15.

2030 (Maturity or Fade)

At this point, we can predict two paths:

- Maturity path: If BFX scales listings, keeps rewards flowing from real fees, and wins licenses and partnerships for traditional market success, the token could go in the $0.60-$1.20 range.

- Stagnation path: If the usage stalls or compliance blocks the “bridge” narrative of this project, we anticipate reversion to $0.10-$0.35 despite the burns and buybacks.

What Is BlockchainFX?

BlockchainFX (BFX) markets itself as the world’s first crypto-native trading super app, where users can trade over 500 assets, including crypto, but also about forex, stocks, ETFs, commodities, options, and bonds.

BlockchainFX claims to be the first crypto trading super app. Source: BlockchainFX

BlockchainFX already runs a live beta platform giving early buyers and potential investors a chance to test its features before diving in.

Tokenomics and Rewards Model

The project’s token, BFX, has a total supply of 3.5 billion, with 50% (1.75 billion) available during the presale. The planned launch price is $0.05, compared to the initial presale price of $0.025.

BFX has a revenue-sharing model with up to 70% of trading fees are redistributed daily to holders in USDT and BFX, creating a potentially lucrative passive income stream.

This mechanism is somewhat similar to how the Binance Coin BNB powered Binance’s rise, but with an added USDT element to provide more stable rewards.

On top of this, new buyers can currently unlock an additional 30% in bonus tokens using the code EXTRA30. This is a presale incentive that significantly boosts allocations for early buyers.

BlockchainFX bonus code. Source: BlockchainFX

Security and Compliance

Security is an essential part of this project’s pitch, as it should be for any trading platform. BlockchainFX has undergone audits from CertiK and Coinsult, two well-known blockchain security firms. The team has also completed KYC verification with Solidproof, a German auditing company.

These steps give BFX stronger credibility than many smaller presales that launch with limited or even without third-party checks.

BlockchainFX audits. Source: BlockchainFX

Roadmap and Future Plans

According to the roadmap in the official project whitepaper, BlockchainFX is currently in its launch phase. This includes selling out the presale, rolling out an affiliate program, and listing the token on Uniswap and several centralized exchanges. Future milestones include:

- Expanding to multiple CEX listings

- Launching the BFX Visa Card with up to $100,000 per transaction and $10,000 monthly ATM withdrawals

- Growing to 100,000+ holders, then 100 million holders globally

- Securing a U.S. license and expanding worldwide marketing campaigns

Why Are Investors Watching BlockchainFX?

A presale with utility: Many presales are built around nothing but hype or memes. BlockchainFX is different because its beta trading platform is already live, which gives it more substance than most tokens at the fundraising stage. Investors are paying attention to it because they can already see the product in action rather than just seeing a roadmap.

Daily staking rewards in USDT and BFX: Another major draw is the revenue-sharing model. Up to 70% of trading fees are redistributed to holders with payouts in BFX and USDT. Plus, early participants can stack even more tokens by using the presale bonus code EXTRA30.

BlockchainFX revenue model. Source: BlockchainFX

Comparisons to exchange token success stories: Exchange tokens have historically performed well when the platforms behind them grew. Binance’s BNB is the classic case, and BlockchainFX is pitching itself as the next in line, with the added twist of bridging traditional finance with crypto.

Security and transparency: Strong security and user trust is absolutely essential for trading platforms. With CertiK and Coinsult involved, the project seems to be much more transparent and secure than many presales that avoid such checks.

Massive market opportunity: BlockchainFX is targeting a massive market. The FX market is regularly reported at around $7.5 trillion a day in turnover.

What Could Drive BlockchainFX’s Price Higher?

Price predictions are more than wild guesses if you base them on data and market statistics. Still, they are only predictions, seeing how a lot is determined by future changes in the market. Here is what could drive BlockchainFX’s price higher in the future:

Exchange Token Momentum

Exchange-linked tokens have shown great success when their platforms gained traction. If BlockchainFX achieves even a fraction of the success of BGB and HYPE, not to mention BNB, its token price could see a tremendous amount of growth.

Fee-Sharing Rewards

With up to 70% of platform trading fees redistributed to BFX holders, the coin is much more attractive to investors than most basic utility tokens. These rewards could bring many investors in, especially those looking for steady passive income, boosting the price in the long term.

Product Already Live

Unlike many presale projects, BlockchainFX already has a beta platform running. In it, traders can test multi-asset swaps across crypto, forex, stocks, and ETFs, which helps validate the use case.

Roadmap Catalysts

Several milestones could be major price drivers here:

- Exchange listings on Uniswap and centralized platforms

- Rollout of the BX Visa Card with global usage

- Ambitions for U.S. regulatory compliance

- Growing the community to millions of holders globally

Risks to Consider Before You Invest in BlockchainFX

New and unproven projects can offer massive growth potential, but they also carry a great deal of risk. That’s why it’s absolutely essential that you understand all of the risks that come with investing in them. Here are some of the main risks that BlockchainFX is facing now:

Execution Risk

BlockchainFX is promising a super app that merges crypto with stocks, forex, and more. The beta is live, but scaling such a complex platform is a tall order. If features are delayed, or if liquidity and user adoption fall short, the token may not reach its projected growth.

Competitive Pressure

BFX is entering a space dominated by giants like Binance and BGB, who already hold multi-billion-dollar valuations. Competing for users against established exchanges with deep liquidity and global recognition is a big challenge.

Regulatory Uncertainty

The roadmap does include plans for a U.S. license, but in reality, this is one of the hardest goals in the crypto market. Many projects have struggled with U.S. regulators. Any regulatory crackdowns could stall adoption or, in a worst-case scenario, even restrict access in major markets.

Token Supply and Inflation

With a total supply of 3.5 billion BFX and 50% allocated to the BlockchainFX presale, the market will need sustained demand to absorb the tokens as they unlock. Even with buybacks and daily burns, new supply entering circulation could put pressure on prices if the trading volumes don’t scale as expected.

Our Methodology – How We Created this BlockchainFX Price Prediction

Price predictions for any token, especially new ones with little history, can’t be pulled from thin air. To build our balanced forecast, we took a look at just about everything BlockchainFX has released. Let’s see what our methodology includes.

Comparative analysis

Price predictions only make sense in context, which is why we will set BFX against the backdrop of what similar tokens have achieved, as well as consider what the market is doing right now.

Hyperliquid’s HYPE and Bitget’s BGB are useful comparables here, with multibillion-dollar market caps during 2025’s run (even though the daily swings remain sharp).

Tokenomics and supply structure

We assess the impact of BFX’s total supply (3.5 billion tokens), with half allocated to presale. Inflation, staking rewards, and buyback/burn mechanics can all shape the price’s behavior in the long term.

Revenue model and utility

Forecasts depend on how much fee revenue the platform actually generates, especially since up to 70% of trading fees are redistributed to holders. This ties the valuation to trading volume growth (much like BNB’s rise was tied to Binance’s success).

Sentiment and hype cycles

Exchange tokens historically outperform when volumes are rising and traders chase rewards. They slump when volumes fail. So, getting retail enthusiasm and social traction is key to success here.

Regulatory environment

BlockchainFX is openly planning a U.S. license, so regulation is a major variable here. Exchange tokens can face sudden challenges when the laws tighten, so predictions must reflect jurisdictional risks.

Where and How to Buy BlockchainFX

If you want to buy BlockchainFX during the presale stage, the process is very simple:

- Set up a self-custody wallet like MetaMask, Best Wallet, TrustWallet, or Coinbase Wallet.

- Choose a payment method. Pay with crypto (ETH, USDT, BTC, BNB, and more) or card (Visa, Apple Pay, Google Pay).

- Confirm the purchase. Enter the amount, approve the transaction in your wallet, and you should see your new BFX coins plus any bonus tokens in your dashboard.

- Earn rewards. Daily USDT and BFX staking rewards start immediately in your account.

- Claim tokens. After the presale ends, your BFX will be available to claim, with the token later launching on Uniswap and other top exchanges.

Note – You can use the bonus code EXTRA30 to receive 30% extra tokens during the BFX crypto presale.

Other Top Presales to Consider in 2026

Now let’s look at how two alternative presales stack up against BFX. When forecasting a future price, it is helpful to see how BFX stands out against its competitors and where it overlaps.

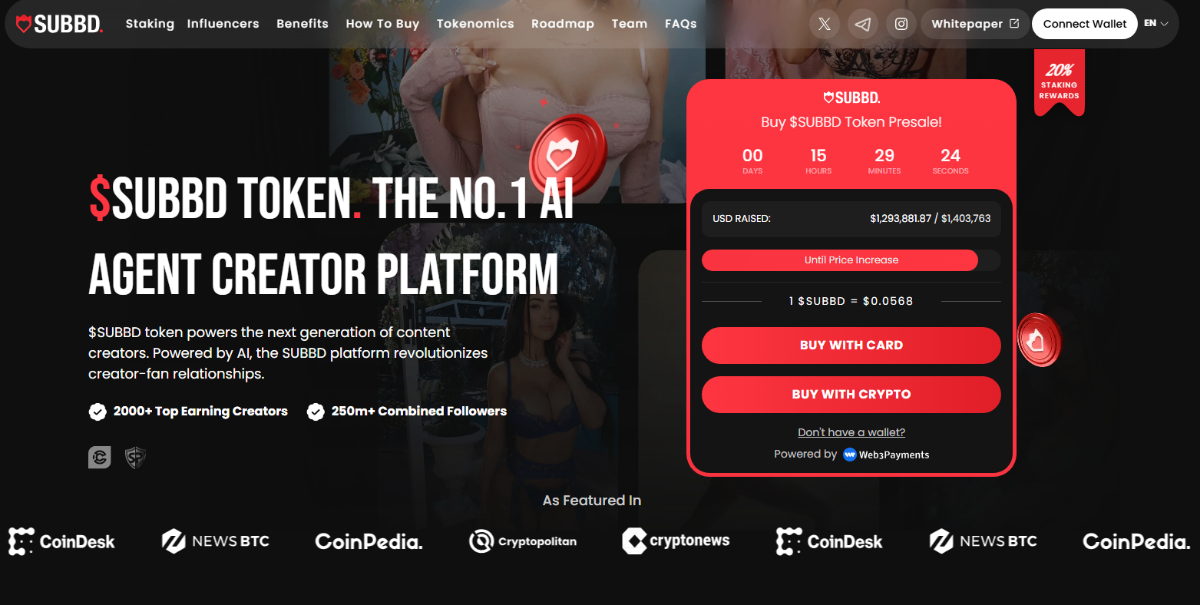

SUBBD Token

SUBBD is an ambitious new project that is building a platform that connects creators and fans via Web3 features, AI utility, token rewards, and more. Users can subscribe, tip, and unlock exclusive content with SUBBD tokens, while creators can help connect with their fans with AI tools. The presale launched in April 2025, with an initial price around $0.055, and has raised over $1.29 million so far.

SUBBD presale homepage. Source: SUBBD

Both SUBBD and BFX are presales that appeal to early-entry investors. They both rely on platform promise and token utility tied to that platform. However, the scale and target audience differ significantly. SUBBD is targeting a niche: the creator economy and content subscription ecosystem. BFX targets broad mainstream trading across asset classes.

Conclusion: Should You Invest in BFX?

BlockchainFX is positioning itself as more than your ordinary presale token. It’s pitching a full trading super app that combines traditional markets and crypto, while distributing a large percentage of fees back to holders. With audits, a live beta, and a clear roadmap, the project has more substance than most early-stage projects.

Still, investors should exercise caution when investing in crypto, especially when it comes to new tokens. Execution, competition, and regulation are key challenges, which is why such projects are considered high-risk, high-reward play. Exchange tokens like BNB, BGB, and HYPE show the upside, but risks remain high.

Our analysis suggests BFX could potentially reach $0.50-$1 in the next few years. However, these guesses depend heavily on steadily rising trading volume and adoption. Longer-term growth will also hinge on technical indicators like trading volume trends, staking activity, and liquidity levels.

Analysis: BFX looks promising, but it remains a speculative bet. Do your own research and only invest what you can afford to risk.

Featured Alternative – Editor’s Choice

- Degen meme coin inspired by max-leverage trading

- A tribute to high-risk hustle — fueled by sweat and conviction

- Ethereum-born, culture-driven, aiming for multichain

FAQ

What is the presale price of BFX?

How do I earn rewards from BFX?

Is BlockchainFX audited?

Can I buy BFX with a credit card?

When will I receive my BFX tokens?

References

- Crypto Sell-Off Wipes Out $1.5 Billion as Investors Liquidate – BusinessInsider

- What Is Market Sentiment? – Investopedia

- What Does It Mean to Burn Crypto – Investopedia

- Trading Volume as a Market Indicator – Schwab

- What Is a Fully Diluted Valuation in Crypto – Coinbase

- BNB: Understanding Its Utility on Binance – Binance

- Top Blockchain Security Companies – Milkroad

- BlockchainFX Whitepaper – BlockchainFX Presale Website

- Bank for International Settlements’ Triennial Survey – BIS Data Portal

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

The team behind IPO Genie has not yet announced an end date for the presale.

AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

14 mins

14 mins

Nadica Metuleva

, 47 postsI’m a seasoned writer with over a decade of professional experience, specializing in crypto, technology, business, and iGaming. Over the years, I’ve built a reputation as a trusted contributor to well-known outlets such as InsideBitcoins, CEOTodayMagazine, and Promo, while also collaborating with leading content and marketing agencies including Skale and Boosta. My portfolio spans a wide range of content types, exchange reviews, how-to guides, long-form comparisons, trend analyses, and thought leadership pieces, crafted to both inform and engage readers across different levels of expertise.

In the crypto space, I’ve developed a deep understanding of blockchain technology, digital assets, and the fast-moving decentralized finance (DeFi) ecosystem. I’ve written extensively on topics such as cryptocurrency exchanges, wallets, tokenomics, NFTs, and global regulatory developments. As a crypto investor myself, I bring a valuable firsthand perspective that allows me to balance technical accuracy with practical insights that resonate with traders, investors, and newcomers alike. Whether I’m breaking down blockchain mechanics or analyzing the latest market shifts, my work combines rigorous research, industry knowledge, and a keen sense of storytelling.

My educational background plays a key role in shaping my writing approach. I hold a Bachelor’s degree in Translation and a Master’s degree in English Literature and Teaching, disciplines that sharpened my ability to research complex subjects, distill technical information into accessible language, and adapt my tone to diverse audiences. This strong academic foundation underpins my clear, insightful, and authoritative style.

Passionate about making complex topics accessible, my mission is to cut through the jargon and deliver content that empowers readers to make informed decisions.

You can learn more about me and explore my portfolio on LinkedIn.