Crypto theft is more common than most traders think, and it rarely takes a sophisticated hack. A forgotten token approval, a poorl...

Wondering how to buy Bitcoin as a first-time investor? Our beginner’s guide explains the step-by-step process, including the top Bitcoin wallets, exchanges, and safety best practices.

Bitcoin (BTC) is the oldest and still the most popular cryptocurrency by far, accounting for well over 50% of the total crypto market cap. This guide will teach you how to buy Bitcoin in 2026, so you can join the millions who already own this hugely popular digital asset.

We’ll show you the easiest and safest way to buy Bitcoin, explore alternative purchase options, and teach you how to store your assets safely. We’ll also explore some of the basics of Bitcoin to find out why it remains the go-to choice for most crypto investors.

How to Buy Bitcoin in 5 Easy Steps

Here is a simplified walkthrough of how to buy Bitcoin in five simple steps:

- Choose a platform that supports Bitcoin purchases, such as a crypto wallet or an exchange.

- Set up basic security (PIN, password, two-factor authentication).

- Decide how much you are comfortable investing.

- Select Bitcoin, choose a payment method, and complete the purchase.

- Store your Bitcoin securely, ideally in a non-custodial wallet you control.

This process might look different depending on the platform you choose. Still, the core steps should remain the same.

How to Buy Bitcoin – Step-by-Step Guide

Here is our detailed guide on how to invest in Bitcoin. We explain each step comprehensively for first-time buyers.

Step 1: Choose a Wallet or Exchange

Instead of pushing one product, most beginners start by choosing between two options:

- A crypto wallet that allows direct purchases via payment partners. Wallets serve several functions, such as allowing investors to send, receive, and store Bitcoin without relying on centralized entities. The best crypto wallets also connect with fiat gateways, so users can buy Bitcoin with traditional money.

- A centralized exchange where you buy Bitcoin first and store or withdraw it later.

Wallets are often preferred by users who want immediate self-custody, while exchanges suit those who plan to trade or convert assets frequently.

Step 2: Secure Your Account

Regardless of which platform you choose, security matters more than convenience.

Use a strong password, enable two-factor authentication, and back up your recovery phrase offline. Losing access credentials usually means losing access to your Bitcoin permanently.

Step 3: Choose a Payment Method

Most platforms support cards, bank transfers, or digital wallets. Card payments are faster but usually come with higher fees, while bank transfers are cheaper but slower.

Always review the final quote, including fees and exchange rates, before confirming.

For more options, see our step-by-step guide on how to buy Bitcoin with a credit card.

Step 4: Decide How Much to Invest

Bitcoin is divisible, so you don’t need to buy a full coin. Many platforms today allow purchases starting at $10-$20.

Only invest what you are prepared to hold through volatility. Sharp price swings are normal in the crypto world.

Once confirmed, the gateway processes the payment instantly. Bank transfers are an exception, taking up to five business days.

Step 5: Store Your Bitcoin Safely

After buying, confirm where your Bitcoin is stored. If it is held by a platform, you are relying on a custodian. If it is in a non-custodial wallet, you control the private keys (and the responsibility that comes with them.

What Is Bitcoin?

Bitcoin is a decentralized digital currency that operates without banks or governments. Proposed in 2008 by a pseudonymous creator known as Satoshi Nakamoto and launched in 2009, it is the first widely adopted decentralized digital currency. No single person or entity controls the Bitcoin network, enabling users to send and receive funds on a peer-to-peer basis.

Transactions are grouped into blocks and added to a public ledger called the blockchain at an average interval of 10 minutes. To secure the network and maintain decentralization, Bitcoin uses a proof-of-work consensus mechanism. Miners use specialized hardware to validate blocks, and approximately every 10 minutes, one miner earns a reward in newly issued bitcoin, currently 3.125 BTC. The original block reward was 50 BTC and is reduced by 50% roughly every four years.

Bitcoin’s protocol enforces a predictable and fixed supply, capped at 21 million coins, with the final bitcoin expected to be mined around the year 2140. Once this limit is reached, no additional coins can be created. Transaction fees fluctuate based on network demand, typically ranging from under $1 to several dollars, though they can rise significantly during periods of heavy usage.

Why Do People Buy Bitcoin?

While most people buy Bitcoin for asset appreciation, other motivations exist. Bitcoin enables seamless cross-border payments, non-custodial ownership, and a hedge against uncontrolled inflation.

Learn more about why hundreds of millions of people own Bitcoin in 2026.

Financial Gains

There is no question that Bitcoin has been the best crypto to buy since its inception, producing unprecedented price gains for its holders. While the digital asset lacks a credible price history during its initial few years, the infamous “Bitcoin Pizza” transaction in 2010 valued BTC at approximately $0.0041. Laszlo Hanyecz’s purchase of two Domino’s pizzas for 10,000 BTC, worth about $41 at the time, has since become part of Bitcoin’s cultural heritage.

The earliest Bitcoin price on CoinMarketCap is $0.048, recorded in July 2010. Since then, Bitcoin has experienced rapid price increases, with multiple major pullbacks.

Compared with traditional investments, Bitcoin remains one of the best-performing assets. Gold and the S&P 500 index, for instance, rose by 115% and 94% in the past five years, respectively. The Bitcoin price has risen by over 720% in the same timeframe. Read our expert Bitcoin price prediction for insights on where the digital gold could be headed next.

How to Earn Bitcoin Yields

The Bitcoin blockchain lacks native support for decentralized finance (DeFi) applications like Ethereum and Solana. Yet, investors earn yields through savings accounts.

Nexo, for instance, offers fixed and flexible accounts with Bitcoin APYs of up to 7%. Consider counterparty risks, as Nexo’s centralized framework means you relinquish control of your Bitcoin private keys.

Cross-Border Payments

Bitcoin was originally created as a digital medium of exchange. Despite its speculative nature and relatively slow and expensive transactions compared to newer cryptocurrencies, some people still use Bitcoin for cross-border payments.

Regardless of the sender’s and receiver’s location, Bitcoin transfers take about 10 minutes. In contrast, international bank payments via SWIFT often take up to five business days.

The network applies a dynamic fee structure based on network demand, although our research shows it rarely exceeds $1. Traditional remittance companies like Western Union and MoneyGram typically charge percentage fees, which increase costs as transfer values rise.

Non-Custodial Ownership

When exploring how to buy Bitcoin, non-custodial ownership appeals to many investors. Non-custodial wallets generate encrypted private keys, which only the Bitcoin holder controls. As third parties cannot access those keys, investors secure real asset ownership without relying on custodians.

The same concept applies to transfers of Bitcoin from one wallet to another. Users send and receive coins via the Bitcoin blockchain without seeking approval from a third party, such as the wallet’s creator or an exchange that operates it.

Investors store traditional assets, like stocks and cash, with centralized institutions. These firms pose various counterparty risks, such as blocked account access, solvency problems, and cybersecurity threats.

Bitcoin investors eliminate these risks when they store coins with a non-custodial provider.

Hedge Against Inflation

Bitcoin helps people hedge inflationary risks, particularly in emerging countries with poor economic policies.

Consider the Turkish lira (TRY), which in 2024 alone experienced peak inflation of over 75%. On a 10-year basis, the lira has declined by over 90% relative to the US dollar. To mitigate these inflationary pressures, several million Turkish residents have rotated into Bitcoin.

The BTC/TRY trading pair price rose by over 4,200% in the past five years, almost six times more than BTC/USD’s growth.

Different Ways to Buy Bitcoin

As a trillion-dollar asset, a wide range of BTC investment methods exist. Consider the following platform types when choosing where to buy Bitcoin.

Crypto Wallets

In our view, crypto wallets provide the best way to buy Bitcoin. Wallets partner with fiat gateways, which allow users to purchase coins without leaving the wallet interface. From Visa and MasterCard to Google/Apple Pay and PayPal, gateways offer a hassle-free way of investing in digital assets.

Best Wallet is a good option for investors who prefer a mobile experience. In addition to instant Bitcoin purchases, the app’s secure non-custodial framework ensures full asset autonomy.

Those who prioritize safety over convenience favor cold storage solutions. Ledger, the popular hardware wallet, stores encrypted private keys offline, eliminating cybersecurity threats. The Ledger Live app and desktop software connect with gateways like MoonPay and Ramp for fiat payments.

Crypto Wallet Pros

- Wallets connect with reputable gateways that support instant payment methods

- Automatically store purchased Bitcoin in a non-custodial environment

- Send and receive coins without third-party approval

- Free wallet types include mobile apps, browser extensions, and desktop software

Crypto Wallet Cons

- Gateways typically charge higher fees than regular crypto exchanges

- Users are responsible for safeguarding their private keys and seed phrases

Centralized Exchanges

Centralized exchanges (CEXs) attract billions of dollars in daily trading volume, with most platform users buying and selling Bitcoin. These platforms function like traditional brokerages, as users open accounts, deposit fiat money, and place limit and market orders.

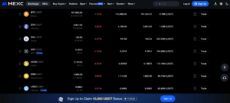

Our research shows that MEXC is one of the best crypto exchanges for asset diversification. Besides Bitcoin, the exchange lists over 4,000 cryptocurrencies, including major altcoins and high-growth meme coins.

MEXC is a centralized cryptocurrency exchange that lists Bitcoin and over 4,000 altcoins. Source: MEXC

Binance is the world’s largest exchange for liquidity, volume, and active traders. It lets users trade Bitcoin at commissions of just 0.1%. The exchange offers lower fees when users hold its native coin, BNB (BNB). Binance offers world-class trading tools with full chart customization.

CEX Pros

- Some CEXs support direct fiat deposits in multiple currencies

- Competitive exchange commissions that average 0.1%

- Instant buy features support debit/credit cards and e-wallets

- Access extensive trading tools like advanced orders and technical indicators

CEX Cons

- Most platforms have strict know-your-customer (KYC) requirements

- Built-in wallets offer custodial storage with counterparty risks

Decentralized Exchanges

Some investors explore how to buy Bitcoin on decentralized exchanges (DEXs), as these platforms eliminate centralized risks and KYC requirements. However, unlike Ethereum, Solana, and other Layer-1 blockchains, Bitcoin lacks decentralized application (dApp) support. This drawback means Bitcoin cannot host DEX platforms.

One workaround is THORChain. The DEX allows traders to swap its proprietary token, THORChain (RUNE), for BTC. The protocol employs liquidity pools and automated market makers (AMMs) to ensure complete decentralization.

Another solution is Wrapped Bitcoin (WBTC). Real BTC backs each WBTC token, which operates on the Ethereum blockchain. Users exchange any ERC-20 token for WBTC on Ethereum-based DEXs like Uniswap and SushiSwap.

DEX Pros

- Buy Bitcoin in a decentralized and non-custodial ecosystem

- Traders avoid KYC requirements

- DEX smart contracts transfer coins directly to the connected wallet

DEX Cons

- DEXs do not accept fiat payments

- Bitcoin lacks dApp support, so users rely on secondary blockchains

Other Ways to Buy Bitcoin

Beyond wallets and exchanges, there are several indirect or alternative ways to gain Bitcoin exposure or buy BTC:

Bitcoin ETFs

Spot Bitcoin ETFs allow investors to gain price exposure without handling private keys. They trade on traditional stock exchanges and are regulated financial products. Fidelity, iShares, VanEck, and other financial institutions offer spot Bitcoin ETFs.

Bitcoin ATMs

Bitcoin ATMs allow cash purchases but often charge fees between 7-15%. Most machines now require identity verification. According to CoinATMRadar, almost 40,000 Bitcoin ATMs operate in over 60 countries.

P2P Exchanges

Peer-to-Peer crypto exchanges connect buyers and sellers directly, often from the same country. Investors use local currency and payment types, transferring money only when the seller funds the P2P escrow wallet. Binance, OKX, and other CEXs offer the biggest P2P exchanges for liquidity.

Payment apps and fintech platforms: Some financial apps offer Bitcoin purchases alongside stocks and ETFs. These platforms usually provide custodial exposure rather than true ownership.

Bitcoin Mining

Bitcoin mining is not a practical way for most people to acquire Bitcoin today. Large-scale operations with specialized hardware and access to cheap energy dominate the industry.

Cloud mining exists, but it carries significant risk, limited transparency, and no guaranteed returns. For most users, buying Bitcoin directly is simpler and more predictable than attempting to mine it.

Where to Buy Bitcoin: Comparing the Best Options

Once you’ve decided how you want to buy Bitcoin, the next step is choosing a platform that fits your priorities (low fees, ease of use, or full self-custody). Below you will find a comparison of some of the most commonly used options these days.

| Platform | Type | Minimum Purchase | Fees |

| Binance | CEX, P2P | $15 | From 0.1% trading fee |

| MEXC | CEX, P2P | $10 | 0% maker / $0.05% taker |

| Coinbase | CEX | $2 | Spread + variable fees |

| Kraken | CEX | $10 | From 0.16% maker / 0.26% taker |

| Ledger | Hardware wallet | Varies by on-ramp | Third-party provider fees |

| MetaMask | Software wallet | $2 | Variable on-ram fees |

| Bitcoin ATMs | Physical kiosks | Varies | Often 7-15% |

| P2P Platforms | Direct buyer/seller | Varies | Platform or seller-set fees |

| BestWallet | Non-custodial software wallet | $10 (via on-ramp) | Variable on-ramp fees, typically 2-3% |

Centralized exchanges generally offer the lowest trading fees and the deepest liquidity.

Wallets and ATMS prioritize accessibility and self-custody, but come at higher costs.

Hardware wallets appeal most to long-term holders who value security over convenience.

Investing in Bitcoin vs Trading Bitcoin

Investing in and trading Bitcoin reflect different goals and outcomes.

Bitcoin investors are typically long-term buyers who hold for months or years. They remain in the market despite short-term volatility to capture extended growth cycles. Most investors keep their coins in a non-custodial wallet for safe storage.

Bitcoin traders are short-term speculators who capitalize on market volatility. They buy and sell BTC over short periods, often for minutes, hours, or days, depending on the strategy.

Regarding the method of trading Bitcoin, traders typically use derivative products like futures and options, since they allow leverage and long and short orders. The best crypto leverage trading platforms offer leverage of up to 1000x, which magnifies position sizes by 1000 times.

Key Considerations to Make Before Buying Bitcoin

Here are some key factors to consider when learning how to buy Bitcoin:

- Choose regulated platforms: Regulated brokers and exchanges are the safest way to invest in Bitcoin. Licensing bodies enforce strict rules, particularly regarding consumer protections, segregated funds, and anti-money laundering controls.

- Consider the investment budget: Never invest more than you can afford to lose. Bitcoin remains a volatile asset, so setting an investment budget is essential.

- Understand buying Bitcoin vs derivatives: When you buy Bitcoin in the traditional sense, you own the underlying coins outright. Derivatives merely mirror global spot prices, so they provide no ownership rights.

- Hold coins in a secure wallet: After you complete the Bitcoin purchase, store your coins in a secure wallet. Ensure the wallet provides non-custodial storage for true BTC ownership.

- Learn about price movements and volatility: Bitcoin has delivered huge gains since its 2009 inception, yet the digital asset often experiences sharp price swings. Always do your own research and be prepared for short-term volatility to reduce emotional risks.

- Understand investment fees: Cryptocurrency wallets, CEXs, DEXs, and other platform types charge trading fees. These eat into your potential BTC profits, so evaluate commission structures when choosing a provider.

- Beware of scams: Cybercriminals steal billions of dollars worth of cryptocurrencies annually. Common scams involve phishing, deception, and remote hacking attacks through malware and viruses. Learn more about the risks of crypto scams to protect your investments.

Is Bitcoin Taxed?

Our research confirms that most countries tax Bitcoin profits the same as other tradable products like stocks, ETFs, and commodities.

As authorities typically tax realized capital gains, the liability triggers only when investors cash out. If an investor buys 1 BTC at $40,000 and sells at $120,000, they make an $80,000 capital gain.

Tax rules and concessions vary across jurisdictions. For example, the U.S. has short and long-term tax structures, where investors qualify for lower tax rates when they hold cryptocurrencies for at least 12 months. Australian investors are also incentivized to hold long-term. They receive a 50% discount when holding for at least one year.

Investors who deposit their BTC coins into a centralized finance (CeFi) service also incur income tax liabilities. Most tax authorities use the daily spot price as the cost basis, based on when investors receive their yields.

How to Sell Bitcoin

To sell Bitcoin for fiat money, investors need an account with a trading platform that supports fiat withdrawal methods, such as withdrawing to a bank account. If you hold BTC in a non-custodial wallet, transfer those coins to the platform and place a sell order.

Follow these steps to sell Bitcoin:

- Open an account with a crypto exchange that accepts your preferred currency. Popular options include MEXC, Binance, Bybit, Coinbase, and Kraken.

- In the exchange account, copy your unique BTC deposit address. Then transfer BTC from your private wallet to the exchange.

- Sell Bitcoin for fiat money on the exchange. Then request a withdrawal to a supported method, such as bank transfers or e-wallets.

If you’ve used Best Wallet to buy Bitcoin, you can use the Swap function to exchange your Bitcoin for a number of other cryptocurrencies or stablecoins like USDT or USDC. You can also transfer your Bitcoin to an exchange to sell it directly for USD.

Remember to review fees and withdrawal timeframes before you sell Bitcoin for cash.

How to Buy Bitcoin: Final Thoughts

Buying Bitcoin in 2026 is more accessible than ever, but the right methods depend on your goals. Some investors prioritize simplicity. Others prioritize self-custody. Finally, some prefer regulated financial products like ETFs.

Understanding fees, storage options, and risks is far more important than choosing a specific app or platform. That being said, take time to research, start small, and treat Bitcoin as a learning process rather than a quick win.

FAQ

How do I buy Bitcoin?

When is the best time to buy Bitcoin?

How much Bitcoin should I buy as a beginner?

What is the best platform to buy Bitcoin?

Should I buy Bitcoin?

What are the risks of buying Bitcoin?

References

- Bitcoin: A Peer-to-Peer Electronic Cash System (Bitcoin.org)

- Why people are so obsessed with bitcoin: The psychology of crypto explained (CNBC)

- Cryptocurrency Ownership Data (Triple A Technologies)

- Bitcoin price history (CoinMarketCap)

Coinspeaker in Numbers

Monthly Users

Articles & Guides

Research Hours

Authors

LiquidChain is a Layer 3 blockchain project that wants to unify the liquidity of Bitcoin, Ethereum, and Solana into a single execu...

The team behind IPO Genie has not yet announced an end date for the presale.

Fact-Checked by:

Fact-Checked by:

17 mins

17 mins

Ibrahim Ajibade

, 373 postsI’m a research analyst with experience supporting Web3 startups and financial organizations through data-driven insights and strategic analysis. My goal is to help organizations make smarter decisions by bridging the gap between traditional finance and blockchain innovation.

With a background in Economics, I bring a solid understanding of market dynamics, financial systems, and the broader economic forces shaping the crypto industry. I’m currently pursuing a Master’s degree in Blockchain and Distributed Ledger Technologies at the University of Malta, where I’m expanding my expertise in decentralized systems, smart contracts, and real-world blockchain applications.

I’m especially interested in project evaluation, tokenomics, and ecosystem growth strategies, as these are areas where innovation can drive lasting impact. By combining my academic foundation with hands-on experience, I aim to provide meaningful insights that add value to both the financial and blockchain sectors.