AI cryptocurrencies combine blockchain with artificial intelligence to power decentralized machine learning networks, GPU computin...

Want to trade Dogecoin futures to access leverage? Read our beginner’s guide on how to trade DOGE futures safely in 2026.

Dogecoin is a volatile asset, which gives traders an opportunity to buy and sell futures contracts to increase their exposure. We researched crypto derivative platforms to identify the best place for Dogecoin futures.

At the top of our list is CoinFutures, a licensed platform with a user-friendly interface that offers 1000x leverage on DOGE markets and margin requirements starting from $1. Alternatively, one of our other picks might suit your trading needs.

Understanding how DOGE futures work is crucial before getting involved. Read on to learn investing best practices, expert-led tips, and proven strategies.

Key Takeaways

- Futures track the Dogecoin spot price, providing exposure to the meme coin without requiring direct ownership of DOGE.

- Investors trade Dogecoin futures to access low margin requirements, enhance capital efficiency, and speculate on the rising and falling prices of Dogecoin.

- Perpetual and simulated contracts typically back Dogecoin futures. Traders provide margin and receive profits/losses in USDT.

- To choose the right platform for DOGE futures, assess trading commissions, leverage limits, average liquidity, and execution speeds.

- While some futures platforms offer substantial leverage multipliers, traders must evaluate liquidation risks before proceeding.

The Best Dogecoin Futures Platforms Ranked

In our view, these are the best Dogecoin futures trading platforms for 2026:

- CoinFutures: Buy and Sell Dogecoin Futures From $1 With 1000x Leverage

- MEXC: Get 300x Leverage on DOGE/USDT Perpetual Futures Contracts

- Binance: Best Option to Trade Coin-M Futures With DOGE Settlement

- Bybit: Tier-One Exchange With Substantial Trading Volumes on DOGE Futures

- CoinEx: Access 45+ Meme Coin Futures Markets on Desktop or Mobile Devices

Best Dogecoin Futures Trading Platforms Reviewed

The research team evaluated over 20 derivative exchanges that support Dogecoin futures.

We ranked the best platforms by core metrics like initial margin requirements, trading fees, account minimums, and deposit methods. Other important factors include derivative contract types and settlement currencies.

Read on to assess our research findings.

1. CoinFutures: The Top DOGE Futures Platform for High Leverage and Low Account Minimums

CoinFutures is a trusted futures trading platform designed for beginners. It offers entry-level trading tools with simple charts and order procedures, and the $1 minimum wager requirement makes it affordable for everyone. Traders select “Up” or “Down” positions to speculate on DOGE prices, depending on which direction they believe the meme coin moves.

The futures provider offers the highest leverage multiples in the industry at 1000x. DOGE traders control significant order amounts with a micro-percentage of the position size. 1000x leverage applies to many of the other best altcoins like Ethereum (ETH) and BNB (BNB).

CoinFutures offers Dogecoin futures markets with 1000x leverage. Source: CoinFutures

Futures markets are simulated products that pair with Tether (USDT). The CoinFutures algorithm ensures DOGE price movements align with global spot prices. This structure benefits derivative beginners, since they enter and exit positions instantly without order matching.

Traders apply margin in USD (or their preferred account currency) to simplify the trading process. Futures represent isolated-style margin, which means traders limit their risk exposure to the initial stake.

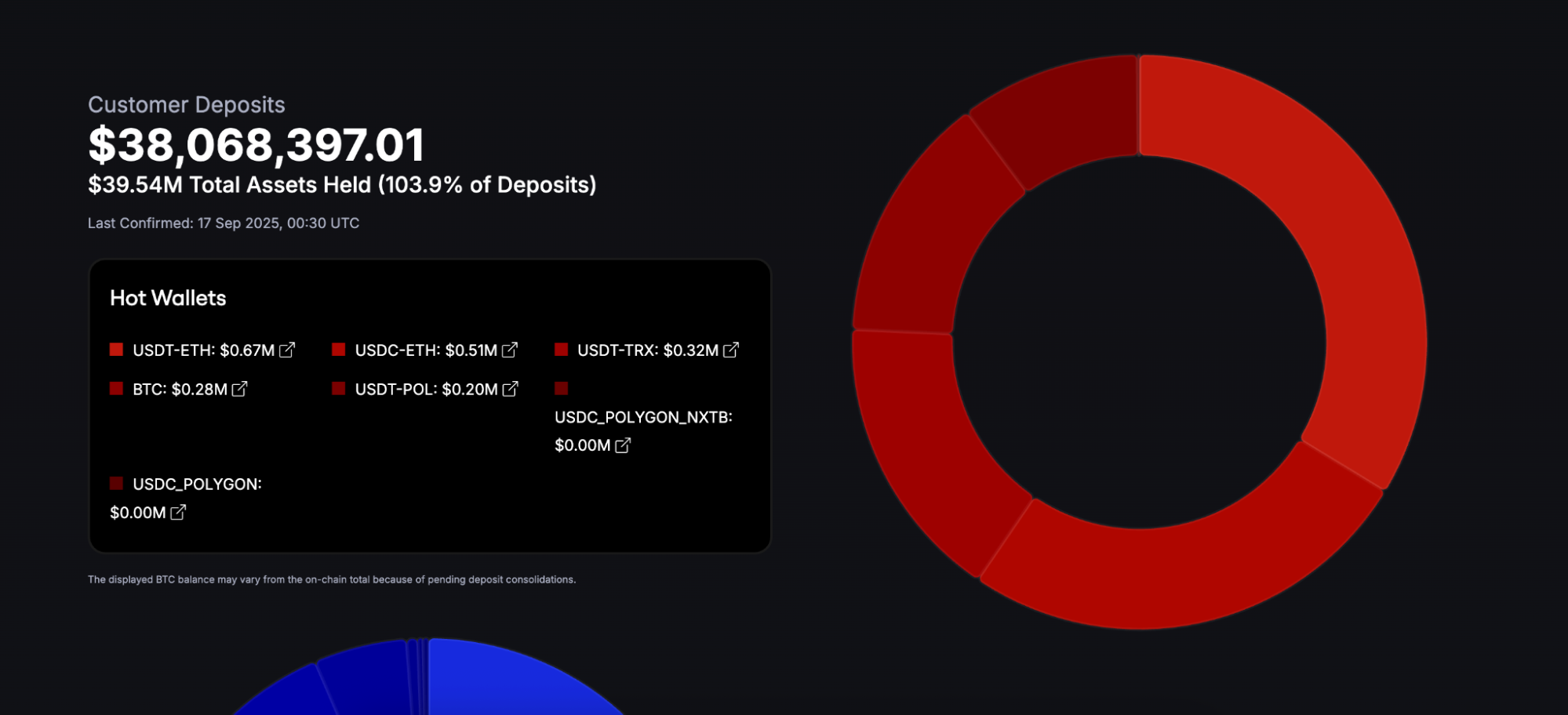

CoinFutures’ approach to transparency includes daily proof of reserves. Source: CoinFutures

CoinFutures eliminates minimum deposits and KYC requirements when traders transfer cryptocurrencies from a private wallet. The platform accepts fiat payments, including debit/credit cards; however, this method requires a $10 minimum.

As the best Dogecoin trading futures platform for safety, CoinFutures secures client-owned deposits in Fireblocks vaults. The tier-one, regulated custodian ringfences capital for institutional clients through MPC-backed cold wallets. Users may verify CoinFutures’ proof of reserves at any time.

Pros

- Amplify DOGE/USDT futures trades by up to 1000x

- The platform caps trading losses to the original wager

- Affordable trade requirements of just $1

- Supports a wide range of other crypto futures markets

- Existing users claim that most withdrawals process instantly

- Fireblocks ringfences client deposits in regulated vaults

Cons

- The trading dashboard is too basic for advanced technical traders

- Fiat payments require a $10 minimum deposit

2. MEXC: Go Long or Short on Dogecoin Prices With 300x Leverage

MEXC is another high-leverage trading platform that supports Dogecoin futures. Exchange users go long or short on DOGE/USDT perpetual contracts, which enables them to keep positions open indefinitely. MEXC charges funding fees every eight hours on these contracts, yet only one side of the market pays them per cycle (longs or shorts).

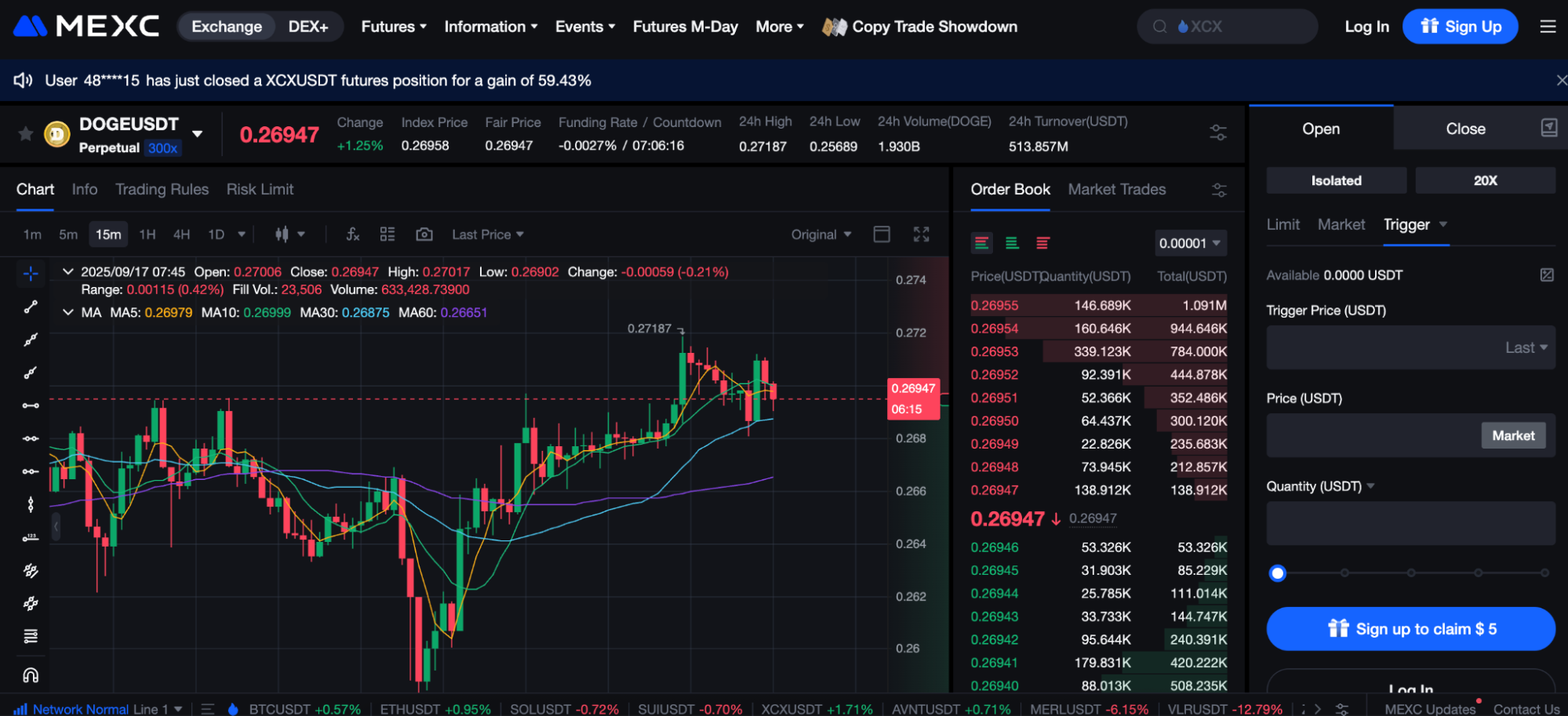

The maximum leverage available on Dogecoin futures is 300x. As traders pay an approximate initial margin of 0.33%, they have access to substantial capital. MEXC shows the liquidation level in DOGE/USDT prices. This helps traders set stop-loss, take-profit, and other risk management orders accordingly.

DOGE/USDT perpetual futures on MEXC offer 300x leverage. Source: MEXC

Besides Dogecoin, MEXC lists over 900 other perpetual futures markets, including the best cryptocurrencies to buy like Bitcoin (BTC), Solana (SOL), and Pepe (PEPE). Since most platform users trade linear contracts, trading volumes tend to be significant. A small number of traders switch to inverse contracts for higher DOGE exposure.

Pros

- Top-rated futures exchange for perpetual contracts

- Trade Dogecoin with leverage of up to 300x

- Pay just 0.1% per side when you place limit orders

- Access 900+ other crypto futures markets

Cons

- Inverse contracts attract minimal trading volumes

- Futures traders pay a 4x premium on market orders

3. Binance: Access Inverse Futures Contracts That Margin and Settle in DOGE

Binance appeals to experienced futures traders with a higher risk-reward profile. The world’s most liquid exchange offers Coin-M futures, which provide traders with inverse contracts that margin and settle in DOGE. These contracts compound profits and losses, as the collateral moves in the same direction as the underlying asset.

Traders with less experience in inverse contracts may prefer perpetual Dogecoin futures. On Binance, perpetuals margin and settle in USDT or USDC (USDC), reducing the exposure and potential losses. The exchange offers a maximum leverage of 75x on Dogecoin positions, which is significantly lower than some competitors.

Binance offers Dogecoin futures markets with linear and inverse settlement. Source: Binance

Binance offers a huge range of tools and features to enhance the trading experience. In addition to technical indicators and powerful charts, it supports automated solutions like bots and copy trading. Pre-built futures trading strategies include grid, arbitrage, and TWAP.

One of the exchange’s biggest drawbacks is accessibility. Traders from some regions cannot access Binance futures, including those in the U.S., UK, and several European countries.

Pros

- A top choice for trading DOGE futures via inverse contracts

- The contracts are margined and settled in DOGE

- Offers the deepest derivative liquidity in the crypto market

- Automated futures solutions include copy trading and algorithmic bots

Cons

- The exchange caps leverage to 75x on Dogecoin markets

- Traders in some countries face derivative restrictions

4. Bybit: Trade DOGE Futures on a High-Volume Exchange With Tight Spreads

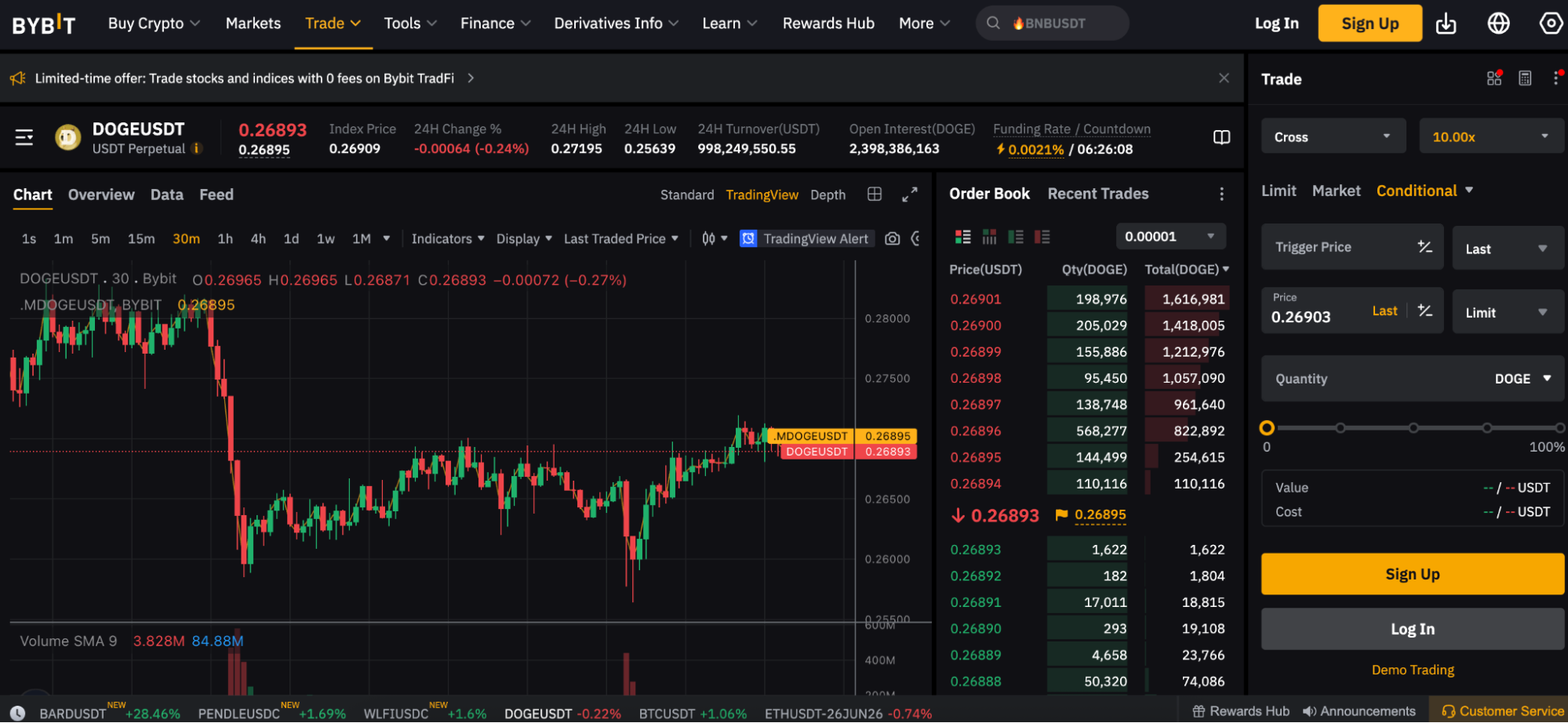

Bybit handles significant trading volumes on the DOGE/USDT futures markets. Traders typically buy and sell over $1 billion worth of contracts per day, which extends to over $2 billion in open interest. By extension, Bybit users access ultra-tight spreads and minimal slippage. They often secure the best exchange rates even when entering large position sizes.

DOGE futures on Bybit include linear and inverse contracts, and cross and isolated margin setups. Advanced traders place conditional orders via markets and limits, and trigger prices include index, last, and mark. Technical analysis tools include dozens of indicators and trend lines like hollow candles, baseline, and bars.

Bybit futures offer tier-one liquidity and trading volumes on the DOGE/USDT market. Source: Bybit

Similar to Binance, Bybit limits Dogecoin futures leverage to 75x. It requires a minimum maintenance margin of 0.75%, although this margin increases as position sizes pass risk thresholds.

Trading commissions range from 0.03% to 0.055% for market takers, depending on volume. Takers pay between 0% and 0.02%, so it makes sense to place limit orders to reduce fees.

Pros

- DOGE/USDT futures average $1 billion in daily volumes

- Supports conditional orders with various trigger points

- Futures trading fees as low as 0% for market makers

- Offers isolated and cross margin for varying risk preferences

Cons

- The minimum maintenance margin requirement is 0.75%

- Leverage limits reduce as traders surpass risk thresholds

5. CoinEx: Multi-Device Futures Exchange With 45+ Meme Coin Markets

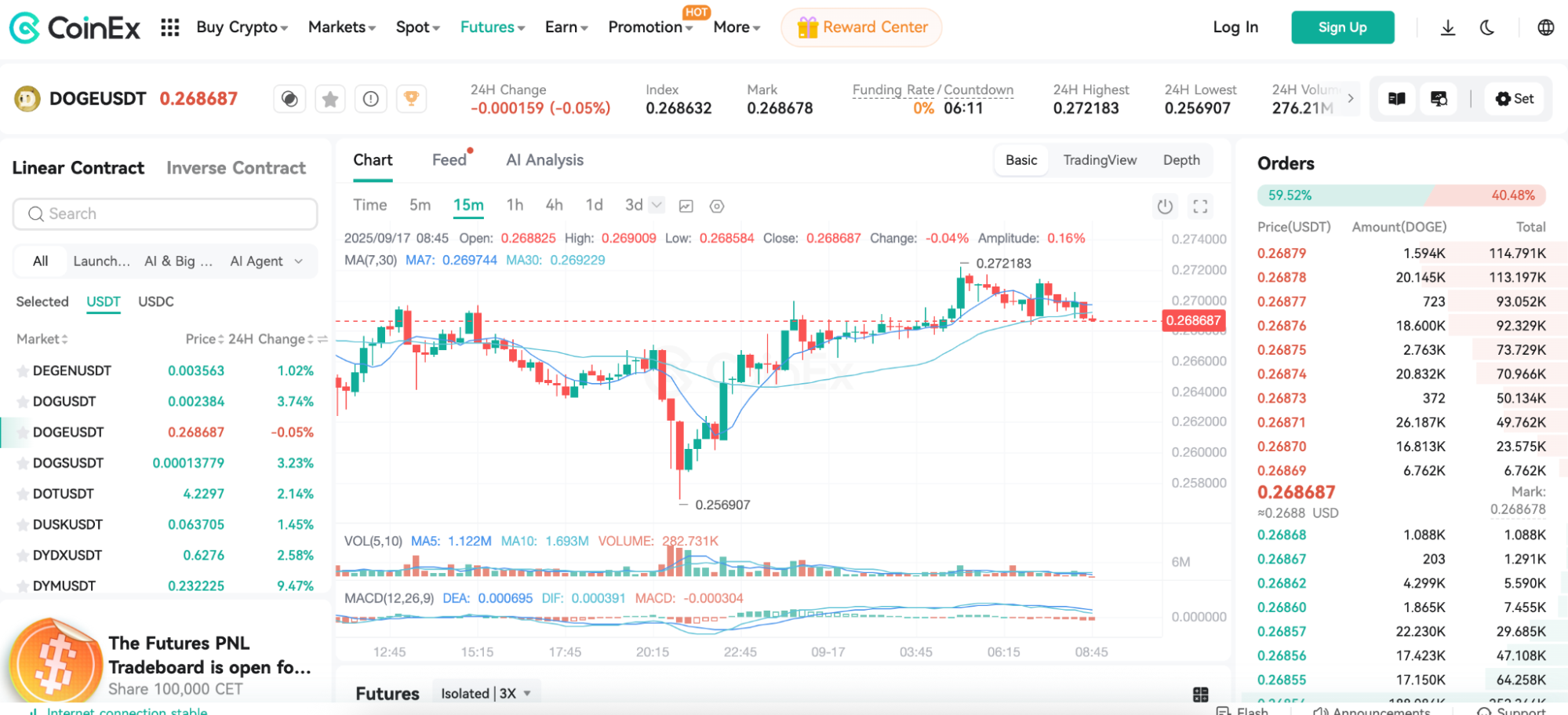

CoinEx is a good option to access a wide range of meme coin markets via perpetual futures contracts. In addition to Dogecoin futures, which offer leverage of up to 50x, the exchange supports over 45 other top meme coins.

Larger-cap markets include PEPE, Bonk (BONK), Shiba Inu (SHIB), and dogwifhat (WIF). Those with a higher appetite for risk may prefer lower-cap meme coins such as Mog Coin (MOG), Degen (DEGEN), and Baby Doge Coin (BABYDOGE). Note that the exchange offers lower leverage on less popular cryptocurrencies to manage its risk exposure.

CoinEx offers over 45 meme coin futures markets, including Dogecoin perpetuals. Source: CoinEx

CoinEx offers a highly accessible trading dashboard without KYC requirements. It allows daily withdrawals of up to $10,000 in digital assets for non-verified users. The platform is compatible with desktop browsers and offers a native app for both Android and iOS. Payment methods range from crypto wallet transfers to peer-to-peer trading and debit/credit cards.

Pros

- Trade DOGE futures besides 45+ other popular meme coins

- The exchange offers a user-friendly mobile app

- Unverified accounts withdraw up to $10,000 daily without KYC

Cons

- Insufficient trading volumes on some futures markets

- Operates without approval from reputable licensing bodies

Comparing the Top Dogecoin Futures Exchanges

The following table shows how the top DOGE futures platforms compare for essential factors:

| Supported DOGE Futures | Settlement Options | Margin Options | Max DOGE Leverage | Mobile App? | Max Futures Trading Fees | KYC? | |

| CoinFutures | Simulated | USDT | Isolated | 1000x | Yes | Variable or commission-based | No |

| MEXC | Perpetual | USDT, USDC, DOGE | Isolated and cross | 300x | Yes | 0.04% | No |

| Binance | Perpetual | USDT, USDC, DOGE | Isolated and cross | 75x | Yes | 0.05% | Yes |

| Bybit | Perpetual | USDT, USDC, DOGE | Isolated and cross | 75x | Yes | 0.055% | No |

| CoinEx | Perpetual | USDT, USDC | Isolated and cross | 50x | Yes | 0.05% | No |

What are Dogecoin Futures?

Dogecoin futures provide an alternative way to speculate on DOGE price movements. Since futures are derivative contracts, they enable profit potential without owning the underlying asset. Traders predict whether DOGE prices rise or fall in the future, and exchange buy and sell contracts accordingly.

The top crypto futures trading platforms let users enter positions without covering the full contract value. Our research shows that the minimum upfront requirement (called the “initial margin”) on Dogecoin futures is 0.1%. A simple example is placing a $100,000 order with a $100 collateral balance.

Traders rely on perpetual contracts to trade DOGE, as exchanges do not yet offer delivery futures with expiration dates. Although these futures markets never expire, traders sometimes pay funding fees, which makes perpetuals a better fit for shorter-term trades.

Another consideration is liquidation risk, which varies by the initial margin provided. If a trader provides a 1% margin on their futures position, they access 100x leverage. The drawback is that the trade becomes liquidated if the DOGE price moves unfavorably by 1%. Liquidated futures positions close automatically, and traders forfeit their margin.

How Does Dogecoin Futures Trading Work?

While traders must learn about contract, margin, and settlement variants, the basics of Dogecoin futures are as follows:

- Traders place buy orders if they predict rising DOGE prices

- Traders place sell orders if they predict falling DOGE prices

To exit the futures position, traders place the opposite order. Similar to spot trading, the profit potential depends on the total position size and percentage gain. This is where leverage matters most. While the initial margin resembles the trader’s stake, that amount is multiplied by the selected leverage multiplier.

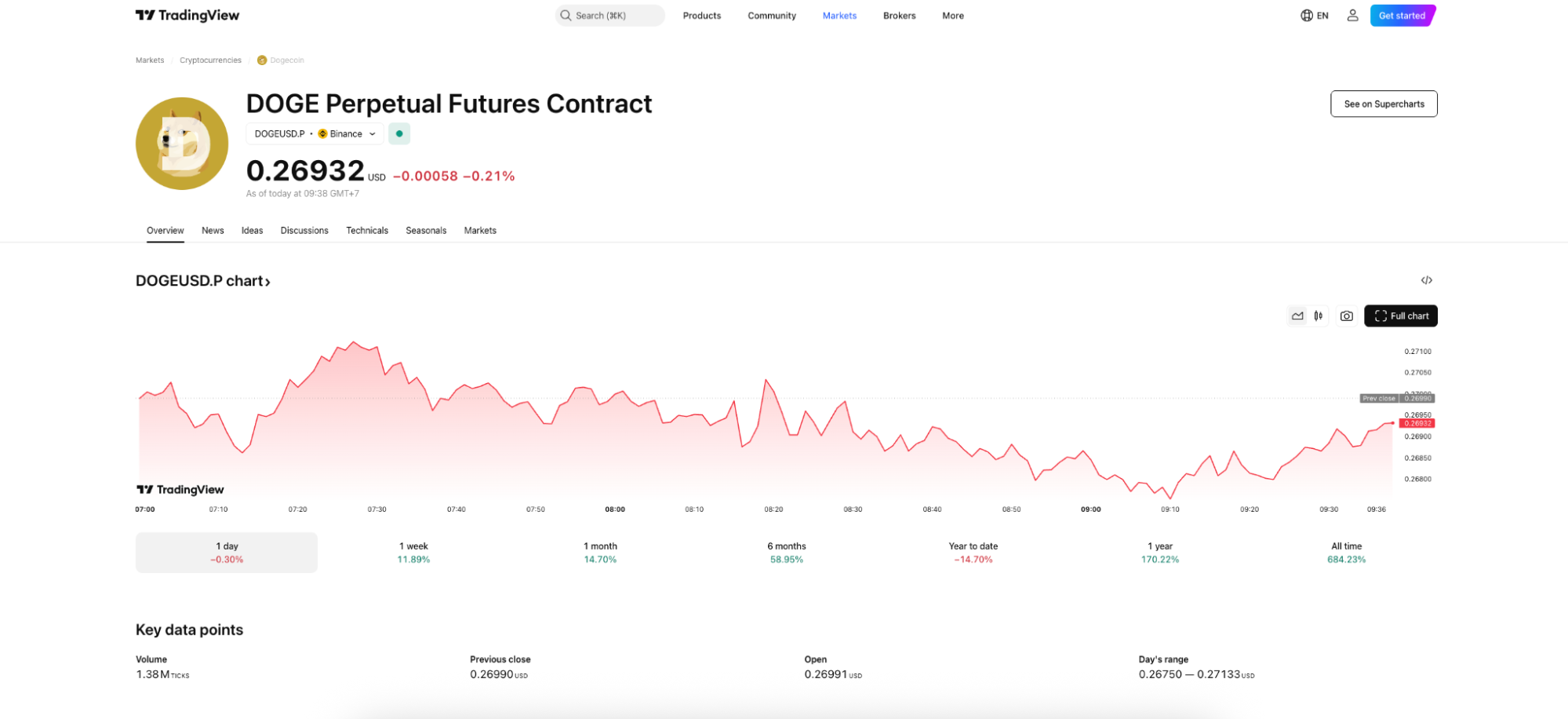

Dogecoin futures require traders to predict rising and falling prices via derivative contracts. Source: TradingView

Suppose a trader is bullish on Dogecoin and decides to deposit $200 as their initial margin. They apply leverage of 50x, so that $200 stake amplifies to $10,000. Any price movements thereafter reflect the $10,000 position size, so a 10% gain amounts to $1,000 profit.

The biggest drawback of high-leverage futures trades is liquidation. In the above example, the trader’s $200 collateral equates to a 2% margin. A 2% decline in the DOGE price forces liquidation; the trade closes automatically, and the trader forfeits the $200 margin balance.

In terms of settlement, linear futures are cash-settled in stablecoins (usually USDT). This means profits and losses adjust in USDT rather than DOGE. If you prefer futures that settle in the underlying asset, use futures exchanges that offer inverse contracts.

How to Trade Dogecoin Futures

This step-by-step guide helps beginners trade Dogecoin futures on CoinFutures. Learn how to set up a long or short position, apply leverage, evaluate liquidation risks, and set risk management orders.

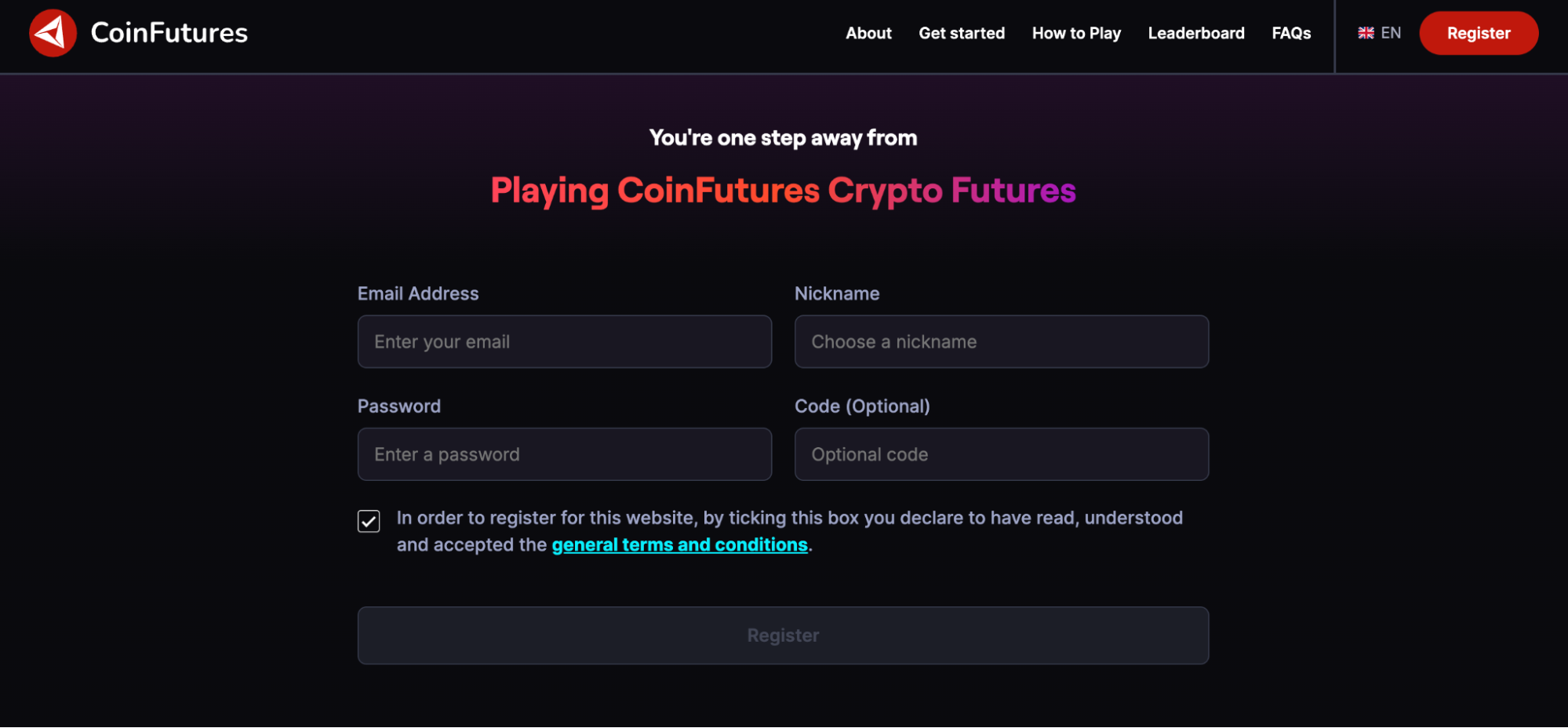

Step 1: Register a Futures Account

Go to the CoinFutures website to set up a trading account.

CoinFutures offers futures trading accounts without KYC verification. Source: CoinFutures

CoinFutures does not require new clients to complete KYC verification. Just enter and verify an email address, and choose a nickname and password.

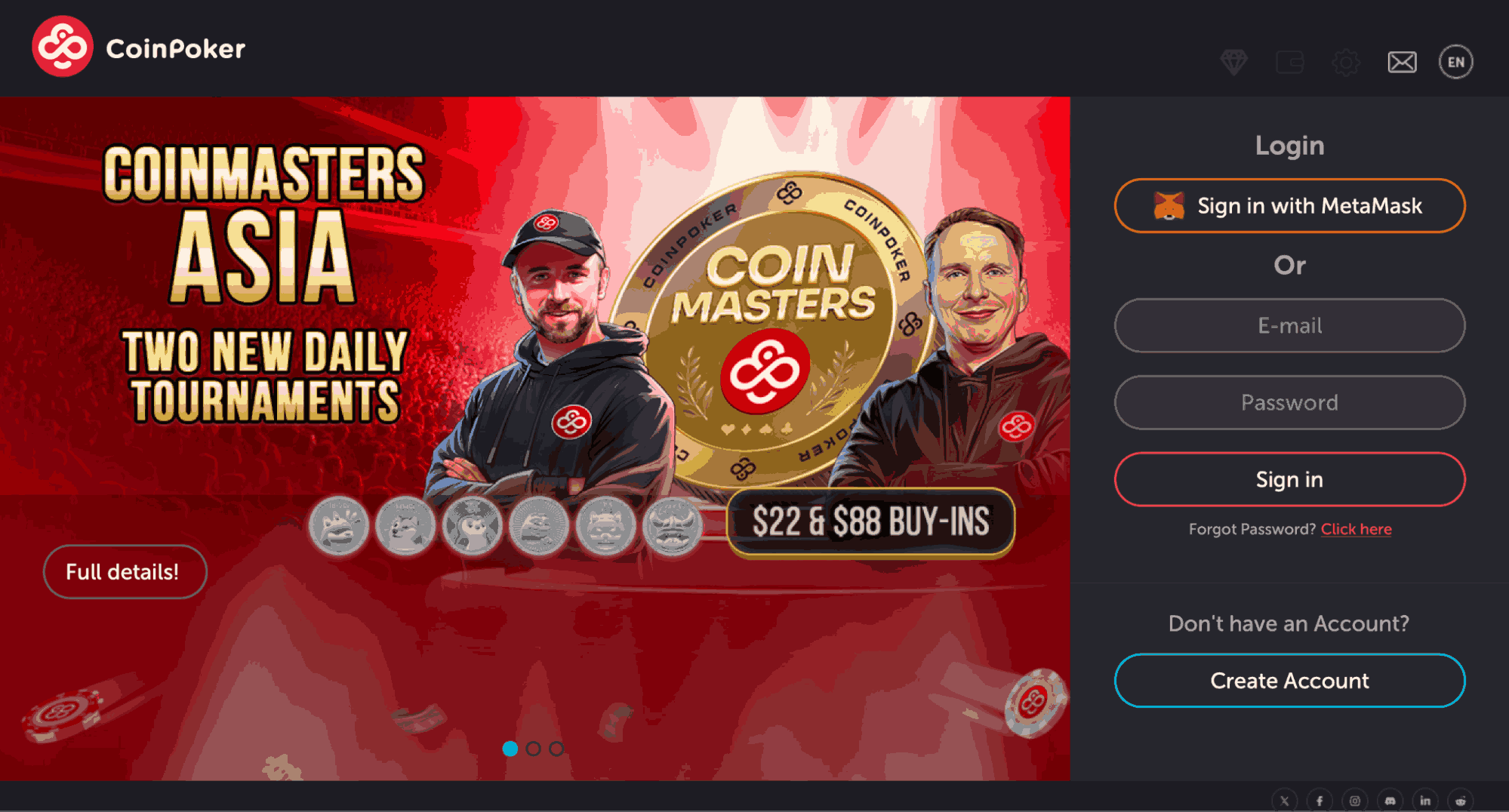

Step 2: Download the Futures Trading Software

CoinPoker, which created the CoinFutures platform, offers native software for desktops and mobiles. If you’re unaware of CoinPoker, it’s an established gambling provider with full licensing, proof of reserves, and a large number of satisfied customers.

CoinFutures users place trades on the CoinPoker software for desktop and mobile. Source: CoinFutures

You need to download the CoinPoker software to trade DOGE futures. Once installed, open the software and sign in with your CoinFutures credentials.

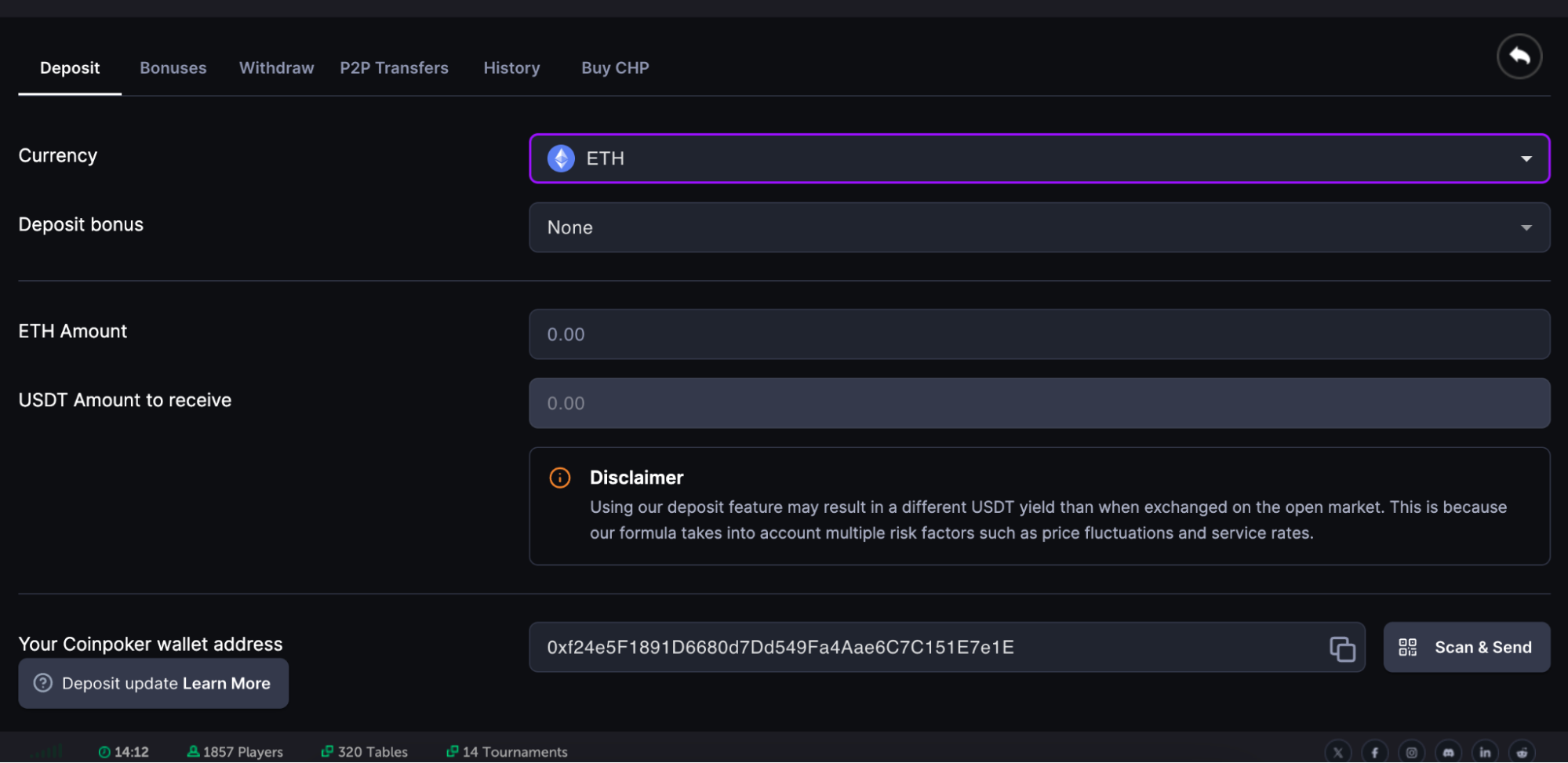

Step 3: Make a Deposit

CoinFutures ensures safe crypto deposits without account minimums. The platform creates a new wallet address specifically for your trading account. Supported digital assets include stablecoins like USDT and USDC, as well as BTC, ETH, SOL, and BNB. The platform displays the deposit address in full form and via a QR code.

CoinFutures accepts deposits through crypto transfers and fiat payments. Source: CoinFutures

Transfers appear in the account once confirmed by the network. Unless you deposit BTC (which takes 10-15 minutes), most crypto deposits arrive in seconds.

Don’t have any crypto to deposit? CoinFutures supports the following fiat payment methods:

- Google Pay

- Apple Pay

- PIX

- Visa

- MasterCard

Deposit at least $10 to meet the minimum fiat requirement. CoinFutures processes fiat deposits instantly, with no additional fees.

Step 4: Go to Crypto Futures and Select DOGE

Exit the cashier page and click “Crypto Futures”.

CoinFutures offers a variety of popular cryptocurrencies.Source: CoinFutures

You need to change the futures market from “BTC/USDT” to “DOGE/USDT”. This takes you to the DOGE futures dashboard.

Step 5: Choose the Trade Parameters

This step requires traders to enter their trade prediction, bet size, and leverage multiplier.

CoinFutures users go long and short by selecting “Up” or “Down” respectively.

Exploring DOGE futures and placing an Up or Down bet. Source: CoinFutures

Enter the total bet size next to the “Wager” tab. Since most beginners trade with small amounts, CoinFutures has a minimum bet requirement of just $1.

Decide how much leverage to apply to the DOGE futures trade. You may choose any amount from 1x up to 1000x. Avoid trading with too much leverage, however, as the liquidation probability rises substantially.

Important: Evaluate the Entry and Liquidation Prices

Traders must assess two prices before they confirm a futures position: the entry price and the bust price.

The entry price is the price at which the platform executes the DOGE futures trade. The bust price, on the other hand, is the liquidation price. Traders lose the original bet if the markets trigger the bust price.

The bust price changes when you adjust the leverage multiplier. Reducing the multiplier moves the liquidation price further from the entry price.

Step 6: Set Exit Parameters and Place a DOGE Futures Trade

CoinFutures lets users place stop-loss and take-profit orders in “Auto” mode.

Enter the maximum amount in USD that you want to risk on the DOGE futures trade. If the stop-loss price triggers, the platform closes the trade. While it’s frustrating to lose money, those losses are greater when positions become liquidated.

An example of DOGE/USDT futures charting tools on the CoinFutures platform. Source: CoinFutures

If you have a profit target, enter the amount in USD. Take-profits work similarly to stop-loss orders, as CoinFutures exits the trade automatically when the price triggers.

Finally, review the full trade parameters, including the wager, leverage multiplier, and exit orders. Click “Place Auto Bet” to confirm your DOGE futures position.

Dogecoin Futures vs Options

Futures and options are derivative instruments that allow contract holders to trade DOGE long and short.

Futures, when traded as perpetual contracts, do not have an expiry date. Traders enter and exit positions through standard buy and sell orders, and make a profit or loss depending on the closing price. Traders post margin to apply leverage multipliers to the DOGE position.

Delivery futures have expiration dates, unlike perpetuals. However, research shows that DOGE delivery contracts have yet to launch on any exchange.

Dogecoin options, currently available on Binance only, differ from futures. Traders purchase call and put options, which resemble buy and sell orders. To enter the market, options traders pay a premium. The premium value depends on the trader’s selected strike price and contract expiration date.

On expiration, those call and put options generate profits if the DOGE price is above or below the strike price, respectively. If not, the trader forfeits the premium, which typically represents a small percentage of the position value.

Key Things to Know About Dogecoin Futures Trading

Let’s break down some key terms and considerations regarding DOGE futures.

Contract Types

The best crypto exchanges sometimes offer two different futures contract types: USDT-M and Coin-M.

USDT-M represents linear contracts, as they’re cash-settled in USDT. This structure helps traders make informed decisions and reduce margin exposure to DOGE volatility. Their USDT account balance adjusts based on the trader’s profit or loss.

Coin-M appeals to traders who prefer Dogecoin futures margined and settled in the underlying coin, DOGE. Once settled, contract holders receive DOGE, which may be more or less than the original margin depending on the trade outcome.

Leverage and Margin

Leverage and margin are inversely related when trading Dogecoin futures.

Applying leverage increases the position size by a certain multiple. The initial margin is the percentage of the total trade value. A trader who applies 25x leverage pays a 4% initial margin, while 10x leverage increases the margin to 10%.

Trading DOGE/USDT futures with 25x leverage reflects a 4% margin. Source: CoinFutures

Consider the maintenance margin, too. It’s the minimum equity req uired to keep the DOGE futures trade open. Should equity fall below that requirement, exchanges liquidate the position.

Isolated and Cross Margin

Initial and maintenance margin determines the upfront and ongoing requirements for the DOGE futures trade. Exchanges also offer the choice between isolated and cross margin.

Isolated margin is the best option. Once traders post the initial margin, they cap the potential trading losses to that amount.

Cross margin lets traders share the same margin account across multiple futures positions, increasing their market exposure. Just one losing position could trigger liquidation across all open trades. This leads to the exchange liquidating the entire margin balance.

Funding Cycles

Traders access Dogecoin futures through perpetual or simulated contracts. Both products remain open without expiration dates, yet exchanges apply funding fees. Most platforms implement those fees every eight hours, although others charge them more frequently.

Per cycle, exchanges charge funding fees either to longs or shorts. If there are more traders long on DOGE, they pay fees to shorts. Conversely, when more traders short DOGE, they pay fees to longs.

Each charge lowers the trader’s maintenance margin and increases the liquidation risk.

What are the Benefits of Trading Dogecoin Futures

Dogecoin futures provide the following advantages:

- Boost Profits With Leverage: Traders apply leverage to their DOGE futures positions to amplify potential profits. The net gain increases by the leverage multiplier, which can deliver massive returns.

- Flexible Trading Orders: Futures exchanges allow users to enter positions with buy or sell orders. This advantage lets traders profit from bullish and bearish prices. It’s also ideal for trading short-term volatility, particularly during sideways markets.

- Increase Capital Efficiency: Another benefit is capital efficiency, since DOGE futures require a small percentage of the total position size. Rather than gain exposure to a single futures market, margin lets traders diversify into multiple cryptocurrencies with the same deposit.

- Circumvent Storage Responsibilities: Traditional investors buy DOGE from an exchange and withdraw those coins to a self-custody wallet. This storage method makes them responsible for cybersecurity threats like remote hacks. As futures traders buy and sell derivative contracts only, they avoid managing a private wallet.

- Hedge Against Uncertain Markets: Seasoned investors often use futures as a hedging tool. They take the opposite position to offset adverse price movements. Long-term holders can short DOGE futures to achieve the same goal. It’s one of the most effective risk mitigation strategies and ensures investors avoid asset disposals.

Pros & Cons of Dogecoin Futures Trading

To summarize, DOGE futures provide the following pros and cons:

Pros

- Futures let traders enter long and short positions

- Enter trades with a minimum margin requirement of just 0.1%

- Leveraged futures trades can produce huge price gains

- Avoid losing more than the original wager through isolated margin

- Short-sell contracts to hedge against meme coin volatility

- Gain exposure to DOGE without wallet security risks

Cons

- High leverage multipliers lead to extreme liquidation risks

- Traders are closed if the maintenance margin depletes

- Trading futures products means you do not own real DOGE

- Perpetual contracts incur regular funding fees

- No exchanges currently offer Dogecoin delivery futures

At CoinFutures, you can trade DOGE futures with 1000x leverage from just $1, as well as other popular cryptocurrencies such as BTC and ETH. As new users register without KYC details, the platform is accessible globally.

FAQs

What are Dogecoin futures?

What are the benefits of trading Dogecoin futures?

Are Dogecoin futures more risky?

What’s the minimum amount you need to trade Dogecoin futures?

How do I trade Dogecoin futures?

What is the best Dogecoin futures trading platform?

References

- What are perpetual futures contracts? (Kraken)

- Cryptocurrency futures and options (Chicago Mercantile Exchange)

- How futures margin works (Charles Schwab Futures and Forex LLC)

- What are derivatives? (Corporate Finance Institute)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

If you have been following VFX token, you probably noticed the same question popping up everywhere: when does Vortex FX token actu...

The VFX token is tied directly to Vortex FX, a regulated forex broker that’s already executing trades and publishing live trading ...

Fact-Checked By:

Fact-Checked By:

21 mins

21 mins

Ibrahim Ajibade

, 373 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.